Академический Документы

Профессиональный Документы

Культура Документы

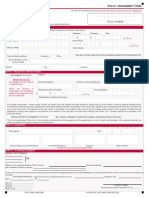

Buysellagreement Template

Загружено:

Alvin Dela CruzИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Buysellagreement Template

Загружено:

Alvin Dela CruzАвторское право:

Доступные форматы

BUY-SELL AGREEMENT BETWEEN STOCKHOLDERS AGREEMENT made this ___ day of ______, ____, by and between all of the

undersigned shareholders (stockholders) and ______________(Company), a corporation organized pursuant to the laws of the State of __________, having its principal place of business at ______________________________(address) (Corporation). PREAMBLE WHEREAS, Stockholders each own shares of Corporations outstanding capital stock; and WHEREAS, Stockholders wish to restrict the transfer of the Corporations stock by providing that the stockholder who wants to sell his tock first offer it for sale to the Corporation; and WHEREAS, Stockholders intend to accomplish this by the provisions of this Agreement. IT IS AGREED AS FOLLOWS: 1. Buy-Sell. Stockholders will sell their stock in accordance with the provisions of this Agreement. 2. Consent of Stockholders. If any stockholder wishes to sell all or any part of his capital stock to a third party and has not received the Corporations prior consent to the sale, he may sell his capital stock only after offering it to the Corporation on the terms and conditions set out in this Agreement. 3. Offer to Sell Stock. The stockholder desiring to sell all or part of his capital stock shall notify the Corporation by certified or registered mail, return receipt requested, or in person at the Corporations principal place of business to the Secretary of the Corporation, that he has a bona fide offer for the sale of the stock. The notice shall state the name and address of the principal person or entity making the offer, the number of shares to be sold, the sales price and terms of payment. The notice must also contain an offer to sell the stock to the Corporation for the same price and for the same terms of payment as those of the bona fide offer. 4. Acceptance of Offer to Sell Stock. The Corporation or stockholders shall have the right to accept the offer or to respond with a counteroffer for a period of 180 days from the date the sellers notice was received at the principal place of business. The offer of counteroffer may be accepted only by certified or registered mail, return receipt requested, addressed to the stockholder desiring to sell the stock. The acceptance shall be effective upon mailing. 5. Purchase of Stock upon Termination of Employment. For shares of stock issued to employees for one dollar ($1.00) per share the Corporation shall redeem such shares for the amount of the purchase price if the employee terminates employment within the first eighteen months of the date said employee began employment. If the employee terminates employment during the period beginning on the first day of the nineteenth month and ending on the last day of the sixtieth month from the date said employee began employment, then the employees stock

shall be valued as determined in Section Three. The amount so determined in Section Three shall be paid out in installments at the end of each calendar year. The installments shall be determined for each calendar year by multiplying the amount determined in Section Three by a fraction whose numerator is the number of months the employee has not worked for the Corporation for that calendar year and using a denominator which is sixty months less the number of months the employee was employed by the Corporation. After the employee has been employed by the Corporation for sixty months, any sale shall be made in accordance with the provisions of Section Three. 6. Sale to Outsider. If the Corporation and Stockholder to whom the offer was made fails to accept the offer within 180 days after the sellers notice of the offer was received or if the Corporation notifies the offering stockholder that it consents to the sale or will not accet the offer, the offering stockholder may sell hi stock only to the person or entity named in the sellers notice at the price and upon the terms of payment set out in the sellers notice; provided that the buyer shall become subject to all of the terms and conditions of the Agreement. However, the sale must be complete within 30 days following the date of the Corporations notice, or within 30 days after the end of the 180 day period, which ever occurs sooner. 7. Failure to accept Counteroffer. If the Corporation makes a counteroffer to purchase the Stockholders shares as described in Section 3, the offering stockholder will within 60 days notify the Board of his decision to accept the counteroffer or to retain the shares offered. 8. Transfer due to Bankruptcy. In the event that the stock of a stockholder shall be transferred by attachment or levy, or made subject to a charging order, or in the event that a stockholder is adjudicated bankrupt or makes an assignment for the benefit of creditors, upon the Corporations discovery of such transfer, the Corporation shall have the right to purchase all of the capital stock owned by the stockholder immediately prior to the transfer for a purchase price determined in accordance with the terms of Section Three. The selling stockholder shall vote when the Corporation is determining whether to purchase his stock, either in his capacity as a stockholder or a director, in any manner that the remaining stockholder, or majority of the remaining stockholders, as the case may be, shall so direct. The Corporation shall exercise its election to purchase within sixty (60) days from the date the Corporation receives written notice of the transfer by giving notice thereof in writing mailed to the transferring stockholder and the third party who possesses the stock or an interest therein, and such notice shall specify a date for the closing of the purchase. In the event the purchase price determined pursuant to the terms herein is greater than the indebtedness owed to such assignee, trustee, bankruptcy or attaching court or officer (the Transferees), the amount so owed the Transferees shall be paid thereto, and the balance, minus any proper items of expense, shall be distributed to the stockholder making the Transfer. If the Corporation or the remaining stockholder(s) do no elect to purchase he sock within the required time limits, then the Corporation and the remaining stockholder(s) shall be deemed to have consented to the transder; provided that

