Академический Документы

Профессиональный Документы

Культура Документы

ICIS East Asia Summary

Загружено:

leonardsmith86Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ICIS East Asia Summary

Загружено:

leonardsmith86Авторское право:

Доступные форматы

East Asia LNG

2011 Market Summary

The past year proved a watershed for the traded LNG market as participants responded to the challenge presented by the natural disaster and subsequent nuclear shutdowns affecting the worlds largest LNG consumer, Japan.

The resultant demand surge posed serious questions over whether the trading sector in an industry dominated until recently by rigid point-to-point contracts could effectively reallocate LNG to Japan. It was a test the market emphatically passed. Preliminary analysis by ICIS Heren shows that LNG sold on a spot basis1 or on mid-term contracts2 met nearly 80% of Japans estimated 14m tonne supply shortfall in 2011. These sales contributed to an unprecedented level of short-term liquidity in the wider region, including South Korea, China and Taiwan. Overall, east Asian buyers received at least 185 cargoes, or 10.76m tonnes, of spot LNG in 2011. Total sales outside long-term contracts accounted for 25m tonnes, capturing 18% of the regional market in 2011. The strength of the supply response was sufficient to reverse the resultant increase in regional spot prices by the end of the year. Having opened the year at $10.045/ MMBtu, ICIS Herens East Asia Index3 front-month assessment rose from March onwards to peak at $17.910/ MMBtu on 6 October, before falling to $15.688/MMBtu by the close of the year. The East Asia Index two-month ahead contract peaked at $18.518/MMBtu on 17 October. The demand shock also had ramifications for European buyers, which had come to rely on flexible LNG to supplement domestic production and pipeline imports. Around 12.5m tonnes was pulled from the Atlantic Basin to east Asian markets in 2011. At least 5.15m tonnes was sold on a spot basis, with the remainder committed over terms of seven months or longer.

Meeting Japans needs

Japans electricity utilities had been finalising procurement plans for the 2011 business year when the 11 March Tohoku offshore earthquake hit. Such a measured approach was soon rendered redundant amid uncertainty over the scale and timing of LNG deliveries needed to bridge nuclear shutdowns. Early estimates assessed the range as between 4.1m and 8.8m tonnes per annum (mtpa) of incremental LNG4. After the Kan government launched an ill-defined policy of stress tests for all nuclear plants in July, these early projections could no longer be taken for granted. By summer, local analysts envisioned a scenario by which Japan could require up to 15m tonnes of incremental LNG in the fiscal year to 31 March 2012, and up to 20m tonnes the following business year if no nuclear restarts were permitted.5 In fact, LNG demand in Japan rose by around 8.5m tonnes to approximately 78.5m tonnes over calendar 2011. Japanese buyers were faced with concurrent challenges on the supply side. Australias Pluto project, from which 3.75mtpa is committed to Japan, was delayed into 2012, while utilities experienced a significant net decline in contracted deliveries stemming from the expiry of deals with Indonesias Pertamina. ICIS Heren estimates importers were obliged to make up an effective deficit of almost 14m tonnes between demand and long-term contracted supply in calendar 2011. In the immediate aftermath of the March disaster, assistance to Japanese buyers took the form of timeswap deliveries6. However, most cargoes had been returned to Japanese and other east Asia buyers by the end of the year and were thus not a significant net source of additional volumes to Japan.

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

East Asia LNG

2011 Market Summary

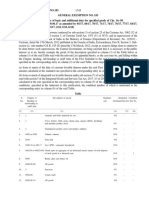

Share of Japans contractual deficit met by source

Source: ICIS Heren

Including string deals offered by portfolio sellers and bridging arrangements for delayed contracts, Japanese buyers are estimated to have procured 6.7m tonnes of LNG on this basis in 2011, making up nearly 46% of the total deficit. Sellers sourced just under a third of these volumes, or 2.15m tonnes, from the Atlantic Basin. Given the month-to-month technical and regulatory uncertainties faced by Japans power utilities over nuclear restarts, it was unsurprising that Japans power utilities also led a surge in procurement of LNG on a spot basis. ICIS Heren estimates that at least 90 cargoes, amounting to more than 5.2m tonnes, were sold into Japan on a pure spot basis over the year. A total of 44% of this was sourced from the Atlantic Basin, with an estimated 1.49m tonnes sourced from Nigeria alone.

