Академический Документы

Профессиональный Документы

Культура Документы

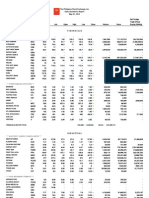

The Philippine Stock Exchange, Inc Daily Quotations Report December 02, 2011

Загружено:

Richard SzeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Philippine Stock Exchange, Inc Daily Quotations Report December 02, 2011

Загружено:

Richard SzeАвторское право:

Доступные форматы

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

FINANCIALS

**** BANKS ****

ASIATRUST

BDO UNIBANK

BPI

CHINABANK

CHINATRUST

CITYSTATE BANK

EXPORT BANK

EXPORT BANK B

METROBANK

PBCOM

PHIL. NATL BANK

PHILTRUST

PSBANK

RCBC

SECURITY BANK

UNION BANK

ASIA

BDO

BPI

CHIB

CHTR

CSB

EIBA

EIBB

MBT

PBC

PNB

PTC

PSB

RCB

SECB

UBP

55.65

54.3

398

23.05

27

67.65

56

54.15

55

70

30.45

96.3

62.1

55.7

54.35

400

28

28.5

67.7

84.95

54.2

72

30.5

96.75

62.7

55.2

53.7

399

66.8

53.8

70

30.5

96.9

62.1

55.65

54.5

399

68.05

54.6

70

30.5

97

62.1

55.15

53.7

398

66.8

53.8

70

30.45

95.5

62.1

55.65

54.35

398

67.65

54.15

70

30.45

96.75

62.1

2,287,090

3,702,720

1,040

4,684,150

176,020

10

17,300

516,700

280

127,095,917.5

201,027,114.5

414,120

316,787,096.5

9,544,368.5

700

526,890

49,874,047

17,388

(4,868,555.5)

57,291,842

7,960

(33,174,673)

1,514,702.5

(213,250)

2,870,577

-

3.97

0.88

1.53

17.8

8.4

0.71

60

2.13

500

1.49

226.4

1,005

1.63

4.4

0.89

1.73

18

10

0.75

62.85

2.2

520

1.5

227

1,009

1.7

3.69

0.89

18.1

8.4

0.88

2.24

490

1.56

229

1,018

1.63

4.8

0.89

18.1

8.4

0.88

2.25

500

1.56

229

1,018

1.65

3.69

0.89

17.7

8.4

0.71

2.13

490

1.5

226.2

1,005

1.63

4.8

0.89

18

8.4

0.71

2.13

500

1.5

226.2

1,005

1.65

54,000

10,000

73,200

200

209,000

12,000

280

2,552,000

2,230

305

219,000

202,880

8,900

1,305,930

1,680

149,960

26,560

139,700

3,828,520

507,480

306,590

360,970

VOLUME :

14,517,525

**** OTHER FINANCIAL INSTITUTION ****

ATR KIM ENG FIN

BANKARD

BDO LEASING

CITISECONLINE

FILIPINO FUND

FIRST ABACUS

FIRST METRO

IREMIT

MANULIFE

MEDCO HLDG.

PHILNARE

PSE

SUN LIFE

VANTAGE

ATRK

BKD

BLFI

COL

FFI

FAF

FMIC

I

MFC

MED

NRCP

PSE

SLF

V

FINANCIALS SECTOR TOTAL

VALUE :

712,126,812

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

ALSONS CONS

CALAPAN VENTURE

ENERGY DEVT.

FIRST GEN

FIRST PHIL HLDG

MANILA WATER

MERALCO A

PETRON

PHOENIX

SALCON POWER

TRANS-ASIA

VIVANT

AP

ACR

H2O

EDC

FGEN

FPH

MWC

MER

PCOR

PNX

SPC

TA

VVT

29.7

1.21

2.64

6.06

13.9

58

19.32

241

12.78

11.66

3.4

1.05

2.6

30

1.23

2.7

6.08

13.92

58.1

19.36

242

12.9

11.84

3.85

1.08

-

29.8

1.21

2.75

6.08

13.64

58.85

19.2

236

12.9

11.5

3.9

1.06

-

30

1.22

2.78

6.17

13.94

58.85

19.36

242

12.92

11.82

3.9

1.08

-

29.5

1.21

2.64

6.02

13.62

57.05

19.2

236

12.78

11.5

3.9

1.05

-

30

1.21

2.64

6.06

13.9

58

19.32

242

12.9

11.82

3.9

1.08

-

3,549,900

266,000

486,000

38,846,800

3,776,000

167,580

640,900

72,240

215,200

452,300

3,000

298,000

-

105,087,955

321,870

1,298,220

235,725,425

51,852,622

9,711,385

12,355,334

17,196,010

2,760,598

5,277,116

11,700

315,850

-

24,146,165

(23,053,120)

9,124,384

(2,894,100)

(1,316,500)

(2,110,692)

129,000

47,280

(11,700)

