Академический Документы

Профессиональный Документы

Культура Документы

Provident

Загружено:

Ben MaoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Provident

Загружено:

Ben MaoАвторское право:

Доступные форматы

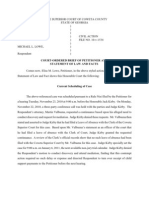

Page 1 of 3

Provident Bank Southern California Wholesale Ratesheets

Indicies

WSJ 1 Year Libor

Prime Rate

0.919%

3.250%

1 Yr Treasury

0.110%

Monday, October 24, 2011

8:14 AM

2011-353

Price Code

Loan Operation Center 1-800-733-3657

10370 Commerce Center, Ste 200, Rancho Cucamonga, CA 91730

Jodi Crocker/Regional Manager

909-238-9090 jcrocker@myprovident.com

Account Executives

Melinda Marin 310-612-8117 mmarin@myprovident.com

Debi Tambellini 949-355-6226 tdebim@aol.com

Wendy Hughes 714-330-4511 whughes@myprovident.com

Sue Crocker 818-515-1390 scrocker@myprovident.com

Linda Kelly 714-345-1794 lkelly@myprovident.com

Patrick Phelan 909-237-2918 pphelan@myprovident.com

Andy Luu 949-885-6134 aluu@myprovident.com

Jim Ward 619-985-5626 jward@myprovident.com

Informational Tips

Visit our Website @ www.pbmwholesale.com

All Locks must be Submitted by 4:00 pm PST

Christina Hosseini 909-758-6282 chosseini@myprovident.com

Gina Koenen 951-403-0567 gkoenen@myprovident.com

Jeff Warner 909-239-1807 jwarner@myprovident.com

Amy Black 707-753-0929 amymtg@gmail.com

Vera Ybarra 619-518-4023 vybarra@myprovident.com

Cindy Morua 310-968-0898 cmorua@myprovident.com

Gilda Crovetti 661-803-6629 gcrovetti@myprovident.com

PBM Extension and Relock Policies

Extensions (Locks not Expired)

1st & 2nd

Days

Extensions

4 Days

30 Days TBD Delivery Dates for Today

10/31/2011

45 Days TBD Delivery Dates for Today

11/7/2011

Effective 9/14/2011 all Refi TBD locks must be locked for 45 days (except

FHA streamline)

7 Days

Cost

0.125

0.250

15 Days

0.375

3rd Extension and Relocks

Worse Case Pricing Plus .125% Cost

For 15 Day Lock

EFFECTIVE IMMEDIATELY!!!!!!

MAX REBATE EXEMPTION

Expiration Dates on Today's Locks

15 Day Lock

11/8/2011

30 Day Lock

11/23/2011

45 Day Lock

12/8/2011

On loan transactions where excess rebate is needed to absorb closing

cost, PBM will allow to exceed the MAX REBATE of 3.0% on the

ratesheet with a .50% price adjustment up to 4% Rebate. This will be

avalable for the following products: PF10, PF11, PF20, PF06, P13H,

PF58, PF57, P13F, P23F, PF13, PF23, FHAF, FHAJ, VAFX. These

transcations must be locked through the WHOLESALE COORDINATOR

until furthur notice.

Loan Officer Compensation Disclosure

This Published Rate Sheet does not include any Loan Officer Compensation. Please make sure you adjust this Rate Sheet with

your Compensation Plan with Provident Bank Mortgage before quoting your customers. If you are not sure what your

Compensation Plan is with Provident Bank Mortgage, please click this link https://www.pbmdirect.com/broker/ and then sign on to

the Broker Portal to get your Compensation Plan.

Classic Conforming Fixed Rate Products

Rate

5.125

4.999

4.875

4.750

4.625

4.500

4.375

4.250

4.125

3.999

3.875

3.750

30 Year Fixed Rate

20 Year Fixed Rate

15 Day

(4.000)

(3.875)

(3.750)

(3.500)

(3.125)

(3.000)

(2.750)

(2.125)

(1.500)

(1.125)

0.375

1.000

Rate

15 Day

30 Day

5.125

(4.125)

(4.000)

4.999

(4.000)

(3.875)

4.875

(3.875)

(3.750)

4.750

(3.625)

(3.500)

4.625

(3.250)

(3.125)

4.500

(3.125)

(3.000)

4.375

(2.875)

(2.750)

4.250

(2.250)

(2.125)

4.125

(1.625)

(1.500)

HomePath Fico/LTV Adjustments

30 Day

(3.875)

(3.750)

(3.625)

(3.375)

(3.000)

(2.875)

(2.625)

(2.000)

(1.375)

(1.000)

0.500

1.125

Product Code: PF10

Maximum Rebate is 3.00%

3.999

15 Day

30 Day

(2.750)

