Академический Документы

Профессиональный Документы

Культура Документы

Comparison Between Northern Rock and Prime Bank

Загружено:

Arnab PaulИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Comparison Between Northern Rock and Prime Bank

Загружено:

Arnab PaulАвторское право:

Доступные форматы

Page | 1

INTRODUCTION

For three days in August 2007, the UK experienced its first run on a bank since over

end and Gurney, the London wholesale discount bank in 1866. Around 3 billion of

deposils veie vilhdiavn (aiound 11 peicenl of lhe lanks lolaI ielaiI deposils) fion

a medium sized bank - Northern Rock (NR). The unedifying spectacle of widely-

publicized long queues oulside lhe lanks lianches leslified lo lhe lanks seiious

piolIens. The NR ciisis vas lhe fiisl line lhe ank of LngIand (OL), lhe UKs

central bank, had operated its new money market regime in conditions of acute

stress in financial markets, and it was the first time it had acted as a lender-of-last-

resort for many years.

Northern Rock (previously a UK mutual building society) converted to bank status

in 1997. Without the previous constraints on its operating permissions, it acquired

legal powers to conduct the full range of banking business. However, it remained

focused predominantly on the residential mortgage market. From the outset, it

adopted a securitization and funding strategy which was increasingly based on

secured wholesale money (by issuing mortgage-backed securities) and other capital

market funding.

Northern Rock is an extreme case of mismanagement in the banking sector. Its

spectacularly imprudent business strategy caused the first run on a British bank in

more than a century. The Treasury was forced to rescue and then nationalize the

bank to protect the wider financial system.

On 12 September 2007, Northern Rock asked the Bank of England, as lender of last

resort in the United Kingdom, for a liquidity support facility due to problems in

raising funds in the money market to replace maturing money market borrowings.

The problems arose from difficulties banks faced over the summer of 2007 in raising

funds in the money market. The bank's assets were always sufficient to cover its

liabilities, but it had a liquidity problem because institutional lenders became

nervous about lending to mortgage banks following the US sub-prime crisis. Bank of

England figures suggest that Northern Rock borrowed 3 billion from the Bank of

England in the first few days of this crisis.

Page | 2

FINANCIAL CRISIS OF 2007

The global financial crisis of 2007-2OO8 is vilhoul a piecedenl ly hisloiys accounl

even though economists tend to compare it to the Great Depression in 1929, the

Russian crisis of 1992 and the Asian one in 97-98, etc. There is almost universal

agreement that the fundamental cause of the crisis was the combination of a credit

boom and a housing bubble.

In the last five to seven years the ratio of debt to national income has gone up by

100% from 3.75 to 4.75 to one. During this same period, house prices grew at a record

rate of 11% per year. Since August 2007, financial markets and financial institutions

all over the world have been hit by shattering developments that had started earlier

with problems in the performance of sub-prime mortgages in the United States. A

housing boom followed by a bust led to defaults, the implosion of mortgages and

mortgage-related securities at financial institutions, and resulting financial turmoil.

Financial institutions have written off losses worth many billions of dollars and are

continuing to do so. Liquidity has virtually disappeared from important markets

and stock markets have plunged. Central banks have provided support with

hundreds of billions, intervening not only to support the markets and provide

liquidity but also to prevent the breakdown of individual institutions. Currently

governments in the United States and Europe are stepping in to support financial

institutions on a massive scale.

Globalization and financial innovation combined with the asymmetry of information

are effectively the main reasons for this financial crisis. The financial system would

have contained the effects from the housing bubble and there would be limited

repercussions if there were not as much systemic risk in the system. The need for a

new regulatory framework is the new paradigm which is being discussed across the

world and which will shape the financial system in the decades to come.

