Академический Документы

Профессиональный Документы

Культура Документы

DI Model

Загружено:

Howard KeziahИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DI Model

Загружено:

Howard KeziahАвторское право:

Доступные форматы

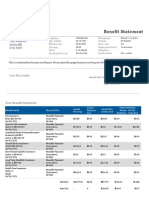

Family Needs If Dan Is Disabled

Should you lose your ability to provide income through an accident or illness, how would you maintain

your lifestyle? Social Security benefits may provide a portion of needed income. How long would your

present assets provide the necessary funds?

Long-term disability is another life uncertainty that prevents the accumulation of wealth.

• Salary stops

• Living expenses continue (medical care often increases)

• Retirement contributions stop

Before age 65, it is 2.93 times more likely that Dan will suffer a long-term

disability than die!1

Consider the effects of a long-term disability. What if you were out of work for two years? Five

years? Until retirement?

Effects on Net Worth of Situation

Net Worth

at

Retirement

Net Worth at % Reduction in

Situation Condition Considered Retirement2 Net Worth at

Retirement

Not Disabled $5,321,674 —

Disabled for Next 2 Years $4,821,872 9.39%

Disabled for Next 5 Years $4,067,555 23.57%

Disabled Now until Retirement $1,756,345 67.00%

A disability before retirement may greatly reduce the amount of assets you will have available for

retirement. You should consider disability income insurance based on the amount of benefits for which

you qualify.

Protect your greatest asset—your ability to earn!

1

2

Based on a disability expected to last more than 2 years following a 60-day elimination period (see Assumptions).

Estimated value at end of year of desired retirement.

Presented by: J. Maxey Sanderson, CLU, ChFC, FLMI November 7, 2008

For Evaluation Purposes Only 6 of 14

Вам также может понравиться

- Statement Redesign Noncovered EarningsДокумент2 страницыStatement Redesign Noncovered EarningsAntonio RodriguezОценок пока нет

- Patricia and Peter OReilly SOAДокумент16 страницPatricia and Peter OReilly SOApatrick wafulaОценок пока нет

- Your Step-By-Step Update To A Wealth of Exciting BenefitsДокумент8 страницYour Step-By-Step Update To A Wealth of Exciting BenefitsMotlatjo RakgothoОценок пока нет

- Health BillsДокумент28 страницHealth BillsBrian AhierОценок пока нет

- Financial Planning QuestionnaireДокумент7 страницFinancial Planning QuestionnairerosanajonesОценок пока нет

- Great Careshield BrochureДокумент5 страницGreat Careshield BrochureK TОценок пока нет

- Your Social Security Statement: Your Payment Would Be AboutДокумент4 страницыYour Social Security Statement: Your Payment Would Be AboutMichael Eugene ChurchОценок пока нет

- HorizonsДокумент8 страницHorizonsNino Dave BauzonОценок пока нет

- Articles SMURetirementPlanДокумент12 страницArticles SMURetirementPlanstarkОценок пока нет

- Martita Togba - Social - Security - StatementДокумент4 страницыMartita Togba - Social - Security - StatementRichlue GeegbaeОценок пока нет

- Allowances Income TestДокумент2 страницыAllowances Income Tests3163105Оценок пока нет

- CeylincoQuoteДокумент3 страницыCeylincoQuotejulani pabasariОценок пока нет

- NMHYDWM069Документ24 страницыNMHYDWM069SHAWKATMANZOORОценок пока нет

- Tim Jane GoldbergДокумент15 страницTim Jane GoldbergFinancial SenseОценок пока нет

- Statement Redesign OnlineДокумент2 страницыStatement Redesign OnlineJoshua LaporteОценок пока нет

- NMHYDWM003Документ33 страницыNMHYDWM003SHAWKATMANZOORОценок пока нет

- NMHYDWM072Документ18 страницNMHYDWM072SHAWKATMANZOORОценок пока нет

- IRS Rates Limits 2019Документ1 страницаIRS Rates Limits 2019claokerОценок пока нет

- Ssa-7005-Sm-Si Leonardo OrtegaДокумент5 страницSsa-7005-Sm-Si Leonardo OrtegaDjibzlaeОценок пока нет

- Notes About Finance in SGДокумент7 страницNotes About Finance in SGYeo JhОценок пока нет

- Brochure - OnePath - LifeДокумент6 страницBrochure - OnePath - LifeRONG HEОценок пока нет

- Your Social Security StatementДокумент4 страницыYour Social Security StatementSimmi Simone RampersadОценок пока нет

- How Tax Reform Changes Retirement PlanningДокумент14 страницHow Tax Reform Changes Retirement PlanningFinancial SenseОценок пока нет

