Академический Документы

Профессиональный Документы

Культура Документы

Income Tax Numericals For Practice

Загружено:

Adil MalikИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Income Tax Numericals For Practice

Загружено:

Adil MalikАвторское право:

Доступные форматы

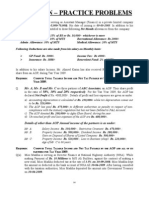

Example 1 Mr. Ali is a manager of a limited company.

He provided the following infromation for the Tax Year 2012

Basic salary Bonus Overtime Commission Cost of living allowance Special allownce Zakat Donation

Example 2 Mr. Sultan is a taxpayer. He provided the following infromation for the Tax Year 2012

200,000 50,000 40,000 30,000 20,000 25,000 10,000 15,000

Basic salary Education allowance Qualification pay cash award by President of Pakistan Free loan from employer Zakat paid Donation Tax withheld on Salary

Example 3 Mr. Jamil is working in ABC & Co. He provided the following infromation for the Tax Year 2012

280,000 40,000 60,000 90,000 100,000 5,000 2,000 6,500

Basic salary Subsistence allowance Utility allowance Senior post allowance Concessional loan @ 8% from employer Share from AOP Donation Tax withheld on electricity bill

Example 4 Mr. Jafar is a taxpayer. He provided the following infromation for the Tax Year 2012

230,000 40,000 30,000 50,000 500,000 100,000 20,000 7,000

Basic salary Bonus Life insurance premium paid by employer Commutation of pension from Govt. Medical expenses re-imbursed Medical allowance Profit on Bank account Donation Tax withheld on Salary

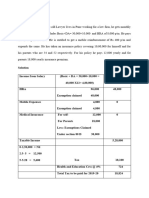

Example 5

200,000 70,000 90,000 200,000 45,000 24,000 50,000 30,000 25,000

Mr. Ahmed is 65 years old and working in a firm. He provided the following infromation for the Tax Year 2012

Basic salary Bonus Life insurance premium paid by employer Commutation of pension from Govt. Medical allowance

200,000 70,000 50,000 200,000 60,000

Tax withheld on cash withdrawal from Bank

Example 6 Mr. Hafeez is a taxpayer. He provided the following infromation for the Tax Year 2012

6,000

Basic salary Leave encashment salary of driver paid by employer Annuity Donation Tax withheld on salary

Example 7 Mr. Rehman provided the following infromation for the Tax Year 2012.

200,000 40,000 120,000 7,500 8,000

Basic salary Leave encashment salary of driver paid by employer Annuity Share from AOP Tax withheld on salary

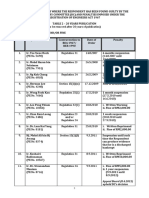

Example 8 Mr. Rafiq is an employee in a private firm. He provided the following infromation for the Tax Year 2012

200,000 30,000 120,000 20,000 60,000 32,000

Basic salary Leave encashment Gratuity approved by Commissioner Prize on prize bond Donation Tax withheld on salary

Example 9

300,000 60,000 245,000 200,000 25,000 50,000

Mr. Bashir provided the following infromation for the for Tax Year 2012.

Basic salary Leave encashment Gratuity approved by FBR Share from AOP Donation Tax deducted on utility bills

255,000 60,000 245,000 100,000 20,000 22,000

Example 10 Mr. Kamran is a taxpayer. He provided the following infromation for the Tax Year 2012

Basic salary Leave encashment Other Gratuity [Not approved] Rent free accommodation provided by the employer Motor vehicle provided for personal use. Cost 500000 Donation

350,000 60,000 245,000

25,000

Tax withheld on salary

Вам также может понравиться

- Examples Salary 2015Документ44 страницыExamples Salary 2015Farhan JanОценок пока нет

- Tax ReviewerДокумент22 страницыTax ReviewercrestagОценок пока нет

- Annexure C ExamplesДокумент21 страницаAnnexure C ExamplesLee Ka FaiОценок пока нет

- Hussainkhawaja 1177 3641 2 LECTURE-10Документ51 страницаHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoОценок пока нет

