Академический Документы

Профессиональный Документы

Культура Документы

BIR 2305 Form

Загружено:

allenkimrinaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BIR 2305 Form

Загружено:

allenkimrinaАвторское право:

Доступные форматы

DLN:

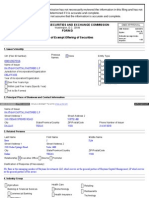

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

(Excluding Compensation Income)

1 For the Year ( YYYY ) Part I 2 Taxpayer Identification No. 1

Certificate of Income Payment Not Subject to Withholding Tax

BIR Form No.

2304

July 1999 (ENCS)

Payee 2

Information

Part III Nature of Income Payment A. Individual Payees

Details of Income Payment ATC Amount of Income Payment

10 11

3 Payee's Name (For Non-Individuals) 3 4 Payee's Name (For Individuals) Last 4A Name First 4B Name Middle 4C Name 5 Registered Address 5A 5A Foreign Address 5C Part II Payor Informat ion Zip Code 5B

10 Interest

11 Rent - Personal Property regardless of amount 12 Premium and Annuity

II 110 II 051 II 060 II 070 II 120 II 090 II 080

12 13 14 15

13 Pension

14 Prizes Amounting to: 10,000 or Less 15 Transportation Contractors for the Carriage of Goods

and Merchandise Below P2,000

16 Others (Specify)

16A 16B

16A 16B

B. Corporate Payees 17 Interest 18 Rent - Personal Property regardless of amount 19 Premium and Annuity 20 Prizes regardless of amount 21 Professional Fees Paid to Gen. Professional Partnerships (Except to partnership of medical practitioners) 22 Transportation Contractors for the Carriage of Goods

and Merchandise Below P2,000

IC170 IC130 I C 14 0 IC120 IC021

17 18 19 20 21

6 Taxpayer 2 6 Identification No. 7 Payor's Name (For Non-Individuals) 7 8 Payor's Name (For Individuals) Last 8A Name First 8B Name Middle 8C Name 9 Registered Address 9A 9A Zip Code 9A 9B

IC160 IC150

22

23 Others (Specify)

23A

23A

23B

23B

24 Total

24

I declare, under the penalties of perjury, that this certificate has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25 Payor/Authorized Agent Signature over Printed Name

26 Title/Position of Signatory

Note: "Others" (Nos. 16 and 23) includes business profits and independent services as defined in the appropriate tax treaty.

FORM 2304 (Certificate of Income Payment Not Subject to Withholding Tax) NOTES: a.) Payor information and explanations thereto are based on the items/numbers provided in the above mentioned certificate b.) Items 2 to 5C refer to the background information of the payee while items 6 to 9B refers to the background information of the payor c.) After accomplishing said certificate please attach to the applicable BIR Form 1701 1. Indicate the year covered by the certificate. 2-5 Payee's Information 2 Indicate the Taxpayer Identification Number 3 If the payee is not an individual indicate the name of the company 4 If the payee is an individual indicate the following on the boxes provided for: 4A - Last name 4B- First Name 4C- Middle Name 5 Refers to the registered address of the payee. Indicate the following on the boxes provided for: 5A- Local Address 5B -Zip Code 5C -Foreign Address if applicable 6 Payor's Information 6 Indicate the Taxpayer Identification Number 7 If the payor is not an individual indicate the name of the company 8 If the payor is an individual indicate the following on the boxes provided for: 8A - Last name 8B - First Name 8C - Middle Name 9 Refers to the registered address. Indicate the following on the boxes provided for: 9A - Local Address 9B - Zip Code 10 - 16 Refers to the nature of Income payments paid to an individual payee 10 Indicate the amount of interest paid which is not subject to withholding tax, such as interest on personal, etc. 11 Indicate the amount paid on rental of personal property regardless of the amount paid.

12 Indicate the amount of premium and annuity paid. Premiums means the agreed price for assuming and carrying the risk which may be payable in one sum or in installments. In this case, premium refers to insurance premium paid to insurance companies by individual or juridical persons except premium paid by government agencies. Annuity is a yearly sum stipulated to be paid to another in fee, or for life or years, and chargeable only on the person of the grantor. 13 Indicate the amount of pension paid in case the withholding agent has no approved retirement plan and has failed to withhold the tax on such income payment. 14 Indicate the amount of prizes and award not exceeding P 10,000.00 except Phil. Charity Sweepstakes and Lotto Winnings 15 Indicate the amount paid to a transportation contractor for the carriage of goods and merchandise not to exceed P 2,000.00 per month regardless of the number of shipments during the month. 16 Indicate the amount of other income, fixed and determinable gain, profit and income such as gain sale of personal assets, goodwill, etc. 17 - 23 Refers to the nature of income payments paid to a corporation 17 Indicate the amount of the interest paid which is not subject to withholding tax, such as interest on personal loans, etc. 18 Indicate the payment, regardless of the amount paid on rental on personal properties. 19 Indicate the amount of premium and annuity paid. Premium means the agreed price for assuming and carrying the risk which may be payable in one sum or in installments. In this case, premium refers to insurance premium paid to insurance companies by individual or juridical persons except premium paid by government agencies. Annuity is a yearly sum stipulated to be paid to another in fee, or for life or years, and chargeable only on the person of the grantor 20 Indicate the amount of pension paid in case the WITHHOLDING AGENT has no approved retirement plan and has failed to withhold the tax on such income payment. 21 Indicate the amount of prizes and award not exceeding P 10,000.00 except Phil. Charity Sweepstakes and Lotto Winnings. 22 Indicate the amount paid to a transportation contractor for the carriage of goods and merchandise not to exceed P 2,000.00 per month regardless of the number of shipments during the month. 23 Indicate the amount of other income, fixed and determinable gain, profit and income such as gain on sale of corporate assets, goodwill, etc. 24 Indicate the total amount of income payment paid by adding the amount listed from nos. 10 to 23. 25 Indicate your name or the name of your authorized agent issuing this certificate and sign over the printed name. 26 Indicate the title / position of the payor / authorized agent who signed this certificate.

Вам также может понравиться

- W9 FormДокумент1 страницаW9 FormChris GreeneОценок пока нет

- Hong Thien PhuocBui2018Документ6 страницHong Thien PhuocBui2018Thien BaoОценок пока нет

- BIR Form 2551MДокумент4 страницыBIR Form 2551MJun Casono100% (2)

- IRS Publication Form 8300Документ5 страницIRS Publication Form 8300Francis Wolfgang UrbanОценок пока нет

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- BIR Form 1600Документ39 страницBIR Form 1600maeshach60% (5)

- Bir Form 2551qДокумент6 страницBir Form 2551qmaeshach100% (2)

- Pilgrim BankДокумент6 страницPilgrim BankSatyajeet JaiswalОценок пока нет

- List of Bir FormsДокумент49 страницList of Bir Formsblessaraynes50% (4)

- Bir Forms 1706 (99) Capital Gains Tax ReturnДокумент5 страницBir Forms 1706 (99) Capital Gains Tax ReturnArnel Melgar100% (2)

- Form 1600Документ4 страницыForm 1600KialicBetito50% (2)

- Personal Financial StatementДокумент4 страницыPersonal Financial StatementKent WhiteОценок пока нет

- Shareholders' EquityДокумент9 страницShareholders' EquityLeah Hope CedroОценок пока нет

- Bir Form Percentage TaxДокумент3 страницыBir Form Percentage TaxEc MendozaОценок пока нет

- 327-329 Plaridel Surety & Insurance v. CIR Collector v. Goodrich International Rubber Co.Документ2 страницы327-329 Plaridel Surety & Insurance v. CIR Collector v. Goodrich International Rubber Co.Eloise Coleen Sulla PerezОценок пока нет

- Sweden - VAT Return FormДокумент1 страницаSweden - VAT Return FormNguyen Thi Hien AnhОценок пока нет

- Bir Form 2000Документ4 страницыBir Form 2000Ricca Pearl SulitОценок пока нет

- Bir Form 0605Документ2 страницыBir Form 0605John Louise Tan100% (1)

- (Andrew Baum Nick Nunnington David Mackmin) The (B-Ok - CC) PDFДокумент359 страниц(Andrew Baum Nick Nunnington David Mackmin) The (B-Ok - CC) PDFSatrio MangkunegoroОценок пока нет