15%

2.1 million tonnes

37%

5.2 million tonnes

48%

6.7 million tonnes

East Asian pricing: shipping costs decisive

Japans additional requirements dominated the regional spot market, with the cost of shipping a decisive factor in setting regional prices. While the initial response to the 11 March earthquake may have been conducted on a non-commercial basis, prices soon rose in line with the cost of securing diversions from competing markets. With supplies from within the Asia-Pacific region and the Middle East reallocated soon after the earthquake, the search for cargoes shifted firmly to the Atlantic Basin. While the $11.50-12.00MMBtu costs of the first additional Qatari cargoes set the floor for the market, rising shipping costs applied upward pressure. The requirement to carry out round trips of up to 60 days from Atlantic Basin LNG plants to east Asia placed severe strains on the availability of a fleet ordered largely for intra-basin trade. Rising charter rates triggered an upward spiral in the prices that east Asian buyers were obliged to pay to divert cargoes away from the Atlantic Basin.

Spot sales (up to 6 months) Mid-term sales (7 months to 4 years) Existing contract structures (inlcuding UQT and time-swaps)

Buyers and sellers also attempted to increase supply within the flexibility offered under long-term contracts. Increases were registered in supply from Malaysia, Brunei and Oman. In many cases this represented a return to nameplate levels rather than stretching contracts to upper quantity tolerance (UQT).7 The vast majority of the increase in volumes came from new commercial arrangements. Contractual sellers and portfolio suppliers competed to commit volumes into the market on a mid-term basis at a discount to long-term supply. Most significantly, Qatargas committed 4m tonnes of additional LNG over the year from March 2011.

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

East Asia LNG

2011 Market Summary

The squeezed midstream: Asia/Europe price differential vs spot charter rates

140000

Source: ICIS Heren

10 9 8

130000

120000 7 110000 6 5 4 3 80000 2 70000 1 0 17/02/2011 01/04/2011 16/05/2011 28/06/2011 10/08/2011 22/09/2011 04/11/2011 19/12/2011

100000

90000

60000 04/01/2011

ICIS Heren Atlantic prompt charter rate ($/day)

Premium of ICIS Heren East Asia Index to Britain LNG assessment ($/MMBtu)

Higher shipping costs encouraged the reactivation of older tonnage, but the lower efficiency of these vessels meant this did little to alleviate shortages. Despite the constraints on shipping, technically inefficient trades persisted due to a lack of flexibility in some long-term contracts. A total of 620,000 tonnes of LNG was reloaded from the US, Belgium and Spain for delivery to east Asian markets in 2011 much of it having already passed west once through the Suez Canal from Middle East suppliers. A bullish crude market, driven by tensions in the Middle East and North Africa, also exercised a pronounced upward influence on LNG prices as the Japan Customscleared Crude (JCC) price rose by 25% to $114.6/bbl from January to August 2011.

Crude oil competed directly with LNG as a source of thermal power generation, as Japanese electricity utilities increased crude oil imports by 67.7% year on year in the first half of Japans 2011 fiscal year from 1 April. Although Japans electricity utilities prioritised securing supply over pricing concerns, rising crude prices also increased the attractiveness of spot LNG procurement relative to nominating more deliveries under long-term oil-indexed contracts. More significantly, rising oil prices affected rates on the new mid-term deals into Japan, which were signed at around 13% of the JCC price, or at higher levels of crude-indexation with a substantial fixed negative component.

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

$/MMBtu

$/day

East Asia LNG

2011 Market Summary

Another key driver of short-term volatility in east Asian LNG pricing was the rapidly changing nuclear situation. Japans power utilities experienced a series of unplanned shutdowns and political challenges to restarting damaged capacity over 2011. This trend was exacerbated on 6 July, when Japans government introduced stress tests as a pre-condition of nuclear restarts. Despite these upward price pressures, the price of spot LNG into Japan remained substantially below that of the Japanese average LNG import price in every month

of 2011 until November. The competitiveness of spot prices contrasted favourably with the months after 2007s Kashiwazaki-Kariwa nuclear outage, following which Japans spot prices rose to levels up to 55% above the contractual average.8 By the end of 2011, Japans LNG buyers showed signs of reaching saturation point in terms of LNG procurement as inventories of the fuel reached comfortable levels amid slackening industrial demand. Japans economic recovery showed signs of faltering in September with industrial

ICIS Heren Japan spot LNG assessment 2011 (adjusted to delivery date)

22

Source: ICIS Heren, Japanese Ministry of Finance

20

18

16

$/MMBtu

14

12

10

6

04/01/2011 04/02/2011 04/03/2011 04/04/2011 04/05/2011 04/06/2011 04/07/2011 04/08/2011 04/09/2011 04/10/2011 04/11/2011 04/12/2011

