Академический Документы

Профессиональный Документы

Культура Документы

Export Assistance and Incentives

Загружено:

Abdul Hafeez GhoriИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Export Assistance and Incentives

Загружено:

Abdul Hafeez GhoriАвторское право:

Доступные форматы

Export Assistance And Incentives INTRODUCTION

Export incentives Devices used by countries to encourage exports. These can include tax incentives for exporters, allowing them exemptions from the normal provisions of anti-monopoly legislation, preferential access to capital markets, priority Developing countries have started manufacturing industries only recently. As a result, their cost of production generally tends to be high because of the following reasons: Total market availability within the country is small with the result that the economies of large-scale production cannot be reaped. Productivity of labor is low because the level of mechanization as compared to that in the developed countries is low. Manufacturing units in developing countries, being small and new, have considerably less expertise in the field of international marketing and because the volume of exports is low, the per unit cost of trade promotion expenditure tends to be high.

India has to raise higher resources for development which has to be done through a number of indirect levies which tend to push up the overall cost of production.Most developing countries have, therefore, resorted to a number of export promotion measures. India has also been providing export assistance to Indian exporters. However, the WTO Agreement on Subsidies and countervailing duties does not allow specific types of export subsidies. The Government of India is, therefore, removing those export incentives which are not WTO compatible. NEW SYSTEM OF EXPORT ASSISTANCE: export incentive system in India has been made simple. There are essentially three major incentives. These are: Market-based Exchange Rate; Fiscal Concessions, and Facilities under the Export-Import Policy.

These are discussed in detail below: MARKET BASED EXCHANGE RATE: For long, external value of the rupee was managed by the Reserve bank of India (RBI) by pegging the value of the rupee to a basket of currencies.

ABDUL GHORI

COMMODITY BOARDS The government of India has established a number of commodity boardsto be responsible for the production, development and export of some commodities liketea, coffee, rubber, tobacco spices etc. These boards are statutory bodies.

TEA BOARD: The Tea Boards head office is in Calcutta. The functions of these boards includes It looks after the production and marketing of tea in India. In order to increase the production, the Tea Board runs various development schemes. Some of them are Tea plantation finance scheme, Newtea unit finance scheme, Small growers development scheme,Special area development scheme etc. Provide financial assistance and grants for tea research institutes Promote research activities on the allied subjects like packaging of tea. The export promotion activities are undertaken to popularize Indian tea andconsumer level with special promotion programme to promote India teas invalue added for like packet tea, tea bags and instant tea. For promotion of tea as beverage the tea board also participates in the genericpromotion programme conducted by tea council at U.K., Germany, US, andCanada and is also member of the International Tea committee. COFFEE BOARD: The functions of coffee board includes The coffee board participates in selected international exhibitions and tradefairs for highlighting the high quality and excellent flavour of Indian coffeefor the awareness of importers and roasters from different countries. Special advertisements on the excellence of the Indian coffee were released inimportant coffee trade journals and magazines in countries, which havepotential markets for Indian coffee. Studies on diseases of coffee and their control were carried out. For improving the productivity and quality of coffee, contact programme was launched in 4 regions covering a total number of 1018 growers. Keeping view the production of quality coffee at estate level, training programme was conducted. TOBACCO BOARD: The following are the functions rendered by tobacco board to promote export of tobacco: Allowing exports to countries facing foreign exchange crunch on long term credit terms. Allowing exports of tobacco to Russia through debt repayment route. Sponsoring delegations abroad and participation in international trade fairs. ABDUL GHORI

Improving yield and quality of tobacco through control of diseases in tobacco nurseries, balanced fertilization, pest and disease control. Improvement of curing and storing facilities by conservation of energy byroof insulation of tobacco barns, supply of tarpaulins and supply of coal forcuring. Improving tobacco grading through establishment of community grading centers. SPICES BOARD

