Академический Документы

Профессиональный Документы

Культура Документы

Cityam 2012-08-09

Загружено:

City A.M.Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cityam 2012-08-09

Загружено:

City A.M.Авторское право:

Доступные форматы

MANCHESTER United is set to become

a publicly traded company tomorrow

after investors filled the order book for

its shares, despite warnings from ana-

lysts that the stock is overpriced.

City A.M. understands that there has

been sufficient demand for the club to

push ahead with its listing on the New

York Stock Exchange, which will see it

issue 16.7m shares priced at between

$16 and $20 raising up to $330m

(210m).

It will be third time lucky for the

club, after the owners, the Glazer fam-

ily, abandoned earlier attempts to

float in Singapore and Hong Kong.

But analyst Ken Perkins at Chicago-

based Morningstar told City A.M. the

proposed share price is aggressive, if

not excessive and said a fairer value

FTSE 100L5,845.92 +4.68 DOWL13,175.64 +7.04 NASDAQ 3,011.25 -4.61 /$ 1.56 unc / 1.26 unc /$ 1.24 unc

See Page XX

HYHYHY-

HYHYHY-

HYHYHYH

Certified Distribution

28/05/2012 till 01/07/2012 is 132,857

BY JAMES WATERSON

DAVID HELLIER: Page 2

L L

MORE: FORUM: Page 13

L L

www.cityam.com FREE

BUSINESS WITH PERSONALITY

ISSUE 1,692 THURSDAY 9 AUGUST 2012

was around $10.

From an investment perspective it

just doesnt seem attractive. Theyre

not going to pay dividends and the

Glazers are going to retain control. As

an investor I dont know what youre

getting other than the hope the club

is going to get bought by someone

else.

An $18 float price would give the

company a steep predicted price-to-

earnings ratio of over 110, compared

to 14.4 for entertainment giant Disney.

The high price has led to industry

speculation that many investors are

individuals who have more interest in

the bragging rights that come from

owning a stake in one of the worlds

most famous football clubs than they

are in achieving a good return on

their investment.

David Gill, Manchester Uniteds chief

executive, was yesterday in London to

help drum up additional support at

an investor roadshow hosted by lead

adviser Jefferies.

Supporters groups have been vocal

in their opposition to the float, com-

plaining that the proceeds will not be

spent on improving the clubs playing

squad but instead will be used to

reduce the 420m debt pile that

Manchester United has carried since

the Glazers leveraged takeover in

2005. If all goes to plan the family will

also enjoy a pay day of around $140m.

Institutional investors have repeat-

edly complained about the proposed

share structure, which will leave the

current owners with 99 per cent of

voting rights.

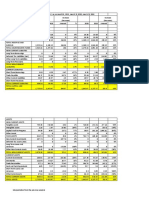

How Manchester Uniteds figures compare

Man United Disney CBS

P/E 2013

110.3

P/E 2013

14.4

P/E 2013

12.4

$8

9

.

2

bn

M

arket cap

Profit 2011

$8bn

Market cap

Profit 2011

$2.5bn

Profit 2011

$18.9m

DAY OF NEAR MISSES FOR TEAM

GB BUT BOXER NICOLA ADAMS

BATTLES THROUGH TO FINAL

VISITORS STEAL THE SHOW

All the action

from yesterdays

Olympics:

Pages 8, 13, 19, 20

MAN UTD KICKS OFF IPO

WITH SKY-HIGH RATING

* P/E =price-to-earnings ratio, the cost of a share comparedtothe firms income per share.

Market cap

$2.95bn

$2

3

bn

L

IN BRIEF

Greeks bid for Credit Agricole unit

nTwo of Greeces largest banks

yesterday joined a race to buy Credit

Agricoles struggling Greek subsidiary

Emporiki, put up for sale to limit the

French lenders exposure to crisis-hit

Greece. National Bank and Eurobank

said in separate bourse filings they

submitted offers for Emporiki, which

lost 1.62bn (0.9bn) in 2011. Alpha

Bank has already said it has made an

offer. But Credit Agricole will have to

recapitalise Emporiki if it wants to

offload the bank. Greeces bank

support fund, the Hellenic Financial

Stability Fund (HFSF), has told

Emporikis potential buyers that it will

approve a sale only if the unit is

recapitalised and fully funded before

it is sold.

Morgan Stanley eyes job cuts

nMorgan Stanley, under fire to boost

profit margins in its retail brokerage

arm, is considering closing brokerage

offices, laying off support staff and

requiring some branch managers also

to generate revenue as advisers under

a cost-cutting drive, according to

reports. Morgan Stanley, which

controls the Morgan Stanley Smith

Barney venture owned jointly with

Citigroup, last week reduced the

number of regions to 12 from 16,

eliminating four manager jobs.

Among the changes under discussion,

they said, is a 10 per cent cut in the

ventures 120 branch complexes,

which are groups of branch offices in a

city or region that share compliance

and administrative staff. Morgan

Stanley spokeswoman Christine Jockle

declined to comment.

THE US regulatory body at the centre

of allegations against Standard

Chartered yesterday came out fight-

ing against criticism that it had acted

without consulting its fellow watch-

dogs, and denied that the case was

proof of an anti-UK bias.

One of the New Yorks state finan-

cial services departments senior offi-

cials told City A.M. yesterday that the

newly formed regulator didnt do

things the standard old boy way and

said it was not involved in pursuing

an anti-London agenda.

He spoke out after widespread criti-

cism from British MPs and policy-

makers that claims against the bank

were part of a campaign to under-

mine a rival financial centre.

The department of financial servic-

es (DFS), run by Benjamin Lowsky,

stunned the City on Monday after it

launched an explosive assault on

Standard Chartered over $250bn in

alleged money laundering transac-

tions tied to Iran.

The order issued by the department

scuppered long-running negotiations

that were already taking place

between the bank and various US

regulators including the Treasury

and the Fed to settle the claims over

the transactions.

Stanchart chief executive Peter Sands apologised yesterday for mistakes made.

2

NEWS

To contact the newsdesk email news@cityam.com

W

AY back in the 1990s, a host

of football clubs decided to

become public companies,

listing their shares on the

London stock market.

They were led by Manchester United,

which floated in 1991, and were fol-

lowed by the likes of Aston Villa,

Sunderland, Chelsea and even

Charlton and Birmingham.

Backers tried to convince investors

they were some sort of early dot.com

play, like Leeds United, which was run

for a while by the wily entrepreneur

Chris Akers before being taken over by

the famously over-ambitious Peter

Ridsdale. They all sold the vision to

investors of ever increasing revenues

on the back of the digital revolution.

Others, like Chelsea, presented a

strategy (which now looks distinctly

flawed) of selling investors the idea of

a football business that was combined

EDITORS

LETTER

DAVID HELLIER

Manchester United heads to the stock market (again)

THURSDAY 9 AUGUST 2012

with general leisure activities such as

hotels and a travel business. Why a

football owner like Ken Bates ever

thought he would run these disparate

businesses with any sort of beneficial

synergies is anybodys guess, but

hindsight is a wonderful thing.

For a while the experiment seemed

to be working and was all the rage,

but in time it became apparent that,

whilst football-related revenues in

most cases did keep rising, they did so

insufficiently quickly to keep up with

ever rising costs, mainly in the form

of player wages.

When the dot com bubble burst,

football club share prices collapsed,

and most of the listed companies

were taken over.

Tomorrow, Manchester United will

become a publicly listed company

again, but this time in New York

rather than London after a similar

attempt to float in Singapore was

abandoned.

Surprisingly, despite almost univer-

sally negative publicity, the flotation,

which hopes to raise 212m, appears

to be meeting targets, with enough

demand being registered for the

shares within the price range of $16-

20. The broker Morningstar values the

shares at a more conservative $10 a

share.

