Академический Документы

Профессиональный Документы

Культура Документы

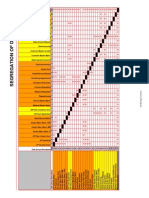

Segregation of Duties Template2

Загружено:

are2007Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Segregation of Duties Template2

Загружено:

are2007Авторское право:

Доступные форматы

Segregation of Duties

Adequate segregation of duties reduces the likelihood that errors (intentional or unintentional) will remain undetected by providing for separate processing by different individuals at various stages of a transaction and for independent reviews of the work performed. The basic idea underlying segregation of duties is that no one employee or group of employees should be in a position both to perpetrate and conceal errors or irregularities in the normal course of their duties. In general, the principal incompatible duties to be segregated are: authorisation, custody of assets, and recording or reporting of transactions. In addition, a control over the processing of a transaction generally should not be performed by the same individual responsible for recording or reporting the transaction.

The potential problem areas are only an indication of where segregation of duties controls are breaking down or are lacking.

Bank and Cash

The handling of cash receipts and accounting for such receipts need to be segregated if all the control objectives are to be met. Adequate segregation of duties reduces the likelihood that errors (intentional or unintentional) will remain undetected by providing an accounting check over the receipt of cash. For example, those who handle cash receipts would not have the authority to prepare or sign cheques, would not have access to accounting records, and would not be involved in reconciling bank accounts. The duties to be considered in determining the adequacy of segregation of duties among those responsible for cash receipts transactions are listed in the following chart. In smaller companies, these duties may also need to be reviewed along with those of other functions, as some individuals may have responsibilities in more than one area. List the names of individuals responsible for particular functions in the column indicated (e.g., the names of the individuals who are responsible for maintaining cash receipts journal would fall into the recording column). Review the chart for individuals whose names are listed in more than one column and then make a determination whether that represents a potential lack of segregation of duties. Description Opening of mail and listing of cheques Handling of cash receipts Preparation of bank deposits Comparison of listing of cheques to bank deposits Maintenance of cash receipts journal Maintenance of debtors masterfile records Reconciliation of bank accounts Authorisation of write-offs of bad debts Control of the accuracy, completeness of, and access to cash receipts programs and data files Authorisation Custody of Assets Recording Control Procedure

Debtors - Accounts Receivable

The order entry, credit, shipping, billing, collecting, credit memo, MIS and general accounting activities need to be appropriately segregated if all control objectives are to be met. For example, those who perform the order entry (sales) activity, including those who maintain contact with customers and issue sales orders, would not perform any credit approval, shipping, billing, cash receipts, credit memo or accounting activities. The duties to be considered in determining the adequacy of segregation of duties among those responsible for sales transactions are listed in the following chart. In smaller companies, these duties may also need to be reviewed along with those of other functions, as some individuals may have responsibilities in more than one area. List the names of individuals responsible for particular functions in the column indicated (e.g., the names of the individuals who are responsible for issuing sales orders would fall into the recording column). Review the chart for individuals whose names are listed in more than one column and then make a determination whether that represents a potential lack of segregation of duties. Also consider whether individuals are performing incompatible duties within the same column (e.g., control procedure).

Description Issuance of sales orders Approval of credit Approval of access to credit-related data files Authorisation of shipments Preparation of shipping documents Handling of inventories for shipment Preparation of billings Verification of billings Approval of access to pricing-related data files Accounting for the numerical sequence of sales invoices Maintenance of the sales journal Maintenance of debtors records Reconciliation of the accounts receivable records with the general ledger control account Review and approval of the monthly aged accounts receivable trial balance Preparation of monthly customer statements Review and follow-up of customer inquiries and differences Handling of cash receipts from customers Authorisation of write-offs of bad debts Control of the accuracy, completeness of, and access to sales and debtor programs and data files

Authorisation

Custody of Assets

Recording

Control Procedure

Payroll - Human Resources

Timekeeping, handling the payroll cash disbursements, MIS, and accounting for payroll need to be appropriately segregated if all the control objectives are to be met. Adequate segregation of duties reduces the likelihood that errors (intentional or unintentional) will remain undetected by providing an accounting check over the payment of salaries and wages. The duties to be considered in determining the adequacy of segregation of duties among those responsible for payroll transactions are listed in the following chart. In smaller companies, these duties may also need to be reviewed along with those of other functions, as some individuals may have responsibilities in more than one area. List the names of individuals responsible for particular functions in the column indicated (e.g., the names of the individuals who are responsible for preparing payroll checks would fall into the recording column). Review the chart for individuals whose names are listed in more than one column and then make a determination whether that represents a potential lack of segregation of duties. Also consider whether individuals are performing incompatible duties within the same column (e.g., control procedure).

