Академический Документы

Профессиональный Документы

Культура Документы

S-Reit Table 120806

Загружено:

Collin NguИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

S-Reit Table 120806

Загружено:

Collin NguАвторское право:

Доступные форматы

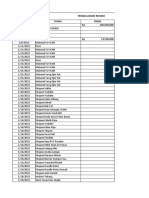

SINGAPORE REITS

Price

($)

Mkt Cap

($ m)

Float

(%)

FYE

(mth)

DPU

(freq)

Curr DPU

(cents)

Fwd DPU

(cents)

Curr Yield

(%)

Fwd Yield

(%)

YTD Return

(%)

D/A

(%)

P/B

(x)

SGD

SGD

SGD

SGD

1.380

1.100

1.140

1.470

Total:

3,920.3

708.1

2,993.0

3,297.1

10,918.4

67.4

73.0

24.5

89.8

Dec

Sep

Dec

Dec

Semi-Anl

Semi-Anl

Semi-Anl

Quarter

7.80

6.80

7.60

9.30

7.80

7.80

7.40

9.10

Average:

5.7

6.2

6.7

6.3

6.2

5.7

7.1

6.5

6.2

6.4

30.8

48.6

37.3

36.7

38.4

30.1

39.5

43.9

39.3

38.2

0.9

0.8

0.9

0.7

0.8

RETAIL (7)

CapitaMall Trust

CapitaRetail China Trust

Frasers Centrepoint Trust

Fortune REIT

Lippo Malls Indo Retail REIT

Mapletree Commercial Trust

Starhill Global REIT

SGD

SGD

SGD

HKD

SGD

SGD

SGD

1.990

1.455

1.765

5.490

0.415

1.065

0.735

Total:

6,628.2

1,004.6

1,452.9

9,307.4

905.0

1,989.3

1,428.1

14,898.3

61.1

60.4

59.1

65.7

55.7

57.3

70.5

Dec

Dec

Sep

Dec

Dec

Mar

Dec

Quarter

Semi-Anl

Quarter

Semi-Anl

Quarter

Quarter

Quarter

9.90

9.40

9.70

31.40

3.30

6.10

4.30

10.70

9.80

10.30

33.90

3.40

6.30

4.60

Average:

5.0

6.5

5.5

5.7

8.0

5.7

5.9

6.0

5.4

6.7

5.8

6.2

8.2

5.9

6.3

6.4

17.1

26.5

22.6

46.0

18.6

25.3

30.1

26.6

37.5

28.1

31.7

24.5

9.3

37.6

30.5

28.5

1.2

1.1

1.3

0.7

0.7

1.1

0.8

1.0

INDUSTRIAL (7)

AIMS AMP Capital Ind REIT

Ascendas REIT

Cache Logistics Trust

Cambridge Industrial Trust

Mapletree Industrial Trust

Mapletree Logistics Trust

Sabana REIT

SGD

SGD

SGD

SGD

SGD

SGD

SGD

1.305

2.290

1.105

0.585

1.295

1.040

1.010

Total:

582.0

5,124.0

775.2

701.4

2,110.4

2,523.4

645.9

12,462.3

92.4

77.2

85.9

94.7

69.4

58.8

88.1

Mar

Mar

Dec

Dec

Mar

Mar

Dec

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

10.70

13.90

8.40

4.80

8.70

6.90

9.30

11.30

14.10

8.60

5.00

8.90

7.00

9.20

Average:

8.2

6.1

7.6

8.2

6.7

6.6

9.2

7.5

8.7

6.2

7.8

8.5

6.9

6.7

9.1

7.7

38.1

25.1

16.3

23.2

20.5

23.1

15.4

23.1

29.7

32.7

27.5

35.8

37.7

37.0

34.1

33.5

0.9

1.2

1.2

1.0

1.3

1.2

1.0

1.1

HOSPITALITY (2)

Ascott Residence Trust

CDL Hospitality Trusts

SGD

SGD

1.200

2.010

Total:

1,361.7

1,944.7

3,306.5

50.6

67.5

Dec

Dec

Semi-Anl

Semi-Anl

8.60

11.90

9.00

12.40

Average:

7.2

5.9

6.5

7.5

6.2

6.8

21.2

30.1

25.7

39.7

25.2

32.5

0.8

1.3

1.1

HEALTHCARE (2)

ParkwayLife REIT

First REIT

SGD

SGD

1.995

0.960

Total:

1,206.9

606.3

1,813.2

57.3

60.2

Dec

Dec

Quarter

Quarter

9.80

7.20

10.70

6.90

Average:

4.9

7.5

6.2

5.4

7.2

6.3

11.5

26.3

18.9

36.4

15.9

26.2

1.3

1.2

1.3

RESIDENTIAL (1)

Saizen REIT

SGD

0.159

Total:

226.5

226.5

89.1

Jun

Semi-Anl

1.07

1.16

Average:

6.8

6.8

7.3

7.3

13.6

13.6

31.6

31.6

0.5

0.5

AVERAGE:

6.6

6.8

26.3

32.0

1.0

OFFICE (4)

CapitaCommercial Trust

Frasers Commercial Trust

K-REIT Asia

Suntec REIT

23 S-REITS

GRAND TOTAL:

43,625.1

BUSINESS TRUSTS

REAL ESTATE (4)

Ascendas India Trust

Indiabulls Properties Invt

Perennial China Retail

Treasury China Trust

SGD

SGD

SGD

SGD

0.775

0.100

0.495

1.440

Total:

598.7

369.2

556.1

365.2

1,889.3

67.7

16.1

37.3

64.7

Mar

Mar

Dec

Dec

Semi-Anl

None

Irreg

Irreg

5.40

N.A.

3.90

1.30

5.70

N.A.

3.30

5.00

Average:

7.0

N.A.

7.9

0.9

5.2

7.4

N.A.

6.7

3.5

5.8

12.3

-28.6

4.2

0.0

-3.0

33.0

20.4

13.7

33.4

25.1

1.3

0.2

0.7

0.3

0.7

INFRASTRUCTURE (2)

CitySpring Infra Trust

K-Green Trust

SGD

SGD

0.420

0.975

Total:

637.9

614.0

1,252.0

62.3

50.7

Mar

Dec

Quarter

Semi-Anl

3.50

7.90

3.50

7.90

Average:

8.3

8.1

8.2

8.3

8.1

8.2

25.4

7.7

16.6

66.8

N.A.

66.8

1.9

0.9

1.4

PORT AND SHIPPING (3)

First Ship Lease Trust

Hutchison Port Holdings

Rickmers Maritime

SGD

USD

SGD

0.150

0.740

0.325

Total:

98.2

6,444.6

137.7

6,680.5

67.1

57.9

66.6

Dec

Dec

Dec

Quarter

Semi-Anl

Quarter

0.00

6.44

2.98

2.48

6.33

2.98

Average:

0.0

8.7

9.2

6.0

16.5

8.6

9.2

11.4

-47.4

19.4

10.2

-5.9

57.1

21.4

53.7

44.0

0.2

0.7

0.3

0.4

AVERAGE:

6.3

8.5

0.4

37.4

0.7

9 BUSINESS TRUSTS

GRAND TOTAL:

9,821.7

Source: Companies, Bloomberg, Yahoo Finance, OIR estimates

NOTES:

1) SGD/JPY = 0.0158; SGD/USD = 1.2411; SGD/HKD = 0.1601; USD/HKD = 0.129

2) Curr DPU and yield refer to the respective Bloomberg consensus distribution and yield forecasts for current financial year

3) Fwd DPU and yield refer to the respective Bloomberg consensus distribution and yield forecasts for next financial year

4) D/A (Debt-to-Asset) and P/B (Price-to-Book) are based on figures reported in last available financial results

DISTRIBUTION DETAILS

K-REIT Asia

Ascendas REIT ^

CapitaMall Trust

Mapletree Logistics Trust

Sabana REIT

Suntec REIT

CapitaCommercial Trust

Frasers Centrepoint Trust

AIMS AMP Capital Ind REIT

First REIT

Mapletree Industrial Trust

Starhill Global REIT

Cache Logistics Trust

Mapletree Commercial Trust

Fortune REIT *

Cambridge Industrial Trust

Ascott Residence Trust

CDL Hospitality Trusts

Lippo Malls Indo Retail Trust

Parkway Life REIT

CapitaRetail China Trust

DPU (S cents)

