Академический Документы

Профессиональный Документы

Культура Документы

Maureen MC Goldberg

Загружено:

Angus Davis0 оценок0% нашли этот документ полезным (0 голосов)

5 просмотров5 страницAssociate Justice - Rhode Island Supreme Court

Оригинальное название

Maureen Mc Goldberg

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAssociate Justice - Rhode Island Supreme Court

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

5 просмотров5 страницMaureen MC Goldberg

Загружено:

Angus DavisAssociate Justice - Rhode Island Supreme Court

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

. @ ° DOH ®PHK/

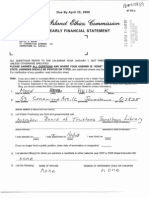

07 FS-1

Due By April 25, 2008 Ke

Khade Island Ethies Commission

2007 YEARLY FINANCIAL STATEMENT

igs 7

MAUREEN MC GOLDBERG

150 ATLANTIC AVENUE

WAKEFIELD RI 02879-0000

s

L 4

ALL QUESTIONS REFER TO THE CALENDAR YEAR JANUARY 1, 2007 THROUGH DECEMBER?31,:2007

UNLESS OTHERWISE SPECIFIED.

PLEASE ANSWER ALL QUESTIONS AND WHERE YOUR ANSWER IS “NONE” OR “NOT APPLICABLE” SO

STATE. ANSWERS SHOULD BE PRINTED OR TYPED, and additional sheets may be used if more space is needed,

For clarification of any question, read instruction sheet.

Note: If you are a state or municipal official or employee that Is required to fle a Yearly Financial Statement, a failure to fle the

Satoment isa violation ofthe law and may subject you to substantial penalties, including fines. If you received a 2007 Year-

ly Financial Statement in the mail but believe you did not hold a public position in 2007 or 2008 that requires such

fling, you should contact the Ethics Commission (See Instruction Sheet for contact information),

1 Goldberg Maureen, Mw

asi or Orca To ee ay

2 _____ Wakefield, RI 02879

‘STREETS ‘eirmTowsy ‘air cover

THRNG RBORESS (art Wam Pas SET

3._ List Public Position(s) you hold and governmental unit:

Associate Justice - RI Supreme Court State

c HUNCH STE OR HERI

‘PUBLIC POSTION BOREAL ATE ON RESORT

was elected on. was appointed on 5/30/97 | was hired on

(date) (ate) (Gate)

If you no longer hold a public position, state date of termination o resignation

4, List elected office(s) for which you werelare a candidate in either calendar year 2007 or 2008 (Read instruction #4)

N/A

5. List the following: NAME OF SPOUSE NAME(S) OF DEPENDENT CHILD OR CHILDREN

Robert D. Goldberg, Esq. N/A

6. List the names of any employer from which you, your spouse, or dependent child received $1,000 or more gross

income during calendar year 2007. f self-employed, lst any occupation from wihich $1,000 or more gross income was

received. If employed by a stale or municipal agency, or if self-employed and services were rendered to a stato or

‘municipal agency for an amount of income in excess of $250, list the date and nature of services rendered. if the

public position or employment listed in #3, above, provides you with an amount of gross income in excess

Of $250 it must be listed here. (Do Not List Amounts.)

NAME OF FAMILY NAME AND ADDRESS DATES AND NATURE

MEMBER EMPLOYED OF EMPLOYER OR OCCUPATION OF SERVICES RENDERED

Maureen McKenna Goldberg Supreme Court Judicial Service

Robert D. Goldberg Self-Employed Atty. Legal Services/

Government Affairs

7. List the address or legal description of any real estate, other than your principal residence, in which you, your spouse,

or dependent child had a financial interest.

NAMES NATURE OF INTEREST ADDRESS OR DESCRIPTION

Maureen M. Goldberg Joint Tenants 226 Cottage St., Pawtucket, RI

Robert D. Goldberg Joint Tenants 226 Cottage St., Pawtucket, RI

Robert D. Goldberg 581 East Ave., Pawtucket, RT

8. List the name of any trust, name and address of the trustee of any trust, from which you, your spouse, or dependent

child or children individually received $1,000 or more gross income. List assets if known. (Do Not List Amounts.)

NAME OF TRUST: N/A

NAME OF TRUSTEE AND ADDRESS: ——

NAME OF FAMILY MEMBER

RECEIVING TRUST INCOME:

ASSETS: = -

9. List the name and address of any business, profit or non-profit, in which you, your spouse, or dependent child held

a position as a director, officer, partner, trustee, or a management position.