-

9.59

14.24

1.39

48

23.5

87.95

53

7.6

2.06

13.88

1.23

1.3

2.42

28.55

119.9

0.126

14.7

47.95

9.78

14.48

1.4

64.95

24

89.7

60

10

2.19

14

1,400

1.24

1.98

2.5

28.9

120

0.129

15.6

48

9.78

14.22

1.39

23.7

88

2.09

14.02

1.17

2.4

29

122.8

0.131

14.8

49.9

9.78

14.5

1.4

23.7

89.7

2.19

14.02

1.26

2.46

29

122.8

0.133

15.58

49.9

9.53

14.22

1.38

23.5

87.9

2.05

14

1.17

2.4

29

119.8

0.126

14.8

47.95

9.78

14.38

1.39

23.5

89.7

2.19

14

1.24

2.46

29

120

0.126

15.58

48

10,700

22,000

980,000

190,200

480,670

22,000

9,200

5,859,000

9,000

4,000

1,186,790

4,270,000

900

6,940,500

103,470

316,106

1,362,120

4,489,350

42,525,926.5

45,440

128,868

7,217,020

21,840

116,000

143,480,645

542,690

13,640

338,122,740

(27,800)

(2,364,850)

6,925,535

22,610

1,430,000

15,527,596

13,230

85,321,245

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ALASKA MILK

ALLIANCE SELECT

BOGO MEDELLIN

COSMOS

GINEBRA

JOLLIBEE

LIBERTY FLOUR

PANCAKE

PEPSI-COLA

PHIL. TOBACCO

PUREFOODS A

RFM CORP

ROXAS AND CO.

ROXAS HLDG.

SAN MIGUEL

SAN MIGUEL CORP.

SWIFT

TANDUAY HLDG.

TARLAC

UNIV ROBINA

ANI

AMC

FOOD

BMM

CBC

GSMI

JFC

LFM

PCKH

PIP

TFC

PF

RFM

RCI

ROX

SMB

SMC

SFI

TDY

CAT

URC

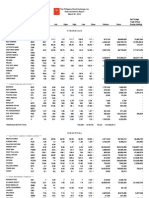

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

VICTORIAS

VITARICH

Symbol

VMC

VITA

Bid

0.44

Ask

0.48

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

0.47

0.48

0.45

0.47

910,000

424,600

202,300

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

AGP INDUSTRIAL

CONCRETE A

CONCRETE B

EEI CORP.

FED. CHEMICALS

HOLCIM

MARIWASA

MEGAWIDE

PHINMA

PNCC

REPUBLIC CEMENT

SEACEM

SUPERCITY

TKC STEEL

VULCAN IND`L

AGP

CA

CAB

EEI

FED

HLCM

MMI

MWIDE

27.5

44

15

3.3

8.95

8.4

3.7

8.3

28.4

85

3.33

9.2

8.48

8.36

28.35

3.3

9

8.01

3.7

8.3

29

3.33

9.55

8.48

3.7

8.36

27.5

3.26

8.95

8

3.7

8.3

27.5

3.3

9.2

8.4

3.7

8.36

17,200

1,293,000

13,600

88,200

103,000

215,100

482,990

4,267,910

125,551

741,564

381,100

1,795,918

(137,950)

(42,300)

140,600

(434,020)

PHN

PNC

RCM

CMT

SRDC

T

VUL

11.3

5.27

1.31

1.2

2.27

0.96

11.9

5.39

1.32

2.3

0.98

5.4

1.32

2.4

0.98

5.4

1.32

2.5

0.99

5.27

1.32

2.2

0.98

5.27

1.32

2.3

0.98

5,800

71,000

1,351,000

254,000

31,216

93,720

3,025,530

249,120

4,420

-

CIP

COAT

EURO

LMG

MVC

MIH

MIHB

MAH

MAHB

PPC

2.36

1.1

2.76

1.2

1.38

1.37

-

2.4

1.72

1.32

1.7

1.7

-

2.36

1.41

-

2.36

1.41

-

2.36

1.41

-

2.36

1.41

-

20,000

1,000

-

47,200

1,410

-

AAI

ALPHA

30.3

32.5

30.5

32.8

35

32.85

35.5

32.85

30.3

32.85

30.5

32.85

46,100

100

1,482,465

3,285

96,000

-

CHIPS

FYN

FYNB

GREEN

8.1

0.011

8.18

0.012

7.89

0.011

8.22

0.011

7.81

0.011

8.18

0.011

4,929,000

21,100,000

39,929,337

232,100

(161,000)

-

5.05

1.01

5

2.02

-

5.1

1.05

6.5

2.06

-

5.1

1.05

2.01

-

5.1

1.05

2.06

-

5.1

1

2.01

-

5.1

1

2.06

-

2,100

56,000

63,000

-

10,710

58,500

127,400

-

VOLUME :

99,311,740

34,900,450

45,785,535

220,892,886

448,600

3,130

1,523,910

99,060

95,773,754

155,624,040

62,700

711,210

274,670

189,660

25,100

577,000

3,136,180

1,228,940

6,121,770

2,420,360

(25,404,130)

30,957,965

14,869,238

(272,000)

55,079,652

40,989,515

780

(373,600)

(8,000)

-

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

EUROMED

LMG CHEMICALS

MABUHAY VINYL

MANCHESTER A

MANCHESTER B

METROALLIANCE A

METROALLIANCE B

PRYCE CORP.

