Академический Документы

Профессиональный Документы

Культура Документы

Spar Invest Investment Concept Suk

Загружено:

AmidiusИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Spar Invest Investment Concept Suk

Загружено:

AmidiusАвторское право:

Доступные форматы

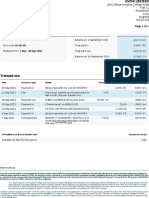

konceptbrochure UK 19/03/03 19:39 Side 1

Prudent investments...

W W W . S P A R I N V E S T . L U

I N V E S T M E N T Sparinvest 2, Grand-Rue L-1660 Luxembourg Postal address: 1a, rue du Nord L-2229 Luxembourg Phone: +352 26 27 47 1 Fax: +352 26 27 47 99 mail@sparinvest.lu Sparinvest Stamholmen 151 Postbox 1933 DK-2650 Hvidovre Phone: +45 36 34 75 00 Fax: +45 36 34 75 99 mail@sparinvest.dk www.sparinvest.dk Sparinvest Baneskellet 1 Hammershj DK-8830 Tjele Phone: +45 87 99 31 00 Fax: +45 87 99 31 99 mail@sparinvest.dk www.sparinvest.dk

C O N C E P T S

konceptbrochure UK 19/03/03 19:39 Side 3

Sparinvest investment products for private and professional investors

5 Powerful Sparinvest Concepts

Sparinvest is an independent provider of longterm and stable investment products. Sparinvests products are aimed at institutional and private investors, and offered through a number of first-class financial institutions across Europe. Sparinvest offers a wide range of investment products categorised in 5 distinct investment concepts. The product range is among the market leaders in terms of diversification and quality. Sparinvest offers active and passive portfolio management. Active management is offered through the fixed income concept, the value concept and in the unique model-based concept. Passive management is offered through index funds and enhanced index funds. Innovation is the key word when Sparinvest launches new products. Sparinvest was among the first providers of products in four out of the five concepts. Sparinvest has decided to operate with five well defined investment concepts in order to highlight, refine and anchor the expertise and knowledge within Sparinvest. In addition the intention is to familiarize existing and potential investors with investment methods. Sparinvest emphasises risk control and a broad diversification. This endeavour is reflected in all of the five clear and concise concepts.

Institutional investors benefit from direct cooperation with Sparinvest, who offers objective investment counselling and professional asset management. Sparinvest offers state-of-the-art investment tools, such as the Asset Allocation Model, as a natural extension of services and knowledge. Individual investors may buy Sparinvest funds through a number of first class financial institutions working together with Sparinvest, or through their personal bank or broker. Through the Investment Advisors of Sparinvests business partners, investors gain access to a professional network of extensive investment experience, knowledge and expertise. Sparinvests profession is investment management. The main priority is to serve investors the best way possible, rather than putting emphasis on asset-gathering or enhancing distribution. The clear objective is to continue to provide investments ranked among the top third of the market. Only by putting emphasis on quality and objective investment counselling will Sparinvest provide for the future of investors, business partners, and ourselves.

Sparinvests asset allocation funds invest according to the revolutionary and Nobel prize-winning theory on how to efficiently diversify investments among asset classes, such as bonds and equities. The funds are aimed at investors focusing on risk exposure. Through the asset allocation funds Sparinvest is able to comply with investor demand.

Index funds are perfect for asset allocation. The exposure is consistent, and historically index funds rank among the top third of the market. Index funds are the strong alternative to those active managed funds providing returns below market average.

If you go for investments in high-risk equities without jeopardizing your wealth, Sparinvests model-based concept is the right choice. A systematic approach with the possibility to go cash in volatile markets supports a risk level below other funds investing in attractive volatile markets.

With a long tradition of being among the market leaders when it comes to fixed income investments, Sparinvest provides a broad range of fixed income funds. A systematic approach has enabled Sparinvest to stay up among the top ranked fixed income funds.

companies trading with a considerable discount to their business value. A number of analyses conclude that value investing offers a lower risk without compromising a high return.

VALUE

Sparinvest is the leading value-manager within Northern Europe. The strategy is based on investing in

FIXED INCOME

MODEL-BASED

INDEX

ASSET ALLOCATION

konceptbrochure UK 19/03/03 19:40 Side 5

Asset allocation

Asset allocation funds are aimed at pension savings including Unit Link pension schemes. The broad diversification and the constant level of risk guarantee investors a return at least as good as the market average for other mutual funds. Investors are provided safety against poor long-term returns, owing to the fact that overexposures to badly performing asset classes are avoided, and besides the risk of bad market timing is eliminated.

