Академический Документы

Профессиональный Документы

Культура Документы

Untitled

Загружено:

paiashokИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Untitled

Загружено:

paiashokАвторское право:

Доступные форматы

What is the?

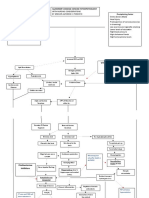

SAP FI Module - Introduction Page 1 of 4 Introduction The SAP FI Module has the capability of meeting all the accounting and financial needs of an organization. It is within this module that Financial Managers as well as other Managers within your business can review the financial position of the company in real time as compared to legacy systems which often times require overnight updates before financial statements can be generated and run for management review. The real-time functionality of the SAP modules allows for better decision making and strategic planning. The FI (Financial Accounting) Module integrates with other SAP Modules such as MM (Materials Management), PP (Production Planning), SD(Sales and Distribution), PM (Plant Maintenance),and PS (Project Systems). The FI Module also integrates with HR(Human Resources) which includes PM(Personnel Management), Time Management, Travel Management, Payroll. Document transactions occurring within the specific modules generate account postings via account determination tables. The FI (Financial Accounting) Module components. The FI Module comprises several sub-modules as follows: o Accounts Receivables o Accounts Payable o Asset Accounting o Bank Accounting o Consolidation o Funds Management o General Ledger o Special Purpose Ledger o Travel Management Accounts Receivables records all account postings generated as a result of Customer sales activity. These postings are automatically updated in the General Ledger. It is within the Accounts Receivables Module that you can monitor aging of the receivables and generate customer analysis. The Accounts Receivable Module also integrates with the General ledger, Sales and Distribution, and Cash Management Modules. Accounts Payable records account postings generated as a result of Vendor purchasing activity. Automatic postings are generated in the General Ledger as well. Payment programs within SAP enables the payment of payable documents by check, EDI, or transfers. Asset Accounting is utilized for managing your companys Fixed Assets. SAP allows you to categorize assets and to set values for depreciation calculations in each asset class. Bank Accounting allows for management of bank transactions in the system including cash management. Consolidation enables the combining of financial statements for multiple entities within an organization. These statements provide an overview of the financial position of the company as a whole. Funds Management allows management to set budgets for revenues and expenses within your company as well as track

these to the area of responsibility. General Ledger is fully integrated with the other SAP Modules. It is within the General Ledger that all accounting postings are recorded. These postings are displayed in real-time providing up-to-date visibility of the financial accounts. Special Purpose Ledger is used to define ledgers for reporting purposes. Data can be gathered from internal and external applications. Travel Management provides management of all travel activities including booking trips and handling of expenses associated with travel. What is the? SAP FI Module - Configuration Page 2 of 4 Primary configuration considerations: Client, company and company code Once a business has decided to use the SAP FI (Financial Accounting) Module, there are several Configurations prerequisite steps that must be completed. Determining the organizational structure is one of the first steps in setting up the business functions in SAP as well as your reporting requirements. The Organizational structure is created by defining the organizational units consisting of the following: o Client o Company o Company Code o Business Area A Client is the highest unit within an SAP system and contains Master records and Tables. Data entered at this level are valid for all company code data and organizational structures allowing for data consistency. User access and authorizations are assigned to each client created. Users must specify which client they are working in at the point of logon to the SAP system. A Company is the unit to which your financial statements are created and can have one to many company codes assigned to it. A company is equivalent to your legal business organization. Consolidated financial statements are based on the companys financial statements. Companies are defined in configuration and assigned to company codes. Each company code must use the same COA (Chart of Accounts) and Fiscal Year. Also note that local currency for the company can be different. Company Codes are the smallest unit within your organizational structure and is used for internal and external reporting purposes. Company Codes are not optional within SAP and are required to be defined. Financial transactions are viewed at the company code level. Company Codes can be created for any business organization whether national or international. It is recommended that once a Company Code has been defined in Configuration with all the required settings then other company codes later created should be copied from the existing company code. You can then make changes as needed. This reduces repetitive input of information that does not change from company code to company code as well as eliminate the possibility of missed data input.

