Академический Документы

Профессиональный Документы

Культура Документы

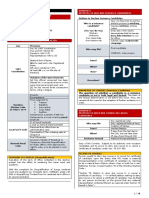

Allowability of Expenses Towards Penalty and Damages in Compensatory Nature

Загружено:

Ronak DesaiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Allowability of Expenses Towards Penalty and Damages in Compensatory Nature

Загружено:

Ronak DesaiАвторское право:

Доступные форматы

8/7/12

A llowability of expenses towards penalty and damages in compensatory nature

Twitter Subscribe Email Facebook Submit Articles Budget 2012 Corporate Law Finance DGFT Articles News Notifications/Circulars

Tax Saving Plans Financial Advice w Personal Touch! Get Relief u/s 80C . Just Apply Now www.Jum pstart.co.in Air India Cheap Flights Flight Tickets At Rs. 99 + Taxes. Quality Service. Book Now & Save! Mak e MyTrip.com /C he ap-Airfare s Prepare For MAT 2012/2013 Get The Best Study C ontent At Make Your Own Destiny. Apply! www.Myod.com /MAT 1 Crore Life Insurance Pay less than Rs.550 every Month Secure your Family for 1 C rore paisabazaar.com /te rm -life -insurance

Home Income Tax ITR Service Tax Excise Custom Duty GST C. Law Judiciary Partnership CA CS CMA RBI SEBI Downloads Home Income Tax Case Laws Allowability of expenses towards penalty and damages in compensatory nature

Allowability of expenses towards penalty and damages in compensatory nature

Friday, September 11, 2009, 2:19 Income Tax Case Laws Judiciary

SUMMARY OF CASE LAW

The payment which is punitive, is not allowable and in case the payment is compensatory, then the payment to the extent the same is of compensatory nature is to be allowed.

taxguru.in//allowability -of-expenses-towards-penalty -and-damages-in-compensatory -nature.html

8/7/12

A llowability of expenses towards penalty and damages in compensatory nature

CASE LAW DETAILS Decided by: ITAT, BANGALORE BENCH `B, In The case of: ACIT v Khoday India Ltd., Appeal No.: ITA No. 338/Bang/08, Decided on: December 12, 2008 RELEVENT PARAGRAPH 2.7 The Honble Apex Court in the case of CIT v Ahmedabad Cotton Manufacturing Co. Ltd. 205 ITR 163 held as under:what needs to be done by an assessing authority under the Incometax Act, 1961, in examining the claim of an assessee that the payment made by such assessee was a deductible expenditure under $.37 of the Income-tax Act although called a penalty is to see whether the law or scheme under which the amount was paid required such payment to be made as penalty or as something akin to penalty, that is imposed by way of punishment for breach or infraction of the law or the statutory scheme. If the amount so paid is found to be not a penalty or something akin to penalty due to the act that the amount paid by the assessee was in exercise of the option conferred upon him under the very law or scheme concerned, then one has to regard such payment as business expenditure of the assessee, allowable under section 37. 2.8 Thus, the law on the allowability of expenses debited as penalty has been fully settled by the Honble Apex Court and it is the duty of the assessee to show that the amounts claimed are compensatory in nature in case these are to be allowed. As per Explanation to section 37, the expenditure incurred for any purpose, which is an offence or which is prohibited by law, is to be treated to have not been incurred for the purpose of the business. Thus, the payment, which is punitive, is not allowable and in case the payment is compensatory, then the payment to the extent of compensatory nature is to be allowed. Since the issue has not been properly dealt either by the Assessing Officer or by the learned CIT(A), therefore, we have no alternative but to set aside this issue on the file of the Assessing Officer so that the assessee files all the material before the Assessing Officer to show that the amounts are allowable because these are compensatory in nature. In case the Assessing Officer finds that the amount is punitive, then it is not allowable. In case, the amount is compensatory as well as punitive, then the Assessing Officer will bifurcate the amount and will allow the amount to the extent it is compensatory.

