Академический Документы

Профессиональный Документы

Культура Документы

IT Declaration

Загружено:

kalpanagupta_purИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IT Declaration

Загружено:

kalpanagupta_purАвторское право:

Доступные форматы

Employees may kindly send proposed investment details sureshj@gvrinfra.

com

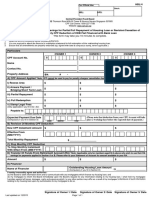

GVR INFRA PROJECTS LIMITED

INCOME TAX INVESTMENT DECLARATION FORM FOR THE FINANCIAL YEAR 2010-11 (For Income Tax Computation Purposes) From Name of the Employee Employee Code Location PAN (Mandatory) Contact No (Mandatory) To Mr.S.CHANDRASEKHAR GM(F&A) Accounts Department Corporate Office Chennai

S.NO

INVESTMENT DESCRIPTION INVESTMENT OVERALL LIMIT OF Rs.1 LAKH UNDER SECTION 80C & 80CC

SECTION

AMT(IN RS)

1 A B C D E F G H I J K L M N 2 A B

LIC- LIFE INSURANCE PREMIUM DIRECTLY PAID BY EMPLOYEE (refer Note 1) HOUSING LOAN PRINCIPAL REPAYMENT (refer Note 2) PPF- PUBLIC PROVIDENT FUND (refer Note 3) PENSION SCHEME INVESTMENTS (refer Note 4) NSC NATIONAL SAVING CERTIFICATE (refer Note 5) DEPOSIT UNDER POST OFFICE SAVING BANK(CTD)RULES,1959 NSS NATIONAL SAVING SCHEME INFRASTRUCTURE INVESTMENT- NOTIFIED U/s 10(23D) ELSS EQUITY LINK SAVING SCHEME OF MUTUAL FUNDS TUITION FEES FOR FULL TIME EDUCATION TO SCHOOL,UNIVERSITY (refer Note 9) 5 YEARS TERM DEPOSIT AN ACCOUNT UNDER POST OFFICE TERM DEPOSIT RULES FIXED DEPOSITS IN SCHEDULE BANKS(TERM PERIOD NOT LESS THAN 5 YEARS) ULIP UNIT LINKED INSURANCE PLAN

MEDICLAIM PREMIUM (Max.Rs.15,000/-) ( refer Note 10) EXPENDITURE ON HANDICAPPED DEPENDENTS/ Deposits made for maintenance of Handicapped Dependents (LIC,UTI or other approved insurer) - (refer Note 11) MEDICAL EXPENSES: Proposed to be incurred ON SPECIFIED DISEASES (AIDS,

80 C 80 C 80 C 80 CCC 80 C 80 C 80 C 80 C 80 C 80 C 80 C 80 C 80 C 80 C 80 D 80 DD 80 DDB

Cancer, Hemophilia, Chroni Renal Failure,Chronic Neurological Diseases..etc) Maximum Rs 40000/- & Rs.60000/- in case aged above 65 years (Certificate of Form 10 IA - Proof of actual expenditure) PERMANENT DISABILITY BENEFIT (SELF) Fixed deduction amount of Rs.50000/- & Rs.100000/-(Suffering from severe physical disability) (Attach Govt.Hospital Medical Certificate) (refer Note 12) INTEREST PAID ON HOUSING LOAN - Maximum Limit for Self-Occupied Properfty Rs.150000/- & if it is let out no ceiling limit (Certificate received from financial institution/Banks) ( refer Note 2) INTEREST ON EDUCATION LOAN (for education)- No Maximum Limit - (refer Note 13) HOUSE RENT PAYMENT: If Rent Lease Agreement is not available, please

80 U

24(1)(vi)

E F G

80 E 10(13A)

Attach Rent Receipts along with Self Declaration

3 a b c 4

INCOME FROM OTHER SOURCES with Form 12C (Optional if you want add to taxable income) Bank Interest Dividend Any Other Income (attached details) Applicable to employees Joining after April 01,2010 Please Submit the Form 16 from Previous employer/Salary Certificate/Form 12B

Declaration I hereby understand and declare that I shall be solely responsible for any false and misleading information disclosed here above in this declaration and also for any financial consequences, resulting due to this declaration.