(2.625)

(2.500)

(2.375)

(2.375)

(2.250)

(2.125)

(2.000)

(1.750)

(1.625)

(1.500)

(1.375)

(1.250)

(1.125)

(1.125)

(1.000)

(0.500)

(0.375)

Product Code: PF20

Maximum Rebate is 3.00%

Fico

LTV

<=60

60.01-70

70.01-75

75.01-80

80.01-85

85.01-90

90.01-97

85.01-97

620-639

640-659

660-679

680-699

700-719

720-739

>=740

0.750

1.500

3.000

3.000

n/a

0.500

1.250

2.500

3.000

n/a

0.500

1.000

2.000

2.500

n/a

n/a

n/a

n/a

n/a

n/a

n/a

0.000

0.500

1.250

1.750

n/a

n/a

n/a

(0.125)

0.500

0.750

1.000

n/a

n/a

n/a

(0.250)

0.000

0.250

0.500

0.500

0.500

0.500

(0.250)

0.000

0.000

0.250

0.250

0.250

0.250

n/a

n/a

2.500

1.500

1.000

0.500

0.250

Conforming Fixed DU Refi Plus Fico/LTV Price Adjustments (Terms Greater >15 years)

(1.125)

Product Code: PF11

Maximum Rebate is 3.00%

Fico

LTV

85.01-90

90.01-95

95.01-105

620-639

640-659

660-679

680-699

700-719

720-739

>=740

If LTV is lower then 85.01% fico adj. above applies. Max Cap on DU Refi Plus Adjustments is 2.00%

3.000

3.000

2.500

1.500

0.750

0.250

0.000

3.000

3.000

2.500

1.500

0.750

0.250

0.000

3.750

3.250

2.750

1.750

1.500

1.000

1.000

10 Year Fixed Rate

15 Year Fixed Rate

Rate

4.250

4.125

4.000

3.875

3.750

3.625

3.500

3.375

3.250

(1.250)

Conforming Fixed Rate Price Adjustments

Conforming Fixed Fico/LTV Price Adjustments (TERMS GREATER THAN 15 YEARS)

Rate

4.250

4.125

4.000

3.875

3.750

3.625

3.500

3.375

3.250

15 Day

30 Day

(2.875)

(2.750)

(2.625)

(2.500)

(2.500)

(2.375)

(2.250)

(2.125)

(1.875)

(1.750)

(1.625)

(1.500)

(1.375)

(1.250)

(1.250)

(1.125)

(0.625)

(0.500)

Product Code: PF06

Maximum Rebate is 3.00%

HomePath Price Adjustments (Other Price Adjustments Apply)

0.250

1.000

Home Path Transaction

LTV 80.01 - 85%

1.750

1.750

LTV 85.01 - 90%

HomePath High Balance

2.250

2.500

LTV 90.01 - 95%

Investment LTV 75.01 -80%

2.750

3.625

Investment LTV 80.01 -85%

LTV 95.01 - 97%

HomePath Product Codes: P13H 30 Year Fixed/P22H 15 Year Fixed

Conforming Fixed Cashout Price Adjustments

Cashout Adjustments

LTV <= 60%

60.01-70% LTV

70.01-75% LTV

75.01-80% LTV

620-639

0.250

1.250

1.500

2.750

640-659

0.250

1.250

1.250

2.250

660-699

0.250

0.750

0.750

1.500

700-719

0.000

0.625

0.625

0.750

720-739

0.000

0.625

0.625

0.750

>=740

0.000

0.250

0.250

0.500

Miscellaneous Adjustments

Investment Purch/RT Refi <=75% LTV

Investment Cashout Refi <=75% LTV

Investment Purchases only 80% LTV

DU Refi Plus Investment

2 Units

3-4 Units

Waive Escrows

Investor Specific

45 Day Lock from 30 Day Price

Rapid Appreciation/ 90 day Flip

Ficos < 720

LTV <=65% & CLTV 80.01 - 95%

LTV 65.01-75% & CLTV 80.01 - 95%

LTV > 75% & CLTV 76.01 - 95%

Loan Amounts $50,000 to $79,999

2.000

Loan Amounts $80,000 to $99,999

2.250

Loan Amounts $100,000 to $119,999

3.000

Condo LTV >75%

3.000

DU Refi Plus Only with CLTV >95%

1.000

DU Refi Plus Only High LTV 95.01%-97%

1.500

DU Refi Plus Only High LTV 97.01-105%

0.250

Greater than 4 Financed Properties

0.250

0.250

0.500

CLTV Adjustments

Ficos >=720

0.500

LTV <=65% & CLTV 80.01 - 95%

0.750

LTV 65.01-75% & CLTV 80.01 - 95%

1.000

LTV > 75% & CLTV 76.01 - 95%

1.000

0.500

0.250

0.750

1.500

0.500

1.000

1.000

0.250

0.500

0.750

Elite Conforming High Balance Fixed Rate and Arm Products

30 Year Fixed Rate

Rate

5.125

4.999

4.875

4.750

4.625

4.500

4.375

4.250

4.125

3.999

3.875

15 Day

(2.500)