What creates returns? It has proved historically that return is not dependent upon whether you buy one stock or another. However, it is important whether it is American or Japanese equities, and whether it is growth or value stocks. In other words, it is important to obtain an optimal allocation of investments. More than 90% of the variability in returns depends on where and in what types of assets you have invested. Picking the right stocks or bonds explains less than 5% of return variability, while attempts at timing the markets historically explain just 2%.

there is a precise theoretical approach to this method of investing, and that it was invented in the Fifties by the American Harry Markowitz. He was awarded the Nobel Prize in economics in 1990 for his remarkable contribution to modern portfolio theory. When investing according to the asset allocation principles, investments are not just randomly diversified. The fact that variability of returns adheres to a certain pattern is utilised they contain what in the statistical community is termed covariance or correlation. If an investor knows that certain types of bonds tend to increase in price, when for instance certain equities are falling, this knowledge may be exploited to achieve a more consistent return

In fact, Sparinvest is among the first asset managers to develop an asset allocation model, and make it available to the investors. When the optimal asset allocation is established, Sparinvest applies the advanced Style Analysis technique to find the best composition of funds. Ultimately it is important to rebalance the portfolio to maintain the determined risk and asset allocation. It implies taking profits in markets that have performed well and investing further in markets that have underperformed. Sparinvests asset allocation concept: Recognized and stable portfolio risk Broad exposure to global regions, equities and bonds Systematic monitoring and optimization

Sparinvest is among the first mutual fund companies to offer a series of funds investing according to the revolutionary Asset Allocation theory. The funds are ideal for long term investment for investors emphasizing risk and return. In short, asset allocation is about optimizing a portfolio of securities by diversifying not just by region, but also among various assets, such as bonds and equities. Through Sparinvests asset allocation funds investors with even limited assets are offered access to around a thousand securities by buying just one unit of a mutual fund. This is made possible through the fund-of-funds principle, according to which the asset allocation funds are buying into other funds. The holding may consist of 10 to 15 other funds, each with holdings in 20 to 150 individual securities, depending on whether it is a bond or equity fund. Such an efficient diversification is not offered through other investment vehicles. Sparinvests asset allocation concept also includes classic balanced funds, offering investors Sparinvests expertise on the other investment concepts.

100%

by investing in both assets. Theoretically it is understood that the portfolio is optimal when all systematic risk is diversified correlations are exploited to the maximum extent. This is the strategy employed by Sparinvests asset allocation funds. On the basis of available investments, Sparinvest calculates how to achieve the best possible return at a certain level of risk.

80%

60%

40%

20%

0% Tactical Asset Allocation (timing): 1,8% Stock-picking: 4,6% Strategic Asset Allocation: 91,5%

Sourse: Ibbotson Associates

In-house asset allocation model To determine which markets and funds fit best into the asset allocation funds, Sparinvest employs an in-house developed asset allocation model.

It is commonly known that it pays off to diversify investments. It may be less well recognized that

ASSET ALLOCATION

konceptbrochure UK 19/03/03 19:40 Side 7

Index

Return in the best third and lower costs Index funds have gone from strength to strength on the American stock market since the beginning of the 1970s. From forming a couple of percent of the market, index funds now account for over 15 percent, and there is a good explanation for this. If you buy an index fund, you are assured a return in the best third of the market in the long term. Sparinvest was the first Danish investment company to set up a large number of index funds and enhanced index funds at the end of 1990s. Sparinvest only provides equity index funds and the strategy is to achieve a return, which comes as close as possible to the market index.

by calculating the average return on the stock market. Charles Henry Dow launched his first index in 1896, and a large number of both equity and bond indices have appeared since then. Sparinvest uses MSCI (Morgan Stanley Capital International), Standard & Poors and the Dow Jones index, which have won acclaim as the best indicators for developments on the global stock markets. In brief, the purpose with an index is to find a representative number of shares on a given stock market, which prove to be a good indicator for general development on that market. Index dictates investments An index is normally used when investors want

not take any chances. They know in advance which stocks will be included in the index, and they do not give preference to a specific type of equities or a specific region. They endeavour exclusively, using advanced models, to produce exactly the same return as that given by the equity index. Suitable building blocks in an asset allocation strategy Index funds have a stable exposure, which only changes marginally when the index provider changes the stocks that are included in the index. In this way index funds are not exposed to style drift, where a host of stock analysts tend to invest in the same type of equities, which was the case with the IT bubble in the second half of the 1990s. This makes index funds especially suitable in an asset allocation context. If you invest according to the asset allocation strategy, you are on the lookout for a stable representative for each investment area.