NAME OF FAMILY MEMBER, NAME AND ADDRESS OF BUSINESS POSITION

Robert:D. Goldberg, Esq. Goldberg Law Offices Partner

226 Cottage Street

Pawtucket, RI 02860

Maureen M. Goldberg The Rhode Island Foundation Director

One Union Station

| Providence, RI 02903

Phoenix Houses of New England Director

131 Wayland Avenue

e@ Providence, RI 029 0h

10. List the name and address of any interested person, or business entity, that made total gifts or total contribu-

tions in excess of $100 in cash or property during calendar year 2007 to you, your spouse, or dependent child.

Certain gifts from relatives and certain campaign contributions are excluded. (See instruction #10)

NAME OF PERSON RECEIVING NAME AND ADDRESS OF PERSON OR ENTITY

GIFT OR CONTRIBUTION MAKING GIFT OR CONTRIBUTION,

None

11. List the name and address of any business in which you, your spouse, or dependent child individually or

collectively holds a 10% or greater ownership interest, or a $5,000 or greater ownership or investment interest.

NAME OF FAMILY MEMBER NAME AND ADDRESS OF BUSINESS

See Attachment A

(Retirement Account)

12, any business listed in #11, above, did business in excess of a total of $250 in calendar year 2007 with a state or

‘municipal agency, AND you are a member or employee of the agency or exercise director legislative control over

the agency, list the following:

NAME AND ADDRESS NAME OF AGENCY DATE AND NATURE.

‘OF BUSINESS OF TRANSACTION

N/A

13. If any business listed in #11, above, was a business entity subject to direct regulation by a state or municipal

agency, AND you are a member or employee of the agency or exercise direct or legislative control over the

agency, list the following:

NAME AND ADDRESS OF BUSINESS NAME OF REGULATING AGENCY

N/A

Вам также может понравиться

- James V MurrayДокумент4 страницыJames V MurrayAngus DavisОценок пока нет

- 2009 Top 75Документ6 страниц2009 Top 75Angus DavisОценок пока нет

- Robert P MurrayДокумент4 страницыRobert P MurrayAngus DavisОценок пока нет

- Robert L MushenДокумент4 страницыRobert L MushenAngus DavisОценок пока нет

- Peter J MurrayДокумент4 страницыPeter J MurrayAngus DavisОценок пока нет

- Stephen MurrayДокумент4 страницыStephen MurrayAngus DavisОценок пока нет

- Thomas H MongeauДокумент4 страницыThomas H MongeauAngus DavisОценок пока нет

- Jeffrey J MurrayДокумент4 страницыJeffrey J MurrayAngus DavisОценок пока нет

- Francis J MurrayДокумент4 страницыFrancis J MurrayAngus DavisОценок пока нет

- Heidi K MoonДокумент4 страницыHeidi K MoonAngus DavisОценок пока нет

- Christopher J MontalbanoДокумент4 страницыChristopher J MontalbanoAngus DavisОценок пока нет

- John J Mulhearm JRДокумент4 страницыJohn J Mulhearm JRAngus DavisОценок пока нет

- David A MurrayДокумент4 страницыDavid A MurrayAngus DavisОценок пока нет

- Patricia L MorganДокумент4 страницыPatricia L MorganAngus DavisОценок пока нет

- Vincent MonafoДокумент4 страницыVincent MonafoAngus DavisОценок пока нет

- George C MooreДокумент5 страницGeorge C MooreAngus DavisОценок пока нет

- Bruce Q MorinДокумент4 страницыBruce Q MorinAngus DavisОценок пока нет

- Mildred S MorrisДокумент4 страницыMildred S MorrisAngus DavisОценок пока нет

- Carylon A MorrisonДокумент4 страницыCarylon A MorrisonAngus DavisОценок пока нет

- David S MorrisonДокумент4 страницыDavid S MorrisonAngus DavisОценок пока нет

- E Pierre MorenonДокумент4 страницыE Pierre MorenonAngus DavisОценок пока нет

- Robert P MulliganДокумент4 страницыRobert P MulliganAngus DavisОценок пока нет

- John J MullaneyДокумент4 страницыJohn J MullaneyAngus DavisОценок пока нет

- Hal MorganДокумент4 страницыHal MorganAngus DavisОценок пока нет

- Kelley N MorrisДокумент4 страницыKelley N MorrisAngus DavisОценок пока нет

- Stephen S MuellerДокумент4 страницыStephen S MuellerAngus DavisОценок пока нет

- William W MuesselДокумент4 страницыWilliam W MuesselAngus DavisОценок пока нет

- Kenneth W MottДокумент4 страницыKenneth W MottAngus DavisОценок пока нет

- Larry V MouradjianДокумент4 страницыLarry V MouradjianAngus DavisОценок пока нет