(2.375)

(2.250)

(2.000)

(1.625)

(1.500)

(1.250)

(0.625)

0.000

0.375

1.875

30 Day

(2.375)

(2.250)

(2.125)

(1.875)

(1.500)

(1.375)

(1.125)

(0.500)

0.125

0.500

2.000

Product Code: PF58

Maximum Rebate is 3.00%

15 Year Fixed Rate

Rate

4.625

4.500

4.375

4.250

4.125

4.000

3.875

3.750

3.625

3.500

15 Day

(1.125)

(1.000)

(0.875)

(0.875)

(0.625)

(0.500)

(0.250)

0.125

0.375

0.625

30 Day

(1.000)

(0.875)

(0.750)

(0.750)

(0.500)

(0.375)

(0.125)

0.250

0.500

0.750

Product Code: PF57

Maximum Rebate is 3.00%

5/1 Arm

7/1 Arm

2.250% Margin & 5/2/5 Caps

Rate

15 Day

30 Day

3.750

(0.500)

(0.375)

3.625

(0.375)

(0.250)

3.500

(0.250)

(0.125)

3.375

0.000

0.125

3.250

0.500

0.625

3.125

1.000

1.125

2.250% Margin & 5/2/5 Caps

Rate

15 Day

30 Day

4.000

1.000

1.125

3.875

0.750

0.875

3.750

0.875

1.000

3.625

1.000

1.125

3.500

1.250

1.375

3.375

1.750

1.875

3.250

2.250

2.375

3.125

2.750

2.875

Conforming High Balance Price Adjustments

Conforming High BalanceFico/LTV Price Adjustments (TERMS GREATER THAN 15 YEARS)

Fico

LTV

<=60

60.01-70

70.01-75

75.01-80

80.01-85

85.01-90

620-639

640-659

660-679

680-699

700-719

720-739

>=740

0.750

1.500

3.000

3.000

3.000

0.500

1.250

2.500

3.000

3.250

0.500

1.000

2.000

2.500

2.750

0.000

0.500

1.250

1.750

1.750

1.750

(0.125)

0.500

0.750

1.000

1.000

1.000

(0.250)

0.000

0.250

0.500

0.500

0.500

(0.250)

0.000

0.000

0.250

0.250

0.250

n/a

n/a

n/a

Max 75% LTV Purchase/Rate & Term Refinance Arm

Conforming Fixed/Arm High Balance DU Refi Plus Fico/LTV Price Adjustments (Terms >15 years)

Fico

LTV

85.01-90

90.01-95

95.01-105

620-639

640-659

660-679

680-699

700-719

720-739

>=740

If LTV is lower then 85.01% fico adj. above applies. Max Cap on DU Refi Plus Adjustments is 2.00%

3.000

3.000

2.500

1.500

0.750

0.250

0.000

3.000

3.000

2.500

1.500

0.750

0.250

0.000

3.750

3.250

2.750

1.750

1.500

1.000

1.000

Miscellaneous Adjustments

Investment Purch/RT Refi <=65% LTV

Investment Cashout Refi <=65% LTV

DU Refi Plus Investment

2 Units

3-4 Units

Waive Escrows

Cashout Adjustment <=60% LTV MAX

Rapid Appreciation/ 90 day Flip

Investor Specific

2.000

n/a

3.000

1.000

1.500

0.250

1.000

0.500

0.250

DTI 45.01% to 50%

DTI 50.01% to 55%

DTI > 55%

Condo LTV >75%

DU Refi Plus Only with CLTV >95%

DU Refi Plus Only High LTV 95.01%-97%

DU Refi Plus Only High LTV 97.01-105%

45 Day Lock from 30 Day Price

0.125

0.250

n/a

0.750

1.500

0.500

1.000

0.250

CLTV Adjustments

Product Code: CM52

Maximum Rebate is 3.00%

Product Code: CM72

Maximum Rebate is 3.00%

Ficos < 720

LTV <=65% & CLTV 80.01 - 95%

LTV 65.01-75% & CLTV 80.01 - 95%

LTV > 75% & CLTV 76.01 - 95%

0.500

0.750

1.000

Ficos >=720

LTV <=65% & CLTV 80.01 - 95%

LTV 65.01-75% & CLTV 80.01 - 95%

LTV > 75% & CLTV 76.01 - 95%

0.250

0.500

0.750

Page 2 of 3

Provident Bank Southern California Wholesale Ratesheets

Monday, October 24, 2011

8:14 AM

2011-353

Price Code

Loan Operation Center 1-800-733-3657

10370 Commerce Center Park, Ste 200, Rancho Cucamonga, CA 91730

Expiration Dates on Today's Locks

15 Day Lock

11/8/2011

11/23/2011

30 Day Lock

45 Day Lock

12/8/2011

Deluxe Conforming Libor Arm Products

3/1 Libor Arm

5/1 Libor Arm

2.250% Margin & 2/2/6 Caps

Rate

15 Day

30 Day

4.250

(0.500)

