Академический Документы

Профессиональный Документы

Культура Документы

Inflation Targeting December 2011: T BSP P S 1. What Is Inflation?

Загружено:

Jasmine LustadoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Inflation Targeting December 2011: T BSP P S 1. What Is Inflation?

Загружено:

Jasmine LustadoАвторское право:

Доступные форматы

Inflation Targeting December 2011

THE BSP AND PRICE STABILITY 1. What is inflation? Inflation refers to the rate of change in the average prices of goods and services typically purchased by consumers. If inflation is low and stable, then we say that there is price stability. Inflation is typically defined as the annual percentage change in the Consumer Price Index (CPI). The CPI represents the average price of a standard basket of goods and services consumed by a typical Filipino family for a given period. This standard basket contains hundreds of consumption items (such as food products, clothing, water and electricity) whose price movements are monitored to determine the change in the CPI, or the level of inflation. The National Statistics Office (NSO) calculates and announces the monthly CPI and the rate of inflation based on a nationwide monthly survey of prices for a given basket of commodities. The NSO also determines the composition of the CPI basket through surveys that are conducted periodically.

2. Why do we want price stability? Studies based on the experience of many countries have shown that price stability supports growth because it allows households and businesses (including export enterprises) to plan ahead and arrive at better informed decisions relative to their consumption, investment, savings and production needs. In the case of export firms, price stability allows them to price their products competitively, reducing the risks related to the rising cost of raw materials. Price stability also promotes income equality by protecting the purchasing power of the poor who do not have adequate assets (real or financial) that serve as a hedge against inflation. The growing consensus in recent years among most economists and policymakers is that the primary objective of central banks should be to achieve price stability. As a result, in the past decade or so, a growing number of countries have granted institutional independence to their central banks and, by law, committed the latters monetary policy to achieving price stability.

3. Why is the BSP the main government agency responsible for promoting price stability? Among the various government bodies, the Bangko Sentral ng Pilipinas (BSP) is uniquely qualified to promote price stability because it has the sole ability to

Department of Economic Research

Inflation Targeting December 2011

influence the amount of money circulating in the economy. By controlling the supply of money, the BSP is able to exert some influence on the prices of goods and services. In addition, as the Philippines central monetary authority, the BSP is tasked to promote price stability conducive to balanced and sustainable economic growth. This is mandated by law under the provisions of Republic Act No. 7653, also known as the New Central Bank Act, which was passed into law on 10 June 1993. Achieving price stability is a universal goal shared by central banks and monetary authorities all over the world. This does not mean, however, that the BSP pursues price stability to the exclusion of other objectives. Although the price stability objective is the BSPs main priority, other economic goalssuch as promoting financial stability and achieving broadbased, sustainable economic growthare given consideration in policy decisionmaking. Thus, the BSP coordinates with other government agencies to make sure that its policies are part of a consistent and coherent overall policy framework.

4. What is the BSPs role in relation to inflation? The BSP controls inflation by influencing, through monetary policy, the supply of money circulating in the economy. The level of money supply affects the overall demand for goods and services in the economy. This, together with the aggregate supply of goods and services, determines the level of prices. One of the main causes of inflation is excessive liquidity, or a situation when there is too much money supply relative to the supply of goods and services. Allowing more money to circulate induces people to increase their demand for goods and services. If this increased demand is not matched by higher production, prices are bid up. Conversely, too little money to support consumption and investment tends to reduce the demand for goods and services. Given the same level of supply, lower demand for goods and services causes prices to fall.1 The BSP has the ability to influence money supply, thereby enabling it to influence the movement in the prices of goods and services. However, the BSP does not have absolute influence over inflation. There are other important factors affecting consumer prices apart from money supply. Some examples are weather disturbances that affect agricultural production, and movements in world oil prices.

1

This relationship is based on the Quantity Theory of Money (QTM). The QTM states that the total amount received by sellers of output [as measured by the volume of goods and services produced (Q)] multiplied by the price (P) is equal to the total amount spent by purchasers of output [defined as the stock of money supply (M)] multiplied by the velocity of money or the number of times the stock of money is turned over during a given period to finance spending on final goods and services (V), i.e., P x Q = M x V. Assuming that the velocity of money and the level of production are stable, an increase in money supply would lead to an increase in prices.

Department of Economic Research

Inflation Targeting December 2011

These factors cannot be controlled by monetary policy and are, therefore, outside the influence of the BSP.