In the end, the financial regulation systems failed in predicting consequences of the

housing bubble. The effect from greater regulation is debatable and the chance for

the regulatory reform to improve financial system's robustness with as little damage

Page | 3

as possible to its efficiency and creativity is negligible. The crisis itself, however, has

made economic agents aware of the existence of black swans which will probably

rationalize expectations on a larger scale than the regulatory framework could ever

achieve. Human knowledge, however, has continued to suffer. My personal belief is

that the future of financial innovation lies in further research on how to measure and

learn more about the underlying systemic risk.

FEW SALIENT POINTS OF CRISIS

The particularly significant aspect of the NR episode is that it was multi-dimensional

in that several issues came together in a single case study. Several key dimensions

are identified:

1. As has been argued, the NR had a particular business model that exposed it to a

low-probability risk (that liquidity would dry-up in the inter-bank and commercial

paper market) but one that would have a high-impact (inability to continue to fund

its business operations).

2. NR had a particularly hazardous business model, which seems not to have been

sufficiently monitored by the supervisory authority. Northern Rock was the only

major UK bank to have securitization as the centerpiece of its business strategy.

3. Solvency v. Liquidity. A distinction is conventionally made between the

solvency and liquidity of a bank. This distinction is more difficult to make in practice

than in theory. At the time of writing (October, 2007) NR remained legally solvent

and yet was dependent on BOE funding because it could not fund its operations in

the markets. However, there must be a question about this concept of solvency when

applied to a bank which:

(a) has serious funding problems in the open market,

(b) Where the cost of funding exceeds the average rate of inteiesl on lhe lanks

assets,

(c) When it is dependent on support from the BOE.

Page | 4

4. Major fault-lines were revealed in the British deposit protection scheme.

5. The government intervened in an ad hoc manner by arbitrarily guaranteeing all

deposits held at NR (and, by implication, all banks in similar circumstances) which

was contrary to the well-established deposit protection scheme. This raises issues of

credibility regarding whatever deposit guarantee system is in place.

6. Serious moral hazard issues have been created with respect to depositor

pioleclion and lhe ioIe of lhe OLs noney naikel opeialions.

7. The NR episode raises important issues regarding corporate governance. In

particular, did the Board of the bank exercise due care with respect to the risk profile

of the bank? What is the responsibility of the Board of a bank in this crucially

important dimension? This raises the question of the practical ability of a Board

(most especially the non-executive directors) to monitor the risk-taking activities of

the management of a bank and, by extension, the interests of the depositors.

SHARE PRICE OF NORTHERN ROCK AFTER THE FINANCIAL

CRISIS

As the figure depicts, in only four months after the global financial crisis, the share

price of Northern Rock decreased from 1200 pence to 450 pence. The reason behind

this decrease was the sudden run on the bank after the subprime crisis in US.

Northern Rock bank had already liquidity problems and after the run on the bank its

share price started decreasing drastically, which led to its nationalization.

Page | 5

COMPARISON BETWEEN NORTHERN ROCK BANK AND

PRIME BANK LTD

We have looked into the unusual figures of Northern Rock bank, which are mainly

affected by the dismissal of the bank. Then we have compared those items to those

of Prime Bank Ltd. This comparison will give us some idea on whether Prime Bank

Ltd. is going to follow the same trend as Northern Rock Bank followed before the

credit crunch.

NET PROFIT AFTER TAX

Net profit after tax tells us whether the organization is making profit or not. This is

an item that many people use to make assumptions about the profitability of the

organization. Net profit after tax of Northern rock and Prime Bank Ltd. is as follows:

Northern Rock Bank: Northern Rock had constant net profit after tax during 2004-

2006. During 2007 and 2008, Northern rock had faced severe decrease in their net

profit after tax. This decrease was caused by the increase in the interest expense and

similar other charges (49% increase in 2007) and increase in Impairment charges on

loans and advances (195% increase in 2007 and 273% increase in 2008). This increase

in expenses drastically reduces the profit of Northern Rock Bank and caused after

tax loss in year 2007 and 2008.Impairment losses on loans and advances increased

very shapely year during 2007 and 2008.

