Академический Документы

Профессиональный Документы

Культура Документы

Major Revival Form 1 Otc Policies

Загружено:

uwrwereiorИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Major Revival Form 1 Otc Policies

Загружено:

uwrwereiorАвторское право:

Доступные форматы

Faidey ka insurance

REQUEST FOR MAJOR REVIVAL OF POLICY- MRF 1

(This form can be used for all OTC policies and for policies being revived within one year from lapsation date) Policy Holder Life Insured

Policy Number Name (Mr/Ms/Title - Surname-First name-Middle name) Contact Number E-mail ID Do your bit for green world & Switch to e-communication. Kindly mark if you would like to receive your communication through electronic mode. Salaried Housewife Student Self Employed Retired Others Salaried Retired Self Employed others

Occupation Details Annual Income

Policy Life Insured Holder* Policy holder* to respond to Q1-4 only If plan is Headstart Joint Life / Long Secure Plus or If WOP rider attached Height in cms/ Weight in Kgs (eg Xcm/ Ykgs)

Q1 Q2 a b Are you currently in Good Health? Since the date of signing the original application, have you Consulted a Medical practitioner for any ailment/injury etc. Been medically advised to/or undergone/currently undergoing a course of medication or any cardio logical/radiological/pathological investigations and/or surgical procedures or have you been advised or required to be hospitalized, in connection with any disease, sickness or accident? Been tested for, or received medical advise, counseling or treatment in connection with sexually transmitted disease, AIDS or infection with Human Immunodeficiency Virus? Remained absent from work or hospitalised for any illness, sickness, disease, injury, accident or disorder for more than 7 days or claimed against his/her health insurance policies Being consuming any of the following - Cigarette / Beedi/ Pan / Gutkha/ Alcohol. If yes, give average daily usage. (Tobacco - nos. / Grams/ packs per day) (Alcohol - ml per day /week/month /year) Suffered from any of the following? a] Diabetes (b) Heart Disease (c) Blood pressure Problems d) Cholesterol problems (e) Stroke (f) Epilepsy (g) Mental Disorder (h) Tuberculosis/ respiratory problems (I) Jaundice/Hepatitis (j) cancer (k) Kidney disease (l) Paralysis or (m) Hereditary disease (n) Any neurological Disorder (o) Vision or Hearing related disorder (p) any blood disorder (q) Thyroid/ Other Endocrine disorders (r) Asthma (s)Tumour/ Cyst (t)Urinary disorders. If YES, please indicate name of illness and age of onset of the said Illness below Female Lives Questions Is the life to be insured pregnant now? or caesarean section after the date of signing the proposal form?

QUESTIONS

Yes

No

Yes* No*

If answers from 2(a) to 4 (c) are in Yes ,please

provide details

Q3 a b

Q4 a

Additional details Do you have any existing policies/simultaneously applied proposaIs/ any proposal or an application for revival of a lapsed Policy on your life, under consideration of this Company or any other Insurer ? (If yes, please give details of Sum Assured, Terms of acceptance) Since the date of signing of the original application, has any proposal on your life/ application for reinstatement been accepted with extra premium, postponed, declined or accepted with modified terms from this company or any other insurance company? Has there been any change in your occupation, avocation or place of residence since the date of signing the original application?

Declaration and Authorization:

SECTION 41 OF THE INSURANCE ACT, 1938 (4 OF 1938): 1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer: Provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not be deemed to be acceptance of a rebate of premium within the meaning of this sub section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide insurance agent employed by the insurer. (2) Any person making default in complying with the provisions of this section shall be punishable with fine which may extend to five hundred rupees. I/We declare that I/We have answered the questions in this Policy Revival form after fully understanding the nature of the questions and the importance of disclosing all information while answering such questions. I/We further declare that the answers given by me /us to all the questions in this form are true and complete in every respect and that I/We have not withheld any material information or suppressed any fact. I/We undertake to notify KOTAK MAHINDRA OLD MUTUAL LIFE INSURANCE LTD. of any change in the state of health of the life to be insured or as to his/her occupation or any decisions about his/her existing policies or proposals subsequent to the signing of this form and before the acceptance of the risk by KOTAK MAHINDRA OLD MUTUAL LIFE INSURANCE LTD.I/We further declare that this policy revival form will also be the basis of the contract of insurance and if any untrue statement is contained in this form, the Company shall have the right to vary the benefits which may be payable and further if there has been a non-disclosure of a material fact the policy may be treated as void and all premiums paid under the policy may be forfeited to the Company. I/We hereby authorise the employer, doctor or hospital of the life to be insured to divulge to the Company any information required by them in connection with the policy contract.I/We understand that the contract will be governed by the provisions of the Insurance Act, 1938 and that the contract will not commence until the Companys written acceptance of this application is received. Place: Date:

Signature/ thumb impression * of the Life insured

Signature/ thumb impression* of the Policy Holder (if different from the life insured)

DECLARATION BY THE PERSON FILLING IN THE FORM (Applicable only where form is filled by a scribe or signed by in vernacular language) I, ________________________________ (Full Name of Scribe) have explained to the Proposer, that the answers to the questions form basis of the contract of Insurance between the Company and the Proposer and that if any untrue statement is contained therein the Company shall have the right to vary the benefits which may be payable and further if there has been any non-disclosure of material facts the policy may be treated as void and all premiums paid under the policy may be forfeited to the Company Address of the Scribe: Signature of the Scribe: Place : Date :

Signature/right thumb impression of the policy holder

Signature of the advisor/broker as witness

Note: 1. Policy can be revived post discontinuance of the same. The revival period would end after 2 years from the date of discontinuance or end of lock in period which ever is earlier. 2. Where the policy is accepted for revival the discontinuance charges deducted from the fund will be added back to the fund value and units of the segregated fund chosen by the policyholder will be allotted at the NAV as on the date of revival 3. Post discontinuance if you want to revive the policy and same is in major revival then you will have to complete the major revival formalities. 4. This policy shall be revived only post fresh underwriting of the case and fulfillment of all requirements as may be called for by the Company. The policy shall be revived only after acceptance of the risk by Underwriters of the Company and due communication of the same to the policy holder after clearance of the cheque. Till then the policy shall not be re-instated. Kotak Mahindra Old Mutual Life Insurance Ltd.

Regn no.107, Regd Office: 4th floor, Vinay Bhavya Complex, 159-A, C.S.T. Road, Kalina, Santacruz (E), Mumbai 400 098 For any correspondence kindly contact us at : Kotak Infiniti, 7th Floor, Building No. 21, Infiniti Park, Off Western Express Highway, Goregaon Mulund Link Road, General A.K. Vaidya Marg, Malad (E), Mumbai 400 097. (+9122) 6605 7757{D} 66200550 {F} http://insurance.kotak.com/ Toll Free No: 1800 209 8800 Insurance is subject matter of solicitation

MRF/v.1.4/2011

We acknowledge the receipt of request for Revival for Policy no.: __________________.

Kotak Mahindra Old Mutual Life Insurance Ltd.

Regn no.107, Regd Office: 4th floor, Vinay Bhavya Complex, 159-A, C.S.T. Road, Kalina, Santacruz (E), Mumbai 400 098 For any correspondence kindly contact us at : Kotak Infiniti, 7th Floor, Building No. 21, Infiniti Park, Off Western Express Highway, Goregaon Mulund Link Road, General A.K. Vaidya Marg, Malad (E), Mumbai 400 097. (+9122) 6605 7757{D} 66200550 {F} http://insurance.kotak.com/ Toll Free No: 1800 209 8800 Insurance is subject matter of solicitation

MRF/v.1.4/2011

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Fdar Samples PresentationДокумент29 страницFdar Samples PresentationKewkew Azilear92% (37)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Sehatvan Fellowship ProgramДокумент8 страницSehatvan Fellowship ProgramShivam KumarОценок пока нет

- Reaching OutДокумент353 страницыReaching OutDebayan NandaОценок пока нет

- The Original Prevention of Sickness PamphletДокумент88 страницThe Original Prevention of Sickness PamphletGeorge Singleton100% (4)

- Pe9 Week3 Pe9pf Le H 41Документ17 страницPe9 Week3 Pe9pf Le H 41Edeli Faith PatrocinioОценок пока нет