MONETARY POLICY AND ITS CURRENT FRAMEWORK 5. What is monetary policy? Measures or actions taken by the central bank to regulate the supply of money in the economy constitute what is called monetary policy. Monetary policy actions of the BSP are aimed at influencing the timing, cost and availability of money and credit, as well as other financial factors, for the purpose of stabilizing the price level. If the BSP believes that money supply is in excess of a desired level, then it can take action to reduce the money supply. This is referred to as contractionary monetary policy. On the other hand, ifbased on the BSPs assessmentthe liquidity situation is tight and there is a need to increase money supply, it implements an expansionary monetary policy. 6. How does the BSP implement monetary policy? The BSP implements monetary policy using various instruments to achieve the inflation target set by the National Government. To contract or expand liquidity in the financial system, the BSP can do any or a combination of the following actions: raising/reducing the BSP's policy interest rates; increasing/decreasing the reserve requirement; encouraging/discouraging deposits in the special deposit account (SDA) facility by banks and trust entities of BSP-supervised financial institutions; increasing/decreasing the rediscount rate on loans extended by the BSP to banking institutions on a short-term basis against eligible collaterals of banks borrowers; and outright sales/purchases of the BSPs holdings of government securities.

The BSPs primary monetary policy instruments are its overnight reverse repurchase (borrowing) rate and overnight repurchase (lending) rate.

7. What is the basic approach to monetary policy in the Philippines? In the past, the BSP followed the monetary aggregate targeting approach to monetary policy. This approach is based on the assumption that there is a stable and predictable relationship between money on the one hand, and output and

Department of Economic Research

Inflation Targeting December 2011

inflation on the other hand. This means that changes in money supply (on the assumption that velocity is stable over time) are directly related to price changes or to inflation. Thus, it is assumed that the BSP is able to determine the level of money supply that is needed given the desired level of inflation that is consistent with the economy's growth objective. In effect, under the monetary targeting framework, the BSP controls inflation indirectly by targeting money supply. This approach was modified beginning in the second semester of 1995 under the modified form of monetary targeting to put greater emphasis on price stability instead of rigidly observing the targets set for monetary aggregates. In addition, monetary authorities wanted to address one of the pitfalls of monetary targeting, i.e., it does not account for the long and variable time lag in the effects of monetary policy on the economy. Under the modified framework, the BSP can exceed the monetary targets as long as the actual inflation rate is kept within program levels. Under this modified approach, policymakers monitor a larger set of economic variables in making decisions regarding the appropriate stance of monetary policy. This includes movements in key interest rates, the exchange rate, domestic credit and equity prices, indicators of demand and supply, and external economic conditions, among other variables. THE SHIFT TO INFLATION TARGETING 8. What is inflation targeting? On 24 January 2000, the BSPs policy-making body, the Monetary Board, approved in principle the shift to inflation targeting as a framework for conducting monetary policy. Inflation targeting focuses mainly on achieving price stability as the ultimate objective of monetary policy. This approach involves the announcement of an explicit inflation target that the central bank promises to achieve over a given time period. The target inflation rate is set and announced jointly by the BSP and the government through an inter-agency body. Although the responsibility of achieving the target rests primarily with the BSP, this joint announcement reflects active government participation in achieving the goal of price stability and government ownership of the inflation target. The BSP formally adopted inflation targeting as the framework for monetary policy in January 2002. The Philippines joined a long list of inflation targeters such as Australia, Canada, Finland, Sweden, New Zealand, the United Kingdom, Israel, Brazil, Chile and Thailand, which have moved from high inflation to low inflation following the successful implementation of inflation targeting in their countries. 9. What are the features of inflation targeting? Over the past two decades, financial deregulation and liberalization resulted in the introduction of new products and changes in the structure of the financial system.

Department of Economic Research

Inflation Targeting December 2011

The said changes, however, appeared to have weakened the traditional relationship linking money supply to income and prices. This has prompted many central banks, including the BSP, to review their approach to monetary policy. Like other central banks, the BSP recognized the important features of inflation targeting as follows: simple framework which can, therefore, be easily understood by the public; allows greater focus on the goal of price stability, which is the primary mandate of the BSP; forward-looking and recognizes that monetary policy actions affect inflation with a lag; reflects a comprehensive approach to policy by taking into consideration the widest set of available information about the economy; promotes transparency in the conduct of monetary policy through the announcement of targets and the reporting of measures that the BSP will adopt to attain these targets, as well as the outcomes of its policy decisions; increases the accountability of monetary authorities to the inflation objective since the announced inflation target serves as a yardstick for the performance of the BSP, and thus helps build its credibility; and does not depend on the assumption of a stable relationship between money, output and prices, and can still be implemented even when there are shocks that could weaken the relationship.