A portfolio of securities which does not change simply because a specific type of shares proves very popular. Through the sub-funds of mutual fund Sparindex, Sparinvest offers a range of index funds for the three main stock markets in the world: USA, Europe and Japan, which are also divided into big cap growth, big cap value and small cap equities. In this way Sparinvests index funds portfolio when an asset allocation strategy is implemented. If you want to buy exclusively into the biggest companies in Europe or the USA, Sparinvest also offers a range of big cap funds, focusing exclusively on the companies with the highest market values in a given market. Sparinvests index concept: Access to market leading equity indices Constant and known exposure Ideal for asset allocation

Index funds outperform in the long term The fact that ordinary mutual funds find it difficult to produce a return in line with the general stock indices has been proved time after time. One of the biggest investigations in the field was performed by the American mutual fund Vanguard, who has analysed the development over almost 30 years of 355 American equity funds. In 1999, only 27 funds, or 7.6 percent of the funds, had produced a return that was higher than the index. Index funds are an important tool for professional investors The first equity index was introduced by the end of the 1800s and, unsurprisingly, it was an American who first saw the possibilities offered

to evaluate how good a return they have achieved compared to what they could otherwise have obtained in the market. Historically, however, it has proved that even the most skilful investment manager finds it incredibly difficult to produce a return, that comes even close to the index return in the long term. One reason for this is that stock analysis is both a time consuming and expensive process, and it is also not uncommon to analyse several hundred companies before you can design a well-diversified equity portfolio. If you buy an index fund instead, which is invested solely in the stocks included in the index, you do not have to spend financial or staff resources on analysing either the stocks that will be included in the portfolio or yet more equities which are not considered to be good investments. Portfolio managers for the index-linked funds do

Performance of surviving funds relative to index

Number of funds 45 40 35 30 25 20 15 10 5 0 -4% or less -3% -2% -1% -1%-0 0-1% 1% 2% 3% 4% or more

Source: Vanguard

Number of US equity funds : 1970 355 1999 169 Abolished 186

Performance of funds relative to the index

INDEX

can be used as a supplement to an existing

konceptbrochure UK 19/03/03 19:40 Side 9

Model-based

Buy-and-hold vs. Sparinvest Sirius: In a traditional buy-and-hold strategy a portfolio is structured on the basis of fundamental analysis. Such analysis results in buying and keeping selected stocks in anticipation of the share prices increasing from X to Y regardless of whether the general market is rising or falling.

Sparinvest endeavour of minimizing the risk of permanent capital losses. The efficiency of the U.S. stock market makes it possible to employ and execute Sirius strategy a strategy demanding that Sparinvest has a high degree of flexibility as an asset manager and can act instantly. Protection against capital losses while exploiting market momentum Model-based investing is not implemented from a buy-and-hold perspective. In fact, Sparinvest uses a method which focuses and operates on the basis of short-term market fluctuations. The goal is clear: to minimize the risk of permanent loss of capital in a bearish market, while at the same time achieving the highest possible return from a bullish market. The method reaching this objective to ride the bulls and abandon the bears lies in the ability to move to cash or short-term bonds. Thus, the Sirius concept acts like a hedge fund in the most positive sense. The degrees of freedom are fully employed which means that the portfolio managers need only to enter the stock market for a very short period of time, if that is what the investment models indicate. The investment models deciding whether or not the Sirius Funds should stay fully invested are constructed on the basis of numerous statistical measures and market factors. These variables are analysed thoroughly before any investment decisions are made. In addition to continuous

research, an indefinite series of tests have been conducted to identify the significant indicators signalling changes in market momentum. In other words, the investment models determine whether the Sirius Funds should be at any time exposed in equities, cash or bonds or a combination of these.

"All trading is done electronically on the U.S. stock market. The one market in the world where supply, demand, volume, pricing and trading costs are to the absolute advantage of the investor.

