Академический Документы

Профессиональный Документы

Культура Документы

Debjani JOURNAL Excel Worksheet

Загружено:

Debjani DeyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Debjani JOURNAL Excel Worksheet

Загружено:

Debjani DeyАвторское право:

Доступные форматы

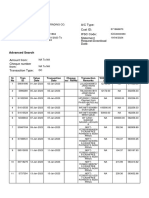

JOURNAL : VASUNDHARA REPAIR COMPANY Date Particulars Dr Rs 180000 180000 Cr Rs

01.07.2012 Cash/Bank a/c To Capital a/c (Capital brought into business by Vashundhara) 02.07.2012 Hire Charges Expenses a/c To Cash/Bank a/c ( hire charges paid for derrick & pulley assmbly) 05.07.2012 Repair Materials (goods) a/c To Cash/Bank a/c To Construction Material Pvt. Ltd a/c (material obtained on credit from Cons.Co.) 06.07.2012 Cash/Bank a/c To Alacrity Consultants Co a/c ( adv. Reced. From M/s Alacrity Cons. Co.) 07.07.2012 M/s Adroit Engg. & Co a/c To Receivable a/c ( billed to Co. for completed work.) 11.07.2012 Misc. Expenses a/c To Cash/bank a/c ( Misc. expenses paid.) 12.07.2012 Fixed Asset equipment a/c To Cash/bank a/c To M/s Ready-mix Co. Ltd. a/c ( purchased concrete mixer partly cash and balance part on credit from M/s ready-mix.) 15.07.2012 Professional Service Expenses a/c To Cash/bank a/c ( paid prof. service charge to M/s Mehta Ass.) 16.07.2012 M/s Automatic Electric Ltd. a/c To Receivable a/c ( billed for repair work to M/s Auto Elec.Co.) 19.07.2012 Advertisement Expenses a/c To cash /bank a/c ( Adv. Expenses incurred ) 20.07.2012 M/s Construction Materials P.Ltd a/c

6800 6800

176000 50000 126000

29600 29600

15000 15000

2950 2950

85600 20800 64800

15000 15000

26800 26800

1900 1900

26000

To Cash/bank a/c ( paid to M/s Construction Mat. Co ) 23.07.2012 Rent Expenses a/c To Cash/bank a/c ( Rent paid for 3 months) 25.07.2012 Fixed Asset Typewriter a/c To Cash/bank a/c ( purchased typewriter for cash) 29.07.2012 Salary Expenses a/c To Cash/bank a/c ( paid Salaries & wages for July-12) 31.07.2012 Cash/bank a/c To M/s Automatic Electric Ltd. ( Reced. Payment from M/s Automatic Co.) 6900

26000

6900

5900 5900

26450 26450

26800 26800

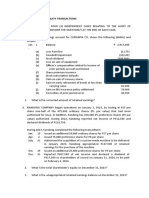

NOTE : 1

1 2nd July entry of Hire Charges a/c paid for six months i.e. 5 months in advance. Hence entry may should be made as under : Debit Prepaid Exp. ( i.e advance hire charges) a/c Rs 5466 Hire Charges a/c Rs 1334 Credit Cash/bank a/c

Rs 6800

NOTE: 2 23rd July entry of rent for 3 months ( july to Sept) should be treated as under: Debit Rent expenses Prepaid Exp ( advance rent) Credit Cash/Bank

Rs 2300 Rs 4600

Rs 6900

Accordingly ledger accounts may be changed as under: New Ledger Head of " PREPAID EXPENSES" to be opened with DEBIT entry of Rs 4600 + Rs 5466 = Rs 10066

Hire Charges Expenses would be then debit fig of Rs 1334 instead of earlier Rs 6800 Similarly , Rent Expenses would be then debit fig of Rs 2300 instead of earlier Rs 6900

Accordingly Trial balance would be as under: S.No. 15 Rent would be Rs 2300 S.No.11 Hire charges would be Rs 1334 & New ledger head would be as under: S.No. 16 "Prepaid Expenses" debit fig Rs 10066

Hence total of Tria Balance remain same.

