Академический Документы

Профессиональный Документы

Культура Документы

Infrastructureand PPP

Загружено:

rajat19915018Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Infrastructureand PPP

Загружено:

rajat19915018Авторское право:

Доступные форматы

Infrastructure Development in India

The importance of infrastructure for sustained economic development is well recognized. High transactions costs arising from inadequate and inefficient infrastructure can prevent the economy from realizing its full growth potential regardless of the progress on other fronts. Physical infrastructure covering transportation, power and communication through its backward and forward linkages facilitates growth; social infrastructure including water supply, sanitation, sewage disposal, education and health, which are in the nature of primary services, has a direct impact on the quality of life. The visible signs of shortfalls in capacity and inefficiencies include increasingly congested roads, power failures, long-waiting lists for installation of telephones and shortages of drinking water illustrate the widening gap between demand and supply of infrastructure and also raises questions concerning the sustainability of economic growth in future. The efficacy of private sector participation in infrastructure development would be contingent upon the capability to commercialize these projects whereby recovery of investments would be through a system of user charges. There is a potential for public private partnerships (PPPs) to contribute more and help bridge the infrastructure gap in India. There has been considerable progress in the last ten years in attracting private investment into the infrastructure sectors; first in telecommunications, then in ports and roads, and in individual projects in other sectors. With the current GDP growth of 8%, in which there is contribution of nearly 51% from services and 16% from manufacturing sector there is a need for proper alignment of resources. To sustain this growth India needs to develop sound infrastructure so that the right input of skilled, qualified and socially contented labor; visible and reliable supply chains; prompt and accurate information for decision making; efficient process and updated technology can be given to the operations of manufacturing and services. The need to provide world class infrastructure that keeps pace with 8 per cent economic growth is clear. City roads are choked with traffic, power cuts are a fact of life and passengers are routinely delayed as booming air travel tests airport capacity. Analysts say the infrastructure sector as a whole needs to grow 8 per cent a year, instead of 5 per cent at the moment, to meet the government's vision of even higher growth, more jobs and better basic living conditions for 260 million poor. Therefore there is a need to holistic approach to look in to infrastructure from the industrial perspective to enhance the quality of inputs to the operations of the company.

Introduction Infrastructure output growth for the first month of the new financial year has come in at a healthy 6.7 per cent as compared to 6 per cent for the same month of previous year. The growth rate for April is higher than the average monthly rates reported for the previous 3 months, but lower than 8.7 per cent reported for March 2006. The new economic policies aimed at stepping up economic growth, improving market efficiency and competitiveness, and integrating the Indian economy with global markets have already placed a heavy demand on all types of urban infrastructure services. The resulting bottlenecks are beginning to pose

serious impediments to enhancing productivity. Urban infrastructure includes water supply and sanitation which are important basic needs for improvement of the quality of life and enhancement of the productive efficiency of citizens.

There has been a steady increase in the urban population on account of rapid industrialization, natural growth and migration from rural areas. This has prompted the working out of alternative ways of meeting the increasing transport demand given the constraints of land and capital, and the need to control energy consumption, pollution and accidents. Infrastructure policy in India: Major policy initiatives such as deregulation, viability gap funding ,India infrastructure finance company, Committee on infrastructure ,rural infrastructure programme , National urban renewal mission, public private partnerships, Launch of private sector infrastructure funds have been implemented in infrastructure sector Road Policy in India: Indian infrastructure policy on roads permit duty free import of high capacity and modern road construction equipments, complete tax holiday for any 10 consecutive years out of 20 years. Longer concession periods of up to 30 years are permitted as per the roads policy of India. Airports Policy in India: Indian airport infrastructure policy permits 100% tax exemption for airport projects for 10 years, 100% equity ownership by Non Resident Indians (NRIs), 100% foreign direct investments (FDI) in India in existing and Greenfield airport projects, Airport policy of India also allows 49%FDI and 100% NRI investment in airport transport services. Ports Policy in India: As per Indian port policy all areas of port operation open for Private Sector Participation .Private sector participation and JVs now permitted. Ports policy of India also allows 100% income tax exemption for a period of 10 years. Power Policy in India: Indian power policy permit 100 percent FDI (except atomic energy) in electricity generation, transmission, and distribution and trading, Establishing power plants without any license, transmission services for Independent power transmission companies. Oil, Gas and mining Policy: 100% FDI permitted for mining (except coal). CASs, levied earlier on crude production, has been abolished for the blocks offered under NELP. In deepwater exploration royalty for areas beyond 400m bathymetry will be charged at half the prevailing rate. In petroleum and natural gas sector 100 FDI is permitted except refining ,subject to sectoral regulations; and in the case of actual Trading and marketing of petroleum products, divestment of 26% equity in favour of Indian partner/public within 5 years .In refining 100% FDI is allowed in private companies and 26% FDI allowed in Public sector companies. Real Estate Policy in India: Corporate tax exemption of up to 100% for industrial parks, SEZs and housing projects are permitted as per Indian Real Estate Policy.