**** DIVERSIFIED INDUSTRIALS ****

ACTIVE ALLIANCE

ALPHALAND

CHIPS

FILSYN A

FILSYN B

GREENERGY

INTEGRATED MICRO

IONICS

PANASONIC

PICOP RES.

SPLASH CORP.

STENIEL

IMI

ION

PMPC

PCP

SPH

STN

INDUSTRIALS SECTOR TOTAL

VALUE :

1,034,625,226.5

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS A

ABOITIZ

ALCORN GOLD

ALLIANCE GLOBAL

ANGLO-PHIL HLDG

ANSCOR

ASIA AMALGAMATED

ATN HOLDINGS A

ATN HOLDINGS B

AYALA CORP

BHI HOLDINGS

DMCI HOLDINGS

F&J PRINCE A

F&J PRINCE B

FIL-ESTATE CORP

FILINVEST DEV.

FORUM PACIFIC

HOUSE OF INV

JG SUMMIT

JOLLIVILLE HLDG

KEPPEL HLDG. A

KEPPEL HLDG. B

LODESTAR

LOPEZ HLDGS.

MABUHAY HLDG.

MARCVENTURES

ABA

AEV

APM

AGI

APO

ANS

AAA

ATN

ATNB

AC

BH

DMC

FJP

FJPB

FC

FDC

FPI

HI

JGS

JOH

KPH

KPHB

LIHC

LPZ

MHC

MARC

1.03

40.65

0.015

10.66

1.97

3.13

2

2.25

2.4

295.2

300

37.95

1.65

1.27

3.53

0.201

3.05

24.75

3.32

3.29

3.28

0.77

4.68

0.5

2.1

1.06

40.9

0.016

10.68

2.01

3.25

2.04

2.3

2.58

296

450

38

1.86

2.4

3.6

0.21

3.13

25.1

3.5

3.69

3.66

0.79

4.69

0.51

2.11

1.07

40.7

10.6

2.02

3.13

2.1

2.5

296

38.1

1.65

3.51

0.21

3.05

25.1

3.9

0.79

4.63

0.52

2.1

1.07

40.9

10.82

2.02

3.13

2.1

2.65

296.8

38.2

1.65

3.6

0.21

3.14

25.1

3.9

0.8

4.68

0.58

2.15

1.01

40.45

10.58

1.93

3.13

2

2.5

295.2

37.9

1.65

3.51

0.2

3.05

25.1

3.3

0.77

4.63

0.5

2.09

1.06

40.9

10.68

2.01

3.13

2

2.65

296

38

1.65

3.6

0.201

3.14

25.1

3.5

0.79

4.68

0.5

2.1

34,155,000

1,121,800

20,643,600

225,000

1,000

759,000

39,000

323,560

4,094,700

38,000

198,000

1,370,000

62,000

1,000

168,000

3,973,000

263,000

11,875,000

1,148,000

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

Symbol

METRO PAC INV

MINERALES IND

MJC INVESTMENTS

PACIFICA A

PRIME MEDIA

PRIME ORION

REPUBLIC GLASS

SEAFRONT RES.

SINOPHIL

SM INVESTMENTS

SOLID GROUP

SOUTH CHINA

TRANSGRID

UNIOIL HLDG.

WELLEX INDUS

ZEUS HOLDINGS

MPI

MIC

MJIC

PA

PRIM

POPI

REG

SPM

SINO

SM

SGI

SOC

SGP

UNI

WIN

ZHI

Bid

3.43

4.25

1.5

0.058

1.54

0.52

1.57

1.08

0.33

530

1.16

1.14

512

0.183

0.15

0.85

Ask

3.44

4.28

1.8

0.059

1.7

0.53

2.29

1.24

0.35

534

1.18

1.19

595

0.186

0.152

0.86

Open

3.41

4.35

1.68

0.057

0.52

1.08

0.34

538

1.18

1.19

0.186

0.15

0.82

High

3.53

4.4

1.68

0.061

0.52

1.08

0.35

538

1.2

1.2

0.186

0.155

0.86

HOLDING FIRMS SECTOR TOTAL

Low

Close

3.41

4.27

1.5

0.057

0.52

1.08

0.33

529

1.15

1.16

0.186

0.15

0.8

3.44

4.28

1.5

0.058

0.52

1.08

0.35

534

1.18

1.18

0.186

0.152

0.86

VOLUME :

236,999,520

Volume

84,134,000

319,000

17,000

25,920,000

258,000

60,000

360,000

487,860

399,000

394,000

660,000

2,190,000

41,342,000

VALUE :

Value

Net Foreign

Trade (Peso)

Buying (Selling)

290,844,410

1,390,400

27,300

1,518,810

134,160

64,800

120,900

258,829,290

472,300

462,130

122,760

332,960

34,919,990

23,497,760

(73,064,295)

(22,220)

(400)

(7,600)

(3,770)

1,159,039,165

PROPERTY

**** PROPERTY ****

A. BROWN

ALCO

ANCHOR LAND

ARANETA PROP

AYALA LAND

BELLE CORP.