Northern Rock

2004 2005 2006 2007 2008

Prime Bank

2006 2007 2008

Page | 6

Prime Bank Ltd.: as we can see in the graph, Prime Bank Ltd. did not have any

decreasing Net profit after tax. Instead, it had increased it after tax profit in the year

2007 and in year 2008, the profit level is stable. The net profit after tax of Prime Bank

Ltd. increased because its interest income increased in year 2007 and 2008.

Northern Rock

Impairment losses on loans and advances

Impairment charges on unsecured investment loans

Page | 7

INVESTMENT SECURITIES AS A PERCENT OF TOTAL ASSET

Northern Rock Bank: If depositors know that the bank is illiquid they may be

induced to withdraw deposits, which, in turn, force the bank to sell assets at a

discount in order to pay out depositors. In September, 2007, customers of Northern

Rock rushed to the bank branches to withdraw their cash from deposit. Within a

day, 5% of total bank asset was withdrawn by the customers. In such situation,

Northern Rock needed assets that are very liquid.

Northern rock had investment securities for sale, which were very liquid but risky in

terms of price. So, when it faced urgency of money, it had to sell its investment

securities in loss.

Prime Bank Ltd.: On the other hand, Prime Bank Ltd. has higher percentage of

investment in securities, but mostly in Government securities. Government securities

are second most liquid asset after the cash and have very low price risk. If Prime

Bank Ltd. faces high liquid emergency, it can sell the government securities very

quickly without making any loss.

Northern Rock Bank

Year 2005 2006 2007 2008

Page | 8

LOANS AND ADVANCES

Northern Rock Bank: One of the most criticized initiatives taken by the Northern

Bank was the aggressive mortgage lending. The bank started giving out loans to

customers with bad credit rating. Customers, who were not eligible for loans, were

approved for loans which were about 7 times of their salary or 125% of their total

asset. Northern Rock increased its investment in loans and advances over years,

which is shown below:

Prime Bank Ltd.

Year 2004 2005 2006 2007 2008

Prime Bank Ltd.

Government securities Others

Page | 9

Prime Bank Ltd.: Prime Bank Ltd. also has increased its loans and advanced over the

years, but it is mainly to expand its business and not an aggressive approach, which

does not lend money to non-qualified customers.

Northern Rock Bank

Loans and advances to customers Loans and advances to banks

Prime Bank Ltd.

2004

2005

2006

2007

2008

Page | 10

NORTHERN ROCK LIABILITIES

Retail deposit funding is perhaps the most stable form of funding available to a

bank. Although retail deposits can be withdrawn on demand, their effective

duration is much longer. Indeed, a stable deposit base figures prominently when

valuing banks in terms of their franchise value. By 2007, only 23 percent of its

liabilities were in the form of retail deposits. The rest of its funding came from short-

term borrowing in the capital markets, or through securitized notes and other

longer-term funding sources.

Page | 11

RETAIL DEPOSITS

The fiisl nolalIe fealuie is hov quickIy Noilhein Rocks lolaI laIance sheel size

outstripped its traditional funding base of retail deposits. Even as total assets grew

by a factor of 6.5 in this period, retail deposits only grew from 10.4 billion pounds to

24 billion pounds. As a result, retail funding fell to 23% of total liabilities on the eve

of the crisis (and much further after the run)

.

The bulk of the retail deposits were non-branch based deposits such as postal and

telephone accounts. It was these non-branch retail deposits that proved most

vulnerable to withdrawal in the aftermath of the run on Northern Rock.

Page | 12

SECURITISED LOAN

The role played by securitized notes has received considerable scrutiny in the

Northern Rock collapse. It has become the received wisdom that such securitized

noles nade Noilhein Rocks lusiness nodeI unusuaI, ils laIance sheel Iess

liadilionaI, and lhal secuiilizalion vas iesponsilIe sonehov in Noilhein Rocks

downfall. Northern Rocks secuiilized noles veie of nediun lo Iong-term maturity,

with average maturity of over one year.