(0.375)

4.125

(0.500)

(0.375)

4.000

(0.375)

(0.250)

3.875

(0.125)

0.000

3.750

0.250

0.375

2.250% Margin & 5/2/5 Caps

Rate

15 Day

30 Day

3.750

(2.000)

(1.875)

3.625

(1.750)

(1.625)

3.500

(1.625)

(1.500)

3.375

(1.375)

(1.250)

3.250

(1.250)

(1.125)

3.125

(1.125)

(1.000)

3.000

(0.750)

(0.625)

2.875

(0.500)

(0.375)

Conforming Arm Price Adjustments

Conforming Arm Fico/LTV Price Adjustments (TERMS GREATER THAN 15 YEARS)

Fico

LTV

<=60

60.01-70

70.01-75

75.01-80

80.01-85

85.01-90

620-639

640-659

660-679

680-699

700-719

720-739

>=740

0.750

1.500

3.000

3.000

3.000

0.500

1.250

2.500

3.000

3.250

0.500

1.000

2.000

2.500

2.750

n/a

n/a

n/a

0.000

0.500

1.250

1.750

1.750

1.750

(0.125)

0.500

0.750

1.000

1.000

1.000

(0.250)

0.000

0.250

0.500

0.500

0.500

(0.250)

0.000

0.000

0.250

0.250

0.250

Conforming Arm DU Refi Plus Fico/LTV Price Adjustments (Terms Greater than 15 years)

Product Code: CM30/C30i

Maximum Rebate is 2.0%

Product Code: CM50/C50i

Maximum Rebate is 2.0%

7/1 Libor Arm

10/1 Libor Arm

2.250% Margin & 5/2/5 Caps

Rate

15 Day

30 Day

4.000

(2.125)

(2.000)

3.875

(2.000)

(1.875)

3.750

(1.875)

(1.750)

3.625

(1.750)

(1.625)

3.500

(1.500)

(1.375)

3.375

(1.375)

(1.250)

3.250

(1.000)

(0.875)

3.125

(0.625)

(0.500)

2.250% Margin & 5/2/5 Caps

Rate

15 Day

30 Day

4.750

(2.250)

(2.125)

4.625

(2.000)

(1.875)

4.500

(1.750)

(1.625)

4.375

(1.500)

(1.375)

4.250

(1.250)

(1.125)

4.125

(1.000)

(0.875)

4.000

(0.750)

(0.625)

3.875

(0.500)

(0.375)

Product Code: CM70/C70i

Maximum Rebate is 2.0%

Product Code: CM10/C10i

Maximum Rebate is 2.0%

Fico

LTV

85.01-90

90.01-95

95.01-105

620-639

640-659

660-679

680-699

700-719

720-739

>=740

If LTV is lower then 85.01% fico adj. above applies. Max Cap on DU Refi Plus Adjustments is 2.00%

3.000

3.000

2.500

1.500

0.750

0.250

0.000

3.000

3.000

2.500

1.500

0.750

0.250

0.000

3.750

3.250

2.750

1.750

1.500

1.000

1.000

Conforming Arm Cashout Price Adjustments

Cashout Adjustments

LTV <= 60%

60.01-70% LTV

70.01-75% LTV

75.01-80% LTV

620-639

0.250

1.250

1.500

2.750

640-659

0.250

1.250

1.250

2.250

660-699

0.250

0.750

0.750

1.500

700-719

0.000

0.625

0.625

0.750

720-739

0.000

0.625

0.625

0.750

>=740

0.000

0.250

0.250

0.500

Miscellaneous Adjustments

Investment Purch/RT Refi <=75% LTV

Investment Cashout Refi <=75% LTV

DU Refi Plus Investment

2 Units

3-4 Units

Waive Escrows

Interest Only (1st 10 Years)

