Академический Документы

Профессиональный Документы

Культура Документы

Sample of The Fin320 Department Final Exam With Solution

Загружено:

norbi113Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sample of The Fin320 Department Final Exam With Solution

Загружено:

norbi113Авторское право:

Доступные форматы

Sample Copy of the Fin320 Department Final Exam Student Name ________________________ Student ID# _________________________ 50 Questions - 2 Points

Each Open Notes - Closed Book This examination paper, with your name on it, must be returned in order to get credit for the examination.

MULTIPLE CHOICE 1. Which of the following factors tend to encourage management to pursue stock price maximization as a goal? a. shareholders link management's compensation to company performance b. managers' reactions to the threats of firing and takeover c. managers do not have goals other than stock price maximization d. statements a and b are both correct e. statements a, b, and c are all correct 2. Capital market instruments include a. negotiable certificates of deposit b. corporate equities c. commercial paper d. treasury bills 3. Activities of the investment banker include a. assuming the risk of selling a security issue b. selling new securities to the ultimate investors c. providing advice to firms issuing securities d. all of the above 4. Savings are generally transferred to the business firms by a. direct transfer of funds b. indirect transfer using the investment banker c. indirect transfer using the financial intermediary d. all of the above

5. Kingsbury Associate's current assets are as follows: Cash $3,000 Accounts Receivable $4,500 Inventories $8,000 If Kingsbury has a current ratio of 3.2, what is its quick ratio? a. 2.07 b. l.55 c. .48 d. none of the above 6. Which of the following represents an attempt to measure the earnings of the firm's operations over a given time period? a. balance sheet b. cash flow statement c. income statement d. none of the above 7. The debt ratio is a measure of a firm's a. leverage b. profitability c. liquidity d. coverage 8. You just purchased a parcel of land for $10,000. If you expect a 14% annual rate of return on your investment, how much will you sell the land for in 10 years? a. $25,000 b. $31,060 c. $37,072 d. $34,310 e. $45,000 9. Loren Billingsley bought a yacht for $60,000 paying $15,000 down and agreeing to pay the balance in ten equal annual installments that include both principal and 9% interest on the declining balance. How big would the annual payment be? a. $5,000 b. $7,000 c. $9,000 d. $11,000 10. You bought a painting 10 years ago as an investment. You originally paid $85,000 for it. If you sold it for $484,050, what was your annual return on investment? a. 47% b. 4.7% c. 12.8% d. 19%

11. Bobby's grandmother deposited $100 in a savings account for him when he was born. The money has been earning an annual rate of 12% interest, compounded quarterly for the last 25 years. He is getting married and would like to take his new bride on a fabulous honeymoon. How much does he have in this account to use? a. $4,165 b. $1,700 c. $5,051 d. $1,922 12. Choose the most correct answer for the following: (1) Which is the measure of risk for choosing an asset which is to be held in isolation? (2) Which is the measure of risk for choosing an asset to be held as part of a well-diversified portfolio? a. Variance; variance. b. Standard deviation; beta. c. Beta; beta. d. Standard deviation; standard deviation. 13. Huit Industries' common stock has an expected return of 12.8% and a beta of 1.2. If the expected risk-free rate is 8%, what is the expected return for the market? a. 8.8% b. 9.5% c. 12.0% d. 13.8% 14. The appropriate measure for risk according to the capital asset pricing model is a. the standard deviation of a firm's cash flows b. the coefficient of variation of a firm's cash flows c. the beta coefficient d. none of the above 15. The risk-return relationship for each financial asset is shown on a. the capital market line b. the security market line c. the New York Stock Exchange market line d. none of the above 16. The yield to maturity on a bond a. is fixed in the indenture b. is lower for higher risk bonds c. is the required return on the bond d. is generally equal to the coupon interest rate 17. Cassel Corp. bonds pays an annual coupon rate of 10%. If investors' required rate of return is now 8% on these bonds, they will be priced at a. par value b. a premium to par value