Telecommunication Policy in India: 74% FDI is allowed in Basic and cellular, Unified Access Services, National/International Long Distance, V-Sat, Public Mobile Radio Trucked Services (PMRTS), Global Mobile Personal Communications Services (GMPCS) and Other value added telecom services, ISP with gateways, radio paging, end-toend bandwidth. 100% FDI is permitted in ISP without gateway, infrastructure provider providing dark fiber, electronic mail and voice mail, subject to the condition that such companies shall divest 26% of their equity in favor of Indian public in 5 years, if these companies are listed in other parts of the world as per the Indian telecommunication policy.

Why India -India at a glance- Attractive Destination India has a population of 1.1 billion. More than 30% of the worlds youth live in India. More than 55% (550 million) of the Indias population is less than 25 years of age. This is nearly twice the total population of the United States. Indias urban population constitutes around 30%. India is a nation growing younger (population in working age group projected to increase) as the developed world faces the problem of aging. India has a huge reservoir of English speaking, skilled and relatively inexpensive manpower with over 2.6 million engineers (degree and diploma holders), 814,000 software professionals, growing every year. It also got a well developed banking system, with over 67,000 branches and banking practices conforming to international best standards with net non performing assets ratio for all commercial banks 1.2%. It has a sophisticated, well regulated capital market with 23 stock exchanges of which the two largest, the National Stock Exchange and Bombay Stock Exchange ranked as no 3 and 5 in the globe by number of transactions. India has more billionaires than China. This year there were 15 billionaires in China but last year in India, there were 20 billionaires, according to the Forbes magazine. Forty-four per cent of Top 100 Fortune 500 companies are present in India. Some of the fortune companies present in India are ABB, Accenture, Alctel, AMD,ANZ, APC, Bosch, CSC, Citibank, Caterpillar, CA, Delphi, Dell, Dupont, Digital , Delloitte ,Ford,HSBC,Hyundai, Google,Intel,GE, Oracle ,Microsoft , Nokia, Siemens. India is the fourth largest economy in terms of purchasing power parity, the tenth most industrialized country in the world, the tenth largest economy in the world in terms of GDP and is one of the fastest growing developing economies today in the world. The most remarkable feature of its impressive growth story, especially over the last decade and a half, is that it has happened in a solid, democratic environment, making the process sustainable. The present infrastructure in India is grossly inadequate for the 1.1 billion populations. To improve the infrastructure of India, large investments have been planned by Indian government.

Infrastructure Potential in India:

Ports infrastructure in India: India has a long coastline of 7,517 km. The existing 12 major ports control around 76 % of the traffic. Due to globalization, Indias ports need to gear up to handle growing volumes. A number of the existing ports have plans for expansion of capacities, including addition of container terminals. The government has launched the National Maritime Development Programme, to cover 276 port projects (including related infrastructure) at an investment of about INR 600 billion by the year 2012. Also, States are increasingly seeking private participation for the development of minor ports, especially on the west ports. Indian ports are projected to handle 875 million tones(MT) of cargo traffic by 2011-12 as

compared to 520MT in 2004-05.There will be an increase in container capacity at 17% CAGR.Cargo handling at all the ports is projected to grow at 19 per cent per annum till 2012. Planned capacity addition of 545 mt at major ports and 345 mt at minor ports. Port traffic is estimated to reach 1350 million tones by 2012 .Containerized cargo is expected to grow at 18 per cent per annum till 2012. Projected Investment in major ports $16 billions and minor ports $9billion during 2007-12.

