Академический Документы

Профессиональный Документы

Культура Документы

Income Balanced Composit 2QTR 2012

Загружено:

jai6480Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Income Balanced Composit 2QTR 2012

Загружено:

jai6480Авторское право:

Доступные форматы

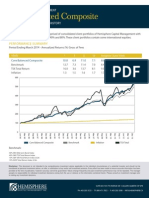

HEMISPHERE CAPITAL MANAGEMENT

Income Balanced Composite

PERFORMANCE SUMMARY AND HISTORY

The Income Balanced Composite is comprised of consolidated client portfolios of Hemisphere Capital

Management with an equity asset mix weight between 15% and 40%. These client portfolios contain some

international equities.

PERFORMANCE SUMMARY

Period Ending June 2012 - Annualized Returns (%) Gross of Fees

YEARS

10

Inception (Sept/1995)

Income Balanced Composite

3.1

8.1

5.7

6.4

7.1

Benchmark

3.3

6.4

4.5

6.1

7.0

Inflation

2.0

1.6

1.7

1.8

1.7

350

300

250

200

150

100

50

0

Sep 11

Sep 10

Sep 09

Sep 08

Benchmark

Sep 07

Sep 06

Sep 05

Sep 04

Income Balanced Composite

Sep 03

Sep 02

Sep 01

Sep 00

Sep 99

Sep 98

Sep 97

Sep 96

Sep 95

Benchmark:

Inflation

35% DEX Mid-Term Bond Index

35% DEX Short-Term Bond Index

20% S&P/TSX Total Return Index

5% S&P 500 Total Return Index $Cdn

5% EAFE Total Return Index $Cdn

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be

considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been

provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager

accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior

to making any investment decisions.

