Академический Документы

Профессиональный Документы

Культура Документы

Director Investment Banking in NYC NY Resume Pascal Kabemba

Загружено:

PascalKabembaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Director Investment Banking in NYC NY Resume Pascal Kabemba

Загружено:

PascalKabembaАвторское право:

Доступные форматы

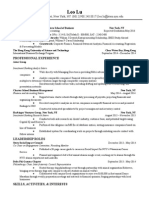

Pascal Kabemba

Mt. Vernon, NY 10552 (917) 282-6536 pascal.kabemba@gmail.com

INVESTMENT BANKING PROFESSIONAL

Client Relationship Expert and Proven Senior Financial Strategist

HIGHLIGHTED QUALIFICATIONS

Industry expert, highly accomplished financial strategist and senior banker with proven record of furthering client goals by developing realistic and actionable business plans. Expert in structuring and closing billions of dollars in complex financing packages for client's acquisition and growth plans. Executive level networker who develops valuable trust-based relationships that generate new business and increase long-term profitability. Skilled communicator and presenter who interacts easily with bankers, attorneys, and corporate executives and is dedicated to meeting their short and long-term organizational goals. Industry expertise in: Health Care, Real Estate, Gaming & Lodging, Consumer Goods, Mining & Energy, Media, Entertainment, Telecom Fortune 1000 Relationship Management Valuation Analysis Strategic Business Planning Financial Model Development Syndication & Distribution In-depth Credit & Risk Analysis Sales & Trading Debt Origination Staff Development

PROFESSIONAL EXPERIENCE

Kashama Holdings LLC, New York, NY June 2009 to Present Managing Principal Consulting and Advisory Services Firm specializing in collaboration with a diverse client base to define strategic direction and build actionable business plans. Consult with the president of HomeMeds, LLC, on strategic planning and acquisition initiatives related to cardiac telemetry monitoring and radiology equipment services. Developed business plan and strategy to bid on copper and cobalt mineral mining rights in the Democratic Republic of the Congo for Osprey Capital Partners. Provided debt capital markets expertise to ESSAR Americas senior management team. Performed cash flow and valuation analysis on a portfolio of film libraries for Cedar Lane Asset Management. Provided expert debt and equity advisory services, corporate financing strategies for restructurings, roll-ups, and recapitalizations, to clients in emerging markets for Nova Capital Partners. Crdit Agricole (previously known as Calyon Securities), New York, NY 2007 to 2009 Director, Debt Capital Markets Structuring Team Corporate and Investment Bank with 13,000 professionals in more than 50 countries, Crdit Agricole specializes in capital markets, investment and corporate banking. Marketed, originated, structured corporate and acquisition financing solutions in mainstream corporations and specialized industries. Minimized capital and mark-to-market trading losses, by coordinating the asset reduction program as key member of Asset Reduction Program Management Committee, reporting to the executive management committee. Established and maintained relationships with key clients originating, structuring and executing complex commercial middle market transactions. Drove and supported the implementation/execution of capital market activities for a billion + US$ portfolio.

Managed complex situations, coordinating sales, sales and trading, debt capital markets teams and external third parties to successful resolutions. Developed a highly effective strategic business plan working with relationship management team that maximized fee generation from client portfolio. Subject matter expert to the sales trading team, providing salient credit and capital market insights. Partnered with Credit Risk Management on restructuring, amendments, and waivers.