3.840

1.800

2.380

1.700

2.270

2.361

3.960

2.600

2.500

1.930

2.260

1.080

1.981

1.537

15.820

1.180

4.517

5.700

0.790

2.480

4.820

Date announced

16 Jul 2012

17 Jul 2012

18 Jul 2012

19 Jul 2012

19 Jul 2012

19 Jul 2012

20 Jul 2012

19 Jul 2012

19 Jul 2012

24 Jul 2012

24 Jul 2012

24 Jul 2012

25 Jul 2012

25 Jul 2012

20 Jul 2012

30 Jul 2012

27 Jul 2012

27 Jul 2012

02 Aug 2012

02 Aug 2012

25 Jul 2012

Ex-date

20 Jul 2012

23 Jul 2012

24 Jul 2012

25 Jul 2012

25 Jul 2012

26 Jul 2012

27 Jul 2012

27 Jul 2012

30 Jul 2012

30 Jul 2012

30 Jul 2012

30 Jul 2012

31 Jul 2012

31 Jul 2012

31 Jul 2012

01 Aug 2012

02 Aug 2012

02 Aug 2012

08 Aug 2012

08 Aug 2012

05 Sep 2012

Record date

24 Jul 2012

25 Jul 2012

26 Jul 2012

27 Jul 2012

27 Jul 2012

30 Jul 2012

31 Jul 2012

02 Aug 2012

01 Aug 2012

01 Aug 2012

01 Aug 2012

01 Aug 2012

02 Aug 2012

02 Aug 2012

03 Aug 2012

03 Aug 2012

06 Aug 2012

06 Aug 2012

13 Aug 2012

13 Aug 2012

07 Sep 2012

Pay date

27 Aug 2012

28 Aug 2012

29 Aug 2012

29 Aug 2012

29 Aug 2012

27 Aug 2012

29 Aug 2012

29 Aug 2012

18 Sep 2012

29 Aug 2012

29 Aug 2012

28 Aug 2012

29 Aug 2012

29 Aug 2012

29 Aug 2012

12 Sep 2012

29 Aug 2012

29 Aug 2012

30 Aug 2012

06 Sep 2012

26 Sep 2012

Annualized yield (%)

4.5

6.2

4.8

6.6

9.0

6.4

5.8

5.9

7.7

8.1

7.0

5.9

7.2

5.8

5.8

8.1

7.6

5.7

7.6

5.0

6.7

Source: Companies, Bloomberg, OIR estimates

NOTES:

1) ^ A-REIT's advanced distribution of 1.73 S cents was paid on 15 Jun 2012; Annualized yield includes advanced distribution

2) * DPU are in HK cents

Updated: 06/08/2012

Вам также может понравиться

- Skilful Studies - Trombone N°1-20Документ8 страницSkilful Studies - Trombone N°1-20Marco MaestriОценок пока нет

- Bolt and Weld Capacities - BS5950Документ1 страницаBolt and Weld Capacities - BS5950Helena DomičićОценок пока нет

- Dollarization in LaosДокумент43 страницыDollarization in Laosapi-3705874Оценок пока нет

- Hse Statistic Performance Desember 2013 EditanДокумент7 страницHse Statistic Performance Desember 2013 EditanTirta BudiawanОценок пока нет

- Authorisation Letter v2Документ1 страницаAuthorisation Letter v2Collin NguОценок пока нет

- Irregular PaymentsДокумент5 страницIrregular PaymentsBeybi EstebanОценок пока нет

- Hull OFOD10e MultipleChoice Questions Only Ch14Документ4 страницыHull OFOD10e MultipleChoice Questions Only Ch14Kevin Molly Kamrath0% (1)

- Investment AvenuesДокумент103 страницыInvestment AvenuesSuresh Gupta50% (2)

- The Winning TraderДокумент7 страницThe Winning TraderRavikanth Chowdary Nandigam100% (1)

- Projectdata NyseДокумент207 страницProjectdata Nyseabhinav3110Оценок пока нет

- Script Tendencia OTCДокумент5 страницScript Tendencia OTCdhuransОценок пока нет

- Resumen Costos EACH - Sept13 PDFДокумент19 страницResumen Costos EACH - Sept13 PDFtomatuvuelto0% (1)

- Example1 Timber DesignДокумент3 страницыExample1 Timber DesignCollin NguОценок пока нет

- Term Paper of Financial Markets & InstitutionsДокумент30 страницTerm Paper of Financial Markets & InstitutionsFowziah Nahid Priya75% (4)

- Interview Preparation PresentationДокумент42 страницыInterview Preparation PresentationAlaksh ParmarОценок пока нет

- Trade AnalaysiДокумент27 страницTrade AnalaysiFreechum8Оценок пока нет

- Vat (2550MQ) - 2012Документ10 страницVat (2550MQ) - 2012Jhessa EssangОценок пока нет