- Entrep - (Week 5-8)Документ16 страницEntrep - (Week 5-8)MikeeeeОценок пока нет

- 2304Документ4 страницы2304fatmaaleahОценок пока нет

- MRL For Tax AuditДокумент3 страницыMRL For Tax AuditDharmesh TrivediОценок пока нет

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsДокумент5 страницRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneОценок пока нет

- Bir 1600Документ13 страницBir 1600Adelaida TuazonОценок пока нет

- Bir Form 2306 PDFДокумент3 страницыBir Form 2306 PDFErwin Bucasas100% (1)

- 2551QДокумент3 страницы2551QJerry Bantilan JrОценок пока нет

- BIR Form No. 2553Документ2 страницыBIR Form No. 2553fatmaaleahОценок пока нет

- Bir46 PDFДокумент2 страницыBir46 PDFJulia SmithОценок пока нет

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasДокумент2 страницыReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneОценок пока нет

- 2551 MДокумент2 страницы2551 MAdrian AyrosoОценок пока нет

- Quarterly Income Tax Return: Line of Business/OccupationДокумент4 страницыQuarterly Income Tax Return: Line of Business/OccupationMark Christian B. ApordoОценок пока нет

- CGT ReturnДокумент2 страницыCGT Returnmborja15Оценок пока нет

- Quarterly Remittance Return of Final Income Taxes Withheld: On Fringe Benefits Paid To Employees Other Than Rank and FileДокумент2 страницыQuarterly Remittance Return of Final Income Taxes Withheld: On Fringe Benefits Paid To Employees Other Than Rank and FilefatmaaleahОценок пока нет

- 1601 C CompensationДокумент2 страницы1601 C Compensationjon_cpaОценок пока нет

- Axis Mutual Fund - Lumpsum FormДокумент3 страницыAxis Mutual Fund - Lumpsum FormPushpakVanjariОценок пока нет

- Occupational Tax and Registration Return For Wagering: Type or PrintДокумент6 страницOccupational Tax and Registration Return For Wagering: Type or Printrobertledoux2Оценок пока нет

- 6681606Документ3 страницы6681606Jay O CalubayanОценок пока нет

- Lead Generation AgreementДокумент4 страницыLead Generation AgreementAngelo Di VeroliОценок пока нет

- Occupational Tax and Registration Return For Wagering: Type or PrintДокумент6 страницOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1Оценок пока нет

- 15 G Form (Pre-Filled)Документ2 страницы15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Bir EtformДокумент3 страницыBir EtformrjgingerpenОценок пока нет

- Barcode: Customer Updation For KYC - NRI / PIO / OCIДокумент3 страницыBarcode: Customer Updation For KYC - NRI / PIO / OCItruecallerfinder456Оценок пока нет

- TMAP Tax Update November 2018Документ22 страницыTMAP Tax Update November 2018Dave BautistaОценок пока нет

- Individual Tax Residency Self Certification FormДокумент5 страницIndividual Tax Residency Self Certification FormYaacov KotlickiОценок пока нет

- F 8233Документ2 страницыF 8233محمدجوزيايОценок пока нет

- Donor's Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". D N 0 1Документ6 страницDonor's Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". D N 0 1JayAnnE.TugnonIIОценок пока нет

- Guidelines 1702-EX June 2013Документ4 страницыGuidelines 1702-EX June 2013Julio Gabriel AseronОценок пока нет

- FKMPS9021Q Q3 2016-17Документ2 страницыFKMPS9021Q Q3 2016-17Hannan SatopayОценок пока нет

- BIR Form 1601 c1Документ2 страницыBIR Form 1601 c1Ver ArocenaОценок пока нет

- Donor's Tax ReturnДокумент4 страницыDonor's Tax ReturnJerome MoradaОценок пока нет

- United States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesДокумент8 страницUnited States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesWilliam HarrisОценок пока нет

- Bir Form 1600wpДокумент2 страницыBir Form 1600wpmaeshachОценок пока нет

- 2307Документ16 страниц2307Mika AkimОценок пока нет

- 1601e PDFДокумент2 страницы1601e PDFJanKhyrelFloresОценок пока нет

- Role of DDO in GovtДокумент27 страницRole of DDO in GovtPratik ViholОценок пока нет

