Академический Документы

Профессиональный Документы

Культура Документы

Explain The Objectives of Financial Management

Загружено:

Nishi AgarwalИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Explain The Objectives of Financial Management

Загружено:

Nishi AgarwalАвторское право:

Доступные форматы

1. Explain the objectives of Financial Management.

The objectives or goals or financial management are- (a) Profit maximization, (b) Return maximization, and (c) Wealth maximization. We shall explain these three goals of financial management as under: (1) Goal of Profit maximization. Maximization of profits is generally regarded as the main objective of a business enterprise. Each company collects its finance by way of issue of shares to the public. Investors in shares purchase these shares in the hope of getting medium profits from the company as dividend It is possible only when the company's goal is to earn maximum profits out of its available resources. If company fails to distribute higher dividend, the people will not be keen to invest their money in such firm and persons who have already invested will like to sell their stocks. On the other hand, higher profits are the barometer of its efficiency on all fronts, i.e., production, sales an management. A few replace the goal of 'maximization of profits' to 'fair profits'. 'Fair Profits' means general rate of profit earned by similar organisation in a particular area. (2) Goal of Return Maximization. The second goal of financial management is to safeguard the economic interest of the persons who are directly or indirectly connected with the company, i.e.,shareholders, creditors and employees. The all such interested parties must get the maximum return for their contributions. But this is possible only when the company earns higher profits or sufficient profits to discharge its obligations to them. Therefore, the goal of maximization of returns are inter-related. 3. Goal of Wealth Maximization. Frequently, Maximization of profits is regarded a the proper objective of the firm but it is not as inclusive a goal as that of maximising it value to its shareholders. Value is represented by the market price of the ordinary share of the company over the long run which is certainly a reflection of company's investment and financing decisions. The log run means a considerably long period in order to work out a normalized market price. The management ca make decision to maximize the value of its shares on the basis of day-today fluctuations in the market price in order t raise the market price of shares over the short run at the expense of the long fun by temporarily diverting some of its funds to some other accounts or by cutting some of its expenditure to the minimum at the cost of future profits. This does not reflect the true wort of the share because it will result in the fall of the share price in the market in the long run. It is, therefore, the goal of the financial management to ensure its shareholders that the value of their shares will be maximized in the long-run. In fact, the performances of the company can well be evaluated by the value of its share.

2. What do you understand by financial decisions? Discuss the major financial decisions. Financial decisions refer to decisions concerning financial matters of a business firm. We can classify these decisions into three major groups: 1. Investing decisions. 2. Financing decisions. 3. Dividend decisions.

Investment Decisions : These involve the allocation of resources among various type of assets. what portion of the firm's fund should be invested in various current assets such as cash. marketable securities and receivable and what portion in fixed assets, such as inventories and plant and equipment. The assets mix affects the amount of income the firm can earn. For example, a

manufacturer is in business to earn income with fixed assets such as machinery and not with current assets. However, placing too high a percentage of its assets in new building or new machinery may leave the firm short of cash to meet an unexpected need or exploit sudden opportunity. The firms financial manager must invest in fixed assets. but not too much. Besides determining the assets mix financial manager must also decide what type of fixed and current assets to acquire. All this covers area pertaining to capital budgeting and working capital management. 2) Financing Decision : It is the next step in financial management for executing the investment decisions once taken a look at the balance - sheet of a company indicates that it obtains finance from shareholders ordinary, preference, debenture holders, or long - term loans from the institutions, bank and other sources. There are variations in the provisions contained in preference shares, debentures, loans papers etc. Thus financing decisions i.e. The financing mix of capital structure. Efforts are made to obtain an optimal financing mix for a particular company. This necessitates study of capital structure as also the short and intermediate term financing plans of the company. In more advanced companies financing decision today , has become fully integrated with top - management policy formulation via capital budgeting, long - range planning , evalution of alternate uses of funds and establishment of measurable standards of performance in financial terms. 3) Dividend Decisions : The third major decision of financial management is the decision relating to the dividend policy. The dividend decision should be analysed in relation to the financing decision of a firm . Two alternatives are available in dealing with the profits of a firm; they can be retained in the business. Which courses should be followed - dividend or retention ? One significant factor is that the dividend pay out ratio i.e. what proportion of net profits should be paid out to the shareholders. The decision will depend upon the preference of the shareholders and investment opportunities available within the firm. The second major aspect of the dividend decision is the factors determining dividend policy of a firm in practice.

