Академический Документы

Профессиональный Документы

Культура Документы

Business Plan Assistance

Загружено:

Mohit ShuklaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Plan Assistance

Загружено:

Mohit ShuklaАвторское право:

Доступные форматы

Business Plan Assistance

All businesses start with a bright Idea. But it is execution that distinguishes successful entrepreneurs from the rest. And for excellence in execution, one needs to plan and strategize well. Companies that invest adequately in planning & strategizing are the ones that execute the best. Remember, your business is your most valuable asset and therefore your business plan has to be rock solid to ensure that you not only survive in this competitive world but also emerge as a distinguished leader.

Drawing up a good Business Plan has multiple benefits. Some of these are:

It helps you in setting up budgets and targets for your team. It helps you in planning your resources requirements be it funding, manpower, or technology. It helps you in defining your business objectives & resultant strategies to achieve them. It is the most important document required for any fund raising; be it Debt or Equity. It helps you in tracking your business performance, when undertaking reviews. A thorough planning exercise, coupled with regular reviews, helps you in strategizing corrective actions, if any. One can derive significant benefits from a Business Plan if the same is prepared professionally.

Some of the ingredients of a good Business Plan are:

Executive Summary Company Overview Products and Services Offering Market Analysis and Plan Management Team Manufacturing or Operations Process Financial Overview Specific Milestones & Targets Current Offering and Use of Proceeds, if any fund raising is undertaken While the above is an illustrative list, one needs to be simple, specific, realistic and should be able to provide complete information to the reader. Use of graphs, charts, ratios and photographs makes the plan document more appealing and reader friendly.

At SuperCFO we provide a range of Business Plan Services. These are: Do it on your own template:

We hold a repository of over 350 Business Plan Templates. These are simple business plan templates with Word and XLS files. Just let us know what industry business plan you need and we could provide you the same for you to work on your own.

Customizing available Business Plan:

If you have a basic Business Plan in place, but would want a professional to review, amend and update it appropriately, let us know. We could even solidify it with a detailed financial forecast model and advise on additional content that should be included, considering your target audience for the plan.

Building a new Business Plan:

If you want to stand out with a unique Business Plan, we begin with a brainstorming session with you and your senior management team on the overall plan. Thereafter we research information about your company, your products/services, your industry and your competition to build the text portion of the Business Plan document. We supplement the plan with detailed financials, including sensitivity scenarios and ratio analysis to ratify various business statements. Thereafter, we also design a version of the financial model for you to track on regular basis, as your working budget file.

Building detailed Financial Model and Sensitivity Scenarios:

Under this, we prepare a detailed financial model, with options for you to undertake sensitivity testing and based on the same we design subset models for you to use as your Operating Budgets

Corporate Planning and Structure

When undertaking Corporate Planning & Structuring exercise, there is no one size fits all approach. There is a common saying: What is good for the Goose is not necessarily good for the Gander. History has shown how companies have tried to mimic successful business models and corporate planning systems of rival companies, yet failed to do so. The reason for that is very simple, and it lies in the need to evolve a solution that is tailored to individual specific needs. The East and the West both have several successful business models across several different spheres and verticals and they have all flourished simply because they stayed true to their ideals and true to their needs.

At SuperCFO, we assist companies with: Business Plan:

Building detailed business model to identify resources required, as well as proposed action plans to achieve desired business goals.

Corporate Structuring:

Deciding what is the best form of legal entity structure considering multiple factors like business risks, resources requirements, fund raising need, local regulatory requirements, tax efficiency, size of the business, compliance costs, etc.

Business Arrangements:

Review and assistance in finalizing commercial structure and format of different business arrangements be it manpower, property, vendors, franchisee partners, bankers and clients.

Funding Strategy:

Having the right quantum of debt and equity in your business helps you in keeping your equity dilution to the minimum, while still providing growth capital which effectively enhances your valuation gains. A Company needs to strategize the how, when, who, how much and from whom of fund raising strategy very well. Deciding on the right timing, quantum and the funding instrument are very important aspects of funding strategy.

Finance & Accounting Function:

To begin with, we map your requirements with team size and specific skill sets that would be required to form a solid Finance and Accounting Team. Wherever required, we supplement your team with our in-house subject matter experts, but the intention is to build a very strong Finance & Accounting function that can assist the company in complying with all regulatory requirements, as well as in facilitating the management team with business MIS and analytics.