RELATED POSTS

S. 37 Allowability of Business Expenditure & case laws Punitive charges paid by the assessee to Railways for overloading of the wagons is compensatory i ... Payment for infringement of patent, being purely compensatory in nature, cannot be disallowed Provision for Expenses - Allowable expenditure - Comments Invited Receipts from activities not having direct nexus with shipping/dredging activities not exempt und ...

Tags: income tax act, income tax act 1961

0

Like

17

taxguru.in//allowability -of-expenses-towards-penalty -and-damages-in-compensatory -nature.html

8/7/12

A llowability of expenses towards penalty and damages in compensatory nature

Write a Comment

Name (required) Comment Mail (required)

Send Comment

Website

Deduction U/s. 80HHF available on sale not on Production or mere allotment No addition could be made solely on the basis of material found in the possession of third party

Popular Budget 2012 Featured Judiciary Exemption to Salaried Employees from Filing of I-T Returns for A.Y. 2012-13 Revised Schedule VI in Excel Format Balance Sheet, Profit Loss A/c, Notes Deduction U/s. 80G of Income Tax Act, 1961 for donation Tds / TCS Rates for FY 2011-12 / AY 2012-13 Deduction u/s. 80C for tuition / school / education fees Depreciation Rates as per Companies Act Read more Popular Posts

SUBSCRIBE TO EMAIL UPDATES

Enter Your Email..

Subscribe

Assessment Audit Budget Budget 2010 CAPIT AL GAIN CBDT CBEC CBI Cestat judgments chartered accountants Companies Act

Custom Duty Notifications DGFT Notifications Direct Tax Code dtc Empanelment Excise Duty Notifications fema Fema Notifications finance minister Government Policy GST high court judgments ICAI ICSI

company law notifications ICWAI

income tax act income tax act 1961 Income tax department Income

Tax Notifications IRDA IRDA Notifications itat

ITAT judgments IT R pranab mukherjee RBI Notifications reserve bank of india SEBI notifications securities and exchange

board of india service tax notifications supreme court judgements tax TDS

taxguru.in//allowability -of-expenses-towards-penalty -and-damages-in-compensatory -nature.html

8/7/12

A llowability of expenses towards penalty and damages in compensatory nature

Cities in India

See how Siemens brings greater quality of life to urban residents! siemens.com/india/city-solutions

RECENT NEWS & ARTICLES

E FILING of Income Tax Return Dos, Donts & Common Errors Dos and Donts for printing & submitting of ITRV Assessment cant be held void if search warrant issued in joint names Income from sale of Government Securities is capital gains, not interest under DTAA If there is no relevant notification, land within 8 kms of municipality limits deemed to be an agricultural land Read More Recent News

LIC Pension 1.45 CA Online Coaching

Pension =

PolicyBazaar.com /Pure Inve stm e nt

Change the way you learn with Online Coaching for CA student

www.C Aclubindia.com /coaching

C, C++, C# courses Aptech

www.Apte ch-Education.com

50 lakh students trained already 25 years of expertise

GRE Online Training

www.GR Ee dge .com

Will Online really work for me? Get advice & 5 day free trial

Taxguru.In on Facebook

Like 4,300 people like Taxguru.In.

H arshada

V ikas

Kapil

M anjusha

Lokesh

N eeraj

A keel

Radha

S anjeev

N gr

F acebook social plugin

taxguru.in//allowability -of-expenses-towards-penalty -and-damages-in-compensatory -nature.html

8/7/12

A llowability of expenses towards penalty and damages in compensatory nature

Copyright TaxGuru 2011. All Rights Reserved. About Us - Advertise - Privacy Policy - Disclaimer - Back to top

taxguru.in//allowability -of-expenses-towards-penalty -and-damages-in-compensatory -nature.html

