Академический Документы

Профессиональный Документы

Культура Документы

Asset Replacement Note

Загружено:

Ajakaiye Khooduz IsholaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asset Replacement Note

Загружено:

Ajakaiye Khooduz IsholaАвторское право:

Доступные форматы

ASSETS REPLACEMENT DECISION Most items of equipment need replacement which is the process by which the various cost

consequences involved are studied so that the optimum replacement decisions can be taken. Once a decision has been made to acquire an asset for a long term project, its likely that the asset will need to be replaced periodically throughout the life of such asset. The decision we are concerned with is how often the asset should be replaced. The two most common replacement decisions relate to: 1) Sudden Failure: These are parts or components that work adequately up to a point and then fail suddenly e.g. Fan Belts, Light Bulbs, Industrial belts etc. 2) Gradual Deterioration: These are the items that deteriorate gradually, these are usually expensive items which could be kept functioning with increasing amount of maintenance e.g. Vehicles, Plant, Machinery & Equipment, and Boiler etc.

Replacement of assets would involve an outlay of capital expenditure which would be deferred when the decision to replace is postponed. The realizable value of an asset will decline as the asset gets older. Early replacement means that higher realizable value would be obtained from the existing asset. Some salient points in Asset replacement Decision are as stated below: As the assets get older, the realizable value will continue to decrease while the maintenance, operating & running cost will increase. The initial, maintenance, operating & running cost of the asset are expected to be deferred over the period of the asset replacement so as to decide the period at which assets can be replaced. The revenue (if any) generated from the usage of the assets are also expected to be deferred over the period of the asset replacement so as to decide the period at which assets can be replaced. The realizable value of the assets is not expected to be deferred because it is the scrap value of the assets at every period. FACTOR TO CONSIDER IN ASSET REPLACEMENT DECISION (mnemonics C,S,O R,I,T,O) 1) 2) 3) i) ii) Capital cost of the new assets: The higher cost of the equipment or asset must be considered and compared with the realizable value of the existing asset. Source of fund: The source of fund to acquire the asset should also be considered against known or possible technical improvements. Operating or Running cost of Existing Asset: Operating cost will be expected to increase as the asset deteriorates over time. It is as a result of: Increase in repairs and maintenance cost Lower quality and quantity of output

Created by moyosore

iii) 4)

5) 6) 7)

Increase in ideal time due to repairs and maintenance. Realisable value of the existing Asset: This is the extent to which old equipment can be traded in for the new one. Therefore, the earlier the replacement the higher is the realizable value of the existing asset and vise versa. Inflation: The general increase in price level and relative movement in the prices of goods and services will influence asset replacement decision. Taxation and Investment Incentives: Taxation and availability of investment incentives (such as capital allowance & investment allowance) will influence asset replacement decision. Opportunity Cost: This is the net benefit forgone as a result of trying to replace the existing asset with a new one. The new asset might increase productivity more than the old asset.

TYPE OF ASSET REPLACMENT DECISION There are two types of replacement decisions: Identical replacement decision Non-identical replacement decision 1) Identical Replacement decision: This involves the replacement of an existing asset with a new but identical asset. Two assets are termed identical if they produce the same cash flows i.e. both the existing asset and the replacing asset have the same financial characteristics. The problem therefore is to decide how frequently the asset should be replaced (i.e. what is the optimum replacement cycle). Non-identical replacement Decision:- When an asset is to be replaced with a non-identical asset the two assets are said to produce different cash flows. The problem is that of deciding on the best time (i.e. when) to replace the existing asset rather than the frequency of replacement. The optimal replacement option can be determined by using the equivalent annual cost which represents the cost of replacement.

2)

STEPS INVOLVED IN NON-IDENTICAL REPLACEMENT DECISION 1) 2) 3) 4) Determine the replacement option of the new asset. Identify the value of the relevant cash flows and discount this using the companys cost of capital. Calculate the Equivalent annual cost/Annual Equivalent Value of the new asset that would be used to replace the existing asset. Determine the replacement options for the existing asset.