Airports infrastructure in India: Passenger and cargo traffic slated to grow at over 20% annually and set to cross 100 million passengers per annum by 2010 and and set to cross cargo traffic of 3.3 million tonnes by 2010.Mumbai and Delhi airports have already been handed over to private players.Kolkata and Chennai airports will also be developed through JV route.

Railways Infrastructure in India: Indian Railways is the largest rail network in Asia and worlds second largest under one management. Indian Railways comprise over one hundred thousand track kilometers and run about 11000 trains every day carrying about 13 million passengers and 1.25 million tones of freight every day. The scope for public private partnership is enormous in railways, ranging from commercial exploitation of rail space to private investments in railway infrastructure and rolling stocks. The Golden quadrilateral is proposed to be strengthened to enable running of more long distance passenger trains and freight trains at a higher speed. Programmed also envisages strengthening of rail connectivity to ports and development of multimodal corridors to hinterland. Construction of 4 mega bridges costing about US$ 750 million is also included in the programme.Construction of a new Railway Line to Kashmir valley in most difficult terrain at a cost of US$ 1.5 Billion and expansion of rail network in Mumbai area at a cost of US$900 million has also been taken up. Freight traffic is growing at close to 10% and passenger traffic at close to 8% annually. Railways have planned a dedicated rail freight corridor running along the railways Golden Quadrilateral (GQ). The double-line freight corridor is expected to evolve systematic and efficient freight movement mechanisms and ease congestion along the existing GQ. It would leave the existing GQ free for passenger trains. The 9260 km dedicated freight corridor to be built at a cost of Rs 60,000 crore (US$ 15 billion) is being funded partially with a US$ 5 billion loan from Japan. The work is expected to be completed within the next 57 years. The first phase of the project would include the DelhiHowrah and the DelhiMumbai routes.

Power Infrastructure in India: Presently the installed capacity of electric power generation stations under utilities stood at 130000MW and in the five year plan the generation capacity is planned to be increased to 2,20,000 MW by 2012.There is a 13% peaking and 8% average shortage of power annually. Central government has already taken steps to increase capacity by building Ultra mega power projects (UMPPs).There is a plan to increase Nuclear power capacity from 3900MW currently to 10000 MW by end of 11th plan.

Telecom Infrastructure in India: Even with the rapid growth of telecom sector in India, the rural penetration is still less than 5%. At 500 minutes a month, India has the highest monthly 'minutes of usage' (MOU) per

subscriber in the Asia-Pacific region, the fastest growth in the number of subscribers at CAGR of more than 50%, the fastest sale of a million mobile phones (in one week), the world's cheapest mobile handset and the world's most affordable colour phone.

Highways and Roads infrastructure: The Indian road network has emerged as the second largest road network in the world with a total network of 3.3 million km comprising national highways (65,569 km.), State highways (128,000 km.) and a wide network of district and rural roads. The US tops the list with a road network of 6.4 million km. Currently, China has a road network of over 1.8 million km only. Out of the 3.38 million Kms of Indian road network, only 47% of the roads are paved. Roads occupy a crucial position in the transportation matrix of India as they carry nearly 65 per cent of freight and 85 per cent of passenger traffic. Over the past decade several major projects for development of highways linking the major cities have been planned and work started on most of them. What is of significance is that private sector involvement (BOT projects) has finally been found to be feasible in the Indian context. This has led to an accelerated growth in this sector which had long been faced with financial constraints. This has also facilitated improvement in the quality of the new highways and introduction of the latest concepts for toll collection, signages etc. The process of development of the new highways is expected to continue for many years to come.