Says Owen Wild of the respected

financial publication IFR:

plain that it will lead to little invest-

ment in the team or its stadium or in

the holding down of rising ticket

prices. The Glazers ownership of the

club appears to have weakened it in

the eyes of fans.

What the likely success of this IPO

will demonstrate though, is that

New York and an adviser such as

Jefferies can succeed in floating UK

household names in a way that

London currently can not.

Recently the vacuum technology

group Edwards IPOd in New York

after failing dismally to do so in

London last year.

More will follow these groups, says

Wild. There must be a lesson here for

London somewhere.

Manchester United is a unique asset.

The power of the Manchester United

brand is like no other and it is hard

for anyone else to replicate.

During the marketing sessions there

have been all sorts of arguments

about how to assess the brand, with

fans groups pouring scorn on the

banking advisers claims that United

has 659m followers.

That United does have an incredible

awareness globally and an army of

zealots that might be prepared to fol-

low its fortunes on web-sites and iPads

and Blackberrys, is not to be doubted

however. The clubs recent $559m

sponsorship agreeemment with

Chevrolet 128 per cent up on its cur-

rent deal underlines the potential of

the clubs revenue growth.

But this flotation is partly about the

Glazer familys desire to monetise

some of its investment, and fans com-

The officials comments came as

Standard Chartered chief executive

Peter Sands spoke out for the first time

since the allegations by the DFS had

been made.

We didnt anticipate this happening

at all, he told City A.M. It was quite sur-

prising because we had been engaged

in a process with five different US regu-

latory agencies, a process we initiated

and we didnt have any reason to

believe that one of the agencies would

act in this way.

He admitted that some transactions

did break US sanctions but these

amounted to only 300 transactions

worth $14m and were all administra-

tive or understandable mistakes.

Standard Chartered PLC

8Aug 2Aug 3Aug 6Aug 7Aug

1,200

1,300

1,100

1,400

1,500

1,600

1,700 p

1,315.50

8Aug

FORUM DEBATE: Page 13

L L

david.helllier@cityam.com

follow me on twitter: @hellierd

We are sorry those mistakes

occurred but they are in the context of

150m transactions and there were no

payments identified that involved indi-

vidually sanctioned entities by the US

government at that time.

Sands also confirmed that Standard

Chartereds executive director of risk

mentioned in the report was Richard

Meddings, now finance director, but

denied that he had described US regu-

lators as f****** Americans.

As far as we can tell and none of the

people at that meeting recall making

that statement so we do not believe

that that quote is correct, he said.

Shares in Standard Chartered

rebounded seven per cent yesterday,

but are still down 18 per cent since the

scandal broke. Sands conceded: we

have paid a price already in terms of

reputational damage.

Bank of England governor Mervyn

King dismissed claims yesterday that

US regulators were engaging in a war

against UK banks but said that UK

authorities would ask that US regulato-

ry bodies work together and refrain

from making too many public state-

ments until the investigation has been

completed.

Standard Chartered is believed to be

considering legal action for reputation-

al damage against the DFS, which on

Monday accused the 160-year old bank

of operating as a rogue institution.

American regulator denies claim

that it has an anti-British stance

BY KASMIRA JEFFORD

Square ties-up deal with Starbucks

Square, the mobile payments start-up

created by Twitter co-founder Jack Dorsey,

yesterday took a big step towards the

mainstream when Starbucks announced it

would use its smartphone technology to

replace transaction systems in its US

coffee shops. Under the deal, Square will

process all Starbucks transactions done

with credit and debit cards.

Avatar creator backs China 3D TV

James Cameron, creator of the

blockbuster film Avatar, is betting that

China is the place to jump-start 3D

television. Cameron Pace Group, the 3D

technology company co-founded by Mr

Cameron, yesterday announced a joint

venture with two Chinese state-backed

companies to produce the advanced

camera equipment needed for 3D filming.

Foreigners to dominate UK property

Foreign institutional investors are on

course to become the dominant force in

the UK commercial-property market,

having pulled level with domestic pension

and insurance funds for the first time.

Overseas financial institutions own 23 per

cent of the UKs 717bn property market.

Cycle success inspires surge in sales

Cycling firms have reported a surge in

demand since recent British triumphs.

Visa Europe reported that bike-related

sales were 15.8 per cent higher last week,

while Evans Cycles reported a 35 per cent

increase in the sale of road bikes.

Cashmere firm crushed by pensions

Shares in Dawson International, one of

the UKs last cashmere manufacturers,

were suspended yesterday after the firm

said it was unlikely to be able to meet its

pension liabilities.

Half of Brits not planning pension

Almost half of all Britons are not planning

to use a pension to fund their retirement,

relying instead on savings, inheritance or

money from their property to see them

through, according to research from

Baring Asset Management.

Royal Wedding carpet firm in pay row

Victoria, the company that made the red

carpet for last years Royal Wedding has

become embroiled in a pay row after its

non-executive directors allegedly

demanded a bonus if the company was sold.

Ex-UBS Traders offered deal

US prosecutors have agreed to shield

several former UBS employees from

criminal charges in return for cooperation

with the escalating investigation of

suspected interest-rate manipulation,

according to a person close to the probe.

New checks on Rolls-Royce engines

European air-safety regulators have

ordered another round of inspections of

Rolls-Royce PLC engines on dozens of

Airbus A380 aircraft, similar to the checks

that followed a 2010 engine blowout.

The new jobs website for London professionals

CITYAMCAREERS.com

WHAT THE OTHER PAPERS SAY THIS MORNING

RUPERT Murdochs News Corp last

night posted a fourth-quarter loss of

$1.55bn (990m) after taking a major

hit on the value of its publishing busi-

ness and setting aside a further $57m

to cover the cost of the ongoing

phone hacking scandal in the UK.

Total revenue for the three months

to 30 June fell to $8.4bn, down 6.7

per cent on the same period last year.

Year-end net income was $1.2bn,

down from $2.7bn in 2011.

Not only did we execute on our

operating plan and deliver on our

financial targets, we returned over

$5bn to shareholders through an

aggressive buyback program and div-

idends, Murdoch said.

Our company has continued to

innovate, grow and consistently

adapt to the rapidly changing media

industry landscape.

News Corp is in a state of transi-

tion, with income from its TV opera-

tions failing to off-set the turmoil in

its traditional publishing business.

Ongoing restructuring led to a

writedown of $1.5bn of goodwill and

News Corp hit

by writedown

on publishing

BY JAMES WATERSON

a further $1.3bn of intangibles in this

quarters accounts, mainly relating to

the Australian newspaper business.

At its US cable business, operating

profit rose 26 per cent to $792m, as

News Corp cranked up the affiliate

fees it charges from cable, phone and

satellite TV distributors.

Income from the companys film

production division was substantially

down from $210m to $120m due to

the absence of major releases in the

last quarter.

Investors were disappointed with

the results and pushed the firms

Class A shares down 3.5 per cent in

after-hours trading on the NASDAQ.

Hung jury in iSoft fraud case

leaves FSA to consider position

THREE former directors of

healthcare IT firm iSoft face an

uncertain future after a jury

yesterday failed to reach a verdict

in their fraud trial for allegedly

overstating the firms results.

The Financial Services Authority

(FSA) now has a month to decide

whether to continue with the case.

Jurors sat through four weeks of

evidence at Southwark Crown

Court but could not come to a

conclusion after deliberating for a

further fortnight.

BY JAMES WATERSON

A further hearing has been

scheduled for 7 September 2012

and the FSA will consider its

position for a retrial, the regulator

said in a short statement.

The FSA began its investigation

into Stephen Graham, Timothy

Whiston and John Whelan in 2006

following accusations of

questionable accounting practices

at the firm, which had a central

role in the botched 6.2bn project

to provide a unified IT system for

the UKs National Health Service.

The central allegation is that the

firm counted revenue from a

54.3m (42.8m) software contract

with the Irish health service as

early as November 2003, even

though the deal was not confirmed

until 2005.