Forecasting & Sensitivity Analysis

Drawing up detailed financial forecasts, with sensitivity scenarios and ratio analysis helps you in setting targets and establishing milestones for business performance. It also demonstrates what you need to do to achieve various goals and prepares you for any eventuality. We begin our exercise with a detailed brainstorming session with the companys senior management team. Thereafter we undertake brief research about the company, their products/services, industry benchmarks and competition financials (wherever available) to build detailed financial model, including sensitivity scenarios and ratio analysis to ratify various business statements. Moreover, we undertake Sensitivity Analysis to evaluate the Companys funding requirements (under different scenarios). This also helps the Company in drawing up Cashflow Forecast and in agreeing on Collection and Payables Policy. Based on the final forecast model, we build simple working files for use by the company as Budgeting Tracking Dashboard. Note that all our financial models are built in XLS and we provide these in open format to allow the company to use the same for their ongoing requirements.

International Structuring

Having a well thought international strategy is vital to implementing an efficient International Holding Structure. It is easy to setup entities in different parts of the world for your business requirements. However, if this is done without proper plannin g and strategy, it can prove costly and inefficient from taxation, funding and leveraging perspective. As a CFO, we help you in designing your international strategy and then advise you with the best available option, considering regulatory & other requirements at

various jurisdictions. Wherever required, we even coordinate and arrange for meetings & opinions from specific subject matter experts, across various jurisdictions.

Following is an illustrative 10 point checklist we use when evaluating International Holding Structure:

Local Tax Structure Double Taxation Avoidance Treaty Benefits Eventual long term Fund Raising / IPO Plans Special Benefits/Subsidies from Local Government Compliance Requirements Investor Perception Manpower cost Accounts Reporting Local Funding Opportunity Local Business Protection Regulations

Strategic Planning

Business Plan Assistance Corporate Planning,structure Capitalization and Fundraising Forecasting,Sensitivity Analysis International Structuring Budgeting and Forecasting

Solutions

Overview Strategic Planning Transaction Support Operational Support Recruitment Services CFO Support Services Accounting Services Exit Strategy Investor Relations Turnaround Management Fund Raising IFRS Conversion Cashflow & Cost Management Services For Non Executive Directors

Submit

Budgeting and Forecasting

To be a successful player in todays environment, one has to have robust budgeting & forecasting system. Following are some of the key benefits from this exercise:

Knowing your cashflow and other resources requirement. Planning and preparing for any contingencies. Setting goals and targets for key management personnel. Drawing up growth strategy and identifying milestones. This is a very important function and if you are planning to raise funds (be it bank debt or PE/VC funding or IPO), you need to have a robust budgeting system that allows you to provide accurate forecasts to your investors & lenders. This cannot be achieved overnight, and comes only through sound planning and undertaking serious budgeting & variance analysis internally, every month. SuperCFO assists in drawing up detailed forecast model which starts with brain storming and discussions with all key stakeholders. We then evaluate information currently available on hand and provide the same in comparable format to take informed decision for forecasting purposes. Thereafter we engage with the senior management team in discussing and debating on the numbers to validate all assumptions, after which we build a detailed forecast model. Our involvement doesnt stop there. From thereon, we help the company in implementing the budgeting system and also hand-hold the companys accounting team with generating monthly variance report for a cycle or two, until they are comfortable generating reports on their own. To simplify the process for the accounting staff we also provide exhaustive templates, with simple data input sheets, wherein they could feed their actual financials from their accounting software and generate detailed management dashboard.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Background To The Arbitration and Conciliation Act, 1996Документ2 страницыBackground To The Arbitration and Conciliation Act, 1996HimanshuОценок пока нет

- Case Study Analysis-BusinessEthicsDilemmaДокумент1 страницаCase Study Analysis-BusinessEthicsDilemmaMeg CariñoОценок пока нет

- CFS Session 1 Choosing The Firm Financial StructureДокумент41 страницаCFS Session 1 Choosing The Firm Financial Structureaudrey gadayОценок пока нет

- Ifm BopДокумент18 страницIfm Bopsunil8255Оценок пока нет

- DPP 01 Gravitation + Geometrical Optics + Electrostatics PhysicsДокумент17 страницDPP 01 Gravitation + Geometrical Optics + Electrostatics PhysicsAditya TripathyОценок пока нет