Date:

Employee Signature THIS FILLED FORM HAS TO BE RETURNED ON OR BEFORE

Note:

1.

Copy of Insurance Premium paid receipt of all the periods in this financial year 2010-2011 taken in the name of Self/Spouse/Children.(Late fee cannot be considered) 2. Copy of Certificate from Financial Institution for the principal paid/payable on housing loan giving the break up of prinicipel & Interest repayment for the F.Y.2010-11. (Online Statement will NOT be considered).In case of Joint loan- To avail 100% benefit a declaration should be submitted. 3. Copy of PPF Contribution paid receipt (Bank Challan) or copy of the pass book which contains the transaction after 1st April 2009 onwards along with Pass book covering page which contains account holder details for the F.Y 2010-11 deposited in the name of only Self/Spouse/Children. 4. Copy of Pension Scheme Investments Premium paid receipt of all the periods in this F.Y. 2010-11 taken in the name of Self/Spouse/Children(Late fee cannot be considered) 5. Copy of NSC Certificate(s)(VIII issue only) invested during the financial year 2010-11 in the name of Self. 6. Copy of the Tax Saving fixed deposit certificate for the amount deposited in the name of Self during the F.Y.2010-11 with tenure of 5 years and above duly confirmed by the bank/post office that the investment qualifies for exemption U/s 80C. (Any other type of fixed deposit with tenure of less than 5 years will not be considered under this section for deduction. 7. Copy of the eligible Infrastructure Investment Bonds Certificate/Allotment Letter/Paid receipt on or after 1st April 2010 for self for the F.Y.2010-11 8. Copy of the unit statement issued by Mutual Fund for the amount invested in the eligible schemes on or after 1st April10 in the name of Self/Spouse/Children.If the investments are made through Systematic Investment Plan (SIP) route,attach copy of the SIP registration letter, unit statement provided by the mutual fund. 9. Copy of the School Fees paid Receipt (only Tuition Fees will be considered) for the F.Y.2010-11 for the purpose full time education of any two children. Amount paid towards Donation, Administration Fees, Books,Amenities..etc will not be considered. 10. Copy of premium paid receipt towards of Medical insurance premium during this financial year 2010-11 for Self/Spouse/Children/Dependent parents.Deduction allowable is Rs.15000/- or actuals whichever is lower. If the insurance is taken for dependent parents then additional deduction allowable shall be Rs.15000/- and if the parents are senior citizen(aged 65 years and above) then deduction allowable shall be Rs.20000/-.To avail the exemption dependent Name, relationship & age should be specified on copy of the receipt.Premium paid through cash is not eligible for deduction. 11. Recent Doctors Certificate working in Government hospital and the medical bill spend in this F.Y.2009-10 for Spouse/Children/Dependent/Parents/Brother/Sister Maximum limit is Rs 50000/-(40% and above) and in case of severe disability Rs 100000(80% and above). Form 10-IA need to be submitted.

12. Doctors Certificate working in Government Hospital for self. Maximum limit is Rs.50000/-(40% and above) and in case of severe disability Rs.100000/- (80% and above) Form 10 IA need to be submitted. 13. Education loan taken for the purpose of pursuing full time higher education in any field including vocational education. Loan taken for self/Spouse/Children and legal guardian of the student and loan repaid to be out of your income chargeable to tax. Copy of Banker certificate giving the break up of Interest and principal repayment to be submitted.Only interest payment is eligible for deduction.

RENT RECEIPT NAME OF THE OWNER ADDRESS OF THE OWNER : :

Received with thanks from_________________________________________________ a sum of Rs._____________(Rupees ______________________________only) per month being Rent payable for the House situated at No._____________________________________

(FULL ADDRESS)

Revenue Stamp Rs.1/-

Note : 1. Get the signature from the Landlord only across the Revenue Stamp. 2. Please note that no Exemption will be given under this Section in absence of a valid Rent Receipt duly signed by the landlord.

