Академический Документы

Профессиональный Документы

Культура Документы

The Indian Logistics Industry Growing Fast

Загружено:

Yash SankrityayanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Indian Logistics Industry Growing Fast

Загружено:

Yash SankrityayanАвторское право:

Доступные форматы

The Indian logistics industry growing fast, but challenges remain

The Indian logistics industry growing fast, but challenges remain

09/Oct/2008 Suffering from chronic underinvestment in transport infrastructure, India's industry has been characterised by systemic supply chain failings. However it seems to some extent that this situation is now being addressed, due to the Government's current emphasis on infrastructure improvements. These improvements, facilitating growth in overseas trade, are particularly helping the development of private companies operating in the shipping logistics sector, many of which are making their own investment in facilities as they gear up to support capacity expansion. The Indian logistics market is characterised not only by the large global 3PLs, but also by many Indian companies. Some of these players have expanded in India via foreign investment, and others are companies providing shipping and shipping related activities, which have diversified into logistics. Meanwhile, many 3PLs in the Indian market have imported expertise through joint ventures with established foreign operators. Allcargo Global Logistics (AGL), for example, raised INR2.42bn ($51 million) this year, through an issue of shares and debentures, using the investment company Blackstone Advisors. Shashi Kiran Shetty, AGL's Chairman and Managing Director, said: "Our company had been looking at raising funds for expansion. With Blackstone, we [have] the opportunities in the logistics space in India and globally." AGL also signed a memorandum of understanding with the state-run Container Corporation of India (Concor), to establish a container freight station (CFS) at the Dadri inland container depot (ICD), near Delhi. The 40,000 sq m facility will have an annual capacity of 84,000 TEUs (twenty-foot equivalent units). It will be operational from January 2009, and handle container traffic from northern India. The company, which has focused on LCL (less than container load) consolidation, FCL (full container load) forwarding and CFS operations, owns and operates three CFS facilities: near Jawaharlal Nehru Port (close to Mumbai), at Chennai, and at the north-west Indian port of Mundra. Another company aiming to become a one-stop shop is the Mumbai-based shipowner Essar Shipping Ports and Logistics Ltd (ESPLL), which is raising US$1.9bn to finance several shipping and logistics expansion projects. ESPLL's Director V Ashok said: "Over the past year we've re-organised from [being] a shipping company into a full-fledged logistics outfit. We've become an integrated player in India, which is unique." The 3PL ESPLL serves the group companies Essar Oil, Essar Steel and Essar Bulk Terminal, in its plans to focus more on the ports sector. Few companies involved in supporting India's maritime infrastructure can offer the range of multimodal logistics solutions provided by Chennai-based Sical Logistics. The group offers solutions for bulk, container and offshore logistics, and operates the container terminal at the port of Tuticorin (in partnership with Singapore's PSA International), among other activities, which include rail, ICD and CFS operations.