10. What are the requirements for the successful adoption of inflation targeting? The success of implementing inflation targeting as the framework for monetary policy depends on the following preconditions that complement and reinforce each other: Firm commitment to price stability. The primary objective of the central bank is to maintain price stability that is conducive to a balanced and sustainable economic growth. As such, the central bank should not be bound by multiple objectives such as financing the governments deficit, keeping the exchange rate at a given level, or other policy agenda of the government unless these are necessary to achieve the goals of price stability. Central bank independence. The central bank must be able to conduct monetary policy without political interference. It must be able to use whatever monetary policy instrument is needed to achieve price stability. The central bank should also have fiscal independence, i.e., it must not be constrained by the need to finance the fiscal deficit. Good forecasting ability. The central bank should have a good statistical model for forecasting inflation.

Department of Economic Research

Inflation Targeting December 2011

Transparency. The central bank should promote transparency by communicating clearly to the public its policy actions and the reasons behind them. Accountability. There should be accountability on the part of the central bank should actual inflation deviate from the target. Sound financial system. The financial system should be fundamentally sound to make monetary policy more effective in influencing output and prices. The financial system acts as the intermediary by which the BSP influences the supply of money and credit in the economy.

11.

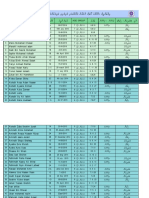

Does the Philippines satisfy all the requirements of inflation targeting? As the table below suggests, the basic requirements for the successful adoption of inflation targeting are already in place in the Philippines.

Requirements for the Adoption of Inflation Targeting Central Bank independence

Is it in place in the Philippines? Yes, the law provides fiscal and administrative independence to the BSP as the central monetary authority. Yes, the law mandates that the BSP should be concerned primarily with maintaining price stability. Inflation forecasting models are continuously being improved; these are supplemented by judgment and discretion given available economic and financial indicators. In addition to existing reports and publications, the BSP also publishes the Inflation Report and the minutes of relevant Monetary Board discussions on monetary policy (with a lag). The BSP stands firmly behind the inflation target and, should there be any deviations, explains the reasons to the public and higher authorities. The financial system is constantly developing, partly in view of the measures implemented by supervisory authorities to strengthen it.

Central Bank commitment

Good forecasting ability

Transparency

Accountability

Sound financial system

Department of Economic Research

Inflation Targeting December 2011

12. How is inflation targeting actually done? Under inflation targeting, the central bank publicly announces a target for inflation and promises to achieve this over a specified time period. The central bank then compares actual headline inflation against its inflation forecasts. The central bank uses the various monetary policy instruments at its disposal to achieve the inflation target. In the case of the Philippines, this involves mainly adjustments in the key policy interest rates of the BSP. Other instruments are also used, which include rediscounting and reserve requirement. The central bank also provides regular reports explaining its policy decisions and containing its assessment of the inflation environment and outlook. If the central bank fails to meet the inflation target, it is required to explain to the public why the target was not achieved and to come up with measures on how to steer inflation towards the target level. MAKING INFLATION TARGETING OPERATIONAL IN THE PHILIPPINES 13. What is the process involved in making inflation targeting operational? The BSP has been observing the following operational guidelines since its implementation of inflation targeting in 2002.

I NFLATION

Government sets inflation target 2 years in advance (in consultation with BSP) 2010: 4.5%1% 2011: 4.0%1%

T ARGETING T

YES

F RAMEWORK

Publish highlights of MB meetings on monetary policy discussions Publish Inflation Report Release press statement

BSP announces inflation target

Is inflation forecast in line with target? Adjust policy interest rate Issue Open letter to the President

BSP Assesses monetary conditions Forecasts inflation Decides on the monetary policy stance