The notes were due to be issued in September of 2007, but the crisis intervened

before the notes could be sold. None of the notes were placed with investors, and the

whole issue of notes - around 5 billion pounds face value - were taken back on to

Noilhein Rocks laIance sheel. In lhis inslance, lhe piolIen vas lhal lhe pIanned

sale of notes did not proceed, depriving Northern Rock of cash, rather than a

problem with the rolling over of existing liabilities.

OTHER LIABILITIES

The gap in funding was made up by securitized notes and other forms of non-retail

funding, such as interbank deposits and covered bonds. Covered bonds are long-

term liabilities written against segregated mortgage assets. As such, they are illiquid

and long-term in nature and other short-run wholesale funding was more closely

implicated in the run on Northern Rock

Page | 13

PRIME BANK LTD. LIABILITIES

From 2004 - 2008

Prime Bank Ltd.s najoiily Ioans cones fion lhe deposils and olhei accounls, il

constitutes of 45% of the overall liabilities. Fixed deposits consist of 36% followed by

5% borrowings from other banks, financial institutions and agents. Current deposit

and saving bank deposits are 5% and 3% respectively with a mere of 1% of bills

payable.

COMPARISON

While comparing Prime Bank Ltd. and Northern Rock, we can see that 23% of

northern rock liabilities came from retail deposits whereas 80% of the liabilities of

Prime Bank Ltd. are from deposits. Retail deposits are considered as the most stable

liabilities for a bank as the bank is aware of its maturity and interest charges. Any

other liabilities such as securities are most likely to be volatile with the market

changes

Series1,

Borrowings

from other

banks,financia

l institutions,

and agents,

1,490,000,000

, 5%

Series1,

Deposits and

other

accounts,

13,470,981,84

9, 45%

Series1,

Current

deposits and

other

accounts,

1,362,942,877

, 5%

Bills payable

1%

Series1,

Savings bank

deposits,

999,076,129,

3%

Series1, Fixed

deposits/Ter

m deposits,

10,981,260,32

0, 36%

Series1, Other

liabilities,

1,666,080,989

, 6%

Page | 14

NORTHERN ROCK ASSETS

2007

Northern Rocks 83% came from residential mortgages which are resulted in

subprime mortgage crisis and nationalisation. In 2007, northern rock was hoping to

recover this loan over the next two to three years and the balance sheet to contract

significantly as Northern Rock customers coming to the end of their mortgage

product redeem and they will continue to restrict new lending volumes. Other

advances viII aIso le ieduce foIIoving lhe decision lo cease offeiing nev Togelhei

products to customers and the withdrawal from new standalone unsecured lending.

Page | 15

PRIME BANK LTD. ASSETS

2007

Loan and advances were the major source of assets for Prime Bank Ltd.. It is

constitutes of 74% of the total assets. Investment is 11% and money with bangladesh

bank and its agent bank (including foreign currency) is 5%.

COMPARISON

Majoiily of Noilhein Rocks assels cone fion ResidenliaI Moilgages.

Loan and advances is the major source of assets for Prime Bank Ltd.

Due to the global demand from investors for securitised mortgages dropped,

Northern Rock faced a heavy downfall

2007, Cash

In hand ,

219,714,704

, 1%

With

Bangladesh

Bank and its

agent bank(s)

(including

foreign

currencies)

5%

2007,

Balance

with other

banks and

financial

institutions,

1132464146

, 3%

2007,

Money at

call and on

short

notice,

335,151,342

, 1%

2007,

Investments

,

4203135875

, 11%

2007, Loans

and

advances,

2845694413

7, 74%

2007, Fixed

assets

including

assets

taken on

lease,

498,428,68

2, 1%

2007, Other

assets,

1,591,194,5

74, 4%

Page | 16

Capacity Ratio(%)

LIQUIDITY ANALYSIS

One of lhe ieasons Ieading lo Noilhein Rocks ank ciisis is Liquidity mismatch, to

tide over the excessive lending over and above their deposit base; Northern Rock

bank took money from the money market. Therefore here is the liquidity analysis

which will give us a comparison between Northern Rock and Prime Bank Ltd..