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Mantras For Specific PurposesДокумент14 страницMantras For Specific Purposessubbu m95% (56)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Defective Real Estate Documents: What Are The ConsequencesДокумент67 страницDefective Real Estate Documents: What Are The ConsequencesForeclosure Fraud100% (7)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Free Ravan Samhita PDF in HindiДокумент2 страницыFree Ravan Samhita PDF in HindiRajeev Sharma33% (9)

- Free Ravan Samhita PDF in HindiДокумент2 страницыFree Ravan Samhita PDF in HindiRajeev Sharma33% (9)

- Law On Succession-Allowance and Disallowance of WillsДокумент27 страницLaw On Succession-Allowance and Disallowance of WillsYollaine GaliasОценок пока нет

- Human Rights Education CLJ2Документ30 страницHuman Rights Education CLJ2Eugene Bert SantiagoОценок пока нет

- Taxguru - In-Checklist For Internal Audit of GSTДокумент2 страницыTaxguru - In-Checklist For Internal Audit of GSTRonak DesaiОценок пока нет

- Sample Share Purchase AgreementДокумент38 страницSample Share Purchase AgreementKriti2604Оценок пока нет

- Example Due DiligenceДокумент3 страницыExample Due DiligenceAzamat ManatauovОценок пока нет

- Example Due DiligenceДокумент3 страницыExample Due DiligenceAzamat ManatauovОценок пока нет

- Gujarat Minimum Wages 1st Oct 2016 To 31st Mar 2017Документ8 страницGujarat Minimum Wages 1st Oct 2016 To 31st Mar 2017Ronak DesaiОценок пока нет

- The Mantra Book - Way of The Prayer PDFДокумент33 страницыThe Mantra Book - Way of The Prayer PDFRonak DesaiОценок пока нет

- 5 Best Accounting Softwares in India With Free DemoДокумент4 страницы5 Best Accounting Softwares in India With Free DemoRonak DesaiОценок пока нет

- ShlokasДокумент1 страницаShlokasRonak DesaiОценок пока нет

- Overview of GST - PPT For GACДокумент57 страницOverview of GST - PPT For GACRonak DesaiОценок пока нет

- Cesarean Section - India ParentingДокумент14 страницCesarean Section - India ParentingRonak DesaiОценок пока нет

- General Checklist of Aud..Документ10 страницGeneral Checklist of Aud..Ronak DesaiОценок пока нет

- Reports ListДокумент1 страницаReports ListRonak DesaiОценок пока нет

- Antenatal Care - India ParentingДокумент13 страницAntenatal Care - India ParentingRonak DesaiОценок пока нет

- Alarming Signs in A Pregnancy - India ParentingДокумент13 страницAlarming Signs in A Pregnancy - India ParentingRonak DesaiОценок пока нет

- Панча карма для европейцев-книгаДокумент55 страницПанча карма для европейцев-книгаRumalaya100% (3)

- Goods Sales TaxДокумент61 страницаGoods Sales Tax✬ SHANZA MALIK ✬Оценок пока нет

- Charaka Samhita, Sutrasthanam, Slokas The Section of Introductory, Theoretical and Philosophical Foundation of AyurvedaДокумент240 страницCharaka Samhita, Sutrasthanam, Slokas The Section of Introductory, Theoretical and Philosophical Foundation of AyurvedaAyurvista89% (9)

- Survey Search and SeizureДокумент130 страницSurvey Search and SeizureyagayОценок пока нет

- Tds Rate Chart Fy 11 12Документ5 страницTds Rate Chart Fy 11 12Cma Atanu MohantyОценок пока нет

- Simeen Hussain Rimi: Early Life and EducationДокумент1 страницаSimeen Hussain Rimi: Early Life and EducationDr. Molla Abdus SattarОценок пока нет

- In the Matter of In The Matter Of Foreclosure Of Tax Liens By Proceeding In Rem Pursuant To Article Eleven Of The Real Property Tax Law by the County of Schuyler. Notice and Petition of Foreclosure: Index No. 16-195.Документ3 страницыIn the Matter of In The Matter Of Foreclosure Of Tax Liens By Proceeding In Rem Pursuant To Article Eleven Of The Real Property Tax Law by the County of Schuyler. Notice and Petition of Foreclosure: Index No. 16-195.Steven GetmanОценок пока нет