The Spices Board has number of schemes of assistance to spice exporters such as Brand promotion, Logo Promotion, grant of Spice House certificate etc. They are explained below: Brand Promotion: Under this scheme, interest free long-term loans up to amaximum of 50% of the promotion cost for a period of three years are provided to theexporters of spices in consumer packs for promoting their individual brands in overseasmarkets. Logo Promotion: In the exports of spices, quality is a key element. The spicesboard has a scheme to promote a "logo mark" as a mark of quality and Indian ness ofspices. The logo mark is awarded to exporters of spices in consumer packs who fulfillcertain stipulated conditions of hygiene/processing/packaging and product quality. Logois registered in six countries and would be registered in another 14 countries. Spice House Certificate: The Board has introduced a concept of 'Spice House' andit is awarded only to those exporters who fulfill the prescribed quality standards and havenecessary processing infrastructure for production of clean quality process. Certificateshave been awarded to many manufacturers/processors of spices. Apart from those schemes, spices board has been supplementing activities of Ministry of Agriculture with a number of schemes that include: Production and supply of quality material and rooted cutting; 1.Replantation of old and diseased plants; 2.Providing assistance to marginal growers innon-traditional areas; 3.Organizing training programmes for growers for quality improvement and post-harvest techniques. EXPORT PROMOTION COUNCILS The basic objective of Export Promotion Councils is to promote and develop the exports of the country. Each council is responsible for the promotion of a particular group of products, projects and services. There are 20 EPCs and a number of specified agencies/boards which shall be regarded as EPCs under the Export and Import Policy. They issue Registration cum membership certificate to exporters The main role of EPC is to project India's image abroad as a reliable supplier of high quality goods and services. The major functions of the EPCs are as under:

ABDUL GHORI

To provide commercially useful information and assistance to their members in developing and increasing their exports. To offer professional advice to their members in areas such as technology up gradation, quality and design improvement, standards and specifications, product development, innovation etc. To organize visits of delegations of its members abroad to explore overseas market opportunities. To organize participation in trade fairs, exhibition and buyer seller meets in India and abroad. To promote interaction between the exporting community and the Government both at the Central and State levels. To build a statistical base and provide data on the exports and imports of the country, exports and imports of their members, as well as other relevant international trade data.

The Export promotion councils are non-profit organizations registered under the Companies Act or the Societies Registration Act, as the case may be. 100% EXPORT-ORIENTED UNITS The scheme of 100 EOU's were introduced in 1980 with a view to generatingadditional production capacity for exports by providing an appropriate policy framework, flexibility of operations and incentives. In order to enable them to operatesuccessfully in the international market such units are allowed to import machinery, rawmaterial, components and consumable at free of custom duties. These units have tooperate under custom bond and achieve the level of value addition fixed by the Board ofApproval. At present more than 500 units are in operation under the EOU scheme..Some of the modifications done to facilitate the exporting units in the EOUs are as follows: Simplification of customs/excise procedures Automatic approval under certain conditions to proposal for setting up units. Leasing of capital goods from domestic companies by EPZ\EOU has been permitted. Encouragement of agro and electronic units by providing higher domestic access.

The following privileges are enjoyed by the Export Oriented Units: An EOU unit may export all goods and services except the items prohibited by the exim policy. An EOU unit may import without payment of duty for all type of goods, includingcapital goods required by it for its activities provided they are not prohibited itemsof imports. EOU units may import/procure from Domestic Tariff Area without payment of duty. Second hand capital goods may also be imported duty free without any age limit. EOU unit shall be positive net foreign exchange earner.

ABDUL GHORI

Only project having an investment of Rs.1 crore and above in building, plant andmachinery shall be considered for establishment under EOU scheme.Application forsetting up of units under EOU scheme may be approved by the units ApprovalsCommittee within 15 days. The entire production of EOU units shall be exported subject to the following: Rejects may be sold in the domestic tariff area on payment of duties on prior intimation to the customs authorities. Scrap/waste arising out of production process or in connection therewith may be sold in the domestic tariff area on payment of duties within the overall ceiling of50% FOB value of exports. By products may also be sold in the domestic tariff are subject to achievement of positive net foreign exchange on payment of applicable duties within the overall entitlement.