TO WHOMSOEVER IT MAY CONCERN I, ______________________________<<name of joint owner>>, being joint owner to the extent of ____% in property ________________________________________________________________ _______________________________________________________<< Address >> , do hereby declare that I am not paying EMI on housing loan taken against the aforesaid property. I am not claiming any deduction on account of interest or principal repayment under any provisions of the Income Tax Act, 1961. Name & Signature of Joint Owner Date : I, __________________________________________<<name of the employee>>,do hereby declare that the above mentioned statement is true and correct and request you to give me the deduction for the entire amount of interest and principle (subject to the limit prescribed under the Act). Further, I also undertake to pay the amount of Income Tax, interest and penalty as may be levied by the tax authorities, in case if a different view is taken by the tax officers with respect to the deduction granted to me on account of Income from House property for any year for which I have claimed such deduction.

Name & Signature of the Employee Date :

Вам также может понравиться

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledДокумент2 страницыSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarОценок пока нет

- Investment Declaration Form - 1314 - IshitaДокумент5 страницInvestment Declaration Form - 1314 - IshitaIshita AwasthiОценок пока нет

- Maulana Azad National Urdu University: CircularДокумент4 страницыMaulana Azad National Urdu University: CircularDebasish BiswalОценок пока нет

- IT Declaration FormatДокумент2 страницыIT Declaration FormatKamal VermaОценок пока нет

- Investment Declaration Form F.Y. 2016-17Документ2 страницыInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- IT Declaration Form FY 2018-19Документ3 страницыIT Declaration Form FY 2018-19sgshekar3050% (2)

- Guidelines For Income Tax DeclarationДокумент9 страницGuidelines For Income Tax Declarationapoorva1801Оценок пока нет

- Income Tax NitДокумент6 страницIncome Tax NitrensisamОценок пока нет

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeДокумент6 страницIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdОценок пока нет

- Investment Declaration Form For The Financial Year 2014 - 15Документ7 страницInvestment Declaration Form For The Financial Year 2014 - 15devanyaОценок пока нет

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsДокумент4 страницыFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiОценок пока нет

- IT Declaration Form 2011-2012Документ1 страницаIT Declaration Form 2011-2012Shishir RoyОценок пока нет

- Guidelines SДокумент5 страницGuidelines SveraristuОценок пока нет

- IT Declaration 2011-12Документ2 страницыIT Declaration 2011-12Vijaya Saradhi PeddiОценок пока нет

- Employees' Pension Scheme, 1995 Form 10-C (EPS) : Who Can Apply ?Документ6 страницEmployees' Pension Scheme, 1995 Form 10-C (EPS) : Who Can Apply ?Siji SasidharanОценок пока нет

- Circular Ay 2010 11Документ4 страницыCircular Ay 2010 11shaitankhopriОценок пока нет

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Документ3 страницыIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaОценок пока нет

- Guidelines For Investment Proof PDFДокумент2 страницыGuidelines For Investment Proof PDFsamuraioo7Оценок пока нет

- Saving Form-Income Tax 12-13Документ9 страницSaving Form-Income Tax 12-13khaleel887Оценок пока нет

- National Institute of Technology CalicutДокумент7 страницNational Institute of Technology CalicutraghuramaОценок пока нет

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationДокумент1 страницаThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantОценок пока нет

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Документ11 страницDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17Оценок пока нет

- Epsf Form & Guideliness - 2016-17Документ8 страницEpsf Form & Guideliness - 2016-17SumanОценок пока нет

- Guidelines For EPSF FY 2012-13.Документ14 страницGuidelines For EPSF FY 2012-13.80ALLAVIОценок пока нет

- Forms Required For Tax Proofs 1011Документ5 страницForms Required For Tax Proofs 1011Neeraj JosephОценок пока нет

- It Declaration Form 2010-2011Документ1 страницаIt Declaration Form 2010-2011Priyanka KhemkaОценок пока нет

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKДокумент9 страницTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuОценок пока нет