said Transferee shall become subject to all of the terms and conditions of this Agreement and shall execute a supplement to that effect; however, the failure to execute such supplement shall not affect the applicability of the Agreement to any party becoming a stockholder of the Corporation. 9. Notice on Stock Certificate. The following legend shall be placed on Corporations certificate of stock immediately following the execution of this Agreement: TAKE NOTICE that the sale, assignment, ransfer or pledge of shares represeneted by this Certificate are subject to restrictions contained in an agreement dated the ____day of ______, 20__, between _________________, and the Corporation, a copy of which is on file at the Corporations offices. 10. Termination of Agreement. This Agreement will terminate upon occurrence of any of the following events: a. Voluntary or involuntary termination of Corporations business; b. By written agreement of the stockholders; 11. Agreement binding on Third Persons. This Agreement is binding on Stockholders and Corporation, their heirs, legal representatives, successors, and assigns. 12. Construction. This Agreement shall be construed in accordance with the laws of the State of Maryland, excluding the conflict of law rules of that state. 13. After Acquired Stock. The provisions of this Agreement shall also apply to all shares of stock of the Corporation hereafter issued, and shall be binding upon and shall inure to the benefit f all persons hereafter becoming Stockholders of the Corporation, whether through the purchase of shares of newly issued stock from the Corporation or through the acquisition of shares from a Stockholder, and accordingly the term Stockholders shall be deemed to include such persons to the same extent as had they originally executed this Agreement as such. All persons herinafter becoming Stockholders of the Corporation shall execute a supplement to the effect that they agree to be bound by all the terms and conditions and restrictions set forth in this Agreement. 14. Invalid Provisions. The invalidity or uneforceability of any particular provision of this Agreement shall not affect the other provisions hereof, and the Agreement shal be construed in all respects as if such invalid o unenforceable provisions were omitted. 15. Boid Transactions. Any sale of stock which does not comply with the terms of this Agreement shall be null and void. 16. Tax Status of the Corporation. (a) The Corporation covenants that within three and one-half (3-1/2) months from the end of each and every taxable year of the Corporation, it shall distribute to its Stockholders on a pro rata basis, an amount at least equal to the maximum individual federal and state income tax which can be assessed on the taxable income of the Coporation and take all other steps necessary and appropriate in connection therewith, provided such distribution will not violate applicable state laws governing dividend distributions. This provision shall apply to any person who was a Stockholder of the Corporation during the time in which taxable income was earned by the

Corporation which was or will be taxed to such individual. The Corporation further covenants and agrees that it will not without the consent of all Stockholders, take any action that would be reasonably likely to, in the opinion of counsel to the Corporation, terminate the Corporations retention of its S corporation status. a. (b) Each Stockholder hereby covenants and agrees that: i. He shall not transfer any share of stock of the Corporation unless (A) at the option of the Board of Directors of the Corporation, the Corporation obtains a legal opinion that such Transfer will not adversely affect the Corporations S election and (B) the transferee consents in writing to be bound by this Agreement as if an original party hereto and consents in writing not to refuse any consent to continue the S election. Nothing contained herein shall operate to permit a sale of stock if such sale is otherwise restricted by the terms of this Agreement, any governmental statute, regulation or rule;