OVERVIEW OF EXPORT AND IMPORT POLICY OF INDIA POLICY AND ITS OBJECTIVES: Under the Foreign Trade (Development and Regulation) Act, 1992 the Central Government has notified the Export and Import Policy for the period 2002-2007 which came into force with effect from 1st April 2002 and shall remain in force up to 31st March2007. The following are the salient features of the policy as amended up to 31st March 2003. The principles objectives of this policy are: To facilitate sustained growth in exports to attain a share of at least 1% ofglobal merchandise trade. To stimulate sustained economic growth of providing access to essential rawmaterials, intermediates, components, consumables and capital goods required foraugmenting production and providing services. To enhance the technological strength and efficiency of Indian agriculture,industry and services, thereby improving their competitive strength whilegenerating new employment opportunities, and to encourage the attainment ofinternationally accepted standards of quality. To provide consumers with good quality goods and services at internationallycompetitive prices while at the same time creating a levelplaying field for thedomestic producers.

II GENERAL PROVISIONS REGARDING IMPORTS AND EXPORTS a)Exports and Imports shall be free except in cases where they are regulated byprovisions of this policy or any other law. The item wise export and import policyshall be, as specified in ITC, published and notified by DGFT.

ABDUL GHORI

b)Any person without an importer-exporter code number shall make no export or import unless specifically exempted.This number shall be issued by DGFT. c)The provisions given in Handbook shall govern import of samples. d) Import of gifts shall be permitted where such goods are otherwise freely importable under this policy. e)Export of samples and Free of charge goods shall be governed by the provisions given in the Hand Book. f)All export contracts currency and invoices shall be denominated in freelyconvertible currency or Indian Rupees but the export proceeds shall be realized infreely convertible currency. g)Goods including edible items of value not exceeding Rs.1,00,000/- in a licensing year, may be exported as a gift. h)Goods imported may be exported in the same or substantially the same formwithout a license/certificate/permission provided that the item to be imported orexported is not mentioned as restricted for Import or Export in the ITC. i)A license shall contain such terms and conditions as may be specified by thelicensing authority may include the quantity, description and value of goods,actual user, the value of addition to be achieved if any. j)Every license shall be valid for the period of validity specified in the license. III PROMOTIONAL MEASURES: 1.Central Assistance to States: State governments shall be encouraged to fully participate in encouraging exports fromtheir respective states.For this purpose, suitable provisions shall be made in the AnnualPlan of the Department of commerce for allocation of funds to the states on the twincriteria of gross exports and the rate of growth of exports from different states.The statesshall utilize this amount for developing complementary and critical infrastructure such asrods connecting production centers and creation of new state level economic processingzones, industrial parks etc. 2.Market Access Initiative: Financial assistance shall be available under this scheme to the Economic ProcessingZones, industry and trade associations etc., on the basis of the competitive merits ofproposal received in this regard for marketing studies on country product focus approachbasis, participation in international trade fairs, seminars, buyer-seller meet etc. 3.Towns of Export Excellence:

ABDUL GHORI

The industrial cluster towns that export substantial portion of their products, which areworld class, should be granted recognition with a view to maximize their export profile.The common service providers in these towns should be entitled for facility underdifferent schemes offered by the Govt. for export promotion. Selected towns producinggoods of Rs.1000 crores or more will be notified as Towns of Export Excellence on thebasis of Potential for growth in exports. 4.Special Focus on Cottage and Handicraft sector: The small-scale sector along with the cottage and Handicraft sector has beencontributing to more than half of the total exports of the country. The cottage andhandicraft sector, which mostly employs artisan and rural people, contributessignificantly to this effort.In recognition of the export performance of this sector and tofurther increase its competitiveness, the following facilities shall be extended to this sector. The units shall be eligible for funds from Market Access Imitative scheme. Under EPCG scheme, these units will not be required to maintain average level of exports. The units shall be entitled to the benefit of export house status on achieving lowertotal export/deemed export performance of Rs.15 crores during the precedingthree licensing years. They are also entitled to duty free imports of specified items upto 3% of FOB value of their exports.