Oct 2008 Transport Intelligence Ltd

The Indian logistics industry growing fast, but challenges remain

The Sical group CEO Sudhir Rangnekar explained: "One of our most prestigious projects is Sical Multimodal and Rail Transport (SMART), which offers competitive container rail logistics services through a network of ICDs, using the `hub-and-spoke' model. Our plan is to have the Multimodal International Hub Airport at Nagpur (MIHAN) as the hub, and Chennai and Bangalore as spokes. We will offer end-to-end solutions across the country." Rangnekar continued: "Our fleet of 2,500 trucks and about 1.1m sq ft of warehouse space allow us to cater to the burgeoning demand for inland logistics. We've introduced GSM/GPS systems for real-time tracking of trucks carrying high value cargo." He added that the group also has several upcoming infrastructure projects managed under a new wholly-owned subsidiary, Sical Infra Asset. One of the companies to be managed by this umbrella outfit is Sical Iron Ore Terminals, which is establishing one of the largest iron ore terminals in India, with a capacity of 12m tonnes. To be managed on a BOT (Build, Operate, Transfer) basis, it is due to become operational by early 2010. One group to have diversified from its core shipping agency business into integrated logistics is Samsara Shipping, part of the Dubai-based Sharaf group. Its two main businesses are a rail-mounted container service, called Hind Terminals, and a chain of CFSs located in strategic points across the country. Mukesh Oza, Samsara's President and CEO, said: "We handle nearly 15,000 TEUs monthly through Hind Terminals in our [Jawaharlal Nehru] ICD, which is a strategic alliance with the (state-run) Central Warehousing Corporation (CWC). Recently we've extended our association with CWC via a similar relationship in Mundra, where we have a 30-acre ICD. We commenced operations in May 2008. We're currently handling 4,000 TEUs per month, have run out of space, and are looking for more area." Hind Terminals has noticed that cargo patterns at the ports of Mundra and Jawaharlal Nehru are different. Mundra has mainly export cargoes, while Jawaharlal Nehru receives more import containers destined for northern India. The repositioning of empties is a critical factor in the operation. Oza explained: "It helps our logistics operation that the boxes from Jawaharlal Nehru and Mundra move on our own rail wagons. We operate eight rakes (container wagon trains), four of them running on the western corridor between Dadri and Jawaharlal Nehru. The other four rakes take boxes to Ludhiana and Kota." Another prominent freight forwarder in India offering global logistics solutions is WSL, which has entered into a partnership with Scan Global Logistics (SGL), part of the Denmark-headquartered Scan Group. Wilson Sandhu Logistics' (WSL's) Chairman and Managing Director Raghbir Singh Sandhu commented: "We want to be a niche player, offering comprehensive services in [the movement of] automobiles, machinery, engineering products, pharmaceuticals and textile products. We also offer specialised project forwarding." WSL was among the first logistics companies in India to launch the concept of total logistics; and is supported by group companies Passage Cargo (a Customs agent) and Satguru Shipping & Transport Logistics. The latter runs its own fleet of trucks across India, in conjunction with the company's 3PL activities.

Oct 2008 Transport Intelligence Ltd

The Indian logistics industry growing fast, but challenges remain

The alliance between WSL and SGL focuses on increasing its presence in emerging and other growth markets, such as China, Brazil, South Korea, Lithuania and Latvia. The alliance's objective is to become a market leader in both India and Europe. The continuing high growth of India's logistics industry is matched by significant challenges for the Government in improving India's inadequate transport infrastructure. But as detailed above, despite these limitations there is no shortage of opportunities for logistics expansion in this market. Source: Transport Intelligence, Oct 09, 2008 2008 TI Briefing. All rights reserved. Republication or redistribution, including by framing or similar means, is expressly prohibited without prior written consent. TI Briefing is a service from Transport Intelligence Ltd. Transport Intelligence shall not be liable for errors or delays in the content, or for any actions taken in reliance thereon.

Oct 2008 Transport Intelligence Ltd

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- H1 2015 China Tech - PWC Moneytree - q1q2 - 2015Документ44 страницыH1 2015 China Tech - PWC Moneytree - q1q2 - 2015Yash SankrityayanОценок пока нет

- India's Top 30 Software CosДокумент17 страницIndia's Top 30 Software CosYash SankrityayanОценок пока нет

- Criteo State of Mobile Commerce q1 2015Документ41 страницаCriteo State of Mobile Commerce q1 2015nata1801100% (1)

- PV Project Finance in India - Working The SystemДокумент2 страницыPV Project Finance in India - Working The SystemYash SankrityayanОценок пока нет

- PR 2012-02-23 HPS Completes AcquisitionДокумент2 страницыPR 2012-02-23 HPS Completes AcquisitionYash SankrityayanОценок пока нет

- Relative or Comparable ValuationДокумент21 страницаRelative or Comparable ValuationYash SankrityayanОценок пока нет

- List of ReferencesДокумент17 страницList of ReferencesYash SankrityayanОценок пока нет

- New Indian Companies Act 2013Документ6 страницNew Indian Companies Act 2013Subba ReddyОценок пока нет