TIPS: Debit the Receiver Credit the Giver Debit what comes IN Credit what goes OUT Debit all Expenses ( losses) Credit all incomes ( Gains) For transactions with Persons, Company, entity etc. FOR PERSONAL ACCOUNTS Transactions for Goods, Cash, items,etc. FOR REAL ACCOUNTS For NOMINAL ACCOUNTS

tions with Persons, Company, entity etc.

ns for Goods, Cash, items,etc.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Detailstatement - 19 4 2024@14 46 25Документ28 страницDetailstatement - 19 4 2024@14 46 25SONU SОценок пока нет

- Chapter 10Документ16 страницChapter 10Charlene LeynesОценок пока нет

- Collection of ChequesДокумент7 страницCollection of Cheques28-RPavan raj. BОценок пока нет

- Nps One PagerДокумент2 страницыNps One PagerldorayaОценок пока нет

- Tutorial Letter 108/0/2023: TAX4861 NTA4861Документ75 страницTutorial Letter 108/0/2023: TAX4861 NTA4861ByouОценок пока нет

- The Fall of The House of Credit PDFДокумент382 страницыThe Fall of The House of Credit PDFRichard JohnОценок пока нет

- JAIIB-PPB-Free Mock Test - JAN 2022Документ3 страницыJAIIB-PPB-Free Mock Test - JAN 2022kanarendranОценок пока нет

- Account Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент2 страницыAccount Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesameer bawejaОценок пока нет

- Proforma Invoice Gilmar 003 02Документ1 страницаProforma Invoice Gilmar 003 02diegomattaОценок пока нет

- Equity Exercises 1Документ3 страницыEquity Exercises 1alcazar rtuОценок пока нет

- Notification 93 2023Документ1 страницаNotification 93 2023tax.contactОценок пока нет

- 2018 Working Capital Management: Test Code: R38 WCAM Q-BankДокумент6 страниц2018 Working Capital Management: Test Code: R38 WCAM Q-BankMarwa Abd-ElmeguidОценок пока нет

- CR Ma 21Документ22 страницыCR Ma 21Sharif MahmudОценок пока нет

- Awareness Among The Traders About The Settlement of Online TradingДокумент13 страницAwareness Among The Traders About The Settlement of Online TradingElson Antony PaulОценок пока нет

- Two Brain MetricsДокумент27 страницTwo Brain MetricsJay MikeОценок пока нет

- MNC Valuation MefДокумент9 страницMNC Valuation MefKabulОценок пока нет

- Asset Rotation Fund: Tactical and FlexibleДокумент2 страницыAsset Rotation Fund: Tactical and FlexibleEttore TruccoОценок пока нет

- Ticket Plus實名制購票流程 2023061301Документ14 страницTicket Plus實名制購票流程 2023061301daniel111478Оценок пока нет

- Risk Bearing Documents in International TradeДокумент8 страницRisk Bearing Documents in International TradeSukrut BoradeОценок пока нет

- Noc From BLDRДокумент3 страницыNoc From BLDRsameersbnОценок пока нет

- Financial Risk SystemДокумент2 страницыFinancial Risk SystembezbraОценок пока нет

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Документ55 страниц23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesОценок пока нет

- Meezan Rozana Amdani FundДокумент2 страницыMeezan Rozana Amdani FundAbdur rehmanОценок пока нет

- P1 Investment Appraisal MethodsДокумент3 страницыP1 Investment Appraisal MethodsSadeep Madhushan0% (1)

- 121-Ugong Issue 5.2 - FINAL - Doc - With Corrections-2nd RevisionДокумент16 страниц121-Ugong Issue 5.2 - FINAL - Doc - With Corrections-2nd RevisionMarq QoОценок пока нет

- Practice Tests Government Grant EtcДокумент10 страницPractice Tests Government Grant EtcgnlynОценок пока нет

- Punjab & Sind Bank: Jump To Navigationjump To SearchДокумент5 страницPunjab & Sind Bank: Jump To Navigationjump To SearchSakshi BakliwalОценок пока нет

- The Jap YenДокумент13 страницThe Jap YenRadhika KashyapОценок пока нет

- Transfer - RemittanceДокумент3 страницыTransfer - RemittanceEman MostafaОценок пока нет

- C1 - Guaranty Trust Bank PLC Nigeria (A)Документ15 страницC1 - Guaranty Trust Bank PLC Nigeria (A)Anisha RaiОценок пока нет