Академический Документы

Профессиональный Документы

Культура Документы

Description: Tags: GEN0313ConsoALLS

Загружено:

anon-34228Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Description: Tags: GEN0313ConsoALLS

Загружено:

anon-34228Авторское право:

Доступные форматы

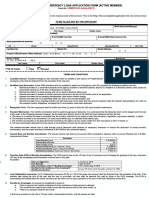

Federal Family Education Loan Program (FFELP) Guarantor, Program, or Lender Identification

Additional Loan Listing Sheet for Federal Consolidation

Loan Application and Promissory Note

WARNING: Any person who knowingly makes a false statement or misrepresentation

on this form is subject to penalties which may include fines, imprisonment, or both,

under the United States Criminal Code and 20 U.S.C. 1097.

Use this form only if you need additional space to list loans in Section D of the Federal Consolidation Loan Application and Promissory Note.

Borrower’s Name _____________________________________________________________ Social Security Number ____________________________________

Spouse’s Name ______________________________________________________________ Social Security Number ____________________________________

(Please print. Enter spouse’s information only if you completed Section B on the Federal Consolidation Loan Application and Promissory Note.)

Section D.1. Education Loan Indebtedness – Loans You Want to Consolidate (Continued)

Read the Instructions for Completing the Federal Consolidation Loan Application and Promissory Note before completing this section. List the education loans you want to

consolidate. Include loans currently held by the lender that will be consolidating your loans. Use the Loan Codes listed in the instructions. Include your spouse’s loans only if

you completed Section B on the Federal Consolidation Loan Application and Promissory Note. Be sure to include this form with your Application and Promissory Note when you

submit it. ONLY LIST LOANS THAT YOU WANT TO CONSOLIDATE IN THIS SECTION.

20. Loan 21. Loan Holder Name and Mailing Address 22. B 23. Loan Account 24. Interest 25. Payoff Amount

Code =Borrower Number Rate

(See S = Spouse

Instructions) J = Joint

Section D.2. Education Loan Indebtedness – Loans You Do Not Want to Consolidate (Continued)

Read the Instructions for Completing the Federal Consolidation Loan Application and Promissory Note before completing this section. List the education loans that you are not

consolidating but want considered in calculating your maximum repayment period. Include loans currently held by the lender that will be consolidating your loans. Use the Loan

Codes listed in the instructions. Include your spouse’s loans only if you completed Section B on the Federal Consolidation Loan Application and Promissory Note. Be sure to

include this form with your Application and Promissory Note when you submit it. ONLY LIST LOANS THAT YOU DO NOT WANT TO CONSOLIDATE IN THIS

SECTION.

27. Loan 32. Current Balance

28. Loan Holder Name and Mailing Address 29. B 30. Loan Account 31. Interest

Code

(See

=Borrower Number Rate

Instructions) S = Spouse

J = Joint

Вам также может понравиться

- Description: Tags: FP0705AttCCORRECTEDAddlLoanListДокумент1 страницаDescription: Tags: FP0705AttCCORRECTEDAddlLoanListanon-844686Оценок пока нет

- Description: Tags: RqstaddДокумент2 страницыDescription: Tags: Rqstaddanon-293961Оценок пока нет

- Description: Tags: GEN0313ConsoAddOnДокумент6 страницDescription: Tags: GEN0313ConsoAddOnanon-687606Оценок пока нет

- IDR Consolidation One DumentДокумент15 страницIDR Consolidation One DumentCaro PericoОценок пока нет

- Description: Tags: Gen0114aДокумент9 страницDescription: Tags: Gen0114aanon-300392Оценок пока нет

- Description: Tags: FP0705AttFAppPNoteStandardДокумент18 страницDescription: Tags: FP0705AttFAppPNoteStandardanon-23498Оценок пока нет

- 1980-19 Guaranteed Loan Closing ReportДокумент4 страницы1980-19 Guaranteed Loan Closing ReportthenjhomebuyerОценок пока нет

- Interactive 1003Документ3 страницыInteractive 1003bradley_germainОценок пока нет

- Add LoansДокумент3 страницыAdd Loansgordon scottОценок пока нет

- State Guaranty Agency: Sample New Data Allegations RESPONSEДокумент4 страницыState Guaranty Agency: Sample New Data Allegations RESPONSEanon-670602Оценок пока нет

- U.S. Bank Recreation Finance National Promissory Note and Security AgreementДокумент4 страницыU.S. Bank Recreation Finance National Promissory Note and Security AgreementSinchai JonesОценок пока нет

- Mortgage App Form 1003Документ5 страницMortgage App Form 1003api-305651288Оценок пока нет

- Blank 1003Документ4 страницыBlank 1003api-296319445Оценок пока нет

- Description: Tags: Iga-Nda358-360Документ3 страницыDescription: Tags: Iga-Nda358-360anon-939395Оценок пока нет

- Uniform Residential Loan Application: I. Type of Mortgage and Terms of LoanДокумент13 страницUniform Residential Loan Application: I. Type of Mortgage and Terms of Loanmalinda_haneyОценок пока нет

- Loan Application and Agreement Form (Revised October 2018)Документ6 страницLoan Application and Agreement Form (Revised October 2018)Pst Elisha Olando AfwataОценок пока нет

- Annex F Revised Statement of Indebtedness Payments and BalancesДокумент5 страницAnnex F Revised Statement of Indebtedness Payments and BalancesRuth Jimenez BayagОценок пока нет

- CashPro Global Special Tax Payments STP Guide - Mexico V1 March 2021 (1) ...Документ14 страницCashPro Global Special Tax Payments STP Guide - Mexico V1 March 2021 (1) ...Peter SimplonОценок пока нет

- Fannie Mae Document Custodian Protocol 08Документ37 страницFannie Mae Document Custodian Protocol 08mariandebonisОценок пока нет

- Credit Application For CEE Home Improvement Loan Programs: I. Lender InformationДокумент3 страницыCredit Application For CEE Home Improvement Loan Programs: I. Lender InformationsandyolkowskiОценок пока нет

- Rental Energy AppДокумент2 страницыRental Energy AppsandyolkowskiОценок пока нет

- CA5106: Liability ClassificationДокумент3 страницыCA5106: Liability ClassificationPATRICIA SANTOSОценок пока нет

- PPP - Forgiveness Application and Instructions - 3508 (1.19.2021) - 508Документ13 страницPPP - Forgiveness Application and Instructions - 3508 (1.19.2021) - 508Srinivas Meduri100% (1)

- BondsДокумент5 страницBondsreigh paulusОценок пока нет

- Business Banking Loan ApplicationДокумент3 страницыBusiness Banking Loan ApplicationBessy BravoОценок пока нет

- Universal Home Loan ApplicationДокумент9 страницUniversal Home Loan Applicationapi-453439542Оценок пока нет

- Your Annual Mortgage Statement Explained - 10-DeC-23 12030556Документ12 страницYour Annual Mortgage Statement Explained - 10-DeC-23 12030556haroonraja579Оценок пока нет

- Bukidnon High School Math AssessmentДокумент4 страницыBukidnon High School Math Assessmentharriette caminoОценок пока нет

- Rehab AppДокумент10 страницRehab AppsandyolkowskiОценок пока нет

- Personalfinancial StatementДокумент3 страницыPersonalfinancial StatementWEBTREE TECHNOLOGYОценок пока нет

- Common Application Format For MSME Loans - IBA ApprovedДокумент5 страницCommon Application Format For MSME Loans - IBA ApprovedPriya KalraОценок пока нет

- Emergency Loan Application Form (Active Member) : Last Name Middle NameДокумент2 страницыEmergency Loan Application Form (Active Member) : Last Name Middle NamePhebe Zhie Zhia CampeñaОценок пока нет

- Uniform Residential Loan Application: I. Type of Mortgage and Terms of LoanДокумент5 страницUniform Residential Loan Application: I. Type of Mortgage and Terms of LoanSean ObrienОценок пока нет