STOCK EXCHANGE BUILDING - SUITE 1280 300 5TH AVENUE SW CALGARY, ALBERTA T2P 3C4

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

PAGE 2

INCOME BALANCED COMPOSITE

PERFORMANCE HISTORY

1Q

Year

2Q

3Q

1995 Gross Fee

Net Fee

Benchmark

1996 Gross Fee

Net Fee

Benchmark

1997 Gross Fee

Net Fee

Benchmark

1998 Gross Fee

Net Fee

Benchmark

4Q

YTD

# of

Port

4.4%

4.4%

4.1%

4.1%

5.1%

5.1%

1.6%

2.8%

3.3%

4.5%

12.7%

1.3%

2.5%

3.2%

4.3%

11.8%

1.4%

2.3%

5.1%

5.1%

14.7%

1.2%

4.5%

3.5%

1.1%

10.7%

1.0%

4.3%

3.3%

0.9%

9.8%

0.1%

6.1%

4.6%

-0.3%

10.7%

3.4%

0.5%

-4.0%

3.3%

3.0%

3.2%

0.3%

-4.2%

3.1%

2.2%

5.5%

0.8%

-3.5%

6.4%

9.2%

1.5%

1.6%

0.0%

1.9%

5.0%

Net Fee

1.3%

1.4%

-0.2%

1.7%

4.2%

Benchmark

1.2%

1.0%

0.0%

5.4%

7.7%

4.0%

2.1%

2.5%

1.6%

10.6%

Net Fee

3.8%

1.9%

2.3%

1.3%

9.6%

Benchmark

4.4%

2.9%

1.6%

-0.9%

8.2%

1.9%

1.5%

-0.3%

3.5%

6.7%

Net Fee

1.7%

1.2%

-0.5%

3.3%

5.8%

Benchmark

-2.6%

0.5%

0.3%

4.0%

2.2%

2.5%

-0.4%

0.6%

2.6%

5.4%

Net Fee

2.3%

-0.6%

0.4%

2.4%

4.5%

Benchmark

0.3%

-0.7%

-1.8%

3.5%

1.2%

1999 Gross Fee

2000 Gross Fee

2001 Gross Fee

2002 Gross Fee

2003 Gross Fee

-1.3%

4.3%

2.2%

3.7%

9.0%

Net Fee

-1.5%

4.1%

2.0%

3.5%

8.2%

Benchmark

-1.7%

5.6%

2.7%

4.3%

11.2%

2004 Gross Fee

3.3%

-1.0%

1.7%

3.2%

7.2%

Net Fee

3.1%

-1.3%

1.5%

3.0%

6.3%

Benchmark

3.0%

-0.6%

1.4%

4.0%

8.0%

2005 Gross Fee

1.1%

3.9%

2.9%

1.7%

9.9%

Net Fee

0.8%

3.7%

2.6%

1.5%

9.0%

Benchmark

1.4%

2.9%

2.2%

1.2%

8.0%

2006 Gross Fee

0.8%

-1.3%

3.2%

2.5%

5.1%

Net Fee

0.5%

-1.5%

3.0%

2.3%

4.2%

Benchmark

2.2%

-1.0%

3.2%

3.9%

8.4%

10

10

Year

2007 Gross Fee

4Q

YTD

# of

Port

35

0.5%

0.5%

0.8%

2.7%

0.6%

0.3%

0.3%

0.6%

1.8%

Benchmark

1.4%

0.3%

1.3%

1.3%

4.3%

0.7%

2.2%

-3.3%

-3.4%

-3.8%

Net Fee

0.5%

2.0%

-3.5%

-3.6%

-4.6%

Benchmark

0.9%

1.4%

-4.5%

-2.9%

-5.1%

2009 Gross Fee

1.8%

4.9%

4.1%

2.8%

14.2%

Net Fee

1.6%

4.7%

3.8%

2.5%

13.2%

Benchmark

0.4%

5.9%

4.7%

1.3%

12.8%

Gross Fee

2.0%

0.8%

4.6%

3.5%

11.3%

Net Fee

1.8%

0.6%

4.3%

3.2%

10.3%

2011 Gross Fee

Net Fee

Benchmark

10

3Q

0.8%

Benchmark

10

2Q

Net Fee

2008 Gross Fee

2010

1Q

1.0%

-0.2%

5.0%

1.9%

7.8%

2.2%

0.8%

0.1%

2.8%

6.0%

1.9%

0.6%

-0.1%

2.6%

5.0%

-0.5%

2.1%

3.5%

1.4%

0.5%

1.8%

-1.6%

Net Fee

1.6%

-1.9%

Benchmark

1.9%

-0.1%

2012 Gross Fee

36

38

38

42

42

12

Benchmark:

15

31

35% DEX Mid-Term Bond Index

35% DEX Short-Term Bond Index

20% S&P/TSX Total Return Index

5% S&P 500 Total Return Index $Cdn

5% EAFE Total Return Index $Cdn

36

38

39

STOCK EXCHANGE BUILDING - SUITE 1280 300 5TH AVENUE SW CALGARY, ALBERTA T2P 3C4

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

Вам также может понравиться

- Income Balanced Composite: Performance SummaryДокумент2 страницыIncome Balanced Composite: Performance Summaryjai6480Оценок пока нет

- Income Balanced Composite - 1QTR 2014Документ2 страницыIncome Balanced Composite - 1QTR 2014jai6480Оценок пока нет

- Core Balanced Composite 2QTR 2012Документ2 страницыCore Balanced Composite 2QTR 2012jai6480Оценок пока нет

- Core Balanced Composite 2QTR 2013Документ2 страницыCore Balanced Composite 2QTR 2013Jason BenteauОценок пока нет

- Core Balanced Composite - 3QTR 2013Документ2 страницыCore Balanced Composite - 3QTR 2013jai6480Оценок пока нет

- Core Balanced Composite - 1QTR 2014Документ2 страницыCore Balanced Composite - 1QTR 2014jai6480Оценок пока нет

- Core Balanced Composite: Performance SummaryДокумент2 страницыCore Balanced Composite: Performance Summaryjai6480Оценок пока нет

- Core Balanced Composite - 2QTR 2014Документ2 страницыCore Balanced Composite - 2QTR 2014jai6480Оценок пока нет

- Conservative Composite 2QTR 2012Документ2 страницыConservative Composite 2QTR 2012jai6480Оценок пока нет

- Conservative Composite - 4QTR 2012-5Документ2 страницыConservative Composite - 4QTR 2012-5Jason BenteauОценок пока нет

- Conservative Composite - 1QTR 2014Документ2 страницыConservative Composite - 1QTR 2014jai6480Оценок пока нет

- Alok Industries LTD: Q1FY12 Result UpdateДокумент9 страницAlok Industries LTD: Q1FY12 Result UpdatejaiswaniОценок пока нет

- Supreme Industries FundamentalДокумент8 страницSupreme Industries FundamentalSanjay JaiswalОценок пока нет

