Академический Документы

Профессиональный Документы

Культура Документы

Fertilisers Note

Загружено:

Harsh BajpaiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fertilisers Note

Загружено:

Harsh BajpaiАвторское право:

Доступные форматы

ICRA Rating Feature

Indian Fertiliser Industry: Subsidy policy changes to determine the industry growth trajectory

Contacts Anjan Ghosh aghosh@icraindia.com +91-22-30470006 K. Ravichandran ravichandran@icraindia.com +91-44-45964301 Ankur Malik ankurm@icraindia.com +91-124-4545347

SUMMARY OPINION

The Indian fertiliser industry has registered a modest demand growth at a compounded annual growth rate (CAGR) of 5.02% over the last five-year period from FY 2004-05 to FY 2009-10. The modest demand growth along with stagnant domestic production led to a sharp increase in imports, reflecting a CAGR of 28.53% along the aforementioned period. ICRA expects healthy growth in the demand for fertilisers, especially phosphatic and other complex fertilisers, on the back of promotion of a more balanced nutrient consumption, with the new nutrient-based subsidy (NBS) policy of the Government of India (GoI) that is effective from 1 April 2010. ICRA expects major policy changes for urea such as the new urea investment policy; modification of the New Pricing Scheme (NPS)-III subsidy policy or adoption of NBS in the near term. Subject to regulatory clarity, ICRA expects the near-to-medium term outlook for the existing operations of cost-efficient urea manufacturers in India to remain stable. The existing urea policy has failed to encourage investments in brownfield and greenfield projects because several issues including rising gas prices have not been fully addressed. The GoI is, therefore, working on new policy changes to propose increase in floor prices; improvement in percentage relationships with the import parity price (IPP) and linking of the latter to gas prices. These changes are expected to be announced in the near term. Assured availability and competitive prices of natural gas are critical for the viability of new urea projects. As for the gas allocation policy of the GoI, the urea sector has been accorded the highest priority. Despite the high priority in gas allocation, which provides some comfort, there is also dependence on Regassified Liquified Natural Gas (R-LNG) for the shortfall. The higher average price on account of rising gas prices results in higher subsidy burden for the GoI within the current framework. However, under the import-paritybased subsidy for new projects and eventual implementation of NBS, the price increase will have to be borne by the respective companies, thus making a negative impact on the profitability of the fertiliser industry. The GoI is considering implementation of a uniform gas pricing policy (through pooling mechanism), which would mitigate the impact of consumption of high-cost gas. In ICRAs view, the credit risk profiles of a few urea manufacturers could deteriorate in the near-to-medium term and their capital structures could be under downward pressure, if they were to finalise their large-scale, capitalintensive, brownfield/greenfield projects, which may be primarily debt-funded.

February 2011

Website www.icra.in

ICRA Rating Services

Page 1

ICRA Rating Feature

Industry Outlook: Fertilisers

Move towards nutrient based subsidy (NBS) in non-urea fertilisers is an important measure by the GoI towards curtailment of subsidy and attainment of a stronger bargaining position in price negotiations with foreign suppliers of inputs and fertilisers. ICRA views the NBS as a long-term positive for the industry owing to lower reliance on subsidy and higher pricing freedom. ICRA also considers the encouraging demand response despite the farm gate price hike as a positive development for the fertiliser industry. ICRA notes that GoIs move to reduce NBS subsidy benchmarks (for FY12) in order to negotiate lower input and fertilisers prices by flexing its bargaining power was not successful. The northward movement in the international prices created divergence with the subsidy benchmarks, thereby leading GoI to roll back the subsidy in order to protect the interests of the industry participants and the farmers. While NBS originally was aimed at a stable subsidy regime, on the strength of the latest development, ICRA expects GoI to intervene and make adjustments to subsidy in a scenario when international price movements and negotiated prices are in major divergence with prefixed benchmarks, atleast over the short to medium term. As a result, the profitability outlook for the phosphatic & complex fertiliser manufacturers should be stable over the medium term. Over the longer term, the interplay of international fertiliser prices; negotiations with suppliers; gradual hike of farm gate prices and subsidy adjustments would determine the profitability of participants in the phosphatic and complex fertilisers industry. ICRA expects the modest influential position of India in the international fertilisers market and strengthening supplier relationships to increasingly contribute towards parity between NBS benchmarks and international prices over the longer term. The provisioning and timeliness of subsidy payment by the GoI in the Union Budgets have remained relatively adequate in the recent past. Going forward, gradual farm gate price decontrol and direct payment of subsidy to the needy farmers, although the idea is riddled with several challenges, should help contain subsidy outflows and improve the liquidity position of the companies over the longer term. With the strategic importance of the fertiliser industry in ensuring food security for the country and price sensitivity associated with the farming community, ICRA expects GoI to continue to control the fertiliser industry over the long term even while initiating reforms (on a limited scale) to the benefit of cost-competitive industry participants.

BACKGROUND The Indian fertiliser industry can be broadly divided into three categories depending on nutrient composition, namely, nitrogenous (N), phosphatic (P) and potassic (K). Due to the political sensitivity of fertiliser prices, the industry has been heavily regulated for decades by the Government of India (GoI). Such regulations have covered among others the farm gate price (FGP); types of fertilisers eligible for subsidy; distribution pattern and returns that can be earned by manufacturers. The level of control varies with the segments, with urea being the most controlled fertiliser. Urea is the key fertiliser consumed within the nitrogenous fertilisers segment and accounts for around 50% of all fertilisers consumed in India. Phosphatic fertilisers are consumed in the form of complex fertilisers with varying levels of NP [that is, mixtures of Nitrogen and Phosphorous including Di Ammonium Phosphate or DAP], and NPK [that is, mixtures of Nitrogen, Phosphorous & Potassium]. Pottassic fertilisers mainly comprise Muriate of Potash (MOP), which is not manufactured in India and is entirely imported.