3 types of ratios have been discussed under Liquidity analysis. They are:-

Capacity Ratio

Cash Position Indicator

Liquidity Securities Indicator

1. CAPACITY RATIO:-

Capacity ratio=

Capacity Ratio indicates the most loans and advances a bank can give out with the

overall size of its asset portfolio.

Year Northern Rock (%) Prime Bank Ltd.(%)

2007 91.61 73.02

2008 88.6 74.05

2009 78.42 74.9

Page | 17

Graph Description: - The graph shows that from 2004 to 2006 the capacity ratio of

Northern Rock has increased, after 2006 it started to decline and decreased more in

2008 whereas the capacity ratio of Prime Bank Ltd. has increased more from 2004 to

2005 and then it increased up to 2008 more or less consistently.

Analysis:- In 2007, the loans and advances of Northern Rock fall drastically due to

the financial crisis, hence their total asset fell too, whereas in Prime Bank Ltd. after

the rise in 2005 it maintained a consistent capacity ratio with their loans and

advances increasing over the years but the total assets increased more

proportionately over the next years. Every time the ratio of Prime Bank Ltd. is lower

than Northern Rock, which indicates that Prime Bank Ltd. is more liquid than

Northern Rock.

2. CASH POSITION INDICATOR:-

Cash Position Indicator =

Year Northern Rock (%) Prime Bank Ltd. (%)

2006 0.95 5.85

2007 0.17 5.75

2008 9.62 5.56

Figure-Northern Rock

Series1,

2004, 0.1

Series1,

2005, 0.08

Series1,

2006, 0.95

Series1,

2007, 0.17

Series1,

2008, 9.62

Cash Position Indicator(%)

Page | 18

Figure: -Prime Bank Ltd.

Graph Description:-

Northern Rock- From 2004 to 2006 the cash position indicator increased after which

it decreased in 2007 and again increased in 2008 by a substantial amount.

Prime Bank Ltd.- From 2004 to 2005 it slightly decreased and in 2006 it again

increased well. After that it started to decrease but by a very small amount.

Analysis:-

A great portion of cash implies that the institution is in a stronger position to handle

immediate cash need. After 2007 when Northern Rock was nationalized its cash

position indicator increased that means it became capable of handling immediate

cash need. In 2008 there was more infusion of money from the government. Before

nationalizing it had high leverage that means it must have enough cash need. For

Prime Bank Ltd. the change was not so drastic and increased or decreased by a small

amount.

Initially, Prime Bank Ltd. was in a good position to handle cash need than Northern

Rock.

Series1,

2004, 3.61

Series1,

2005, 3.25

Series1,

2006, 5.85

Series1,

2007, 5.75

Series1,

2008, 5.56

Cash Position Indicator(%)

Page | 19

Series1, 2004,

17.47

Series1, 2005,

9.21

Series1, 2006,

10.24

Series1, 2007,

10.77

Series1, 2008,

10.62

Liquidity Services Indicator(%)

3. LIQUIDITY SECURITIES INDICATOR:-

Liquidity securities indicator (LSI) =

Year Prime Bank Ltd. (%)

2004 17.47

2005 9.21

2006 10.24

2007 10.77

2008 10.62

Figure: -Prime Bank Ltd.

Graph Description: - It compares the most marketable securities an institution can

hold with the overall size of its asset portfolio.

From 2004 to 2005 Prime Bank Ltd.s Liquidily Secuiilies Indicaloi has decieased a

lot from 17.47% to 9.21%. But then it started to increase consistently.