NO

Department of Economic Research

Inflation Targeting December 2011

Setting of the inflation target. The target-setting process is largely based on the existing framework for coordination among government economic agencies under the Development Budget Coordinating Committee (DBCC), an interagency body responsible for setting the annual government targets for macroeconomic variables, particularly the Gross National Product (GNP) and Gross Domestic Product (GDP) growth rates and inflation, which are important inputs in the formulation of the revenue, expenditure and financing programs of the National Government. The National Government, through the DBCC, sets the inflation target two years ahead in consultation with the BSP. The public announcement of the inflation target is made by the BSP Governor, and it is the BSPs responsibility to conduct monetary policy in order to achieve the target. When the BSP adopted the inflation targeting framework in 2002, the inflation target was defined in terms of a range (for example, the target range for 2006 was 4-5 percent). In 2006, the Governments inflation target was respecified from a range target to a point target with a tolerance interval of 1 percentage point starting in the target for 2008. The inflation target is 4.5 percent 1 percentage point (or a range equivalent to 3.5-5.5 percent) for 2010 and 4.0 percent 1 percentage point (or a range equivalent to 3-5 percent) for 2011. On 15 July 2010, the Monetary Board announced the BSPs shift to a fixed inflation target for the medium term of 4 1 percent for 2012-2014. The shift to a fixed medium-term inflation target from a variable annual inflation target was approved by the DBCC on 9 July 2010 under DBCC Resolution No. 2010-3. This shift from a range target to a point target with a tolerance interval effectively widens the BSPs target band. A broader target band is seen to provide added flexibility to monetary authorities in steering inflation. It helps ensure that the design of the inflation target is more consistent with the countrys economic circumstances, and safeguards the credibility of the inflation targeting framework. It also helps align monetary policy practices in the Philippines with those in other inflation targeting countries. Under the inflation targeting framework, there is a need to distinguish between the inflation target and the inflation forecast. The inflation target represents policymakers desired inflation rate, which they commit to achieve over the policy horizon (which is two years in the Philippine case). Inflation targets, because of their institutional nature, tend to be less susceptible to revisions although countries with a history of high inflation tend to set a decelerating path for inflation targets across a period of several years. The inflation forecast, meanwhile, represents the expectation or prediction of the inflation rate over the policy horizon, given information currently available. The inflation forecast changes over time, as important new information is incorporated in the assessment of future inflation. The forecast is a major factor considered by monetary authorities when deciding on whether monetary policy instruments should be adjusted to attain the inflation target.

Department of Economic Research

Inflation Targeting December 2011

Measure of inflation. The BSP uses the rate of change in the CPI in expressing its target for monetary policy. Also known as the headline inflation rate, the rate of change in the CPI is a commonly used and widely known measure of inflation. It is also monitored by an independent statistical agency namely, the NSO, thereby ensuring data integrity, and is announced to the public with a relatively short time lag. The CPI itself represents the average price of a standard basket of goods and services consumed by a typical family. In the Philippines, this CPI is composed of various consumer items as determined by the nationwide Family Income and Expenditure Survey (FIES) conducted every six years by the NSO. In conducting monetary policy, the BSP also monitors what is known as core inflation. A common observation with CPI inflation is that, historically, it tends to be affected by the transitory effects of volatile price movements of certain commodities found in the CPI. Temporary shocks or disturbances in certain areas of the economy, often due to factors outside the direct control of economic policy (e.g., oil price shocks), may cause fluctuations in the CPI inflation that may not necessarily require a monetary response. By eliminating the impact of such disturbances on price data, core or underlying inflation serves as a useful alternative indicator of the path of inflation. The NSO definition of core inflation is computed by excluding selected unprocessed food and energy-related items from the CPI.

Models for inflation forecasting. The BSP uses quantitative models to forecast the monthly inflation rate up to a period of two years. Statistical tests indicate that these models track the actual inflation rate reasonably well. The BSP is in the process of refining its macroeconomic inflation forecasting model (using annual data) that is capable of projecting the inflation rate further into the future. Meetings on monetary policy. Starting in 2012, the Monetary Board will hold eight (8) monetary policy meetings a year to discuss and decide on the appropriate monetary policy stance of the BSP in order to keep inflation within the target. Based on the assessment of the macroeconomic environment and the price situation of commodities, the Monetary Board takes the necessary actions consistent with the chosen monetary policy stance. These actions consist of the various instruments discussed in Item No. 6. The decisions of the Monetary Board concerning monetary policy are determined by a majority vote. No attribution of votes to individual Board members is made in order to emphasize the collegial, consensus-based nature of the decision-making process. To strengthen the decision-making process, the Monetary Board of the BSP receives recommendations from the Advisory Committee (AC), a technical body which meets regularly a few days prior to each MB monetary policy meeting. The Advisory Committee is composed of the following members: (1) the BSP Governor, who serves as Chairman; (2) the Deputy Governor for Monetary

Department of Economic Research

Inflation Targeting December 2011

Stability; (3) the Deputy Governor for Supervision and Examination; (4) the Assistant Governor of the Monetary Policy Sub-Sector; and (5) the Assistant Governor of the Treasury Department. The meetings of the AC are intended to serve as a forum for in-depth, comprehensive, broad-ranging and balanced assessment of monetary conditions, the economic outlook, inflationary expectations and the forecast inflation path. The AC members agree by majority vote on a set of recommendations that are then submitted to the Monetary Board.

Transparency and accountability mechanism. The BSP has a number of disclosure and reporting mechanisms to help the public monitor better its commitment to achieving the inflation target. In addition to various reports and publications, the BSP publishes the Quarterly Inflation Report and the Highlights of the Meeting of the Monetary Board on Monetary Policy. The BSP also holds regular seminars and conferences involving the discussion of monetary developments and policy issues. To ensure accountability in cases where the BSP fails to achieve the inflation target, the BSP Governor issues an Open Letter to the President outlining the reasons why actual inflation did not fall within the target, along with the steps that will be taken to bring inflation towards the target. Open Letters to the President have been issued on 16 January 2004, 18 January 2005, 25 January 2006, 19 January 2007, 14 January 2008, and 26 January 2009.