Spot trades into Japan Average customs-recorded import price

Delivered date

ICIS Heren Japan front month (assessed 30 days prior to delivery) ICIS Heren two-month ahead (assessed 30 days prior to delivery) Mid-term contract deliveries

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

East Asia LNG

2011 Market Summary

ICIS Heren East Asia Index 2011 (adjusted to delivery date)

20

Source: ICIS Heren

18

16

$/MMBtu

14

Roll to December delivery

12

Front month demand for November delivery collapses due to full inventories, resulting in sharp assessment fall.

10

Sharp rise in April delivery assessment following Japanese earthquake.

6 04/01/2011 03/02/2011 05/03/2011 04/04/2011 04/05/2011 03/06/2011 03/07/2011 02/08/2011 01/09/2011 01/10/2011 31/10/2011 30/11/2011 30/12/2011

East Asia Index front-month (assessed 30 days prior to delivery) East Asia Index two month-ahead (assessed 30 days prior to delivery) Spot trade Commissioning cargo

Delivered date

production falling for the first month since the earthquake, as fears over the eurozone took hold. The ICIS Heren front-month Japan price peaked at $18.05/MMBtu on 6 October 2011, before falling to $15.75/MMBtu by the end of the year. In spite of the growth of Japans spot procurement in 2011, buyers in South Korea, Taiwan and China procured a total of 5.53m tonnes on a spot basis with activity split roughly equally among the countries.

All three markets showed a trend toward increased buying outside of traditional peak seasons through summer capacity leasing in South Korea, more balanced procurement in Taiwan and the start-up of two new terminals in China. Spot prices in the three countries followed the general direction set by the regions biggest market. Some buyers in the region continued to pay divergent prices for short-term cargoes, partly reflecting differences in fundamentals faced by different regional markets and partly due to inefficient procurement practices, such as restricted tenders.

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

East Asia LNG

2011 Market Summary

South Korea managing growing demand

The growth of South Koreas LNG consumption continued apace in 2011, with imports rising by more than 4m tonnes year on year to 36.7m tonnes, according to official statistics. This rise in demand was managed by KOGAS through the purchase of an estimated 8m tonnes of LNG on a spot or mid-term basis in addition to long-term supply. Portfolio suppliers predominated in these sales, with 4.46m tonnes originating from the Atlantic Basin. The forward procurement strategy appeared to limit South Koreas activity in the spot market for the majority of 2011, although at least 1.56m tonnes was procured on this basis, just over half sourced from the Atlantic Basin. KOGASs procurement strategy allowed it to divert several cargoes to Japans TEPCO in April with the return volumes arriving before or during the countrys winter peak period. While South Koreas winter spot procurement was atypically subdued, counter-seasonal liquidity was maintained by South Koreas independent buyers. Power and industrial sector buyers utilised import capacity leased from KOGAS to access the market through summer. At least eight cargoes were imported into South Korea on a spot basis between April and September ICIS Heren assessed front-month prices for delivery into South Korea in 2011 at an average discount of $0.14/ MMBtu to those into Japan in 2011. The South Korean front-month price was assessed at a premium or parity to Japan for periods from late September onwards ahead of South Koreas winter peak season.

of LNG on a short- or mid-term basis in 2011. This represented 24.3% of total LNG consumption, the highest proportion among the four east Asian markets. While traditionally a summer-peaking market, the countrys year-round dependence on the spot market was demonstrated by the procurement of 593,000 tonnes of LNG on a spot basis over the first quarter of 2011. After Japans earthquake, Taiwan was unable to refrain from spot procurement during the peak summer season, sourcing a further 1.08m tonnes on a spot basis for delivery between April and September. Taiwans disproportionate reliance on spot saw it bid competitively even with the Japanese market. The ICIS Heren Taiwan price was assessed at a premium or at parity with the East Asia Index on 91 occasions over 2011.

China a maturing market

China was another market that procured a disproportionate amount of LNG on a short term-term basis in 2011. Chinese buyers procured around 2.3m tonnes of short- and mid-term volumes, an estimated 20% of total LNG imports. The regions winter-peaking Shanghai terminal led procurement at the start of the year, receiving 250,000 tonnes of spot LNG at prices in line with other buyers in the region. Elsewhere, the postponement of contracts with Qatargas meant Petrochinas Jiangsu and Dalian terminals proved a focus of short-term demand, importing nearly 870,000 tonnes of LNG on a spot basis. Aside from commissioning cargoes, these volumes were procured at market rates. The Chinese governments decision to reduce tax on gas imports and raise regulated gas prices both augured well for the development of the market in 2012.