3. Critically analyze the functions of Financial Manager in a large scale industrial establishment.

The financial manager performs the following functions: 1. Finance manager manages the funds in such a way to ensure their optimum utilisation with the available resources. 2. He forecasts the requirement of funds for both short term and long term purposes.

3. He also actively takes part in budgeting, risk management and financial reporting. 4. He makes financial reports, have and eye on profits and losses, etc. 5. He decides how much of the firms profits should be invested, how much should be given to the shareholders in the form of dividends and how much should be kept as reserves. 6. He also monitors the cash flows, prepares accounts and works on financial models. 7. He decides what type of capital structure is required be the company and decides whether to raise funds from loans/borrowing or from share capital. 8. He also ensures that adequate funds at cheap rates are supplied to various parts of the organization at the right time. 9. He constantly reviews the financial performance of various units of the organization. 10. He also ensures that no excess cash is lying idle.

4. What is capital budgeting? Examine its need and importance.

Capital budgeting is the process of making investment decisions in capital expenditure. A capital expenditure may be defined as an expenditure the benefits of which are expected to be received over period of time exceeding one year. Examples would include the development of a major new product, a plant site location, or an equipment replacement decision.

1. 2. 3. 4.

5.

Capital budgeting decision must be approached with great care because of the following reasons: Long time period: consequences of capital expenditure extends into the future and will have to be endured for a longer period whether the decision is good or bad. Substantial expenditure: it involves large sums of money and necessitates a careful planning and evaluation. Irreversibility: the decisions are quite often irreversible, because there is little or no second hand market for may types of capital goods. Over and under capacity: an erroneous forecast of asset requirements can result in serious consequences. First the equipment must be modern and secondly it has to be of adequate capacity. Long term effect on profitability: These decisions have a long-term and significance on the profitability. An unwise decision may prove disastrous and fatal to the very existence of the concern.

5 What are the various types of capital investment decisions known to you?

One of the classifications is as follows,

Expansion of existing business Expansion of new business Replacement and moderation

Expansion and Diversification A company may add capacity to its existing product lines to expand existing operation. For example, the Company Y may increase its plant capacity to manufacture more X. It is an example of related diversification. A firm may expand its activities in a new business. Expansion of a new business requires investment in new products and a new kind of production activity within the firm. If a packing manufacturing company invest in a new plant and machinery to produce ball bearings, which the firm has not manufacture before, this represents expansion of new business or unrelated diversification. Sometimes a company acquires existing firms to expand its business. In either case, the firm makes investment in the expectation of additional revenue. Investment in existing or new products may also be called as revenue expansion investment. Replacement and Modernization The main objective of modernization and replacement is to improve operating efficiency and reduce costs. Cost savings will reflect in the increased profits, but the firms revenue may remain unchanged. Assets become outdated and obsolete with technological changes. The firm must decide to replace those assets with new assets that operate more economically. If a Garment company changes from semi automatic washing equipment to fully automatic washing equipment, it is an example of modernization and replacement. Replacement decisions help to introduce more efficient and economical assets and therefore, are also called cost reduction investments. However, replacement decisions that involve substantial modernization and technological improvements expand revenues as well as reduce costs.