Вам также может понравиться

- DEED OF ABSOLUTE BlankДокумент1 страницаDEED OF ABSOLUTE BlankAlvin Dela CruzОценок пока нет

- Drama of The Ages - WДокумент225 страницDrama of The Ages - WRyan O'Neil 船 SeatonОценок пока нет

- Acknowledgement Receipt and UnderstandingДокумент1 страницаAcknowledgement Receipt and UnderstandingAlvin Dela CruzОценок пока нет

- The Wrath of GodДокумент1 страницаThe Wrath of GodAlvin Dela CruzОценок пока нет

- Deed of Absolute Sale (House & Lot) PDFДокумент3 страницыDeed of Absolute Sale (House & Lot) PDFJoemer Urmanita86% (7)

- Commentary On Romans 7Документ9 страницCommentary On Romans 7Alvin Dela CruzОценок пока нет

- Deed of Sale VehicleДокумент1 страницаDeed of Sale VehicleAlvin Dela CruzОценок пока нет

- Commentary On Hebrews 10 - 26-27Документ2 страницыCommentary On Hebrews 10 - 26-27Alvin Dela CruzОценок пока нет

- Justification and SanctificationДокумент1 страницаJustification and SanctificationAlvin Dela CruzОценок пока нет

- SDA's BelieveДокумент448 страницSDA's BelieveDennis CharlesОценок пока нет

- AnnexДокумент1 страницаAnnexAlvin Dela CruzОценок пока нет

- Area PaintДокумент4 страницыArea PaintAlvin Dela CruzОценок пока нет

- Our Church and Our Regular Activities:: Doc. RonaldДокумент1 страницаOur Church and Our Regular Activities:: Doc. RonaldAlvin Dela CruzОценок пока нет

- 2016 03 14 - StrengthingДокумент49 страниц2016 03 14 - StrengthingAlvin Dela Cruz100% (1)

- AIA Philam Life Policy Assignment FormДокумент1 страницаAIA Philam Life Policy Assignment FormAlvin Dela CruzОценок пока нет

- Agreement To SellДокумент4 страницыAgreement To SellAlvin Dela CruzОценок пока нет

- Coastal RD.: St. Domini C Hospit Al Aniban Central SchoolДокумент1 страницаCoastal RD.: St. Domini C Hospit Al Aniban Central SchoolAlvin Dela CruzОценок пока нет

- CR TilesДокумент2 страницыCR TilesAlvin Dela CruzОценок пока нет

- How Is The Bill of Rights Strengthened in The 1987 Constitution?Документ1 страницаHow Is The Bill of Rights Strengthened in The 1987 Constitution?Alvin Dela CruzОценок пока нет

- Acknowledgement Receipt: Erwin S. Dela Cruz Seller/OwnerДокумент1 страницаAcknowledgement Receipt: Erwin S. Dela Cruz Seller/OwnerAlvin Dela CruzОценок пока нет

- Furring and Hardiflex Updated - BM Pricelist-1Документ5 страницFurring and Hardiflex Updated - BM Pricelist-1Alvin Dela CruzОценок пока нет

- Proposed Warehouse Cost EstimateДокумент2 страницыProposed Warehouse Cost EstimateAlvin Dela CruzОценок пока нет

- Planets in Our Solar System: Mercury to UranusДокумент9 страницPlanets in Our Solar System: Mercury to UranusAlvin Dela CruzОценок пока нет

- Justineville Project Cost EstimateДокумент6 страницJustineville Project Cost EstimateAlvin Dela CruzОценок пока нет

- DominicДокумент2 страницыDominicAlvin Dela CruzОценок пока нет

- Erdc Bar ChartДокумент6 страницErdc Bar ChartAlvin Dela CruzОценок пока нет

- Proposed Warehouse Cost EstimateДокумент2 страницыProposed Warehouse Cost EstimateAlvin Dela CruzОценок пока нет

- Estimate FenceДокумент16 страницEstimate FenceAlvin Dela CruzОценок пока нет

- ERDC Konstrukt Co.: Daily Time RecordДокумент4 страницыERDC Konstrukt Co.: Daily Time RecordAlvin Dela CruzОценок пока нет

- Administrator of EstateДокумент4 страницыAdministrator of EstateAlvin Dela CruzОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)