KEY TRENDS & RATING IMPLICATIONS Healthy demand growth and stagnancy in production due to policy and pricing uncertainties result in higher dependence on imports of fertilisers. Demand growth has been aided by price protection of fertilisers in a volatile commodity price scenario. However, improved farm economics provide scope for gradual increase in prices and reduction in subsidy. The domestic demand growth for fertilisers has remained healthy on the back of healthy crop prices and rising nutrient application rates. On the other hand, domestic production of fertilisers has stagnated on account of lack of encouraging policies for fresh investments and constraints with

ICRA Rating Services Page 2

ICRA Rating Feature

Industry Outlook: Fertilisers

respect to availability and prices of raw materials. Consequently, there has been higher dependence on imported fertilisers and, therefore, an increase in the subsidy bills of the GoI, particularly during times of spikes in commodity prices. The demand growth has been aided by the stable farm gate price regime over the last decade. The farm gate prices of fertilisers in India have remained largely constant in 2000-2010 even during periods of sharp fluctuations in fertiliser and input prices, thus leading to a high level of subsidisation. Nevertheless, the rising crop/grain prices should enable farmers to absorb the higher prices of fertilisers, as reflected to a moderate degree in 2010-11, when fertiliser demand posted a robust growth despite a 5-10% rise in prices. Chart 1&2: Trend in Farm Gate Prices and International Prices of Urea and DAP

30000

25000

20000 15000

10000 5000

0

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

45000 40000 35000 30000 25000 20000 15000 10000 5000 0

Urea MRP (Rs/MT)

Urea Imported price (Rs/MT)

Source: FAI; ICRA Analysis With the above industry backdrop, the perspective of ICRA on the demand for key fertilisers is as follows: Urea: The domestic consumption of urea has grown steadily at a CAGR of 5.2% during the period from 2004-05 to 2009-10. The production of urea in this period remained stagnant at around 20-21 million MT due to feedstock constraints and lack of fresh capacity on account of policy uncertainties. Due to stagnancy in indigenous production, the imports grew at a significant rate. Even the recent increase in farm gate prices (by 10%/ Rs. 480/MT with effect from 1 April 2010) has not affected consumption levels, as the prices remained unchanged over the last decade while foodgrain prices increased manifold during the same period. Urea consumption witnessed an increase of 5% in the period from April 2010 to November 2010 (8M 2010-11) over the same period in the previous year. ICRA expects the demand growth in urea to be moderate at around 3% due to the potential for move towards a more balanced nutrient consumption. Chart 3: Demand-Supply Gap of Urea in India

30.00 25.00

millon MT

20.00 15.00 10.00 5.00 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10

Domestic Consumption

Domestic Production

Imports

Imports % of Demand

Source: FAI; ICRA Analysis

DAP: The dependence of India on DAP imports increased significantly to 60% in FY 2009-10 from 10% in FY 2004-05 on account of a steady rise in demand and stagnancy in domestic production due to raw material constraints as well as price volatility. The domestic production witnessed a moderate decline during the period from 2004 to 2008 on account of raw material constraints (mainly

ICRA Rating Services Page 3

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

DAP MRP (Rs/MT)

DAP Imported price (Rs/MT)

30% 25%

20% 15% 10% 5% 0%

ICRA Rating Feature

Industry Outlook: Fertilisers

phosphoric acid and rock phosphate), while a significant decline was witnessed in FY 2008-09 due to production cutback in a scenario of crash in DAP prices in H2, FY 2008-09, which normalised in 200910. While production levels have remained volatile, consumption has shown a consistently high growth of 23% in 2008-09 and 13% in 2009-10. The demand growth slowed down to 5% during 8M 2010-11 over the corresponding period in the previous year due to greater substitution by complex fertilisers. ICRA expects domestic demand for DAP to grow at 5% a year while high import dependence should continue in the medium term due to lack of any major capacities. Chart 4: Trend in Domestic Production, Consumption and Imports of DAP

120.00 100.00 70%

Lakh tonnes

90% 80%

80.00

60.00

60%

50% 40%

40.00

30% 20%

20.00

10% 2004-05 2005-06 2006-07 2007-08 2008-09 Imports 2009-10 7M 2010-11 Imports % of Demand 0%

Domestic Consumption

Domestic Production

Source: FAI, Industry, ICRA Analysis Complex Fertilisers: The demand for complex fertilisers has averaged at around 6% over FY 200810. The trend in production for complex fertilisers differs from that of DAP due to substitution between the two, depending upon subsidy and international price levels, as reflected in the varying consumption patterns. A positive development has been the opening up of imports of complex fertilisers with effect from 1 April 2010 and the move towards NBS, which has encouraged the consumption of customised complex fertilisers. As a result of healthy demand growth and higher availability, the demand for complex fertilisers increased by 33% in 8M 2010-11 over 8M 2009-10. The resilience in demand growth in a period marked by an increase in complex fertiliser prices by around Rs. 1,000/tonne proves the underlying potential in the sector, according to ICRA. Chart 5: Trend in Domestic Production, Consumption and Imports of Complex Fertilisers

