Академический Документы

Профессиональный Документы

Культура Документы

Sony 00

Загружено:

Abhishek Singh0 оценок0% нашли этот документ полезным (0 голосов)

22 просмотров1 страницаАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

22 просмотров1 страницаSony 00

Загружено:

Abhishek SinghАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

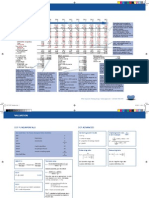

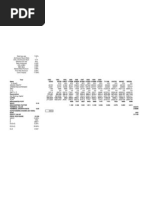

Inputs

Book Value of Equity = Estimated ROE = Capital Expenditures = Depreciation = Current Revenues = Non-cash WC as % of revenue = 1795 5.25% 103 76 2593 8.48%

Debt outstanding = Market Value of Equity = Debt/(Debt +Equity) = Bottom-up Beta = Riskfree Rate = Market Risk Premium =Expected long term growth =

Market Value Book Value 624 624 9306 1795 6.28% 25.80% 1.10 2.00% 4.00% 3%

Output

Estimated FCFE Net Income next year = (Net Cap Ex) (1-DR) = (chg WC) (1-DR) = FCFE Cost of Equity = 94.24 20.64 4.89 68.71 6.40%

Value of Equity =

2020.775

Вам также может понравиться

- Financial PlanningДокумент26 страницFinancial PlanningKevinVdKОценок пока нет

- Valuation Spreadsheet DCFДокумент8 страницValuation Spreadsheet DCFHilal MilmoОценок пока нет

- Equity ValuationДокумент2 424 страницыEquity ValuationMuteeb Raina0% (1)

- Accounting and Finance Formulas: A Simple IntroductionОт EverandAccounting and Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- BUS322Tutorial8 SolutionДокумент10 страницBUS322Tutorial8 Solutionjacklee1918100% (1)

- DCF TakeawaysДокумент2 страницыDCF TakeawaysvrkasturiОценок пока нет

- CPA Review Notes 2019 - BEC (Business Environment Concepts)От EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Рейтинг: 4 из 5 звезд4/5 (9)

- DCF and WACC - Sun by OracleДокумент11 страницDCF and WACC - Sun by OracleAmol Mahajan50% (2)

- Value Stock Tankrich v1.23Документ13 страницValue Stock Tankrich v1.23pareshpatel99Оценок пока нет

- Simplifies LBO ModelДокумент8 страницSimplifies LBO ModelAliya UmairОценок пока нет

- DCF FCFF ValuationДокумент0 страницDCF FCFF ValuationSneha SatyamoorthyОценок пока нет

- Cost of CapitalДокумент26 страницCost of CapitalRiti Nayyar100% (1)

- Eva ProblemsДокумент10 страницEva Problemsazam4989% (9)

- Valuation ModelsДокумент47 страницValuation ModelsAshwin Kumar100% (1)

- Tata India 10 ValuationДокумент117 страницTata India 10 ValuationPankaj GuptaОценок пока нет

- Chapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinДокумент19 страницChapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- Market Assumptions Cal. Year Year Gr. Rate Equity AssumtionsДокумент3 страницыMarket Assumptions Cal. Year Year Gr. Rate Equity AssumtionsAnonymous 31fa2FAPhОценок пока нет

- Brand Name ValueДокумент9 страницBrand Name ValueGanapathiraju SravaniОценок пока нет

- Financial Statement Analysis RatiosДокумент4 страницыFinancial Statement Analysis RatiosSumeet DekateОценок пока нет

- Chapter 14 Excel Supports For Power PointДокумент4 страницыChapter 14 Excel Supports For Power PointRob GuillenОценок пока нет

- Economic Profit Model and APV ModelДокумент16 страницEconomic Profit Model and APV Modelsanket patilОценок пока нет

- Cost of Equity: DR (CA) Anil AroraДокумент41 страницаCost of Equity: DR (CA) Anil AroraladosehrawatОценок пока нет

- CUC International Case Study.: Business Analysis and ValuationДокумент3 страницыCUC International Case Study.: Business Analysis and Valuationvikasmax50100% (2)

- Valuation Models: Aswath DamodaranДокумент47 страницValuation Models: Aswath DamodaranSumit Kumar BundelaОценок пока нет

- Glob CrossДокумент18 страницGlob Crossminhthuc203Оценок пока нет

- FM Case Study 4Документ7 страницFM Case Study 4Arush BahglaОценок пока нет

- Undervalue (DCF)Документ32 страницыUndervalue (DCF)dav3sworldОценок пока нет

- Boeing Financial AnalysisДокумент21 страницаBoeing Financial AnalysisMohamed Ali SalemОценок пока нет