Merrill Lynch & Co., New York, NY 2004 to 2007 Vice President, Leveraged Finance One of the world's largest financial institutions, serving individual consumers, small and middle market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk-management products and services. Performed every aspect of transaction analysis and execution, from day-to-day management of corporate finance transaction to closing over $30 billion in financing at Merrill Lynch, including the $15 billion private equity purchase of Hertz Corporation by CD&R, Carlyle Group, and MLPE. Took firm from number 15 to top 5 within 3 years through comprehensive management and execution of all aspects of senior debt transactions across diverse sectors. Reduced exposure to senior debt underwriting positions by maximizing fee income and managing all aspects of syndication and deal transaction process. Negotiated with clients and investors the key transaction terms and associated legal documents, including commitment papers, bridge loan papers, term sheets, and credit arrangements. Presented senior management with syndicated loan underwriting proposals and distribution strategy for approval. Assisted clients in optimizing their balance sheets and resolving financial issues. WestLB AG, New York, NY 1998 to 2004 Relationship Manager, Corporate Finance (2001 to 2004) Global bank, focusing on lending, corporate and structured finance, capital market and private equity products, and transaction services. Led direct calling efforts that secured and developed numerous new client relationships with investment and non-investment grade companies in the media, telecommunication, and sports sectors. Increased net profits $1.5+ million, and generated 25% ROE by spearheading the establishment of WestLB AG in the sports financing sector. Ensured overall success and growth by deepening relationships with existing clients and through the acquisition of new clients. Continually partnered with existing clients to fully understand their businesses, goals, strategies and challenges. Developed business plans for clients, proactively assessing financial needs and delivering a portfolio of effective solutions to meet clients strategic goals. Cross sold value-added products, including asset securitization, private placement, FX, interest rate derivatives, Eurobonds, and letters of credit. Vice President, Credit Risk & Execution Team (1998 to 2001) Led and distributed syndicated credit facilities while managing credit exposure and concentration risk. Mentored and managed associates in performing due diligence, credit analysis, valuation analysis, and the approval and documentation process.

PROFESSIONAL SKILLS

NASD Certifications, Series 7 & 63 Proficient in French Candidate for CFA Level 1

EDUCATION

Master of Business Administration New York University, Stern Graduate School of Business, New York, NY. BA, Natural Science Concentration in Mathematics and Physics Colgate University, Hamilton, NY.

Вам также может понравиться

- Homework 1 Doug DiamondДокумент2 страницыHomework 1 Doug DiamondIgnacio Andrés VinkeОценок пока нет

- Chapter 8: Risk and ReturnДокумент56 страницChapter 8: Risk and ReturnMohamed HussienОценок пока нет

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideДокумент9 страницCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesОценок пока нет

- A Guide To Preparing For Sales and TradiДокумент4 страницыA Guide To Preparing For Sales and TradiBrenda WijayaОценок пока нет

- Spring Week GuideДокумент32 страницыSpring Week Guidevimanyu.tanejaОценок пока нет

- Investment Banking Interview Question 1565173573 PDFДокумент19 страницInvestment Banking Interview Question 1565173573 PDFONKAR BHAGATОценок пока нет

- The Complete Investment Banker ExtractДокумент19 страницThe Complete Investment Banker ExtractJohn MathiasОценок пока нет

- Elevator Pitch DraftДокумент2 страницыElevator Pitch DraftJack JacintoОценок пока нет

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsОт EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsОценок пока нет

- Senior Investment Strategist Portfolio Manager in Detroit MI Resume Clarence LewisДокумент2 страницыSenior Investment Strategist Portfolio Manager in Detroit MI Resume Clarence LewisClarenceLewisОценок пока нет

- Kevin Cullen Resume 2018Документ2 страницыKevin Cullen Resume 2018Kevin CullenОценок пока нет

- Jaime Cooper Consulting (Business Development Resume)Документ2 страницыJaime Cooper Consulting (Business Development Resume)jcooper_bostonОценок пока нет

- Rob Brown, PHD, Cfa 5054 Evanwood AvenueДокумент4 страницыRob Brown, PHD, Cfa 5054 Evanwood Avenuekurtis_workmanОценок пока нет

- Succeeding in An Investment Banking Interview by Jared HaftelДокумент1 страницаSucceeding in An Investment Banking Interview by Jared HafteljaflorentineОценок пока нет

- Helpful WSO PostsДокумент23 страницыHelpful WSO PostsalbertОценок пока нет

- NavДокумент2 страницыNavFaisal ZaheerОценок пока нет

- Investment BankingДокумент52 страницыInvestment BankingShera BhaiОценок пока нет

- Networking WSOДокумент14 страницNetworking WSOladyjacket420% (1)

- A Case For Senior LoansДокумент20 страницA Case For Senior LoansstieberinspirujОценок пока нет

- Credit AnalysisДокумент3 страницыCredit AnalysisLinus ValenciaОценок пока нет

- What Is The Difference Between P & L Ac and Income & Expenditure Statement?Документ22 страницыWhat Is The Difference Between P & L Ac and Income & Expenditure Statement?pranjali shindeОценок пока нет

- NYIF Investment Banking Certification Program BrochureДокумент18 страницNYIF Investment Banking Certification Program BrochureChristian Ezequiel ArmenterosОценок пока нет

