Академический Документы

Профессиональный Документы

Культура Документы

Itc Case

Загружено:

Niket VarmaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Itc Case

Загружено:

Niket VarmaАвторское право:

Доступные форматы

ITC in Rural India Imperial Tobacco Company (ITC), a FMCG major and along with Hindustan Unilever, one

of the two leaders of FMCG market in India, was poised to expand rapidly in Rural India, in 2007.Although, it already held a major advantage in rural India market, but with the influx of MNCs like Wal-Mart, the scenario would rapidly change if steps were not taken to consolidate the market. Before, we analyse the rural markets and how both, ITC and HUL have built their strategy for the rural markets, we will look at some facts concerning India. About 70% on Indians live in 638,000 villages. Out of these, 88% people had income of less than $2 per day. Rural transportation and communication is limited. Concerned about poverty alleviation, government announced a rural jobs program to life 60 million people out of poverty. In 2004, the rural voters voted out the incumbents as they felt that economic growth was disproportionate and benefited the urban areas. NGOs of various kinds provide assistance to the poor and the voiceless. India is emerging as a strong economic market, growth averaging 8.4% between 2003 and 2006. FDI also rose to $8.3 billion during that time. Government of India restricted FDI. It allowed wholly owned FDI in export oriented trading companies. In 2006 it started granting approvals for 51% FII in retail sector with some constraints like the company should engage in single brand trading etc. Despite widespread poverty in rural areas, for some products rural demand exceeded urban demand. In 2005, 56% demand for Fast Moving Consumer Goods (FMCG).FMCG accounted for 80% of all Indian consumers spending. Business was mainly concentrated in the informal sector or unorganized sector comprising of small cottage farms and had many exemptions which were applicable to larger farms in organised sector. Retail sales were primarily concentrated in small, family owned stores. Only after 2000 organised sector stepped in and had 3% of the market. Most of products bought by rural customers were manufactured, distributed and sold by the informal sector. Large companies distribution was limited to wholesalers

located in small towns. Village shopkeepers came to these towns and bought products on a cash-and-carry basis and transported them in hired vehicles.

Challenges and opportunities presented by rural India Challenges: 88.44 % of total rural population earns less than 2$/day Main occupation is agriculture and it is not a very profitable venture given the current distribution system of agriculture produce. Lack of awareness among the rural population. Basic infrastructure like roads, rail and telecommunication is poor. Lack modern amenities like internet connectivity. Erratic power supply Labour available is unskilled and needs plenty of guidance and training. Consumers are not easily convinced that it was worth paying significantly higher for larger companies branded products For the increased rural penetration, it was possible that politicians, NGOs and others might question companies social impact and demand controls to discourage the potential abuse of market power.

Opportunities: Huge untapped market ( 70% population resides in Rural areas) Significant markets for products like tea, cooking oil, electric bulbs, footwear, bicycles and radios. FMCG accounted for 80% of all Indian consumer spending CAGR (cumulative annual growth rate) for FMCG products is in the range 5% to 16%. An abundance of low wage labour Services such as marketing and advertising are readily available. For some products rural demand exceeds urban demand Indias GDP is projected to grow at 5.9 % better than all the countries barring a few exceptions like China This GDP growth will have a direct impact on the disposable income. ITC network made it possible to trace and certify the origin of commodities, which would enable growth of organic product sales.

One to one interaction with the rural population can be leveraged by creating awareness amongst the rural populace and thus influencing them to grow high value strains of commodities.

ITC Strategy vs. HUL Strategy HUL is into a one-to-one interaction with the end user. The company is directly interacting with the customer through the medium of project-Shakti, Shaktivani and I-Shakti campaigns. For promoting and selling the non-food items, it is using the above mentioned mediums. ITC is into agri business, which happens on a mutual basis, i.e. company purchases as well as sells products, directly to the farmers. The company is trying to set-up an all things available zone for the farmers and thus adding value to their work. Basis of Difference Main Idea HUL Strategy Concentrated segment ITC Strategy on FMCG Into Multiple businesses like : Five-star chain of Hotels, FMCG, Non-FMCG, Agri-Products Mainly dependent on Shakti Mainly dependent on Agri Business 30,800(1,00,000) 100,000(500,000) 600,000,000 16$pm 6.500(10,000) 39000(100,000) 1,00,00,000 125$pm

Strategy Components Total no. Of Stakeholders Villages Covered Actual (Planned) Population Covered Stake holder Earning Additional Services Remarks