Rapid Appreciation/ 90 day Flip

Investor Specific

Ficos < 720

LTV <=65% & CLTV 80.01 - 95%

LTV 65.01-75% & CLTV 80.01 - 95%

LTV > 75% & CLTV 76.01 - 95%

Loan Amounts $50,000 to $79,999

2.000

Loan Amounts $80,000 to $99,999

2.250

Loan Amounts $100,000 to $119,999

3.000

Condo LTV >75%

1.000

DU Refi Plus Only with CLTV >95%

1.500

DU Refi Plus Only High LTV 95.01%-97%

0.250

DU Refi Plus Only High LTV 97.01-105%

1.000

45

Day Lock from 30 Day Price

0.500

0.250

CLTV Adjustments

Ficos >=720

0.500

LTV <=65% & CLTV 80.01 - 95%

0.750

LTV 65.01-75% & CLTV 80.01 - 95%

1.000

LTV > 75% & CLTV 76.01 - 95%

1.000

0.500

0.250

0.750

1.500

0.500

1.000

0.250

0.250

0.500

0.750

Freddie Mac Standard Conforming Fixed Rate Products

30 Year Conforming Fixed Rate

Rate

5.250

5.125

5.000

4.875

4.750

4.625

4.500

4.375

4.250

4.125

4.000

15 Day

(4.500)

(4.000)

(3.625)

(3.125)

(2.500)

(2.125)

(1.625)

(1.000)

0.125

1.125

1.625

30 Day

(4.375)

(3.875)

(3.500)

(3.000)

(2.375)

(2.000)

(1.500)

(0.875)

0.250

1.250

1.750

Product Code: P13F

Maximum Rebate is 3.00%

Conforming Fixed Rate Price Adjustments

Conforming Fixed Fico/LTV Price Adjustments (TERMS GREATER THAN 15 YEARS)

15 Year Conforming Fixed Rate

Rate

4.750

4.625

4.500

4.375

4.250

4.125

4.000

3.875

3.750

15 Day

(4.375)

(4.125)

(3.875)

(3.500)

(3.125)

(2.750)

(2.500)

(2.125)

(1.625)

30 Day

(4.250)

(4.000)

(3.750)

(3.375)

(3.000)

(2.625)

(2.375)

(2.000)

(1.500)

Fico

LTV

<=60

60.01-70

70.01-75

75.01-80

80.01-85

85.01-90

90.01-95

620-639

640-659

660-679

680-699

700-719

720-739

>=740

0.750

1.500

3.000

3.250

3.250

0.500

1.250

2.750

3.250

3.250

0.500

1.000

2.250

2.750

2.750

n/a

n/a

n/a

n/a

0.000

0.500

1.250

1.750

1.750

1.750

(0.125)

0.500

0.750

1.000

1.000

1.000

1.000

(0.250)

0.000

0.250

0.500

0.500

0.500

0.500

(0.250)

0.000

0.250

0.250

0.250

0.250

0.250

720-739

0.000

0.625

0.625

0.750

>=740

0.000

0.250

0.250

0.500

n/a

n/a

n/a

Conforming Fixed Cashout Price Adjustments

Product Code: P23F

Maximum Rebate is 3.00%

Cashout Adjustments

LTV <= 60%

60.01-70% LTV

70.01-75% LTV

75.01-80% LTV

Miscellaneious Adjustments for all Freddie Mac Products

Investment Purchase/RT Refi <=75% LTV

Investment Purchases 75-80% LTV

Investment Cashout Refi <=75% LTV

Open Access Investment

2-4 Units

Condos LTV> 75% LTV

Loan Amounts $50,000 to $79,999

Loan Amounts $80,00 to $99,999

Loan Amounts $100,000 to $119,999

CLTV > 95% for Open Access Program only

Waived Escrows

45 Day Price from 30 Day Price

Rapid Appreciation/ 90 day Flip

1.750

3.000

2.250

2.500

1.500

0.750

1.000

0.500

0.250

1.500

0.250

0.250

0.500

620-639

0.250

1.250

1.500

2.750

640-659

0.250

1.250

1.250

2.250

660-699

0.250

0.750

0.750

1.500

700-719

0.000

0.625

0.625

0.750

***Product Code: PF13 30 Year / PF23 15 Year Open Access***

Open Access Fico/LTV Price Adjustments (TERMS GREATER THAN 15 YEARS)

Fico

LTV

80.01-90%

90.01-95%

95.01-97%

97.01-105%

620-639

1.750

1.750

1.750

1.750

640-659

660-679

680-699

700-719

If LTV is lower then 80.01% fico adjustment above applies.

