Академический Документы

Профессиональный Документы

Культура Документы

BMTI Short Sea Report - 2012 Week 27

Загружено:

Ben PerryАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BMTI Short Sea Report - 2012 Week 27

Загружено:

Ben PerryАвторское право:

Доступные форматы

No 27

05 to 11 July, 2012

BMTI Short Sea Report

FOR BMTI-SUBSCRIBER . Baltic Sea & North Sea Markets Holding Firm Ahead of Holiday Season The bump-up in North Sea demand in late June is long gone, it would seem, with 3-5,000 dwt vessels doing just a little better than a TC equivalent of EUR 2,000 daily on trips via ECUK. With the European holiday season arriving and grains still meagre, there are limited hopes for a revival in the near term with owners hoping to leverage higher freights due to their plight in operating costs with bunker prices rising again. ECUK/N.Spain 3,000mt general cargoes are getting around EUR 15.516.5/mt at present, down from the EUR 17-18/mt range seen two weeks ago. The holiday season, which normally affects the Scandinavian Baltic trips the most, has yet to be as heavy on the Baltic trades as we continue to see steady demand for steels from Russia with SPB/ARA cargoes of 3,000mt getting steady rates of around EUR 16-17/mtthough pressure is rising on owners to succumb to lower freights. So far, freights are trending flat in both the North Sea and Baltic Sea, though July will likely be a quiet month, so owners are still hoping to cover long term. Wheat of 3,000mt is seen for Liepaja/Koge at EUR 14.5/mt. Timber of 5,000cbm is fixing at EUR 15/cbm for S.Sweden/ECUK, area brokers report.

20

Baltic Westward [2011-12]

18

/mt

16

14

12 Week 27 31 35 39 43 47 51 3

7 11 15 19 23 27

This graph tracks average freight rates for a general short sea cargo of 3.000 mt shipped from the Baltic States to the ARA region.

Azov Market Split Between Present Flatness and Expected Mid-July Grain Drive While steels, construction cargoes, clay and coal are the dominant cargoes in the Azov now, expectations are all about grainwhich is set to start hitting the market by early next week and is prompting charterers to consent to rates up to US$ 2-5/mt higher than current levels. Charterers' brokers in the Azov report Rostov/Marmara freights for 3,000mt/10% wheat getting Rostov/Marmara business at US$ 30/mt though we have heard from others that the same trip is doable at US$ 27/mt. Freights for the same cargo ex-Rostov are: US$ 27-28/mt to the Turkish Black Sea, US$33-35/mt to Izmir, US$50-52/mt to Mersin, US$53-55/mt to the Egyptian Med and US$ 55-57/mt to the Adriatic. Rates remain stable generally, but we expect to see more demand by midJuly when grain cargoes start to arrive. "At the same time," a charterers' broker tells BMTI, "as river freight rose over the last few weeks, a gap between the same and small seagoing coasters appeared. Now we have rates ex-Taganrog for a 2,500-3,000mt wheat cargo at mid US$ 20s/mt to Marmara, high US$ 20s/mt to Izmir and mid US$ 40s/mt to the Egyptian Med."

Black Sea Grain Prospects Drive July Decisions for Charterers & Owners Alike As with the Azov markets, Black Sea sentiment is pinned overwhelmingly on the outcome of the grain season this monthan outcome that might have been strongly modified after the devastating flooding in Russia's Black Sea coast over the weekEurope's leading trend experts for the shipping industry

end. While grain stocks are stable at Novorossiisk and other grain ports, the ability for grain to be carried to the ports is now in doubt with many damaged grain-supply rail lines and roads that lead to the terminals. Even before the flooding, owners

10 July 2012 Page 1 of 7 Yr30/27

BMTI SHORT SEA REPORT

www.bmti.de

service@bmti.de

have been playing hardball with charterers, accepting only premium freights (upwards of US$5/mt higher than spot) and for mid-to-late July positions. A good number of ships are simply idling at major hubs in wait of the oncoming grain demand. As such, the spot market has gone into a bit of a standstill quality with principals waiting for the other side to make the first move. On the charterers' side, however, a generally low cargo market means that they are able to conclude spot freights at (or slightly below) lastdone levels. Steels cargoes of 3,000mt are going for freights of US$ 15-16/mt for Ilyichevsk/Trabzon business. Grains of 3,000mt are being quoted at US$ 27/mt for Odessa/Alex, but may climb significantly if/when grain shipments begin to engage en masse.