- MCQ Taxation 2Документ24 страницыMCQ Taxation 2Mahesh VekariyaОценок пока нет

- Your 2013 Income Taxes Have Gone UP Folks!Документ2 страницыYour 2013 Income Taxes Have Gone UP Folks!mikerogeroОценок пока нет

- Fringe Benefit Tax RulesДокумент2 страницыFringe Benefit Tax RulesAngel Chane OstrazОценок пока нет

- Dozer Limited: Capital Budgeting ModelДокумент61 страницаDozer Limited: Capital Budgeting ModelBrian Jeric MorilloОценок пока нет

- Ed Practice Problems For TaxationДокумент6 страницEd Practice Problems For TaxationKIYYA QAYYUM BALOCH100% (1)

- MAC CEO Tax CalculationДокумент4 страницыMAC CEO Tax CalculationhafsaОценок пока нет

- PF Employee Contribution Interest Taxability FAQsДокумент3 страницыPF Employee Contribution Interest Taxability FAQssusannaОценок пока нет

- Allowable Deductions Part 1Документ3 страницыAllowable Deductions Part 1John Rich GamasОценок пока нет

- Tax1 Quiz 3 Fringe Benefit TaxДокумент17 страницTax1 Quiz 3 Fringe Benefit TaxJan Mark2Оценок пока нет

- Discussions Updated 24.03Документ28 страницDiscussions Updated 24.03rajawatswadheentaОценок пока нет

- Malaysian Taxation Lecture 2 Employment Income 1Документ35 страницMalaysian Taxation Lecture 2 Employment Income 1Hafizah Mat NawiОценок пока нет

- Income From SalaryДокумент9 страницIncome From Salaryvinod nainiwalОценок пока нет

- 3.1 Employment Income Tax Edited March 2021Документ22 страницы3.1 Employment Income Tax Edited March 2021Bimmer MemerОценок пока нет

- Acctg 4. Bonus Computation4Документ1 страницаAcctg 4. Bonus Computation4RAMOS, Jann Julianne D.Оценок пока нет

- Income from Salaries: Taxation of Salary IncomeДокумент15 страницIncome from Salaries: Taxation of Salary IncomeAliakbar SayaniОценок пока нет

- SalaryДокумент66 страницSalaryFurqan AhmedОценок пока нет

- Individual-Txation-FY-2018-19-with - JJДокумент64 страницыIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYОценок пока нет

- Question CAP III AND CA MEMBERHSIP New OneДокумент17 страницQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaОценок пока нет

- Income Tax - I Subj - Code:113020 Section-AДокумент3 страницыIncome Tax - I Subj - Code:113020 Section-AThiru VenkatОценок пока нет

- 05M Fringe BenefitДокумент4 страницы05M Fringe BenefitMarko IllustrisimoОценок пока нет

- 04 LectureДокумент23 страницы04 Lecturehsmalik777Оценок пока нет

- Module 08 - Exclusions From Gross IncomeДокумент19 страницModule 08 - Exclusions From Gross IncomeJANELLE NUEZОценок пока нет

- TAX Quiz 1Документ2 страницыTAX Quiz 1NaLyn SuLit44% (9)

- COMPENSATION BENEFITS BANK KPOДокумент33 страницыCOMPENSATION BENEFITS BANK KPORinky NarangОценок пока нет

- BudgetДокумент21 страницаBudgetshweta_narkhede01Оценок пока нет

- IDBI Federal Incomesurance Plan BenefitsДокумент3 страницыIDBI Federal Incomesurance Plan BenefitsVipul KhandelwalОценок пока нет

- T 5 Business Expenses PT 2 2015Документ15 страницT 5 Business Expenses PT 2 2015DarshiniОценок пока нет

- FM NumericalДокумент3 страницыFM NumericalNitin KumarОценок пока нет

- Quiz2 1Документ4 страницыQuiz2 1Stanley ArenasОценок пока нет

- Module 8: Exclusions from Gross IncomeДокумент82 страницыModule 8: Exclusions from Gross IncomeDonna Chelsea OrdialesОценок пока нет

- Evaluation of Opportunity Cost of Studying MBA at IBAДокумент5 страницEvaluation of Opportunity Cost of Studying MBA at IBAAhsan Azhar Shopan100% (1)