5.Agri Export Zones: The services, rendered to Agri Export Zones which would be managed andcoordinated by state government would include provision of pre/post harvest treatmentand operations plant protection, processing,. Packing, storage and related R & D etc.Units Agri export zones would be entitled for all the facilities available for exports ofgoods in terms of provisions of the respective schemes. 6.Brand Promotion and Quality: The central government will extend support and assistance to trade and industry tolaunch a nationwide programme on quality awareness and to promote the concept of totalquality management. The Regional Sub-Committee on quality complaints shallinvestigate quality complaints received from foreign buyers. 7.Status Certificate Merchant as well as manufacturer exporters, service providers, Export Oriented Unitsshall be eligible for such recognition. The status holders shall be eligible for thefollowing new\special facilities: License/certificate/Permissions and customs clearances for both imports and exports on selfdeclaration basis. Fixation of input-output norms on priority, within 60 days. Exemption from compulsory negotiation of documents through banks. The remittance, however, would continue to be received through banking channels. Enhancement in normal repatriation period from 180 days to 360 days.

ABDUL GHORI

Duty free import entitlement for status subject to some conditions. Alls status certificates shall be valid from 01-04-2002 to 31-03-2007.

8.Service Exports: The Service providers shall be entitled for all the facilities mentioned in the policy. 9.Electronic Data Interchange: Applications received electronically shall be cleared within 24 hours. Apart from the above provisions, benefits and facilities the new Export and Import Policy showed its emphasis through the following schemes: Duty Exemption Scheme Duty Remission Scheme Duty Entitlement Pass Book Scheme Export Promotion Capital Goods Scheme

CONCLUSION In short, the EXIM policy since 1992 acknowledges that the trade can flourish ina regime of substantial freedom. It also recogninses the need for reasonable stability of the policy, by making the duration of the policy 5 years. The implication of the new policy is that survival of a firm will depend on its competitiveness in the globalizing environment and the competitive firms will have plentiful opportunities. Indian firms will have to gear up them selves to survive and to become successful in the emerging borderless world. Export Incentives The Government of India provides various incentives & facilities to the exporter. These export incentives and facilities are as follow. * Duty Drawback (DBK) * Duty Entitlement Passbook Scheme (DEPB) * Focus Market Scheme (FMS) * Focus Product Scheme (FPS). * Duty Exemption Scheme * Vishesh Krishi and Gram Udyog Yojna (VKGUY) * Marketing Development Assistance (MDA) * Export Promotion Capital Goods Scheme * Served from India Scheme * Exchange earner Foreign Currency Account (EEFC A/C) Duty Drawback The duty drawback refers to the refund in respect of central Excise & Custom duties paid by manufacturer and/or exporter in relation to the inputs used for manufacturing of the products. Duty