32 30 28 26 USD/mt 24 22 20

Black Sea Southward [2011-12]

18 Week 27 31 35 39 43 47 51 3

7 11 15 19 23 27

General cargo 3-5,000mt from Azov Sea to Marmara region

Caspian Sea Freights Treading Water Ahead of Expected Surge in August Despite increased activity by Iranian importers and not yet fully firm: Volgograd (Volga River) to Iran at steady steels demand, Caspian Sea freights remain US$ 45/mt, Saratov (Volga River) to Iran at US$ 55under pressure with average freights losing about 56/mt and Kazan (Volga River) to Iran at US$ 70 US$ 0.5/mt in the past week. A charterer's broker /mt. Owners are not happy with the above due to working in the region tells BMTI that, "the Azov high disbursement accounts (d/a) in Iran, the usual market is the same as last weekquite poor. Foreign slow load/discharge and likely a long ballast after buyers are still waiting for the new crop and haven't discharging. The Black Sea-Caspian Sea market looks bought many grains, delays being worsened due to fuller and rates, I supposed, are not so badholding strong rains in south Russia. This situation prompts relatively stable since spring. Turkmenbashi port is commodities charterers to pay as low as ever this heavily congested. All rates are anticipated to grow year. As such, the Caspian market is almost empty. I in August-September and stay more or less high have seen these freights basis grains, though they are until the end of river navigation in mid-November. Mediterranean Overview Market Update from an Area Ship Broker Egypt: Some fresh fertilizer cargoes hit the market last week compounded by small steels lots destined for the Black Sea. Cargo activity can be seen slightly improving. The volume of tonnage appearing open for prompt dates is considerable and one wonders if cargoes will be sufficient in the next two weeks. Some spot tonnage seen in the area. Freights stable. Turkish Med: Gypsum, bagged cement and bauxite cargoes have been seen quoted on the market last week. Activity overall, however, continues to be sluggish with few steels being quoted. Freights are stable. Some spot tonnage has been seen in the area.

47 45 43 41 USD/mt 39 37 35 33 31 Week 27 31 35 39 43 47 51 3 7 11 15 19 23 27 This tracks average freight rates for a general short sea cargo of 3-5,000mt shipped from Black Sea to North Africa.

Greece: Cargo activity continues to be promising with fresh steels, wheat, aluminium, pumice and fertilizers all freshly quoted on the market. Overall freights remain poor with some cargoes still unfixed from last week from poor freights indicated by most charterers, who seem to be in no rush to fix. Freights are stable. Some spot tonnage seen in the area. A lot has been said about Greek shipowners and whether they are doing enough to help the Greek government fight the ongoing humanitarian crisis in Greece. Just last week, we come across an interesting article on a well-known Greek shipping magnate who has taken social responsibility to a new level. This Greek tycoon decided to buy back Greek (debt) bonds at a fraction of their face value in secondary markets. Considering the scope of the European debt crisis and the catastrophic consequences on a humanitarian scale being felt by each and every Greek family, we would like to share the link: www. greecedebtfree.org. This is one of many initiatives that the Greek shipping community has been involved in, however the scope of this particular

Black Sea - N. Africa [2011-12]