c. a discount to par value d. cannot be determined from information given 18. The discount rate used to value a bond is a. the coupon interest rate b. determined by the issuing company c. fixed for the life of the bond d. the market rate of interest 19. UVP preferred stock pays an annual dividend of 5%. Par value of UVP's preferred stock is $100 per share. If your required rate of return is 13%, how much will you be willing to pay for one share? a. $ 38.46 b. $ 26.26 c. $ 65.46 d. $100.00 20. Which of the following is false? a. preferred stock has some characteristics of both common stock and bonds b. common stockholders are essentially creditors of the firm c. the pre-emptive right on common stock protects the shareholder from dilution in ownership and value 21. Which of the following statements about NPV and IRR is/are false? a. the NPV will be positive if the IRR is less than the cost of capital b. any independent project acceptable by the NPV method will also be acceptable by the IRR method (if the multiple IRR problem does not exist) c. when IRR = k, NPV = 0 d. both a and b above are false e. both b and c above are false 22. The calculation of differential cash flows over a project's life should include a. labor and material savings b. additional revenue c. interest to bondholders d. a and b 23. The internal rate of return is a. the discount rate that makes the NPV positive b. the discount rate that equates the present value of the cash inflows with the present value of the cash outflows c. the discount rate that makes NPV negative d. the rate of return that makes the NPV positive 24. You are considering investing in a project with the following year-end after tax cash flows Year l: $5,000

Year 2: $3,200 Year 3: $7,800 If the initial outlay for the project is $12,113, compute the project's internal rate of return. a. 14% b. 10% c. 32% d. 24% 25. Which of the following best describes why cash flows are utilized rather than accounting profits when evaluating capital projects? a. cash flows have a greater present value than accounting profits b. cash flows reflect the timing of benefits and costs more accurately than accounting profits c. cash flows are more stable than accounting profits d. cash flows improve the tax position of a firm more than accounting profits e. none of the above 26. Which of the following is the best definition of an incremental cash inflow/outflow? a. cash flows that are achieved by diverting sales from other projects of the firm b. cash flows that are associated with the financing of a project c. cash flows that occur a little at a time d. what the cash flows will be if the project is undertaken versus what they will be if the project is not undertaken e. none of the above 27. Increased depreciation expenses affect tax-related cash flows by a. increasing taxable income, thus increasing taxes b. decreasing taxable income, thus reducing taxes c. decreasing taxable income, with no effect on cash flow since depreciation is a non-cash expense d. none of the above 28. Current assets would usually not include a. plant and equipment b. marketable securities c. accounts receivables d. inventories 29. Which of the following is a disadvantage of the use of current liabilities to finance assets? a. greater risk of illiquidity b. less flexibility c. higher interest cost d. both a and b 30. In order to maximize firm value, management should invest in new assets a. so long as a project's IRR is greater or equal to the firm's marginal cost of capital

b. so long as a project's IRR is positive c. so long as a project's accounting rate of return is greater or equal to the firm's marginal cost of capital d. b and c 31. Your company is considering an investment in a project which would require an initial outlay of $300,000 and produce expected cash flows in years 1-5 of $87,385 per year. You have determined that the current after-tax cost of the firm's capital (required rate of return) for each source of financing is as follows Cost of Debt 8% Cost of Preferred Stock 12% Cost of Common Stock 16% Long term debt currently makes up 20% of the capital structure, preferred stock 10%, and common stock 70%. What is the net present value of this project? a. -$13,876 b. $0 c. $287,692 d. $1,568 32. Which of the following would be considered a component in calculating a firm's cost of capital? a. accounts payable b. inventory c. accruals d. accounts receivable e. bonds 33. Given the following information on S & G Inc.'s capital structure, compute the company's weighted average cost of capital. Type of Capital Bonds Preferred Stock Common Stock (Internal Only) Percent of Capital Structure 40% 5% 55% Before Tax Component Cost 7.5% 11% 15%