- Economic Profit Model and APV ModelДокумент16 страницEconomic Profit Model and APV Modelnotes 1Оценок пока нет

- LSE-TMX Merger Weighted Average Cost of CapitalДокумент6 страницLSE-TMX Merger Weighted Average Cost of CapitalMartin YauОценок пока нет

- Conta RefreshДокумент1 страницаConta RefreshRenzo Viale PaivaОценок пока нет

- FM II Midterm Formula SheetДокумент1 страницаFM II Midterm Formula SheetSalman J. SyedОценок пока нет

- Apv PDFДокумент9 страницApv PDFAnkit ThakurОценок пока нет

- Market PriceДокумент1 страницаMarket PriceAdeeba NazОценок пока нет

- Boston Beer CompanyДокумент1 страницаBoston Beer CompanyBunny SethiОценок пока нет

- FirmmultДокумент2 страницыFirmmultPro ResourcesОценок пока нет

- Firm Multiples: Current InputsДокумент2 страницыFirm Multiples: Current InputssambarocksОценок пока нет

- Firm Multiples: Current InputsДокумент2 страницыFirm Multiples: Current InputszОценок пока нет

- WACCДокумент3 страницыWACCsalsabilawidyaОценок пока нет

- The Leveraged Buyout of ISSДокумент8 страницThe Leveraged Buyout of ISSAkshay GuptaОценок пока нет

- Excel-Based Model To Value Firms Experiencing Financial DistressДокумент4 страницыExcel-Based Model To Value Firms Experiencing Financial DistressgenergiaОценок пока нет

- Solved ProblemsДокумент24 страницыSolved ProblemsSammir MalhotraОценок пока нет

- Wealth Management: (Page 1 of 2) (Printed Only On One Side)Документ2 страницыWealth Management: (Page 1 of 2) (Printed Only On One Side)mohakbhutaОценок пока нет

- Solutions To Cost of Capital ExercisesДокумент8 страницSolutions To Cost of Capital ExercisesZe GramaxoОценок пока нет

- CH 15 SolДокумент4 страницыCH 15 SolSilviu TrebuianОценок пока нет

- Midterm FA 2012 MBA - v1Документ13 страницMidterm FA 2012 MBA - v1millenlppОценок пока нет

- Business Valuation Models: Two Methods: 1. Discounted Cash Flow 2. Relative ValuesДокумент24 страницыBusiness Valuation Models: Two Methods: 1. Discounted Cash Flow 2. Relative ValuesIndra S ChaidrataОценок пока нет

- Valuasi Saham MppaДокумент29 страницValuasi Saham MppaGaos FakhryОценок пока нет

- Assigment 2Документ5 страницAssigment 2Hager SalahОценок пока нет

- Closure in Valuation: Estimating Terminal Value: Problem 1Документ3 страницыClosure in Valuation: Estimating Terminal Value: Problem 1Silviu TrebuianОценок пока нет

- Cost of Capital of AstraZeneca For 2015Документ6 страницCost of Capital of AstraZeneca For 2015Vicky GuleriaОценок пока нет

- Estimating Terminal Value in Valuation ModelsДокумент3 страницыEstimating Terminal Value in Valuation ModelsSandeep MishraОценок пока нет

- Ch12sol PDFДокумент3 страницыCh12sol PDFAmine IzamОценок пока нет

- Calculating Cost of Debt and Equity for NikeДокумент9 страницCalculating Cost of Debt and Equity for NikeindunanОценок пока нет

- Corporate FinanceДокумент3 страницыCorporate FinanceTEJWANI PREETKUMAR AMRUTLALОценок пока нет

- Solution: Part (A)Документ12 страницSolution: Part (A)Ahmed Raza MirОценок пока нет

- Knowledge Check - DCF: Facts: DCF Inc. Relevant Free Cash Flow ItemsДокумент1 страницаKnowledge Check - DCF: Facts: DCF Inc. Relevant Free Cash Flow ItemsMichael Sho LiuОценок пока нет

- 8-Security-Valuation 2Документ29 страниц8-Security-Valuation 2saadullah98.sk.skОценок пока нет

- Persistent inflation necessitates rate hike to curb rising pricesДокумент9 страницPersistent inflation necessitates rate hike to curb rising pricesAbhishek SinghОценок пока нет

- Volatility Index: I TH I I I IДокумент16 страницVolatility Index: I TH I I I ILokesh YadavОценок пока нет

- Some Concepts of FinanceДокумент16 страницSome Concepts of FinanceAbhishek SinghОценок пока нет

- Increase Reliance Baking Soda Profits by 10Документ3 страницыIncrease Reliance Baking Soda Profits by 10Abhishek SinghОценок пока нет