Health and hygiene Variety from insurance to information motorcycles, diesel, health services No savings for farmers Savings of $ 6million for farmers New strategy is availability of I New strategy is Saagars covering Shakti multiple products and companies

ITCs strategy of expanding the network of Saagar to 100 by 2010

First of all it is important to describe the context in which ITC has made this decision. ITCs of opening 100 Saagar stores is a rural centric growth strategy. -ITC has a network of 6,500 e-choupals. Out of these Saagar stores were planned only in areas where clusters of about 40 E-choupal stores were present. -The price competency that ITC had with respect to other large brands is very strong. ITC is able to provide goods like apparel at 30-40 % the prices of similar urban products even when apparels remain one of the highest margin yielding commodities at the Saagar stores (Refer the following table). Product category Apparel and footwear Agricultural Inputs FMCG Consumer Durables Share of Sales (%) 20 30 20 10 Margin(%) 30 3 15 6

-One of the biggest bottlenecks that ITC may experience in the growth of its Saagar stores may be the lack of awareness among the rural population about the quality of ITC products, and also the personal rapport of the rural kirana owners with the rural customer. But ITC can easily overcome this hurdle because it already has means to communicate to the rural population through its kiosks, Sanchalaks, Samyojaks, etc. In this scenario it is a wise decision on the part of ITC to open Saagar stores at areas of concentration of e-choupals. - The planned proximity of the Saagar stores to small towns as well as a large number of villages will aid in the success of these stores in two aspects: 1.The cost of infrastructure., esp., land will be low. 2.The store will benefit from both the expansion of the small towns as well as the villages.

Potential Threats to the Saagar plan:

Political Uncertainty: The several ingredients in the rural growth formula of ITC are very much interdependent on one another. Eg., The Saagar stores are linked to the procurement centres, e-choupals, etc. Therefore, any change in government policy which affects one is going to affect all. HUL is gearing up to an equally aggressive rural marketing strategy of establishing a rural distribution network that can reach a staggering 600 million people in rural areas. However there are two key differences between the strategy of HUL and ITC:

HUL concentrates only on own brands whereas ITC has other brands also in its store. - HUL largely concentrates on FMCG only whereas Saagar stores sell 80% nonFMCG products. In this scenario, though HUL may seem an obvious competitor to ITC it actually is not the biggest threat. One of the key risks in the strategy of ITC is the large investment involved in setting up the infrastructure for the Saagar stores and their running costs. Item Cost ($) Land 1.5 million Annual Running Costs 60000 This problem is avoided by HUL since it provides only a more deeper distribution network which required mush less investment on infrastructure.

The Current Scenario:

ITC had opened 18 Saagar stores in three different states by 2007. The data regarding the oldest one is as follows: Year 2005-06 2006-07 Sales ($) 500,000 750,000 Growth 50%

-An average margin of 12% is obtained from the different products sold at the store. Though it might take a bit longer to break even as far as the capital investments are concerned , even with half the current growth rate , margins of more than double the current operating costs are realizable in the first year operation itself. - With ITC planning to expand to 10,000 e-choupals taking its network to more than 10 million farmers in 100,000 villages by 2012, the stage for success of the 100 plus Saagar stores is already set.

Effect on Stakeholders at BOP:

Its important to note that the stakeholders at the Bottom of pyramid, in this case are farmers, sanchalaks and samyojaks. Now, with the FMCG companies coming into the picture, the future, if it remains same, looks promising for the farmers. They are getting the value for

their products along with an assurance in terms of price they get. In the ITC model, for the sanchalaks and samyojaks, it is creating a promising opportunity for employment. Also, if we analyse the HUL model, it also is creating jobs for the women under its Shakti programme. However, there is a slight risk here. If the company (ITC here) fails, then since they have entered and exited the market, they would have caused a great level of friction between mandi traders and farmers, which could lead to exploitation of farmers at the mandi, leading to less income for farmers from their produce.