When defining company codes, the following key are as must be updated: o Company Code Key- identifies the company code and consists of four alpha-numeric characters. Master data and business transactions are created by this key. o Company Code Name- identifies the name of the business organization within your organizational structure. o Address- identifies the street address, city, state, zip code for the company code created. This information is also used on correspondence and reports. o Country- identifies the country to which your business is based. Country codes within SAP are based on ISO Standards. o Country currency- identifies the local currency for the company code that you have defined. o Language- identifies the language to be used for you company code and is also used for text in your documents. SAP unlike other applications, offers over thirty languages including EN( English) , ES (Spanish), FR (French), DE (German), EL (Greek), IT(Italian), AR( Arabic), ZH (Chinese) , SV (Swedish) , and JA (Japanese) to name a few. What is the? SAP FI Module - More Configuration More FI configuration considerations: Business Area, COA, GL, Fiscal year and Currencies Business Area is optional and is equivalent to a specific area of responsibility within your company or business segment. BA (Business Area) also allows for internal and external reporting. Another configuration requirement for set-up in SAP are the Basic settings consisting of the following: o Chart of Accounts(COA) o Fiscal Year Variants. o Currencies The COA (Chart of Accounts) lists all General Ledger accounts that are used by the organization. It is assigned in configuration to each company code and allows for daily General Ledger postings. The General Ledger accounts are made up of such data as account number, company code, a description of the account, classification of whether the account is a P & L Statement Account or a Balance Sheet Account. Control data of the GL Account is where currency is specified, Tax category (posting without tax allowed) , marking the account as a reconciliation account ( e.g. Customer, Asset, Vendors, Accounts Receivable) or not. Marking the G/L Account as a reconciliation account allows for postings to an Asset Account ( for example) as well as automatic update to the G/L Account. Configuration prevents direct postings to reconciliation accounts thereby assisting in maintaining integrity of the data. This allows reconciliation between the sub-ledger and general ledger to always be guaranteed. Within the General Ledger control data , you can also designate whether line item display is possible in the account. The system then stores an entry per line in an index table which links back to the account. (Display of

line item details are then available for reporting purposes ,etc.) Open Item Indicators can be set on the G/L Account allowing for better management of open items. Examples include: Bank Clearing Accounts, GR/IR Clearing Accounts, Payroll, etc. Fiscal Year configuration is a must and can be defined to meet your companys reporting periods whether Fiscal (any period combination that is not calendar) or Calendar (JanDec). Posting Periods are defined and assigned to the Fiscal Year. Within the periods you specify start dates and finished dates. SAP allows for 12 posting periods along with specially defined periods that can be used for year-end financial closing. Currencies are another basic configuration setting requirement which defines your companys legal means of payment by country. It is recommended that all Currency set-ups in SAP follow the ISO Standards. The ISO Standards ensure Global conformity across businesses worldwide utilizing SAP What is the? SAP FI Module - Integration Points Page 4 of 4 What are some of the integration points of the FI module? SAP is marketed as a fully integrated system, therefore knowing some of the integration points enable the Users to better understand the Modules. Organization units are not only defined in FI (Financial Accounting) but also in other SAP Modules. The SD ( Sales & Distribution) Module requires the set-up of Sales Organizations, Distribution Channels and Divisions ; Purchasing requires purchasing organizations, plants, and storage locations; and CO (Controlling) requires a Controlling area to be defined. To transfer data between FI(Financial Accounting) and CO (controlling) as well as other modules, a Company Code must be assigned to each of the Modules. Business Areas must be entered when generating business transactions if you would like visibility of those transactions impacting a certain BA(Business Area). You can also update your Master Records to include BA(Business Area) for example Cost Center. Document postings are automatically posted in the year and periods that you created in the Fiscal Year variant set-ups based on the month, start and end dates to which postings are allowed within a given period as defined. There are several integration points in SAP, the above lists a few . We hope you have enjoyed reading this tutorial. What is the? SAP CO Module - Introduction Page 1 of 4