Вам также может понравиться

- Customers Switching Intentions Behavior in Retail Hypermarket Kingdom of Saudi Arabia: Customers Switching Intentions Behavior in Retail HypermarketОт EverandCustomers Switching Intentions Behavior in Retail Hypermarket Kingdom of Saudi Arabia: Customers Switching Intentions Behavior in Retail HypermarketОценок пока нет

- Can The Market Add and SubtractДокумент6 страницCan The Market Add and SubtractSundas ArifОценок пока нет

- Can The Market Add and SubtractДокумент37 страницCan The Market Add and SubtractJaved IqbalОценок пока нет

- Balance Sheet ExampleДокумент2 страницыBalance Sheet ExampleKC XitizОценок пока нет

- Darlene Cook Company Engaged in The Following Transactions DurinДокумент1 страницаDarlene Cook Company Engaged in The Following Transactions DurinM Bilal SaleemОценок пока нет

- Corporate Social ResponsibilityДокумент15 страницCorporate Social ResponsibilityVinay VinuОценок пока нет

- Monometallism BimetallismДокумент22 страницыMonometallism BimetallismMissVirginia1105Оценок пока нет

- Determinants of Economic Growth and DevelopmentДокумент5 страницDeterminants of Economic Growth and Developmentpaban2009100% (1)

- Chap 006Документ14 страницChap 006Adi SusiloОценок пока нет

- Business Ethics Concepts and Professional EthicsДокумент10 страницBusiness Ethics Concepts and Professional EthicsGaurav ChavhanОценок пока нет

- IrsДокумент12 страницIrsabinashnayak1Оценок пока нет

- Module 1 Nature, Purpose, and Scope of Financial ManagementДокумент11 страницModule 1 Nature, Purpose, and Scope of Financial ManagementSofia YuОценок пока нет

- Central Bank FunctionsДокумент3 страницыCentral Bank FunctionsPrithi Agarwal50% (2)

- Chapter 2Документ5 страницChapter 2Sundaramani SaranОценок пока нет

- Ethics in Negotiation-1Документ24 страницыEthics in Negotiation-1Farid AhmedОценок пока нет

- 001b 10 Principles of EconomicsДокумент7 страниц001b 10 Principles of EconomicsAbigael Esmena100% (1)

- Working Capital IntroductionДокумент18 страницWorking Capital IntroductionShanmuka SreenivasОценок пока нет

- Credit and Collection: Chapter 6 - Credit Decision MakingДокумент51 страницаCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataОценок пока нет

- Security AnalysisДокумент41 страницаSecurity Analysishadassah VillarОценок пока нет

- Lending OperationsДокумент2 страницыLending OperationsKei SamsonОценок пока нет

- Classification of Financial MarketsДокумент8 страницClassification of Financial MarketsChowdary PurandharОценок пока нет

- Chapter 11 - Short-Run Technology ConstraintДокумент2 страницыChapter 11 - Short-Run Technology ConstraintTasnim SghairОценок пока нет

- Business Plan OutlineДокумент12 страницBusiness Plan OutlineMuhammadOwaisKhanОценок пока нет

- Money, Banking and Financial Institutions ExamДокумент2 страницыMoney, Banking and Financial Institutions ExamKennedy WaweruОценок пока нет

- CRM EssayДокумент9 страницCRM EssaykennethkennedyОценок пока нет

- Retail ManagementДокумент40 страницRetail ManagementAditya GowriОценок пока нет

- Prelim Assignment 4 ApuanДокумент2 страницыPrelim Assignment 4 ApuanPrimo HorneОценок пока нет

- Interventionist TheoryДокумент1 страницаInterventionist TheoryHeisnam BidyaОценок пока нет

- 10 Myths About Business EthicsДокумент3 страницы10 Myths About Business EthicsKyn Mukhim100% (1)

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsДокумент30 страницFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonssonaliОценок пока нет

- Banking CH 2 Central BankingДокумент10 страницBanking CH 2 Central BankingAbiyОценок пока нет

- EC10120-Economic Principles and Skills I - Why Do Countries Trade With Each OtherДокумент3 страницыEC10120-Economic Principles and Skills I - Why Do Countries Trade With Each OtherdpsmafiaОценок пока нет