CASE ANALYSIS

ITC IN RURAL INDIA

SUBMITTED BY: GROUP L2, SECTION-2 PGP-1

Вам также может понравиться

- ITC in Rural IndiaДокумент11 страницITC in Rural IndiaArun KumarОценок пока нет

- Rural Markets (HUL vs. ITC)Документ77 страницRural Markets (HUL vs. ITC)Jay LohanaОценок пока нет

- Rural Marketing in India - FinalДокумент18 страницRural Marketing in India - FinalDeep BhalodiaОценок пока нет

- FMCG Project ReportДокумент45 страницFMCG Project Reportnavneetdevsingh100% (3)

- Dabur Vatika Hair OilДокумент72 страницыDabur Vatika Hair Oildisha_puraswani491981Оценок пока нет

- Fast Moving Consumer Goods (FMCG) in Rural IndiaДокумент14 страницFast Moving Consumer Goods (FMCG) in Rural IndiaSwati TiwariОценок пока нет

- SIRMДокумент9 страницSIRMshailendra369Оценок пока нет

- Project Report OnДокумент55 страницProject Report OnPratik Patel100% (1)

- Hul Shakti Project ReportДокумент55 страницHul Shakti Project ReportAnusha ReddyОценок пока нет

- A Study of Buying Behaviour of Rural Consumer: A Proposal With Reference To Kumaun Division of UttarakhandДокумент4 страницыA Study of Buying Behaviour of Rural Consumer: A Proposal With Reference To Kumaun Division of UttarakhandEditor IJTEMTОценок пока нет

- Report On FMCGДокумент4 страницыReport On FMCGKomal PriyaОценок пока нет

- VIBHAДокумент68 страницVIBHAPraveen SharmaОценок пока нет

- Executive SummeryДокумент5 страницExecutive SummeryRajesh MoreОценок пока нет

- Abhinav - Rural Markets Are Future BattlegroundsДокумент48 страницAbhinav - Rural Markets Are Future BattlegroundsAashi SharmaОценок пока нет

- Entrepreneurial Opportunity in FMCG Industry: A) TechnologyДокумент9 страницEntrepreneurial Opportunity in FMCG Industry: A) TechnologyJack mazeОценок пока нет

- CRM Assignment: On FMCG IndustryДокумент10 страницCRM Assignment: On FMCG IndustryagarwalomОценок пока нет

- Rural Marketing 920Документ46 страницRural Marketing 920nithinmamidalaОценок пока нет

- Project ONДокумент31 страницаProject ONpavanbatteОценок пока нет

- Last Updated: February 2011Документ14 страницLast Updated: February 2011nallarishyuОценок пока нет

- Effects of Branding On FMCG Products With Reference To NestleДокумент65 страницEffects of Branding On FMCG Products With Reference To NestleMohammed AffanОценок пока нет

- Topic 1: No of Households (M) Demographic Classification Urban Rural TotalДокумент13 страницTopic 1: No of Households (M) Demographic Classification Urban Rural TotalNikhil KhannaОценок пока нет

- Introduction of AcquirerДокумент25 страницIntroduction of AcquirerMohit MidhaОценок пока нет

- Innovation and EntrepreneurshipДокумент19 страницInnovation and EntrepreneurshipVicky RamakrishnanОценок пока нет

- FMCG Companies in Rural MarketsДокумент28 страницFMCG Companies in Rural MarketsDurga DuttОценок пока нет

- FMCGДокумент96 страницFMCGAnkita Sadani0% (1)

- Innovation of Rural MarketingДокумент12 страницInnovation of Rural MarketingVirendra ChoudhryОценок пока нет

- Module - 1 Introduction To Rural MarketingДокумент15 страницModule - 1 Introduction To Rural MarketingZara HussainОценок пока нет

- Pharma Sector Financial Analysis: How To Research The Consumer Products Sector (Key Points)Документ4 страницыPharma Sector Financial Analysis: How To Research The Consumer Products Sector (Key Points)tbnjhjlkkkkkkОценок пока нет

- The Distant Voices - RevisedДокумент11 страницThe Distant Voices - RevisedSamrat GuptaОценок пока нет

- Rural Marketing by FMCG SectorДокумент5 страницRural Marketing by FMCG SectorsagarsononiОценок пока нет

- History of FMCG in IndiaДокумент18 страницHistory of FMCG in IndiaRonil Shah50% (2)

- Rural Marketing-Challenges, Opportunities & StrategiesДокумент5 страницRural Marketing-Challenges, Opportunities & StrategiesAjay Pandey Leo CollegeОценок пока нет

- Raw Data On FDI Retail PolicyДокумент16 страницRaw Data On FDI Retail PolicySuresh ParajuliОценок пока нет

- GoPik Rural Retail Market InsightsДокумент5 страницGoPik Rural Retail Market InsightsPooja VermaОценок пока нет

- Role of It in Rural MarketingДокумент3 страницыRole of It in Rural MarketingdigganthОценок пока нет

- FMCG Sector Industry Analysis FinalДокумент10 страницFMCG Sector Industry Analysis FinalLohith KumarОценок пока нет