The company's marginal tax rate is 40% a. 13.3% b. 7.1% c. 10.6% d. 10%

34. According to the moderate view of capital costs and financial leverage, as the use of debt financing increases a. the cost of capital continuously decreases b. the cost of capital remains constant c. the cost of capital continuously increases d. there is an optimal level of debt financing 35. Operating leverage refers to a. financing a portion of the firm's assets with securities bearing a fixed rate of return b. the additional chance of insolvency borne by the common shareholder c. the incurrence of fixed operating costs in the firm's income stream d. none of the above 36. The Modigliani and Miller view (independence hypothesis) to capital structure puts forth that: a. the value of the firm will be maximized at a debt-to-assets ratio of 40%. b. the cost of capital increases with the increasing leverage c. the value of the firm will be unaffected by increases or decreases in debt financing. d. the total value of the firm falls with increasing leverage. 37. The inclusion of bankruptcy risk in firm valuation a. acknowledges that a firm has an upper limit to debt financing b. provides a rationale for a saucer-shaped cost of capital curve c. is ignored in the Independence Hypothesis. d. all of the above 38. Dividend policy is influenced by a. a company's investment opportunities b. a company's availability of internally generated funds c. a & b 39. Exchange rate risk: a. Exists when the contract is written in terms of the foreign currency b. Arises from the fact that the spot exchange rate on a future date is a random variable c. Can be hedged in the forward markets d. All of the above 40. A cash flow statement can be used to answer a variety of questions. Which of the following would this statement not be likely to answer? a. Why was money borrowed? b. Where did profits go? c. What is the current level of inventory? d. Were there any new investment activities? TRUE/FALSE

41. The agency problem arises due to the separation of ownership and control in a firm. T F 42. An IPO (Initial Public Offering) is an example of secondary market transaction. T F 43. Market risk refers to the tendency of a stock to move with the general stock market. A stock with above-average market risk will tend to be more volatile than an average stock and it will also have a beta which is greater than 1.0. T F 44. Preferred stock has some characteristics of both common stock and bonds. T F 45. If the IRR > Required Rate of Return , a project generates an abnormally high rate of return that will increase shareholder wealth. T F 46. Financial leverage measures the responsiveness of the firm's earnings per share to fluctuations in EBIT. T F 47. Financial risk includes the probability of insolvency as well as the variability of earnings resulting from the use of fixed-charge (debt) securities in the capital structure. T F 48. The objective of capital-structure management can be viewed as the endeavor to find the financing mix that will minimize the firm's composite cost of capital and maximize the value of the stock. T F 49. The clientele effect suggests that firms can change their dividend policy frequently with no potential adverse effect on the firm. T F 50. After a stock split of 2:1, each investor will have one-half of the percentage ownership in the firm that he had before the split. T F

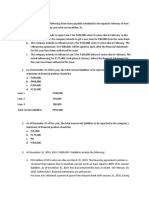

Solutions 1d 2b 3d 4d 5b CA=3+4.5+8=15.5 CR=15.5/CL=3.2 CL=4.84 QR=7.5/4.84=1.55 6c 7a 8c Using TVM P/Y=1; PV=-10,000; I/Y=14; N=10; FV=?; FV=$37,072 9b Using TVM P/Y=1; PV=45,000; I/Y=9; N=10; FV=0; PMT=?; PMT=$7,012 10 d Using TVM P/Y=1; PV=-85,000; I/Y=?; N=10; FV=484,050; PMT=0; I/Y=19 11 d Using TVM P/Y=4; PV=-100; I/Y=12; N=25x4=100; FV=?; PMT=0; FV=1,922 12 b 13 c Using the CAMP equation, 12.8=8+1.2(km-8) km=12% 14 c 15 b 16 c 17 b 18 d 19 a Dividend per share = ($100)(0.05)=$5 Share price = (5)/(0.13)=$38.46 20 b 21 Ignore choices d and e. Then, answer is a. 22 d

23 b 24 a CF0=-12,113; C01=5,000; F01=1; C02=3,200; F02=1; C03=7,800; F03=1; IRR=?; IRR=14% 25 b 26 d 27 b 28 a 29 d 30 a 31 Cost of capital = weighted average cost of capital = (weight of debt)(after-tax cost of debt) + (weight of preferred stock)(cost of preferred stock) + (weight of common stock)(cost of common stock) = (0.2)(8)+(0.1)(12)+(0.7)(16)=1.6+1.2+11.2=14% CF0=-300,000 C01=87,385 F01=5 I=14 NPV=? NPV=-0.22=0 Answer: b 32 e 33 c Cost of capital = weighted average cost of capital = (weight of debt)(after-tax cost of debt) + (weight of preferred stock)(cost of preferred stock) + (weight of common stock)(cost of common stock) = (0.4)(7.5)(1-0.4)+(0.05)(11)+(0.55)(15)=1.8+0.55+8.25=10.6% 34 d 35 c 36 c 37 d 38 c (Recall residual dividend policy.) 39 d 40 c 41 T 42 F 43 T 44 T 45 T 46 T 47 T 48 T 49 F 50 F

Вам также может понравиться

- Intermediate Accounting Exam 2 ReviewДокумент1 страницаIntermediate Accounting Exam 2 ReviewBLACKPINKLisaRoseJisooJennieОценок пока нет

- Ratio Analysis and Financial Ratios from Chanakya Business SchoolДокумент15 страницRatio Analysis and Financial Ratios from Chanakya Business Schoolsajith santy0% (1)

- Seatwork 01 Financial Statement Analysis PDFДокумент5 страницSeatwork 01 Financial Statement Analysis PDFHannah Mae VestilОценок пока нет

- Functional and activity-based budgeting guideДокумент5 страницFunctional and activity-based budgeting guidePATRICIA PEREZОценок пока нет

- Auto Parts Manufacturers Feel the Pinch as Euro RisesДокумент7 страницAuto Parts Manufacturers Feel the Pinch as Euro RisesNishanth M S HebbarОценок пока нет

- 2012 EE enДокумент76 страниц2012 EE enDiane MoutranОценок пока нет

- Chapter 3Документ4 страницыChapter 3Thiện Thảo100% (1)

- Relevant Costing Concepts for Short-Term Decision MakingДокумент5 страницRelevant Costing Concepts for Short-Term Decision MakingPATRICIA PEREZ100% (1)

- ch17 InvestmentsДокумент38 страницch17 InvestmentsKristine Wali0% (1)

- Cordillera Career Development College Financial Management IIДокумент6 страницCordillera Career Development College Financial Management IIJungie Mablay WalacОценок пока нет

- Finacct Mock Exam 1Документ7 страницFinacct Mock Exam 1Joseph Gerald M. ArcegaОценок пока нет

- Prequalifying Exam Level 2 3 Set B FSUU AccountingДокумент9 страницPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloОценок пока нет

- Which of The Following Would Indicate That A Note Receivable or Other Loan Is ImpairedДокумент1 страницаWhich of The Following Would Indicate That A Note Receivable or Other Loan Is ImpairedJAHNHANNALEI MARTICIOОценок пока нет

- Cash and RecДокумент30 страницCash and RecChiara OlivoОценок пока нет

- Accounting Cash and Liquidity ManagementДокумент19 страницAccounting Cash and Liquidity ManagementMarsОценок пока нет

- AP 59 FinPB - 5.06Документ8 страницAP 59 FinPB - 5.06Anonymous Lih1laaxОценок пока нет

- Balance Sheet Presentation of Liabilities: Problem 10.2AДокумент4 страницыBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Exercises Lesson 16 IAS 37Документ2 страницыExercises Lesson 16 IAS 37Florentina O. OpanioОценок пока нет

- Chapter 07 - Exercises - Part IДокумент2 страницыChapter 07 - Exercises - Part IRawan YasserОценок пока нет

- Man Econ Ass. Module 6Документ2 страницыMan Econ Ass. Module 6Trisha Mae AbocОценок пока нет

- PrE3 Final ExamДокумент16 страницPrE3 Final ExamLyca MaeОценок пока нет

- Bus Combination 2Документ8 страницBus Combination 2Angelica AllanicОценок пока нет

- Midterms Conceptual Framework and Accounting StandardsДокумент9 страницMidterms Conceptual Framework and Accounting StandardsMay Anne MenesesОценок пока нет

- Multiple Choices - Quiz - Chapter 1-To-3Документ21 страницаMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaОценок пока нет

- Income Statement and Balance Sheet AnalysisДокумент18 страницIncome Statement and Balance Sheet AnalysisKailash KumarОценок пока нет

- Reviewer Incremental Analysis 1Документ5 страницReviewer Incremental Analysis 1Shaira Rehj RiveraОценок пока нет

- ABMF3174 TUTORIAL 5-8v2Документ18 страницABMF3174 TUTORIAL 5-8v2Ray100% (1)

- Finals With AnswersДокумент6 страницFinals With AnswersWilfred Diaz BumanlagОценок пока нет

- Masquerade (Regional Eliminations)Документ5 страницMasquerade (Regional Eliminations)Ayvee BlanchОценок пока нет

- 109Документ34 страницы109danara1991Оценок пока нет

- 21 Intangible AssetsДокумент6 страниц21 Intangible AssetsAdrian MallariОценок пока нет

- Lecture Notes On Revaluation and Impairment PDFДокумент6 страницLecture Notes On Revaluation and Impairment PDFjudel ArielОценок пока нет

- Ais The Expenditure Cycle Purchasing To Cash Disbursements Test BankДокумент29 страницAis The Expenditure Cycle Purchasing To Cash Disbursements Test Bankgutlaysophia06Оценок пока нет

- Book Value Per Share Basic Earnings PerДокумент61 страницаBook Value Per Share Basic Earnings Perayagomez100% (1)

- REVIEW QUESTIONS Investment in Debt SecuritiesДокумент1 страницаREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokОценок пока нет

- Fin Act - PUP-Manila - July 2009Документ8 страницFin Act - PUP-Manila - July 2009Lara Lewis AchillesОценок пока нет

- Practice Exam - Part 3: Multiple ChoiceДокумент4 страницыPractice Exam - Part 3: Multiple ChoiceAzeem TalibОценок пока нет

- Repair Cost Probabilit yДокумент2 страницыRepair Cost Probabilit yNicole AguinaldoОценок пока нет

- E. All of The Above. A. Total Revenue Equals Total CostДокумент22 страницыE. All of The Above. A. Total Revenue Equals Total CostNicole KimОценок пока нет

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyДокумент33 страницыChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- CAT Challenge - Answers PDFДокумент6 страницCAT Challenge - Answers PDFnivea gumayagayОценок пока нет

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFДокумент60 страницAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeОценок пока нет

- Testbank-Quizlet RelevantCost2Документ12 страницTestbank-Quizlet RelevantCost2Lokie PlutoОценок пока нет

- Intermediate Accounting I IntroductionДокумент6 страницIntermediate Accounting I IntroductionJoovs JoovhoОценок пока нет

- ACC107 1ST PERIODIC EXAM REVIEWДокумент9 страницACC107 1ST PERIODIC EXAM REVIEWRyan Malanum AbrioОценок пока нет

- NFJPIA - Mockboard 2011 - MAS PDFДокумент7 страницNFJPIA - Mockboard 2011 - MAS PDFDanica PelenioОценок пока нет

- Chapter 16Документ22 страницыChapter 16Dominic RomeroОценок пока нет

- DocxДокумент40 страницDocxJamaica DavidОценок пока нет

- All in CupДокумент11 страницAll in CupRosemarie Qui0% (1)

- Group Assignment@FM IIДокумент2 страницыGroup Assignment@FM IIsamuel debebe100% (1)

- Mock Cost Quiz 1Документ8 страницMock Cost Quiz 1May Zablan PangilinanОценок пока нет

- Tutorial 1 Chapter 7Документ8 страницTutorial 1 Chapter 7Aqila Syakirah IVОценок пока нет

- IFRS 4 Insurance ContractsДокумент5 страницIFRS 4 Insurance Contractstikki0219Оценок пока нет

- Justa Corporation US market analysisДокумент11 страницJusta Corporation US market analysisMohsin Rehman0% (1)

- MAS 7 Exercises For UploadДокумент9 страницMAS 7 Exercises For UploadChristine Joy Duterte RemorozaОценок пока нет

- Lecture Notes On Government GrantsДокумент2 страницыLecture Notes On Government Grantsjudel ArielОценок пока нет

- Ford Motor Company A Case Study Presentation With TransitionsДокумент22 страницыFord Motor Company A Case Study Presentation With TransitionsMelissa FabillarОценок пока нет

- Multiple Choice Questions on Finance TopicsДокумент12 страницMultiple Choice Questions on Finance TopicsHamid UllahОценок пока нет