Construction Infrastructure in India: Construction accounts for nearly 7 per cent of Indian GDP and is the second biggest contributor (to GDP) after agriculture. Construction is a capital-intensive activity. Broadly the services of the sector can be classified into infrastructure development (54%), industrial activities (36%), residential activities (5%) and commercial activities (5%). The main entities in the construction sector are construction contractors, equipment suppliers, material suppliers and solution providers. Indias construction equipment sector is growing at a scorching pace of over 30 per cent annually--driven by huge investments by both the Government and the private sector in infrastructure development. It is estimated that there is USD860 billion worth of construction opportunities in India Oil, Gas Hydrocarbon Infrastructure in India With the exponential increase in the population of vehicles and industrial requirement, the consumption of petrol products is likely to increase to 300 MMT by the year 2010. India has established geological reserves of more than 6 billion and exploration acreages are available on offer on continuous basis. It is estimated that investment over the next 10-15 years shall be in the range of US$ 100-150 billion. Additional refining capacity of 110 million tonnes shall be required by 2010. Opportunities have emerged in business areas linked to Natural Gas. Private opportunities also exist in infrastructure like jetties, storage tanks, movement of oil and petro-products. Oil import constitute largest share of total import and therefore Government has taken many initiatives to mitigate the situation and attract the foreign investors.100% foreign investment has been allowed in this sector. Deregulation and delicensing has been done for the petroleum products. Rationalization of pricing has taken place by decontrol and import parity. Private sector can import most products, pipelines, terminals and tank ages cleared for private investment. JV can be formed for the development of infrastructure, marketing and, refining activities.

NEW INSTITUTIONAL MECHANISM FOR PPP

The creation of world class infrastructure would require large investments in addressing the deficit in quality and quantity. , it is necessary to explore the scope for plugging this deficit through Public Private Partnerships (PPPs) in all areas of infrastructure like roads, ports, energy, etc. Given the risks involved in large projects the government has realized that only public sector involvement with central government development assistance for infrastructure projects is not adequate to meet the challenge. Recognizing the imponderable risks, which infrastructure projects entail, with long gestation periods, high costs and budget constraints, the government has proposed a flexible funding scheme, which will find support from budgetary allocation to fund public-private-partnerships (PPPs) for infrastructure projects. The government has proposed India Infrastructure Finance Company (IIFC) and formulated a scheme to support PPPs in infrastructure. As part of this scheme, PPP opportunities are to be awarded through competitive bidding in a transparent manner and for each project, performance is to be assessed against easily measurable standards, based on unambiguously defined criteria, in order to inspire confidence among investors.

Recently, legal and regulatory changes have been made to enable PPPs in the infrastructure sector, across power, transport, and urban infrastructure. For example, the Electricity Act allowed for private sector participation in the Distribution of electricity in specified area(s) of the distribution licensees under the role of a franchisee. The recognition of the franchisee role is a significant step towards fostering PPP in the distribution of electricity. In some cases, the impact of private sector involvement in terms of end-user benefits has been felt almost immediately. A case in point is the initial Build-Operate-Transfer (BOT) experience at Jawaharlal Nehru Port, where the Minimum Guaranteed Traffic requirement at the end of 15 years, identified as part of the concession agreement, was met in just 2 years. The experiment is being replicated across other major ports as well. Public Private Partnership means an arrangement between a government / statutory entity / government owned entity on one side and a private sector entity on the other, for the provision of public assets and/or public services, through investments being made and/or management being undertaken by the private sector entity, for a specified period of time, where there is well defined allocation of risk between the private sector and the public entity and the private entity receives performance linked payments that conform (or are benchmarked) to specified and pre-determined performance standards, measurable by the public entity or its representative. Essential conditions in the definition are as under: i.Arrangement with private sector entity: The asset and/or service under the contractual arrangement will be provided by the Private Sector entity to the users. An entity that has a majority non-governmental ownership, i.e., 51 percent or more, is construed as a Private Sector entity1. ii.Public asset or service for public benefit: The facilities/ services being provided are traditionally provided by the Government, as a sovereign function, to the people. The most significant criteria for a continued growth rate of an economy is rests on the provision of a quality infrastructure. According to the Planning Commission, an