Europe's leading trend experts for the shipping industry

10 July 2012

Page 2 of 7

Yr30/27

BMTI SHORT SEA REPORT

www.bmti.de

service@bmti.de

initiative is one that sets it apart from the rest as it enable everyone of us to participate in our own way. Adriatic market: Cargo activity continues to be fairly good with timber, agri-products, steels, aluminium and project cargoes quoted on and off market. Freights are stable. No spot tonnage is seen in the area. West Coast Italy: Fresh steels, salt and marble can be seen quoted on the market yet again last week. No shortage of open tonnage in the area. Freights are stable. Some spot tonnage is seen in the area. Summary: In the Greece-Turkish Med-Egypt trade region, there is slightly improving cargo activity out of Egypt and Greece. Freights appear to be stable with some spot tonnage seen in all areas. The market, like the rough sea, is spitting out all the garbage on to the coast and, as such, every week we notice more and more circulations by owners and brokers of fraudulent behaviour. Last week, a Greek coaster owner circulated a Turkish charterer and agent for "unprofessional" behaviour. As the market continues to hit record lows we expect that more and more circulations of this nature will see the light of day. We strongly urge owners, charterers and brokers to report suspect activity as the market needs to be warned and made aware of questionable behaviour that, in some cases, could result in dire consequences to the innocent victims. Needless to say, we expect a further slowdown in activity over the next few weeks in the Med and, with this in Due to very active dry cargo demand, Latvia's third biggest port Liepaja saw a robust jump in cargo throughput in the first six months of the yearup 48.6% year-on-year to 3.52 Mt. Grain shipments via the port rose 235% in the six-month period to 1.34 Mt while coal throughput rose 154% to 0.11 Mt. While oil product transits fell 57.6% to 0.28 Mt, container traffic leapt by 46% to 2,016 TEU. Latvia's main Baltic Sea port, Ventspils, saw a strong 19.5% jump in traffic to 17.3 Mt in the six months. The throughput growth was driven primarily by traffic at the Nafta Terminal (+21%), Ventbunkers (+43%) Dry Bulk Commodity News High coal stocks in Europe are keeping ARA thermal coal prices flat, though September prices have been edging upward on the futures market, a bullish sign. An ARA-delivered 50,000mt cargo is said to have been traded via globalCOAL at US$ 90.25/mt CIF. Thermal Coal Spot Prices (FOB) usd/mt

export terminal this week last week change % diff

French Med: We are finally starting to see some grain activity last week complemented by light steel movements. Some spot tonnage is being seen in the area, traders report. Freights are under pressure. South Spain-Spanish Med: Fresh steels, agri-products and fertilizer cargoes can be seen quoted in good numbers. Many cargoes continue to be recirculated from the week before. Some spot tonnage is seen in the area. Freights are under pressure.

mind, keeping ships employed and running steadily will be a challenge in itself at above operating cost. In the S.Spain-French Med-WC Italy-Adriatic area, cargo activity has slightly improved. Spot tonnage is seen in all sectors except the Adriatic. Freights are either under pressure or stable. The market has since lost any direction with some charterers picking numbers out of thin air and offering them as freight ideas. When the pencil is put to paper many owners are astonished at how such freights can even be justified by charterers. The pure reality, though, is there is no justification for the numbers being pushed around on the market "as last done levels". In some cases, sales are subject to freights being in line with charterers' ideas; otherwise no sales are made. In principle what is happening is owners are being expected to subsidize the sales by offering low freight in order to fix some cargoes. and the Baltic Coal Terminal (+27%). Not only did crude oil shipments jump 25% (to 9.3 Mt) but coal volumes surged 57% in the six months to 4.7 Mt. Throughput at Kleipeda, meanwhile, dropped 8.5% in the six months to 16.9 Mt, according to new figures. Liquid bulk slipped 11.7% to 4.9 Mt while dry and bulk cargoes fell 8.7% to 6.4 Mt. General cargo fell 5.1% to 5.4 Mt. Fertilizers plummeted 18% to 3.9 Mt. Nonetheless, the number of ships calling at the port was unchanged with 3,370 arrivals in the six months (compared to 3,377 vessels last year).

Ports & Waterways Strong Demand Drives Traffic Surge at Latvia's Baltic Ports

Newcastle Richards Bay DES ARA

90.40 90.70 90.00

89.20 88.00 89.70

+1.20 +2.70 +0.30

+1% +3% +0%

Russian coal export shipmentsthanks to high demand to the Far Eastare up by 15% in the year-todate to 48.2 Mt. Exports to China alone were 6.2 Mt in the year so far, more than twice the volumes Russia exported to China in the same period last year. By coal type, the growth in exports from Russia has been dominated by thermal coal (as opposed to coking coal) with EU buyers the largest share of demand for Russian thermal coal with 46% of the total, followed by Japan (40%) and South Korea