Explanation clauses, or exemptions to the inflation target. Explanation clauses refer to the predefined set of acceptable circumstances under which an inflationtargeting central bank like the BSP may fail to achieve its inflation target. Such exemptions recognize the fact that there are limits to the effectiveness of monetary policy and that deviations from the inflation target may sometimes occur because of factors beyond the control of the central bank. Under the inflation-targeting framework of the BSP, these exemptions include price pressures arising from: (1) volatility in the prices of agricultural products; (2) natural calamities or events that affect a major part of the economy; (3) volatility in the prices of oil products; (4) significant government policy changes that directly affect prices such as changes in the tax structure, incentives and subsidies. In using explanation clauses, the BSP will have to explain carefully and clearly to the public how these factors resulted in the deviation of the inflation outcome from the target. It will also describe the actions to be taken and the length of time involved to achieve the inflation target.

14. Since the BSP adopted inflation targeting, have the targets met actual inflation? In 2009, year-on-year headline inflation averaged 3.2 percent, well within the National Governments target range of 2.5-4.5 percent for the year. Likewise,

Department of Economic Research

10

Inflation Targeting December 2011

headline inflation in 2010 averaged at 3.8 percent, well within the target range of 3.5-5.5 percent for the year. In 2011, headline inflation [computed using the 2000based Consumer Price Index (CPI) series] averaged at 4.4 percent, within the announced Government target of 3.0-5.0 percent Meanwhile, the new 2006-based CPI series released by the NSOwhich was derived using an updated consumer basket of goods and servicesshowed a higher 2011 average inflation of 4.8 percent but also remained within the Government's target range. The matrix below summarizes the inflation developments since the BSP shifted to inflation targeting framework, indicating among others, the actual inflation compared to the target.

Department of Economic Research

11

Inflation Targeting December 2011

Inflation Developments, 2002 2010 Actual Inflation Actual Inflation Target Year vs Developments/Factors affecting inflation (in (in Target percent) percent)1 2002 2.9 4.5-5.5 Lower Slowdown in food inflation and subdued demand-pull inflationary pressures Absence of significant demand-driven pressures with the continued soft spots in overall demand, soft labor market conditions, and moderate capacity utilization in industries such as manufacturing Easing cost-push inflationary pressures with the abatement of the El Nio phenomenon and the downtrend in international oil prices Supply-side shocks including the increase in global oil prices (which led to higher domestic pump prices of petroleum products and hikes in transport fares) as well as the spate of typhoons and domestic supply constraints affecting the availability of certain food products Higher meat prices linked to the recurrence of avian flu in other countries Continued rise in consumer prices particularly those for food, energy, and transportation Global increase in oil prices leading to higher domestic pump prices, adjustments in minimum wage throughout the country, as well as hikes in the transport fares and utility charges Adverse effect of El Nio dry weather on agricultural output, especially on rice and corn production

2003

3.0

4.5-5.5

Lower

2004

5.5

4.0-5.0

Higher

2005

7.6

5.0-6.0

Higher

Department of Economic Research

12

Inflation Targeting December 2011

Higher world oil prices, the twopercentage point increase in the VAT, and the removal of certain VAT exemptions in 2005 Generally stable prices for major food items, favorable supply conditions, particularly the sustained growth in agriculture, and the subsiding base effect of the RVAT on CPI Firm peso tempering the impact on domestic prices of increasing global commodity prices, including food and oil, which rose during the latter part of the year Confluence of global and supply-side factors beyond the direct control of the BSP such as the big surge in the international prices of oil and food commodities, resulting in higher domestic rice and pump prices of fuel Supply shocks over a longer period, which contributed to second-round effects, affected wage and price-setting behavior of businesses and households; inflation expectations also rose Slowdown in inflationary pressures during the early until the middle part of the year owing to lower oil and other commodity prices due, in large part, to subdued demand conditions Slight uptick in consumer prices towards the latter part of the year, particularly those for food and petroleum products, due to weather disturbances and lifting of price cap on petroleum products

2006

6.2

4.0-5.0

Higher

2007

2.8

4.0-5.0

Lower

2008

9.3

4.01

Higher

2009

3.2

3.51

Within

Department of Economic Research

13

Inflation Targeting December 2011

Food inflation was lower especially in the first half of the year as domestic supply recovered from the impact of the previous years typhoons. It posted an uptick in the third quarter as prices of agricultural commodities went up; in particular, sugar prices increased as El Nio affected the harvest and delayed the milling season. This was more than offset by higher nonfood inflation which can be traced to the surge in the prices of electricity and petroleum products. Food inflation was generally stable as ample supply in the aftermath of typhoons tempered the price increases, despite supply shocks triggered by weatherrelated factors which resulted in production disruptions and agricultural damages thus initially pushing food inflation higher. Meanwhile, non-food inflation trended upwards during the year as domestic prices of petroleum crude tracked the movement in the international market. Adjustments in electricity and water rates also contributed to the increase.

2010

3.8

4.51

Within

2011

4.4

4.01

Within

* For 2002-2004, actual inflation figures used 1994 as the base year whereas inflation data for 2005-2011 used 2000 as the base year. 1 Annual targets r revised

Department of Economic Research

14

Вам также может понравиться

- Inflation TargetingДокумент16 страницInflation TargetingKathryn PuyatОценок пока нет

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationОт EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationОценок пока нет

- Inflation TargetingДокумент17 страницInflation Targetingrosalyn mauricioОценок пока нет

- T BSP P S 1. What Is Inflation?Документ18 страницT BSP P S 1. What Is Inflation?gladys manaliliОценок пока нет

- MEDIUMДокумент19 страницMEDIUMMarielle CatiisОценок пока нет

- Inflation Targeting For Discussion v2.0Документ18 страницInflation Targeting For Discussion v2.0Zace RuruОценок пока нет

- TargetingДокумент18 страницTargetingchingОценок пока нет

- MONETARY POLICY ModuleДокумент2 страницыMONETARY POLICY ModuleMarielle Catiis100% (1)

- Why Is The BSP The Main Government Agency Responsible For Promoting Price StabilityДокумент4 страницыWhy Is The BSP The Main Government Agency Responsible For Promoting Price StabilityMarielle CatiisОценок пока нет

- Monetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheДокумент7 страницMonetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheKikujo KikuОценок пока нет

- Targeting PDFДокумент19 страницTargeting PDFMia Siong CatubigОценок пока нет

- Monetary Policy in Pakistan: BackgroundДокумент6 страницMonetary Policy in Pakistan: BackgroundChoudhery Saleh MohammadОценок пока нет

- Abstract:: Why Focus On Price Stability?Документ11 страницAbstract:: Why Focus On Price Stability?Farooq SiddiquiОценок пока нет

- Monetary Policy of The PhilippinesДокумент6 страницMonetary Policy of The PhilippinesRocetteAnn O'Callaghan PiconesОценок пока нет

- Measurement of Inflation and The Philippine Monetary Policy FrameworkДокумент11 страницMeasurement of Inflation and The Philippine Monetary Policy FrameworkChaiiОценок пока нет

- Monetary & Fiscal PolicyДокумент10 страницMonetary & Fiscal Policyaruna koliОценок пока нет

- Monetary Policy of BangladeshДокумент11 страницMonetary Policy of BangladeshGobinda sahaОценок пока нет

- Monetary Policy (Group 15)Документ24 страницыMonetary Policy (Group 15)Darwin SolanoyОценок пока нет

- MBA510 AssignmentДокумент10 страницMBA510 AssignmentNafiz Al SayemОценок пока нет

- Topic 3Документ4 страницыTopic 3jay diazОценок пока нет

- Monetary PolicyДокумент6 страницMonetary Policypremsid28Оценок пока нет

- Finmar Chapter 12Документ30 страницFinmar Chapter 12Lee TeukОценок пока нет

- Thesis Monetary PolicyДокумент6 страницThesis Monetary Policycgvmxrief100% (2)

- Differences Between Fiscal and Monetary PoliciesДокумент7 страницDifferences Between Fiscal and Monetary PoliciesCheapestPapersОценок пока нет

- Critical Analysis GROUP-2Документ6 страницCritical Analysis GROUP-2Angelo MagtibayОценок пока нет

- Fiscal and Monetary PolicyДокумент14 страницFiscal and Monetary PolicyPiyush JainОценок пока нет

- Central Bank of The PhilippinesДокумент5 страницCentral Bank of The PhilippinesBERNALDEZ NESCEL JOYОценок пока нет

- Bangko Sentral NG Pilipinas - Report EconДокумент46 страницBangko Sentral NG Pilipinas - Report EconMarc Myer De AsisОценок пока нет

- Final ProjectДокумент42 страницыFinal ProjectAnonymous g7uPednIОценок пока нет

- Research Paper On Monetary Policy of PakistanДокумент7 страницResearch Paper On Monetary Policy of Pakistanefeh4a7z100% (1)

- Fiscal and Monetary Policy and Other PoliciesДокумент5 страницFiscal and Monetary Policy and Other PoliciesNathaniel GampolОценок пока нет