Northern Rock has no marketable or government securities for which there is no

liquidity Securities indicator.

Page | 20

Analysis:- In 2005, Prime Bank Ltd. was in need of cash which is why they sold their

major government securities, which is the most liquid marketable securities. Hence

there was a sudden fall in liquidity securities indicator, after that government

security were increasing that caused LSI to increase consistently.

LEVERAGE RATIOS

Leverage ratios are used to calculate how much debt is present in the capital

structure of a company. Hence, the calculation of leverage ratios will indicate the

impact of excessive loans on that company. For leverage ratios, we calculated the

equity multiplier of the company. We know that, equity multiplier is calculated by:

Equity multiplier=

,

since total asset is made up of debt and equity if there is any debt at all the figure

will be higher than 1 and if there is no debt then the figure for equity multiplier will

be equal to 1. Hence, the higher the number the more leveraged the company is.

It is common knowledge that Northern Rock had a lot of loans due to the fact that

they were incapable of paying off their short term debts and had to resort to taking

loans. The equity multiplier figures for Northern Rock and Prime Bank Ltd. are

given below:

2004 2005 2006 2007 2008

Northern Rock 47.17 33.22 32.75 45.19 155.12

Prime Bank Ltd. 15.05 14.92 15.63 14.91 16.01

Page | 21

Graph description: ve can see lhal Noilhein Rock anks figuie iose diaslicaIIy in

2008 which indicates the amount of loan they took in that year. In 2004, the figure

was 47.17 but it declined in the next two years and started rising again from 2007

and it 2008 it reached an astronomically high figure of 155.12. Prime Bank Ltd. on the

other had pretty consistent figures throughout the five-year period. It was initially

15.05 in 2004 then dropped to 14.92 in 2005 then rose again in 2006 and then fell to

14.91 in 2007 and then finally became 16.01 in 2008 exhibiting a stable pattern.

Graph analysis: though the numbers are very high for both the banks, it must be

noted that banks usually have high figures when it comes to equity multiplier ratio.

Since, banks are in the business of taking deposits and then lending to borrowers,

they end up having a lot of liabilities as their assets are financed by debts. However,

the figures for Northern Rock bank are way too high indicating a huge amount of

debt. Prime Bank Ltd. on the other hand has manageable amount of debt and figures

like that are quite common for banks. Therefore, we can conclude that Northern

Rock Bank is more leveraged than Prime Bank Ltd.

We also calculated the times interest earned ratio of both the companies. As we

know times interest earned ratio indicates whether there is enough operating profit

to cover the interest expenses of the company which is calculated by:

Page | 22

Times Interest Earned Ratio=

,

The figure that we get indicates the number of times interest expense can be paid

with the operating profit.

2004 2005 2006 2007 2008

Northern Rock 1.17 1.15 1.15 0.97 0.76

Prime Bank Ltd. 0.5 0.44 0.44 0.5 0.38

Graph description: The graph above indicates that Northern Rock experienced a

drop in the ratio from 2007 and onwards. For the first three years the figures were

pretty consistent. It started with 1.17 in 2004, remained 1.15 for the next two years

and fell in 2007 to 0.97 and dropped to 0.76 in 2008. Prime Bank Ltd.s figuies veie

less than 1 throughout the five-year period. It was 0.5 in 2004 and was 0.44 for the

next two years and became 0.5 in 2007 and fell to 0.38 in 2008.

Graph analysis: The graph clearly points out that Northern Bank had difficulty

paying their interest expense from 2007 and onwards, before that they could at least

pay their interest expense once. This obviously is owing to their huge debts which

resulted in high amount of interest expense which they were unable to pay off.

Prime Bank Ltd. on the other hand has low figures due to their low operating profit.

However, since they have low debt and low interest expense they ended up having

high net income.

Page | 23

Z-SCORE CALCULATION

The Z-score is generally applied to the large manufacturing companies. The

foinuIa lo caIcuIale lhe Z-score is as follows:

Z = 1.2 X1 + 1.4 X2 + 3.3 X3 + 0.6 X4 + 0.999 X5

Where:

Assets Total

Capital Working

X

1

Assets Total

Earnings tained

X

Re

2

Assets Total

Taxes and Interest Before Earnings

X

3

s Liabilitie Total

Equity

X

4

Assets Total

Sales

X

5

7KHLQWHUSUHWDWLRQVRI=score are as follows:

x A score higher than 3 indicates a Low Risk.

x A score under 3 indicates further investigation is necessary.

x A score under 1.81 implies an inherent weakness and the probability of

company failure within 2 years.

x A consistent downward trend requires investigation even when the score is

satisfactory.

Page | 24

Year Northern Rock Prime Bank Ltd

2006 5.46 2.71

2007 3.02 1.29

2008 1.48 1.03

We can see from the figure above, before the financial crisis, Northern Rock had a

healthy Z-score of 5.46. This indicates a sound financial position. The value of Z-

score fell down to an abysmal 1.48, when the recession was at its peak. Northern

Rocks figure was 3.02 in 2007, which reflects the gradual decline in their financial

performance as the financial crisis was right around the corner.

Northern Rock

2006

2007

2008

Prime Bank

2006

2007

2008

Page | 25

Prime Bank on the other hand, is at an even worse condition in 2008, as the Z-score

value is way below the cut-off point of 1.81. Even before the recession back in 2006,

their score was 2.71, which does not indicate a crisis but shows Northern Rock was

financially much better off than Prime Bank.

CONCLUSION

Northern Bank has issued a note of caution to the investors. Investors must know the

internal and external strengths before depositing their hard earned money in the

banks otherwise they will be putting themselves in a lot of trouble. Northern Bank

on the other hand must not have dealt with subprime borrowers, as default risk

becomes very high then.

However, if we have to compare we can conclude by saying that Prime Bank Ltd.

has performed better when it comes to liquidity securities indicator, cash position

indicator and capacity ratio. Northern Rock as expected is more leveraged than

Prime Bank Ltd. and which eventually led to its bankruptcy.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Yogeshmbaproject Report On Apple InclastДокумент76 страницYogeshmbaproject Report On Apple InclastHarita ShahОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Apple Inc 2008Документ7 страницApple Inc 2008Arnab PaulОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Smartphones in BangladeshДокумент21 страницаSmartphones in BangladeshArnab PaulОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- 2012 - 2015 Strategic Marketing Plan For Apple Iphone Series Smart Phones in ChinaДокумент36 страниц2012 - 2015 Strategic Marketing Plan For Apple Iphone Series Smart Phones in ChinaArnab PaulОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Apple Iphone Marketing Strategy AnalysisДокумент11 страницApple Iphone Marketing Strategy AnalysisArnab PaulОценок пока нет

- Smartphones in BangladeshДокумент21 страницаSmartphones in BangladeshArnab PaulОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- 1030818030Документ5 страниц1030818030Arnab PaulОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- ConventionsДокумент11 страницConventionstrulyblessedmilleОценок пока нет

- Introduction To Administrative LawДокумент344 страницыIntroduction To Administrative Lawintcomlaw89% (9)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 2.0assessment Exam Problem 2Документ3 страницы2.0assessment Exam Problem 2Joe Honey Cañas Carbajosa100% (1)

- Stock Market IndicesДокумент15 страницStock Market IndicesSIdhu SimmiОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Proposed Business Case Analysis 1Документ19 страницProposed Business Case Analysis 1Kathlene JaoОценок пока нет

- PRC - 05 ITB Mock JAN-23Документ7 страницPRC - 05 ITB Mock JAN-23Aayesha Noor0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Chapter 9 SolutionsДокумент41 страницаChapter 9 SolutionsRodОценок пока нет