ABDUL GHORI

drawback is not applicable in the respect of a product if (a)- No excise/custom duties were paid for its manufacturer and/or exporter. (b)- Amount of the drawback is less then 1 % of FOB value.(except where the amount of drawback is more than Rs 500 per shipment) (c) - manufacturer and/or exporter is by 100% EOU/EPZ/SEZ Units. (d)- If manufacturer and/or exporter apply for duty entitlement pass book scheme. Duty Drawback Rates The government of India announces every year on 31 may, the rates of Duty drawback in respect of scheduled items. All such rates are called all industry rates. The rates indicated custom & excise duty allocation. These rates are generally made effective for one year from 1 June. In case duty drawback rates are not announced for a product, then you can submit an application in the prescribed form for determination of specific rate of duty drawback for the particles product. Such a rate is known as Brand rate. If the rate of duty drawback is less then 80 % of the duties paid then the exporter can apply for its upwards revision in prescribes form. Duty Drawback Under EDI System In all custom station where EDI system has been introduced for processing of shipping documents, the exporter are not required to file duty drawback claims, such claims are processed simultaneously with shipping documents. For receiving this amount you have to be maintain a bank account with a bank, which is link with customhouse. Duty Entitlement Pass Book (DEPB) Under the Duty Entitlement Pass Book (DEPB) scheme, exporter is eligible to claim credit as specified percentage of FOB value if exports made in freely convertible currency. The rate of Duty Entitlement Pass Book (DEPB) is announced by DGFT. The rates of Duty Entitlement Pass Book (DEPB) are decided by DGFT after every 5 years but they have right to change the rates at nay time. Vishesh krishi And Gram Udyog Yojna The objective of this scheme is to prompt the export of fruits, vegetables, flower, minor forest product and their value added product. Export of agricultural product shall be entitled for duty credit scrip equivalent to 5 % of FOB value of exports for each licensing year. Focus Market Scheme Government of India gives the duty credit scrip equivalent to 2.5 % of FOB value of exports to some countries to increase the export in these countries.

ABDUL GHORI

Focus Product Scheme Government of India gives the duty credit scrip equivalent to 1.25 % of FOB value of exports to some products to increase the export of these products.

Export Promotion Capital Goods Scheme (EPCG) According to this scheme, a domestic manufacturer can import machinery and plant without paying customs duty or settling at a concessional rate of customs duty. But his undertakings should be as mentioned below: Customs Duty Rate 10% Export Obligation 4 times exports (on FOB basis) of CIF value of machinery. 6 times exports (on FOB basis) of CIF value of machinery or 5 times exports on net foreign earnings basis of CIF value of machinery. 6 times exports (on FOB basis) of CIF value of machinery or 5 times exports on net foreign earnings basis of CIF value of machinery. Time 5 years

Nil in case CIF value is Rs200mn or more.

8 years

Nil in case CIF value is Rs50mn or more for agriculture, aquaculture, animal husbandry, floriculture, horticulture, poultry and sericulture.

8 years

ABDUL GHORI

Вам также может понравиться

- Import Procedure and DocumentationДокумент14 страницImport Procedure and DocumentationBalkar SinghОценок пока нет

- ProductДокумент60 страницProductAbhinav SachdevaОценок пока нет

- A Study On Causes of Fluctuations in The Exchange Rate of INR Vs USDДокумент21 страницаA Study On Causes of Fluctuations in The Exchange Rate of INR Vs USDAbilasha YadavОценок пока нет

- Factors Affecting Marketing MixДокумент11 страницFactors Affecting Marketing Mixmanjusri lalОценок пока нет

- International Production TheoryДокумент49 страницInternational Production Theorykoodhorah0% (1)

- Export Promotion and Import Substitution Notes ofДокумент12 страницExport Promotion and Import Substitution Notes ofProud IndianОценок пока нет

- 6 Pricing ApprochesДокумент8 страниц6 Pricing ApprocheskmvilasОценок пока нет

- Terms of TradeДокумент3 страницыTerms of TradeRavi KiranОценок пока нет

- Product Classification: - Products, by Definition Include - Product Should Be Considered AsДокумент26 страницProduct Classification: - Products, by Definition Include - Product Should Be Considered AsMylavarapu SatyamachirajuОценок пока нет

- International Trade Law QUESTION PAPER 2020Документ1 страницаInternational Trade Law QUESTION PAPER 2020Himanshu Dargan67% (3)

- International Business EnvironmentДокумент3 страницыInternational Business EnvironmentNeelabh KumarОценок пока нет