- Mycare - Mycare Plus: An Eldershield Supplement With Higher Payouts For Long-Term CareДокумент12 страницMycare - Mycare Plus: An Eldershield Supplement With Higher Payouts For Long-Term CareKH LaiОценок пока нет

- CPF Planner - Retirement IncomeДокумент2 страницыCPF Planner - Retirement Incomedinesh.rairikarОценок пока нет

- Retireready Plus English BrochureДокумент2 страницыRetireready Plus English Brochurerumralkar0% (1)

- Sample Manulife ProposalДокумент7 страницSample Manulife ProposalRicci MelecioОценок пока нет

- 5 Big Social Security Changes Took Effect in January 2024Документ4 страницы5 Big Social Security Changes Took Effect in January 2024617249399Оценок пока нет

- HDFC Life Income Benefit On Accidental Disability RiderДокумент4 страницыHDFC Life Income Benefit On Accidental Disability RiderrechargemystuffОценок пока нет

- Tax Penalty Fact SheetДокумент2 страницыTax Penalty Fact SheetOutboundEngineОценок пока нет

- IB On AD Rider Brochure - 2 PDFДокумент4 страницыIB On AD Rider Brochure - 2 PDFsusman paulОценок пока нет

- Ensure Regular Income, Even in Case of DisabilityДокумент4 страницыEnsure Regular Income, Even in Case of DisabilitySam SonОценок пока нет

- Age Pension Age Set To Change 2023Документ11 страницAge Pension Age Set To Change 2023FrankОценок пока нет

- The 1% Difference: Synergy Financial GroupДокумент4 страницыThe 1% Difference: Synergy Financial GroupgvandykeОценок пока нет

- Open Cs ReportДокумент3 страницыOpen Cs ReportAlexОценок пока нет

- NMHYDWM070Документ21 страницаNMHYDWM070SHAWKATMANZOORОценок пока нет

- Financial AnalysisДокумент7 страницFinancial AnalysisJason TangОценок пока нет

- 5 Big Social Security Changes Took Effect in January 2024Документ4 страницы5 Big Social Security Changes Took Effect in January 2024617249399Оценок пока нет

- Benefit Statement: Test Retro 62 Test Address Noida, MB D1D 4S25Документ3 страницыBenefit Statement: Test Retro 62 Test Address Noida, MB D1D 4S25007shivangОценок пока нет

- Prop Af223025a99kjen2 PDFДокумент8 страницProp Af223025a99kjen2 PDFCKhae SumaitОценок пока нет

- Read This First:: Loan & General InfoДокумент14 страницRead This First:: Loan & General InfoJoannaОценок пока нет

- Candidate Facing Benefits Sheet 2Документ4 страницыCandidate Facing Benefits Sheet 2brendaОценок пока нет

- Manulife SmartRetire (II) English BrochureДокумент2 страницыManulife SmartRetire (II) English BrochurePhan Gia HuấnОценок пока нет

- AA1B Index Statement of AccountsДокумент5 страницAA1B Index Statement of AccountsbscurОценок пока нет

- Statement of AdviceДокумент11 страницStatement of Advicepatrick wafulaОценок пока нет

- FintooДокумент70 страницFintoorakeshОценок пока нет

- SBI Life - MR - MuralidharanДокумент36 страницSBI Life - MR - MuralidharanPradipta TripathyОценок пока нет

- Aviva MyLongTermCare BrochureДокумент18 страницAviva MyLongTermCare BrochureHarmony TeeОценок пока нет

- Aviva MyRetirementДокумент16 страницAviva MyRetirementAkbar AkhtarОценок пока нет

- Accumulation Account Insurance Guide: Issued 28 February 2022Документ39 страницAccumulation Account Insurance Guide: Issued 28 February 2022Joyce SohОценок пока нет

- Retirement Planning CalculatorДокумент4 страницыRetirement Planning CalculatorkitchaaОценок пока нет

- 07 Retirement-CalculatorДокумент5 страниц07 Retirement-CalculatorrealtorsinfaridabadОценок пока нет

- Basic Medicaid Eligibility Chart 2016 09 19Документ3 страницыBasic Medicaid Eligibility Chart 2016 09 19Lydia CowartОценок пока нет

- LolcQuotation OutputДокумент3 страницыLolcQuotation OutputYasiru rasanjanaОценок пока нет

- Retirement Plan InputsДокумент3 страницыRetirement Plan Inputsapi-645059243Оценок пока нет

- Insurance in Your Super Member Number: 600318930Документ6 страницInsurance in Your Super Member Number: 600318930Eggy PalangatОценок пока нет

- New Sme For MdselamaДокумент3 страницыNew Sme For MdselamaHS INNOVATORОценок пока нет

- Problem Set 4Документ2 страницыProblem Set 4Haseeb RazaОценок пока нет

- Assignment 3 - Group 3Документ9 страницAssignment 3 - Group 3bhavya_dosiОценок пока нет