Created by moyosore

5)

Estimate the relevant cash flows for each replacement options. The cash flow for each option will include the Equivalent annual cost or Annual Equivalent Value of the new asset. Calculate the NPV of each replacement options. The option with lowest NPV of cost or highest NPV of revenue will represent the optimal replacement period.

6) 7)

METHODS OF EVALUATION IN ASSET REPLACEMENT DECISION 1) AVERAGE COST METHOD: This method involves the determination of average cost of each asset. It has to do with replacement decision without discounting.

It is calculated as: Average Cost = TC/RP Where: TC = Total cost RP = Replacement Period. The period which gives the lowest average cost represents the optimal replacement period. This method is used where discount rate is not given in the question. Wyse Pack Q1 pg 61 T Ltd 2) SUDDEN FAILURE METHOD There are three categories of cost under this method:1) 2) 3) The replacement cost of the asset: This is usually the purchase price at the time of replacement The consequential cost of failure The cost involved in the actual replacement of the assets.

STEPS INVOLVED IN SUDDEN FAILURE METHOD a) Calculate the expected life of the assets to be replaced using expected value technique. b) Calculate the average replacement of the assets.

Created by moyosore

AR=

Total items available = Expected life

Number in use Expected life

Where: AR= Average replacement c) Calculate cost of individual replacement as they fail that is Average Replacement X Cost of Individual Replacement. d) Form an Asset failure table to calculate the Cumulative replacement e) Calculate the total cost as: TC = cumulative replacement cost + mass replacement cost. f) Calculate average cost for decision making AC = TC/RP Wyse Pack Q 2 Pg 61

3)

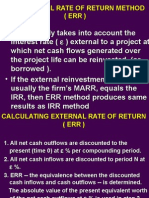

EQUIVALENT ANNUAL COST METHOD(EAC) OR ANNUAL EQUIVALENT VALUE(AEV) METHOD:- The length of life of an asset should not affect the decision on the asset but where the asset can be replaced or where a project is repeatable then the length of life of an asset becomes relevant factor to be considered. The investment criteria will be based on equivalent annual cost or annual equivalent value method which is defined as follows: EAC = NPV of Cost Annuity Factor OR AEV = NPV of Revenue Annuity factor

The best strategy is to calculate the NPV of cost/revenue over one of replacement and then divide by the Annuity Factor. Therefore, the optimal replacement period will be the period that has the lowest EAC or the highest AEV. The EAC is that amount that could be paid annually in arrears to finance the replacement options. NOTE:1) 2) Where project are one-off investment the selection procedure will be based on NPV. Where projects can be repeated indefinitely, the selection procedure would be based on EAC or AEV.

Created by moyosore

3)

Where the NPV of project is positive Annual Equivalent Value will be calculated and the option with the highest annual equivalent value will represent the optimal solution.

Wyse Pack Q3 Pg 61 Wyse Pack Q 4 Pg 62 ABDUL LTD 4) LOWEST COMMON MULTIPLE METHOD (LCM): The LCM of the various replacement cycles is determined and the NPV of cost over this cycle of replacement is also calculated. The LCM is used to determine the numbers of replacement cycle and it is very useful when inflation is involved in asset replacement decision.

STEPS INVOLVED IN LCM METHOD 1) Determine the replacement options 2) Determine LCM of the period of all the replacement cycle. 3) Estimates the cash flows over the LCM of the period for each option. 4) Discount the cash flows using the cost of capital over the LCM of the period. 5) The option with the lowest NPV of cost or highest NPV of revenue will represent the optimal replacement period. Wyse Pack Q9 Pg63 Kwara Express Wyse Pack Q8 pg63 Non identical replacement decision Question Wyse Pack Q12 Pg65 NEW SAW Wyse Pack Q12 Pg65 - OLD SAW 5) FINITE HORIZON: In practice when the maximum life of the asset is more than four (4) years, the lowest common multiple method becomes a difficult process and very long to compute. This will give rise to finite horizon method. For example, if the life of the asset is 5, the replacement option would be 1,2,3,4 or 5 year and the LCM would be 120. It would be difficult to use Lowest Common Multiple Method; therefore finite horizon method would be used to calculate the present value of cost over a significant time.