Taiwan growing beyond seasonal procurement

Taiwan has become increasingly dependent on shortterm volumes in the face of industrial and power sector demand. The country imported at least 2.9m tonnes

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

East Asia LNG

2011 Market Summary

Summary The value of surplus capacity

The events of 2011 demonstrated the importance of both a functioning traded market and the existence of flexible surplus production capacity. While non-commercial cooperation served to alleviate the burden for distressed buyers on a short-term basis, long-term contract structures were overwhelmed by the scale of Japans additional demand. Only the allocative efficiency of a liquid short-term market could effectively ensure the point of highest demand was met. One precondition for the sustainability of the traded market is the acceptance of transparent regional price benchmarks. In 2011, the East Asian Index responded to the regions actual LNG supply and demand fundamentals. The regions dominant proxy benchmark, JCC crude, did not. Instead it was supported by tensions through the Arab world and the robust economic performance of developing countries. A second precondition for a functioning market is flexible surplus capacity. In 2012 this was provided from Atlantic Basin sources, from Qatar and from regional suppliers such as Indonesias Pertamina, which was left with flexible supply by the expiry of long-term deals. All of these sources will come under pressure in 2012. Qatar will need to ramp up deliveries under new commitments, including those for Petrochinas new terminals. Pertamina will need to commit surplus LNG to meet the demand from new domestic terminals. New production should come online by the end of the first quarter in the form of Angola LNG and the delayed Pluto project. The withdrawal of shipping capacity from the market to serve these projects will provide an even more challenging midstream environment for traders. On the demand side, Japans new administration has made positive signals about the restart of nuclear power, although opposition remains at the local level. The extent to

which Japans fiscal year 2012 demand avoids the full 20m tonne increment envisioned in the case of a total nuclear shutdown will ultimately be a function of political will. The LNG market has developed in terms of liquidity and transparency since 2007-2008, when spot prices rocketed in the wake of the Kashiwazaki-Kariwa nuclear shutdown.9 A further increase in demand at the upper end of this range would provide a sterner test of this progress. January 2012

Contact: Simon Ellis, LNG Analyst (0044) 0207 911 1953 simon.ellis@icisheren.com

Request a copy of the latest LNG Markets Daily report

1. Spot trades throughout this analysis are defined as all sales of one cargo or multiple cargoes for delivery within the six months following the transaction date. This does not represent a direct correlation with the delivery windows which ICIS Heren assesses for the East Asia Index or regional DES assessments. Commissioning cargoes are included within the terms of this study if procured on a spot basis as defined above. 2. Mid-term contracts are described in this analysis as deals under which cargoes are to be delivered over a period of more than six months but less than four years from the transaction date. 3. Known until January 16 2012 as the ICIS Heren Asian Pool Price. 4. Deutsche Bank Global Market Research, 15 March 2011 5. Institute of Energy Economics,Japan, 28 July 2011, http://eneken.ieej.or.jp/data/4032.pdf 6. The rescheduling of contractual cargoes among buyers on a non-commercial basis, with the cargo later made good by an equivalent delivery 7. LNG contracts typically allow buyers to nominate an increase of 5-10% in deliveries above or below the nameplate level known as Annual Contract Quantity (ACQ) in a given year. 8. At the peak of the market in November 2008, a Japanese buyer paid $23.28/MMBtu for a Trinidad cargo. The Japan Average LNG import price stood at $15.05/MMBtu on an unweighted basis for the same month. 9. Institute of Energy Economics,Japan, 28 July 2011, http://eneken.ieej.or.jp/data/4032.pdf

Copyright 2012 Reed Business Information Ltd. ICIS is a member of the Reed Elsevier plc group. ICIS accepts no liability for commercial decisions based on the content of this document

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- LNG For Non Technical PeopleДокумент3 страницыLNG For Non Technical Peoplesandeep lalОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PV GAS VUNG TAU TERMINAL PORT INFORMATION AND REGULATIONSДокумент46 страницPV GAS VUNG TAU TERMINAL PORT INFORMATION AND REGULATIONSDong Nguyen0% (1)

- Spec Unloading Arms IIДокумент221 страницаSpec Unloading Arms IIOmiros Aggelides100% (3)