1.750

1.750

1.000

0.500

1.750

1.750

0.750

0.500

1.750

1.750

1.250

1.000

1.750

1.750

1.750

1.500

Maximum Cap on Open Access Adjustments is 2.50%

720-739

>=740

0.000

0.000

0.500

1.000

0.000

0.000

0.500

1.000

CLTV Adjustments (All Products)

Ficos < 720

LTV <=65% & CLTV 80.01 - 95%

LTV 65.01-75% & CLTV 80.01 - 95%

LTV > 75% & CLTV 76.01 - 95%

0.500

0.750

1.000

Ficos >=720

LTV <=65% & CLTV 80.01 - 95%

LTV 65.01-75% & CLTV 80.01 - 95%

LTV > 75% & CLTV 76.01 - 95%

0.250

0.500

0.750

Government Fixed Rate and Arm Products

FHA 30 Year Fixed Rate

FHA 5/1 Arm

VA 30 Year Fixed Rate

Rate

15 Day

30 Day

Rate

15 Day

30 Day

Rate

4.500

4.375

4.250

4.125

4.000

3.875

3.750

(5.375)

(5.250)

(4.750)

(3.500)

(3.125)

(2.500)

(2.125)

(5.250)

(5.125)

(4.625)

(3.375)

(3.000)

(2.375)

(2.000)

4.500

4.375

4.250

4.125

4.000

3.875

3.750

(5.000)

(4.875)

(4.375)

(3.125)

(2.750)

(2.125)

(1.750)

(4.875)

(4.750)

(4.250)

(3.000)

(2.625)

(2.000)

(1.625)

4.125

4.000

3.875

3.750

3.625

3.500

3.375

3.250

3.125

3.000

15 Day

30 Day

2.250% Margin & 1/5 Caps

(3.250)

(3.125)

(3.000)

(2.875)

(2.750)

(2.625)

(2.375)

(2.250)

(2.250)

(2.125)

(2.125)

(2.000)

(1.875)

(1.750)

(1.625)

(1.500)

(0.500)

(0.375)

(0.375)

(0.250)

FHA/VA Price Adjustments

Base Loan Amounts $50,000 to $99,999

0.500

Base Loan Amounts $100,000 to $119,999

0.375

Base Loan Amounts $120,000 to $149,999

0.250

Base Loan Amounts > $417,000 (FHAJ)

0.750

Base Loan Amounts > $417,000 (VA)

1.250

FHA Fico Scores 620 to 639-Discontinued until further notice

VA Fico Scores 620 to 639-Discontinued until further notice

FHA & VA Fico Scores 640 to 659

0.375

Fico Scores 720 +

(0.125)

45 Day Lock from 30 Day Price

0.250

Investor Specific

0.250

FHA Fixed ONLY Rapid Appreciation/ 90 day Flip

1.000

*Minimum Fico Scores 640 for FHA Flips & High Balance

FHAF: Base Loan Amounts Less than or Equal to $417,000

FHAJ: Base Loan Amounts Greater than $417,000

Product Code: FHAF

Maximum Rebate is 3.00%

Product Code: VAFX

Maximum Rebate is 3.00%

FHA 15 Year Fixed Rate

Rate

4.375

4.250

4.125

4.000

3.875

3.750

3.625

3.500

15 Day

(2.750)

(2.375)

(2.125)

(1.875)

(1.625)

(1.500)

(0.750)

(0.500)

30 Day

(2.625)

(2.250)

(2.000)

(1.750)

(1.500)

(1.375)

(0.625)

(0.375)

Product Code: FH15

Maximum Rebate is 3.00%

Rate

15 Day

30 Day

4.375

4.250

4.125

4.000

3.875

3.750

(2.375)

(2.000)

(1.750)

(1.500)

(1.250)

(1.125)

(2.250)

(1.875)

(1.625)

(1.375)

(1.125)

(1.000)

Product Code:

Maximum Rebate is

Product Code: FH5A

Maximum Rebate is 3.00%

Page 3 of 3

Provident Bank Southern California Wholesale Ratesheets

Loan Operation Center 1-800-733-3657

10370 Commerce Center Park, Ste 200, Rancho Cucamonga, CA 91730

Monday, October 24, 2011

8:14 AM

2011-353

Price Code

Expiration Dates on Today's Locks

15 Day Lock

11/8/2011

11/23/2011

30 Day Lock

45 Day Lock

12/8/2011

New Aggressive Jumbo Fixed Rate and Arm Product

5/1 Arm Jumbo

7/1 Arm Jumbo

10/1 Arm Jumbo

2.250% Margin & 5/2/5 Caps

2.250% Margin & 5/2/5 Caps

2.250% Margin & 5/2/5 Caps

30 Year Jumbo Fixed Rate

15 Year Jumbo Fixed Rate

Rate

30 Day

45 Day

Rate

30 Day

45 Day

5.375

(1.750)

(1.500)

5.125

(2.125)

(1.875)

Rate

30 Day

45 Day

Rate

30 Day

45 Day

Rate

30 Day

45 Day

(2.000)

