Академический Документы

Профессиональный Документы

Культура Документы

Principal-Protected Products Could Benefit From Solvency II

Загружено:

BuyLowSellHighИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Principal-Protected Products Could Benefit From Solvency II

Загружено:

BuyLowSellHighАвторское право:

Доступные форматы

Principal-protected products could benefit from Solvency II - Risk.

net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Our digital network: Risk.net CentralBanking.com FX Week Hedge Funds Review Risk Books Jobs in Risk Unquote WatersTechnology

Search Subscribe Email alerts Mobile RSS Home News Media centre Opinion Features Special reports Technical papers Training & Events Directory Journals

Asia Risk Custody Risk Energy Risk Operational Risk & Regulation Risk magazine Structured Products Life & Pension Risk Derivatives Risk Management Regulation Technology Hedge Funds Investment

1 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Liability Management People More categories

Derivatives Risk Management Regulation Technology Investment Liability Management More Categories Derivatives Risk Management Regulation Technology Hedge Funds Investment Liability Management More categories Derivatives Risk Management Regulation Technology Investment More Categories Credit Risk Market Risk Equity Derivatives Interest Rate Derivatives ALM More Categories Conferences In-house Training e-Learning Public Training

Computational Finance Risk Credit Risk Operational Risk Risk Model Validation Energy Markets

2 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Investment Strategies

Where am I? Home Regulation Insurance Solvency II News

Principal-protected products could benefit from Solvency II

Published online only Source: Risk magazine Author: Mark Pengelly Source: Risk magazine | 22 Mar 2011 Categories: Solvency II Topics: Deutsche Bank, Morgan Stanley, Solvency II, Socit Gnrale (SG), Capital guaranteed, Principal protected note, Insurance, Structured products

A boon for structuring desks? New risk-based capital rules for insurers could help demand for products with principal protection, say bankers The European market for principal-protected structured products could benefit from Solvency II, say bankers, as insurance companies adapt their portfolios to cater for the new risk-based capital rules.

3 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Related articles Basel 2.5 prompts flurry of asset sales and risk transfer deals Corporates fear CVA charge will make hedging too expensive Developing structured solutions for Solvency II The encroachment of Solvency II Solvency II is occupying the minds of insurers and bankers alike, but market participants warn the rules are a work in progress. In January, the European Commission adopted a proposal that would allow for a transition period of up to 10 years for some of the most onerous aspects of the legislation. Meanwhile, the results of a quantitative impact study published on March 14 are expected to lead to further tweaks to the rules. Despite the possibility of further changes, the rules are expected to have an impact on the investment portfolios of European insurance companies. Youve changed the capital framework for insurers, so youve also changed the risk-reward framework of every asset class and its attractiveness on an absolute and relative basis, says Jeff Sayer, managing director of institutional solutions at Morgan Stanley in London. If you can provide any kind of principal protection there could be a benefit compared with an unprotected asset While asset classes including asset-backed securities are expected to suffer under the new regime, bankers believe products that incorporate some form of principal protection or capital guarantee could benefit. The inclusion of these guarantees, they note, could help pare down the capital charge for investing in a range of risky asset classes. If you can provide any kind of principal protection not necessarily 100% protection there could be a benefit compared with an unprotected asset. Were spending a lot of time internally looking at the cost and benefit of protection and whether it makes sense for insurance companies, says Andrew Berman, co-head of European insurance and pensions sales at Deutsche Bank in London. For a passive equity portfolio tracking an index, this might involve buying a put (financed by the sale of a call) to protect against downside risk. In addition to equities, bankers say insurers might try to cheapen regulatory capital requirements in other asset classes using some form of protection, including hedge finds and commodities. One product being actively touted towards insurers is Titanium by Socit Gnrale Corporate and Investment Banking. The bank looked at a range of strategies in an attempt to determine which performed best from a return and capital perspective. We did a big study on the best way to invest in equities under Solvency II and we compared the different equity options strategies insurers would be implementing. We ran a lot of simulations to determine the average internal rate of return of the various investments, net of the average cost of Solvency II capital, says Ludovic Antony, director of global solutions for financial institutions at the bank in Paris. The analysis compared various ways of investing in equities, including constant proportion portfolio insurance products and direct investments with collars where the purchase of a put is partly or wholly financed by the sale of a call. The bank simulated returns on the strategies over an eight-year period, trying to find the best return compared with the cost of capital under the new rules. We found that investing in medium- to long-term capital-guaranteed products with indexation to equity performance was the most efficient method. The long-term guarantee provided significant capital relief, while

4 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

enabling the companies to benefit significantly from positive equity performances, says Antony. The study served as a starting point for the banks efforts to tailor Solvency II-efficient structured products. One of these is Titanium a product that offers an equity investment with a capital guarantee that pays out like a bond, with annual coupons exposed to yearly equity performance through a volatility adjustment. The structure is intended to provide better long-term performance than traditional long equity exposure with hedges (collars), but is subject to a reduced capital requirement under Solvency II. As it is structured as a bond, it can also benefit from friendly accounting treatment under International Financial Reporting Standards, the bank claims. Topics: Deutsche Bank, Morgan Stanley, Solvency II, Socit Gnrale (SG), Capital guaranteed, Principal protected note, Insurance, Structured products