- Monetary Policy and Its Influence On Aggregate Demand.Документ16 страницMonetary Policy and Its Influence On Aggregate Demand.Anonymous KОценок пока нет

- Effectiveness of Monetary PolicyДокумент8 страницEffectiveness of Monetary PolicyMiguel SmithОценок пока нет

- Assignment On Monetary Policy in BangladeshДокумент6 страницAssignment On Monetary Policy in BangladeshAhmed ImtiazОценок пока нет

- Introduction To Monetary PolicyДокумент6 страницIntroduction To Monetary Policykim byunooОценок пока нет

- Business EnviromentДокумент19 страницBusiness EnviromentHarshit YОценок пока нет

- FINAL Paper - Inflation Targeting Framework of The BSPДокумент17 страницFINAL Paper - Inflation Targeting Framework of The BSPLeyCodes LeyCodes100% (1)

- Presentation Development 20Документ8 страницPresentation Development 20Hussain RizviОценок пока нет

- UCP AssignmentДокумент16 страницUCP AssignmentSaniya SaddiqiОценок пока нет

- Monetary Policy of BangladeshДокумент26 страницMonetary Policy of Bangladeshsuza054Оценок пока нет

- What Does Inflation MeanДокумент3 страницыWhat Does Inflation MeanMandeep Singh DuaОценок пока нет

- Monetary Policy and Fiscal PolicyДокумент23 страницыMonetary Policy and Fiscal PolicyIam hackerОценок пока нет

- Macro Term PaperДокумент10 страницMacro Term PaperMoshfeqa KarimОценок пока нет

- BSP and Monetary PolicyДокумент49 страницBSP and Monetary PolicySimone Reyes50% (2)

- Monetary PolicyДокумент18 страницMonetary Policymodasra100% (2)

- Understanding Monetary PolicyДокумент16 страницUnderstanding Monetary PolicyBernraf OrpianoОценок пока нет

- Macro 1Документ6 страницMacro 1Dipanshu SinhaОценок пока нет

- Group 5 Monetary Central BankingДокумент19 страницGroup 5 Monetary Central BankingAurea Espinosa ErazoОценок пока нет

- Note Monitary PolicyДокумент7 страницNote Monitary PolicyPark Min YoungОценок пока нет

- Assignment 1 BankingДокумент3 страницыAssignment 1 BankingChelsea MedranoОценок пока нет

- ME AssignmentДокумент23 страницыME AssignmentAshutosh AshishОценок пока нет

- Fiscal and Monetary Policy PDFДокумент2 страницыFiscal and Monetary Policy PDFAbbas KazmiОценок пока нет

- The Effects of Monetary Policy On Inflation in Ghana.Документ9 страницThe Effects of Monetary Policy On Inflation in Ghana.Alexander DeckerОценок пока нет

- Deepak Mohanty: Executive Director, Reserve Bank of India: Inflation DynamicsДокумент4 страницыDeepak Mohanty: Executive Director, Reserve Bank of India: Inflation DynamicsParvez SheikhОценок пока нет

- The Instruments of Macroeconomic Policy.Документ10 страницThe Instruments of Macroeconomic Policy.Haisam Abbas IIОценок пока нет

- What Is Fiscal Policy?: TaxationДокумент7 страницWhat Is Fiscal Policy?: TaxationNathaniel GampolОценок пока нет

- Article 3.0Документ9 страницArticle 3.0Vinish ChandraОценок пока нет

- R O M P I C I Submitted By:: OLE F Onetary Olicy N Ontrolling NflationДокумент17 страницR O M P I C I Submitted By:: OLE F Onetary Olicy N Ontrolling NflationSanjeevОценок пока нет

- Economic Policy - Monetary PolicyДокумент17 страницEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaОценок пока нет

- A Study On Cross Cultural PracticesДокумент56 страницA Study On Cross Cultural PracticesBravehearttОценок пока нет

- Budo Hard Style WushuДокумент29 страницBudo Hard Style Wushusabaraceifador0% (1)

- Jurnal SejarahДокумент19 страницJurnal SejarahGrey DustОценок пока нет

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Документ2 страницыRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYОценок пока нет

- Medieval Societies The Central Islamic LДокумент2 страницыMedieval Societies The Central Islamic LSk sahidulОценок пока нет

- Open Quruan 2023 ListДокумент6 страницOpen Quruan 2023 ListMohamed LaamirОценок пока нет

- 01-Cost Engineering BasicsДокумент41 страница01-Cost Engineering BasicsAmparo Grados100% (3)