Superior supplement to an existing portfolio The relatively low risk of the Sirius Funds and the unique model-based investment method are very attractive when added to an investors existing portfolio. In addition to the attractive riskadjusted returns, the Sirius Funds have a very low correlation with other stock market indices and equity funds, even though they may invest in the exact same types of stocks. Normally, the risk associated with U.S. big cap,

The Sirius Funds base their investment decisions on whether or not the general market is expected to rise. Sirius reduces its equity exposure whenever the general stock market is expected to fall. Aggressive stock investing and moderate risk are not normally related. However, Sparinvest has developed a method that combines these two interesting features. Sparinvests model-based concept, the Sirius brand, has its similarities with other Sparinvest concepts. Sirius strategy and investment policy is clear and well-defined and is employed with strict discipline and without any deviations. The similarities stop here. The Sirius Funds focus on investing in sectors and groups of stocks which seem to offer investors the most attractive risk/reward ratios. The selection and portfolio composition is not static; many sectors which currently do not qualify for investment may become attractive in the future. With a model-based concept, investors get the opportunity of investing in the sectors of the future, while maintaining the focus on the usual

Liquidity in underlying stocks Sirius Fund investments take place mainly in the US stock market where the high volume and narrow spreads give an opportunity to enter and exit the market very efficiently and at a very low cost.

health care, biotech, finance, semiconductor and telecom stocks (some of the industries the Sirius Funds invest in) will reach high levels. However, the Sirius concept has helped Sparinvest reduce volatility to a large extent removing half of the risk. Sparinvests model-based concept:

The individual stocks qualifying for investment are not subject to a thorough, traditional stock analysis. When Sirius decides to enter the market, all trading is done electronically by purchasing a basket of health care stocks, for example, identical to an index or a market-leading mutual fund. When Sparinvest or some leading US rating agencies identify mutual funds and asset managers who are believed to run the best portfolios in the market, the Sirius Funds will buy replicating baskets of such funds if it proves to be attractive to stay fully invested in that particular part of the market. Aggressive stock investing with relatively low risk - taking the asset classes into account Access to sectors of the future Investments in liquid, large cap US Stocks No buy-and-hold in cash or bonds when the markets are most bearish and volatile Focus on capital preservation Attractive risk-adjusted returns

MODEL-BASED MODELBASERET

konceptbrochure UK 19/03/03 19:40 Side 11

Fixed income

Market leading products covering most major bond markets Sparinvest has for years been among the market leaders when it comes to fixed income. Sparinvest is one of the asset managers with the longest tradition in this field. The first bond fund was created as early as 1974. The investment concept is based on the view that all available information is already taken into account in bond prices. However, the theory and concept is not followed so inflexibly that Sparinvest will not exploit apparent disparities in the market. No unnecessary risks are taken, which is also the case for the other Sparinvest concepts. As Sparinvest does not claim to have special abilities in the bond market when it comes to predicting market trends, the endeavour is to deliver a relative return, regardless of market developments. Consistent asset allocation Initially three types of issuers are identified; Government bonds, callable and non-callable mortgage bonds. Callable mortgage bonds are further sub-divided into low, par and high coupon bonds.

Sparinvest aims to be present in all these types of bonds, as experience shows that asset allocation also decides long term bond returns. Next, duration limits are determined for each fund, which are never exceeded. In order to avoid unnecessary risk, Sparinvest emphasises a systematic process prior to investing. Yield curve considerations are furthermore included in the final portfolio allocation, without affecting the overall allocation. Test of numerous scenarios Each Sparinvest fund is of course measured against a benchmark. The objective is to offer a higher return than the benchmark. The process is to analyse benchmark returns in a long series of various market scenarios. Subsequently the same analysis is carried out for all bonds to discover the allocation offering the best return compared to the benchmark in most scenarios. This process means that Sparinvest has the optimal allocation to all three types of bond issuers. For a number of years this has produced returns among the best in the industry. The remaining part of the process, in which individual securities are evaluated, is the most demanding. However, according to Sparinvests