- Form B: Province of British Columbia Page 1 of - PagesДокумент17 страницForm B: Province of British Columbia Page 1 of - PagesAndrew federОценок пока нет

- Loan Rein Ex InfoДокумент5 страницLoan Rein Ex InfoGomezLiliОценок пока нет

- 20200403-Forms-EML Active FillableДокумент2 страницы20200403-Forms-EML Active FillableChesca Angel ReyesОценок пока нет

- Emergency Loan Application Form (Active Member) : Last Name Middle NameДокумент2 страницыEmergency Loan Application Form (Active Member) : Last Name Middle NameDeese Marie ZabalaОценок пока нет

- 20200403-Forms-EML Active Fillable PDFДокумент2 страницы20200403-Forms-EML Active Fillable PDFBusyMae CabadonОценок пока нет

- Emergency Loan Application Form (Active Member) : Last Name Middle NameДокумент2 страницыEmergency Loan Application Form (Active Member) : Last Name Middle NameGian Paula MonghitОценок пока нет

- Emergency Loan Application Form (Active Member) : Last Name Middle NameДокумент2 страницыEmergency Loan Application Form (Active Member) : Last Name Middle NameKarena WahimanОценок пока нет

- 20200403-Forms-EML Active Fillable PDFДокумент2 страницы20200403-Forms-EML Active Fillable PDFKarena WahimanОценок пока нет

- Partner MCQSДокумент1 страницаPartner MCQSHussain ZareerОценок пока нет

- Promissory NoteДокумент2 страницыPromissory Notemasha.brarОценок пока нет

- Personal Loan AgreementДокумент2 страницыPersonal Loan AgreementRome Dela CruzОценок пока нет

- MEMO#1 Loan Contract 2020Документ1 страницаMEMO#1 Loan Contract 2020Crishelyn UmaliОценок пока нет

- PPP Lender Application Form FillableДокумент2 страницыPPP Lender Application Form FillableryanОценок пока нет

- Emergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantДокумент2 страницыEmergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantChristian de LunaОценок пока нет

- Disclosure StatementДокумент3 страницыDisclosure StatementEstrelita B. SantiagoОценок пока нет

- Provident Loan FormДокумент3 страницыProvident Loan FormrobotmatinoОценок пока нет

- EL Application Form Active MembersДокумент2 страницыEL Application Form Active MembersCharles De Saint AmantОценок пока нет

- Sav3062 4Документ6 страницSav3062 4MichaelОценок пока нет

- Emergency contact and important details sheetДокумент117 страницEmergency contact and important details sheetNaresh N BabuОценок пока нет

- ACC101 Chapter9newДокумент19 страницACC101 Chapter9newXiao HoОценок пока нет

- GCL-REV 1: RD TH RD THДокумент2 страницыGCL-REV 1: RD TH RD THhenryОценок пока нет

- Bosa Loan FormДокумент4 страницыBosa Loan FormIsaac OkotОценок пока нет

- Emergency Loan (Active Member) Application FormДокумент2 страницыEmergency Loan (Active Member) Application FormenzoОценок пока нет

- Description: Tags: FP0705AttIReqtoAddLoansДокумент3 страницыDescription: Tags: FP0705AttIReqtoAddLoansanon-938044Оценок пока нет

- FIS Statement Website Packet Rev. 6 6 5 19 2Документ10 страницFIS Statement Website Packet Rev. 6 6 5 19 2Rob WrightОценок пока нет

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionОт EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionОценок пока нет

- Impact of The Green Revolution: Chapter-VДокумент28 страницImpact of The Green Revolution: Chapter-VAnantHimanshuEkkaОценок пока нет

- Direct Tax Chapter 1 To 10 AmendedДокумент45 страницDirect Tax Chapter 1 To 10 AmendedAsad RizviОценок пока нет

- Court upholds partnership rulingДокумент68 страницCourt upholds partnership rulingJan Miguel ManuelОценок пока нет

- Chapter 16Документ13 страницChapter 16Andi Luo100% (1)