Introduction The SAP CO (Controlling) Module provides supporting information to Management for the purpose of planning, reporting, as well as monitoring the operations of their business. Management decision-making can be achieved with the level of information provided by this module. Some of the components of the CO(Controlling) Module are as follows: Cost Element Accounting Cost Center Accounting Internal Orders Activity-Based Costing ( ABC) Product Cost Controlling Profitability Analysis Profit Center Accounting The Cost Element Accounting component provides information which includes the costs and revenue for an organization. These postings are automatically updated from FI (Financial Accounting) to CO (Controlling). The cost elements are the basis for cost accounting and enables the User the ability to display costs for each of the accounts that have been assigned to the cost element. Examples of accounts that can be assigned are Cost Centers, Internal Orders, WBS(work breakdown structures). Cost Center Accounting provides information on the costs incurred by your business. Within SAP, you have the ability to assign Cost Centers to departments and /or Managers responsible for certain areas of the business as well as functional areas within your organization. Cost Centers can be created for such functional areas as Marketing, Purchasing, Human Resources, Finance, Facilities, Information Systems, Administrative Support, Legal, Shipping/Receiving, or even Quality. Some of the benefits of Cost Center Accounting : (1) Managers can set Budget /Cost Center targets; (2) Cost Center visibility of functional departments/areas of your business; (3) Planning ; (4) Availability of Cost allocation methods; and (5) Assessments/Distribution of costs to other cost objects. Internal Orders provide a means of tracking costs of a specific job , service, or task. Internal Orders are used as a method to collect those costs and business transactions related to the task. This level of monitoring can be very detailed but allows management the ability to review Internal Order activity for better-decision making purposes. Activity-Based Costing allows a better definition of the source of costs to the process driving the cost. ActivityBased Costing enhances Cost Center Accounting in that it allows for a process-oriented and cross-functional view of your cost centers. It can also be used with Product Costing and Profitability Analysis. Product Cost Controlling allows management the ability to analyze their product costs and to make decisions on the optimal price(s) to market their products. It is within this module of CO (Controlling) that planned, actual and target values are analyzed. Sub-components of the module are: Product Cost Planning which includes Material Costing ( Cost estimates with Quantity structure, Cost estimates

without quantity structure, Master data for Mixed Cost Estimates, Production lot Cost Estimates) , Price Updates, and Reference and Simulation Costing. Cost Object Controlling includes Product Cost by Period, Product Cost by Order, Product Costs by Sales Orders, Intangible Goods and Services, and CRM Service Processes. Actual Costing/Material Ledger includes Periodic Material valuation, Actual Costing, and Price Changes. Profitability Analysis allows Management the ability to review information with respect to the companys profit or contribution margin by business segment. Profitability Analysis can be obtained by the following methods: Account-Based Analysis which uses an account-based valuation approach. In this analysis, cost and revenue element accounts are used. These accounts can be reconciled with FI(Financial Accounting). Cost-Based Analysis uses a costing based valuation approach as defined by the User. Profit Center Accounting provides visibility of an organizations profit and losses by profit center. The methods which can be utilized for EC-PCA (Profit Center Accounting) are period accounting or by the cost-of-sales approach. Profit Centers can be set-up to identify product lines, divisions, geographical regions, offices, production sites or by functions. Profit Centers are used for Internal Control purposes enabling management the ability to review areas of responsibility within their organization. The difference between a Cost Center and a Profit Center is that the Cost Center represents individual costs incurred during a given period and Profit Centers contain the balances of costs and revenues. Primary configuration considerations There are several configuration steps that must be considered when implementing the CO (Controlling) Module. Creating the Controlling area is one of the first steps in the CO (Controlling) configuration process. SAP has provided standard controlling areas and company codes which can be utilized as a basis for creating your companys Controlling Area. The SAP Standard for Controlling Area is 0001 and for company code is 0001. It is recommended that these be used as a basis to create the Controlling Area or Company Code that you would like to define . Certain defaults setting such as number ranges have already been set-up in the standard SAP settings, thereby eliminating the need to redo this configuration requirement. Through the SAP Configuration process, you can create a copy of the Standard Controlling Area and Company Code, then update the other fields as needed including the four character alpha numeric field which identifies these areas. (You may want to change the controlling area from 0001 to A001 and the Company Code from 0001 to AA01 as an example.) Keep in mind that Company Codes are assigned to Controlling Areas and affect the COA (Chart of Accounts), the Fiscal Year Variants, and Currency set-ups. Cost Center hierarchy and Reconciliation ledger settings are also include in the Controlling Area set-up. The Control Indicator activates and deactivates certain functions in the Controlling Area. The Controlling Area can also be used for cross-company code business transactions.