- Brunon BradДокумент2 страницыBrunon BradAdamОценок пока нет

- RwservletДокумент2 страницыRwservletsallyОценок пока нет

- .. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiДокумент3 страницы.. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiLisleОценок пока нет

- Developing A Business Plan For Your Vet PracticeДокумент7 страницDeveloping A Business Plan For Your Vet PracticeMujtaba AusafОценок пока нет

- CH 1 QuizДокумент19 страницCH 1 QuizLisa Marie SmeltzerОценок пока нет

- Service Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsДокумент3 страницыService Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsSriram SridharОценок пока нет

- (BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeДокумент5 страниц(BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeMiklós GrécziОценок пока нет

- Script PDFДокумент1 страницаScript PDFWahid KhanОценок пока нет

- 99 Names of AllahДокумент14 страниц99 Names of Allahapi-3857534100% (9)

- Form Audit QAV 1&2 Supplier 2020 PDFДокумент1 страницаForm Audit QAV 1&2 Supplier 2020 PDFovanОценок пока нет

- Is Modern Capitalism Sustainable? RogoffДокумент107 страницIs Modern Capitalism Sustainable? RogoffAriane Vaz Dinis100% (1)

- Series I: Episode OneДокумент4 страницыSeries I: Episode OnesireeshrajuОценок пока нет

- Challenges in Leadership Development 2023Документ26 страницChallenges in Leadership Development 2023Girma KusaОценок пока нет

- Census 2011 PDFДокумент2 страницыCensus 2011 PDFvishaliОценок пока нет

- Industrial Marketing StrategyДокумент21 страницаIndustrial Marketing StrategyNor AzimaОценок пока нет

- Simple Compound Complex and Compound Complex SentencesДокумент7 страницSimple Compound Complex and Compound Complex SentencesRanti HarviОценок пока нет

- FRA - Project - NHPC - Group2 - R05Документ29 страницFRA - Project - NHPC - Group2 - R05DHANEESH KОценок пока нет

- Aarushi VerdictДокумент273 страницыAarushi VerdictOutlookMagazine88% (8)

- Correctional Case StudyДокумент36 страницCorrectional Case StudyRaachel Anne CastroОценок пока нет

- Jurisdiction and Kinds of JurisdictionДокумент3 страницыJurisdiction and Kinds of JurisdictionANUKULОценок пока нет

- Comprehensive Problem Excel SpreadsheetДокумент23 страницыComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- 7wonders ZeusДокумент18 страниц7wonders ZeusIliana ParraОценок пока нет

- Variable Costing Case Part A SolutionДокумент3 страницыVariable Costing Case Part A SolutionG, BОценок пока нет

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (98)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationОт EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationРейтинг: 4 из 5 звезд4/5 (11)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- The Meth Lunches: Food and Longing in an American CityОт EverandThe Meth Lunches: Food and Longing in an American CityРейтинг: 5 из 5 звезд5/5 (5)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsОт EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsРейтинг: 5 из 5 звезд5/5 (3)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesОт EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesРейтинг: 4.5 из 5 звезд4.5/5 (8)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОт EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОценок пока нет

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsОт EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsРейтинг: 4.5 из 5 звезд4.5/5 (94)

- This Changes Everything: Capitalism vs. The ClimateОт EverandThis Changes Everything: Capitalism vs. The ClimateРейтинг: 4 из 5 звезд4/5 (349)

- Second Class: How the Elites Betrayed America's Working Men and WomenОт EverandSecond Class: How the Elites Betrayed America's Working Men and WomenОценок пока нет

- How an Economy Grows and Why It Crashes: Collector's EditionОт EverandHow an Economy Grows and Why It Crashes: Collector's EditionРейтинг: 4.5 из 5 звезд4.5/5 (103)

- The Profit Paradox: How Thriving Firms Threaten the Future of WorkОт EverandThe Profit Paradox: How Thriving Firms Threaten the Future of WorkРейтинг: 4.5 из 5 звезд4.5/5 (13)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyОт EverandChip War: The Quest to Dominate the World's Most Critical TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (229)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationОт EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationРейтинг: 4.5 из 5 звезд4.5/5 (46)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailОт EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailРейтинг: 4.5 из 5 звезд4.5/5 (238)

- Requiem for the American Dream: The 10 Principles of Concentration of Wealth & PowerОт EverandRequiem for the American Dream: The 10 Principles of Concentration of Wealth & PowerРейтинг: 4.5 из 5 звезд4.5/5 (213)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistОт EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistРейтинг: 4.5 из 5 звезд4.5/5 (37)

- Look Again: The Power of Noticing What Was Always ThereОт EverandLook Again: The Power of Noticing What Was Always ThereРейтинг: 5 из 5 звезд5/5 (3)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОт EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОценок пока нет