- Director VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas KaehrДокумент3 страницыDirector VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas KaehrThomasKaehrОценок пока нет

- WSO ReviewДокумент1 страницаWSO ReviewJohn MathiasОценок пока нет

- Mezzanine Finance Explained PDFДокумент9 страницMezzanine Finance Explained PDFCedric TiuОценок пока нет

- VFC Meeting 8.31 Discussion Materials PDFДокумент31 страницаVFC Meeting 8.31 Discussion Materials PDFhadhdhagshОценок пока нет

- #2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?Документ8 страниц#2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?helloОценок пока нет

- Lu Leo ResumeДокумент2 страницыLu Leo ResumeLeo LuОценок пока нет

- Investment Banking Resume II - AfterДокумент1 страницаInvestment Banking Resume II - AfterbreakintobankingОценок пока нет

- M&A Course SyllabusДокумент8 страницM&A Course SyllabusMandip LuitelОценок пока нет

- IBIG 04 01 Core ConceptsДокумент32 страницыIBIG 04 01 Core ConceptsKrystleОценок пока нет

- How To Prepare For An Asset Management Interview - Online Version2 PDFДокумент11 страницHow To Prepare For An Asset Management Interview - Online Version2 PDFGuido FranchettiОценок пока нет

- IBIG 03 03 Your Own DealsДокумент17 страницIBIG 03 03 Your Own DealsіфвпаіОценок пока нет

- Investment Banking Interview Guide: Course OutlineДокумент20 страницInvestment Banking Interview Guide: Course OutlineTawhid SyedОценок пока нет

- Interview Questions IBDДокумент10 страницInterview Questions IBDSirVicNYОценок пока нет

- Lazard - Analyst Recruitment Process For WebsiteДокумент3 страницыLazard - Analyst Recruitment Process For WebsiteAndor JákobОценок пока нет

- Value Measurement PresentationДокумент18 страницValue Measurement Presentationrishit_93Оценок пока нет

- Undergrad Student Investment Banking Resume TemplateДокумент3 страницыUndergrad Student Investment Banking Resume TemplateMike MillerОценок пока нет

- Technical Interview Questions - MenakaДокумент15 страницTechnical Interview Questions - Menakajohnathan_alexande_1Оценок пока нет

- Corporate Banking Summer Internship ProgramДокумент2 страницыCorporate Banking Summer Internship ProgramPrince JainОценок пока нет

- Private Eq Interview QsДокумент7 страницPrivate Eq Interview QsVignesh VoraОценок пока нет

- IB Transactions Questions AnswersДокумент8 страницIB Transactions Questions Answerskirihara95Оценок пока нет

- Wso Experienced Deals Resume Templatev4Документ2 страницыWso Experienced Deals Resume Templatev4John GonesОценок пока нет

- Ascend Hedge Fund Investment Due Diligence Report 0811redactedДокумент17 страницAscend Hedge Fund Investment Due Diligence Report 0811redactedJoshua ElkingtonОценок пока нет

- Ibig 04 08Документ45 страницIbig 04 08Russell KimОценок пока нет

- Askivy Article List of Competency Interview Questions PDFДокумент4 страницыAskivy Article List of Competency Interview Questions PDFEkrem SafakОценок пока нет

- Resume ExampleДокумент1 страницаResume ExampleDavid Bonnemort100% (13)

- High Yield Bond Basics USДокумент4 страницыHigh Yield Bond Basics USJDОценок пока нет

- Consolidated Interview Questions (IB) PDFДокумент7 страницConsolidated Interview Questions (IB) PDFEric LukasОценок пока нет

- Careers in Finance and Finance Interview PrepДокумент14 страницCareers in Finance and Finance Interview PrepAlyssa HarrisonОценок пока нет

- Investment Banking PrepДокумент6 страницInvestment Banking PrepNeil GriggОценок пока нет

- Empirical Studies in FinanceДокумент8 страницEmpirical Studies in FinanceAhmedMalikОценок пока нет

- Company Analysis and ValuationДокумент13 страницCompany Analysis and ValuationAsif Abdullah KhanОценок пока нет

- What Industry Trends You Will Look at When You Are Looking For A Potential Investment?Документ7 страницWhat Industry Trends You Will Look at When You Are Looking For A Potential Investment?helloОценок пока нет

- Lesson1 Topic 2 Credit and Financial Analysis-NotesДокумент16 страницLesson1 Topic 2 Credit and Financial Analysis-Notesshantam singhОценок пока нет

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskОт EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskРейтинг: 3.5 из 5 звезд3.5/5 (1)

- Private Equity Unchained: Strategy Insights for the Institutional InvestorОт EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorОценок пока нет

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingОт EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingОценок пока нет

- FMДокумент17 страницFMRaghav Agarwal100% (3)

- B01028 - Chapter 3 - Managing and Pricing Deposit ServicesДокумент57 страницB01028 - Chapter 3 - Managing and Pricing Deposit ServicesNguyen GodyОценок пока нет

- MK 5BДокумент3 страницыMK 5BFaqih NuriandaОценок пока нет

- Bezu Aster Kema HW - 3Документ8 страницBezu Aster Kema HW - 3Michael SeyiОценок пока нет

- Co. Ltd. 1901) : Hare AND Hare ApitalДокумент16 страницCo. Ltd. 1901) : Hare AND Hare ApitalNavya BhandariОценок пока нет

- Letter From James PallottaДокумент2 страницыLetter From James PallottaDealBook100% (2)

- TawteenДокумент19 страницTawteenjaymuscatОценок пока нет

- Acturial AnalysisДокумент14 страницActurial AnalysisRISHAB NANGIAОценок пока нет

- Indian Capital Markets notes-BBA 3rd MDU PDFДокумент35 страницIndian Capital Markets notes-BBA 3rd MDU PDFShruti Shree100% (4)

- Trading Strategies Involving OptionsДокумент21 страницаTrading Strategies Involving OptionsSoumya ShobhanaОценок пока нет

- Anish Arora: EducationДокумент1 страницаAnish Arora: EducationAbhishek SrivastavaОценок пока нет

- Corporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementДокумент39 страницCorporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementSichen UpretyОценок пока нет

- HSBC India Roe0115Документ18 страницHSBC India Roe0115bombayaddictОценок пока нет

- Final Preboard Examination On Auditing Problems Suggested Answers/solutionsДокумент8 страницFinal Preboard Examination On Auditing Problems Suggested Answers/solutionsLoren Lordwell MoyaniОценок пока нет

- ProspectusДокумент254 страницыProspectusSourav RoyОценок пока нет

- Adeel BMДокумент27 страницAdeel BMttsopalОценок пока нет

- The Original Online News Article : KOC3436 Individual AssignmentДокумент3 страницыThe Original Online News Article : KOC3436 Individual AssignmentWANG CHENANОценок пока нет

- Finance Test PaperДокумент5 страницFinance Test PaperSuryansh Srivastava FitnessОценок пока нет

- 4 TABLE - Kode Etik Manajer Investasi - Updated 20170324 Bilingual - FINALДокумент6 страниц4 TABLE - Kode Etik Manajer Investasi - Updated 20170324 Bilingual - FINALSheila AriskaОценок пока нет

- One 97 Communications LTD RHPДокумент539 страницOne 97 Communications LTD RHPTIAОценок пока нет

- Long Term InvestingДокумент8 страницLong Term InvestingkrishchellaОценок пока нет

- PLI Premium Calculator NewДокумент63 страницыPLI Premium Calculator NewvivekОценок пока нет

- FINAL Ceilli English 20142015Документ126 страницFINAL Ceilli English 20142015Cheong Weng ChoyОценок пока нет

- SSLM in General Mathematics For G11 Q2 Module 5Документ6 страницSSLM in General Mathematics For G11 Q2 Module 5OmarieОценок пока нет

- Barclays Back To School Consumer ConferenceДокумент37 страницBarclays Back To School Consumer ConferenceBrian FanneyОценок пока нет

- Evolution of Central Banking in IndiaДокумент15 страницEvolution of Central Banking in Indiapaisa321Оценок пока нет

- Perhitungan Kriteria Investasi: Net Present Value (NPV)Документ12 страницPerhitungan Kriteria Investasi: Net Present Value (NPV)Nurul FitrianaОценок пока нет

- HSE Project 1Документ80 страницHSE Project 1akr574Оценок пока нет

- MBA - Chapter 7Документ2 страницыMBA - Chapter 7GauravОценок пока нет