- Bank CertificateДокумент1 страницаBank CertificateUCO BANKОценок пока нет

- Mayor Miguel Paderanga Vs Judge Cesar AzuraДокумент2 страницыMayor Miguel Paderanga Vs Judge Cesar AzuraewnesssОценок пока нет

- Bayotas Case DigestДокумент2 страницыBayotas Case DigestLorde Basura LapotОценок пока нет

- German Law Review 06+vol - 19 - No - 04 - GraverДокумент34 страницыGerman Law Review 06+vol - 19 - No - 04 - GraverObservatory Pol. Rights & CitizenshipОценок пока нет

- The Punjab Consumer Protection Act 2005Документ10 страницThe Punjab Consumer Protection Act 2005Asif MalikОценок пока нет

- Clubbing of Income Under Income Tax ActДокумент7 страницClubbing of Income Under Income Tax ActAnwar Ashraf AshrafiОценок пока нет

- Kalinga Colleges of Science and Technology Department of CriminologyДокумент15 страницKalinga Colleges of Science and Technology Department of Criminologyjingky SallicopОценок пока нет

- 125 Bautista vs. Gonzales - 1990Документ6 страниц125 Bautista vs. Gonzales - 1990JanWacnangОценок пока нет

- Revised: Federal Public Service CommissionДокумент3 страницыRevised: Federal Public Service CommissionAR MalikОценок пока нет

- Adel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesДокумент10 страницAdel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesJoesil Dianne0% (1)

- No Immigration Rules For Coastal VesselsДокумент1 страницаNo Immigration Rules For Coastal Vesselsalive2flirtОценок пока нет

- G.R. No. 182434 March 5 2010 Tomawis CaseДокумент13 страницG.R. No. 182434 March 5 2010 Tomawis CaseMarcial SiarzaОценок пока нет

- Gayoso Vs Twenty TwoДокумент8 страницGayoso Vs Twenty TwoEnnavy YongkolОценок пока нет

- Miriam College vs. CAДокумент2 страницыMiriam College vs. CAICTS BJMPRO 7Оценок пока нет

- R V Robb (1991) 93 CRДокумент2 страницыR V Robb (1991) 93 CRJeree Jerry AzreeОценок пока нет

- Baker Hostetler's Interim Fee ApplicationДокумент31 страницаBaker Hostetler's Interim Fee ApplicationDealBookОценок пока нет

- PG Admission 2021 2022Документ2 страницыPG Admission 2021 2022Dj Lucky AllahabadОценок пока нет

- Chapter 22Документ5 страницChapter 22api-235651608Оценок пока нет

- 7 The Crown As Corporation by Frederick MaitlandДокумент14 страниц7 The Crown As Corporation by Frederick Maitlandarchivaris.archief6573Оценок пока нет

- Voice of Freedom 96Документ16 страницVoice of Freedom 96NoTwoLiesОценок пока нет

- Wadia Institute of Himalayan Geology: Application Form For Scientific PostsДокумент15 страницWadia Institute of Himalayan Geology: Application Form For Scientific PostsJeshiОценок пока нет

- Labour Act 2003Документ14 страницLabour Act 2003Arunjeet Singh RainuОценок пока нет

- Location Release Form - Sahar HalimiДокумент1 страницаLocation Release Form - Sahar HalimiSahar23Оценок пока нет

- QP - Class X - Social Science - Mid-Term - Assessment - 2021 - 22 - Oct - 21Документ7 страницQP - Class X - Social Science - Mid-Term - Assessment - 2021 - 22 - Oct - 21Ashish GambhirОценок пока нет

- UCPB v. BelusoДокумент4 страницыUCPB v. BelusotemporiariОценок пока нет