- Assignment 2 of International MarketingДокумент4 страницыAssignment 2 of International MarketingShashwat ShuklaОценок пока нет

- Financial Modeling Question PaperДокумент2 страницыFinancial Modeling Question PaperPooja NairОценок пока нет

- Foreign Exchange &Документ13 страницForeign Exchange &Amal JerryОценок пока нет

- Marketing Mix PriceДокумент23 страницыMarketing Mix Priceshail_pariОценок пока нет

- 2.strategic IntentДокумент23 страницы2.strategic IntentAnish ThomasОценок пока нет

- IE GA Notes - 1 PDFДокумент113 страницIE GA Notes - 1 PDFsurajdhunnaОценок пока нет

- International EconomicsДокумент15 страницInternational EconomicsKathy MorrisОценок пока нет

- International Pricing StrategiesДокумент19 страницInternational Pricing StrategiesshailuОценок пока нет

- CH 5 International MarketingДокумент26 страницCH 5 International MarketingyoanesalimОценок пока нет

- Chapter 1 - Introduction: Definition of International MarketingДокумент67 страницChapter 1 - Introduction: Definition of International MarketingMala niveОценок пока нет

- Effects of Foreign Exchange Rates On Indian EconomyДокумент43 страницыEffects of Foreign Exchange Rates On Indian EconomyMohamed Rizwan0% (1)

- International EntrepreneurshipДокумент16 страницInternational EntrepreneurshipVinay RaoОценок пока нет

- Key Trends in Global TradeДокумент44 страницыKey Trends in Global TradesornamalathiОценок пока нет

- Euro-Currency Market DNCДокумент44 страницыEuro-Currency Market DNCmadhurakhanganОценок пока нет

- International Marketing - Assignment OneДокумент7 страницInternational Marketing - Assignment OneBelle TaylorОценок пока нет

- Free Trade NotesДокумент15 страницFree Trade Noteschrisr-hОценок пока нет

- Incoterms: Eneral NformationДокумент4 страницыIncoterms: Eneral NformationrooswahyoeОценок пока нет

- International Marketing ManagementДокумент3 страницыInternational Marketing ManagementprasadkulkarnigitОценок пока нет

- International MarketingДокумент40 страницInternational MarketingThanga DuraiОценок пока нет

- Import - Export Policy of IndiaДокумент13 страницImport - Export Policy of Indiaravi pratapОценок пока нет

- Strategy Indira.1Документ20 страницStrategy Indira.1Praveen MishraОценок пока нет

- Lecture Class - 4 - International Parity RelationshipsДокумент23 страницыLecture Class - 4 - International Parity Relationshipsapi-19974928Оценок пока нет

- Constraints To International MarketingДокумент52 страницыConstraints To International Marketingrohitbatra100% (2)

- Trade BarriersДокумент4 страницыTrade BarriersNikhl MahajanОценок пока нет

- GATT To WTO PesentationДокумент13 страницGATT To WTO PesentationsusanОценок пока нет

- Managerial EconomicsДокумент7 страницManagerial EconomicsAravind 9901366442 - 9902787224Оценок пока нет

- Key Statistics and Trends: in International TradeДокумент35 страницKey Statistics and Trends: in International Tradetatiana postolachi100% (1)

- Export Import PolicyДокумент11 страницExport Import Policypromilagoyal100% (1)

- Balance of PaymentsДокумент14 страницBalance of Paymentsনীল রহমানОценок пока нет

- Differences Between Domestic and Foreign MarketsДокумент2 страницыDifferences Between Domestic and Foreign MarketsChandini PriyaОценок пока нет

- MBA Notes - Nature and Scope of Marketing - e Notes MBAДокумент3 страницыMBA Notes - Nature and Scope of Marketing - e Notes MBAAravind KingОценок пока нет

- Devaluation of RupeeДокумент24 страницыDevaluation of Rupeesweetjiya2010Оценок пока нет