Print Comment Send Share Linkedin Retweet More from CPSS-Iosco lifts cloud from forex options clearing Risk Espaa rankings 2012 Dealers draw up contract for covered bond CDSs Are you ready for Basel III? Get similar articles delivered to your inbox

5 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Risk magazine Monthly Newsletter

Related media Are you ready for Basel III? Risk awards video: What are the biggest challenges for 2012? Sponsored forum: The future of e-trading for bonds Sponsored forum: OTC derivatives Most read Barclays steals the show with double-digit digital CPSS-Iosco lifts cloud from forex options clearing Use of PIT model neutralises impact of counter-cyclical capital buffer US debate grows over value of stress testing Whitepapers White paper: Open source governance in highly regulated companies White paper: Open source drives innovation in financial services White paper: Customer success story Financial services Related conferences Risk and Return Russia Russia, 25th Apr 2012 Risk & Return Россия 2012 Russia, 25th Apr 2012 Credit Risk USA USA, 22nd - 23rd May 2012 Related training Systemic and Tail Risk Management for Financial Institutions UK, 19th - 20th Apr 2012 Marcello Minenna on Derivative Pricing and Model Calibration: Tools and Techniques USA, 25th - 27th Apr 2012 Marcello Minenna on Derivative Pricing and Model Calibration: Tools and Techniques USA, 25th - 27th Apr 2012

6 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Comment on this article Subscribe Free trial RSS Email alerts Share Comments There are no comments submitted yet. Do you have an interesting opinion? Then be the first to post a comment. Comment on this article Related books

Theory and Practice of Shipping Freight Derivatives

Investing in Insurance Risk

7 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Lessons from the Financial Crisis

View all Risk Books Login Subscribe Free trial Email alerts Access your premium magazine online Username (email) Password Need help logging in? Remember my login on this computer Risk.net is your online gateway to information on the international financial risk management sector. Call our corporate license team now on 0207 484 9929 or +212-457-7865 For more information on individual products, click on the following:

Sign up in 2 minutes for FREE and immediate access to premium content.

Click on one of the following publications to get started:

8 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Join your company's corporate subscription

Every week our editorial team deliver a range of email bulletins to ensure our readers know what is happening in their markets around the world.

Advertisement

Email alerts

Sign up for Risk.net email alerts

Register for regular alerts to receive up to date news directly into your inbox

Weekly poll Is bail-inable debt attractive? Will plans to make senior bondholders absorb bank losses a central feature of the so-called bail-in regime reduce investor demand for bank debt? (www.risk.net/2163763) Yes No

9 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

View poll results More polls

Advertisement

Technology white papers

White paper: Open source governance in highly regulated companies White paper: Open source drives innovation in financial services White paper: Customer success story Financial services

Related Jobs

Operational Risk Monitoring Manager Salary: Competitive Location: London We have an exciting new opportunity for an Operational Risk Monitoring Manager within our UK Wealth division at The Royal Bank of Scotland Group. Retail Pricing Team Salary: Competitive package dependent on Location: Manchester

10 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Were looking for commercially minded people to join our new retail pricing team. Governance Specialists Salary: c. 60k plus benefits (Fixed term Location: Base can be in any major HMRC office in England or Scotland If you have specialist expertise in evaluating risk in a tax context, this is a once-in-a-lifetime opportunity to make a difference to the UK economy. View all jobs Topics of interest BNP Paribas BlackRock China Citi Commerzbank Deutsche Bank Greece HSBC International Organization of Securities Commissions (IOSCO) Italy LCH.Clearnet Nomura Saudi Arabia Settlement Spain Powered by:

Related brands:

11 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Home News Media centre Opinion Features Special reports Technical papers Training & Events Directory Journals

Incisive Media Investments Limited 2012 , Published by Incisive Financial Publishing Limited, Haymarket House, 28-29 Haymarket, London SW1Y 4RX, are companies registered in England and Wales with company registration numbers 04252091 & 04252093 Search About Risk.net: About Risk.net SUBSCRIBE FREE TRIAL FAQ User Guide Advertise Contact Us Sitemap Categories: Awards Central Banks Commodities Derivatives Economics Exchanges Foreign Exchange Hedge Funds Investment Liability Management People Rankings Regulation

12 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Risk Management Technology Related Events: Private Equity Hedge Funds Mortgage Finance Business Finance Business Technology Regulatory Financial Technology Investment Risk & Derivatives Central Banking Energy Trading Oil Refining Public Training In-house Training Online Training LinkedIn Groups: Asia Risk Central Banking Energy Risk FX Week Hedge Funds Review Life & Pension Risk Operational Risk & Regulation Risk Cutting Edge Risk Risk Journals Structured Products Twitter: Duncan_Wood EnergyRisk FXweek HedgeFundsRev mark_pengelly OpRiskandReg RiskNetNews RiskCuttingEdge LPRisk Related websites: Central Banking Information

13 of 14

4/18/2012 3:48 PM

Principal-protected products could benefit from Solvency II - Risk.net

http://www.risk.net/risk-magazine/news/2035888/principal-protected-pr...