- Management Control SystemДокумент11 страницManagement Control SystemomkarsawantОценок пока нет

- Provident Fund Act 1952: ObjectiveДокумент2 страницыProvident Fund Act 1952: Objectivebarakkat72Оценок пока нет

- Illustration 1 and 2 Salary - 21-22 Nov 2023Документ5 страницIllustration 1 and 2 Salary - 21-22 Nov 2023Chinmay HarshОценок пока нет

- Program 1 Preparation of Income Statement: ReceiptsДокумент2 страницыProgram 1 Preparation of Income Statement: ReceiptsDineshkumarAparnaОценок пока нет

- Income From Salary GuideДокумент53 страницыIncome From Salary GuideBoRO TriAngLEОценок пока нет

- Compensation IncomeДокумент34 страницыCompensation IncomeAdelade MaryosaОценок пока нет

- Why You Just Can't Withdraw A Bounce Back Loan From Company?Документ2 страницыWhy You Just Can't Withdraw A Bounce Back Loan From Company?kainat fatimaОценок пока нет

- Income Tax Numerical QuestionsДокумент2 страницыIncome Tax Numerical QuestionsAli0% (2)

- Tax Imposed To CorporationДокумент13 страницTax Imposed To CorporationRandz RamosОценок пока нет

- 4.2 Home Assignment Questions - Income From SalaryДокумент3 страницы4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- CIA 1 Taxation LawsДокумент1 страницаCIA 1 Taxation LawsNALIN.S 19111423Оценок пока нет

- Provident FundДокумент18 страницProvident FundRashmi Ranjan Panigrahi100% (1)

- Ftxmys 2012 Jun QДокумент13 страницFtxmys 2012 Jun Qaqmal16Оценок пока нет

- Final Exam Guide for Financial Planning UnitДокумент16 страницFinal Exam Guide for Financial Planning UnitAnas HassanОценок пока нет

- Employt Revision Qns. 2023Документ8 страницEmployt Revision Qns. 2023Mbeiza MariamОценок пока нет

- OthInvestment Declaration Help Document F Y 2021-22-1Документ12 страницOthInvestment Declaration Help Document F Y 2021-22-1Gurprit SinghОценок пока нет

- AbelДокумент12 страницAbelErmi ManОценок пока нет

- PUBLIC FINANCE AND TAXATION- BCOM ACC, FIN & BBAДокумент13 страницPUBLIC FINANCE AND TAXATION- BCOM ACC, FIN & BBAMaster KihimbwaОценок пока нет

- PUBLIC FINANCE AND TAXATION- BCOM ACC, FIN & BBAДокумент13 страницPUBLIC FINANCE AND TAXATION- BCOM ACC, FIN & BBAMaster KihimbwaОценок пока нет

- Income TaxationДокумент56 страницIncome TaxationCianne Alcantara0% (2)

- Incorporation For Physicians in British Columbia CanadaДокумент9 страницIncorporation For Physicians in British Columbia CanadachadОценок пока нет

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeОт EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeОценок пока нет

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawОт EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawРейтинг: 3.5 из 5 звезд3.5/5 (4)

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineОценок пока нет

- Credit Risk ManagementДокумент6 страницCredit Risk ManagementAdil MalikОценок пока нет

- SWOT Analysis of Al-Yarmouk HospitalДокумент9 страницSWOT Analysis of Al-Yarmouk HospitalAdil MalikОценок пока нет

- The Muslim Scholars Have Unanimously Agreed That When Examining Any New Subject or Incident That Has No Legal ValueДокумент1 страницаThe Muslim Scholars Have Unanimously Agreed That When Examining Any New Subject or Incident That Has No Legal ValueAdil MalikОценок пока нет

- FBR Assignment..Документ178 страницFBR Assignment..Adil MalikОценок пока нет

- Income Tax Numericals For PracticeДокумент3 страницыIncome Tax Numericals For PracticeAdil MalikОценок пока нет

- CBCP Monitor Vol14-N12Документ20 страницCBCP Monitor Vol14-N12Areopagus Communications, Inc.Оценок пока нет