Created by moyosore

Вам также может понравиться

- A Firm's Sources of FinancingДокумент19 страницA Firm's Sources of FinancingisqmaОценок пока нет

- Budgeting Case Study: Put Laura's Budget TogetherДокумент2 страницыBudgeting Case Study: Put Laura's Budget TogetherUsman Ali50% (2)

- Code of Conduct for NBP EmployeesДокумент9 страницCode of Conduct for NBP Employeesasif khaniОценок пока нет

- Control Obj For Non-Current AssetsДокумент6 страницControl Obj For Non-Current AssetsTrần TùngОценок пока нет

- Negotiable Instruments Act, 1881 PDFДокумент61 страницаNegotiable Instruments Act, 1881 PDFmackjbl100% (3)

- Engineering Economy Replacement StudyДокумент28 страницEngineering Economy Replacement Studycyper zoonОценок пока нет

- 3 Service DesignfghДокумент51 страница3 Service DesignfghThomasGetyeОценок пока нет

- Guide to Hire Purchase FinancingДокумент21 страницаGuide to Hire Purchase FinancingkarthinathanОценок пока нет

- Perk Valuation of Motor CarДокумент18 страницPerk Valuation of Motor CarcapkaggarwalОценок пока нет

- Intercity Operations RFPДокумент11 страницIntercity Operations RFPJoseph LimОценок пока нет

- 3.1 Intro Equip Leasing Types of LeasesДокумент12 страниц3.1 Intro Equip Leasing Types of LeasesDecoster PardeepОценок пока нет

- Over-Capitalization Meaning, Causes and EffectsДокумент9 страницOver-Capitalization Meaning, Causes and EffectsselvakrishnaОценок пока нет

- Hire PurchaseДокумент30 страницHire PurchaseLeny MichaelОценок пока нет

- Hire Purchase PPT 1Документ17 страницHire Purchase PPT 1Virender Singh SahuОценок пока нет

- Example of Asset ReplacementДокумент1 страницаExample of Asset ReplacementflorentinaОценок пока нет

- Advantages and Disadvantages of LeasingДокумент1 страницаAdvantages and Disadvantages of LeasingMaribel ZafeОценок пока нет

- Data Bundles - MTN OnlineДокумент3 страницыData Bundles - MTN Onlineboewulf100% (1)

- Lecture 10-12 Capital Reconstruction SchemeДокумент23 страницыLecture 10-12 Capital Reconstruction SchemeGabriel korteyОценок пока нет

- Notes On Provident Fund & E.S.IДокумент2 страницыNotes On Provident Fund & E.S.IBhumika Pithadiya100% (2)

- Periodic Inventory SystemДокумент16 страницPeriodic Inventory SystemSohel Bangi100% (1)

- Plastic MoneyДокумент20 страницPlastic MoneyMohammad Saba100% (1)

- Types of LeasingДокумент22 страницыTypes of LeasingRavish Chitgope100% (2)

- How Companies Turn Cost Centers Into Profitable Business UnitsДокумент8 страницHow Companies Turn Cost Centers Into Profitable Business UnitschandanshaktiОценок пока нет

- Business Law Module GuideДокумент21 страницаBusiness Law Module GuideKai Sheng TanОценок пока нет

- TSI Physical Verification & TaggingДокумент6 страницTSI Physical Verification & TaggingCA Virendra ChhajerОценок пока нет

- Depreciation Calculation in ExcelДокумент8 страницDepreciation Calculation in ExcelVasanth Kumar VОценок пока нет

- Airport SLA GuideДокумент3 страницыAirport SLA GuideSa Xev100% (1)

- Asset Management: How AMCs Work for InvestorsДокумент2 страницыAsset Management: How AMCs Work for InvestorsDhoni KhanОценок пока нет

- BPMS Project IT HelpDeskДокумент16 страницBPMS Project IT HelpDeskfanwellОценок пока нет

- 06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansДокумент40 страниц06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansTarannum Aurora 20DM226Оценок пока нет

- Operating CostingДокумент37 страницOperating CostingkhairejoОценок пока нет

- 1 Lecture Let's Write An Impactful Business Plan!Документ41 страница1 Lecture Let's Write An Impactful Business Plan!Billyrefanto JpgОценок пока нет

- Hire PurchaseДокумент8 страницHire PurchaseAdityaОценок пока нет

- Finance InductionДокумент19 страницFinance InductionmenonpratishОценок пока нет

- Factoring Advantages and Dis AdvantagesДокумент1 страницаFactoring Advantages and Dis AdvantagesSiva RockОценок пока нет

- Guidelines for Preparing Effective Industrial Attachment ReportsДокумент7 страницGuidelines for Preparing Effective Industrial Attachment ReportsDZADZA YAOVIОценок пока нет

- Inventory Management ProjectДокумент89 страницInventory Management ProjectVinay Singh100% (1)

- E-PAYMENTДокумент3 страницыE-PAYMENTDave EdgarОценок пока нет

- Project Hire Purchase and LeasingДокумент29 страницProject Hire Purchase and Leasingsawantrohan214Оценок пока нет

- Leverage (Financial Management)Документ2 страницыLeverage (Financial Management)Rika Miyazaki100% (1)

- Chapter Five: Freight Forwarding OverviewДокумент19 страницChapter Five: Freight Forwarding OverviewAhmed HonestОценок пока нет

- Housing Finance: Presented by Sulekha Beri I.D.NO .43847Документ46 страницHousing Finance: Presented by Sulekha Beri I.D.NO .43847mehakdadwalОценок пока нет

- Expense ManagementДокумент4 страницыExpense Managementdemiss gebrieОценок пока нет

- Replacement Analysis: by Group IДокумент18 страницReplacement Analysis: by Group I55MESuman sahaОценок пока нет

- Replacement Analysis RevisedДокумент54 страницыReplacement Analysis RevisedCha Tingjuy100% (1)

- Engineering Economins-Replacement and Retention DecisionsДокумент74 страницыEngineering Economins-Replacement and Retention DecisionsAlbany SmashОценок пока нет

- Solar PV Sys Engg-Mod 10 1W Economic-Cons-mksДокумент39 страницSolar PV Sys Engg-Mod 10 1W Economic-Cons-mksOsama AsgharОценок пока нет

- Replace Equipment AnalysisДокумент12 страницReplace Equipment AnalysisPOGAKU KEERTHI MADHURIОценок пока нет

- EOQ and Differential Cost AnalysisДокумент4 страницыEOQ and Differential Cost AnalysisMerlita TuralbaОценок пока нет

- Principles of Engineering Economy: Analyze Costs & Maximize ProfitsДокумент4 страницыPrinciples of Engineering Economy: Analyze Costs & Maximize Profitsadamong99Оценок пока нет

- 6.3 Applying Annual-Worth Analysis 6.3.1 Benefits of AE AnalysisДокумент6 страниц6.3 Applying Annual-Worth Analysis 6.3.1 Benefits of AE Analysisshintya nadaОценок пока нет

- Replacement AnalysisДокумент34 страницыReplacement AnalysisShamsul AffendiОценок пока нет

- The Objective of Chapter 9 Is To Address The Question of Whether A Currently Owned Asset Should Be Kept in Service or Immediately ReplacedДокумент24 страницыThe Objective of Chapter 9 Is To Address The Question of Whether A Currently Owned Asset Should Be Kept in Service or Immediately ReplacedAykut YıldızОценок пока нет

- Asset Investment DecisionДокумент8 страницAsset Investment DecisionOnaderu Oluwagbenga EnochОценок пока нет

- Types of Replacement Policies:: Classification: InternalДокумент4 страницыTypes of Replacement Policies:: Classification: InternalCMОценок пока нет

- Replacement AnalysisДокумент18 страницReplacement AnalysisVishal MeenaОценок пока нет

- Life cycle costing for assetsДокумент19 страницLife cycle costing for assetsByamukama AsaphОценок пока нет

- Replacement and Maintenance AnalysisДокумент53 страницыReplacement and Maintenance AnalysisHimanshu MishraОценок пока нет

- Lecture NotesДокумент26 страницLecture NotesSAMSONIОценок пока нет

- CALCULATE EXTERNAL RATE OF RETURN (ERRДокумент19 страницCALCULATE EXTERNAL RATE OF RETURN (ERRJomer GiraoОценок пока нет