- Notes - Franchising Unit 1 & 2Документ19 страницNotes - Franchising Unit 1 & 2Amyra JohnsonОценок пока нет

- PPT-10 - Ethics in Consumer Protection and Community RelationsДокумент31 страницаPPT-10 - Ethics in Consumer Protection and Community RelationsMuhammad Ali AdnanОценок пока нет

- Chapter 7 ProblemsДокумент6 страницChapter 7 ProblemsOkabe RinОценок пока нет

- Perceiving Ourselves and Others in OrganizationДокумент54 страницыPerceiving Ourselves and Others in OrganizationYana RamliОценок пока нет

- Differences Between Domestic Marketing and International MarketingДокумент7 страницDifferences Between Domestic Marketing and International Marketingsonidips07Оценок пока нет

- Assesement of Working Capital RequirementsДокумент11 страницAssesement of Working Capital RequirementsBibin JoyОценок пока нет

- Good Governance and Social ResponsibilityДокумент26 страницGood Governance and Social ResponsibilitySeniorb LemhesОценок пока нет

- Factors Working CapitalДокумент3 страницыFactors Working Capitalkiran808Оценок пока нет

- Chapter 5 Finacial Market RegulationsДокумент20 страницChapter 5 Finacial Market RegulationshabtamuОценок пока нет

- FSA Group Assignment - Analysis of Caltex CompanyДокумент22 страницыFSA Group Assignment - Analysis of Caltex CompanyĐạt ThànhОценок пока нет

- Chap001 - International BusinessДокумент31 страницаChap001 - International BusinessDr-Malkah NoorОценок пока нет

- Interest Rates and Their Role in FinanceДокумент17 страницInterest Rates and Their Role in FinanceClyden Jaile RamirezОценок пока нет

- Theory of Consumer BehaviorДокумент32 страницыTheory of Consumer Behaviorkiesha pastranaОценок пока нет

- New Product DevelopmentДокумент37 страницNew Product DevelopmentAditya MaluОценок пока нет

- CH 11 Interpersonal BehaviorДокумент7 страницCH 11 Interpersonal BehaviorAbdullah Al Mamun Tusher100% (1)

- Credit and Collection Module1Документ9 страницCredit and Collection Module1Aicarl JimenezОценок пока нет

- Inventory Management TechniquesДокумент16 страницInventory Management Techniquessavio barlaОценок пока нет

- Exchange FunctionДокумент14 страницExchange Functionangelica_jimenez_200% (1)

- Corporate Governance and Other StakeholdersДокумент44 страницыCorporate Governance and Other Stakeholdersswatantra.s8872450% (1)

- Basic Accounting PrinciplesДокумент3 страницыBasic Accounting PrinciplesSonu JoiyaОценок пока нет

- Hardees - FinalДокумент9 страницHardees - FinalYash DurdenОценок пока нет

- FM Sheet 4 (JUHI RAJWANI)Документ8 страницFM Sheet 4 (JUHI RAJWANI)Mukesh SinghОценок пока нет

- Canalization in IndiaДокумент39 страницCanalization in IndiaDimpleBhatia100% (1)

- Business Ethics Chapter 6Документ24 страницыBusiness Ethics Chapter 6nakarsha0% (1)

- Economic DevelopmentДокумент17 страницEconomic DevelopmentVher Christopher Ducay100% (1)

- International Business hw1Документ3 страницыInternational Business hw1Zbw88Оценок пока нет

- Linear ProgrammingДокумент27 страницLinear ProgrammingBerkshire Hathway cold100% (1)

- PGS AP100080 AP Withholding Tax PMNT RPTДокумент16 страницPGS AP100080 AP Withholding Tax PMNT RPTSarwar GolamОценок пока нет

- United States Court of Appeals, First CircuitДокумент10 страницUnited States Court of Appeals, First CircuitScribd Government DocsОценок пока нет

- Semis Examination BДокумент12 страницSemis Examination BCHENG50% (2)