- 3 - Sat0720151654 - Declaration - Field - Staff 15-16Документ2 страницы3 - Sat0720151654 - Declaration - Field - Staff 15-16Faiz AhmedОценок пока нет

- Pensioners - IT Declaration Form - Annexure1Документ3 страницыPensioners - IT Declaration Form - Annexure1Sudeep MitraОценок пока нет

- AIL-Investment Declaration Form 2013-2014Документ2 страницыAIL-Investment Declaration Form 2013-2014G A PATELОценок пока нет

- Tax Proof Submission Document 2022-23Документ7 страницTax Proof Submission Document 2022-23Jagadeesh DatlaОценок пока нет

- SSS Form Salary LoanДокумент4 страницыSSS Form Salary LoanMikoy Lacson100% (4)

- Income Tax Declaration FormДокумент1 страницаIncome Tax Declaration Formdiwakar1978Оценок пока нет

- Investment Declaration Form 2012-13 PDFДокумент1 страницаInvestment Declaration Form 2012-13 PDFnovalhemantОценок пока нет

- Declaration Form For 2014-2015Документ3 страницыDeclaration Form For 2014-2015RahulKumbhareОценок пока нет

- Employee Proof Submission Form - 2011-12Документ5 страницEmployee Proof Submission Form - 2011-12aby_000Оценок пока нет

- Guidelines For Investment Proof Submission 2023-2024Документ7 страницGuidelines For Investment Proof Submission 2023-2024rajdelhi000Оценок пока нет

- Income Tax Ready Reckoner 2011-12Документ28 страницIncome Tax Ready Reckoner 2011-12kpksscribdОценок пока нет

- Declaration For InvestmentsДокумент6 страницDeclaration For InvestmentsAnonymous EkFiHy0QoОценок пока нет

- IT Declaration Form 2012-13Документ1 страницаIT Declaration Form 2012-13Suresh SharmaОценок пока нет

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Документ2 страницыArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050Оценок пока нет

- Form HBL4Документ3 страницыForm HBL4klerinetОценок пока нет

- Investment Proof Submission Form - 2017-18Документ5 страницInvestment Proof Submission Form - 2017-18vishalkavi18Оценок пока нет

- Theorem Tax Plan 2012-13Документ1 страницаTheorem Tax Plan 2012-13Ashwini PadhyОценок пока нет

- Investment Declaration Guidelines For The Fy 2020-21: Important NoteДокумент8 страницInvestment Declaration Guidelines For The Fy 2020-21: Important NoteGeetha ArunОценок пока нет

- DeductionsДокумент11 страницDeductionsguest1Оценок пока нет

- INSTRUCTIONSДокумент2 страницыINSTRUCTIONSRohit KohliОценок пока нет

- Investment Declaration Form (Hemarus)Документ4 страницыInvestment Declaration Form (Hemarus)Shashi NaganurОценок пока нет

- Income Tax Declaration Form 2012-13Документ2 страницыIncome Tax Declaration Form 2012-13asfsadfSОценок пока нет

- Complete Tax DetailsДокумент23 страницыComplete Tax DetailsAnish GuptaОценок пока нет

- 1 .Income Tax On Salaries - (01.06.2015)Документ57 страниц1 .Income Tax On Salaries - (01.06.2015)yvОценок пока нет

- IT Saving Declaration FormДокумент7 страницIT Saving Declaration FormAbhishek MathurОценок пока нет

- Ifci Infra Bonds Terms Sept2011Документ1 страницаIfci Infra Bonds Terms Sept2011navneet1107Оценок пока нет

- Form10D Instructions EngДокумент8 страницForm10D Instructions EngSuganthi SukhiОценок пока нет

- Tax 3Документ1 страницаTax 3Rakesh KumarОценок пока нет

- Investment DeclarationДокумент2 страницыInvestment DeclarationshivshenoyОценок пока нет

- IFCI Infra Bond 2012 Application FormДокумент2 страницыIFCI Infra Bond 2012 Application FormPrajna CapitalОценок пока нет

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- Bodiongan v. CA DigestДокумент2 страницыBodiongan v. CA DigestmyrahjОценок пока нет