- Akbayan Vs AquinoДокумент2 страницыAkbayan Vs AquinoAlyssa Clarizze MalaluanОценок пока нет

- Demand Letter WiwiДокумент1 страницаDemand Letter WiwiflippinturtleОценок пока нет

- Homework For Non Current Assets Held For SaleДокумент2 страницыHomework For Non Current Assets Held For Salesebosiso mokuliОценок пока нет

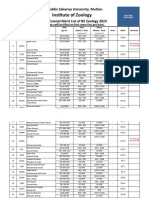

- 5953-6th Merit List BS Zool 31-8-2023Документ22 страницы5953-6th Merit List BS Zool 31-8-2023Muhammad AttiqОценок пока нет

- International Business Review: Farok J. Contractor, Ramesh Dangol, N. Nuruzzaman, S. RaghunathДокумент13 страницInternational Business Review: Farok J. Contractor, Ramesh Dangol, N. Nuruzzaman, S. RaghunathQuang NguyễnОценок пока нет

- Mobile Services: Your Account Summary This Month'S ChargesДокумент4 страницыMobile Services: Your Account Summary This Month'S Chargeskumar JОценок пока нет

- Association of Mutual Funds in India: Application Form For Renewal of Arn/ EuinДокумент5 страницAssociation of Mutual Funds in India: Application Form For Renewal of Arn/ EuinPiyushJainОценок пока нет

- JD 1-Moral Values: Kathrina Lana S. LanajaДокумент2 страницыJD 1-Moral Values: Kathrina Lana S. LanajaBrigitte YambaОценок пока нет

- Davao October 2014 Criminologist Board Exam Room AssignmentsДокумент113 страницDavao October 2014 Criminologist Board Exam Room AssignmentsPRC Board0% (1)

- Beso v. DagumanДокумент3 страницыBeso v. DagumanMarie TitularОценок пока нет

- F8 Theory NotesДокумент29 страницF8 Theory NotesKhizer KhalidОценок пока нет

- PCARD AssignmentДокумент7 страницPCARD AssignmentMellaniОценок пока нет

- Digest - Go V UCPBДокумент2 страницыDigest - Go V UCPBamberspanktowerОценок пока нет

- TNPSC Group 1,2,4,8 VAO Preparation 1Документ5 страницTNPSC Group 1,2,4,8 VAO Preparation 1SakthiОценок пока нет

- Peavey Valveking 100 212Документ12 страницPeavey Valveking 100 212whitestratОценок пока нет

- First Church of Seventh-Day Adventists Weekly Bulletin (Spring 2013)Документ12 страницFirst Church of Seventh-Day Adventists Weekly Bulletin (Spring 2013)First Church of Seventh-day AdventistsОценок пока нет

- Presentation Flow: Public © 2023 SAP SE or An SAP Affiliate Company. All Rights Reserved. ǀДокумент31 страницаPresentation Flow: Public © 2023 SAP SE or An SAP Affiliate Company. All Rights Reserved. ǀAbhijeet PawarОценок пока нет

- Gabriela SilangДокумент9 страницGabriela SilangEshaira Morales100% (1)

- GR No. 186417 People vs. Felipe MirandillaДокумент1 страницаGR No. 186417 People vs. Felipe MirandillaNadine GabaoОценок пока нет

- Grant, R - A Historical Introduction To The New TestamentДокумент11 страницGrant, R - A Historical Introduction To The New TestamentPaulo d'OliveiraОценок пока нет

- Tenancy Contract 1.4 PDFДокумент2 страницыTenancy Contract 1.4 PDFAnonymous qKLFm7e5wgОценок пока нет

- Presidential Commission On Good Government vs. Gutierrez, 871 SCRA 148, July 09, 2018Документ15 страницPresidential Commission On Good Government vs. Gutierrez, 871 SCRA 148, July 09, 2018calmandpeaceОценок пока нет

- Rent Agreement FormatДокумент2 страницыRent Agreement Formatrahul_gulrajani7615Оценок пока нет

- City of Fort St. John - COVID-19 Safe Restart GrantДокумент3 страницыCity of Fort St. John - COVID-19 Safe Restart GrantAlaskaHighwayNewsОценок пока нет

- Biotech Bo SeriesДокумент2 страницыBiotech Bo SeriesArlinda Friyanti CallistaОценок пока нет