Description Maintenance of personnel files Approval of access to personnel master files Approval of wage and salary increases, hirings, and terminations Control of timekeeping Maintenance of payroll journals Preparation of payroll cheques Approval of the payroll Signing of cheques Distribution of cheques Control of unclaimed payroll cheques Reconciliation of payroll bank accounts Control of the accuracy, completeness of, and access to payroll programs and data files

Authorisation

Custody of Assets

Recording

Control Procedure

Creditors - Puchases - Accounts Payable

The requisition, ordering, receiving, paying and general accounting activities need to be appropriately segregated if all control objectives are to be met. For example, those who perform the ordering (purchasing) activity, including those who maintain contact with outside suppliers and issue purchase orders, would not perform any receiving, accounting, or cash disbursement activities. The duties to be considered in determining the adequacy of segregation of duties among those responsible for purchases transactions are listed in the following chart. In smaller organizations, these duties may also need to be reviewed along with those of other functions, as some individuals may have responsibilities in more than one area. List the names of individuals responsible for particular functions in the column indicated (e.g., the names of the individuals who are responsible for issuing purchase requisitions would fall into the recording column). Review the chart for individuals whose names are listed in more than one column and then make a determination whether that represents a potential lack of segregation of duties. Also consider whether individuals are performing incompatible duties within the same column (e.g., control procedure).

Description Issuance of purchase requisitions Approval of purchase requisitions Issuance of purchase orders Approval of access to creditor master files Approval of purchase orders Approval of access to purchase-related data files Issuance of debit memos to creditors Issuance and signing of receiving reports Matching of invoices to purchase orders and receiving reports Capturing of creditor inoices / coding account distribution of creditor invoices Approval of vouchers for payment Preparation of cheques Signing of cheques Distribution of cheques Maintenance of the purchases journals Maintenance of creditors records Reconciliation of the accounts payable records (or the total of unpaid vouchers) with the general ledger control account Control of the accuracy, completeness of, and access to purchasing and accounts payable programs and data files

Authorisation

Custody of Assets

Recording

Control Procedure

Вам также может понравиться

- Manage Expenditures, Fixed Assets & InventoryДокумент23 страницыManage Expenditures, Fixed Assets & Inventoryswissdude100% (3)

- Apps Segregation of DutiesДокумент31 страницаApps Segregation of DutiesMahmoud Fawzy100% (1)

- BDO Segregation of Duties ChecklistДокумент34 страницыBDO Segregation of Duties Checklisthaseebahmed999100% (2)

- Segregation of Duties MatrixДокумент1 страницаSegregation of Duties MatrixSandeep BajajОценок пока нет

- Segregation of Duties MatrixДокумент1 страницаSegregation of Duties MatrixAbubakar Siddique100% (6)

- Bestitdocuments InventoryДокумент51 страницаBestitdocuments InventorynoneОценок пока нет

- SOX ProcessДокумент6 страницSOX ProcessPrakaash100% (3)

- QuamtoДокумент4 страницыQuamtoClarissa dela Cruz0% (1)

- Segregation of Duties MatrixДокумент10 страницSegregation of Duties MatrixAnonymous c1nF8A100% (1)

- Segregation of DutiesДокумент8 страницSegregation of DutiesmanishmestryОценок пока нет

- SOX Internal Controls ChecklistДокумент31 страницаSOX Internal Controls Checklistkamal_bagchi100% (4)

- Segregation of Duties ReviewДокумент4 страницыSegregation of Duties ReviewManishОценок пока нет

- SOD Risk Summary - SAP With Mitigating ControlsДокумент15 страницSOD Risk Summary - SAP With Mitigating ControlsAbhijit Podder100% (2)

- SOD GuideДокумент26 страницSOD Guidebkumar1979Оценок пока нет

- Negotiability of instruments examined in Philippine casesДокумент54 страницыNegotiability of instruments examined in Philippine casesJohn Paul Angelou VillasОценок пока нет

- EY Segregation of Duties PDFДокумент16 страницEY Segregation of Duties PDFEduard ArceОценок пока нет

- Segregation of Duties - SoDДокумент7 страницSegregation of Duties - SoDJulio Turchan OleaОценок пока нет

- Segregation of DutiesДокумент1 страницаSegregation of DutiesjadfarranОценок пока нет

- Segregation of Duties MatrixДокумент13 страницSegregation of Duties MatrixForumnoj100% (1)

- Sox Compliance ChecklistДокумент6 страницSox Compliance Checklistsiddhesh8Оценок пока нет

- Master Training and Certifications Guide - Microsoft PDFДокумент65 страницMaster Training and Certifications Guide - Microsoft PDFhello100% (2)

- Starting a Chocolate Company Business PlanДокумент26 страницStarting a Chocolate Company Business PlanYummy Choc83% (6)

- Deloitte SODДокумент25 страницDeloitte SODSPMeher100% (2)

- SOD EvaluatorДокумент1 страницаSOD Evaluatoralejandroctay100% (1)

- C23 - Segregation of DutiesДокумент16 страницC23 - Segregation of Dutieskannie_bОценок пока нет

- 2007 SOX 404 Testing Guidelines FINALДокумент83 страницы2007 SOX 404 Testing Guidelines FINALMichelle CheregoОценок пока нет

- Segregation of Duties OverviewДокумент1 страницаSegregation of Duties OverviewKarthik EgОценок пока нет

- Practice Aid: Enterprise Risk Management: Guidance For Practical Implementation and Assessment, 2018От EverandPractice Aid: Enterprise Risk Management: Guidance For Practical Implementation and Assessment, 2018Оценок пока нет

- Segregation of Duties QuestionnaireДокумент25 страницSegregation of Duties QuestionnaireManna MahadiОценок пока нет

- Segregation of Duties APM 2.25.55Документ46 страницSegregation of Duties APM 2.25.55Yai Ibrahim100% (2)

- Segregration of DutiesДокумент30 страницSegregration of Dutiesafzallodhi736Оценок пока нет

- SOD MatrixДокумент1 страницаSOD MatrixAjai SrivastavaОценок пока нет

- Internal Controls: Guidance for Private, Government, and Nonprofit EntitiesОт EverandInternal Controls: Guidance for Private, Government, and Nonprofit EntitiesОценок пока нет

- SAP GRC Access Control Approach DocumentДокумент32 страницыSAP GRC Access Control Approach Documentbarbarian11Оценок пока нет

- Segregation of Duties Framework OverviewДокумент2 страницыSegregation of Duties Framework OverviewChinh Lê ĐìnhОценок пока нет

- SAP Security Baseline Template V1.9Документ149 страницSAP Security Baseline Template V1.9Pasquale Vinci75% (4)

- Segregation of Duty Risks in Financial ProcessesДокумент57 страницSegregation of Duty Risks in Financial ProcessesLinh HuynhОценок пока нет

- SAP GRC (Basic) ,: Biju (Jays)Документ42 страницыSAP GRC (Basic) ,: Biju (Jays)Peter PanterОценок пока нет

- Configure Segregation of Duties (SOD) ReviewsДокумент17 страницConfigure Segregation of Duties (SOD) ReviewsPabitraKumarОценок пока нет

- Sappress Sap Security AuthorizationsДокумент60 страницSappress Sap Security Authorizationswaheguru009Оценок пока нет

- Security: Tier I Audit GuideДокумент6 страницSecurity: Tier I Audit GuideLavinia GligaОценок пока нет

- Sod MatrixДокумент2 382 страницыSod Matrixbarber bob0% (2)

- SAP Security Controls in Under 40Документ19 страницSAP Security Controls in Under 40sandeep kumarОценок пока нет

- Sod AnalyzeДокумент9 страницSod AnalyzeChim RaОценок пока нет

- Segregation of Duties Review (SOD Review) Description and Workflow ConfigurationДокумент26 страницSegregation of Duties Review (SOD Review) Description and Workflow ConfigurationDouglas CruzОценок пока нет

- Acknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Документ1 страницаAcknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Christina Pic-it BaguiwanОценок пока нет

- List of SOD Conflicts - 1.29.18Документ5 страницList of SOD Conflicts - 1.29.18YasserAl-mansourОценок пока нет

- SAP Security GRC Consultant in United States Resume Rory GoreeДокумент2 страницыSAP Security GRC Consultant in United States Resume Rory GoreeRoryGoreeОценок пока нет

- SAP GRC SOD Conflicts High RiskДокумент12 страницSAP GRC SOD Conflicts High RiskRyan Pitts100% (6)

- Isaca - Intro To Sap Security v3 Final 03Документ43 страницыIsaca - Intro To Sap Security v3 Final 03Prasanjit GroverОценок пока нет

- Top 20 SAP ConflictsДокумент12 страницTop 20 SAP ConflictsAndrew MalcolmsonОценок пока нет

- SoD Documentation v1 93-With Javier Comments-02Документ112 страницSoD Documentation v1 93-With Javier Comments-02FErnandoОценок пока нет

- Manage service orders, warranties, equipment & serial numbersДокумент4 страницыManage service orders, warranties, equipment & serial numbersanupam0022Оценок пока нет

- Matriz Sod SapДокумент10 страницMatriz Sod SapEduardo EdОценок пока нет

- Adequate Segregation of DutiesДокумент3 страницыAdequate Segregation of DutiesdddibalОценок пока нет

- GRC RulesetДокумент6 страницGRC RulesetDAVIDОценок пока нет

- Sarbanes-Oxley Walkthrough ChecklistДокумент1 страницаSarbanes-Oxley Walkthrough Checklistmehmet aliОценок пока нет

- SOX Audit SAP Basis Test ControlsДокумент65 страницSOX Audit SAP Basis Test ControlsT. LyОценок пока нет

- Segregation of Duties MatrixДокумент48 страницSegregation of Duties MatrixMariano SanchezОценок пока нет

- How to Create an Authorization Matrix in SAPДокумент2 страницыHow to Create an Authorization Matrix in SAPArunKhemaniОценок пока нет

- Chapter 04Документ79 страницChapter 04Amylia AmirОценок пока нет

- MS Holdings Offer Document PDFДокумент217 страницMS Holdings Offer Document PDFInvest StockОценок пока нет

- Impact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaДокумент10 страницImpact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaBrijbhushan ChavanОценок пока нет

- Tally GST Module Question Set - 3Документ3 страницыTally GST Module Question Set - 3Boni HalderОценок пока нет

- F6 (BWA) Taxation PaperДокумент11 страницF6 (BWA) Taxation Papertrue100% (1)

- Citi Relationship Transfer FaqДокумент11 страницCiti Relationship Transfer FaqEM CRОценок пока нет

- Get Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024Документ26 страницGet Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024ajay.patelОценок пока нет

- Unit 1 Introduction To Cost AccountingДокумент4 страницыUnit 1 Introduction To Cost AccountingReema DsouzaОценок пока нет

- Phillips PLL 6e Chap02Документ56 страницPhillips PLL 6e Chap02snsahaОценок пока нет

- Debt Settlement Letter SampleДокумент13 страницDebt Settlement Letter Samplehassan789cppОценок пока нет

- Philippine Christian University Dasmariñas CampusДокумент14 страницPhilippine Christian University Dasmariñas CampusKrystalove JjungОценок пока нет

- Savera HotelsДокумент21 страницаSavera HotelsMansi Raut Patil100% (1)

- Taxable Income and Tax Calculation for Starlight LimitedДокумент8 страницTaxable Income and Tax Calculation for Starlight LimitedAlina ZubairОценок пока нет

- Chap 19Документ28 страницChap 19N.S.RavikumarОценок пока нет

- FDIC PresentationДокумент31 страницаFDIC PresentationMuthiani MuokaОценок пока нет

- EXERCISE Bank Po PreparationДокумент91 страницаEXERCISE Bank Po PreparationvirusyadavОценок пока нет

- Logical Reasoning 2Документ2 страницыLogical Reasoning 2luigimanzanaresОценок пока нет

- 1 182Документ182 страницы1 182Allison SnipesОценок пока нет

- For HDFC ERGO General Insurance Company LTDДокумент2 страницыFor HDFC ERGO General Insurance Company LTDvivaan shahОценок пока нет

- Budget Process Flow ChartДокумент1 страницаBudget Process Flow Chartkkworld2Оценок пока нет

- New Folder - AUD - AUD-1 OutlineДокумент9 страницNew Folder - AUD - AUD-1 OutlineDaljeet SinghОценок пока нет

- Leo 2Документ44 страницыLeo 2cadeau01Оценок пока нет

- State Bank of IndiaДокумент1 страницаState Bank of IndiaBala SundarОценок пока нет

- 2020 Form M706, Estate Tax Return: For Estates of A Decedent Whose Date of Death Is in Calendar Year 2020Документ3 страницы2020 Form M706, Estate Tax Return: For Estates of A Decedent Whose Date of Death Is in Calendar Year 2020daveyОценок пока нет

- PGDM II FINANCE ElectivesДокумент21 страницаPGDM II FINANCE ElectivesSonia BhagwatОценок пока нет