- ART THERAPY, Encyclopedia of Counseling. SAGE Publications. 7 Nov. 2008.Документ2 страницыART THERAPY, Encyclopedia of Counseling. SAGE Publications. 7 Nov. 2008.Amitranjan BasuОценок пока нет

- Emotion-Focused Family Therapy (A Transdiagnostic Model For Caregiver-Focused Interventions)Документ245 страницEmotion-Focused Family Therapy (A Transdiagnostic Model For Caregiver-Focused Interventions)danivillavicencio917Оценок пока нет

- Bosanquet Etal DMCN 2013Документ9 страницBosanquet Etal DMCN 2013ramopavelОценок пока нет

- Happy Cities Summit 2018 SummaryДокумент63 страницыHappy Cities Summit 2018 SummaryCherukupalli Gopala KrishnaОценок пока нет

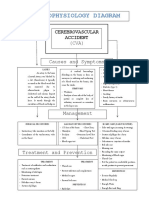

- Pathophysiology DiagramДокумент1 страницаPathophysiology Diagramzebzeb STEMAОценок пока нет

- Startup StoryДокумент1 страницаStartup StorybmeghabОценок пока нет

- Cupuncture: Victor S. SierpinaДокумент6 страницCupuncture: Victor S. SierpinaSgantzos MarkosОценок пока нет

- Lab 7 HIV Detection Using ELISAДокумент24 страницыLab 7 HIV Detection Using ELISAAhmed AbedoОценок пока нет

- Drug Formulary HospitalДокумент98 страницDrug Formulary HospitalahmshmОценок пока нет

- San Antonio and Bexar County Petition For TRO Against Gov. Abbott Over Local Control of COVID-19 Prevention EffortsДокумент29 страницSan Antonio and Bexar County Petition For TRO Against Gov. Abbott Over Local Control of COVID-19 Prevention EffortsKENS 5Оценок пока нет

- Brucellosis - DR Esayas Kebede GudinaДокумент44 страницыBrucellosis - DR Esayas Kebede GudinaEsayas KebedeОценок пока нет

- Exercise Science Honours 2016Документ22 страницыExercise Science Honours 2016asdgffdОценок пока нет

- CHOLECYSTITISДокумент6 страницCHOLECYSTITISAnar ChuluunОценок пока нет

- Evolution of Spaces With Respect To Child PsychologyДокумент28 страницEvolution of Spaces With Respect To Child PsychologyDevvrat ChowdharyОценок пока нет

- Health Professional Evaluation CertificateДокумент1 страницаHealth Professional Evaluation CertificateWasim UllahОценок пока нет

- Guidelines For Handling Medico Legal CasesДокумент5 страницGuidelines For Handling Medico Legal CasesVaishnavi Jayakumar80% (5)

- Nama Kelompok: 1. Ahmad Kasyaf 2. Tio Rizki Kurniawan Kelas: Ix 1Документ9 страницNama Kelompok: 1. Ahmad Kasyaf 2. Tio Rizki Kurniawan Kelas: Ix 1didy rachmanОценок пока нет

- Approach To The History and Evaluation of Vertigo and DizzinessДокумент24 страницыApproach To The History and Evaluation of Vertigo and DizzinessPAULA GABRIELA ABAD POLOОценок пока нет

- MAPEH 7 3rd Summative TestДокумент5 страницMAPEH 7 3rd Summative TestFerlyn Bautista Pada100% (1)

- Primitive ReflexesДокумент10 страницPrimitive Reflexesbun_yulianaОценок пока нет

- Anemia ProjectДокумент33 страницыAnemia ProjectNilesh BagalОценок пока нет

- CH 23 Infectious Diseases Skill WSДокумент2 страницыCH 23 Infectious Diseases Skill WSChing Man TamОценок пока нет

- Beneficence and NonДокумент4 страницыBeneficence and NonRoselle Farolan LopezОценок пока нет

- June 2021Документ90 страницJune 2021SEIYADU IBRAHIM KОценок пока нет

- Stress N CopingДокумент5 страницStress N CopingSmriti BordoloiОценок пока нет