- Rural ItcДокумент4 страницыRural ItcVivek SharanОценок пока нет

- Distribution Strategies in Rural MarketsДокумент7 страницDistribution Strategies in Rural Marketsmadhuri_amol75% (4)

- Pestel Analysis On FMCG Industry:: Political FactorsДокумент6 страницPestel Analysis On FMCG Industry:: Political FactorsRoshan GupthaОценок пока нет

- Agri RetailДокумент19 страницAgri RetailPrathap G MОценок пока нет

- Industry Analysis For HulДокумент4 страницыIndustry Analysis For HulRadhika SinghalОценок пока нет

- Branding in Rural AreasДокумент23 страницыBranding in Rural AreasAmrita SonkusaleОценок пока нет

- Rural Marketing HLL - NewДокумент20 страницRural Marketing HLL - NewD BhaskarОценок пока нет

- Role of IT in Rural MarketingДокумент4 страницыRole of IT in Rural MarketingmukulbobadeОценок пока нет

- Innovation in Rural RetailДокумент19 страницInnovation in Rural Retailaksr27Оценок пока нет

- FMCG Industry - OutlineДокумент5 страницFMCG Industry - Outlineapi-3712367100% (1)

- Comparative Analysis Between FMCG and Infrastructure Sector: Portfolio ManagementДокумент14 страницComparative Analysis Between FMCG and Infrastructure Sector: Portfolio ManagementShivam GuptaОценок пока нет

- Rural FMCG - Final ReportДокумент19 страницRural FMCG - Final Reportthe record breakerОценок пока нет

- Hul in Rural Markets Vs Urban MarketsДокумент57 страницHul in Rural Markets Vs Urban MarketsRita JainОценок пока нет

- Fast Moving Consumer GoodsДокумент16 страницFast Moving Consumer GoodsTushar Mane100% (1)

- 64th NFA 2016 CatalogueДокумент10 страниц64th NFA 2016 CatalogueKunal ShiindeОценок пока нет

- Appetite for Convenience: How to Sell Perishable Food Direct to ConsumersОт EverandAppetite for Convenience: How to Sell Perishable Food Direct to ConsumersОценок пока нет

- Vending Machine Business: How to Start Making Money from Vending MachinesОт EverandVending Machine Business: How to Start Making Money from Vending MachinesОценок пока нет

- The Chinese Consumer Market: Opportunities and RisksОт EverandThe Chinese Consumer Market: Opportunities and RisksLei TangОценок пока нет

- 2020 Vision (Review and Analysis of Davis and Davidson's Book)От Everand2020 Vision (Review and Analysis of Davis and Davidson's Book)Оценок пока нет

- The Economy of Waste: With Collaboration with Ailin E. Babakhanian and Edward BabakhanianОт EverandThe Economy of Waste: With Collaboration with Ailin E. Babakhanian and Edward BabakhanianОценок пока нет

- Aid for Trade in Asia and the Pacific: Promoting Economic Diversification and EmpowermentОт EverandAid for Trade in Asia and the Pacific: Promoting Economic Diversification and EmpowermentОценок пока нет

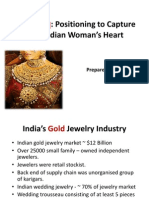

- Tanishq JRM 090729172938 Phpapp01Документ25 страницTanishq JRM 090729172938 Phpapp01Niket VarmaОценок пока нет

- Vicky SoodДокумент40 страницVicky SoodNiket VarmaОценок пока нет

- Internship Report-HDFC STD LIFE INSURANCEДокумент49 страницInternship Report-HDFC STD LIFE INSURANCEmadeshmb83% (6)

- Business Plan TemplateДокумент9 страницBusiness Plan TemplatebrendosОценок пока нет

- National Bicycle Company (A) SolutionДокумент4 страницыNational Bicycle Company (A) SolutionNiket VarmaОценок пока нет

- Yes BankДокумент4 страницыYes BankNiket VarmaОценок пока нет

- Business ResearchДокумент27 страницBusiness ResearchMuhammad Salman SiddiquiОценок пока нет

- Communism in USSRДокумент8 страницCommunism in USSRNiket VarmaОценок пока нет

- Amul & India's NDDBДокумент7 страницAmul & India's NDDBNiket VarmaОценок пока нет

- Castrol India LTDДокумент1 страницаCastrol India LTDNiket VarmaОценок пока нет

- Communism in USSRДокумент8 страницCommunism in USSRNiket VarmaОценок пока нет

- Poverty Remains An Issue in India Even in 2012: Group L2Документ14 страницPoverty Remains An Issue in India Even in 2012: Group L2Niket VarmaОценок пока нет

- Diffusion of InnovationДокумент19 страницDiffusion of InnovationNiket VarmaОценок пока нет

- JP Morgan Fixed Income Correlation Trading Using SwaptionsДокумент7 страницJP Morgan Fixed Income Correlation Trading Using Swaptionscoolacl100% (2)

- Business PlanДокумент7 страницBusiness PlanWinz QuitasolОценок пока нет

- Wadhwa Commission Report On Orissa PDSДокумент187 страницWadhwa Commission Report On Orissa PDSDebabrata MohantyОценок пока нет

- A Study of Customer Satisfaction Toward Service Quality in Retail With Referance To Reliance SmartДокумент75 страницA Study of Customer Satisfaction Toward Service Quality in Retail With Referance To Reliance SmartAkanksha DeepОценок пока нет

- (93986064) SWOT Matrix MedoraДокумент3 страницы(93986064) SWOT Matrix Medorasmarty669Оценок пока нет

- Al Barkat Flour Mill: Estimated Cost of LandДокумент35 страницAl Barkat Flour Mill: Estimated Cost of LandSheIkh AbdullAhОценок пока нет

- TCN Quotation - TCN Vending (16th, March)Документ8 страницTCN Quotation - TCN Vending (16th, March)Gusthavo VidalОценок пока нет

- Anrs Investment Commissin WWW - Investamhara.gov - Et: Project Profile On Baking Powder ProductionДокумент25 страницAnrs Investment Commissin WWW - Investamhara.gov - Et: Project Profile On Baking Powder ProductionThomas MОценок пока нет

- ORBITRADE - New Trading RulesДокумент57 страницORBITRADE - New Trading RulesFaliq Dziy NuhaОценок пока нет

- Macrec2 Problem Set 1 PDFДокумент2 страницыMacrec2 Problem Set 1 PDFBrian TakataОценок пока нет

- Title 5 - Tourism Demand 2021Документ36 страницTitle 5 - Tourism Demand 2021RAZIMIE BIN ASNUH -Оценок пока нет

- SMC Project FinalДокумент53 страницыSMC Project FinalSahil KhannaОценок пока нет

- Demand and Supply PracticeДокумент3 страницыDemand and Supply PracticeM KОценок пока нет

- Customer Perception Study With Respect To Vishal Mega MartДокумент80 страницCustomer Perception Study With Respect To Vishal Mega MartSunnnyReaderОценок пока нет

- Expansion of Opium Production in TurkeyДокумент22 страницыExpansion of Opium Production in TurkeyCarla CruzeñaОценок пока нет

- Agricultural MarketingДокумент65 страницAgricultural MarketingOliver TalipОценок пока нет

- A Study of Audience Perception About TheДокумент2 страницыA Study of Audience Perception About TheRahat HaneefОценок пока нет

- ACTG 243 Decision Making With Accounting Information Final Exam 01Документ3 страницыACTG 243 Decision Making With Accounting Information Final Exam 01Đinh Ngọc Minh ChâuОценок пока нет

- Financial Management Chapter FourДокумент76 страницFinancial Management Chapter Fourbiko ademОценок пока нет

- IDEA Project DharmenderДокумент62 страницыIDEA Project Dharmendermss_sikarwar3812Оценок пока нет

- Financial Statement Analysis Cheat Sheet: by ViaДокумент2 страницыFinancial Statement Analysis Cheat Sheet: by Vianassim foguiОценок пока нет

- 2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Документ7 страниц2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Nicole Anne Santiago SibuloОценок пока нет

- This Study Resource WasДокумент9 страницThis Study Resource Wasshivam chugh100% (2)

- Management Control System Group Task SumДокумент6 страницManagement Control System Group Task SumPujianto SlametОценок пока нет

- Exercises Revenue and Labor Budgeting-University SettingДокумент14 страницExercises Revenue and Labor Budgeting-University SettingJenelyn UbananОценок пока нет

- Cost-Volume-Profit Analysis: True / False QuestionsДокумент25 страницCost-Volume-Profit Analysis: True / False QuestionsNaddie50% (2)

- Chapter 7Документ36 страницChapter 7Mai PhamОценок пока нет

- DK Selling StrategiesДокумент7 страницDK Selling StrategiesMilan DzigurskiОценок пока нет

- Topic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IIДокумент4 страницыTopic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IINur WahidaОценок пока нет

- Marketing StrategyДокумент16 страницMarketing StrategySagar ChachondiaОценок пока нет