- IPC Down Jones TuckoДокумент2 страницыIPC Down Jones TuckoTucko UrbanoОценок пока нет

- Precios Fecha Precio Apertura Máximo Mínimo Cierre VolumenДокумент4 страницыPrecios Fecha Precio Apertura Máximo Mínimo Cierre VolumenTucko UrbanoОценок пока нет

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutДокумент2 страницыKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasОценок пока нет

- Transaction Date Product Number Units Sold Unit Price Sub Total Tax Total SaleДокумент22 страницыTransaction Date Product Number Units Sold Unit Price Sub Total Tax Total SaleEmilieAnn SumalloОценок пока нет

- Soil Investigation ReportДокумент51 страницаSoil Investigation ReportErina Cahya PutriОценок пока нет

- Kaushik - Data File For VaRДокумент71 страницаKaushik - Data File For VaRAlia BoseОценок пока нет

- VaR ParametricДокумент25 страницVaR ParametricShirsenduSarkarОценок пока нет

- Dena BankДокумент36 страницDena BankManish SankrityayanОценок пока нет

- Nike Inc - HMДокумент8 страницNike Inc - HMHumphrey OsaigbeОценок пока нет

- Chapter 20Документ59 страницChapter 20Tess CoaryОценок пока нет

- Proyectos AvanzadosДокумент7 страницProyectos AvanzadosJair MalacatusОценок пока нет

- Aylik Gi̇der Geli̇rДокумент6 страницAylik Gi̇der Geli̇rsira sukronОценок пока нет

- Libro 4Документ117 страницLibro 4MelizaОценок пока нет

- Irregular PaymentsДокумент5 страницIrregular PaymentsBeybi EstebanОценок пока нет

- TSLAДокумент8 страницTSLAJose JerezОценок пока нет

- Bangun RumahДокумент8 страницBangun RumahPutri Pratiwi NasutionОценок пока нет

- Notificadas 17 de AgostoДокумент3 страницыNotificadas 17 de AgostoDelanieОценок пока нет

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Документ5 страницThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalОценок пока нет

- Chương 3 - Financial ModelingДокумент6 страницChương 3 - Financial ModelingHUONG NGUYEN THIОценок пока нет

- Datos de Examen - Finanzas CorporativasДокумент15 страницDatos de Examen - Finanzas CorporativasSofia CarvajalОценок пока нет

- 100 Year Worldwide Financial PlanДокумент163 страницы100 Year Worldwide Financial PlanAbel YagoОценок пока нет

- 13 Tablas Pivote Control de Rutas y Plazos de EntregaДокумент63 страницы13 Tablas Pivote Control de Rutas y Plazos de EntregaElso ReyesОценок пока нет

- FERM Exporting OracleДокумент91 страницаFERM Exporting OracleAkshat JainОценок пока нет

- Spice Jet Data For Business Analytics'Документ47 страницSpice Jet Data For Business Analytics'Namita BhattОценок пока нет

- Spice Jet Data For Business Analytics'Документ47 страницSpice Jet Data For Business Analytics'onkarОценок пока нет

- Salary For OperatorДокумент5 страницSalary For OperatorJayampathi AsangaОценок пока нет

- Transaction Date Product Number Units Sold Unit Price Sub Total Tax Total SaleДокумент22 страницыTransaction Date Product Number Units Sold Unit Price Sub Total Tax Total SaleEmilieAnn SumalloОценок пока нет

- Transaction Date Product Number Units Sold Unit Price Sub Total Tax Total SaleДокумент22 страницыTransaction Date Product Number Units Sold Unit Price Sub Total Tax Total SaleEmilieAnn SumalloОценок пока нет

- 2G Degraded Cells 14 September 2020 PHCДокумент72 страницы2G Degraded Cells 14 September 2020 PHCMark EmakhuОценок пока нет

- Tugas - Perhitungan TRIS-W - Septian Dwi Anggoro (023102201063)Документ16 страницTugas - Perhitungan TRIS-W - Septian Dwi Anggoro (023102201063)Septian Dwi AnggoroОценок пока нет

- Date Product Price of Product Units: Total SalesДокумент8 страницDate Product Price of Product Units: Total SalesMariana TorresОценок пока нет

- Table StyleДокумент5 страницTable StyleYe YintОценок пока нет

- Back Tes Forex Terbaru (AutoRecovered)Документ35 страницBack Tes Forex Terbaru (AutoRecovered)main gameОценок пока нет