CEBU HLDG.

CEBU PROPERTY A

CEBU PROPERTY B

CENTURY PROP

CITY & LAND

CITYLAND DEVT.

CROWN EQUITIES

CYBER BAY

EMPIRE EAST

ETON

EVER-GOTESCO

FILINVEST LAND

GLOBAL-ESTATE

GOTESCO LAND A

GOTESCO LAND B

HIGHLANDS PRIME

INTERPORT A

INTERPORT B

KEPPEL PROP

MARSTEEL A

MARSTEEL B

MEGAWORLD

MRC ALLIED

PHIL ESTATES

PHILREALTY

POLAR PROPERTY

PRIMETOWN PROP.

PRIMEX CORP.

ROBINSONS LAND

SAN MIGUEL PROP

SHNG PROPERTIES

SM DEVT

SM PRIME HLDG.

STA.LUCIA LAND

SUNTRUST HOME

UNIWIDE HLDG.

VISTA LAND

BRN

ALCO

ALHI

ARA

ALI

BEL

CHI

CPV

CPVB

CPG

LAND

CDC

CEI

CYBR

ELI

ETON

EVER

FLI

GERI

GO

GOB

HP

IRC

IRCB

KEP

MC

MCB

MEG

MRC

PHES

RLT

PO

PMT

PRMX

RLC

SMP

SHNG

SMDC

0.161

18.5

0.47

15.96

4.31

2.5

2.65

2.65

2.1

1.49

1.03

0.07

0.78

0.61

3.13

0.137

1.07

2.23

1.6

0.71

0.8

1.6

1.82

0.305

0.126

0.52

2.65

2.1

11.7

360

1.98

7.35

0.165

19

0.5

15.98

4.35

2.6

2.95

2.95

2.11

1.8

1.23

0.072

0.79

0.62

3.2

0.148

1.08

2.25

1.9

0.78

1

1.8

1.83

0.31

0.139

0.53

2.77

2.89

11.72

590

1.99

7.36

0.165

19

16

4.3

2.45

3.8

2.65

2.16

0.78

0.61

3.14

0.155

1.09

2.16

0.78

0.8

1.85

0.315

0.134

0.53

2.7

11.9

2

7.4

0.165

19

16.04

4.43

2.45

3.8

2.65

2.16

0.79

0.61

3.14

0.155

1.09

2.28

0.78

0.8

1.85

0.315

0.134

0.53

2.77

11.9

2

7.4

0.165

19

15.96

4.28

2.45

3.8

2.65

2.08

0.78

0.61

3.14

0.15

1.07

2.16

0.7

0.8

1.81

0.31

0.125

0.51

2.7

11.7

1.88

7.31

0.165

19

15.98

4.31

2.45

3.8

2.65

2.11

0.79

0.61

3.14

0.15

1.07

2.24

0.7

0.8

1.83

0.31

0.125

0.52

2.77

11.7

1.99

7.36

410,000

5,000

19,235,400

10,957,000

4,000

1,000

25,000

1,088,000

489,000

847,000

6,000

80,000

38,800,000

4,789,000

319,000

28,000

44,803,000

8,410,000

1,580,000

7,750,000

69,000

2,151,200

225,000

698,400

67,650

95,000

307,703,156

47,992,180

9,800

3,800

66,250

2,286,220

382,540

516,670

18,840

12,050

41,993,040

10,765,350

231,520

22,400

81,760,380

2,611,750

205,240

4,103,500

186,550

25,183,330

446,990

5,142,550

(95,000)

(1,987,144)

13,113,860

(31,066,810)

4,311,310

(58,886,260)

(266,450)

(4,329,722)

(62,400)

1,506,040

SMPH

SLI

SUN

UW

VLL

12.92

0.71

0.54

2.91

12.94

0.72

0.57

2.92

12.8

0.73

0.54

2.93

12.92

0.73

0.57

2.95

12.8

0.7

0.54

2.87

12.92

0.72

0.55

2.92

7,210,700

7,592,000

170,000

1,027,000

92,786,258

5,359,610

93,760

2,981,690

57,353,726

5,560

(689,970)

114,340

162,818

44,400

71,250

PROPERTY SECTOR TOTAL

VOLUME :

159,128,700

VALUE :

633,322,034

SERVICES

**** MEDIA ****

ABS-CBN

GMA NETWORK

MANILA BULLETIN

MLABROADCASTING

ABS

GMA7

MB

MBC

30.9

6.41

0.6

2.85

31

6.42

0.63

-

30.9

6.45

0.6

2.85

31

6.45

0.6

2.85

30.9

6.4

0.6

2.85

31

6.41

0.6

2.85

3,700

25,400

74,000

25,000

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

**** TELCOMMUNICATION ****

DIGITEL

GLOBE TELECOM

LIBERTY TELECOM

PLDT

PLDT ENERGY

PT&T

DGTL

GLO

LIB

TEL

PCEV

PTT

1.58

982

2.92

2,432

5.15

-

1.59

990

3

2,436

5.18

-

1.58

983

2.93

2,460

5.18

-

1.58

990

2.93

2,460

5.18

-

1.58

970

2.92

2,420

5.18

-

1.58

990

2.92

2,436

5.18

-

3,793,000

32,180

21,000

147,075

100

-

5,992,940

31,697,770

61,350

358,516,020

518

-

5,955,020

4,649,245

(2,972,600)

