Академический Документы

Профессиональный Документы

Культура Документы

M F Print

Загружено:

smtpnd25Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

M F Print

Загружено:

smtpnd25Авторское право:

Доступные форматы

OBJECTIVES OF THE STUDY

1. 2. 3. 4. 5.

To find out the Preferences of the investors for Asset Management Company. To know the Preferences for the portfolios. To know why one has invested or not invested in SBI Mutual fund To find out the most preferred channel. To find out what should do to boost Mutual Fund Industry.

6. Scope of the study

7. A big boom has been witnessed in Mutual Fund Industry in resent times. A large number of new players have entered the market and trying to gain market share in this rapidly improving market. 8. The research was carried on in Dehradoon. I had been sent at one of the branch of State Bank of India Dehradoon where I completed my Project work. I surveyed on my Project Topic A study of preferences of the Investors for investment in Mutual Fund on the visiting customers of the SBI Boring Canal Road Branch. 9. The study will help to know the preferences of the customers, which company, portfolio, mode of investment, option for getting return and so on they prefer. This project report may help the company to make further planning and strategy.

10.INTRODUCTION TO MUTUAL FUND AND ITS VARIOUS ASPECTS. 11.Mutual fund is a trust that pools the savings of a number of investors who share a common

financial goal. This pool of money is invested in accordance with a stated objective. The joint ownership of the fund is thus Mutual, i.e. the fund belongs to all investors. The money thus collected is then invested in capital market instruments such as shares, debentures and other securities. The income earned through these investments and the capital appreciations realized are shared by its unit holders in proportion the number of units owned by them. Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost. A Mutual Fund is an investment tool that allows small investors access to a well-diversified portfolio of equities, bonds and other securities. Each shareholder participates in the gain or loss of the fund. Units are issued and can be redeemed as needed. The funds Net Asset value (NAV) is determined each day. 12. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced. Diversification reduces the risk because all stocks may not move in the same direction in the same proportion at the same time. Mutual fund issues units to the investors in accordance with quantum of money invested by them. Investors of mutual funds are known as unit holders.

Вам также может понравиться

- SCDL Project PGDBA FinanceДокумент101 страницаSCDL Project PGDBA Financevipulgupta1988100% (4)

- VIKAS Blackbook ProjectДокумент12 страницVIKAS Blackbook Projectansari danish75% (4)

- Mutual Funds Industry in India and Its Comparative AnalysisДокумент46 страницMutual Funds Industry in India and Its Comparative AnalysisShahzad SaifОценок пока нет

- Project On MFДокумент43 страницыProject On MFAbhi Rajendraprasad100% (1)

- CHAPTERS18&19 Corporate Bonds & Government BondsДокумент12 страницCHAPTERS18&19 Corporate Bonds & Government Bondstconn8276Оценок пока нет

- Project On Financial Planning and Portfolio ManagementДокумент60 страницProject On Financial Planning and Portfolio Managementvipul57% (7)

- Acctg 201A Midterm Exam 1st Sem 20-21 QuestionsДокумент10 страницAcctg 201A Midterm Exam 1st Sem 20-21 QuestionsYameteKudasaiОценок пока нет

- FM 101 SG 2Документ5 страницFM 101 SG 2Kezia GwynethОценок пока нет

- Mutual Fund Is An Alternative Investment OptionДокумент30 страницMutual Fund Is An Alternative Investment OptionNiraj SahОценок пока нет

- A Study On Investors Behavior Towards Mutual Funds Ijariie6493Документ12 страницA Study On Investors Behavior Towards Mutual Funds Ijariie6493deepak singhОценок пока нет

- Investment in Sbi Mutual FundДокумент63 страницыInvestment in Sbi Mutual FundNavneetОценок пока нет

- A Study of Investors Perception Towards SBI Mutual Funds in Jalgaon DistrictДокумент4 страницыA Study of Investors Perception Towards SBI Mutual Funds in Jalgaon DistrictAbdul Kadir ArsiwalaОценок пока нет

- Study On MVMFДокумент60 страницStudy On MVMFManîsh SharmaОценок пока нет

- Analysis of Investment in Mutual FundsДокумент96 страницAnalysis of Investment in Mutual FundsAnonymous lNwEvIgWqОценок пока нет

- Mutual Funds: Project Report OnДокумент40 страницMutual Funds: Project Report OnShilpi_Mathur_7616Оценок пока нет

- Executive Summary Investor Preferences Towards Mutual FundsДокумент49 страницExecutive Summary Investor Preferences Towards Mutual FundsVishnu Sharma100% (1)

- A Study of Sbi Mutual FundsДокумент34 страницыA Study of Sbi Mutual FundssatishgwОценок пока нет