- Barbara C RaoДокумент4 страницыBarbara C RaoAngus DavisОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Community-Based Health Planning Services: Topic OneДокумент28 страницCommunity-Based Health Planning Services: Topic OneHigh TechОценок пока нет

- Evidence Cases Feb 11Документ45 страницEvidence Cases Feb 11Josh CelajeОценок пока нет

- Checklist ISO 22000Документ30 страницChecklist ISO 22000Abdelhamid SadОценок пока нет

- CCP Motivation Letter 2022Документ3 страницыCCP Motivation Letter 2022mohammed ahmed0% (1)

- Among The Nihungs.Документ9 страницAmong The Nihungs.Gurmeet SinghОценок пока нет

- Case Digest - LawДокумент11 страницCase Digest - Lawjonjie.jumamil.23Оценок пока нет

- Bagabag National High School Instructional Modules in FABM 1Документ2 страницыBagabag National High School Instructional Modules in FABM 1marissa casareno almueteОценок пока нет

- Hon. William Ruto's Speech at The Jubilee Manifesto LaunchДокумент10 страницHon. William Ruto's Speech at The Jubilee Manifesto LaunchH.E. President Uhuru KenyattaОценок пока нет

- Cost of Preferred Stock and Common StockДокумент20 страницCost of Preferred Stock and Common StockPrincess Marie BaldoОценок пока нет

- Bharat Prachin Eanv Aadhunik Shiksha Pranali: Ek Gahan AdhyayanДокумент6 страницBharat Prachin Eanv Aadhunik Shiksha Pranali: Ek Gahan AdhyayanAnonymous CwJeBCAXpОценок пока нет

- What Is Ecocroticism - GlotfeltyДокумент3 страницыWhat Is Ecocroticism - GlotfeltyUmut AlıntaşОценок пока нет

- Proposing A New InitiativeДокумент8 страницProposing A New InitiativeMike WonderОценок пока нет

- 12 Business Combination Pt2 PDFДокумент1 страница12 Business Combination Pt2 PDFRiselle Ann SanchezОценок пока нет

- Kanchipuram Silk SareesДокумент12 страницKanchipuram Silk SareesChandni Agarwal Dixit100% (2)

- Drugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Документ23 страницыDrugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Dimple Lasala ElandagОценок пока нет

- Marathi 3218Документ11 страницMarathi 3218Nuvishta RammaОценок пока нет

- CCOB 021 and CCOC 021 Module Outline For 2022Документ5 страницCCOB 021 and CCOC 021 Module Outline For 2022Matodzi ArehoneОценок пока нет

- PolinationДокумент22 страницыPolinationBala SivaОценок пока нет

- Division of Pagadian City Zamboanga Del Sur National High SchooolДокумент3 страницыDivision of Pagadian City Zamboanga Del Sur National High SchooolMyra KadatuanОценок пока нет

- Ludermis Suardi Rhetorical Analysis EditedДокумент5 страницLudermis Suardi Rhetorical Analysis Editedapi-253530551Оценок пока нет

- AcadinfoДокумент10 страницAcadinfoYumi LingОценок пока нет

- Crim 2 Pointers With AnswersДокумент15 страницCrim 2 Pointers With AnswersJessel EstradaОценок пока нет

- Part II. Market Power: Chapter 4. Dynamic Aspects of Imperfect CompetitionДокумент9 страницPart II. Market Power: Chapter 4. Dynamic Aspects of Imperfect Competitionmoha dahmaniОценок пока нет

- Athletics Federation of India: Men & U23 Men U20 MenДокумент3 страницыAthletics Federation of India: Men & U23 Men U20 Menl3spawlОценок пока нет

- Vidrine Racism in AmericaДокумент12 страницVidrine Racism in Americaapi-512868919Оценок пока нет

- Bhuri Nath v. State of J&K (1997) 2 SCC 745Документ30 страницBhuri Nath v. State of J&K (1997) 2 SCC 745atuldubeyОценок пока нет

- Par Vol2i10Документ66 страницPar Vol2i10Bakhita MaryamОценок пока нет

- Experience Certificate For English TeacherДокумент2 страницыExperience Certificate For English TeacherShaher Alburaihy86% (7)

- Revelry in TorthДокумент43 страницыRevelry in TorthArets Paeglis100% (2)

- Accounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsДокумент9 страницAccounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsKanika BajajОценок пока нет