- q4 1Документ7 страницq4 1JimmyChaoОценок пока нет

- FINC521-Most Important QuestionsДокумент24 страницыFINC521-Most Important QuestionsAll rounder NitinОценок пока нет

- CFA Level II - Equity - Equity Valuation Applications and ProcessesДокумент10 страницCFA Level II - Equity - Equity Valuation Applications and ProcessesQuy Cuong BuiОценок пока нет

- Public To Private Equity in The United States: A Long-Term LookДокумент82 страницыPublic To Private Equity in The United States: A Long-Term LookYog MehtaОценок пока нет

- Chapter-9, Capital StructureДокумент21 страницаChapter-9, Capital StructurePooja SheoranОценок пока нет

- Literature Review CompletedДокумент13 страницLiterature Review CompletedRaji SinghОценок пока нет

- Parker Economic Regulation Preliminary Literature ReviewДокумент37 страницParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuОценок пока нет

- MGT201 Finalterm GoldenFileДокумент230 страницMGT201 Finalterm GoldenFilemaryamОценок пока нет

- Assignment 2 LuceroДокумент3 страницыAssignment 2 LuceroJessa100% (1)

- Chap 012 BBДокумент8 страницChap 012 BBMyaОценок пока нет

- Dissertation Titles and Academic Job PlacementДокумент9 страницDissertation Titles and Academic Job PlacementRavi AgarwalОценок пока нет

- Basic Accounting-RatiosДокумент22 страницыBasic Accounting-RatiosSala SahariОценок пока нет

- Practical Computrized AccountingДокумент13 страницPractical Computrized Accountingshaafie saladОценок пока нет

- The Market Mafia Chronicle of India's High-Tech Stock Market Scandal The Cabal That Went Scot-Free.Документ237 страницThe Market Mafia Chronicle of India's High-Tech Stock Market Scandal The Cabal That Went Scot-Free.Honey MustardОценок пока нет

- Session 1 ToДокумент127 страницSession 1 TonisargpritamlondheОценок пока нет

- Valuation Concepts and MethodsДокумент6 страницValuation Concepts and MethodsHeizeruОценок пока нет

- Project On JSW Financial Statement AnalysisДокумент24 страницыProject On JSW Financial Statement AnalysisRashmi ShuklaОценок пока нет

- Topics For ThesisДокумент24 страницыTopics For ThesisMussadaq JavedОценок пока нет

- Graham Doddsville Winter 2017Документ61 страницаGraham Doddsville Winter 2017marketfolly.comОценок пока нет

- RTP June 2020 QNДокумент14 страницRTP June 2020 QNbinuОценок пока нет

- Corporate Formation EssentialsДокумент11 страницCorporate Formation EssentialsmarinОценок пока нет

- FINANCIAL MARKETS Test Bank 1Документ12 страницFINANCIAL MARKETS Test Bank 1KyleОценок пока нет

- Discriminating Between Competing HypothesesДокумент33 страницыDiscriminating Between Competing HypothesesFridRachmanОценок пока нет

- Mudajaya's Power Plant in IndiaДокумент13 страницMudajaya's Power Plant in IndiaAhmad CendanaОценок пока нет

- Assignment (Business Environment)Документ15 страницAssignment (Business Environment)YggOrr83% (6)

- Wrigley AR 2004Документ20 страницWrigley AR 2004SteveMastersОценок пока нет

- Acme IPOДокумент314 страницAcme IPOankitpa13Оценок пока нет

- Law 3 Test Banks PDFДокумент42 страницыLaw 3 Test Banks PDFCheramie Encabo QuezolОценок пока нет

- Departmental Account PDFДокумент30 страницDepartmental Account PDFAdeshОценок пока нет

- The Various Types of Incentives Are Classified Into Two Broad CategoriesДокумент7 страницThe Various Types of Incentives Are Classified Into Two Broad CategoriesOlusegun Olasunkanmi PatОценок пока нет

- Lesson 8 Developing A Trading Plan & Resources: by Adam KhooДокумент15 страницLesson 8 Developing A Trading Plan & Resources: by Adam Khoosesilya 14Оценок пока нет

- Security Analysis and Portfolio Management Unit IvДокумент42 страницыSecurity Analysis and Portfolio Management Unit IvAlavudeen ShajahanОценок пока нет