- 8th Annual New York: Value Investing CongressДокумент53 страницы8th Annual New York: Value Investing CongressVALUEWALK LLCОценок пока нет

- Drphungdinhthuc 101122091831 Phpapp01Документ44 страницыDrphungdinhthuc 101122091831 Phpapp01nguyen van thuan100% (1)

- European Commission Gas Quality ReportДокумент48 страницEuropean Commission Gas Quality ReportVu Duc NguyenОценок пока нет

- LNG Daily: Asia LNG: Prices Rise On Early Concerns of Suez Canal Situation, Off-Peak DemandДокумент16 страницLNG Daily: Asia LNG: Prices Rise On Early Concerns of Suez Canal Situation, Off-Peak DemandSaputra Manalu100% (1)

- LNG Mottakterm Moss Maritime OffshoreДокумент30 страницLNG Mottakterm Moss Maritime OffshorePatricio LeonardoОценок пока нет

- AspenTech's Solutions For Engineering Design and ConstructionДокумент13 страницAspenTech's Solutions For Engineering Design and Constructionluthfi.kОценок пока нет

- Turky PPT PDFДокумент30 страницTurky PPT PDFSanjai bhadouriaОценок пока нет

- BOG Rate Calculation DetailsДокумент2 страницыBOG Rate Calculation DetailsAdhicahyo Prabowo100% (1)

- Foamglas Insulation SpecificationsДокумент7 страницFoamglas Insulation Specificationsjohn_p47Оценок пока нет

- CWHEsДокумент2 страницыCWHEsOlumuyiwa FasehunОценок пока нет

- SpaceДокумент87 страницSpaceGus BovaОценок пока нет

- 2012-12-21.TH - Pttep, Partners Award Mozambique LNG FEED ContractsДокумент3 страницы2012-12-21.TH - Pttep, Partners Award Mozambique LNG FEED ContractsJustinОценок пока нет

- Natural Gas AlbertaДокумент16 страницNatural Gas AlbertacjОценок пока нет

- 2020 Strategic PlanДокумент55 страниц2020 Strategic PlansbssbsantosОценок пока нет

- Dokumen - Tips - 1 CNG Dealer Training 2 What Is CNG CNG Is Natural Gas Compressed To A Pressure of 200 250 KGCM G Why CNG Is Used in Vehicles Instead of NaturalДокумент39 страницDokumen - Tips - 1 CNG Dealer Training 2 What Is CNG CNG Is Natural Gas Compressed To A Pressure of 200 250 KGCM G Why CNG Is Used in Vehicles Instead of NaturalCandraОценок пока нет

- Dew Journal Editorial CalenderДокумент4 страницыDew Journal Editorial CalenderALOK RANJANОценок пока нет

- Alimak Se-Ex: Passenger and Goods Lifts For Hazardous AreasДокумент8 страницAlimak Se-Ex: Passenger and Goods Lifts For Hazardous AreasJod RichОценок пока нет

- Severn Cryo Butterfly Valves V1.1Документ5 страницSevern Cryo Butterfly Valves V1.1Thắng Trần QuangОценок пока нет

- Risks and Rewards of Capital Market InvestmentДокумент278 страницRisks and Rewards of Capital Market InvestmentRumana SharifОценок пока нет

- Ethane Extraction For Petrochemical Feedstock: ABSTRACT Preliminary Studies Have Shown That AДокумент15 страницEthane Extraction For Petrochemical Feedstock: ABSTRACT Preliminary Studies Have Shown That ARhyana Trisartika SirumpaОценок пока нет

- Company Profile 2019Документ106 страницCompany Profile 2019aida orolfoОценок пока нет

- Natural Gas in Cyprus: Choosing The Right OptionДокумент35 страницNatural Gas in Cyprus: Choosing The Right OptionGerman Marshall Fund of the United States100% (1)

- Oil and Gas Industry of PakistanДокумент74 страницыOil and Gas Industry of PakistandanialoneОценок пока нет

- G.E. 183 PDFДокумент118 страницG.E. 183 PDFchandramohanОценок пока нет

- Coal, Oil, and Natural Gas (Energy Today) (Geoffrey M. Horn) PDFДокумент49 страницCoal, Oil, and Natural Gas (Energy Today) (Geoffrey M. Horn) PDFjuannОценок пока нет

- Pipeline NetworkДокумент17 страницPipeline Networkaymansh3204Оценок пока нет

- Matarbari Port Development Project Final ReportДокумент268 страницMatarbari Port Development Project Final Reportrk100% (1)