-

BHI

DFNN

IMP

IMPB

CLOUD

0.188

5.75

7.23

6.8

2.51

0.19

6

9.9

13

2.52

0.199

5.82

7.5

2.5

0.2

6

7.6

2.52

0.185

5.8

7.5

2.49

0.19

6

7.5

2.52

74,610,000

56,800

7,800

80,000

14,225,740

330,875

58,720

200,200

104,300

-

EG

IP

IS

ISM

NXT

WEB

TBGI

22.2

1.85

0.063

3.5

14.7

2.81

23.9

1.88

0.064

3.54

14.84

3.28

22.1

1.93

0.05

3.48

14.84

-

24.05

1.93

0.068

3.54

14.86

-

22.1

1.84

0.05

3.48

14.8

-

24

1.85

0.063

3.54

14.84

-

7,300

7,479,000

241,950,000

7,000

168,400

-

173,830

13,929,100

13,429,350

24,430

2,498,090

-

74,900

17,320

(48,940)

-

ATI

ATS

CEB

ICT

LSC

MAC

TOL

PAL

7.52

1.33

69.25

53.1

1.04

2.81

7.05

5.95

8

1.47

69.3

53.5

1.1

3

8.4

6

1.45

70

54.7

1.06

3

5.9

1.45

70

54.7

1.06

3

5.95

1.45

69.25

52.75

1.04

2.85

5.9

1.45

69.25

53.5

1.04

2.85

5.95

23,000

349,230

11,397,890

48,000

323,000

53,900

33,350

24,286,989

613,305,826.5

49,940

935,200

319,815

(14,750,509)

249,903,141

(677,200)

-

ACE

GPH

LR

MJC

PRC

PEP

WPI

2.85

25

9.82

1.4

6.5

0.29

0.51

3.2

32

9.83

1.43

6.8

0.295

0.52

9.78

1.4

6.4

0.295

0.52

9.98

1.46

6.5

0.3

0.52

9.74

1.4

6.4

0.29

0.51

9.82

1.4

6.5

0.29

0.52

2,263,900

142,000

20,900

2,850,000

536,000

22,334,998

200,030

135,760

834,050

273,940

490,000

14,600

-

CEU

FEU

IPO

8.7

1,015

4.65

9

1,095

5

9

4.6

9

5

9

4.6

9

5

13,000

19,000

117,000

92,980

SEVN

APC

BCOR

ECP

ICTV

JTH

MET

LOTO

PAX

PHC

PGOLD

18.4

0.6

15.04

1.8

0.41

2.66

28

18.54

1.38

15.16

25

0.61

21.5

2.2

0.42

2.75

31

18.88

1.4

15.2

0.6

1.8

0.42

2.6

28

18.54

1.38

15.3

0.61

1.8

0.425

2.75

28

18.54

1.4

15.3

0.6

1.8

0.4

2.6

28

18.54

1.36

15.18

0.6

1.8

0.41

2.75

28

18.54

1.4

15.18

762,000

24,000

3,830,000

856,000

100

23,800

422,000

4,481,200

458,200

43,200

1,558,750

2,252,700

2,800

441,252

579,620

68,196,600

90,700

(411,000)

1,912,074

VOLUME :

357,091,075

600,600

561,220

45,000

6,176,884

2,210

280,495

598,700

4,957,800

3,675,077

2,916,260

875,037,850

340,678,550

(105,600)

(4,248,204)

(327,700)

(408,000)

147,255

27,000

14,005,150

**** INFORMATION TECHNOLOGY ****

BOULEVARD HLDG.

DIVERSIFIED

IMPERIAL A

IMPERIAL B

IP CONVERGE

IP E-GAME

IPVG CORP.

ISLAND INFO

ISM COMM.

NEXTSTAGE

PHILWEB

TRANSPACIFIC BR

**** TRANSPORATION SERVICES ****

ASIAN TERMINALS

ATS CONSO.

CEBU AIR, INC.

INTL CONTAINER

LORENZOSHIPPING

MACROASIA

METRO PACIFIC

PAL HOLDINGS

**** HOTEL & LEISURE ****

ACESITE HOTEL

GRAND PLAZA

LEISURE

MANILA JOCKEY

PHIL. RACING

PREMIER ENT.