Europe's leading trend experts for the shipping industry

10 July 2012

Page 3 of 7

Yr30/27

BMTI SHORT SEA REPORT

www.bmti.de

service@bmti.de

(32%). Despite this healthy growth, analysts expect the second half of the year to show a steady drop in coal exports as Russia lowers its coal mining output due to lower prices and declining profitability. Crop damage due to frost and drought in Russia's Krasnodar region prompted SovEcon to downgrade forecast for Russia's wheat crop in the year starting this month to 48.5 Mt, from a prior 51 Mt. Russian wheat prices are at record highs of US$ 275/mt. Devastating floods that hit Russia's Black Sea coast on the weekend have stalled inland shipments to Russia's top grain terminal Novorossiysk. Inventories are mostly unharmed, however rail lines and roads leading to the port are blocked indefinitely. In the phosphates markets, Russian MAP exports in May declined by a significant 13% year-on-year to 147.504mt. Year-to-date MAP exports from Russia amount to 636,722, a whopping 53% lower than the same period last year. The main recipients of Russia's MAP exports this year have been Brazil (with 187k mt), US (96k mt) and Estonia (74k mt). New Zealand Chartering Report The remark is eerily calm. Reduced bunker prices have recently taken the acid of time charter rates. Charterers who are seeing cheaper outcomes from lower bunker costs are less likely to try to take more from time charter rates than they do when bunkers are going the other way. However, going into the slow season, sooner or later, something is going to give. How much and how quickly is undecided. There does not appear to be an imminent collapse in time charter rates about to occur but something China Coastal & Far East Handy Bulk Report China's so-called ghost fleet of aging and plentiful coastal trading vessels is drawing the ire of larger Handysizes operating on the coal trades of Indonesia and the Indian Ocean at large. These older vessels of 10-50,000 dwt are not well-equipped to venture far from the Pacific watersand thus ply China's coastal watersare increasingly moving farther afield as the economic downturn has forced them to look for opportunities elsewhere. Numbering up to 2,000 strong, these Chinese coaster ships are moving into traditional Handysize markets and, in the words of one shipbroker, "attacking the Indonesian coal business and undercutting everybody." More ships are idling at Chinese ports than there have been in many years and the competition is getting fierce, owners complain. China's coastal coal shipping trade has surged 88% since 2006 to 640 Mt at present but it has already fallen by 3% in the year to date. In the past week the Pacific has seen a reasonably healthy demand for the Supra-Handymax types and

Europe's leading trend experts for the shipping industry

European potash buyers and potash producers have concluded Q3 price deals with the agreement to let Q2 prices roll over unchanged. Granular MOP supply prices will stay at EUR 360-375/mt CIF with demand across northwestern Europe still sluggish.

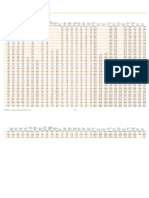

Grain Freight Rates 2011-12

65 60 55 50

USD/mt

45 40 35 30 25 20 15 27 31 35 39 43 47 51 3 7 11 15 19 23 27 USG/EU Ukraine/Morocco USG/Japan Ukraine/Italy Brazil/EU N.France/Egypt

Week

downward will occur. Considering it is winter, with generally slow production, log volumes from New Zealand remain buoyant. There are some market forces and winter storms that may cause the situation to change suddenly. All will be revealed in the next six weeks. Log markets are going down. India is a particular issue and it may be several months, given the disorderly situation there, before the market regains its composureprobably post monsoon in October.

while activity slackened as the week closed, rates remained steady if a bit positional. The period interest was softer and this reflected the uncertainty as to the immediate market direction. The Handysizes have been weaker on a lack of requirements but don't look as though they are about to completely collapse.

China Coastal Bulker Freight Index 2011-12 1900 1700 1500 1300 1100 900 700 500

27 31 35 39 43 47 51 3 coal 7 11 15 19 23 27 Week metal ore grain

10 July 2012

Page 4 of 7

Yr30/27

BMTI SHORT SEA REPORT

www.bmti.de

service@bmti.de

BMTI Sale and Purchase ReportWeek 28 S&P prices continue to weaken with especially Japanese and South Korean vessels of various ages being very attractive for Greek and other bargain hunters. As Sanko Steamship filed for bankruptcy on 2 July, there will be no lack of supplies in the near term mostly with Handies and Supras. Other Japanese owners also are placing tonnage on the secondhand market trying to come to terms with the strong yen and the weak economy. The sale of a just oneyear old South Korean-built, 180,000 dwt Cape at a price of US$ 38m to a Greek buyer displays a new low in assets for this size of vessels. This is the same price a Chinese built resale obtained just a week ago. Demolition prices apparently have bottomed out as this week an upward trend is noted in most of the markets. With an Indian Supreme Court order banning the import of vessels containing hazardous wastes, announcing a hearing on 19 July regarding this topic, buying activity is limited. Rival markets in Bangladesh, Pakistan China and Turkey are ready to take over the business if a market closure in India becomes reality. Prices in Bangladesh are standing at US$ 375/ldt at present; India is giving US$ 365/ldt and Pakistan around US$ 360/ldt. In China prices are hovering around last weeks level with US$ 340 /ldt and Turkey is offering about US$ 320/ldt.