- Why Dividends Differ from FCFEДокумент34 страницыWhy Dividends Differ from FCFENikhil ChitaliaОценок пока нет

- Canadian Value Fund 1QTR 2012Документ2 страницыCanadian Value Fund 1QTR 2012Jason BenteauОценок пока нет

- Company Visit Q1 11 ThaiДокумент49 страницCompany Visit Q1 11 ThaiMeghna GuptaОценок пока нет

- Ishares Core S&P 500 Etf: Historical Price Performance Quote SummaryДокумент3 страницыIshares Core S&P 500 Etf: Historical Price Performance Quote SummarywanwizОценок пока нет

- NielsenДокумент17 страницNielsenCanadianValue0% (1)

- ES - Avalon Presentation - May 2014Документ34 страницыES - Avalon Presentation - May 2014macconsa0% (1)

- Cfa Research PaperДокумент5 страницCfa Research Paperfvey0xan100% (1)

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Документ45 страницAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200Оценок пока нет

- 4Q11 Earnings Release: Conference Call PresentationДокумент23 страницы4Q11 Earnings Release: Conference Call PresentationMultiplan RIОценок пока нет

- XLS092-XLS-EnG Tire City - RaghuДокумент49 страницXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeОценок пока нет

- 4Q08 Conference Call PresentationДокумент17 страниц4Q08 Conference Call PresentationJBS RIОценок пока нет

- Office of The Company SecretaryДокумент15 страницOffice of The Company SecretaryChrisBeckerОценок пока нет

- DCFValuationGuideДокумент6 страницDCFValuationGuidemichelelinОценок пока нет

- 1Q 2015 Results ReviewДокумент39 страниц1Q 2015 Results ReviewJeck Hong TanОценок пока нет

- Bank of Kigali Announces Q1 2010 ResultsДокумент7 страницBank of Kigali Announces Q1 2010 ResultsBank of KigaliОценок пока нет

- Petgas 060420111Документ13 страницPetgas 060420111Sky KhooОценок пока нет

- Deloitte GCC PPT Fact SheetДокумент22 страницыDeloitte GCC PPT Fact SheetRakawy Bin RakОценок пока нет

- Lanka Floortiles PLC - (Tile) - q4 Fy 15 - BuyДокумент9 страницLanka Floortiles PLC - (Tile) - q4 Fy 15 - BuySudheera IndrajithОценок пока нет

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Документ33 страницыValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasОценок пока нет

- Basics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseДокумент18 страницBasics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseKGGGGОценок пока нет

- Basics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseДокумент18 страницBasics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseKGGGGОценок пока нет

- RSE Acquisition of Flinder ValvesДокумент4 страницыRSE Acquisition of Flinder Valvesraulzaragoza0422100% (1)

- Analysis of Financial StatementsДокумент36 страницAnalysis of Financial StatementsHery PrambudiОценок пока нет

- ITG TCA - Koscom Seminar March 2013Документ32 страницыITG TCA - Koscom Seminar March 2013smallakeОценок пока нет

- Chapter 19: Financial Statement AnalysisДокумент11 страницChapter 19: Financial Statement AnalysisSilviu TrebuianОценок пока нет

- Eclectica Agriculture Fund Feb 2015Документ2 страницыEclectica Agriculture Fund Feb 2015CanadianValueОценок пока нет

- SPH Reit - Hold: Upholding Its StrengthДокумент5 страницSPH Reit - Hold: Upholding Its StrengthventriaОценок пока нет

- 4Q15 PresentationДокумент21 страница4Q15 PresentationMultiplan RIОценок пока нет

- FY 2011-12 Third Quarter Results: Investor PresentationДокумент34 страницыFY 2011-12 Third Quarter Results: Investor PresentationshemalgОценок пока нет

- Platinum 2004 ASX Release FFH Short PositionДокумент36 страницPlatinum 2004 ASX Release FFH Short PositionGeronimo BobОценок пока нет

- Interpreting Results: Session OverviewДокумент8 страницInterpreting Results: Session OverviewDuong Duc AnhОценок пока нет

- REITs WatchlistДокумент9 страницREITs WatchlistKhriztopher PhayОценок пока нет

- Analyze Financial RatiosДокумент33 страницыAnalyze Financial RatiosSiva UdОценок пока нет

- Financial Leverage Du Pont Analysis &growth RateДокумент34 страницыFinancial Leverage Du Pont Analysis &growth Rateahmad jamalОценок пока нет