- Tower Sacco October Issue Final Sunday HPДокумент36 страницTower Sacco October Issue Final Sunday HPEric ObocyrehОценок пока нет

- Exception in Case of Necessaries Supplied To A MinorДокумент3 страницыException in Case of Necessaries Supplied To A MinorRadhika PrasadОценок пока нет

- FACTS: The Republic of The Philippines Seeks The Review On Certiorari of The Order Dated 17Документ7 страницFACTS: The Republic of The Philippines Seeks The Review On Certiorari of The Order Dated 17Ken MarcaidaОценок пока нет

- CHAPTER 3 PrescriptionДокумент2 страницыCHAPTER 3 PrescriptionJhoana Parica FranciscoОценок пока нет

- 5Документ11 страниц5Youssef MohammedОценок пока нет

- CIR vs. LA FLOR DEla ISABELA, 2019Документ3 страницыCIR vs. LA FLOR DEla ISABELA, 2019Fenina Reyes0% (1)

- Fundamental Analysis of Banking SectorsДокумент63 страницыFundamental Analysis of Banking SectorsDeepak Kashyap75% (4)

- Class 11 - Business StudiesДокумент26 страницClass 11 - Business StudiesSri RaghulОценок пока нет

- Class Exercise Session 5 and 6Документ8 страницClass Exercise Session 5 and 6Sumeet KumarОценок пока нет

- Auditing Full Notes Auditing Full NotesДокумент15 страницAuditing Full Notes Auditing Full NotesMonikamit Tushir67% (3)

- Finance & CreditДокумент3 страницыFinance & Creditel khaiat mohamed amineОценок пока нет

- Tahun 4 - Peperiksaan Pertengahan Tahun - Jawapan PDFДокумент2 страницыTahun 4 - Peperiksaan Pertengahan Tahun - Jawapan PDFKanang UsopОценок пока нет

- Employee Details: Old PPO NumberДокумент2 страницыEmployee Details: Old PPO NumberShubham ShakyaОценок пока нет

- Omega AirlinesДокумент7 страницOmega AirlinesRahmatullah MardanviОценок пока нет

- Mod 1. 4. Capacity To ContractДокумент10 страницMod 1. 4. Capacity To ContractTejal1212Оценок пока нет

- 1st Preboard - TaxДокумент17 страниц1st Preboard - TaxKriztleKateMontealtoGelogoОценок пока нет

- Islamic BK CH 3 PDFДокумент27 страницIslamic BK CH 3 PDFAA BB MMОценок пока нет

- Income TaxesДокумент10 страницIncome TaxesLohraine DyОценок пока нет

- Blackbook Project On International Banking - 16340Документ67 страницBlackbook Project On International Banking - 16340Vinod ChaurasiyaОценок пока нет

- GM ROI CalculationДокумент1 страницаGM ROI CalculationArhamОценок пока нет

- DCF Application - Asian PaintsДокумент6 страницDCF Application - Asian PaintsKashish PopliОценок пока нет

- Ch. 14 Payout PolicyДокумент68 страницCh. 14 Payout PolicyRiyan DarmawanОценок пока нет

- Renters Policy PDFДокумент18 страницRenters Policy PDFMumy MoraОценок пока нет

- Neraca Dan Laba Rugi (Blank Form)Документ2 страницыNeraca Dan Laba Rugi (Blank Form)Ugi Dwiki PОценок пока нет

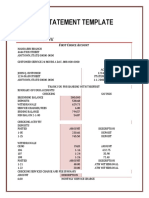

- Bank Statement Template 16 PDFДокумент2 страницыBank Statement Template 16 PDFBara Creatives50% (2)

- T778 Child Care Expenses DeductionДокумент4 страницыT778 Child Care Expenses DeductionbatmanbittuОценок пока нет

- Catalogue of Major Financial Institutions in The PhilippinesДокумент4 страницыCatalogue of Major Financial Institutions in The PhilippinesROXAN magalingОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОт EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОценок пока нет

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет