Академический Документы

Профессиональный Документы

Культура Документы

Number 1

Загружено:

Joe DareИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Number 1

Загружено:

Joe DareАвторское право:

Доступные форматы

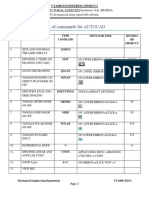

PROBLEM SET NO. 2 ES 321 1.

A certain fluidized-bed combustion vessel has an investment cost of $100,00, a life of 10 years and negligible market (resale) value. Annual cost of materials, maintenance, and electric power for the vessel are expected to total to $8,000.00. A major relining of combustion vessel will occur during the fifth year at a cost of $20,000; during this year, the vessel will not be in service. If the interest rate is 15% per year, what is the lump sum equivalent cost of this project at the present time?

A = annual cost = $8,000 i =interest rate per year = 15% n = 10 years IC =initial investment cost = $100,000 A5 = $20,000

Present worth = IC + Present worth

= $100 ,000 +

A 1 ( 1 + i )10 + ( A5 A )( 1 + i )5 i

$8 ,000 1 ( 1 + 0.15 )10 + ($ 20 ,000 $8 ,000 )( 1 + 0.15 )5 0.15 Present worth = $146 ,116 .27

Вам также может понравиться

- Number 1Документ1 страницаNumber 1jod_reeОценок пока нет

- Engineering EconomyДокумент1 страницаEngineering Economyjod_reeОценок пока нет

- Number 1Документ1 страницаNumber 1Joselito DaroyОценок пока нет

- Example 1.: (B) The Annual Percent Return On The Total Initial Investment AfterДокумент3 страницыExample 1.: (B) The Annual Percent Return On The Total Initial Investment AfterBansi TumbadiaОценок пока нет

- Tutorial 8 Time Value Money 2021Документ8 страницTutorial 8 Time Value Money 2021Hai Liang OngОценок пока нет

- Assignment 3Документ8 страницAssignment 3octoОценок пока нет

- Engineering Economy Alday Ric Harold MДокумент6 страницEngineering Economy Alday Ric Harold MHarold AldayОценок пока нет

- Capitalized Costs and Uniform ArithmeticДокумент3 страницыCapitalized Costs and Uniform ArithmeticMaimai PanilagaoОценок пока нет

- Math Economy Bibat 1Документ14 страницMath Economy Bibat 1Cams SenoОценок пока нет

- Engineering Economy Homework 3: Student Name: Student IDДокумент4 страницыEngineering Economy Homework 3: Student Name: Student IDMinh TríОценок пока нет

- Soal EtkДокумент2 страницыSoal EtkNiswatun ChasanahОценок пока нет

- WRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevДокумент11 страницWRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevMeg TОценок пока нет

- 610 Midterm 2 S11 02 With SolДокумент6 страниц610 Midterm 2 S11 02 With SolabuzarОценок пока нет

- CIVABTech66829BrEstrAP - Valuation NumericalsДокумент3 страницыCIVABTech66829BrEstrAP - Valuation NumericalsAditiОценок пока нет

- 5.economic Analysis cb311 Spring-2015Документ47 страниц5.economic Analysis cb311 Spring-2015ahmedОценок пока нет

- Tvmreviewlecture 131226185711 Phpapp02Документ19 страницTvmreviewlecture 131226185711 Phpapp02Đào Quốc AnhОценок пока нет

- Time Value of MoneyДокумент20 страницTime Value of MoneyAkashdeep SaxenaОценок пока нет

- Replacement Analysis: Economic Life of AssetsДокумент9 страницReplacement Analysis: Economic Life of AssetsMustafa Gökhan YavuzОценок пока нет

- Chapter 11Документ10 страницChapter 11Syed Sheraz AliОценок пока нет

- Economy Prob Set 1Документ12 страницEconomy Prob Set 1Joselito DaroyОценок пока нет

- Replacement Breakeven AnalysisДокумент8 страницReplacement Breakeven AnalysisZoloft Zithromax ProzacОценок пока нет

- Time Value of Money Practice Problems - SolutionsДокумент12 страницTime Value of Money Practice Problems - Solutionslex_jung100% (1)

- Replacement Analysis: SolutionДокумент10 страницReplacement Analysis: Solutionthawatchai112225120% (1)

- Engineering Economy Question and Answer 5eДокумент10 страницEngineering Economy Question and Answer 5eCarlo Mabini BayoОценок пока нет

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIДокумент6 страницIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezОценок пока нет

- Engineering Economy Problem Set 5Документ24 страницыEngineering Economy Problem Set 5Nurullah DemirОценок пока нет

- Engineering Economics: Finding P, F and AДокумент14 страницEngineering Economics: Finding P, F and Abyun baekОценок пока нет

- Ch11 Homework SolutionДокумент5 страницCh11 Homework Solutionashwn17Оценок пока нет

- End of Chapter 11 SolutionДокумент19 страницEnd of Chapter 11 SolutionsaniyahОценок пока нет

- Control No 3 V MF XXVIII Tema B SolucionarioДокумент7 страницControl No 3 V MF XXVIII Tema B SolucionarioJohnny TrujilloОценок пока нет

- Tutorial Sheet - 1 (UNIT-1)Документ5 страницTutorial Sheet - 1 (UNIT-1)Frederick DugayОценок пока нет

- Assignment #5 (Sep2019) - GDB3023-SolutionДокумент4 страницыAssignment #5 (Sep2019) - GDB3023-SolutionDanish Zabidi100% (1)

- 3415 Corporate Finance Assignment 2: Dean CulliganДокумент13 страниц3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersОценок пока нет

- BreakevenДокумент3 страницыBreakevenMae Florizel FalculanОценок пока нет

- Untitled 1Документ6 страницUntitled 1hagos dargoОценок пока нет

- Engineering EconomyДокумент7 страницEngineering EconomyBurn-Man Hiruma Villanueva100% (1)

- Econlesson4fe PDFДокумент7 страницEconlesson4fe PDFLibyaFlowerОценок пока нет

- Brigham Chap 11 Practice Questions Solution For Chap 11Документ11 страницBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterОценок пока нет

- Anasco, Act6 EcoДокумент6 страницAnasco, Act6 EcoDolph Allyn AñascoОценок пока нет

- Anasco, Act6 EcoДокумент6 страницAnasco, Act6 EcoDolph Allyn AñascoОценок пока нет

- PR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaДокумент14 страницPR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaArsyil AkhirbanyОценок пока нет

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Документ7 страницWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Chapter II Methods of Comparing Alternative ProposalsДокумент17 страницChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- PracticeДокумент5 страницPracticearif khanОценок пока нет

- Inde301 Final ExamДокумент4 страницыInde301 Final ExamLouay BaalbakiОценок пока нет

- FinalДокумент6 страницFinalRoronoa ZoroОценок пока нет

- Solution Assignment Chapter 9 10 1Документ14 страницSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuОценок пока нет

- Capital Budgeting CSTDДокумент3 страницыCapital Budgeting CSTDSardar FaaizОценок пока нет

- Activity 4 8Документ7 страницActivity 4 8Dinah Fe Tabaranza-OlitanОценок пока нет

- PPE ProblemsДокумент10 страницPPE ProblemsJhiGz Llausas de GuzmanОценок пока нет

- Engineering Economy Sample Problem 2Документ1 страницаEngineering Economy Sample Problem 2ariga thanksОценок пока нет

- Econ Asgment 2Документ6 страницEcon Asgment 2rahmani_4Оценок пока нет

- Ce231 Problem Set 4 Solutions 2016 PDFДокумент23 страницыCe231 Problem Set 4 Solutions 2016 PDFMiguel Ángel Salgado ÁlvarezОценок пока нет

- Coporate FinanceДокумент6 страницCoporate Financeplayjake18Оценок пока нет

- IENG 302 Lecture 08modДокумент15 страницIENG 302 Lecture 08modJohnalbert L. SibullenОценок пока нет

- Equivalent Uniform Annual CostДокумент40 страницEquivalent Uniform Annual CostDr. Rogelio C. Golez, JrОценок пока нет

- CH 6Документ24 страницыCH 6Joko AnilaОценок пока нет

- Sheet 2 Engineering Economy 2018-2019Документ3 страницыSheet 2 Engineering Economy 2018-2019حسن علي جاسمОценок пока нет

- Reducing Business Jet Carbon Footprint: Using the Power of the Aircraft Electric Taxi SystemОт EverandReducing Business Jet Carbon Footprint: Using the Power of the Aircraft Electric Taxi SystemОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- G and M Programming For Mills ManualДокумент98 страницG and M Programming For Mills ManualyendiОценок пока нет

- Research Process, Phases and 10 Step ModelДокумент5 страницResearch Process, Phases and 10 Step ModelJ.B ChoОценок пока нет

- Measure of Dispersion Kurtosi, SkiwnessДокумент22 страницыMeasure of Dispersion Kurtosi, SkiwnessJOHN TUMWEBAZEОценок пока нет