- STP CaseДокумент2 страницыSTP CaseSumit SinghОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Arvedi Esp DetailsДокумент38 страницArvedi Esp Detailsprasenjitsayantan100% (1)

- Bulk Deformation Processes in Metalworking: Review QuestionsДокумент22 страницыBulk Deformation Processes in Metalworking: Review QuestionsAnant Kumar0% (1)

- Group 4 - Sitaram TextilesДокумент17 страницGroup 4 - Sitaram Textileschetan4664100% (1)

- Excavator SelectionДокумент10 страницExcavator SelectionMario HezkeeaОценок пока нет

- Saudi Cast Product Catalogue 2017 (Covers & Drains)Документ251 страницаSaudi Cast Product Catalogue 2017 (Covers & Drains)syed mustafa ali100% (4)

- MangalloyДокумент1 страницаMangalloyMohamed Ishaq AdamsaОценок пока нет

- Blast Furnace in BSPДокумент51 страницаBlast Furnace in BSPAbhishek KhareОценок пока нет

- Mesin LarikДокумент12 страницMesin LariknorzaiwanОценок пока нет

- Construction Specification Guideline For Concrete Streets and Local Roads IS119P 4Документ24 страницыConstruction Specification Guideline For Concrete Streets and Local Roads IS119P 4wickremasingheОценок пока нет

- USS PlateДокумент78 страницUSS Platepipedown456Оценок пока нет

- Corus SteelДокумент56 страницCorus SteelnatrajiitmОценок пока нет

- Tnker Operator Magazine 09-2015 PDFДокумент52 страницыTnker Operator Magazine 09-2015 PDFyyxdОценок пока нет

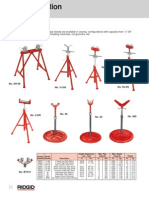

- Pipe StandДокумент3 страницыPipe StandDavid Chusnul KhotimОценок пока нет

- Lat LongДокумент115 страницLat LongPulokesh GhoshОценок пока нет

- List of Headers Associated With PEOn DLTДокумент8 197 страницList of Headers Associated With PEOn DLTLokesh Ranjan KrishОценок пока нет

- Logistics TerminologyДокумент11 страницLogistics TerminologypatilshashiОценок пока нет

- Specs Concrete BrickДокумент1 страницаSpecs Concrete Bricksagar_srОценок пока нет

- Personalities in ConstructionДокумент7 страницPersonalities in ConstructionMicaela Cruz100% (1)

- MN 206 Market Survey CopperДокумент210 страницMN 206 Market Survey CopperArjun MishraОценок пока нет

- Import Formalities in RomaniaДокумент6 страницImport Formalities in RomaniaAncaBuduОценок пока нет

- PERC RefДокумент2 страницыPERC RefSamir RanjanОценок пока нет

- KHP Cancer Centre at Guy's: ContentsДокумент19 страницKHP Cancer Centre at Guy's: ContentsShowki WaniОценок пока нет

- Internship ReportДокумент42 страницыInternship ReportMuzammil MukhtarОценок пока нет

- Is 5620Документ31 страницаIs 5620Lokesh Krishnappa0% (1)

- Car Loan BankДокумент5 страницCar Loan BankPajila KilixОценок пока нет

- Logistic Term Intercoterm 2010 PDFДокумент1 страницаLogistic Term Intercoterm 2010 PDFOudam HunphyОценок пока нет

- Quiz 737-400 Electric SystemДокумент4 страницыQuiz 737-400 Electric SystemKhurram Naseem100% (1)

- Hard MachiningДокумент16 страницHard MachiningAlen HusagićОценок пока нет

- Form WorkДокумент18 страницForm WorkCharudathan MbОценок пока нет

- Brochure - Micro Plasma Arc Welding Training Programme 15-16 July 2013Документ5 страницBrochure - Micro Plasma Arc Welding Training Programme 15-16 July 2013pavi32Оценок пока нет