- Nit 391 Ninl Erp TenderdocДокумент405 страницNit 391 Ninl Erp TenderdocK Pra ShantОценок пока нет

- (Defamation) Cassidy V Daily Mirror NewspapersДокумент4 страницы(Defamation) Cassidy V Daily Mirror NewspapersHoey Lee100% (4)

- Business Studies: One Paper 3 Hours 100 MarksДокумент10 страницBusiness Studies: One Paper 3 Hours 100 MarksHARDIK ANANDОценок пока нет

- Court Rules Criminal Charges Not Covered by Stay OrderДокумент6 страницCourt Rules Criminal Charges Not Covered by Stay OrderSharon BakerОценок пока нет

- Removal of Directors or Trustees: by The SEC - After Notice and Hearing and Only OnДокумент2 страницыRemoval of Directors or Trustees: by The SEC - After Notice and Hearing and Only OnApple Ke-eОценок пока нет

- The Phantom Landlord - City Limits Magazine - March, April 2012Документ52 страницыThe Phantom Landlord - City Limits Magazine - March, April 2012City Limits (New York)Оценок пока нет

- A Chronology of Key Events of US HistoryДокумент5 страницA Chronology of Key Events of US Historyanon_930849151Оценок пока нет

- Oracle Applications EBS - Accounting EntriesДокумент43 страницыOracle Applications EBS - Accounting EntriesUdayraj SinghОценок пока нет

- LIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYДокумент1 страницаLIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDarrenОценок пока нет

- Inventory Accounting and ValuationДокумент13 страницInventory Accounting and Valuationkiema katsutoОценок пока нет

- The Boone and Crockett Club HistoryДокумент48 страницThe Boone and Crockett Club HistoryAmmoLand Shooting Sports NewsОценок пока нет

- PPL Law R13Документ13 страницPPL Law R13Dhruv JoshiОценок пока нет

- Training Design SKMTДокумент4 страницыTraining Design SKMTKelvin Jay Cabreros Lapada67% (9)

- Raquana Neptune 5S English A SBA CXCДокумент15 страницRaquana Neptune 5S English A SBA CXCraquan neptuneОценок пока нет

- Immanuel Sangcate ResumeДокумент2 страницыImmanuel Sangcate ResumeNonjTreborTendenillaToltolОценок пока нет

- Derbes, Program of Giotto's ArenaДокумент19 страницDerbes, Program of Giotto's ArenaMarka Tomic DjuricОценок пока нет

- Guimba, Nueva EcijaДокумент2 страницыGuimba, Nueva EcijaSunStar Philippine NewsОценок пока нет

- CorpF ReviseДокумент5 страницCorpF ReviseTrang DangОценок пока нет

- Full Download Understanding Human Sexuality 13th Edition Hyde Test BankДокумент13 страницFull Download Understanding Human Sexuality 13th Edition Hyde Test Bankjosiah78vcra100% (29)

- Notes Labor RevДокумент4 страницыNotes Labor RevCharmagneОценок пока нет

- 5 Years Program Detailed Curriculum 2014 PDFДокумент106 страниц5 Years Program Detailed Curriculum 2014 PDFInder singhОценок пока нет

- CrowdfundingДокумент5 страницCrowdfundingMehwish SiddiquiОценок пока нет

- Key provisions of the Philippine Civil Code on laws and jurisprudenceДокумент7 страницKey provisions of the Philippine Civil Code on laws and jurisprudenceIzay NunagОценок пока нет

- Mcdo vs. Mcjoy (Speccom)Документ2 страницыMcdo vs. Mcjoy (Speccom)nikkimayorОценок пока нет

- Heirs dispute over lands owned by their fatherДокумент23 страницыHeirs dispute over lands owned by their fatherVeraNataaОценок пока нет

- Achievements of Fatima JinnahДокумент5 страницAchievements of Fatima JinnahmuhammadrafayОценок пока нет

- Navy Leave ChitДокумент2 страницыNavy Leave ChitBrandon FischerОценок пока нет

- Wa0008.Документ8 страницWa0008.Md Mehedi hasan hasanОценок пока нет

- Uy v. CAДокумент6 страницUy v. CAnakedfringeОценок пока нет