- Government Expenditure and Revenue Scotland 2011-2012Документ94 страницыGovernment Expenditure and Revenue Scotland 2011-2012Gordon LoganОценок пока нет

- Foreign Trade Policy of India (Need, Objectives, Features of FTP 2009-2014)Документ17 страницForeign Trade Policy of India (Need, Objectives, Features of FTP 2009-2014)Shitansh NigamОценок пока нет

- Cost-Effectiveness of Outsourcing Local Government Revenue Collection in Tanzania: The Case of Kinondoni and Morogoro Municipal CouncilsДокумент18 страницCost-Effectiveness of Outsourcing Local Government Revenue Collection in Tanzania: The Case of Kinondoni and Morogoro Municipal CouncilsGlobal Research and Development ServicesОценок пока нет

- Chapter - 5 - International Trade Theory - Updated - 20.02.2015Документ16 страницChapter - 5 - International Trade Theory - Updated - 20.02.2015AylalaОценок пока нет

- Regional Integrations IBMДокумент64 страницыRegional Integrations IBMdileepsuОценок пока нет

- The Product Life Cycle TheoryДокумент6 страницThe Product Life Cycle TheoryAyiik ToktookОценок пока нет

- Theories of Foreign ExchangeДокумент19 страницTheories of Foreign Exchangerockstarchandresh0% (1)

- International Marketing Research ExplanationДокумент3 страницыInternational Marketing Research ExplanationAngelie Shan NavarroОценок пока нет

- Changing Role of WtoДокумент33 страницыChanging Role of Wtorimpyanita100% (1)

- Bangladesh Trade PoliciesДокумент20 страницBangladesh Trade Policieskartik jainОценок пока нет

- Differences in CulturesДокумент28 страницDifferences in CulturesNader DohaiaОценок пока нет

- Marketing Information Systems-1Документ27 страницMarketing Information Systems-1Aaqib rajputОценок пока нет

- Export Promotion MeasuresДокумент3 страницыExport Promotion MeasuresRammi BeygОценок пока нет

- Report On RMG Industry Bangladesh - Economic PerspectiveДокумент87 страницReport On RMG Industry Bangladesh - Economic PerspectiveRuhin Afrin Joyee100% (1)

- India GST For Beginners by Jayaram Hiregange, Deepak RaoДокумент108 страницIndia GST For Beginners by Jayaram Hiregange, Deepak Raonarasimma8313Оценок пока нет

- Export Promotion: Presented by Rudra Sharma Sanjib BorthakurДокумент32 страницыExport Promotion: Presented by Rudra Sharma Sanjib BorthakurkanikabagariaОценок пока нет

- Duty Entitlement Pass Book Scheme (DEPB)Документ25 страницDuty Entitlement Pass Book Scheme (DEPB)Abirami VasudevanОценок пока нет

- Fitzgerald TransformationOpenSource 2006Документ13 страницFitzgerald TransformationOpenSource 2006muthu.manikandan.mОценок пока нет

- John Lewis Snead v. W. Frank Smyth, JR., Superintendent of The Virginia State Penitentiary, 273 F.2d 838, 4th Cir. (1959)Документ6 страницJohn Lewis Snead v. W. Frank Smyth, JR., Superintendent of The Virginia State Penitentiary, 273 F.2d 838, 4th Cir. (1959)Scribd Government DocsОценок пока нет

- Political Teaching of T. HobbesДокумент15 страницPolitical Teaching of T. HobbesАЛЬБИНА ЖАРДЕМОВАОценок пока нет

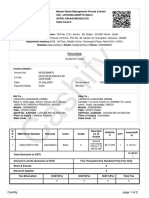

- FM Cia 3Документ14 страницFM Cia 3MOHAMMED SHAHIDОценок пока нет

- Bill Iphone 7fДокумент2 страницыBill Iphone 7fyadawadsbОценок пока нет

- COM670 Chapter 5Документ19 страницCOM670 Chapter 5aakapsОценок пока нет

- Britmindogroupcompanyprofile PDFДокумент20 страницBritmindogroupcompanyprofile PDFSatia Aji PamungkasОценок пока нет