- CEO Bonus Plan Sample-GenericДокумент2 страницыCEO Bonus Plan Sample-Genericexpertceo_productionОценок пока нет

- Cover Letter Examples Kitchen StaffДокумент7 страницCover Letter Examples Kitchen Staffafjwfoffvlnzyy100% (1)

- MVV Issue FormДокумент2 страницыMVV Issue FormSomendraОценок пока нет

- G.R. No. 187226 January 28, 2015 CHERYLL SANTOS LEUS, Petitioner, vs. St. Scholastica'S College Westgrove And/Or Sr. Edna Quiambao, OSB, RespondentsДокумент55 страницG.R. No. 187226 January 28, 2015 CHERYLL SANTOS LEUS, Petitioner, vs. St. Scholastica'S College Westgrove And/Or Sr. Edna Quiambao, OSB, RespondentsDenis F. Delos SantosОценок пока нет

- Request For Proposal RFP Mardan 1510Документ74 страницыRequest For Proposal RFP Mardan 1510Engr AhmadОценок пока нет

- What Do Chemical Engineers Do?: Chemical Engineer in The Water IndustryДокумент9 страницWhat Do Chemical Engineers Do?: Chemical Engineer in The Water IndustrymoccappucinoОценок пока нет

- Communication SkillsДокумент19 страницCommunication SkillsAlisha GargОценок пока нет

- Exam Success in Economics For Cambridge IGCSE AnswersДокумент30 страницExam Success in Economics For Cambridge IGCSE AnswersAKARESH JOSE EBOOKS100% (1)

- Child Labour Amendment Act PolityДокумент5 страницChild Labour Amendment Act PolityRanjith RanjuОценок пока нет

- California Pizza KitchenДокумент3 страницыCalifornia Pizza KitchenTommy HaleyОценок пока нет

- Recruitment, Selection, Placement & Induction PDFДокумент23 страницыRecruitment, Selection, Placement & Induction PDFGirraj Prasad Mina67% (3)

- HP2.EOU TEST U7 PreInterДокумент6 страницHP2.EOU TEST U7 PreInterMinh Hải TrầnОценок пока нет

- Report FinalДокумент24 страницыReport FinalRob PortОценок пока нет

- Assignment: Topic: Case Study Course Title Course CodeДокумент19 страницAssignment: Topic: Case Study Course Title Course CodeSumaiyaОценок пока нет

- PDF - Js ViewerДокумент21 страницаPDF - Js ViewerJovial Nivenis100% (1)

- A) Consideration Need Not Be Adequate But It Must Be Sufficient.' DiscussДокумент5 страницA) Consideration Need Not Be Adequate But It Must Be Sufficient.' DiscussAbdullah GujjarОценок пока нет

- NBCC Book Final Page 10 To 107Документ98 страницNBCC Book Final Page 10 To 107Manish PandeyОценок пока нет

- Softronic HCMS Brochure (Recruitment Edition)Документ10 страницSoftronic HCMS Brochure (Recruitment Edition)Asif MaqboolОценок пока нет

- Development of The Behaviorally Anchored Rating Scales For The Skills Demonstration and Progression GuideДокумент38 страницDevelopment of The Behaviorally Anchored Rating Scales For The Skills Demonstration and Progression GuideGhaida AlharbiОценок пока нет

- Logistics Officer: Job DescriptionДокумент3 страницыLogistics Officer: Job DescriptionAbdala Eda'oОценок пока нет

- The Essential Guide:: To HR ComplianceДокумент16 страницThe Essential Guide:: To HR ComplianceAtthrayyeОценок пока нет

- Wilkins, A Zurn Company: Aggregate Production Planning: Group-6Документ10 страницWilkins, A Zurn Company: Aggregate Production Planning: Group-6guntupalli manojОценок пока нет

- Resume SOUMYAДокумент3 страницыResume SOUMYASoumya SwainОценок пока нет

- Template Letter Post DoctoralДокумент3 страницыTemplate Letter Post DoctoralPamela Grace AnzuresОценок пока нет

- Which Is Good For You": Mujtaba M. MominДокумент7 страницWhich Is Good For You": Mujtaba M. Momincaesar victorianОценок пока нет

- CGP Week1Документ2 страницыCGP Week1PRECIOUS KATE LIMBAUANОценок пока нет

- PKДокумент42 страницыPKSafeer Shibi100% (1)

- Solicitud de TrabajoДокумент6 страницSolicitud de Trabajoblogger_sixpackОценок пока нет

- Biggest Challenges of HR Professionals in COVID-19 PandemicДокумент54 страницыBiggest Challenges of HR Professionals in COVID-19 PandemicSarita MoreОценок пока нет