- Comersurchi E.I.R.L Fecha de Venta Total de Venta N/C Devol. Anulado CréditoДокумент2 страницыComersurchi E.I.R.L Fecha de Venta Total de Venta N/C Devol. Anulado CréditoAlejandra Yaranga CahuanaОценок пока нет

- Prices Date Open High Low CloseДокумент14 страницPrices Date Open High Low ClosemarethaОценок пока нет

- Pitchbook DataДокумент118 страницPitchbook DataAkshay ShettyОценок пока нет

- Closing Price and Returns, TurjoДокумент6 страницClosing Price and Returns, TurjoShahinul KabirОценок пока нет

- V.41. Indeks Nilai Tukar Nominal Rupiah Terhadap Mata Uang Mitra Dagang UtamaДокумент2 страницыV.41. Indeks Nilai Tukar Nominal Rupiah Terhadap Mata Uang Mitra Dagang UtamaIzzuddin AbdurrahmanОценок пока нет

- Remesas BancosДокумент8 страницRemesas BancosANGELINE VARGASОценок пока нет

- Hollow ZДокумент1 страницаHollow ZAshwani KumarОценок пока нет

- BajazДокумент10 страницBajazVibin NivasОценок пока нет

- Transaction Period# of Transactions Total # of Transactions DTFДокумент8 страницTransaction Period# of Transactions Total # of Transactions DTFDaily PhalanxОценок пока нет

- GUARDADITOДокумент4 страницыGUARDADITOJesus GarzaОценок пока нет

- Loan Calculator: Sample ComputationДокумент5 страницLoan Calculator: Sample ComputationallanОценок пока нет

- FM AssignmentДокумент6 страницFM AssignmentSHRIJHA NОценок пока нет

- Tipos de Cambio (Pesos Por Dólar)Документ4 страницыTipos de Cambio (Pesos Por Dólar)nikoskavezonОценок пока нет

- Unemployment Rate Poverty Rate Education HDI Year Data Year Data Year Data 1 Data 2 Year Data 1 Data 2Документ2 страницыUnemployment Rate Poverty Rate Education HDI Year Data Year Data Year Data 1 Data 2 Year Data 1 Data 2Tiffany SagitaОценок пока нет

- PA2 - Wk6Документ13 страницPA2 - Wk6Ranjan KoiralaОценок пока нет

- Ecoindicadores Final 2019Документ64 страницыEcoindicadores Final 2019CESAR AUGUSTO MARTINEZ CORTESОценок пока нет

- Authorid Income Earned Initial Contract Date Years Under Contract Number of Titles in Print Number of Books Sold Sell PriceДокумент7 страницAuthorid Income Earned Initial Contract Date Years Under Contract Number of Titles in Print Number of Books Sold Sell PricerohitnshenoyОценок пока нет

- Weston Aug 2013Документ1 страницаWeston Aug 2013HigginsGroupREОценок пока нет

- MATL LC Statement Report 2022Документ3 страницыMATL LC Statement Report 2022Zakir HossenОценок пока нет

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019От EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019Оценок пока нет

- Profitability of simple fixed strategies in sport betting: Soccer, Belgium Jupiter League, 2009-2019От EverandProfitability of simple fixed strategies in sport betting: Soccer, Belgium Jupiter League, 2009-2019Оценок пока нет

- F2150RA Xhe-Dynamic - F2150RAL Xhe-DynamicДокумент16 страницF2150RA Xhe-Dynamic - F2150RAL Xhe-DynamicCollin NguОценок пока нет

- tb0006 PDFДокумент12 страницtb0006 PDFCollin NguОценок пока нет

- AxiTrader Setup GuideДокумент10 страницAxiTrader Setup GuideCollin NguОценок пока нет

- 1 Input Data: Profis Anchor 2.6.6Документ6 страниц1 Input Data: Profis Anchor 2.6.6Collin NguОценок пока нет

- 3urgxfwv &dofxodwru: +RPH $Erxw8V 3urgxfwv &Dvh6Wxglhv, Qgxvwu//Lqnv 'Rzqordgv) $4V 1Hzv 6xssruw 5Htxhvw%Urfkxuh &Rqwdfw8VДокумент2 страницы3urgxfwv &dofxodwru: +RPH $Erxw8V 3urgxfwv &Dvh6Wxglhv, Qgxvwu//Lqnv 'Rzqordgv) $4V 1Hzv 6xssruw 5Htxhvw%Urfkxuh &Rqwdfw8VCollin NguОценок пока нет