S&P general cargo

"Bernd" | 8,874dwt | blt98 | China | 650 TEU | 2x150t crns | Wartsila | to UT Bank of Ghana | USD 3.5m "Sinar Tuban" | 5,690dwt | blt06 | Indonesia | Caterpillar | sold to undiscl. byrs "Sipan" | 1,650dwt | blt07 | Croatia | 102 TEU | MaK | sold to Indonesian byrs

forthcoming holidays Date 11 Jul 2012 12 Jul 2012 13 Jul 2012 14 Jul 2012 15 Jul 2012 Country no holidays Sao Tome; Tonga; Northern Ireland (UK) Montenegro; Northern Ireland (UK) Buenaventura / Valle del Cauca (Colombia); France; Guadeloupe; Iraq; Martinique; Montenegro; New Caledonia; Reunion; St. Pierre and Miquelon; Tahiti Deseado / Santa Cruz (Argentina); Palermo / Sicily (Italy)

2012 by BMTI gmbh for . All rights reserved.

http://twitter.com/bmti_daily http://www.facebook.com/bmti.daily http://linkd.in/ispYAJ

BMTI forex crossrates

USD/EURO 0.81 GBP 0.65 JPY 79.57 CHF 0.98 DKK 6.05 SEK 7.01 NOK 6.10

Baltic Indices

for . Actuals DRY (BDI): HANDYSIZE (BHSI): 1,160 704 Previous (1,063) (717) % + 9% - 2% + 97 - 13 Trend Min/Maxlast 12 mos 647 2,173 366 829 Min/Max-Volatility

( % from Act. )

1,526 132% 463 66%

Europe's leading trend experts for the shipping industry

10 July 2012

Page 5 of 7

Yr30/27

BMTI SHORT SEA REPORT

www.bmti.de

service@bmti.de

BMTI Bunker Report Week 28 Oil prices were falling on Tuesday morning after the strike of oil workers in Norway came to an end and China released data indicating a further slowdown of its economy. Light, sweet crude for August shows at US$ 84.98 per barrel on the NYMEX while Brent crude for August stand at US$ 98.55 a barrel on the ICE futures exchange in London. Some suppliers in Rotterdam advise being fully booked until 13-14 July. High and low sulphur bunker fuel is still tight and congestion at Rotterdam and Antwerp loading installations are reported. One player in Malta reports no availability of low sulphur product until the end of next week. In Fujairah local sources advise demand below average with fair avails at the port. Prices for IFO 180 and 380 are at extremely low levels in St. Petersburg at the moment. Reportedly, the bunker stocks there are more than adequate.

bunker price info

Herewith some representative fuel oil prices in US currency / delivered

IFO 380 Actuals Previous 350 (360) 615 (615) 590 (595) 577 (575) 610 (605) 600 (599) 595 (579) 597 (584) 635 (610) s/e (s/e) IFO 180 Actuals Previous 360 (370) 645 (645) 625 (620) 598 (603) 640 (635) 633 (636) 615 (598) 627 (613) 660 (630) s/e (s/e) MGO Actuals Previous 830 (820) 888 (900) 907 (885) 860 (855) 908 (930) 895 (909) 890 (890) 893 (870) 942 (920) s/e (s/e) Availability Fair Fair Fair Fair Fair Tight Fair Fair Fair Tight