- BMA101B Tutor Slides 5-2020Документ16 страницBMA101B Tutor Slides 5-2020sicelo ncubeОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

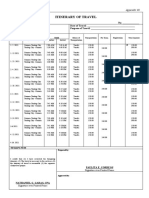

- Barangay Captain Itenerary 2021Документ11 страницBarangay Captain Itenerary 2021Dan MarkОценок пока нет

- Marketing 401 Marketing Management: Creating Value For Customers Temple UniversityДокумент4 страницыMarketing 401 Marketing Management: Creating Value For Customers Temple UniversityLee JОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Barilla SpaДокумент7 страницBarilla SpaSatrajit Chakraborty100% (2)

- Synopsis of Customer Acquisition and Retention StrategyДокумент9 страницSynopsis of Customer Acquisition and Retention StrategyGopi Krishnan.nОценок пока нет

- Prospectus: El Tucuche Fixed Income FundДокумент34 страницыProspectus: El Tucuche Fixed Income FundDillonОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Marketinf Final ProjectДокумент9 страницMarketinf Final ProjectAhsan SaniОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Questionnaire On ParleДокумент3 страницыQuestionnaire On ParleKaustubh ShindeОценок пока нет

- Absorption (Variable) Costing and Cost-Volume-Profit AnalysisДокумент41 страницаAbsorption (Variable) Costing and Cost-Volume-Profit AnalysisPapsie PopsieОценок пока нет

- Assignment 1 Reverse Logistics Study MaterialДокумент42 страницыAssignment 1 Reverse Logistics Study MaterialBabarKalamОценок пока нет

- What Is Amazon's Customer Value Proposition? (What Are The Merits of This Proposition? Has It Changed Over Time? How Should It Evolve in The Future?)Документ9 страницWhat Is Amazon's Customer Value Proposition? (What Are The Merits of This Proposition? Has It Changed Over Time? How Should It Evolve in The Future?)Surbhi JainОценок пока нет

- Colegio de Sta, Teresa de Avila Foundation IncДокумент3 страницыColegio de Sta, Teresa de Avila Foundation IncHarold LuceroОценок пока нет

- Clarkson QuestionsДокумент5 страницClarkson QuestionssharonulyssesОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Oracle Inventory Item TypesДокумент2 страницыOracle Inventory Item TypesmuradОценок пока нет

- Definition of Credit RatingДокумент6 страницDefinition of Credit RatingJethro Timothy CornejoОценок пока нет

- Entrepreneurial Marketing: After Completion of The Course, The Students Will Be Able ToДокумент2 страницыEntrepreneurial Marketing: After Completion of The Course, The Students Will Be Able ToMurugan MОценок пока нет

- Boston CreameryДокумент5 страницBoston CreameryTheeraphog Phonchuai100% (1)

- Job-Description-Management Trainee - HRДокумент2 страницыJob-Description-Management Trainee - HRatika_ja_218563Оценок пока нет

- of DettolДокумент15 страницof DettolFerdows Abid ChowdhuryОценок пока нет

- Best Practices For Supply Chain Management Techniques and Concepts Across IndustriesДокумент17 страницBest Practices For Supply Chain Management Techniques and Concepts Across IndustriesSeerat JangdaОценок пока нет

- Assignment On Business EconomicsДокумент2 страницыAssignment On Business EconomicsSaad Cynosure100% (1)

- Assignment 2Документ4 страницыAssignment 2Gobe JamОценок пока нет

- Evidence Plan: Bookkeeping NC IiiДокумент2 страницыEvidence Plan: Bookkeeping NC IiiJeremy Ortega67% (3)

- A.8.2 Engagement Letter 31032023 - IFCДокумент3 страницыA.8.2 Engagement Letter 31032023 - IFCAyush AgrawalОценок пока нет

- Warehouse Management QuizzДокумент8 страницWarehouse Management Quizzvishvjeetpowar0202Оценок пока нет