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

FAR EASTERN U

IPEOPLE

**** DIVERSIFIED SERVICES ****

7-11

APC GROUP

BERJAYA

EASYCALL

ICTVI

JTH DAVIES

MIC HOLDINGS

PACIFIC ONLINE

PAXYS

PHILCOMSAT

PUREGOLD

SERVICES SECTOR TOTAL

VALUE :

1,178,990,545.5

MINING & OIL

**** MINING ****

ABRA MINING

APEX MINING A

APEX MINING B

ATLAS MINING

ATOK

BENGUET A

BENGUET B

CENTURY PEAK

DIZON MINES

GEOGRACE

LEPANTO A

LEPANTO B

AR

APX

APXB

AT

AB

BC

BCB

CPM

DIZ

GEO

LC

LCB

0.0066

4.4

4.26

17.46

22.1

27.05

27.1

2.03

8.55

0.54

1.72

1.81

0.0067

4.45

4.5

17.48

24.6

27.9

27.35

2.04

8.64

0.55

1.73

1.82

0.0066

4.4

4.5

17.4

22.1

27.5

27.35

2.04

8.69

0.55

1.6

1.7

0.0066

4.4

4.5

17.46

22.1

27.9

27.35

2.06

9

0.55

1.73

1.83

0.0066

4.31

4.5

17.38

22.1

27.05

27.1

2.02

8.43

0.54

1.58

1.7

0.0066

4.4

4.5

17.46

22.1

27.9

27.1

2.04

8.64

0.55

1.72

1.81

91,000,000

128,000

10,000

354,800

100

10,200

22,000

2,436,000

428,500

5,391,000

523,375,000

190,875,000

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

Symbol

MANILA MINING A

MANILA MINING B

NICKELASIA

NIHAO

OMICO CORP.

ORIENTAL P

PHILEX

SEMIRARA MINING

UNITED PARAGON

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MA

MAB

NIKL

NI

OM

ORE

PX

SCC

UPM

0.064

0.065

19.7

4.36

0.73

3.89

23.1

210

0.022

0.065

0.066

19.98

4.37

0.83

3.9

23.2

210.2

0.023

0.063

0.064

20.05

4.46

4.01

23.2

210

0.023

0.065

0.066

20.05

4.47

4.05

23.2

210

0.023

0.063

0.063

19.7

4.35

3.89

22.85

209

0.022

0.065

0.066

19.7

4.37

3.9

23.2

210

0.022

1,215,250,000

284,420,000

64,000

13,563,000

2,541,000

1,428,400

98,200

109,200,000

78,510,720

18,367,690

1,274,314

59,439,480

9,986,260

32,951,665

20,542,568

2,502,000

(67,560)

(6,003,760)

97,500

9,389,060

(11,118,032)

-

BSC

OPM

OPMB

0.209

0.017

0.017

0.213

0.018

0.018

0.208

0.017

-

0.209

0.018

-

0.208

0.017

-

0.209

0.017

-

790,000

54,000,000

-

164,560

919,200

-

PERC

PXP

OV

PEC

PECB

5.85

7.15

0.021

27

50

6

7.25

0.022

60

7.1

0.021

60

7.15

0.022

60

7.07

0.021

60

7.15

0.021

60

484,500

136,300,000

1,100

3,447,592

2,962,300

66,000

(1,313,034)

60,000

**** OIL ****

BASIC PETROLEUM

ORIENTAL A

ORIENTAL B

PETROENERGY

PHILEXPETROLEUM

PHILODRILL A

PNOC A

PNOC B

MINING AND OIL SECTOR TOTAL

VOLUME :

2,632,170,800

VALUE :

1,466,664,995

PREFERRED

ALLIEDBANK PREF

DMCI PREFERRED

ABC

PBCP

ACPA

ACPR

DMCP

FIRST GEN F

FGENF

100.6

FIRST PHIL HOLD

PETRON PREF

FPHP

PPREF

104.1

112.1

112.5

112.5

112.5

112.5

112.5

4,460

501,750

SMC PREF 1

SMCP1

77

78.6

SMPFC PREFS

GMA HOLDINGS

PFP

SFIP

BCP

ABSP

GMAP

1,014

0.99

30.5

31

6.11

1,015

1.2

32

6.12

1,015

0.99

6.1

1,015

0.99

6.15

1,015

0.99

6.1

1,015

0.99

6.12

200

9,000

164,400

203,000

8,910

1,005,804

(765,000)

GLOBE PREF A

GLOPA

PLDT A

TELA

TLAA

TELB

TLBB

TELC

TLCC

TELD

TLDD

TELE

TLEE

TELF

TLFF

TELG

TLGG

TELH

TLHH

TELI

TELJ

TELK

TELL

TELM

TELN

TELO

TELP

TELQ

TELR

TELS

TELT

TELU

TELV

TELW

TELX

TELY

TELZ

ATSP

1.95

PBCP PREFERRED

AYALA PREF. A

AYALA PREF. B

SWIFT PREF

BENGUET PREF. A

ABS-CBN PDR

PLDT AA

PLDT B

PLDT BB

PLDT C

PLDT CC

PLDT D

PLDT DD

PLDT E

PLDT EE

PLDT F

PLDT FF

PLDT G

PLDT GG

PLDT H

PLDT HH

PLDT I

PLDT J

PLDT K

PLDT L

PLDT M

PLDT N

PLDT O

PLDT P

PLDT Q

PLDT R

PLDT S

PLDT T

PLDT U

PLDT V

PLDT W

PLDT X

PLDT Y

PLDT Z

ATS CONSO.P

540

-

549

-

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

Symbol

Bid

Ask

Open

High

Low

PREFERRED TOTAL

Close

VOLUME :