ST. PETERSBURG GDANSK GOTHENBURG ROTTERDAM IMMINGHAM GIBRALTAR 2 MALTA PIRAEUS 1 ISTANBUL NOVOROSSIYSK 2

1

prices ex wharf | 2delivered

05 to 11 July, 2012

BMTI Short Sea Freight Rates

Damietta | Szczecin | phosphate | 12,000mt | $25.0 Alexandria | Polisbarletta | wheat | 10,000mt | $15.0 Mariupol | Bari | clay | 7,500mt | $23.0 Oktyabrskiy | Damietta | rebar | 7,250mt | $25.0 Novorossiysk | Marghera | coils | 6,500mt | $25.0 Izmir | La Spezia | minerals | 6,500mt | $19.5 Zarzis | Barletta | salt | 6,000mt | $14.0 La Nauvelle | Jorf Lasfar | maize | 5,600mt | $19.75 Novoross. | Santander | pig iron | 5,500mt | $37.0 Nikolayev | Bayonne | SFM 56' | 5,400mt | $44.0 Corruna | Annaba | rebar | 5,000mt | $27.5 Cartagena | Izmir | agri-prods | 5,000mt | $17.0 Taranto | Thessaloniki | steels | 5,000mt | $15.0 Sousse | Marghera | minerals | 5,000mt | $12.5 S. Spain | Upper Baltic | general | 5,000mt | 20.0

Europe's leading trend experts for the shipping industry

Milos | Bilbao | bulk perlite | 5,000mt | $30.0 Iskenderun | Bejaia | cement | 5,000mt | $25 Catania | Tenes | steel bars | 4,924mt | $24.5 Varna | Alexandria | minerals | 4,750mt | $22.0 Kerch | Libya | wheat | 4,750mt | $30.0 Hereke | Misurata | WRIC | 4,700mt | $24.25 Izmir | Poti | clinker | 4,200mt | $14.0 French Bay | ECUK | general | 4,000mt | 13.5 Yuzhny | Ravenna | urea | 4,000mt | $30.0 N. France | S. Spain | general | 4,000mt | 19.5 West Med | WCUK | general | 4,000mt | 19.5 Bejaia | Tripoli | bagged sugar | 4,000mt | $29.0 Constanza | Lanauvelle | SFM 65' SF| 4,000mt| $31.0 El Arish | Damietta | beechwood | 3,800mt | $25.0 Ilichevsk | Barcelona | SFMP 57' | 3,750mt | $36.0

10 July 2012 Page 6 of 7 Yr30/27

BMTI SHORT SEA REPORT

www.bmti.de

service@bmti.de

Irish Sea | ARAG | general | 3,500mt | 10.5 1 Finland | Lisbon | scrap 35' | 3,500mt | 27.5 Iskenderun | Novorossiysk | gen. | 3,000mt | $11.0 El-Arish | Tripoli | salt | 3,000mt | $9.0 Damietta | Livorno | silica sand | 3,000mt | $20.0 1 Marmara | Turkmenbashi | steels | 3,000mt | $60.0 Nikolayev | Turkmenbashi | steels | 3,000mt | $65.0

Nemrut | Oran | steels | 3,000mt | $30.0 Aghia Marina | Ghent | bauxite | 3,000mt | $38.5 Thessaloniki | Oristano | wheat | 3,000mt | $19.25 El Arish | Thessaloniki | clinker | 3,000mt | $13.0 SPB | 1 Germany | aluminium | 2,500mt | 14.5 Alexandria | Diliskelesi | steels | 2,500mt | $17.5 Alexand. | Skikda | petroleum clay | 2,200mt | $30.0

These European short sea fixtures have been concluded within the last seven days and have been assembled from a variety of broker sources close to BMTI. A number of these fixtures have been supplied by ISTFIX in cooperation with BMTI.

this report is distributed for the primary use of the BMTI subscriber . and must not be redistributed by any means unless a specific agreement in writing with BMTI gmbh has been achieved. in case of breach of the subscription contract, the BMTI subscribers may be subject of a contractual penalty of us$ 10,000 sued by BMTI as compensation. all reported details are believed to be correct but without guarantee ! all BEX data are published with one business day delay.