To enable this function the Controlling Area must be assigned to all company codes used for cross-company code accounting. Number ranges Configuration in the CO (Controlling) Modules requires maintenance of number ranges for documents generated from business transactions. A systems generated document number is assigned for every CO (Controlling) posting. These numbers are sequential and are required to be assigned to number range groups. The number range groups consists of two number intervals, one for internal document numbering and one for external document numbering. The SAP R/3 system keeps track of those document numbers that are externally generated and fed to SAP via batches and User manual input, otherwise, the system generates the next internally assigned document number for the transaction posted. As previously stated when defining the Controlling Area, you have the ability to copy the Standard SAP Controlling Area 0001 which already has the number ranges defined eliminating the need for maintenance of number ranges. Keep in mind that you also have the flexibility to change number ranges and number range groups to meet your business needs. As a caution, never overlap number intervals in a group . For example, if you decide to assign number range interval 10000000 thru 199999999 to the number range group 05, you can not assign it to number range group 06. Number ranges should never be transported for data consistency purposes, therefore create these manually in each system. Within the CO (Controlling) Module, you can configure Plan Versions. Maintaining Plan Versions allows for set-up of planning assumptions and determination of plan rates for allocation and plan activity purposes. The SAP Standard Version 000 is created for a five year fiscal year plan. It is recommended that the standard version be utilized for your plan/actual comparisons if you do not require multiple plan versions. SAP always allows the flexibility to create additional Plan versions by coping the Standard Version 000 and changing certain fields as required. There is also the option of defining and creating a totally new Plan Version. Other configuration After the Controlling Area, Number Ranges, and Plan Versions have been defined and maintained, then settings for the other components in the CO(Controlling) Module should be maintained. (Cost Center Accounting, Cost Element Accounting, Activity-Based Costing, Internal Orders, Product Cost Controlling, Profitability Analysis, and Profit Center Accounting.) The Account Assignment Logic allows configuration for Validation and Substitution Rules whose purpose is to check certain input values as defined by the User. More specifically, Validations allow for business transactions to either post or not post documents based on the criteria defined in the validation rule. Certain input conditions are checked as defined by the User and if those conditions are met then the document(s) are updated and/or posted in the system. If the condition is not met, then an error message is generated to the User with a brief explanation of the error. These messages are defined in

Configuration and can be identified as a warning, error, or a note. You also have the option to deactivate messages. Substitutions on the other hand, checks input values and replaces the values with another value if the criteria as defined is met. Maintaining Currency and Valuation Profiles allows for the definition of valuation approaches to be used in accounting components . These valuation profiles are checked in the system when activated in the Controlling Area. Certain rules apply if there is a need to maintain the currency and valuation profiles: (1) Company Code Currency must be assigned to a legal valuation approach, (2) Valuation approaches must also be maintain in the material ledger, and (3) Profit Center valuations can only be maintained if you are using Profit Center Accounting. The CO(Controlling)Module has multiple configuration steps that must be followed for complete implementation of this module. Each sub-component of the CO (Controlling) Module has its level of configuration requirements. Once you have defined your business needs in the Controlling Area, a determination can be made as to what should be configured and what you do not need. We hope you have enjoyed reading this tutorial.