Volume

178,060

VALUE :

Net Foreign

Trade (Peso)

Buying (Selling)

Value

1,719,464

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

OMICO-W

INTERPORTWA

INTERPORTWB

MEG-WARRANTS

MEG-WARRANTS2

PLDT-USD

OMW2

IRWA

IRWB

MEGW1

MEGW2

DTEL

0.08

0.82

0.79

-

0.11

0.85

0.8

-

0.82

-

0.87

-

0.81

-

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

0.85

-

VOLUME :

359,000

-

359,000

VALUE :

293,960

-

293,960

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

MAKATI FINANCE

RPL

MFIN

4.25

1.81

4.76

-

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

3,499,219,360

VALUE :

VALUE :

6,184,768,778

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

NO. OF ADVANCES:

79

NO. OF DECLINES:

74

NO. OF UNCHANGED:

42

NO. OF TRADED ISSUES: 195

NO. OF TRADES:

17659

BLOCK SALES

SECURITY

BPI

MBT

SECB

SECB

ICT

URC

URC

URC

EDC

PRICE

52.3112

66.131

96.9

95.4968

54

50.4645

50.1878

50.5

6.0749

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

950,000

3,530,635

450,000

239,521

483,600

735,745

2,756,225

1,294,530

5,300,000

VALUE

49,695,640

233,484,423.185

43,605,000

22,873,489.0328

26,114,400

37,129,003.5525

138,328,869.055

65,373,765

32,196,970

266,639

208,824.86

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

311,092,596

2,901,909,408.78

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

939.42

7,000.57

3,377.35

1,506.13

1,575.64

24,031.2

4,288.9

2,989.41

948.63

7,021.15

3,397.47

1,509.18

1,575.64

24,724.18

4,299.5

2,999.6

939.42

6,963.42

3,375.31

1,503.7

1,552.91

24,001

4,278.37

2,989.41

947.57

7,006.85

3,392.27

1,505.15

1,561.47

24,724.18

4,290.92

2,999.6

0.79

0.02

0.63

-0.09

-1.16

3.01

0.01

0.35

7.43

1.12

21.36

-1.31

-18.3

722

0.33

10.33

19,688,882

109,404,273

237,013,569

159,158,495

357,583,889

2,632,377,147

1,061,798,014.42

1,307,696,594.09

1,159,080,002.23

633,366,404.54

1,205,140,063.51

1,466,698,083.89

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

3,515,226,255 Php 6,833,779,162.6753

Php 3,568,061,336.07

Php 2,969,753,610.04

Companies Under Suspension by the Exchange as of 12/02/2011

ASIA

- ASIATRUST

BRN

- A. BROWN

CBC

- COSMOS

EIBA

- EXPORT BANK

EIBB

- EXPORT BANK B

FC

- FIL-ESTATE CORP

FYN

- FILSYN A

FYNB

- FILSYN B

GO

- GOTESCO LAND A

GOB

- GOTESCO LAND B

MAH

- METROALLIANCE A

MAHB

- METROALLIANCE B

MC

- MARSTEEL A

MCB

- MARSTEEL B

NXT

- NEXTSTAGE

PHC

- PHILCOMSAT

PNC

- PNCC

TDY

- TANDUAY HLDG.

TELA

- PLDT A

TELB

- PLDT B

TELC

- PLDT C

TELD

- PLDT D

TELE

- PLDT E

TELF

- PLDT F

TELG

- PLDT G

TELH

- PLDT H

TELI

- PLDT I

The Philippine Stock Exchange, Inc

Daily Quotations Report

December 02 , 2011

Name

TELJ

TELK

TELL

TELM

TELN

TELO

TELP

TELQ

TELR

TELS

TELT

TELU

TELV

TELW

TELX

TELY

TELZ

TLAA

TLBB

TLCC

TLDD

TLEE

MED

PCP

PMT

PPC

PTT

STN

UW

VMC

TLFF

Symbol

-

Bid

PLDT J

PLDT K

PLDT L

PLDT M

PLDT N

PLDT O

PLDT P

PLDT Q

PLDT R

PLDT S

PLDT T

PLDT U

PLDT V

PLDT W

PLDT X

PLDT Y

PLDT Z

PLDT AA

PLDT BB

PLDT CC

PLDT DD

PLDT EE

MEDCO HLDG.

PICOP RES.

PRIMETOWN PROP.

PRYCE CORP.

PT&T

STENIEL

UNIWIDE HLDG.