90.00 80.00 25% 20% 15%

70.00

Lakh tonnes

60.00 50.00 40.00

10% 5%

0% -5%

30.00 20.00

10.00 -

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

Domestic Consumption

Domestic Production

Growth in demand

Source: FAI, Industry; ICRA Analysis

ICRA Rating Services

Page 4

ICRA Rating Feature

Industry Outlook: Fertilisers

Changes in Subsidy Framework for Different Fertilisers and Related Issues UREA: Urea industry functions under normative cost plus return based subsidy mechanism (that is, NPS); modifications to the prevailing NPS-III expected to be announced in the near term: The urea units in the country function under the New Pricing Scheme (NPS), wherein they are divided into six groups depending on their feedstock and plant vintage. The subsidy (above the farm gate price) is linked to the actual Retention Price (RP) of the units or the group average RP, whichever is lower. Under NPS-III (which was functional with effect from 1 April 2006), the normative parameters pertaining to capacity utilisation and energy consumption were tightened and capital related charges (CRC) and conversion costs were further rationalised as compared to NPS II. These had offset some of the positive features like higher reimbursement of energy savings, update of freight costs and reimbursement of actual taxes on inputs, thus leading to a marginal decline in profitability for the industry. (See Charts 6 & 7.). Chart 6 & 7: PBIT Margins & RoCE of Major Urea Manufacturers in India

25.0%

30.0%

25.0%

RoCE (%)

PBIT Margin (%)

20.0%

15.0%

10.0% 5.0% 0.0% 2006-07 2007-08 2008-09 2009-10

20.0% 15.0% 10.0% 5.0% 0.0% 2006-07 2007-08 RoCE Chambal (Fert division) KRIBHCO RCF (Thal Urea division) IFFCO NFL Zuari 2008-09 2009-10

PBIT Margin

Chambal (Fert division) IFFCO

KRIBHCO

RCF (Thal Urea division) Median

NFL

Zuari Linear (Median)

Median

Linear (Median)

Source: Annual Reports; ICRA Analysis While urea units are assured a return of 12% post-tax RoE, their actual performance depends upon their RP in relation to group average; energy consumption in relation to their own pre-set norm; capacity utilisation levels and under recoveries on certain operational expenditure and taxes. The median return on capital employed (RoCE) of above six urea players has been 12.5% over the last four years, whereas efficient players such as Chambal Fertilisers and RCF have turned in RoCE of around 18-19% during the same period. Although NPS-III expired on 1 April 2010, GoI has extended it further on a provisional basis. A modified version of NPS is expected to be announced in the near term, a key expectation from which is increase in the fixed cost component of RP by Rs. 350/tonne so that the actual rise in fixed costs will be defrayed to some extent. As the fixed cost part of RP has not been revised since 2002-03, a marginal increase in the same will be a positive for the industry. Conversion of liquid fuel based urea units into gas is essential to reduce overall subsidy outflow; however, significant delays have occurred due to constraints on gas availability and pipeline connectivity to such units. In order to reduce overall subsidy outflow, the GoI mandated conversion of high-cost, liquid fuel (naphtha, Furnace Oil (FO), Low Sulphur Heavy Stock (LSHS) based units into natural gas under NPS-III. The original deadline (of 31 March 2010) laid down under NPS-III for conversion was extended by the GoI due to non-availability and connectivity of gas for most of these units. Upon expiry of the deadline, subsidy to such units was to be restricted to prevailing import parity price or their own RP, whichever is lower. In order to assist the units to achieve completion, the GoI has ensured gas availability and connectivity to such units. Among such units, the naphtha-based units (such as ZIL, MCFL and MFL) are supposed to recover their investments through energy savings (for a period of 5 years), as their energy consumption norms would not be revised during this period. Besides, the units would also benefit from lower working capital (due to lower cost of feedstock) and excess ammonia production. However, in case of FOLSHS based units (such as GNFC and NFL), the capital expenditure required for conversion is relatively steep in relation to the naphtha-based unit; and energy savings alone are not sufficient to ensure viability. As a result, the GoI has announced a provision for special fixed cost reimbursement per tonne of urea for five years for such units, which in combination with the energy savings are

ICRA Rating Services Page 5

ICRA Rating Feature

Industry Outlook: Fertilisers

targeted to generate a 12% post-tax equity return for the project. While returns under such projects are assured on paper, ICRA expects the key determinants for the same to be the achievement of the target level of energy savings and timely completion of projects without any cost overruns. Expansion of urea capacities essential to promote self-sufficiency for India and insulate against international price cycle. Indigenous gas-based urea is competitive against imports. Lack of an encouraging investment policy has discouraged investment in urea, thus resulting in higher reliance on imported urea (of about 20% in 2009-10) and the consequent high subsidy outgo, particularly during times of higher urea prices. Therefore, it is in the interest of the Government of India to promote self-sufficiency in urea, as the cost of indigenous, gas-based urea has been largely competitive as compared to imported urea and is expected to remain so in the future. As seen in Chart 8, indigenous urea has been competitive in relation to imported urea over the period from 200304 to 2018-19, even after factoring in the high-cost urea from liquid, fuel-based units. It may be noted that the cost of indigenous urea was marginally higher than imported urea in 2009-10 due to moderation in international urea prices (average of US$275/tonne in 2009-10) and increase in domestic gas prices, which has however reversed in 2010-11 with the upturn in urea prices to US$400/tonne. Nevertheless, the rising use of higher cost gas (such as R-LNG) remains a concern in this regard. Chart 8: Comparison of Subsidy on Imported and Indigenous Urea

25000

20000

Subsidy (Rs/MT)