(1.750)

4.750

(2.250)

(2.000)

5.125

(2.125)

(1.875)

5.250

(1.625)

(1.375)

5.000

(2.000)

(1.750)

4.375

5.125

(1.500)

(1.250)

4.875

(1.875)

(1.625)

4.250

(1.875)

(1.625)

4.625

(2.125)

(1.875)

5.000

(2.000)

(1.750)

(1.500)

4.125

(1.750)

(1.500)

4.500

(2.000)

(1.750)

4.875

(1.875)

(1.625)

(1.375)

4.000

(1.625)

(1.375)

4.375

(1.875)

(1.625)

4.750

(1.750)

(1.500)

(1.500)

(1.250)

4.250

(1.750)

(1.500)

4.625

(1.625)

(1.375)

5.000

4.875

(1.375)

(1.250)

(1.125)

(1.000)

4.750

4.625

(1.750)

(1.625)

4.750

(1.125)

(0.875)

4.500

(1.500)

(1.250)

3.875

4.625

(0.750)

(0.500)

4.375

(1.250)

(1.000)

3.750

(1.375)

(1.125)

4.125

(1.625)

(1.375)

4.500

(1.500)

(1.250)

4.500

(0.375)

(0.125)

4.250

(1.250)

(1.000)

4.000

(1.500)

(1.250)

4.375

(1.375)

(1.125)

0.125

0.375

4.125

(0.750)

(0.500)

3.625

4.375

(1.000)

(0.750)

3.500

(1.125)

(0.875)

3.875

(1.250)

(1.000)

4.250

(1.125)

(0.875)

3.375

(0.875)

(0.625)

3.750

(1.000)

(0.750)

4.125

(0.875)

(0.625)

4.250

0.625

0.875

Product Code: JF30G

Maximum Rebate is .75%

4.000

(0.375)

(0.125)

Product Code: JF15G

Maximum Rebate is .75%

Product Code: JA51G

Maximum Rebate is .75%

Product Code: JA71G

Maximum Rebate is .75%

Product Code: JA101G

Maximum Rebate is .75%

Aggressive Fixed and Arm Price Adjustments

Jumbo Fixed Adjustments

Features

Jumbo ARM Adjustments

Features

Adjustments

Adjustments

LTV

<= 60%

60.01 - 65%

65.01 - 70%

70.01 - 75%

>75%

LTV

<= 60%

60.01 - 65%

65.01 - 70%

70.01 - 75%

>75%

<=$1.0M and FICO <720

<=$1.0M and FICO 720-750

<=$1.0M and FICO >750

0.000

(0.125)

(0.250)

0.000

0.000

(0.125)

0.000

0.000

0.000

0.000

0.000

0.000

0.500

0.375

0.250

<=$1.0M and FICO <720

<=$1.0M and FICO 720-750

<=$1.0M and FICO >750

(0.125)

(0.250)

(0.250)

0.000

0.000

(0.125)

0.000

0.000

0.000

0.000

0.000

0.000

0.500

0.375

0.250

>$1.0M <= $1.5M and FICO 720-750

0.000

0.000

0.125

0.125

0.500

>$1.0M <= $1.5M and FICO 720-750

(0.125)

0.125

0.125

0.125

0.500

>$1.0M <= $1.5M and FICO >750

(0.125)

(0.125)

0.125

0.125

0.375

>$1.0M <= $1.5M and FICO >750

(0.125)

0.000

0.125

0.125

0.375

>$1.5M <= $2.0M and FICO 720-750

0.250

0.375

0.500

0.625

1.000

>$1.5M <= $2.0M and FICO 720-750

0.375

0.500

0.625

0.625

1.000

>$1.5M <= $2.0M and FICO >750

0.125

0.250

0.375

0.500

0.875

>$1.5M <= $2.0M and FICO >750

0.250

0.375

0.500

0.500

0.875

Cashout Refinance

2 unit

3 & 4 units

Site Condo

20 Year Term

0.000

0.250

1.000

0.250

0.250

0.500

0.000

0.250

0.250

1.000

0.250

0.250

0.500

0.000

0.375

0.250

1.000

0.250

0.250

n/a

0.000

0.375

0.500

1.000

0.500

0.250

n/a

0.000

0.500

0.500

1.000

0.500

0.250

n/a

0.250

Cashout Refinance

2 unit

3 & 4 units

Site Condo

0.250

0.250

1.000

0.250

0.375

0.250

1.000

0.250

0.500

0.250

1.000

0.250

0.500

0.500

1.000

0.500

0.500

0.500

1.000

0.500

Second Home

DTI>40 and <=45

0.500

0.000

0.500

0.250

n/a

0.250

n/a

0.250

n/a

0.375

(0.250)