- Credit ApplicationДокумент1 страницаCredit ApplicationAndrew Montegrejo BarcomaОценок пока нет

- Timov - XLSX - ExcelДокумент2 страницыTimov - XLSX - Excelitalianmonkey14Оценок пока нет

- Pantaleon v. American Express International, Inc. G.R. No. 174269 (May 8, 2009) FactsДокумент2 страницыPantaleon v. American Express International, Inc. G.R. No. 174269 (May 8, 2009) FactsSamantha GuevaraОценок пока нет

- F 9. BPI V Concepcion & Hijos, IncДокумент2 страницыF 9. BPI V Concepcion & Hijos, IncChilzia Rojas50% (2)

- AFFP Naga RoadshowДокумент19 страницAFFP Naga RoadshowMabelGaviolaVallenaОценок пока нет

- Installment SalesДокумент21 страницаInstallment SalesheyheyОценок пока нет

- Mail - Ann Dwyer - OutlookДокумент6 страницMail - Ann Dwyer - OutlookAnn DwyerОценок пока нет

- Civ Digest 2017 2018 PDFДокумент122 страницыCiv Digest 2017 2018 PDFAilish Zoe EstrailaОценок пока нет

- 2012 05 - Project Finance Newswire - May 2012Документ56 страниц2012 05 - Project Finance Newswire - May 2012api-165049160Оценок пока нет

- Sale With MortgageДокумент2 страницыSale With Mortgagebryan100% (1)

- Tan Vs CAДокумент3 страницыTan Vs CAAlykОценок пока нет

- 18 Reparations Commission v. Universal Deep-Sea Fishing Corp PDFДокумент9 страниц18 Reparations Commission v. Universal Deep-Sea Fishing Corp PDFSarah C.Оценок пока нет

- Obligations and Contracts CasesДокумент293 страницыObligations and Contracts CasesKaye DinamlingОценок пока нет

- Strategy Guide-Best Practices For Affordable Housing RehabДокумент74 страницыStrategy Guide-Best Practices For Affordable Housing RehabCP TewОценок пока нет

- Fundamentals of Banking Multiple Choice Question (GuruKpo)Документ18 страницFundamentals of Banking Multiple Choice Question (GuruKpo)GuruKPO100% (3)

- Debt Acknowledgement LetterДокумент1 страницаDebt Acknowledgement LetterMyers BautistaОценок пока нет

- Jerin RectificationДокумент3 страницыJerin RectificationJerin Asher SojanОценок пока нет

- POA UploadДокумент3 страницыPOA Uploadrohit desaiОценок пока нет

- Business Plan For The Small Construction FirmДокумент31 страницаBusiness Plan For The Small Construction FirmAlvie Borromeo Valiente100% (1)

- The Money MastersДокумент93 страницыThe Money MastersSamiyaIllias100% (1)

- Nigerian PAYE Calculator 4.0Документ2 страницыNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- What Is A 'Financial Crisis?'Документ3 страницыWhat Is A 'Financial Crisis?'Abdul Ahad SheikhОценок пока нет

- Sps Ong v. Roban Lending Corporation, G.R. No. 172592Документ8 страницSps Ong v. Roban Lending Corporation, G.R. No. 172592Krister VallenteОценок пока нет

- Final Internship Report of RBLДокумент62 страницыFinal Internship Report of RBLmrs solutionОценок пока нет

- Brij Narain Vs Mangala PrasadДокумент3 страницыBrij Narain Vs Mangala PrasadAnwesh Panda100% (2)

- Definition of PledgeДокумент3 страницыDefinition of PledgeWhoopiJaneMagdozaОценок пока нет

- Briones vs. CAДокумент5 страницBriones vs. CAJanet Jamerlan-FigueroaОценок пока нет

- DBBL Internship ReportДокумент67 страницDBBL Internship ReportMd Khaled NoorОценок пока нет

- Asset Privatization Vs Ca (300 Scra 579)Документ1 страницаAsset Privatization Vs Ca (300 Scra 579)Girlie Marie SorianoОценок пока нет