BMTI brokers markt & trend informationen gmbh Triberger Strae 9 D-14197 Berlin Responsible / MD: H.Piper T +49 / 30.85 222 58 F +49 / 30.85 222 59 sales@bmti.de | www.bmti-report.com Amtsgericht Berlin HRB 91539

Europe's leading trend experts for the shipping industry

10 July 2012

Page 7 of 7

Yr30/27

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- 2012 Fuel Hedging at JetBlue AirwaysДокумент181 страница2012 Fuel Hedging at JetBlue Airwaysjk kumar100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- European Marketscan: European Products ($/MT) ICE FuturesДокумент9 страницEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyОценок пока нет

- Virtual Barrels Quantitative Trading in The Oil MarketДокумент461 страницаVirtual Barrels Quantitative Trading in The Oil Marketrohitgaikwad01012000Оценок пока нет

- CMO Historical Data AnnualДокумент27 страницCMO Historical Data AnnualDEPRI AFRIAN LAMBUTOОценок пока нет

- Agriculture and Chemical Menu. by JPMДокумент15 страницAgriculture and Chemical Menu. by JPMAhmad So MadОценок пока нет

- LW 20180731Документ10 страницLW 20180731Victor FernandezОценок пока нет

- TTP CFD Instrumnet List - EnglishДокумент13 страницTTP CFD Instrumnet List - EnglishThe Trading PitОценок пока нет

- F T I L: Monday, August 16, 2021Документ20 страницF T I L: Monday, August 16, 2021Deepak MОценок пока нет

- Mba Project On OpecДокумент65 страницMba Project On Opecmukesh_saroj0070% (1)

- BofA Global Research-Commodity Strategist Year Ahead 2023 Commodity Outlook-99278411Документ96 страницBofA Global Research-Commodity Strategist Year Ahead 2023 Commodity Outlook-99278411杨舒Оценок пока нет

- Living in A World With Low Crude Oil Prices, An El Niño and Biodiesel SubsidiesДокумент32 страницыLiving in A World With Low Crude Oil Prices, An El Niño and Biodiesel SubsidiesUsman MahmoodОценок пока нет

- Icis Report - Asia Pacific - Jan 15Документ7 страницIcis Report - Asia Pacific - Jan 15Sadman Faiz HaqueОценок пока нет

- Opec Momr May 2021Документ94 страницыOpec Momr May 2021DanielОценок пока нет

- World Bank Commodity Price Data (The Pink Sheet)Документ166 страницWorld Bank Commodity Price Data (The Pink Sheet)Vincent LauОценок пока нет

- 3nd Meeting SolomonДокумент28 страниц3nd Meeting SolomonJean-Louis KouassiОценок пока нет

- Oilgram Price Report: Valero Makes Big Splash Into MethanolДокумент25 страницOilgram Price Report: Valero Makes Big Splash Into MethanolPaolo Del Aguila RojasОценок пока нет

- Apic2015 Zhao NaДокумент24 страницыApic2015 Zhao NaSandip LadvaОценок пока нет

- Euromktscan11072013 PDFДокумент8 страницEuromktscan11072013 PDFMelody CottonОценок пока нет

- Petroleum EconomicДокумент97 страницPetroleum EconomicAli A.FalihОценок пока нет

- Case Study AnalysisДокумент12 страницCase Study AnalysisPerovich CreekОценок пока нет

- OPEC - Monthly Oil Market ReportДокумент75 страницOPEC - Monthly Oil Market Reportrryan123123Оценок пока нет

- Comoditiy MarketДокумент57 страницComoditiy MarketMukesh ManwaniОценок пока нет

- Ecopetrol-CCI Asphalt Market Update - Feb162022Документ26 страницEcopetrol-CCI Asphalt Market Update - Feb162022Fabián Quesada UribeОценок пока нет

- Crude Oil Prices and Charts - Data From QuandlДокумент4 страницыCrude Oil Prices and Charts - Data From QuandlPrakarn KorkiatОценок пока нет

- LNG Daily - 30092021Документ21 страницаLNG Daily - 30092021Đức Vũ NguyễnОценок пока нет

- PLATTS Crude 20190809Документ24 страницыPLATTS Crude 20190809Huixin dong100% (1)

- Daily PivotДокумент150 страницDaily PivotmanjuypОценок пока нет

- Erp Practice Exam 2Документ42 страницыErp Practice Exam 2amritesh pandeyОценок пока нет

- Specifications Guide: Americas Crude OilДокумент19 страницSpecifications Guide: Americas Crude OileducacionОценок пока нет

- Lufthansa Interim Q1 2010Документ44 страницыLufthansa Interim Q1 2010riverofgiraffesОценок пока нет