Вам также может понравиться

- NEW GL FUNCTIONALITY AUTOMATICALLY SPLITS ACCOUNTSДокумент7 страницNEW GL FUNCTIONALITY AUTOMATICALLY SPLITS ACCOUNTSpaiashokОценок пока нет

- Sales Manual 1Документ20 страницSales Manual 1paiashokОценок пока нет

- Controlling User ManualДокумент8 страницControlling User ManualpaiashokОценок пока нет

- Vendor Master Checklist For MMДокумент23 страницыVendor Master Checklist For MMpaiashokОценок пока нет

- Tax Code Create ProcedureДокумент9 страницTax Code Create ProcedurepaiashokОценок пока нет

- Vendor Master Checklist For FIДокумент8 страницVendor Master Checklist For FIpaiashokОценок пока нет

- Ps Co IntegrationДокумент43 страницыPs Co Integrationpaiashok100% (4)

- SM35 Various Options ExplanationsДокумент2 страницыSM35 Various Options ExplanationspaiashokОценок пока нет

- Controlling User ManualДокумент8 страницControlling User ManualpaiashokОценок пока нет

- Vendor Master Checklist For FIДокумент8 страницVendor Master Checklist For FIpaiashokОценок пока нет

- (Refer PO# 4530000002 in Client 300) : Import EntriesДокумент4 страницы(Refer PO# 4530000002 in Client 300) : Import EntriespaiashokОценок пока нет

- Introduction To Netweaver Terp02 IДокумент3 страницыIntroduction To Netweaver Terp02 IpaiashokОценок пока нет

- How To Find Transaction Codes Assigned To UserДокумент4 страницыHow To Find Transaction Codes Assigned To UserpaiashokОценок пока нет

- Excise ProcessesДокумент44 страницыExcise ProcessespaiashokОценок пока нет

- Transaction Codes For IndiaДокумент3 страницыTransaction Codes For IndiaJayanth MaydipalleОценок пока нет

- Enterprise Structure & Master DataДокумент10 страницEnterprise Structure & Master DatapaiashokОценок пока нет

- Clearing Large Volume of TransactionsДокумент8 страницClearing Large Volume of TransactionspaiashokОценок пока нет

- Certfication NotesДокумент5 страницCertfication NotespaiashokОценок пока нет

- Direct Printing FacilityДокумент3 страницыDirect Printing FacilitypaiashokОценок пока нет

- Cash Paid For Asset AcquisitionДокумент11 страницCash Paid For Asset AcquisitionpaiashokОценок пока нет

- Asset Register ZasregДокумент1 страницаAsset Register ZasregpaiashokОценок пока нет

- Entry Date Field in Sap ReportsДокумент4 страницыEntry Date Field in Sap ReportspaiashokОценок пока нет

- Change Vendor Recon AccountДокумент3 страницыChange Vendor Recon AccountpaiashokОценок пока нет

- Creating FI Customers TR-CODE FD01Документ3 страницыCreating FI Customers TR-CODE FD01paiashokОценок пока нет

- Controlling User ManualДокумент8 страницControlling User ManualpaiashokОценок пока нет

- Check Length Field SE11Документ1 страницаCheck Length Field SE11paiashokОценок пока нет

- Cash Journal - Asset Payment and CapitalizationДокумент11 страницCash Journal - Asset Payment and CapitalizationpaiashokОценок пока нет

- Direct Printing FacilityДокумент3 страницыDirect Printing FacilitypaiashokОценок пока нет

- Enterprise Structure & Master DataДокумент10 страницEnterprise Structure & Master DatapaiashokОценок пока нет

- Dep Income TaxДокумент7 страницDep Income TaxhottyrahulОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Lesson Plan 1Документ8 страницLesson Plan 1api-573197365Оценок пока нет

- Jim Kwik - 10 Morning Habits Geniuses Use To Jump Start The Brain - YouTube Video Transcript (Life-Changing-Insights Book 15) - Stefan Kreienbuehl PDFДокумент5 страницJim Kwik - 10 Morning Habits Geniuses Use To Jump Start The Brain - YouTube Video Transcript (Life-Changing-Insights Book 15) - Stefan Kreienbuehl PDFCarlos Silva100% (11)