Foreign Exchange news Hedge Funds News Buy-side Analysis Risk Management Books Private Equity News Fund Catalyst Incisive Media: About Incisive Media Accessibility Terms & Conditions Privacy Policy 1

Tweet

0

Like

Share

StumbleUpon Submit

14 of 14

4/18/2012 3:48 PM

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Operational RiskДокумент6 страницOperational Risksobi malikОценок пока нет

- Director Administration Finance Operations in Boston MA Resume Tamra BlakeДокумент2 страницыDirector Administration Finance Operations in Boston MA Resume Tamra BlakeTamraBlakeОценок пока нет

- Risk Management in BankingДокумент45 страницRisk Management in Bankingpanaskar.umesh100% (3)

- Amended MBA Thesis Proposal Paper On Assessment of Risk: Management Practices in Nib International Bank S.CДокумент36 страницAmended MBA Thesis Proposal Paper On Assessment of Risk: Management Practices in Nib International Bank S.Cfitsum tesfayeОценок пока нет

- Risk Management in Indian Banking IndustryДокумент5 страницRisk Management in Indian Banking Industryarpit55Оценок пока нет

- MR ZulfaДокумент14 страницMR ZulfaHalim Pandu LatifahОценок пока нет

- GARP FRM Practice Exams - 2007 PDFДокумент116 страницGARP FRM Practice Exams - 2007 PDFLe Dinh Nhat ThuyenОценок пока нет

- CAR Guideline ExplainedДокумент360 страницCAR Guideline ExplainedAshley CherianОценок пока нет

- STRICTLY PRIVATE and CONFIDENTIAL ChiefДокумент56 страницSTRICTLY PRIVATE and CONFIDENTIAL ChiefFaidz FuadОценок пока нет

- Risk Management in Indian Banking Sector and The Role of RBIДокумент6 страницRisk Management in Indian Banking Sector and The Role of RBIPooja GarhwalОценок пока нет

- Internal Control & ComplianceДокумент30 страницInternal Control & ComplianceAijaz Ali MughalОценок пока нет

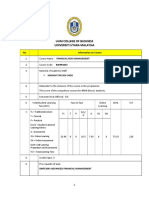

- Uum College of Business Universiti Utara MalaysiaДокумент7 страницUum College of Business Universiti Utara MalaysiaSyai GenjОценок пока нет

- Indian Institute of Banking & Finance: Certificate Examination in Risk in Financial ServicesДокумент10 страницIndian Institute of Banking & Finance: Certificate Examination in Risk in Financial Servicesbenzene4a1Оценок пока нет

- Data Governance PlaybookДокумент168 страницData Governance PlaybookVinh Tran100% (13)

- Project Reort New ShubhamДокумент92 страницыProject Reort New ShubhamDinesh ChahalОценок пока нет

- Guidelines on operational risk managementДокумент16 страницGuidelines on operational risk managementebru zamanОценок пока нет

- ORM Designation Candidate Guidebook - 2022-01 - v3Документ15 страницORM Designation Candidate Guidebook - 2022-01 - v3Mohuddin Aboobakar MemonОценок пока нет

- 204-Article Text-509-1-10-20210127Документ13 страниц204-Article Text-509-1-10-20210127Aida HamdanОценок пока нет

- (Ioannis S. Akkizidis, Vivianne Bouchereau) Guide PDFДокумент436 страниц(Ioannis S. Akkizidis, Vivianne Bouchereau) Guide PDFARMANDO MESTASОценок пока нет

- Accenture Embedding Operational Risk Appetite Framework in Decision Making Large European BankДокумент4 страницыAccenture Embedding Operational Risk Appetite Framework in Decision Making Large European Bankvandana005Оценок пока нет

- The Role of Operational Risk in Rogue TradingДокумент6 страницThe Role of Operational Risk in Rogue TradingpsoonekОценок пока нет

- Senior Bank Operations Manager in New York Resume Cheryl WilsonДокумент2 страницыSenior Bank Operations Manager in New York Resume Cheryl WilsonCherylWilsonОценок пока нет

- Study Guide-FRM24Документ30 страницStudy Guide-FRM24motiquotes4Оценок пока нет

- e Banking ReportДокумент40 страницe Banking Reportleeshee351Оценок пока нет

- FRM2023 Candidate Guide EnglishДокумент20 страницFRM2023 Candidate Guide EnglishShhshshshОценок пока нет

- Bank CapitalДокумент54 страницыBank CapitalGragnor PrideОценок пока нет

- Kotak Mahindra Bank climate risk disclosureДокумент41 страницаKotak Mahindra Bank climate risk disclosureJanviОценок пока нет

- Practice Question Implementing Robust Risk Appetite FrameworksДокумент8 страницPractice Question Implementing Robust Risk Appetite FrameworksBlack MambaОценок пока нет

- BA7026 Banking Financial Services ManagementДокумент33 страницыBA7026 Banking Financial Services ManagementrajamanipradeepОценок пока нет

- Cognita KatalogДокумент258 страницCognita KatalogMirko MiricОценок пока нет