VICTORIAS

PLDT FF

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

Вам также может понравиться

- Bmsa Book With CoverДокумент251 страницаBmsa Book With CoverHurol Samuel100% (7)

- Market Penetration of Maggie NoodelsДокумент10 страницMarket Penetration of Maggie Noodelsapi-3765623100% (1)

- Primer On Market ProfileДокумент4 страницыPrimer On Market Profilechalasanica100% (2)

- The Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report October 05, 2011Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report October 05, 2011Burn LimОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report April 02, 2012Документ9 страницThe Philippine Stock Exchange, Inc Daily Quotations Report April 02, 2012srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report September 13, 2010Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report September 13, 2010Nelkie Matilla-SidoconОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report December 28, 2012Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report December 28, 2012srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 23, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 23, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report October 05, 2012Документ6 страницThe Philippine Stock Exchange, Inc Daily Quotations Report October 05, 2012Rufino Gerard MorenoОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipОценок пока нет

- Stockquotes 02042015 PDFДокумент8 страницStockquotes 02042015 PDFsrichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report December 12, 2012Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report December 12, 2012srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 29, 2013Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 29, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Документ9 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Melissa BaileyОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 24, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 24, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report December 26, 2012Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report December 26, 2012srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Документ7 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014John Paul Samuel ChuaОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Art JamesОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014Документ8 страницThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014John Paul Samuel ChuaОценок пока нет

- Millionaire Traders: How Everyday People Are Beating Wall Street at Its Own GameОт EverandMillionaire Traders: How Everyday People Are Beating Wall Street at Its Own GameРейтинг: 4 из 5 звезд4/5 (3)

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsОт EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsОценок пока нет

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceОт EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceОценок пока нет

- Service Failure at Axis Bank (Case Study)Документ11 страницService Failure at Axis Bank (Case Study)Snehil Mishra0% (1)

- Ch15 SG BLTS 8eДокумент31 страницаCh15 SG BLTS 8eHolli Boyd-White100% (1)

- Appendix 32 BrgyДокумент4 страницыAppendix 32 BrgyJovelyn SeseОценок пока нет

- Shriram Transport Finance Company LTD: Customer Details Guarantor DetailsДокумент3 страницыShriram Transport Finance Company LTD: Customer Details Guarantor DetailsThirumalasetty SudhakarОценок пока нет

- NAB Satellite Uplink Operators Training SeminarДокумент5 страницNAB Satellite Uplink Operators Training SeminarChucx I. ChucxОценок пока нет

- DO-178B Compliance: Turn An Overhead Expense Into A Competitive AdvantageДокумент12 страницDO-178B Compliance: Turn An Overhead Expense Into A Competitive Advantagedamianpri84Оценок пока нет

- BUS 206 Milestone OneДокумент3 страницыBUS 206 Milestone OneTrish FranksОценок пока нет

- Hunt V Spotlight Transcript 2Документ585 страницHunt V Spotlight Transcript 2Alan Jules WebermanОценок пока нет

- 810 Pi SpeedxДокумент1 страница810 Pi SpeedxtaniyaОценок пока нет

- Satyam Cnlu Torts RoughdraftДокумент4 страницыSatyam Cnlu Torts RoughdraftSatyam OjhaОценок пока нет

- ITIL Test PaperДокумент9 страницITIL Test PaperNitinОценок пока нет

- Revaluation ModelДокумент7 страницRevaluation ModelkyramaeОценок пока нет

- Rutgers Newark Course Schedule Spring 2018Документ2 страницыRutgers Newark Course Schedule Spring 2018abdulrehman786Оценок пока нет

- Paytm Payment Solutions - Feb15Документ30 страницPaytm Payment Solutions - Feb15AlienOnEarth123100% (1)

- SEB - ISO - XML Message For Payment InitiationДокумент75 страницSEB - ISO - XML Message For Payment InitiationbpvsvОценок пока нет

- totallyMAd - 18 January 2008Документ2 страницыtotallyMAd - 18 January 2008NewsclipОценок пока нет

- List of Cases For Insurance Law-MidtermsДокумент3 страницыList of Cases For Insurance Law-MidtermsJudith AlisuagОценок пока нет

- RTHD L3gxiktДокумент2 страницыRTHD L3gxiktRobin RahmanОценок пока нет

- Amity School of Engineering & Technology: B. Tech. (MAE), V Semester Rdbms Sunil VyasДокумент13 страницAmity School of Engineering & Technology: B. Tech. (MAE), V Semester Rdbms Sunil VyasJose AntonyОценок пока нет

- CH 5 Answers To Homework AssignmentsДокумент13 страницCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- IRS Depreciation Guide With Optional Rate TablesДокумент118 страницIRS Depreciation Guide With Optional Rate TablesManthan ShahОценок пока нет

- Mian Muhammad Ateeq SheikhДокумент2 страницыMian Muhammad Ateeq SheikhAashq LoveОценок пока нет

- 02 Company Profile 08 09 100623Документ8 страниц02 Company Profile 08 09 100623Peter MarvelОценок пока нет

- Sip Zudus PerformanceДокумент104 страницыSip Zudus PerformanceAkshay Jiremali100% (1)

- Annual Report Mustika Ratu 2018 PDFДокумент147 страницAnnual Report Mustika Ratu 2018 PDFdiah putriОценок пока нет

- Affidavit of NonliabilityДокумент3 страницыAffidavit of Nonliabilityzia_ghiasiОценок пока нет

- IMRADДокумент21 страницаIMRADRosalie RosalesОценок пока нет