15000 10000

5000

0 2004-05 2005-06 2006-07 2007-08 Indigenous urea 2008-09 2009-10

Imported urea

Source: FAI; ICRA Analysis ...However, the current urea investment policy fails to encourage brownfield and greenfield investments: The existing urea investment policy was announced in August 2008. It allows for realisation equivalent to 90% of the import parity price (IPP) for brownfield and greenfield projects and 85% of IPP in case of debottlenecking/revamp projects, wherein the IPP (under both cases) is subject to a floor of US$ 250/MT and a cap of US$ 425/MT. The new investment policy resulted in an increase in indigenous urea capacity by 1.5 million MT, (that is, 7% of domestic capacity) by way of revamped projects. Although many companies announced brownfield expansion plans, the investment policy has failed to encourage finalisation of these plans. This is due to the fact that the viability of such projects is uncertain on account of increasing gas prices and inadequate compensation corresponding to the same; under-recovery in gas transportation and lack of assurance regarding gas availability in certain cases. The two key variables affecting the viability of projects under the current policy are international urea prices and gas costs. According to ICRAs estimate, the cost of production (including interest & depreciation) of urea is estimated at US$270/tonne, assuming the landed cost of gas to be US$7/mmbtu, which means the international price (FOB) of urea has to be at least US$300/tonne for such expansion projects to break even (considering the 90% linkage). Although global urea prices have shown a gradual recovery from the bottom of the commodity cycle of US$200/tonne (CFR India) in November 2008 to around US$ 400/tonne (CFR India) in January 2010, the long-term (10-year average) prices remain lower at US$256/tonne (CFR India). ICRA expects urea prices to correct in the medium term due to capacity additions leading to higher surplus. As per several independent consultant reports, the potential global urea surplus is expected to increase to 19 million MT in 2014 from 4.4 million MT in 2010. This is likely to put pressure on urea prices and the viability of these projects unless the policy is modified.

ICRA Rating Services

Page 6

ICRA Rating Feature

Industry Outlook: Fertilisers

Chart 9: Urea Brownfield Project IRR with Landed Cost of Gas at US$6.55/mmbtu1

30.00%

25.36%

Cost of production (in US$/tonne)

350 300 250 200

Chart 10: Cost of Production of Urea from a Brownfield Project at Various Gas Prices

332

311 290 269

25.00%

Project IRR (Pre-Tax)

248

227

20.00%

16.24%

15.00%

10.71% 10.00% 5.00% 0.00% 250 300 350 425 7.88%

150 100 50 5 6 7 8 9 10

IPP of urea (US$/tonne)

Landed cost of gas (US$/MMBTU)

Source: ICRA Analysis Chart 11: Trend in Urea Prices over the Last 10 Years

600 500 400 300 200

US $/Tonne - CFR India

100

0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Source: FAI; ICRA Analysis GoI considering modifications in urea investment policy upon the requests of industry participants; the ability of the new policy to address the issue of rising gas costs is critical: Due to uncertainties with respect to project returns with the current policy, given the rising gas prices, the GoI is considering changes to the policy, upon the requests of industry participants, such as: 1) increase in floor prices 2) linking of import parity urea prices to gas prices 3) increasing percentage linkage and 4) inclusion of other expenses such as custom duty, handling and bagging expenses in addition to the bare IPP. The GoI is expected to announce the changes to the policy in the near term. While ICRA awaits clarity on the new policy, it believes that the manner in which the new policy addresses the issue of rising gas costs would be most critical. Therefore, the GoI is also actively considering implementation of uniform gas pricing (through pooling mechanism), which could reduce the uncertainty covering the viability of such projects. Availability of natural gas is critical for the urea industry: The availability of gas is critical for the growth of the urea industry and assumes greater importance, given the rising demand from existing operations (that is, conversion of liquid fuel based units) and incremental capacities. In this regard, the highest priority accorded by the GoI to the urea sector in its gas allocation policy serves as a source of comfort. Capital structures of urea manufacturers are likely to get depressed due to expansion plans: Many urea manufacturers have envisaged expansion plans, which are expected to be finalised upon announcement of the new investment policy. ICRA notes that urea operations are capital-intensive, with estimated investment for a minimum economic size urea project (of 1 million MT) ranging from Rs. 4000 crore to Rs. 4500 crore. Consequently, companies that opt to finalise their expansion projects should witness an increase in their financial risk profiles.

Note: The key assumptions for the project viability are: Project cost at Rs. 42 billion for a 3,500 tpd urea plant; Energy consumption at 5.2 Gcal/tonne of urea; LCV of gas at 8,100 Kcal/m3; Rs/US$ = 45 ICRA Rating Services Page 7

ICRA Rating Feature

Industry Outlook: Fertilisers

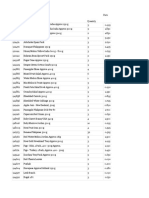

Table 1: Capital Structure of Urea Companies Contemplating Expansion Projects 31 March 2010 Gearing (times) 1.88 2.70 0.01 0.82 1.01 0.81 0.37 Net Gearing (times) 1.59 2.45 -0.34 0.06 -0.02 0.42 -0.19 Net Worth (Rs Crore) 1,390 4,271 2,697 1,837 1,069 4,283 1,408

Chambal Fertilisers IFFCO KRIBHCO RCF Zuari Industries Limited Tata Chemicals Limited National Fertilisers Limited Source: Annual Reports; ICRA Analysis

GoI contemplating introduction of NBS in urea; however, conversion of all liquid fuel-based units into gas is a pre-requisite for uniform implementation of NBS: The Government of India is also contemplating introduction of nutrient-based subsidy (NBS) for urea and decontrol of its MRP with effect from April 2011 along with decanalisation of imports. The urea industry is heterogeneous on account of varying feedstock, plant vintage and energy consumption, thereby resulting in large variations in the cost of production for each unit. As a result, the uniform adoption of NBS for urea may lead to disparity in gains amongst units. Further, due to delay in conversion of liquid fuel-based units, universal and standard implementation of NBS would be difficult to achieve in the near term. ICRA notes that even after these units are converted into gas, their energy consumption would be on the higher side, which coupled with dependence on high-cost R-LNG raise concerns about their competitiveness in a scenario of NBS and low import parity urea prices. Nevertheless, there is also a school of thought that proposes heterogeneous adoption of NBS in urea, wherein separate subsidy could be paid to liquid, fuel-based units prior to their conversion. While ICRA believes that gas-based urea is expected to be competitive in relation to imported urea (as discussed earlier), clarity is awaited on the phasing of industry towards decontrol through the NBS scheme.

PHOSPHATIC AND COMPLEX FERTILISERS Move from cost plus mechanism to import parity pricing (IPP) regime (during FY09 and FY10) introduced volatility in the performance of fertiliser companies by linking them to the vagaries of commodity price cycles: As opposed to urea, the subsidy policy for phosphatic fertilisers has undergone various changes over the last three years from 2008-09 to 2010-11, which along with the dynamic global price environment caused volatility in the financial performance of manufacturers as well as traders. Until March 2008, a cost plus based subsidy regime resulted in a separate subsidy scheme for indigenous DAP and imported DAP. The subsidy for manufacturers was based on the prices of P (rock phosphate and phosphoric acid) and N (ammonia), depending upon their levels of integration and feedstock. However, the Government of India modified the subsidy policy for DAP to 2 import parity price (with effect from 1 April 2008, which lasted until 31 March 2010) as compared to the previous cost plus mechanism, thereby equalising the subsidy on imported and indigenous DAP. 3 In case of complex fertilisers, the subsidy calculation derived the price of P , that is, phosphoric acid, from the landed cost of imported DAP as opposed to the industry negotiated price. The cost of N and K for complexes continued to be assessed as before. However, the implementation of IPP coincided with a period of high volatility in the prices of DAP and inputs in 2008-09. As a result, the manufacturers made abnormal gains by virtue of commodity price upcycle in the first half of the year 2008-09, previously unseen in the cost plus regime. However, the crash in DAP prices in H2 2008-09 and anomaly in the price parity between DAP and phosphoric acid resulted in negative and low profits during H2 2008-09 and 2009-10, respectively.

Monthly concession for import/indigenous DAP was based upon average of high/low of DAP prices published in FMB & Ferticon from US Gulf fob plus Tampa-Mundra freight for the previous to previous month or actual weighted average of landed price for the current month whichever is lower. In addition, it included interest for 105 days, normative handling & distribution charges (Rs 730/MT), return component (Rs 50/MT) and dealers margin. 3 P was derived as: (Delivered cost of Imported DAP less Conversion costs (Rs. 1979/MT) less dealer margin less cost of 18 N in DAP)/46 ICRA Rating Services Page 8

ICRA Rating Feature

Industry Outlook: Fertilisers

Introduction of NBS in DAP and complexes with effect from FY11, primarily aimed at reducing GoIs subsidy bill and commanding stronger position in price negotiations with foreign suppliers: With effect from 1 April 2011, the Government of India announced a move towards nutrient-based subsidy for non-urea fertilisers by fixing the level of subsidy for each nutrient (across non-urea fertilisers) before the start of the year based on certain price benchmark. Although the move was also accompanied by decontrol of farm gate prices, the same has been limited to the extent of 8% increase in MRP, as the same continues to be determined in consultation with the GoI. The NBS regime marks a departure from fixed MRP and variable subsidy to fixed subsidy and variable MRP regime. The move is primarily aimed at reducing GoIs subsidy bill, besides imparting pricing freedom to manufacturers as well as encouraging balance nutrient consumption. NBS also aims at keeping an indirect check on international prices of fertilisers/inputs by bringing out a fixed price benchmark (for subsidy determination), which can be used as a tool by the industry for price negotiations with industry suppliers. ICRA believes that the move towards NBS is positive for the industry over the long term due to lower reliance on subsidy and higher pricing freedom. While, scenarios such as increase in raw material prices (with fixed subsidy and farm gate prices) pose a threat to profitability of industry participants, GoI is expected to make moderate adjustments to subsidy to protect the interests of the industry. ICRA also expects improved certainty with regard to the profitability of fertiliser trading operations under the NBS regime because prior knowledge of subsidy can help importers take informed business decisions. Chart 12: Trend in International Prices of DAP and Phosphoric Acid

1,800

US$/Tonne (India CFR)

1,600 1,400

1,200 1,000

800 600 400

200 2003 2004 2005 2006 2007 2008 2009 2010 2011

DAP

Phos Acid

Source: FAI; ICRA Analysis

Box No; 1: HOW ARE SUBSIDY RATES CALCULATED UNDER NBS? Under NBS, GoI derives subsidy rates for N, P and K based on benchmark price of imported commodities: Urea, DAP and MOP, respectively. The MRP of the fertiliser is deduced from the benchmark import parity price to calculate benchmark subsidy. From the benchmark subsidy, the subsidy for the nutrient is extracted from the product subsidy based on the percentage nutrient content in the latter. An estimated derivation of the subsidy for each nutrient for FY11 is presented below:

ICRA Rating Services

Page 9

ICRA Rating Feature

Industry Outlook: Fertilisers

NBS positive for manufacturers of SSP and customised fertilisers: The manufacturers of single super phosphate (SSP) have benefited significantly from implementation of NBS, as the latter has equalised the subsidy on the P content in SSP with that in DAP. In the past, discriminatory regulations due to lower subsidy for P content as compared to DAP and inadequate price revisions resulted in weak profitability in certain years for the SSP industry. However, with the recent policy measures, ICRA expects consumption of SSP to get a fillip, resulting in increased interest by fertiliser manufacturers in this product line. Further, with inclusion of separate subsidy for micro-nutrient carrying customised fertilisers, their production and consumption should also be boosted. Profitability of manufacturers of phosphatic and complex fertilisers improves in 2010-11 due to adequate price benchmarks and stable raw material prices. The profitability of phosphatic/complex fertiliser manufacturers increased in H1 2010-11, as the level of subsidy announced under NBS for 2010-11 was higher than the previous regime, the latter having been influenced by subdued price environment. Moreover, the prices of key inputs -- phosphoric acid and rock phosphate -- remained relatively stable in the current year. Chart 13 & 14: Trend in Quarterly PBIT Margins of Phosphatic Fertiliser Manufacturers and their Median in India

25.0%

20.0%

16.0% 14.0% 13.6%

PBIT Margin (%)

Median PBIT Margin (%)

15.0%

12.0%

10.0%

5.0% 0.0%

10.4%

10.0%

8.0% 6.0% 7.1%

6.6%

-5.0%

-10.0%

Q3 2009-10

Q4 2009-10

Q1 2010-11

Q2 2010-11

4.0% 2.0%

0.0% Q3 2009-10 Q4 2009-10 Q1 2010-11 Q2 2010-11

Cormandel

ZIL Deepak Fertilisers (Fert division)

PPL

GSFC (Fert division) Liberty Phosphates

Source: Press Releases GoIs attempt to flex its bargaining power by reducing subsidy benchmarks for FY12 unsuccessful due to sharp rise in international prices, subsequent subsidy rollback is a positive for the industry participants and farmers: In November 2010, GoI announced its subsidy under NBS in advance for FY 2011-12, which marked around an average of 20% reduction in subsidy versus FY 2010-11 levels by fixing lower price benchmarks for DAP, urea and MOP. The step was aimed at negotiating lower prices with international suppliers. However, since the subsidy benchmarks were at a steep discount (25-30%) to the international prices, the industry feared decline in profitability because of inability to negotiate lower prices with suppliers and raise farm gate prices accordingly. As a result, GoI rolled back the subsidy cuts and brought the subsidy benchmarks within 5-10% discount of the prevailing international prices, thus significantly reducing the requirement for negotiating lower prices or raising farm gate prices. On the strength of the latest development, ICRA expects GoI to intervene and make adjustments to subsidy in a scenario when international price movements and negotiated prices are in major divergence with prefixed benchmarks, over the short to medium term. While, over the longer term, increasing of farm gate prices in order to reduce subsidy levels would be relevant.

ICRA Rating Services

Page 10

ICRA Rating Feature

Industry Outlook: Fertilisers

Chart 15 & 16: Comparison of NBS benchmarks & International prices for FY11 & FY12E

600 500

41 (7%)

700 600

$/Tonne

50 (8%)

$/Tonne

400

300 200 100 0

60 (16%)

500 400 300 200

55 (14%)

10 (3%)

310

509

375

100 0

350

Urea (N)

580

DAP (P)

390

MOP (K)

Urea (N)

NBS Benchmark: FY11

DAP (P)

MOP (K)

Discount to Avge prices of 9M FY11

NBS Benchmark: FY12

Discount to current prices

Source: Industry, ICRA Analysis As shown in charts above, the relation between NBS benchmarks & international prices for N & P for FY12 are largely in line with 9M FY11, ie discount of 14-16% in case of N and 7-8% in case of P. As a result, the profitability levels in FY12 should remain in line with 9M FY11 if the current international prices and their relation with feedstock prices are to sustain in FY12. It is be noted that discount to international prices as shown in charts above, does not directly impact the profitability of manufacturers as their input prices (natural gas & ammonia for N and phosphoric acid for P) remain more stable than their benchmark product. Longer term interplay of global prices, gradual phasing towards price decontrol and subsidy adjustments to determine industry profitability: ICRA expects the interplay between international fertiliser prices, negotiations with suppliers and gradual decontrol of farm gate prices and subsidy adjustments to determine the profitability in the phosphatic and complex fertiliser industry in the long run. While, the current global demand supply dynamics and upward movement in international prices prevented the industry from bargaining lower prices to mitigate the subsidy reduction, Indias improving position in the international phosphate market should allow it to achieve price gains over the long term. Strengthening supplier relationships (major global suppliers such as OCP and GCT have joint ventures with Indian majors) should also assist in this regard. Table 2: Indias share in worlds export of fertiliser nutrients and inputs CY 2008/ 'Million tonnes Nutrient wise N P205 K20 Total All nutrients Product wise Phosphoric acid Rock Phosphate MOP Ammonia Source: FAI, ICRA Analysis As witnessed in Table 2, India plays a significant role in the international market, particularly in phosphoric acid where it accounts for 48% of total world exports. Timeliness of subsidy payments critical for the liquidity position of fertiliser manufacturers; gradual move towards price decontrol and lowering dependence on subsidy should partly mitigate the same over the longer term: In general, the liquidity position of the fertiliser manufacturers is influenced significantly by the timeliness of subsidy disbursement. Robust demand

ICRA Rating Services Page 11

India's Import

World's Exports

India's Import as % of World Exports

3.8 3.1 3.4 10.2

27.7 12.8 27.6 68.1

14% 24% 12% 15%

2.0 5.0 4.1 1.7

4.2 30.6 41.2 18.7

48% 16% 10% 9%

ICRA Rating Feature

Industry Outlook: Fertilisers

growth, multi-fold increase in imports and rising commodity prices have caused fertiliser subsidy to increase by around 300% over the period from 2004 to 2010. It may be noted that the subsidy bill witnessed a 2.5 fold increase in 2008-09 over 2007-08 due to peaking of commodity prices, thereby stressing the finances of the GoI. Fertiliser subsidy is expected to show an increase of around 30% from Rs 62000 crore in 2009-10 to Rs 80,000 crore in 2010-11 due to one time hike in APM gas prices for urea plants and significant rise in consumption of complex fertilisers. Fertilizer subsidy accounts for around 40% of GoIs total subsidy budget, which covers food, fertilizer and petroleum products. During 2007-08 and 2008-09, the GoI started payment of subsidy through bonds, which suffered from poor liquidity and discount to face value, thus affecting the liquidity position of fertiliser companies further, while they were later discontinued upon the requests of industry participants. Nevertheless, ICRA takes comfort from the fact that the subsidy disbursals have been fairly prompt in 2009-10 and 9M 2010-11 due to stability in prices and accurate subsidy estimation due to NBS, respectively. Going forward, part price decontrol and direct subsidy payment to the needy farmers, although the idea is riddled with several challenges, should assist in containing the subsidy outflows of the GoI over the long term. Chart 18: Subsidy Bill of the GoI since 2004

120000 100000 95849 80000

80000

Rs Crore

62000 60000 40338 40000 25952 18299

20000

0

15779

2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11E

Source: Industry Reports; ICRA Analysis The GoI has a longer-term goal of making subsidy payments directly to farmers instead of manufacturers/traders. The same is prevalent in China, Malaysia and the Philippines. However, this could be cumbersome, given the administrative hassles involved with payment of subsidy to individual farmers. CONCLUSION ICRA expects the outlook for the credit risk profiles of urea operations of rated entities to remain stable under the current normative, cost-plus-return regime, which is expected to continue in the near term with minor modifications. While uniform implementation of nutrient-based subsidy (NBS) in urea would be difficult in the near term, heterogeneous adoption of the same along with farm gate price decontrol is an increasing possibility. However, the approach of the expected new urea investment policy changes towards addressing the issue of increasing gas prices would be critical, as many urea manufacturers have envisaged brownfield expansion plans. Nevertheless, such manufacturers could witness an increase in their financial risk profiles if they finalise such largely debt-funded capacity expansion programmes. The Government of India is also considering implementation of uniform pooled prices for gas, which could address problems related to high prices of gas with urea expansion projects. With regard to DAP and complex fertiliser business, ICRA is of the opinion that the trend towards NBS is positive for the profitability of cost efficient industry players over the long term. Moreover, the recent demonstrated support of the GoI to the industry by way of subsidy adjustments lends confidence to the sustainability of NBS and accords visibility to the profitability in the near term. As a result, outlook for phosphatic and complex fertiliser business remains stable. February 2011

ICRA Rating Services Page 12

ICRA Rating Feature

Industry Outlook: Fertilisers

ANNEXURE Table 1: Portfolio of ICRA Rated Fertiliser Companies Company Aditya Birla Nuvo Limited (ABNL)^ Bohra Industries Limited Chakradhar Chemicals Private Limited Chambal Fertilisers & Chemicals Limited Deepak Fertilisers & Petrochemicals Corporation Limited Gujarat Narmada Valley Fertilizers Company Limited Gujarat State Fertilizers & Chemicals Limited Liberty Phosphates Limited Mosaic India Private Limited Paradeep Phosphates Limited Rashtriya Chemicals & Fertlizers Limited Subhash Fertilizers Private Limited Zuari Industries Limited Products Urea SSP Zinc Sulphate Urea Complex fertilisers Urea, Complex fertilisers DAP, Urea, Complex fertilisers SSP DAP DAP, Complex Fertilisers Urea, Complex Fertilisers Complex fertilisers Urea, DAP, Fertilisers Complex Ratings Outstanding * LAA+/A1+ LBB(Stable)/A4 LBB(Stable)/A4 A1+ LAA(Stable)/A1+ LAA-(Stable)/A1+ A1+ LB+/A4 A1 LBBB(Stable)/A2 LAA-(Stable) LBB-(Stable)/A4 LA+(Stable)/A1

Note: ^: ABNL is a diversified company with interests in carbon black, viscose filament yarn (VFY), flax yarn and linen fabric, garments, fertilisers and insulators. Source: ICRA Limited

ICRA Rating Services

Page 13

ICRA Rating Feature

Industry Outlook: Fertilisers

ICRA Limited An Associate of Moodys Investors Service CORPORATE OFFICE nd Building No. 8, 2 Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002 Tel: +91 124 4545300; Fax: +91 124 4545350 Email: info@icraindia.com, Website: www.icraratings.com, www.icra.in REGISTERED OFFICE th 1105, Kailash Building, 11 Floor; 26 Kasturba Gandhi Marg; New Delhi 110001 Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434 0043/9659/8080, 2433 0724/ 3293/3294, Fax + (91 44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283 1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax + (91 80) 559 4065 Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251, Fax + (91 40) 2373 5152 Pune: Tel + (91 20) 2552 0194/95/96, Fax + (91 20) 553 9231

Copyright, 2011, ICRA Limited. All Rights Reserved. Contents may be used freely with due acknowledgement to ICRA. ICRA ratings should not be treated as recommendation to buy, sell or hold the rated debt instruments. ICRA ratings are subject to a process of surveillance, which may lead to revision in ratings. Please visit our website (www.icra.in) or contact any ICRA office for the latest information on ICRA ratings outstanding. All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although reasonable care has been taken to ensure that the information herein is true, such information is provided as is without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or implied, as to the accuracy, timeliness or completeness of any such information. All information contained herein must be construed solely as statements of opinion, and ICRA shall not be liable for any losses incurred by users from any use of this publication or its contents.