- Analyze Financial Statements and RatiosДокумент11 страницAnalyze Financial Statements and Ratiosnpiper29100% (1)

- Zambeef's Annual Report Highlights Strong PerformanceДокумент116 страницZambeef's Annual Report Highlights Strong PerformancegovindchormaleОценок пока нет

- ANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESДокумент145 страницANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESWaqas NawazОценок пока нет

- Bajaj AllianzДокумент30 страницBajaj AllianzArchana S100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ10 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- Chap 7Документ27 страницChap 7Joanne Chau100% (1)

- Chapter 8 - Financial AnalysisДокумент36 страницChapter 8 - Financial AnalysisSameh EldosoukiОценок пока нет

- Fundamental Analysis For AIRASIA BERHAD: 1 - History of Consistently Increasing Earnings, Sales & Cash FlowДокумент13 страницFundamental Analysis For AIRASIA BERHAD: 1 - History of Consistently Increasing Earnings, Sales & Cash FlowPraman ChelseaОценок пока нет

- PTTEP FinalДокумент27 страницPTTEP FinalBancha WongОценок пока нет

- Chapter 3 - OutlineДокумент7 страницChapter 3 - OutlineBen YungОценок пока нет

- ABG ShipyardДокумент9 страницABG ShipyardTejas MankarОценок пока нет

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОт EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОценок пока нет

- Canadian Value Fund: Performance SummaryДокумент2 страницыCanadian Value Fund: Performance Summaryjai6480Оценок пока нет

- Core Balanced Composite: Performance SummaryДокумент2 страницыCore Balanced Composite: Performance Summaryjai6480Оценок пока нет

- Core Balanced Composite - 2QTR 2014Документ2 страницыCore Balanced Composite - 2QTR 2014jai6480Оценок пока нет

- Canadian Value Fund - 2QTR 2014Документ2 страницыCanadian Value Fund - 2QTR 2014jai6480Оценок пока нет

- Select Shares US Fund 2QTR 2012Документ2 страницыSelect Shares US Fund 2QTR 2012jai6480Оценок пока нет

- Canadian Value Fund: Performance SummaryДокумент2 страницыCanadian Value Fund: Performance Summaryjai6480Оценок пока нет

- Canadian Value Fund - 2QTR 2014Документ2 страницыCanadian Value Fund - 2QTR 2014jai6480Оценок пока нет

- Canadian Value Fund - 2QTR 2014Документ2 страницыCanadian Value Fund - 2QTR 2014jai6480Оценок пока нет

- Conservative Composite - 1QTR 2014Документ2 страницыConservative Composite - 1QTR 2014jai6480Оценок пока нет

- Conservative Composite - 1QTR 2014Документ2 страницыConservative Composite - 1QTR 2014jai6480Оценок пока нет

- Conservative Composite 2QTR 2012Документ2 страницыConservative Composite 2QTR 2012jai6480Оценок пока нет

- Core Balanced Composite - 1QTR 2014Документ2 страницыCore Balanced Composite - 1QTR 2014jai6480Оценок пока нет

- Canadian Value Fund - 2QTR 2014Документ2 страницыCanadian Value Fund - 2QTR 2014jai6480Оценок пока нет

- Income Balanced Composit 2QTR 2012Документ2 страницыIncome Balanced Composit 2QTR 2012jai6480Оценок пока нет

- Select Shares US Fund 2QTR 2012Документ2 страницыSelect Shares US Fund 2QTR 2012jai6480Оценок пока нет

- Canadian Value Fund - 3QTR 2013Документ2 страницыCanadian Value Fund - 3QTR 2013jai6480Оценок пока нет

- Conservative Composite 2QTR 2012Документ2 страницыConservative Composite 2QTR 2012jai6480Оценок пока нет

- Canadian Value Fund 2QTR 2012Документ2 страницыCanadian Value Fund 2QTR 2012jai6480Оценок пока нет

- Select Shares US Fund 2QTR 2012Документ2 страницыSelect Shares US Fund 2QTR 2012jai6480Оценок пока нет

- Nemalux BrochureДокумент15 страницNemalux Brochurejai6480Оценок пока нет

- White Label AtmДокумент5 страницWhite Label AtmAliza SayedОценок пока нет

- SUBHAM Micro Finance AssignmentДокумент13 страницSUBHAM Micro Finance AssignmentSubham ChoudhuryОценок пока нет