approximation of 8 percent of the Gross Domestic Product or GDP needs to be invested. This would help in acquiring a prospective economy as stated in the 11th Five Year Plan. Fund investment of over US $ 494 billion has been conceived of according to the 11th Five Year Plan with effective from 2007 to 2012. The investment sectors under consideration are inclusive of telecommunications, electric power, water transport, road, rail, air, water supply as well as irrigation amounts to about Rs. 20,27,169 crore according to 2006-07 prices. In order to meet such demands, various Public Private Partnerships or PPPs are being promoted for implementation of infrastructure projects. PPP is often described as a private business investment where 2 parties comprising government as well as a private sector undertaking form a partnership. The deficit can be overcome by ensuring much more private capital investment. Expert guidance is the only way out for enabling efficiency through subsequent reduction in cost. Promotion of PPP is therefore necessary since its the most preferred mode. Despite of its benefits, there are some constraints too which can be summarized as:

Sufficient instruments as well as the ability to undertake long-term equity cannot be provided by the market in the present financial scenario. Also financial liability required by infrastructure projects would not be sufficed. Most sectors face a lot of hindrance in enabling a regulatory framework as well as a consolidated policy. So its important to convert such policies into PPP friendly. To achieve the desires results, active participation of various state projects are essential. Lack of ability of private sectors to fit into the risk of investing in diversified projects also needs to be overcome. Modernization of new airports, transmission systems and building power generating plants are some of the avenues which required skilled manpower. Ability of public institutions to manage the PPP process should also be subdued. Maximizing the return of the stakeholders needs to be managed due to the involvement of long term deals including the life cycle of the asset infrastructure. Lack of credibility of bankable infrastructure projects used for financing the private sector should also be overcome. Inconsistency is still visible in the limitations of PPP projects, despite of continued initiatives by States and Central ministries. Inadequate support to enable greater acceptance of PPPs by the stakeholders forms another source of constraint.

Several initiatives have been undertaken by Government of India to enable a greater PPP framework in order to eradicate the above mentioned constraints. Various foreign as well as private investments by waving off charges are encouraged. Framing of standardized contractual documents for laying down the terminologies related to risks, liabilities and performance standards have been devised. Approval schemes for PPPs in the central sector has been streamlined through Public Private Partnership Appraisal Committee or PPPAC. A website has been launched for the purpose of virtual PPP market serves as an online database for PPP projects.

PPPs can only be mainstreamed by continuous response to the varying goal of people and economy in general. The boundary domains of PPPs should be increased in order to prosper the infrastructure development of India.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Project Report On Technical AnalysisДокумент97 страницProject Report On Technical Analysisvishalnabde80% (59)

- AAPA Guide To The Handling Storage Manufacture of PMB's Final Version Jan 2013 PDFДокумент15 страницAAPA Guide To The Handling Storage Manufacture of PMB's Final Version Jan 2013 PDFhongleukОценок пока нет

- 25-00-18 Sicma 9581Документ307 страниц25-00-18 Sicma 9581ollieknightОценок пока нет

- LOad On Bridge 2Документ140 страницLOad On Bridge 2shamsukarim2009Оценок пока нет

- Aditya Joshi CVДокумент23 страницыAditya Joshi CVAditya JoshiОценок пока нет

- MK ProjectДокумент42 страницыMK Projectrajat19915018Оценок пока нет

- E-Banking: Dr. Rana Singh Associate ProfessorДокумент45 страницE-Banking: Dr. Rana Singh Associate ProfessorBinny TalatiОценок пока нет

- Bank of IndiaДокумент15 страницBank of Indiashreyaasharmaa100% (1)

- COMMUNIQUEДокумент28 страницCOMMUNIQUErajat19915018Оценок пока нет

- Advantages of DbmsДокумент2 страницыAdvantages of Dbmsrajat19915018Оценок пока нет

- Advantages of DbmsДокумент2 страницыAdvantages of Dbmsrajat19915018Оценок пока нет

- Oct 18 To Planning CommissionersДокумент12 страницOct 18 To Planning CommissionerssamtlevinОценок пока нет

- AR-00 00 000-TOC en A 1 MainДокумент14 страницAR-00 00 000-TOC en A 1 Mainaboamerhhh8Оценок пока нет