philosophy it is the preceding process establishing the overall allocation that contributes most to the return. Bond funds with useful characteristics Common sense influences the choice of which funds Sparinvest is providing. As it was the case when the information technology sector ascended to unrealistic levels in the late Nineties, and Sparinvest decided as one of the very few fund companies not to offer a narrow sector fund, Sparinvest is neither influenced by trends in the fixed income area. Trends risk leading investors to run for the same asset classes leading to subsequent losses. The objective for all fixed income products is to set aside short term trends and focus on longterm sustainable solutions. Sparinvests fixed income products are characterised by an attractive relationship between risk and return, either individually or as part of a portfolio of equities and bonds. Despite the starting point that all publicly available information is incorporated in bond prices Sparinvest naturally uses analyses and reports from leading economists. Nevertheless in-house analyses are as frequently used to decide where and when we are investing. Identification of market trends and disparities

that influence long-term returns, irrespective of the fact that the comments and analysis must often be considered as noise, can not be done unless Sparinvest look at the general market view. Long-term trends that may influence the bond market are reviewed at monthly and quarterly strategy meetings in Sparinvests Investment Committee.

Asset Allocation for fixed income products Goverment bonds Non-callable Callable Low coupon Par coupon High coupon

Sparinvests fixed income concept: Relative performance irrespective of market development Market leading low-risk funds Funds covering the entire yield curve

FIXED INCOME

konceptbrochure UK 19/03/03 19:41 Side 13

Va l u e

"An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative". Benjamin Graham, founder and father of Value investing

Sparinvest decided to implement the value approach in a selection of funds in the mid Nineties, and has adhered to it ever since, through good times and bad. Sparinvest has

get closer to the business value of the companies in the long run.

Sparinvests value concept: Investment in undervalued companies

Finally, investments are only made when the market price is considerably lower than the business value minimum 40% to 50% below. This difference between the market value and the business value is called the margin of safety. Sparinvests philosophy is to buy a 100 Euro note for 50 Euro when investing in value stocks for the portfolios. A wide margin of safety secures the investments

Wide margin of safety and low risk compared to general equity investments Focus on absolute return and preservation of capital

What do you do when value stocks are underperforming? Exactly the same as when they are outperforming. We work in a disciplined way using the principles we have chosen. It is important to be consistent in this respect. Sparinvest

Large potential through long-term investment in undervalued companies Value stocks are the designation of equities which are low priced compared to the companies business or intrinsic value. Two values are attached to all listed companies Sparinvest invests at the lowest value

extensive expertise in the field of value investing at its disposal, which has resulted in some of the top ranked funds among value funds, when measuring both long-term return and risk. At Sparinvest the value approach has been refined through a conservative attitude towards when a company qualifies as a value stock. Tough criteria in a very conservative analysis

against a permanent loss of capital even though short-term adverse market movements may and will occur. The stocks are sold when the market price gets close to the business value. Subsequently, the amount is invested in other companies trading at a big discount in relation to the business value. The aim for Sparinvests value products is first of all to preserve capital. In other words: As wide a margin of safety as possible, and thereby the lowest possible risk. Consequently, value investors must demonstrate patience when growth stocks are most popular among investors. History has shown that value stocks and growth stocks alternately lead the performance statistics. In the long run there is no doubt. Stocks in value companies, which have a higher survival bias, offer a better return than growth companies disregarding the fact that value stocks have a lower risk.

The theory of Value Investing was invented by Benjamin Graham as early as in 1934, and is based on the assumption that two values are attached to all companies. The first is the market price the value of the company on the stock exchange. The second is a companys business value. All companies have an intrinsic value or business value, which is based on the value at a merger with a competitor or at takeover. Alternatively the owners may consider the business value as the amount that could be achieved by breaking up the company and selling all the companys assets. The ownership is evaluated in order to estimate In the long term, stock prices reflect this value, but in the short and medium term, market prices are often far above or below this value. Value investing aims at making the most out of this disparity. whether a single stock holder may be part of the explanation for the low valuation of the company. The latter, however, does not change the fundamental attitude at Sparinvest. Irrespective of whether the companies are conducting a nonshareholder friendly policy, the stock price will A close eye is kept on the accounting principles, when the value of earnings, assets and cash flow is estimated. Peer group pricing is performed on the basis of real world mergers and acquisitions. The methodology involves screening thousands of companies on the global equity markets to select those companies fulfilling criteria on earnings, assets and stock price. Subsequently, companies meeting the requirements are subject to a thorough but traditional analysis leading to a very conservative valuation of the assets.