- Profit and Loss Statement Template V11Документ24 страницыProfit and Loss Statement Template V11Rahul agarwal100% (4)

- Payroll Schemas and Personnel Calculation Rules (PCR'S) : Saltar Al Final de Los Metadatos Ir Al Inicio de Los MetadatosДокумент22 страницыPayroll Schemas and Personnel Calculation Rules (PCR'S) : Saltar Al Final de Los Metadatos Ir Al Inicio de Los MetadatosGregorioОценок пока нет

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionДокумент11 страницChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGОценок пока нет

- Internship Report On Bank Alfalah On MarkeintgДокумент64 страницыInternship Report On Bank Alfalah On Markeintgliza007100% (1)

- Enron Scandal - Wikipedia, The Free EncyclopediaДокумент31 страницаEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88Оценок пока нет

- Gruber4e ch18Документ46 страницGruber4e ch18Amber Pierce100% (2)

- 01 19 2022 - MainStreetRenewalInvoice 21 InvoiceДокумент50 страниц01 19 2022 - MainStreetRenewalInvoice 21 InvoiceAlexander BonillaОценок пока нет

- Partnership LiquidationДокумент20 страницPartnership LiquidationIvhy Cruz Estrella0% (1)

- Tugas Pajak InternasionalДокумент3 страницыTugas Pajak Internasionalthapin RfОценок пока нет

- Partnership Deed FormatДокумент3 страницыPartnership Deed FormatMan SinghОценок пока нет

- Harvey and Annette Whittemore Sue The SeenosДокумент24 страницыHarvey and Annette Whittemore Sue The SeenossirjsslutОценок пока нет

- Cost Accounting 1 8 FinalДокумент16 страницCost Accounting 1 8 FinalAsdfghjkl LkjhgfdsaОценок пока нет

- Judgement Day Algorithmic Trading Around The Swiss Franc Cap RemovalДокумент30 страницJudgement Day Algorithmic Trading Around The Swiss Franc Cap RemovalTorVikОценок пока нет

- DCFValuation JKTyre1Документ195 страницDCFValuation JKTyre1Chulbul PandeyОценок пока нет

- Analysis of The Impact of Foreign Direct Investment On The Indian EconomyДокумент212 страницAnalysis of The Impact of Foreign Direct Investment On The Indian EconomylovejotsinghcbsОценок пока нет

- Loan Customer Characteristics Analysis Using Data MiningДокумент24 страницыLoan Customer Characteristics Analysis Using Data MiningUtkarsh Tyagi100% (1)

- Credit Rating Report G.P. 2 PDFДокумент16 страницCredit Rating Report G.P. 2 PDFMohammad AdnanОценок пока нет

- Bankers Trust and Birth of Modern Risk ManagementДокумент49 страницBankers Trust and Birth of Modern Risk ManagementIgnat FrangyanОценок пока нет

- Thesis Proposal For MbsДокумент5 страницThesis Proposal For Mbsdpknvhvy100% (2)

- Chapter 5 Practice QuestionsДокумент5 страницChapter 5 Practice QuestionsFarah YasserОценок пока нет

- 2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalДокумент54 страницы2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalAdedimeji FredОценок пока нет

- Aof Dsa Odmfs05837 30112023Документ8 страницAof Dsa Odmfs05837 30112023kbank0510Оценок пока нет

- Axis Bank LTD CVДокумент4 страницыAxis Bank LTD CVPrayagraj PradhanОценок пока нет

- The Dynamics of International Business NegotiationsДокумент6 страницThe Dynamics of International Business NegotiationsRavi GaubaОценок пока нет

- ICAP MSA 1 AdditionalPracticeQuesДокумент34 страницыICAP MSA 1 AdditionalPracticeQuesAsad TariqОценок пока нет

- Alveo Trading API - Apiary FundДокумент2 страницыAlveo Trading API - Apiary Fundfuturegm2400Оценок пока нет

- IB Tutorial 7 Q1Документ2 страницыIB Tutorial 7 Q1Kahseng WooОценок пока нет

- EBIT (Earnings Before Interest and Taxes) Analysis: Common Stock Financing Debt FinancingДокумент2 страницыEBIT (Earnings Before Interest and Taxes) Analysis: Common Stock Financing Debt FinancingKunalОценок пока нет