- Dr. San Htin Lin - APOST FESS Workshop - Final Info PackageДокумент6 страницDr. San Htin Lin - APOST FESS Workshop - Final Info PackageHtin Lin SanОценок пока нет

- Guillermo Leon Suarez Ardila, 17dec 1248 BucaramangaДокумент2 страницыGuillermo Leon Suarez Ardila, 17dec 1248 BucaramangaGuillermo SuárezОценок пока нет

- ME 2010 04 Vehicle Front-End Active AerodynamicsДокумент6 страницME 2010 04 Vehicle Front-End Active AerodynamicsAsha DashОценок пока нет

- Manual Do Fis Jit VWДокумент23 страницыManual Do Fis Jit VWJose Augusto Santos NetoОценок пока нет

- Pot Bearings Technical Data Sheets All Standards PDFДокумент30 страницPot Bearings Technical Data Sheets All Standards PDFStefanoPalumboОценок пока нет

- Consumer Behavior and Effect of Marketing Strategy On Atul Autofinal-1Документ58 страницConsumer Behavior and Effect of Marketing Strategy On Atul Autofinal-1rutvik080808Оценок пока нет

- Flying The Flag': Mapping IAL & Boac RoutesДокумент7 страницFlying The Flag': Mapping IAL & Boac RoutesDave FaganОценок пока нет

- Long-Term Pavement Performance Program Manual For FWD PDFДокумент82 страницыLong-Term Pavement Performance Program Manual For FWD PDFzakwanramliОценок пока нет

- Worksheet Titanic Python PDFДокумент8 страницWorksheet Titanic Python PDFrashmimehОценок пока нет

- ValPark Drainage ProjectДокумент19 страницValPark Drainage Projectjonathan_guthrie_5Оценок пока нет

- ProfilSTRAIL Installation InstructionsДокумент5 страницProfilSTRAIL Installation InstructionsPop PollyОценок пока нет

- North Star: Yacht Charter Details For 'North Star', The 63.1m Superyacht Built by Sunrise YachtsДокумент3 страницыNorth Star: Yacht Charter Details For 'North Star', The 63.1m Superyacht Built by Sunrise YachtsXavi RedondoОценок пока нет

- Kami Export - CrumpleZonesSE PDFДокумент10 страницKami Export - CrumpleZonesSE PDFAlaina VillatoroОценок пока нет

- 4.1 Routine Communication With DSC Call Readingcomprehension Book4 - 1Документ1 страница4.1 Routine Communication With DSC Call Readingcomprehension Book4 - 1AdiОценок пока нет

- Automotive HistoryДокумент6 страницAutomotive HistoryJohn Kheil Oliquino Obina100% (1)

- SIRE 2.0 Question Library - Question Programming Attributes - Version 1.0 (January 2022)Документ86 страницSIRE 2.0 Question Library - Question Programming Attributes - Version 1.0 (January 2022)Caner DoguОценок пока нет

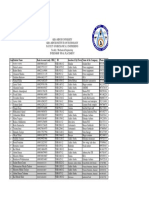

- S.no Student Name Bank Account (Only CBE) ID Location (City/Town) Name of The Company Phone NumДокумент1 страницаS.no Student Name Bank Account (Only CBE) ID Location (City/Town) Name of The Company Phone NumTewodros DereseОценок пока нет

- Nitrogen Gas Charging InstructionsДокумент5 страницNitrogen Gas Charging InstructionsnelsonyОценок пока нет

- 110 PMK.010 2018perДокумент1 страница110 PMK.010 2018perAnonymous 17flK4W100% (1)

- Fuses and Circuit Breakers PDFДокумент5 страницFuses and Circuit Breakers PDFOskars ŠtālsОценок пока нет

- How To Setup gp2Документ8 страницHow To Setup gp2Aniello IaccarinoОценок пока нет

- Rigging-Manual Dart16Документ10 страницRigging-Manual Dart16Adi ATMОценок пока нет

- P66 XC Aviation Hydraulic Oil SDSДокумент8 страницP66 XC Aviation Hydraulic Oil SDSMik AeilОценок пока нет

- A Review On Yard Management in Container TerminalsДокумент17 страницA Review On Yard Management in Container TerminalsBui kienОценок пока нет