- Comparative Analysis On Mutual Fund SchemeДокумент77 страницComparative Analysis On Mutual Fund SchemehschaggarОценок пока нет

- Mutual Funds in IndiaДокумент111 страницMutual Funds in IndiaJigar JainОценок пока нет

- Consumer Preferences For SBI Mutual FundДокумент68 страницConsumer Preferences For SBI Mutual FundSavita Chaudhary100% (2)

- Shruti Kulkarni ProjectДокумент28 страницShruti Kulkarni ProjectPravin KulkarniОценок пока нет

- Comparative Analysis On Mutual Fund Scheme: Post Graduate Diploma in ManagementДокумент77 страницComparative Analysis On Mutual Fund Scheme: Post Graduate Diploma in Managementsee248985Оценок пока нет

- Ap Sarjana ProjectДокумент51 страницаAp Sarjana ProjectGanesh GaneshОценок пока нет

- Mutual Fund About SMCДокумент61 страницаMutual Fund About SMCshaileshОценок пока нет

- Analysis of Investment of Mutual FundsДокумент74 страницыAnalysis of Investment of Mutual FundsJuhi ChawlaОценок пока нет

- Najeef Project On Mutual FundsДокумент75 страницNajeef Project On Mutual FundstahirОценок пока нет

- Project On Mutual FundsДокумент75 страницProject On Mutual FundstahirОценок пока нет

- MFДокумент49 страницMFDeep SekhonОценок пока нет

- Introduction 1 ProjectДокумент15 страницIntroduction 1 ProjectShyam davidОценок пока нет

- Abhilash SynopsisДокумент7 страницAbhilash SynopsisMoin KhanОценок пока нет

- 11Документ84 страницы11Obaid AhmedОценок пока нет

- Comparative Analysis On Mutual Fund Scheme MBA ProjectДокумент83 страницыComparative Analysis On Mutual Fund Scheme MBA Projectvivek kumar100% (1)

- Introduction To StudyДокумент3 страницыIntroduction To StudySushma ReddyОценок пока нет

- Factors Affecting Car Buying Behaviour oДокумент14 страницFactors Affecting Car Buying Behaviour oShairab Yar KhanОценок пока нет

- "Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationДокумент18 страниц"Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationJay Prakash Khampariya100% (1)

- A Study On Investor Perception Towards Mutual FundsДокумент68 страницA Study On Investor Perception Towards Mutual FundsTom Salunkhe0% (1)

- Uti Mcom ProjectДокумент42 страницыUti Mcom ProjectParinShah100% (3)

- "Mutual Funds Is The Better Investments Plan": A Project Report ONДокумент17 страниц"Mutual Funds Is The Better Investments Plan": A Project Report ONJay Prakash KhampariyaОценок пока нет

- Mutual FundДокумент10 страницMutual FundRohini ThakurОценок пока нет

- A Study On Mutual Funds at Reliance Mutual FundsДокумент82 страницыA Study On Mutual Funds at Reliance Mutual FundsRajesh BathulaОценок пока нет

- Management Research Project Project ProposalДокумент5 страницManagement Research Project Project ProposalParam JeetОценок пока нет

- Final Research Paper DURGAДокумент13 страницFinal Research Paper DURGAVIKRANTОценок пока нет

- Sachin Dhande Mutual Fund ReportДокумент60 страницSachin Dhande Mutual Fund Reportrakeshkumar040590Оценок пока нет

- Project ReportДокумент63 страницыProject ReportVarun UtrejaОценок пока нет

- Research Guide Submitted byДокумент76 страницResearch Guide Submitted byGaurav SawlaniОценок пока нет

- Amity Global Business School, Mumbai: "A Study On The Mutual Fund Industry in India "Документ60 страницAmity Global Business School, Mumbai: "A Study On The Mutual Fund Industry in India "ryotsuОценок пока нет

- Mutual Funds - HDFCДокумент9 страницMutual Funds - HDFCmohammed khayyumОценок пока нет

- GAUAV-Customer Perception Towards Mutual FundsДокумент67 страницGAUAV-Customer Perception Towards Mutual FundsStarОценок пока нет

- DFFFFДокумент61 страницаDFFFFGaurav JaiswalОценок пока нет

- Comparative Study of Mutual Funds in India: Project OnДокумент80 страницComparative Study of Mutual Funds in India: Project OnTallam Sudheer KumarОценок пока нет

- Project Synopsis On Mutual Fund - Mahesh RahejaДокумент16 страницProject Synopsis On Mutual Fund - Mahesh RahejaRajiv KumarОценок пока нет

- Anamika Certificate (Autosaved) BBBBBДокумент112 страницAnamika Certificate (Autosaved) BBBBBanamika tiwariОценок пока нет