- Data Structures Algorithms and Applications in C by Sartraj SahaniДокумент826 страницData Structures Algorithms and Applications in C by Sartraj SahaniMohammed Nassf100% (1)

- Phys 31 Module 4Документ42 страницыPhys 31 Module 4Coyzz de GuzmanОценок пока нет

- Brian Speed Keith Gordon Kevin Evans: Found Math - Spec B00.qxd 02/03/06 13:23 Page IДокумент6 страницBrian Speed Keith Gordon Kevin Evans: Found Math - Spec B00.qxd 02/03/06 13:23 Page IDavid ReesОценок пока нет

- The Progress of Consolidation in A Clay Layer Increasing-Gibson PDFДокумент12 страницThe Progress of Consolidation in A Clay Layer Increasing-Gibson PDFAnonymous GnfGTwОценок пока нет

- ResearchДокумент19 страницResearchJonesa SerranoОценок пока нет

- WRM Y6 Autumn b3 Four Operations Assessment BДокумент2 страницыWRM Y6 Autumn b3 Four Operations Assessment BĐặng Minh TuấnОценок пока нет

- Comparative Study of RP-HPLC and UV Spectrophotometric Techniques For The Simultaneous Determination of Amoxicillin and Cloxacillin in CapsulesДокумент6 страницComparative Study of RP-HPLC and UV Spectrophotometric Techniques For The Simultaneous Determination of Amoxicillin and Cloxacillin in Capsulesiabureid7460Оценок пока нет

- Unit 4 - Lesson 2Документ3 страницыUnit 4 - Lesson 2api-243891235Оценок пока нет

- Chapter 11Документ12 страницChapter 11JeromeОценок пока нет

- Stat Module 5Документ10 страницStat Module 5Remar Jhon PaineОценок пока нет

- Mphasis Aptitude Questions AnswersДокумент11 страницMphasis Aptitude Questions Answersmaccha macchaОценок пока нет

- A Meta-Analysis of Research On Sensory Integration TreatmentДокумент10 страницA Meta-Analysis of Research On Sensory Integration TreatmentPaula CelsieОценок пока нет

- Development of The 3rd Generation Balanced Scorecard - ParДокумент11 страницDevelopment of The 3rd Generation Balanced Scorecard - ParhshafeeqОценок пока нет

- 33 As Statistics Unit 5 TestДокумент2 страницы33 As Statistics Unit 5 TestThomas BeerОценок пока нет

- Quality Control and Analysis: Ujvnl Ae 2016Документ7 страницQuality Control and Analysis: Ujvnl Ae 2016Sagar ThengilОценок пока нет

- PDFДокумент589 страницPDFJean Raziel Cabansag BaysonОценок пока нет

- AP Stats Reference SheetДокумент7 страницAP Stats Reference SheetRamenKing12Оценок пока нет

- GATE 2020 Online Test Series:: Civil EngineeringДокумент6 страницGATE 2020 Online Test Series:: Civil EngineeringAvinash JhaОценок пока нет

- Niterói, Volgograd and Trans-Tokyo Bay Steel Bridge Decks Abraham - Sanchez - Corriols - 2de2Документ135 страницNiterói, Volgograd and Trans-Tokyo Bay Steel Bridge Decks Abraham - Sanchez - Corriols - 2de2Miguel PerezОценок пока нет

- Frequency Distribution Table GraphДокумент10 страницFrequency Distribution Table GraphHannah ArañaОценок пока нет

- AI - Lecture 2 - Uninformed SearchДокумент20 страницAI - Lecture 2 - Uninformed SearchHunterxHunter03Оценок пока нет

- Hydra 325 Laboratory Experiment No.1Документ2 страницыHydra 325 Laboratory Experiment No.1lalguinaОценок пока нет

- Advanced Statistics Course SyllabusДокумент7 страницAdvanced Statistics Course SyllabusKristina PabloОценок пока нет

- Abstract Classes Versus Interfaces: C# (And Other Languages) Polymorphism Explained To Young PadawansДокумент4 страницыAbstract Classes Versus Interfaces: C# (And Other Languages) Polymorphism Explained To Young Padawanssridevishinas100% (1)

- ProblemДокумент2 страницыProblemJishnuОценок пока нет

- List of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareДокумент15 страницList of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareShakeelОценок пока нет

- Numerical Methods PPT AYUSH MISHRAДокумент11 страницNumerical Methods PPT AYUSH MISHRAsubscribe.us100Оценок пока нет