- PES Hilti M10 HSA Report RunnerДокумент4 страницыPES Hilti M10 HSA Report RunnerCollin NguОценок пока нет

- Canopy Height Size Uplift Downwards Moment Shear No + 1.2M Sq. M KN KN KNM KNДокумент1 страницаCanopy Height Size Uplift Downwards Moment Shear No + 1.2M Sq. M KN KN KNM KNCollin NguОценок пока нет

- 1 Input Data: Profis Anchor 2.6.0Документ2 страницы1 Input Data: Profis Anchor 2.6.0Collin NguОценок пока нет

- PES Hilti M10 HSA ReportДокумент4 страницыPES Hilti M10 HSA ReportCollin NguОценок пока нет

- Base CHS X 10tДокумент7 страницBase CHS X 10tCollin NguОценок пока нет

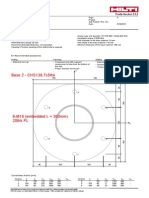

- Base 2 - CHS139.7x5thk: 8 Installation DataДокумент1 страницаBase 2 - CHS139.7x5thk: 8 Installation DataCollin NguОценок пока нет

- Base 1 - CHS139.7x10thk: 8 Installation DataДокумент1 страницаBase 1 - CHS139.7x10thk: 8 Installation DataCollin NguОценок пока нет

- Brealey. Myers. Allen Chapter 22 SolutionДокумент8 страницBrealey. Myers. Allen Chapter 22 SolutionPulkit Aggarwal100% (1)

- Why Do Financial Institutions ExistДокумент39 страницWhy Do Financial Institutions Existkafi100% (1)

- Marine National Bank v. National City BankДокумент2 страницыMarine National Bank v. National City BankChimney sweepОценок пока нет

- Effect of Financial Distress On TAДокумент12 страницEffect of Financial Distress On TAcindytantrianiОценок пока нет

- Fundamentals of Capital MarketДокумент37 страницFundamentals of Capital MarketBharat TailorОценок пока нет

- Universiti Teknologi Mara Final ExaminationДокумент8 страницUniversiti Teknologi Mara Final Examinationnorita siratОценок пока нет

- Exchange Rate Regimes of The WorldДокумент14 страницExchange Rate Regimes of The WorldKajal Chaudhary100% (1)

- Basel Committee On Banking Supervision: Revisions To The Basel II Market Risk FrameworkДокумент35 страницBasel Committee On Banking Supervision: Revisions To The Basel II Market Risk FrameworkSatya JitОценок пока нет

- Accounting Theory & Practice Fall 2011 - Ch4Документ26 страницAccounting Theory & Practice Fall 2011 - Ch4eileen_floodxoxoОценок пока нет

- Markowitz TheoryДокумент4 страницыMarkowitz TheoryshahrukhziaОценок пока нет

- MF 0015Документ312 страницMF 0015Aayush Singhal100% (1)

- WEM of Siemens India - 1Документ9 страницWEM of Siemens India - 1Renjith KrishnanОценок пока нет

- A Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeДокумент45 страницA Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeBalakrishna ChakaliОценок пока нет

- Unit 5 Time Value of Money BBS Notes eduNEPAL - Info - PDFДокумент3 страницыUnit 5 Time Value of Money BBS Notes eduNEPAL - Info - PDFTorreus AdhikariОценок пока нет

- Weekly FinДокумент6 страницWeekly FinInternational Business TimesОценок пока нет

- Akshat MittalДокумент1 страницаAkshat Mittalkh5892Оценок пока нет

- INNOBIZ Presentation1-6Документ13 страницINNOBIZ Presentation1-6Juan Carlos ZamoraОценок пока нет

- Major Players of The IndustryДокумент5 страницMajor Players of The IndustrySurbhi RastogiОценок пока нет

- PYETJE Tregje FinanciareДокумент4 страницыPYETJE Tregje FinanciarepavligjinkoОценок пока нет

- Invoice: Order SummaryДокумент1 страницаInvoice: Order SummaryELFIRA UTAMIОценок пока нет

- Financial Planning Association of MalaysiaДокумент36 страницFinancial Planning Association of MalaysiaMie ChipsmieОценок пока нет

- Credit Risk: by Prof. Divya GuptaДокумент26 страницCredit Risk: by Prof. Divya GuptaKaibalyaprasad MallickОценок пока нет