VALUE

konceptbrochure UK 19/03/03 19:41 Side 15

Sparinvest has a firm attitude towards risk and return

Prudent investment is the philosophy and the backbone of the products and investment counselling provided by Sparinvest. Sparinvest strives to provide long-term investment products with a superior relationship between risk and return, rather than aiming for quick high-risk profits - and losses! The track record of Sparinvest confirm the consistent position among the market leaders of mutual funds.

Prudent investments...

Prudent investments are the philosophy and the heart of our objective that is profoundly rooted in the culture at Sparinvest. It is on the basis on which we aim to provide long-term investment products.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- New Heritage DollДокумент26 страницNew Heritage DollJITESH GUPTAОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Chapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelДокумент3 страницыChapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelJedediah Samuel Marato0% (1)

- Solution - Cash Flow Projection - FinalДокумент51 страницаSolution - Cash Flow Projection - Finalanon_355962815100% (1)

- Overview of The IBBL 1.editedДокумент4 страницыOverview of The IBBL 1.editedNur sadiaОценок пока нет

- SIM ACP 323 Week 4 5Документ32 страницыSIM ACP 323 Week 4 5Helga MatiasОценок пока нет

- Updates in Managerial Accounting Module 1 2Документ44 страницыUpdates in Managerial Accounting Module 1 2master limarioОценок пока нет

- Optimal Capital StructureДокумент4 страницыOptimal Capital StructurevinyspОценок пока нет

- Auditing 1 Final ExamДокумент8 страницAuditing 1 Final ExamEdemson NavalesОценок пока нет

- CHAPTER ONE Accounting For Partnership Firms - Fundamentals PDFДокумент35 страницCHAPTER ONE Accounting For Partnership Firms - Fundamentals PDFMsmacademy Stu's ClubОценок пока нет

- Accounting 2Документ3 страницыAccounting 2Minas SydОценок пока нет

- ReSA B42 AUD Final PB Exam - Questions, Answers - SolutionsДокумент25 страницReSA B42 AUD Final PB Exam - Questions, Answers - SolutionsLuna VОценок пока нет

- Ch09 3310Документ16 страницCh09 3310Muhammad AhmedОценок пока нет

- Ross12e Chapter06 TBДокумент26 страницRoss12e Chapter06 TBHải YếnОценок пока нет

- Financial Statements of BMW AgДокумент32 страницыFinancial Statements of BMW AgGate Bennet4Оценок пока нет

- Managerial Accounting Prelim ExamДокумент39 страницManagerial Accounting Prelim ExamshaneОценок пока нет

- L7 Private EquityДокумент35 страницL7 Private EquityDeepak Kumar SubudhiОценок пока нет

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsДокумент4 страницыBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniОценок пока нет

- WORKSHEET (Lembar Jawaban)Документ2 страницыWORKSHEET (Lembar Jawaban)I Gede Wahyu krisna DarmaОценок пока нет

- Dividend Discount ModelДокумент54 страницыDividend Discount ModelVaidyanathan Ravichandran100% (1)

- L1 - ABFA1163 FA II (Student)Документ8 страницL1 - ABFA1163 FA II (Student)Xue YikОценок пока нет

- The Big Sho (R) T: TalkofthetownДокумент4 страницыThe Big Sho (R) T: Talkofthetownashu soniОценок пока нет

- HKICPA QP Exam (Module A) Sep2008 Question PaperДокумент9 страницHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- CAPITAL BUDGETING AssignmentДокумент4 страницыCAPITAL BUDGETING Assignmentqurban baloch100% (1)

- WCAДокумент18 страницWCAleninanthony89488Оценок пока нет

- Capital Budgeting ExamplesДокумент8 страницCapital Budgeting Examplesaldamati2010Оценок пока нет

- AwДокумент6 страницAwRobin SalivaОценок пока нет

- Cash Flow Analysis Lyst5937Документ5 страницCash Flow Analysis Lyst5937Vibhav SinghОценок пока нет

- Statement September 2021Документ1 страницаStatement September 2021Julio DelarozaОценок пока нет

- Survey of Accounting 6Th Edition Warren Solutions Manual Full Chapter PDFДокумент46 страницSurvey of Accounting 6Th Edition Warren Solutions Manual Full Chapter PDFzanewilliamhzkbr100% (7)

- Segmental AnalysisДокумент2 страницыSegmental AnalysisEsmeldo MicasОценок пока нет