- Agent of Social Change EssayДокумент3 страницыAgent of Social Change Essaytori avaricioОценок пока нет

- 2014 JC2 H2 Econs Prelim Paper 2Документ3 страницы2014 JC2 H2 Econs Prelim Paper 2Ezra Notsosure WongОценок пока нет

- Panaya SetupGuideДокумент17 страницPanaya SetupGuidecjmilsteadОценок пока нет

- Roy FloydДокумент2 страницыRoy FloydDaniela Florina LucaОценок пока нет

- PepsiДокумент101 страницаPepsiashu548836Оценок пока нет

- Annales School Impact on Contemporary History WritingДокумент11 страницAnnales School Impact on Contemporary History Writingrongon86Оценок пока нет

- Pathophysiology of Alzheimer's Disease With Nursing ConsiderationsДокумент10 страницPathophysiology of Alzheimer's Disease With Nursing ConsiderationsTiger Knee100% (1)

- OAU004301 UMG8900 Data Configuration and Routine Maintenance R003 ISSUE2!0!20050622Документ56 страницOAU004301 UMG8900 Data Configuration and Routine Maintenance R003 ISSUE2!0!20050622firas1976Оценок пока нет

- Islamic Capital Markets: The Role of Sukuk: Executive SummaryДокумент4 страницыIslamic Capital Markets: The Role of Sukuk: Executive SummaryiisjafferОценок пока нет

- Legion of Mary - Some Handbook ReflectionsДокумент48 страницLegion of Mary - Some Handbook Reflectionsivanmarcellinus100% (4)

- Qimen Grup2Документ64 страницыQimen Grup2lazuli29100% (3)

- Cultural Identity and Diaspora in Jhumpa Lahiri's The NamesakeДокумент10 страницCultural Identity and Diaspora in Jhumpa Lahiri's The NamesakeOlivia DennisОценок пока нет

- Back Order ProcessДокумент11 страницBack Order ProcessManiJyotiОценок пока нет

- 2015 International Qualifications UCA RecognitionДокумент103 страницы2015 International Qualifications UCA RecognitionRodica Ioana BandilaОценок пока нет

- Communication Process Quiz AnswersДокумент3 страницыCommunication Process Quiz AnswersAbigail CullaОценок пока нет

- Advertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Solutions Manual Full Chapter PDFДокумент36 страницAdvertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Solutions Manual Full Chapter PDFjames.graven613100% (13)

- TSR 9278 - DLR1 - OtherlandsДокумент106 страницTSR 9278 - DLR1 - OtherlandsDiego RB100% (5)

- General Session PresentationsДокумент2 страницыGeneral Session PresentationsKrishna Kanaiya DasОценок пока нет

- Sociology of Behavioral ScienceДокумент164 страницыSociology of Behavioral ScienceNAZMUSH SAKIBОценок пока нет

- Final InternshipДокумент64 страницыFinal Internshippradeep100% (2)

- Documentary Photography: Exploring Cultural Change in TibetДокумент29 страницDocumentary Photography: Exploring Cultural Change in TibetSofia YosseОценок пока нет

- PROACTIVITYДокумент8 страницPROACTIVITYShikhaDabralОценок пока нет

- Doctors not guilty of negligence in patient's deathДокумент1 страницаDoctors not guilty of negligence in patient's deathAlleine TupazОценок пока нет

- Marxist Approaches in AnthropologyДокумент30 страницMarxist Approaches in AnthropologyLions_Read_Theory100% (1)

- John 1.1 (106 Traduções) PDFДокумент112 страницJohn 1.1 (106 Traduções) PDFTayna Vilela100% (1)

- Fear of Allah-HW Assignment by TahiyaДокумент10 страницFear of Allah-HW Assignment by TahiyashafaqkaziОценок пока нет

- Designing Organizational Structure: Specialization and CoordinationДокумент30 страницDesigning Organizational Structure: Specialization and CoordinationUtkuОценок пока нет

- Hughes explores loss of childhood faithДокумент2 страницыHughes explores loss of childhood faithFearless713Оценок пока нет