- "A Study Mutual FundsДокумент103 страницы"A Study Mutual FundsMaster PrintersОценок пока нет

- Comparitive Study Betwee Reliance and Other Mutual Funds in DehradunДокумент77 страницComparitive Study Betwee Reliance and Other Mutual Funds in Dehradunvipul tandonОценок пока нет

- Mini Project Report SushantДокумент50 страницMini Project Report SushantSushant PatilОценок пока нет

- Index Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortОт EverandIndex Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortРейтинг: 5 из 5 звезд5/5 (38)

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersОт EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersОценок пока нет

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingОт EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingОценок пока нет

- Portfolio Management - Part 2: Portfolio Management, #2От EverandPortfolio Management - Part 2: Portfolio Management, #2Рейтинг: 5 из 5 звезд5/5 (9)

- How to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementОт EverandHow to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementОценок пока нет

- Indian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaОт EverandIndian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingОт EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingОценок пока нет

- Draft Subscription Agreement - SIAA - Clean - 06.08.2020Документ25 страницDraft Subscription Agreement - SIAA - Clean - 06.08.2020Zahed IbrahimОценок пока нет

- U.S. Securities and Exchange Commission - Fiscal Year 2013 Agency Financial ReportДокумент156 страницU.S. Securities and Exchange Commission - Fiscal Year 2013 Agency Financial ReportVanessa SchoenthalerОценок пока нет

- Bitcoin Sec ShaverДокумент2 страницыBitcoin Sec ShaverMossad NewsОценок пока нет

- Chapter 07Документ14 страницChapter 07Abu Bakarr ContehОценок пока нет

- 3 Money MarketДокумент28 страниц3 Money MarketHariОценок пока нет

- Birla Sun Life Century SIPДокумент33 страницыBirla Sun Life Century SIPmaakabhawan26Оценок пока нет

- AGM ReportДокумент64 страницыAGM ReportRekhaОценок пока нет

- Greed & FearДокумент10 страницGreed & Fearmegadeath100% (1)

- LCR Regulation - IndiaДокумент50 страницLCR Regulation - IndiaRajeevОценок пока нет

- Sea LTD - Recent Developments Are Positive For The CompanyДокумент5 страницSea LTD - Recent Developments Are Positive For The Companytanmabel16Оценок пока нет

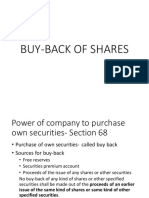

- Buy BackДокумент12 страницBuy BackNiraj PandeyОценок пока нет

- Busfin Final FinalДокумент36 страницBusfin Final FinalSheena Mae PeraltaОценок пока нет

- ALCO 2020 Annual Report AMENDED 5.14.21Документ266 страницALCO 2020 Annual Report AMENDED 5.14.21OIdjnawoifhaoifОценок пока нет

- MGT211 Shortnotes 1 To 45 LecДокумент12 страницMGT211 Shortnotes 1 To 45 LecEngr Imtiaz Hussain GilaniОценок пока нет

- ProspectusДокумент3 страницыProspectusJimmiОценок пока нет

- Nalco Holding CO 10-K (Annual Reports) 2009-02-25Документ135 страницNalco Holding CO 10-K (Annual Reports) 2009-02-25http://secwatch.com100% (1)

- Case StudyДокумент28 страницCase StudyXyza Faye Regalado100% (1)

- EEB 2.2. Capital MarketДокумент37 страницEEB 2.2. Capital Marketkaranj321Оценок пока нет

- Chapter 23 Statement of Cash FlowsДокумент24 страницыChapter 23 Statement of Cash FlowsSyahrul GunawanОценок пока нет

- IDirect EIH Q3FY22Документ9 страницIDirect EIH Q3FY22Parag SaxenaОценок пока нет

- The Payment System in ZambiaДокумент16 страницThe Payment System in ZambiaWishfulDownloadingОценок пока нет

- After The Storm FinalДокумент106 страницAfter The Storm FinalNye Lavalle100% (2)

- Money Credit & BankingДокумент23 страницыMoney Credit & Bankingenrico menesesОценок пока нет

- Objective Type Questions SAPMДокумент15 страницObjective Type Questions SAPMSaravananSrvn77% (31)

- 2022-08-02-ZOMT - NS-HSBC-Zomato (ZOMATO IN) - Buy 1Q23 From Over-Exuberance To Over-... - 97775767Документ8 страниц2022-08-02-ZOMT - NS-HSBC-Zomato (ZOMATO IN) - Buy 1Q23 From Over-Exuberance To Over-... - 97775767Daemon7Оценок пока нет

- A Fuller OFC: K-REIT AsiaДокумент5 страницA Fuller OFC: K-REIT Asiacentaurus553587Оценок пока нет