Patrick Cryne, the former iSoft

chairman and owner of Barnsley

football club, will be tried

separately later this year on the

same charges.

Two years ago Ian Storey, iSofts

former financial controller,

admitted giving false information

to auditors between 2003 and 2005

and was banned from working as

an accountant for eight years.

Rupert Murdoch says his firm is in the middle of great change.

News Corp

8Aug 2Aug 3Aug 6Aug 7Aug

22.80

23.00

23.20

23.40

23.60

23.80

24.00

$

23.72

8Aug

PRIVATE equity firm Carlyle

Group reported a nearly two per

cent drop in assets under

management yesterday, as it

revealed a second quarter loss.

Total assets have declined $3bn

(1.91bn) since March to $156bn,

although rival private equity

groups have suffered larger

declines in assets.

The group, one of the largest

private equity fund managers in

the world, also saw an economic

net loss of $57m from a profit of

$392m last quarter and $237m a

year ago.

While the short-term outlook is

cloudy, I would argue that we have

historically made some of our best

Carlyle Group upbeat despite

$3bn quarterly asset value drop

BY MICHAEL BOW

investments during times like

these, Carlyles co-chief executive

William Conway said. Great

investments can be made in a bad

economy and lousy investments

can be made in a vibrant

economy.

The group revealed it had raised

$3.9bn from investors in the second

quarter -- the most since 2008 -- tak-

ing the total raised this year to

$6bn.

Co-chief executive David

Rubenstein, who helped set up the

firm, said: The nearly $4bn in new

capital we raised this quarter

reflects the expected pick-up in

fundraising as our sixth US buyout

fund began to close on new com-

mitments.

THURSDAY 9 AUGUST 2012

3

NEWS

cityam.com

IN BRIEF

GERMANYS exports fell in June,

official statistics showed yesterday,

though imports fell even faster,

expanding the trade deficit.

Industrial output also slid 0.9 per

cent, after rising 1.9 per cent in May.

The patchy data didnt deter

ratings agency Fitch from affirming

its AAA rating with a stable outlook.

And one of the founding fathers of

the euro, former European Central

Bank chief economist Otmar Issing,

said Germany will fare better if it

remains in the single currency

though he conceded other Eurozone

members could pull out.

Across the border, the Banque de

France warned that France could

suffer a shallow recession, with

output likely to contract in the third

quarter after falling 0.1 per cent in

the first three months. The countrys

trade deficit widened from 5.5

(4.3bn) to 6.0bn in June.

Spain also endured a raft of

troubling statistics, with its

industrial output tanking 6.3 per

cent in May its tenth straight

month of decline.

Germany and

France endure

gloomy stats

BY MARION DAKERS

THE BANK of England slashed its

growth forecasts yesterday, as its gov-

ernor Sir Mervyn King warned that

the UK economy still faces a tempes-

tuous time ahead.

We are navigating rough waters,

and storm clouds continue to roll in

from the euro area, King said, after

the Banks latest Inflation Report

showed that economic growth will

be flat in 2012.

The previous report, released in

May, predicted around one per cent

growth this year. That document

also showed growth reaching around

1.8 per cent going into 2013, while

yesterdays report halved that rate to

approximately 0.9 per cent.

And King added that the Banks

forecasts were unable to account for

potentially severe knocks that could

King warns of

storms ahead

as forecasts cut

BY JULIAN HARRIS

occur, most likely from the Eurozone

crisis. A black cloud of uncertainty is

hanging over investment, he said,

adding that a strengthening pound

decreases the competitiveness of

British exports.

On top of uncertainty from over-

seas, deputy governor Charlie Bean

said that the Bank is perplexed at

seemingly contradictory rise in

employment while output is falling

a circumstance that suggests an

unprecedented dive in productivity.

We are in a genuine economic puz-

zle that we dont really understand,

Bean admitted.

The Banks projections also showed

inflation nearing two per cent by the

end of the year, while Mays report

forecast the consumer price index to

steady at approximately 2.6 per cent

at the same stage.

2008 09 10 11 12 13 14 15

0

1

2

-2

-1

3

4

5

6

7

Percentageincreaseinprices onyear earlier

August 2012 CPI estimate

TECH giant Hewlett-Packard

(HP) yesterday increased its

third quarter earnings forecast

despite an $8bn (5.1bn)

writedown on the value of its

services business.

The staggering writedown,

attributed by HP to market

conditions coupled with recent

trading values of its stock,

provided fuel for analysts who

accused HP of overpaying for its

$13bn acquisition of EDS in

2008.

The division, the companys

second biggest revenue driver

behind computers, has

struggled since then as

competition during the

recession has seen the value of

contracts plunge. Its sales

HP forced to write off $8bn

on struggling services arm

BY KATIE HOPE

growth was flat for the first

half of the year at $17.5bn.

However, HPs decision to

boost its third quarter earnings

guidance to $1 a share from its

previous guidance of $0.94 to

$0.97 seemed to appease

investors. The shares rose 2.4

per cent to $19.41 yesterday, but

remain almost 60 per cent lower

than their price at the time of

the EDS acquisition.

HP, which revealed a major

restructure in May involving

27,000 job cuts, also raised the

pre-tax charge it expects for the

quarter to between $1.5bn and

$1.7bn from $1bn. It said this

was due to a higher than

expected rate of acceptance for

its early retirement and

workforce reduction

programmes.

SKY could be free to charge its rivals

higher prices for its sports channels

after winning a competition appeal

against Ofcom yesterday.

The competition appeals tribunal

found the regulators concerns over

Skys dominance to be

unfounded, paving the way for

rules to be lifted on the amount

Virgin Media and BT pay for Sky

Sports 1 and 2 .

Ofcom said it was surprised and

disappointed at the judgment,

which comes two years after the

regulators demands.

A full ruling is due in coming

months, and is likely to be appealed

regardless of the decision. Virgin

Media vowed to pursue all available

options.

Sky appeal on

sports upheld

BY JAMES TITCOMB

MCDONALDS yesterday reported flat

sales in July at established

restaurants around the world, its

worst performance in more than

nine years and a sign that a

weakening global economy is hitting

discretionary spending among

mainstream diners.

The results marked the first time

since April 2003 that same-

restaurant sales failed to rise. Just

two weeks ago, McDonalds

predicted an increase in July same-

restaurant sales, albeit by less than

the 3.7 per cent gain reported in the

second quarter. The flat result

suggested that sales significantly

decelerated in the days after

McDonalds issued guidance on 23

July. US sales slipped by 0.1 per cent

last month, while European

revenues dropped by 0.6 percent.

Sales flattening

at McDonalds

BY CITY A.M. REPORTER

FORUM: Page 12

L L

THURSDAY 9 AUGUST 2012

5

NEWS

cityam.com

SERVCORP, THE WORLDS

FINEST SERVICED OFFICES

Level 17, Dashwood House

69 Old Broad Street, London

T l 0207 786 6700

Level 18 Canary Wharf

40 Bank Street, London

T l 0203 059 7945

Sorry

Regus

VIRTUAL OFFICE -

EVERYTHING BUT THE OFFICE

140 locations worldwide

W l servcorp.co.uk

Your dedicated receptionist

Your prestigious address

Worldwide access to boardrooms,

meeting rooms and business lounges

1ST MONTH FREE - NO FURTHER OBLIGATION

The new

jobs website

for London

professionals

C

I

T

Y

A

M

C

A

R

E

E

R

S

.

c

o

m

August 2012 GDP estimate

2008 09 10 11 12 13 14 15

8

6

4

2

-2

-4

-6

-8

Percentageincreases inoutput onayear earlier

ONS data

Bank estimates of past growth Projection

0

2008 09 10 11 12 13 14 15

0

1

2

-2

-1

3

4

5

6

7

Percentageincreaseinprices onyear earlier

May 2012 CPI estimate

...BUT AT LEAST INFLATION IS STARTING TO EASE

May 2012 GDP estimate

2008 09 10 11 12 13 14 15

8

6

4

2

-2

-4

-6

-8

Percentageincreases inoutput onayear earlier

ONS data

Bank estimates of past growth Projection

0

Inflation has stuck above three per cent for 36 of the last 54 months, consistently

embarrassing the Banks two per cent target. However, the Bank now says external price

pressures have passed, and that inflation should return to target by the end of the year.

The Bank of England slashed its near term growth forecasts, and also said that in the

medium run growth is set to remain below its trend rate. The UK economy is slowly

healing, Sir Mervyn King said, adding that sharp risks still remain.

GROWTH WILL BE EVEN LOWER THAN EXPECTED...

IN WHAT has become a torrid fort-

night for mining companies, Rio

Tinto yesterday unveiled a 34 per

cent slump in first half profits to

$5.5bln (3.3bn).

However declining global demand

for natural resources hit Rio less dra-

matically than its peers: Xstrata,

Anglo-American and BHP have all

revealed sharp falls in underlying

earnings over the past two weeks.

In fact, Rios results exceeded ana-

lysts expectations, and the shares

finished nearly three per cent higher

yesterday, one of the best perform-

ances in the FT-SE 100 index.

Record first-half revenues from Rios

Australian Pilbara iron ore mines

failed to counter slowing shipments

to China. But, unlike his counterpart

at Xstrata, Rio chief executive Tom

Albanese believes that Chinese

demand is on the rise.

We expect to see signs of improve-

ments in Chinese activity by the end

of the year ... as government stimulus

measures begin to flow to infrastruc-

ture investment, he said. Rio expects

Chinese GDP to expand by eight per

Rio Tinto bets

on expansion

as profits drop

BY MICHAEL BOW

cent this year, exceeding the Chinese

governments own expectations.

Despite a rising cost base -- net debt

jumped by 55 per cent over the first

six months of the year to $13.2bn --

Albanese has no plans to shave his

$16bn capital expenditure budget for

2012, attributing the strong perform-

ance of the Pilbara mines to invest-

ment-generated efficiency.

From autonomous trucks and

trains to faster underground tun-

nelling and advanced mineral recov-

ery, all these initiatives are aimed at

reducing costs and improving pro-

ductivity, Albanese said.

The interim dividend rose by 34 per

cent to $0.725 a share.

Government claims businesses

helped it save 5.5bn last year

BIG names from the business world

assisted the government in finding

over 5.5bn in efficiency savings

during the last fiscal year, Cabinet

Office minister Francis Maude

revealed this morning.

The coalition claims it has cut

9.25bn from the last two years of

central government budgets, and

hit out at Labour leader Ed Miliband

for failing to rein in spending while

he was in government.

Theres no reason why Miliband,

when he was sitting in my chair,

BY JULIAN HARRIS

couldnt have done this but he

didnt. It depends on there being a

minister who cares about it, Maude

said. Labour retaliated: For all their

talk of savings, this Tory-led

governments failures are costing

this country dear, said shadow

Cabinet Office minister Jon Trickett.

Miliband spent 13 months at the

Cabinet Office during the previous

Labour administrations term.

Announcing the efficiency

savings, Maude paid homage to

business leaders who are helping

the government along the way.

We have a lot of useful input

from very senior business people on

the Efficiency and Reform Board, he

said, naming Sir Philip Green, Lord

Browne, Sir Peter Gershon, Martin

Read, Dame Lucy Neville-Rolfe and

Martha Lane Fox.

Green found some departments

were spending seven times as much

as others on printer cartridges,

Maude cited as one example. Green

also advised Whitehall on leveraging

its size and quality of credit to secure

better purchasing contracts.

Bulk-buying, along with cutting

consultancy, marketing and

property spend, drove the savings.

Rio Tinto PLC

8Aug 2Aug 3Aug 6Aug 7Aug

2,900

3,000

3,100

3,200

3.300

3,400 p

3,220.00

8Aug

The shares have been weak and volatile performers this year, driven by

near-term risks surrounding the outlook for global growth and higher industry

costs. However, we are positive on the stock, and believe it is a highly

liquid way to gain exposure to long-term emerging market growth.

ANALYST VIEWS

Underlying earnings of $5.2bn is a small beat on consensus at $5.04bn,

down 34 per cent on lower prices. Outlook in line with rest of other players with

lower prices but continued strong earnings and cashows. Order books

remain full and Chinese GDP is expected to be 8 per cent in 2012.

Iron ore weaker than expected, underlying earnings $4.7bn and differ-

ence at the revenue line is likely weaker than anticipated iron ore realisations.

Given our expectation of strength in iron ore from Q4 when the Chinese

stimulus plans we remain buyers.

HOW DID RIO TINTO DO

AGAINST ANALYSTS

EXPECTATIONS? By Michael Bow

JONATHAN JACKSON KILLIK & CO

CAILEY BARKER NUMIS

RICHARD KNIGHTS LIBERUM CAPITAL

THURSDAY 9 AUGUST 2012

6

NEWS

cityam.com

Technology guru Martha Lane Fox Retail chief Dame Lucy Neville-Rolfe

Business tycoon Sir Philip Green Former BP chief executive Lord Browne

FRANCE has not exactly covered itself

in glory in its somewhat peevish reac-

tion to Great Britains utter domina-

tion of track cycling at London

2012 and it seems they just

wont let it go.

First came suggestions

from crestfallen French

cycling chiefs that the

success of Sir Chris

Hoy and Co could be

down to magic

wheels which were

suspiciously hidden

away after races.

Undeterred by

the mockery that

provoked on this side of

the Channel, respected

French sports

newspaper LEquipe yesterday asked

readers whether Team GBs heroics

were tainted. Of the tens of

thousands who responded, some 70

per cent responded oui.

Particularly galling was Jason

Kennys victory over Gregory Bauge

in the mens sprint final. Bauge

bettered Kenny earlier this year to

regain his world title but

found himself trailing in

London. Clearly cheesed

off, Bauge raised eyebrows

in the post-race media

conference when he

interrogated Kenny

about the reasons

behind Team GBs

dominance.

Whatever happened to

the Gallic shrug and

their famed air of indif-

ference?

Got A Story? Email

thecapitalist@cityam.com

8

cityam.com

cityam.com/the-capitalist

THECAPITALIST

THURSDAY 9 AUGUST 2012

AT LONDON2012

LONDON 2012 IMAGE OF THE DAY

SARAH Attar of Saudi Arabia became only

the second woman from the country to ever

compete at an Olympic Games yesterday,

after running in the first round of the

Women's 800m heats.

Throughout the Olympics, City A.M. will be

publishing its Olympic Image of the Day. If

you have a shot you think our readers will

like, please email pictures@cityam.com

French use sour

grapes for GB

whine-making

CAN THE OLYMPICS LEAVE A

LASTING LEGACY?

It depends on how well the site is inte-

grated and the transport links are

maintained. If we continue to fund our sports well

then further success is guaranteed in the future.

These views are those of the individuals above and

not necessarily those of their company

GREG MURRAY

LLOYDS

CITYVIEWS

Interviews by Alex Woodall

London has the size and dynamism

of population to ensure that the sta-

dium is used in future. I think the Olympics will

spur on sport in the UK.

ANDREAS LIESCHE

TRINOVA REAL ESTATE

I think that much of the Olympic

buzz will fade after the Games. But

the Olympic park complex is simply too good

to go to waste and will nd a good use.

MALCOLM BIRD

RR DONNELLY

Jason Kennys victory

upset the French

HEALTHCARE provider Bupa yester-

day said a lack of competition among

UK private hospitals had contributed

to a 22 per cent fall in profits in its

European and US businesses.

Posting a 35m profit for its UK,

Spanish and US operations, down

from 45m last year, Bupa said this

lack of competition was pushing up

the cost of treatment and threaten-

ing to make its health insurance

unaffordable, forcing customers

away.

The firms UK customer numbers

fell five per cent to 2.7m in the first

six months, it reported.

Chief executive Stuart Fletcher,

who took over in March, said:

There are some consultants

charging a good deal more than

others, but who display no better

quality of health outcomes for the

customer.

There was good news away from

the West where 63 per cent of

Bupas turnover is generated with

international profits up ten per

cent. Globally, underlying pre-tax

profit was up five per cent.

Bupa hurt by

rising cost of

UK healthcare

BY MICHAEL BOW

INSURER Old Mutual saw its share

price hit a three-month high

yesterday after revealing a 12 per

cent rise in profits and plans to

expand into sub-Saharan Africa.

Chief executive Julian Roberts said

that the firm would boost its footprint

in East and West Africa to combat,

sustained low growth.

The firm, based in South Africa,

posted a pre-tax operating profit of

791m for the first six months of the

year beating analysts expectations

of 776m.

This was despite a fall in assets

managed by its Old Mutual Asset

Management division to 260.7bn,

down two per cent from 264.7bn a

year earlier.

The firm also increased its interim

Old Mutual coy

over plans for

Nedbank sale

BY MICHAEL BOW

dividend 17 per cent to 1.75p.

Its star performer was its majority

owned South African banking arm

Nedbank it posted a 27 per cent

jump in profits. Roberts declined to

comment on whether Old Mutual

still intended to sell Nedbank.

Old Mutuals planned sale of its 52

per cent holding in Nedbank to

HSBC fell through in 2010.

Old Mutual PLC

8Aug 2Aug 3Aug 6Aug 7Aug

160

162

164

166

168

170

172 p

169.40

8Aug

BAILED-OUT banking and

insurance group ING yesterday

posted a 22 per cent fall in

quarterly net profit to 1.17bn

(923m) yesterday, missing

forecasts as the cost of

restructuring and the Eurozone

financial crisis took their toll.

The Dutch firm has cut its

exposure to Spanish debt from

Eurozone debt damages profit

at bailed-out bancassurer ING

BY MARION DAKERS 41.4bn to 34.9bn since the start

of the year, and yesterday booked a

loss of 178m to account for its de-

risking efforts.

As part of its plan to overhaul

the business following a 10bn

bailout in 2008, ING said it is

hoping for a quick sale of its $7bn

Asian insurance arm and is

plotting IPOs for its European and

US insurance units. Shares in the

firm closed down 1.3%.

FANNIE Mae yesterday reported a

quarterly profit due in part to

stronger home prices and said the

mortgage financier did not need

additional taxpayer funds to stay

solvent, the second consecutive

quarter the company did not

request help since it was seized by

federal authorities during the

Fannie Mae makes $5.2bn profit

BY CITY A.M. REPORTER

financial crisis.

Fannie Mae said net income for

the second-quarter ending in June

was $5.1bn (3.32bn). In the first

quarter, the company said it earned

$2.7bn. The higher income allowed

Fannie Mae to make a $2.9bn

dividend repayment to the US

Treasury. So far, the company has

drawn $116.1bn in taxpayer money

and has repaid $25.6bn.

Chief executive Jan Hommen said the results were solid amid economic uncertainty

THURSDAY 9 AUGUST 2012

9

NEWS

cityam.com

Kingston

Business

School

If you want a successful career in the world of banking and

nance, this dynamic MSc course has been designed to get

you there, even if you have not graduated in this eld.

Combining the latest theory with practical implementation,

you will cover all aspects of banks, money markets,

capital markets, offshore banks, Islamic banking, regulation,

as well as corporate nance and investment concepts.

Students can gain hands on experience in the Bloomberg

Trading Room and get to grips with all types of nancial

instruments, and enrol free in Bloombergs Product

Certication Programme, ready for the working world.

Full and part time options start in September 2012

business.kingston.ac.uk/bankingandfnance

=

MSc in BANKING AND

FINANCE@KINGSTON

LONDON LOCATION

A CORNER OF A GREEN AND VIBRANT CITY

+

+

EXCEPTIONAL TEACHING STANDARDS

SPECIALIST PRACTICAL TRAINING

BLOOMBERG TRADING ROOM

RESEARCH ACTIVE STAFF

The Color Company are here when you really need us. We are

Londons leading digital print company with locations throughout

central London with the added advantage of a 24/7 branch in the

heart of Mayfair.

Our range of services include onsite and offsite print rooms, bid

production, presentations, large format and exhibition graphics,

all produced throughout the day and night.

Drop in when you need us, even if it is 3am and you need

something printed and dispatched to New York for next day*

CALL US TO DISCUSS 0800 93 94 93

or FIND YOUR NEAREST STORE on www.color.co.uk

*Authorised Fedex ShipCentre provided is

subject to standard terms and conditions

THE PRINT COMPANY

THAT NEVER SLEEPS

e when you r e her The Color Company ar

Londons leading digital print company with locations thr

central London with the added advantage of a 24/7 branch in the

. t of Mayfair hear

vices include onsite and of Our range of ser

esentations, lar oduction, pr pr

oughout the day and night. oduced thr all pr

e ar eally need us. W e when you r

oughout Londons leading digital print company with locations thr

central London with the added advantage of a 24/7 branch in the

ooms, bid fsite print r vices include onsite and of

mat and exhibition graphics, ge for esentations, lar

oughout the day and night.

e e ar

oughout

central London with the added advantage of a 24/7 branch in the

ooms, bid

mat and exhibition graphics,

op in when you need us, even if it is 3am and you need Dr

something printed and dispatched to New Y

CALL US TO DISCUSS

or FIND YOUR NEAREST STORE

ovided is e pr *Authorised Fedex ShipCentr

ms and conditions d ter subject to standar

op in when you need us, even if it is 3am and you need

ork for next day* tched to New Y Yo

CALL US TO DISCUSS 0800 93 94 93

FIND YOUR NEAREST STORE .co.uk .color on www

ovided is

ms and conditions

op in when you need us, even if it is 3am and you need

The new

jobs website

for London

professionals

THEFORUM

L L

SEE PAGES 12-13

JOIN THE DEBATE

cityam.com/forum

L

I

F

E

&

S

T

Y

L

E

T

E

C

H

N

O

L

O

G

Y

L L

SEE PAGE 16

ZOE STRIMPEL

reviews the

best travel apps

IN BRIEF

BP sells fuel arm for 40.5m

nSupport services group DCC paid

40.5m in cash for BPs liquefied

petroleum gas (LPG) distribution arm,

which supplies fuel to industrial,

commercial and domestic customers.

BP will retain its automotive LPG

business, which operates the groups

petrol stations.

Sportingbet on track for profit

nSportingbets full-year profits, due in

October, will meet expectations despite

challenging economic conditions in

Europe, the bookie said yesterday.

Sportingbet, which also runs a

successful operation in Australia,

reported a slump in profits in the first

quarter, following a temporary closure

of the Spanish gambling market.

Severn Trent puts unit on the block

n Water company Severn Trent yester-

day put its Analytical Services business

up for sale to address competition con-

cerns. The unit, which provides water

testing and landfill monitoring, accounts

for around 1.5 per cent of group rev-

enues, according to Severn Trent. Utilities

regulator Ofwat yesterday opened a con-

sultation into the sale proposal.

IAG hedges its Amadeus stake

n BA parent IAG yesterday locked in the

value of Amadeus, by hedging its entire

7.5 per cent stake in the high-flying air-

line booking system. Madrid-listed

Amadeus shares have risen by more than

30 percent over the past year, while

Spains Ibex index slid by 15 per cent.

The deal valued the shares at 492m.

G

E

T

T

Y

BRITISH defence technology group

Cobham said US budget disputes

and the impending presidential elec-

tion have hit order books, as the

company cut its earnings forecast.

Shares fell six per cent on the news,

as Cobham reported a five per cent

drop in revenue to 892m and a 10

per cent fall in profits to 90m in the

first half of the year.

The company aims to boost its com-

mercial aviation business -- which

accounts for 32 per cent of revenues

-- to counter uncertainty over defence

spending in both the US and in cash-

strapped European countries, said

chief executive Bob Murphy, who

joined from BAE two months ago.

Cobham orders

hit by row in US

BY JAMES TITCOMB

The outlook for the US defence and

security market for the end of 2012

and 2013 is particularly uncertain

due to the upcoming US elections

and the lack of political consensus on

US government budgets, Murphy

added.

Cobham PLC

8Aug 2Aug 3Aug 6Aug 7Aug

225.0

222.5

227.5

230.0

232.5

235.0

237.5

240.0 p

225.70

8Aug

CATHAY Pacific Airways yesterday

posted its worst first-half loss since

2003, surprising investors with

complaints of weak cargo traffic,

high fuel costs and a fall in

premium passengers.

Hong Kong-listed Cathay, which

issued a profit warning in March,

reported a net loss of HK$935m

(77m) for the six months to the

end of June, its weakest

performance since the outbreak of

a viral epidemic in 2003 spooked

Asian flyers.

European freight business was

particularly slow in the half,

Cathay Pacific posts worst half

since 2003 as fuel costs surge

BY MARION DAKERS

knocking cargo revenues down 7.6

per cent to HK$11.9bn.

In a further blow, the firm

reported that fuel costs rose 6.5 per

cent on a year ago, accounting for

41.6 per cent of total operating

expenses.

Passenger numbers rose 8.6 per

cent to 14.3m, but the firm said

yields came under pressure due to

a slide in premium traffic.

Shares fell 4.3 per cent yesterday.

Chairman Christopher Pratt said:

Aviation will always be a volatile

and challenging industry and our

business will always be subject to

factors... which are beyond our

control.

RYANAIR failed to halt a

competition probe into its

minority stake in takeover target

Aer Lingus.

The Competition Appeal

Tribunal yesterday threw out

Ryanairs case, allowing an

investigation by the Competition

Commission to continue.

Ryanair loses Aer Lingus appeal

BY MARION DAKERS

Ryanair tried to argue that the

body did not have the power to

investigate its 30 per cent stake.

Aer Lingus welcomed the

decision, saying in a statement it

looks forward to assisting the

Competition Commission in its

ongoing investigation.

Ryanair, which offered to take

over Aer Lingus in June, plans to

appeal yesterdays ruling.

THURSDAY 9 AUGUST 2012

10

NEWS

cityam.com

Cathay chairman Christopher Pratt said aviation was a volatile and challenging industry

THURSDAY 9 AUGUST 2012

11

LONDONREPORT

Wall St almost

flat as volumes

remain down

T

HE Standard & Poors 500 just

barely extended a streak of

gains to a fourth day yesterday,

ending above 1,400 in another

thinly traded session.

Expectations for stimulus from the

European Central Bank and the US

Federal Reserve triggered the recent

gains, but investors found little reason

to keep pushing stocks higher after

driving the market to three-month

highs.

The three major US stock indexes

opened lower but recovered at midday,

led by consumer staples and health

care. Both are defensive plays, an indi-

cation that investors are keeping their

enthusiasm in check.

In a sign of that weakening demand,

McDonalds fell 1.7 per cent to $87.53

after reporting flat same-store sales in

July, the worst performance for the

Dow component in more than nine

years. The Bank of England gave little

indication that it would rush to pour

in further stimulus even as it sharply

cut its forecast for medium-term eco-

nomic growth in Britain. Frances cen-

tral bank forecast a contraction in

growth going into the third quarter,

citing weak demand from the periph-

ery and Britain.

The Dow Jones industrial average

rose 7.04 points, or 0.05 per cent, to

13,175.64 at the close. The Standard &

Poors 500 Index edged up just 0.87 of a

point, or 0.06 per cent, to finish at

1,402.22. But the Nasdaq Composite

Index slipped 4.61 points, or 0.15 per-

cent, to end at 3,011.25.

Spanish benchmark 10-year debt

yields briefly rose above seven per

cent, underscoring the cautious tone

from investors recently disappointed

by lack of coordination from European

officials in their efforts to revive the

troubled region.

B

RITAINS blue chip share index rose

by just a few points yesterday,

consolidating around a four-month

peak as a slide in a batch of stocks

trading without their dividend

entitlements offset gains in banking and

mining stocks.

Fifteen blue chip stocks traded ex-

dividend yesterday including

heavyweights Royal Dutch Shell, BP,

AstraZeneca, GlaxoSmithKline, and

Barclays knocking 25.41 points in total

off the FTSE 100.

Standard Chartered, which was also

trading ex-dividend, rebounded seven

per cent after losing more than 20 per

cent over the previous two days after

New Yorks regulator accused the

London-based bank of hiding

transactions tied to Iran.

At the close, the UK blue chip index

was up just 4.68 points, or 0.1 per cent at

5,845.92, although that was its highest

closing level since early April.

The index showed little reaction to the

Bank of Englands sharp cut in its

medium-term economic growth forecast

for Britain in its latest inflation report.

The bank said the factors that have

dragged on growth since the financial

crisis may persist longer than first

thought.

Miners were strong performers, led by

Rio Tinto, which gained 2.9 per cent

after its first-half results came in at the

better end of expectations. Rio saw a 34

per cent drop in first-half profit, but said

it

was sticking to its $16bn spending

plans for the year. Peer Xstrata was also

higher, up 1.8 per cent after its well-

FTSE maintains its four-month high

despite hit from ex-dividend stocks

BESTof theBROKERS

Serco Group PLC

2Aug 3Aug 6Aug 7Aug 8Aug

610

605

595

585

590

600

575

580

p 579.00

8Aug

SERCO

UBS has moved its rating

on the firm from buy to

neutral with a target

price of 6, after a strong

share price performance,

remaining upbeat on the

UK and Europe but less

optimistic on the US

business.

DASHBOARD CITY

NEW YORK

REPORT

YOUR ONE-STOP SHOP FOR JOB MOVES,

BROKER VIEWS AND MARKET REPORTS

cityam.com

WHoLz ScoTTisH LoasTzn & CHis

eoisois o= esicnvi - eoisois o= eiseoescxs - eoisois o= cnv wen=

19.9S

15 Eccleston Street,

London, SW1W 9LX

020 7730 6922

Swedeland Court,

202 Bishopsgate

London, EC2M 4NR

020 7283 1763

Cabot Place

Canary Wharf

London, E14 4QT

020 7715 5818

S

u

b

j

e

c

t

t

o

a

v

a

i

l

a

b

i

l

i

t

y

u

n

t

i

l

1

6

A

u

g

u

s

t

2

0

1

2

TELEPHONE RESERVATIONS ONLY.

Quote CITY AM when making your booking.

coio, eoceso on cniiiso wixe ceies on sio

"oisoALz TnANsronm A

cnzAT mzAL iNTo AN zvzNT

www.soisois.co.u

ricii !iuss

FTSE

2Aug 3Aug 6Aug 7Aug 8Aug

5,850

5,800

5,825

5,725

5,750

5,775

5,700

5,675

5,845.92

8 Aug

National Grid PLC

2Aug 3Aug 6Aug 7Aug 8Aug

695

690

680

670

675

685

p 690.50

8Aug

NATIONAL GRID

Liberum Capital has

upgraded the utility from

hold to buy with a

raised target price of 730p

after seeing proposals for

the firm until 2021. It

estimates annual total

return of nine per cent

over the next eight years.

Secure Trust Bank PLC

2Aug 3Aug 6Aug 7Aug 8Aug

800.00

1,100.00

1,000.00

900.00

850.00

p 1,091.00

8Aug

SECURE TRUST

Numis has downgraded

Secure Trust Bank from

add to hold and cut

the target price from

1223p to 1167p. The broker

says the shares now offer

fair value to investors,

rather than being cheap

as they were previously.

Utilyx

The energy management

specialist has appointed Jo Butlin

as its managing director. She has

an extensive career in the energy

sector, including senior roles at

Powergen, and she most recently

worked as vice president,

operations at SmartestEnergy.

Bahrain Mumtalakat

The investment arm of the Kingdom of Bahrain has

appointed Tony Robinson as its new chief financial officer.

He joined in April 2011 as investment manager and

coordinator, and previously held management roles at RAC

Insurance and a Bahraini investment bank.

Charles Stanley

The stock broker has announced the appointments of

Matthew Guy and Joanna Danes as investment managers in

its asset management department. They both join from

Barclays Wealth, where they were investment managers.

Pioneer Investments

The investment management firm has expanded its

European equity research team by appointing two research

analysts. Nick Aslibekian joins from Standard Life as a

healthcare analyst. Virna Valenti becomes a financials

analyst. She was previously a senior credit analyst at

Pioneer Investments.

Valiant Petroleum

Stephen Horton and Philip Vingoe have joined the oil

exploration company as non-executive directors. Horton

worked at BP for 27 years, and reached the position of

worldwide director of drilling. Vingoe also worked at BP,

and was most recently its chief geophysicist.

Jones Lang LaSalle

Guy Bransby has been promoted to the role of regional

director at real estate services firm. He was previously lead

director of its planning and development team.

WHOS SWITCHING JOBS Edited by Tom Welsh

+44 (0)20 7092 0053

morganmckinley.com

SPECIALISTS IN GLOBAL PROFESSIONAL RECRUITMENT

CITY MOVES

To appear in CITYMOVES please email your career updates and pictures to citymoves@cityam.com

in association with

F

OUR years after she was

plucked from Juneau, Alaska,

in an ill-fated attempt to save

John McCains presidential

campaign, Sarah Palin

continues to confound. Books, Tea

Party rallies and appearances on Fox

News have provided her with a

powerful soapbox. In this years

Republican Senate primaries, just

one of the five candidates she has

endorsed has witnessed defeat. Most

vice presidents cant boast of this

kind of rapport with the grassroots.

Neither can most Presidents.

As Queen of the Tea Party, Palin

has taken an erstwhile diffuse but

highly-motivated movement of free

market activists and social

conservatives, and consolidated

O

LYMPIC mania seems unable

to prevent the coalition from

entering a new crisis phase.

The latest nail in the coffin

was the Bank of England

revising down its UK growth forecast

for 2012 to zero, which heaped more

pressure on a government already

beset by political problems.

The abandonment of House of Lords

reform has angered the Lib Dems. Nick

Clegg has vowed to vote against the

changes to constituency boundaries

considered crucial to the Conservatives

winning a majority in 2015. For those

who warned of the dangers of coalition

government, this transactional, tit-for-

tat approach to policy is unsurprising.

But the key point is that it will leave

huge resentment between the two par-

ties unless they can agree on a new

agenda.

For the Prime Minister, these woes

were compounded by the resignation

of Louise Mensch, the Conservative MP

for Corby. Her departure will result in a

by-election and an almost inevitable

loss of the seat to Labour. This may not

seem significant, but Toby Fenwick of

Spread betting, CFDs and

Trade today at www.cityindex.co.uk/dailyfact

Canadian housing starts have

doubled since their 2009 low while

unemployment is near a 3-yr low.

FACT OF

THE DAY

cityam.com/forum

The resignation of

Louise Mensch makes a

centre-left coalition

mathematically possible

THEFORUM

Twitter: @cityamforum on the web: cityam.com/forum or by email: theforum@cityam.com

Agree? Disagree? Got a sharp comment?

The Forumwants you to join the debate.

Top responses will be reprinted in The Forum.

12

THURSDAY 9 AUGUST 2012

RYAN BOURNE

Only radical reform can pull us out

of a growing economic quagmire

Fleishman Hillard has pointed out that

it will make a centre-left coalition

mathematically possible for the first

time. A Labour-Lib Dem coalition, sup-

ported by their Northern Irish spin-

offs, Plaid Cymru and the Green party,

would not require the support of the

Scottish National Party or Democratic

Unionist Party. The Lib Dems might

just have a potential escape route from

the coalition after all, meaning David

Cameron cant take their continued

support for granted.

The preservation of the coalition

requires a new, unifying agenda.

Rhetorically, at least, all agree that the

economy is the top priority, and the

government plans to use legislative

time, freed up by the abandonment of

Lords reform, for a grandly-named

Economic Regeneration Bill.

This makes sense. Our economy is 4.5

per cent smaller than its peak at the

start of 2008, and the governments

watered-down deficit reduction strate-

gy is predicated on optimistic growth

forecasts. Meanwhile, the two parties

only hope of electoral success is a sig-

nificantly growing economy by 2015.

Ronald Reagan once opined that voters

will ask whether they are better off

than at the last election. The answer at

the moment is a resounding no.

What, then, should this bill for the

economy contain?

So far, public current expenditure

has continued to rise, as capital spend-

ing has been slashed and a range of

taxes hiked. You dont need to be a

Keynesian to realise that this combina-

tion is likely to hurt growth, both in

the short and medium term. The coali-

tion should instead scale back on the

functions of the state, and merge some

current government departments to

encourage more joined-up thinking

and to save money. Any savings, and

deeper cuts to current expenditure,

should be used for targeted tax cuts on

business and increased infrastructure

investment in projects like new airport

capacity where limited government

funds can unlock huge private sector

investment.

More important, however, is the need

for dramatic supply-side reform.

Planning laws should be liberalised,

not just to fast-track new infrastruc-

ture, but to encourage home building.

This is desperately needed, and yet

planning laws exclude vast amounts of

green belt land and put existing home-

owners in a strong position to block

new development. A scrapping of the

sustainable development require-

ment should form part of a deregulato-

ry component of the bill. This would

also exempt smaller businesses from a

raft of job-destroying regulations and

employment legislation.

Energy policy should also be re-exam-

ined and focused towards growth. Last

week, a US economist compared the

UKs decision to ignore shale gas with

deciding to ignore a cure for cancer. Its

unforgivable that we are neglecting a

domestic source of cheap fuel. It also

highlights a lack of clarity of thought

on energy policy. The government

wants more gas (largely imported), but

next year is set to make gas more

expensive by introducing a carbon

price floor. This must be abandoned

it will make us uncompetitive, and

merely exports carbon emissions else-

where. Cheaper energy is essential to a

rebalancing away from credit-based

industries, and the UK is well-placed to

expand advanced, high-tech manufac-

turing if these conditions are realised.

Will the desire for self-preservation

prove enough for the two parties to

undertake the radical economic action

necessary? We can only hope.

Ryan Bourne is head of economic research

at the Centre for Policy Studies.

them into her own Palin-branded

coalition. Elites despise her, but

Palins stump speeches at Tea Party

rallies get activists to trudge to the

polls, donate to candidates, and toil

in their campaign offices. The Tea

Party movement has seen its

obituary sketched out before but,

with Palin, its more organised and

relevant than ever. These are also

the very people Mitt Romney needs

to mobilise to vote for him in

November. But does this mean he

needs Palin?

There is certainly a segment of the

electorate that is attracted to Palin.

But her enormous favourability

deficit in national polls has

prevented her from taking on a

more prominent role in Romneys

presidential campaign. Romney

already has some Tea Party proxies,

but he also understands cost-benefit

analysis. Some Republicans shun

Palin rather than endure jabs from

their opponents. Palin wont have

been on Romneys vice presidential

shortlist and shes unlikely to give a

speech at the Republican

convention. Even Palins most

fervent supporters are well aware of

her liabilities. A poll earlier this year

indicated that two thirds of Tea

Partiers opposed her running for

President. They adore Palin. But they

care more about defeating Barack

Obama.

Palin has not faded into

insignificance in the presidential

elections solely because of her

divisiveness. Its also because shes

not really needed. One Republican

operative in a key swing state put it

simply: In a race this tight, staying

at home, or not voting for Romney

on Election Day, gets Obama re-

elected. The Tea Party doesnt need

Palin to get motivated to defeat

Obama, even if its reticent about

supporting Romney. Palin might

speak on behalf of the Tea Party

movement. But, in November, the

Tea Party is already spoken for.

The Tea Partys relationship with

Romney is one of common interest.

It could only truly break down over

the selection of his running mate, or

if it had reason to believe he would

renege on his pledge to repeal

Obamas healthcare law. But,

whether Romney wins or not, Palin

will emerge in November with a

handful of conservative Republican

senators in Washington with her to

thank for their seats. What currently

matters to the Tea Party, however, is

winning the biggest seat of all.

Ewan Watt is a Washington DC-based

consultant. You can follow him on Twitter

@ewancwatt

THE WHITE

HOUSE RACE

EWAN WATT

Romney can mobilise the Tea Party without Sarah Palins divisive favours

In association with

FX trading can result in losses greater than your initial deposit.

TRADE USD/CAD WITH

CITY INDEX TODAY

13

Anti-British bias

[Re: Standard Chartered is the victim of US

warfare against British banking, yesterday]

John Mann is correct. US regulatory

pressure is unfair, excessive, and

unbalanced, and solely seeks to protect US

self-interests. The UK government should

protect British interests unequivocably. We

shouldnt fear the loss of the strategic

partnership, especially if it is used by one

side as a means of arm-twisting the other.

SimonShaw

The US political trend to blame the British

pre-dates this current election season. We

shouldnt forget Obamas frequent references

to British Petroleum, after BPs Deepwater

Horizon crisis in the Gulf of Mexico.

LeoLiebster

Coalition chaos

[Re: After Lib Dem-Tory splits on

constitutional reform, will the coalition last

until 2015, yesterday]

Mark Field is wrong to assume that the

coalitions central economic purpose will

hold it together. Any blind man can see that

it wont last its full course. The closer it gets

to a new election, the more the Lib Dem

panic will set in. Theyll leave in droves

towards the end.

Andrew Jackson

I dont think many people care if the

coalition will last. It has no public support,

shocking economic credentials, and its only

attractive because it stands in the way of

government by Ed Miliband.

Paul Monford

T

HE countrys heroic athletes

may have grabbed all the

headlines, but they are far

from the only Britons to have

risen to the challenge of

making the London 2012 Olympics

such an overwhelming, mood-

boosting success.

There is another group of people,

which has brought every bit as much

sunshine into the lives of Londoners,

and the multitudes visiting for these

two weeks, as Mo Farah or Jessica

Ennis or GBs near-invincible

cyclists but without the fanfare.

Except this group doesnt depend

on gold medals or world records or

even making a final; they are on

their game every single day and

dont get anything back but a smile

or some fleeting bonhomie.

They are the Games Makers, the

purple and pink bedecked volunteers

who line the route to our gleaming

new venues, gently, merrily helping

spectators on their way.

I have been to every day of the

Games, from Stratford to

Wimbledon, Greenwich to Hyde

Park, and I havent heard anything

but effusive praise about a single one

of them. What politicians would do

for that kind of approval rating.

Their brilliance lies in their pecu-

liarly amateurish British jollity,

which makes them much more than

mere stewards. It would be enough if

they just performed their primary

function, coaxing people in the direc-

tion of the Olympic Stadium or the

ExCel. But they also act as cheerlead-

ers, high-fiving and cajoling passers-

by with an irresistible enthusiasm.

Whoever encouraged them to be so

expressive is a genius. It might have

been easier, less problematic, to tell

them just to do their jobs. But, by

allowing them personality, they have

become the living, breathing, laugh-

ing face of London 2012. Some even

TOP TWEETS

Its up to UK regulators, not US, to show that

they are determined to learn lessons and clean

up quickly, vigorously and transparently.

@TWJGrey

Mervyn King blames the euro and oil prices for

weak growth. He doesnt mention consumers

squeezed by inflation and the weak pound.

@asentance

Im not sure David Cameron is the kind of

visionary leader who can outline a new

economic path for the UK. He tinkers at best.

@CintaArsenal

The government says it will put 110 per cent

into saving the economy. Thats all you need

to know about its business acumen.

@PadBrit

As Manchester United nears its share listing,

is the club likely to prosper by going public?

YES

Manchester Uniteds listing raises issues at the heart of football

finance. This listing values United almost 50 per cent greater than the

1.5bn it is quoted at elsewhere. But there are three ways it can be

justified. First, the club has potential, especially if it can monetise its

Asian fan base. Secondly, United has a unique brand position. And

thirdly, its competitors can only hope to catch up with its status by

spending vast amounts of money. The owners of Chelsea and

Manchester City have spent billions to do this. Ultimately, the club

will not pay reasonable dividends to shareholders. Only half the sale

will go to paying down debt, leaving United with debts of around

350m. Equally, fans are demanding that more is spent on new

players. But the club has a remarkable ability to confound sceptics,

as its latest sponsorship deal with General Motors shows.

Tom Cannon is professor of strategic development at the University

of Liverpool Management School.

Tom Cannon

NO

Duncan Drasdo

Although public ownership has some key advantages, it isnt the key

question. Who does the owning is. We oppose this IPO, but were

not against the principle wed just like to see a fairer offer, with the

interests of the club, supporters and shareholders given equal

consideration. Barcelona and Real Madrid are fan-owned, but

perhaps the German clubs have executed the model most

successfully. Their commercial revenues per supporter dwarfs that of

privately owned clubs like Manchester United. Supporter-club

affinity is the key. Companies need shared agendas with all their

stakeholders, and in football its even more crucial. Fans deserve a

vested interest in the clubs they support passionately and financially.

We dont want to run United leave that to the professionals. Wed

just like owners to have the same interests as fans.

Duncan Drasdo is chief executive of the Manchester United

Supporters Trust.

RAPIDresponses

have megaphones, which they

employ with visible relish.

Most incredible of all, perhaps, is

that they are doing it for nothing but

the experience. We endure miserable

customer service all too often, and

thats from the professionals. These

selfless individuals outperform the

vast majority of their paid counter-

parts without any material reason.

Its a motivational marvel.

Perhaps to some extent its because

we expect less, due to their volunteer

status. Rather than taking their assis-

tance for granted, we are grateful for

their homespun, genuine eagerness,

like kindly village fete attendants

manning the raffle stall.

There is no shortage of candidates

for praise where this Games is con-

cerned from Danny Boyle and his

extraordinary crew of performers

(also volunteers) at the opening cere-

mony, to the athletes themselves

and, some ticketing issues aside,

administrators such as Lord Coe and

Dave Brailsford.

Many of those will likely receive fur-

ther rewards in the Queens New

Years Honours. But what of the

Games Makers? It may be unlikely

that theyll receive the gold medals

for showcasing this country that

they deserve, but a permanent trib-

ute in the renovated Olympic Park

would be a start. For truly making

this Games, it is the least they

deserve.

Frank Dalleres is sports editor of City

A.M. You can follow him on Twitter

@frankdalleres

THURSDAY 9 AUGUST 2012

FRANK DALLERES

Printed by Newsfax International, BeamReach 5 Business Park, Marsh Way, Rainham, Essex, RM13 8RS

Distribution helpline

If you have any comments about the

distribution of City A.M.

please ring 0203 201 8955, or email

distribution@cityam.com