0.250

(0.250)

0.250

(0.250)

0.250

(0.250)

0.250

n/a

0.250

FICO >=720

No Escrow

(0.500)

0.250

(0.500)

0.250

(0.500)

0.250

(0.250)

0.250

n/a

0.250

Second Home

DTI>40 and <=45

FICO >=720

No Escrow

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Kodak SWOT Analysis and Financial RatiosДокумент31 страницаKodak SWOT Analysis and Financial RatiosZineb Elouataoui100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Goitom Proposal 2020Документ44 страницыGoitom Proposal 2020GebrekirosОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- MS-44J (Working Capital Management)Документ13 страницMS-44J (Working Capital Management)juleslovefenОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Analysis For Financial Management 10th Edition Higgins Test BankДокумент23 страницыAnalysis For Financial Management 10th Edition Higgins Test BankEdwinMyersnayzsОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Karachi Stock ExchangeДокумент13 страницKarachi Stock Exchangesehrish tahir100% (2)

- Mezzanine Loan and Preferred Equity Comparison ChartДокумент4 страницыMezzanine Loan and Preferred Equity Comparison ChartTuan Nguyen MinhОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Critical Risk Contingency Business ProposalДокумент7 страницCritical Risk Contingency Business ProposalAman jainОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Peaceful Gobal Currency ResetДокумент25 страницThe Peaceful Gobal Currency Resetkaren hudesОценок пока нет

- What is a credit rating? Its types and agencies in IndiaДокумент19 страницWhat is a credit rating? Its types and agencies in IndiaParth MahajanОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Senior High School: Asia Academic School, IncДокумент5 страницSenior High School: Asia Academic School, IncAbdel-Nasser AbdurayaОценок пока нет

- IBBI's Role in Implementing India's Insolvency and Bankruptcy CodeДокумент10 страницIBBI's Role in Implementing India's Insolvency and Bankruptcy CodeGaurav Tripathi0% (1)

- Business Finance Week 1 To 3 Without Answer KeyДокумент29 страницBusiness Finance Week 1 To 3 Without Answer KeyKristel Anne Roquero Balisi100% (1)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Employee Discipline: Finance and Administration ManualДокумент17 страницEmployee Discipline: Finance and Administration ManualAbqary AlonОценок пока нет

- Midterm Examination 2Документ5 страницMidterm Examination 2Timbas TОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Structure and Risks of Investment BanksДокумент28 страницStructure and Risks of Investment BanksShahed A. GhabbouraОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Analysis NikeДокумент16 страницAnalysis NikeMario Mitsuo100% (2)

- Model Financial Statements For Non-Corporate EntitiesДокумент39 страницModel Financial Statements For Non-Corporate EntitiesCA Vinit SharmaОценок пока нет

- 2011.01.20 Statement of Law and Facts Judge - Baldwin - Brief - Elisa Lowe ProSeДокумент16 страниц2011.01.20 Statement of Law and Facts Judge - Baldwin - Brief - Elisa Lowe ProSeelisa_loweОценок пока нет

- Definition of 'Debt Funds': What Is A Mutual Fund?Документ5 страницDefinition of 'Debt Funds': What Is A Mutual Fund?Girish SahareОценок пока нет

- Bridgewater: Global Conditions, Asset Returns and Investment StrategyДокумент341 страницаBridgewater: Global Conditions, Asset Returns and Investment StrategyValueWalk100% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Accounting Textbook Solutions - 8Документ19 страницAccounting Textbook Solutions - 8acc-expertОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Loanable Fund TheoryДокумент2 страницыLoanable Fund TheoryharrycreОценок пока нет

- Building and Enhancing New LiteraciesДокумент7 страницBuilding and Enhancing New LiteraciesQueenie Joy Tamayo BaguioОценок пока нет

- Oblicon - FEBRUARY 2, 2022Документ4 страницыOblicon - FEBRUARY 2, 2022Alona JeanОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Rethinking Banking Institutions in Contemporary Economies: Are There Alternatives To The Status Quo?Документ23 страницыRethinking Banking Institutions in Contemporary Economies: Are There Alternatives To The Status Quo?monetary-policy-reduxОценок пока нет

- Interest - Mini SurveyДокумент1 страницаInterest - Mini SurveyRay FaustinoОценок пока нет

- Extinguishment of ObligationsДокумент4 страницыExtinguishment of ObligationsRussel SirotОценок пока нет

- Ald MergedДокумент31 страницаAld MergedleonardoОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Case Study Russian Ruble Crisis 1998Документ2 страницыCase Study Russian Ruble Crisis 1998Immanuel SolomonОценок пока нет

- Oblicon CasesДокумент117 страницOblicon Casesdianne rosalesОценок пока нет