- Deductions On Gross EstateДокумент5 страницDeductions On Gross EstatefcnrrsОценок пока нет

- The Mortgage Forgiveness Debt Relief Act and Debt CancellationДокумент3 страницыThe Mortgage Forgiveness Debt Relief Act and Debt CancellationPeter Smothers100% (1)

- Legal Notice 1231859 26862565Документ2 страницыLegal Notice 1231859 26862565Manthan ShahОценок пока нет

- Bonds Ch14int3Документ15 страницBonds Ch14int3Ma Teresa B. Cerezo0% (1)

- Virginia SBA Prefered Lenders ListДокумент16 страницVirginia SBA Prefered Lenders ListDarren DawkinsОценок пока нет

- RoutledgeHandbooks 9780203713303 Chapter3Документ57 страницRoutledgeHandbooks 9780203713303 Chapter3samyghallabОценок пока нет

- Petitioners Vs Vs Respondents Jose P Malabanan Jose R DimayugaДокумент10 страницPetitioners Vs Vs Respondents Jose P Malabanan Jose R DimayugaJuana Dela VegaОценок пока нет

- Predatory Lending What Is Predatory Lending?: EquityДокумент5 страницPredatory Lending What Is Predatory Lending?: EquityNiño Rey LopezОценок пока нет

- 6a Pred Working Cap MGT 2Документ9 страниц6a Pred Working Cap MGT 2SamОценок пока нет

- Zeit I Att IIДокумент45 страницZeit I Att IINikos PatraszОценок пока нет

- FDIC Review of Failed Almena State BankДокумент5 страницFDIC Review of Failed Almena State BankSaga LourdusamyОценок пока нет

- PNB v. PinedaДокумент3 страницыPNB v. PinedaAnonymous XvwKtnSrMRОценок пока нет

- Canara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Документ8 страницCanara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Santosh KumarОценок пока нет

- Ralph Winterowd Interviews Donna BaranДокумент16 страницRalph Winterowd Interviews Donna Baranaweb1Оценок пока нет

- CHAPTER 3 Financial Markets and InstitutionsДокумент13 страницCHAPTER 3 Financial Markets and InstitutionsMichelle Rodriguez Ababa100% (4)

- Citi Mortgage Settlement DocumentsДокумент314 страницCiti Mortgage Settlement DocumentsFindLawОценок пока нет

- Part 1 - Blockchain TechnologiesДокумент14 страницPart 1 - Blockchain TechnologiesRajat BhatiaОценок пока нет

- ICAEW Financial ManagementДокумент20 страницICAEW Financial Managementcima2k15Оценок пока нет

- Punjab Smart Book 2021-22Документ137 страницPunjab Smart Book 2021-22Syed Ali TurabОценок пока нет

- Solid Investment, The HYIPДокумент48 страницSolid Investment, The HYIPshastaconnect0% (1)

- Axita Cotton LTDДокумент23 страницыAxita Cotton LTDVaishnavi DeolekarОценок пока нет

- BUDGETING SUCKS Garrett Gunderson Dale ClarkeДокумент136 страницBUDGETING SUCKS Garrett Gunderson Dale ClarkeRich Diaz100% (1)

- Study of NPA in UCO BankДокумент63 страницыStudy of NPA in UCO BankSunil Shekhar Nayak0% (1)

- HW Assignment For Week 2:: FV PV × (1+ I) FV $ 2,000 × (1+0.06) FV $ 2,000 × (1,06) FV $ 2,676.45Документ6 страницHW Assignment For Week 2:: FV PV × (1+ I) FV $ 2,000 × (1+0.06) FV $ 2,000 × (1,06) FV $ 2,676.45Lưu Gia BảoОценок пока нет

- 15 Bank Management and Funds Transfer PricingДокумент23 страницы15 Bank Management and Funds Transfer PricingCalebОценок пока нет

- Investment Analysis of Global IME BankДокумент35 страницInvestment Analysis of Global IME BankNa Ge ShОценок пока нет