ICRA Rating Services

Page 14

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Constraints in The Production and Marketing of Maize in PunjabДокумент9 страницConstraints in The Production and Marketing of Maize in PunjabNitish Kumar Singh PHD Management 2017Оценок пока нет

- 1432199420cedar Grove - May 2015 PDFДокумент20 страниц1432199420cedar Grove - May 2015 PDFCoolerAdsОценок пока нет

- Xanthophyta and PhaeophytaДокумент18 страницXanthophyta and PhaeophytaPablo VeraОценок пока нет

- Shahico Trading Co. W.L.L-TM 1 Galali - DH Stores Bahrain W.l.l-Po247212Документ3 страницыShahico Trading Co. W.L.L-TM 1 Galali - DH Stores Bahrain W.l.l-Po247212fahaddar_88Оценок пока нет

- A2 English Grammar Test 02 PDFДокумент3 страницыA2 English Grammar Test 02 PDFAnne MarinОценок пока нет

- Ulangan 1Документ4 страницыUlangan 1Reza Gunandi FadillahОценок пока нет

- Agriculture For Rwandan Schools - Student's Book - Senior OneДокумент190 страницAgriculture For Rwandan Schools - Student's Book - Senior OneEsthelasabella100% (1)

- Bio FertilizersforOrganicAgricultureДокумент7 страницBio FertilizersforOrganicAgriculturenimra imtiazОценок пока нет

- The ManualДокумент12 страницThe ManualDiana DainaОценок пока нет

- State: BIHAR Agriculture Contingency Plan For District: DARBHANGAДокумент42 страницыState: BIHAR Agriculture Contingency Plan For District: DARBHANGAYajneshОценок пока нет

- Plant Tissue CultureДокумент15 страницPlant Tissue CultureVijay KishoreОценок пока нет

- Wheateldoret Publication PDFДокумент14 страницWheateldoret Publication PDFWilliam ChemosiОценок пока нет

- Laporan Produksi Wafer Maret 2022Документ662 страницыLaporan Produksi Wafer Maret 2022yuna AmeliaОценок пока нет

- Codex Soybean ProductsДокумент163 страницыCodex Soybean ProductskfujiwarОценок пока нет

- Devoir de Synthèse N°2 Collège Pilote - Anglais - 7ème (2019-2020) MR Sahbi AbdelafouДокумент4 страницыDevoir de Synthèse N°2 Collège Pilote - Anglais - 7ème (2019-2020) MR Sahbi AbdelafouMesmed NacОценок пока нет

- Formulation of Lipbalm of "Orange Fruit Juice" (Citrus X Aurantium L.) As AntioxydanДокумент21 страницаFormulation of Lipbalm of "Orange Fruit Juice" (Citrus X Aurantium L.) As AntioxydanDevi YulikaОценок пока нет

- Test - 2 (SST) Board Test (Paper)Документ7 страницTest - 2 (SST) Board Test (Paper)Amit SinghОценок пока нет

- 2nd Sem Research Group 1AДокумент53 страницы2nd Sem Research Group 1ALovely LaplanaОценок пока нет

- Crop Production and Management-Exercises PDFДокумент3 страницыCrop Production and Management-Exercises PDFShrey DОценок пока нет

- Design of Thrust BlockДокумент35 страницDesign of Thrust BlockBalaji Rao Ch100% (1)

- The Objective of The Project Is To Study Market Potential of Parag Milk and To Know TheconsumerДокумент13 страницThe Objective of The Project Is To Study Market Potential of Parag Milk and To Know TheconsumerNeeraj SinghОценок пока нет

- Organic Farming Final PDFДокумент47 страницOrganic Farming Final PDFaakumaОценок пока нет

- Farm Equipment TractorsДокумент131 страницаFarm Equipment TractorsLalit Kumar100% (1)

- Readings in Philippine History-Chapter 5-LemanaДокумент56 страницReadings in Philippine History-Chapter 5-LemanaKenneth DraperОценок пока нет

- Issues: Milk Production Milk Specification Milk Output Profile Dairy OpsДокумент5 страницIssues: Milk Production Milk Specification Milk Output Profile Dairy OpsshaunaryaОценок пока нет

- Weasler FlipbooxДокумент134 страницыWeasler FlipbooxJoe UnanderОценок пока нет

- Fruits150058 PDFДокумент21 страницаFruits150058 PDFJimantolo AjiОценок пока нет

- Lesbela ProfileДокумент34 страницыLesbela ProfileAbdullahlasiОценок пока нет

- Botany - Flower Structure PDFДокумент5 страницBotany - Flower Structure PDFMia Justine Soriano100% (1)

- Master Peter Deunov (Beinsa Douno) : Selected Lectures I "Peace Be With You"Документ82 страницыMaster Peter Deunov (Beinsa Douno) : Selected Lectures I "Peace Be With You"Beinsa Douno Net100% (3)