- Davao October 2014 Criminologist Board Exam Room AssignmentsДокумент113 страницDavao October 2014 Criminologist Board Exam Room AssignmentsPRC Board0% (1)

- Role of The Head of Internal AuditДокумент28 страницRole of The Head of Internal Auditsaiful2522Оценок пока нет

- The People Who Matter Most: P. SainathДокумент9 страницThe People Who Matter Most: P. SainathkannadiparambaОценок пока нет

- Week 4, 5, 6 Adjustments and Financial Statement Prep - ClosingДокумент61 страницаWeek 4, 5, 6 Adjustments and Financial Statement Prep - ClosingAarya SharmaОценок пока нет

- Vak Dec. '21 PDFДокумент28 страницVak Dec. '21 PDFMuralidharanОценок пока нет

- Bookkeeping Exercises 2022Документ6 страницBookkeeping Exercises 2022Anne de GuzmanОценок пока нет

- Meteorology - Rain Measures - Specification: Indian StandardДокумент8 страницMeteorology - Rain Measures - Specification: Indian Standardjibeesh cmОценок пока нет

- US vs. TANDOCДокумент2 страницыUS vs. TANDOCRay MondОценок пока нет

- 1394308827-Impressora de Etiquetas LB-1000 Manual 03 Manual Software BartenderДокумент55 страниц1394308827-Impressora de Etiquetas LB-1000 Manual 03 Manual Software BartenderMILTON LOPESОценок пока нет

- Alternative Approaches and Best Practices Potentially Benefiting TheДокумент54 страницыAlternative Approaches and Best Practices Potentially Benefiting Thechiffer venturaОценок пока нет

- China Signposts: A Practical Guide For Multinationals in 2022Документ16 страницChina Signposts: A Practical Guide For Multinationals in 2022APCO WorldwideОценок пока нет

- Celebration of International Day For Street ChildrenДокумент3 страницыCelebration of International Day For Street ChildrenGhanaWeb EditorialОценок пока нет

- First MassДокумент28 страницFirst Masstrixie lavigne65% (23)

- Digest NegoДокумент9 страницDigest NegoMichael RentozaОценок пока нет

- Complaint LettersДокумент3 страницыComplaint LettersPriyankkaa BRОценок пока нет

- Jashim Otobi Furniture: Proprietor: Md. Jashim SheikhДокумент2 страницыJashim Otobi Furniture: Proprietor: Md. Jashim SheikhAr-rahbar TravelsОценок пока нет

- Labour and Industrial Law: Multiple Choice QuestionsДокумент130 страницLabour and Industrial Law: Multiple Choice QuestionsShubham SaneОценок пока нет

- GR No. 186417 People vs. Felipe MirandillaДокумент1 страницаGR No. 186417 People vs. Felipe MirandillaNadine GabaoОценок пока нет

- First Law of ThermodynamicsДокумент21 страницаFirst Law of ThermodynamicsMariam50% (2)

- Share INTRODUCTION TO CRIMINOLOGYДокумент9 страницShare INTRODUCTION TO CRIMINOLOGYDonbert AgpaoaОценок пока нет

- United States v. Salvatore Salamone, 902 F.2d 237, 3rd Cir. (1990)Документ6 страницUnited States v. Salvatore Salamone, 902 F.2d 237, 3rd Cir. (1990)Scribd Government DocsОценок пока нет

- Business School: University of Dar Es SalaamДокумент5 страницBusiness School: University of Dar Es SalaamCosta Nehemia MunisiОценок пока нет

- Act of State DoctrineДокумент6 страницAct of State Doctrineaquanesse21Оценок пока нет