- DepreciationДокумент26 страницDepreciationBalu BalireddiОценок пока нет

- (Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsДокумент185 страниц(Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsFaridElAtracheОценок пока нет

- Vdocuments - MX - Blackbook Project On Mutual Funds PDFДокумент88 страницVdocuments - MX - Blackbook Project On Mutual Funds PDFAbu Sufiyan ShaikhОценок пока нет

- Abacus v. AmpilДокумент11 страницAbacus v. AmpilNylaОценок пока нет

- AHAP Insurance Financial SummaryДокумент2 страницыAHAP Insurance Financial SummaryluvzaelОценок пока нет

- Philippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentДокумент2 страницыPhilippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentGeralyn GabrielОценок пока нет

- Retail IndustryДокумент3 страницыRetail IndustryakavinashkillerОценок пока нет

- Financial MarketДокумент8 страницFinancial Marketindusekar83Оценок пока нет

- Accounting For Cash and Cash TransactionДокумент63 страницыAccounting For Cash and Cash TransactionAura Angela SeradaОценок пока нет

- Goods and Services Tax (GST) in IndiaДокумент30 страницGoods and Services Tax (GST) in IndiarupalОценок пока нет

- SOLMAN-CHAPTER-14-INVESTMENTS-IN-ASSOCIATES_IA-PART-1B_2020ed (3)Документ27 страницSOLMAN-CHAPTER-14-INVESTMENTS-IN-ASSOCIATES_IA-PART-1B_2020ed (3)Meeka CalimagОценок пока нет

- Ark Israel Innovative Technology Etf Izrl HoldingsДокумент2 страницыArk Israel Innovative Technology Etf Izrl HoldingsmikiОценок пока нет

- EF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Документ30 страницEF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Mamta Patel100% (1)

- St. Mary's Financial Accounting Comprehensive ExerciseДокумент5 страницSt. Mary's Financial Accounting Comprehensive ExerciseOrnet Studio100% (1)

- My - Invoice - 12 Jan 2023, 18 - 01 - 08Документ2 страницыMy - Invoice - 12 Jan 2023, 18 - 01 - 08Rohit Kumar DubeyОценок пока нет

- CPA Exam Questions on FASB Conceptual FrameworkДокумент26 страницCPA Exam Questions on FASB Conceptual FrameworkTerry GuОценок пока нет

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFДокумент11 страницACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainОценок пока нет

- Dvorak Mar 23Документ103 страницыDvorak Mar 23glimmertwins100% (1)

- Computation FY 18-19 PDFДокумент6 страницComputation FY 18-19 PDFRuch JainОценок пока нет

- ICE Cotton BrochureДокумент6 страницICE Cotton BrochureAmeya PagnisОценок пока нет

- Accounts - Past Years Que CompilationДокумент393 страницыAccounts - Past Years Que CompilationSavya SachiОценок пока нет

- Landbank RequirementsДокумент3 страницыLandbank Requirementsgee gambol50% (4)

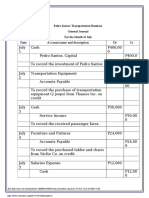

- Pedro Santos' Transportation Business General Journal For The Month of JulyДокумент8 страницPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლОценок пока нет

- A Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFДокумент7 страницA Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFMegan Jane JohnsonОценок пока нет

- Mobile Services Tax InvoiceДокумент3 страницыMobile Services Tax Invoicekumarvaibhav301745Оценок пока нет

- Entrepreneur Management Questions and AnswersДокумент24 страницыEntrepreneur Management Questions and AnswersArun DassiОценок пока нет

- Implementing Your Business PlanДокумент10 страницImplementing Your Business PlanGian Carlo Devera71% (7)

- Intercompany transactions elimination for consolidated financial statementsДокумент13 страницIntercompany transactions elimination for consolidated financial statementsicadeliciafebОценок пока нет

- ZF-02 Posting Credit Note SPPLДокумент10 страницZF-02 Posting Credit Note SPPLGhosh2Оценок пока нет

- OBLICON - Chapter 1 ProblemДокумент1 страницаOBLICON - Chapter 1 ProblemArahОценок пока нет