- Bir 53Документ4 страницыBir 53toofuuОценок пока нет

- 1701qjuly2008 (ENCS)Документ6 страниц1701qjuly2008 (ENCS)alvie_budОценок пока нет

- Petunjuk DGT Per 25 PJ 2018Документ2 страницыPetunjuk DGT Per 25 PJ 2018RJF HsbnОценок пока нет

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasДокумент4 страницыWithholding Tax Remittance Return: Kawanihan NG Rentas InternasfatmaaleahОценок пока нет

- ITR62 Form 15 CAДокумент5 страницITR62 Form 15 CAMohit47Оценок пока нет

- MDR Application FormДокумент2 страницыMDR Application FormJerome Christopher CoОценок пока нет

- RMLO Report - RC System©™ Standard Terms: Total Combined Annual Income: $Документ2 страницыRMLO Report - RC System©™ Standard Terms: Total Combined Annual Income: $GeraldОценок пока нет

- Form 8 3 6 Interest Withholding TaxДокумент4 страницыForm 8 3 6 Interest Withholding TaxAlfa BetaОценок пока нет

- Lecture 12 Tax Law - UpdatedДокумент39 страницLecture 12 Tax Law - UpdatedAatir ImranОценок пока нет

- Rental Rehab Loan ApplicationДокумент4 страницыRental Rehab Loan ApplicationetapiaalfaroОценок пока нет

- Astec LifeSciences - Corporate Profile - Sep2014Документ23 страницыAstec LifeSciences - Corporate Profile - Sep2014Dusmant Kumar ParidaОценок пока нет

- Analysis of Business CombinationsДокумент58 страницAnalysis of Business Combinationstehsin123Оценок пока нет

- List of Requirements BIR - Transfer of Shares of StockДокумент1 страницаList of Requirements BIR - Transfer of Shares of Stockiris_irisОценок пока нет

- 207A Midterm ExaminationДокумент5 страниц207A Midterm ExaminationAldyn Jade Guabna100% (1)

- CIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFДокумент10 страницCIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFZenith EuropaОценок пока нет

- 16 IFRS 6 Exploration For and Evaluation of Mineral Resources (Wasting Assets and Depletion)Документ7 страниц16 IFRS 6 Exploration For and Evaluation of Mineral Resources (Wasting Assets and Depletion)Zatsumono YamamotoОценок пока нет

- Income TaxationДокумент2 страницыIncome TaxationJorge TornoОценок пока нет

- Financial Due DiligenceДокумент4 страницыFinancial Due DiligencenОценок пока нет

- SNVM Unit 3Документ21 страницаSNVM Unit 3Megha PatelОценок пока нет

- FA2 Part 5Документ5 страницFA2 Part 5uzma qadirОценок пока нет

- Ch05 Quiz Solution 052416Документ5 страницCh05 Quiz Solution 052416sum pradhanОценок пока нет

- Big Picture: MetalanguageДокумент25 страницBig Picture: MetalanguageANGEL ROSALОценок пока нет

- Adjustments Points To Be Kept in Mind: Term ExplanationДокумент1 страницаAdjustments Points To Be Kept in Mind: Term ExplanationSachinSharmaОценок пока нет

- VP Sales Business Development in United States Resume Gary DelMattoДокумент2 страницыVP Sales Business Development in United States Resume Gary DelMattoGaryDelMattoОценок пока нет

- Insider Trading: Mohammed Imdad Mousam Ku Roy Rahul Pandey Abdul Noor Abdul HaiДокумент28 страницInsider Trading: Mohammed Imdad Mousam Ku Roy Rahul Pandey Abdul Noor Abdul HaiMousam RoyОценок пока нет

- A-Z Accounting Terms and MeaningsДокумент23 страницыA-Z Accounting Terms and MeaningsRomilie Mae BalagtasОценок пока нет

- Fin304 1midterm2Документ5 страницFin304 1midterm2darkhuman343Оценок пока нет

- AFSA Cash Flow AnalysisДокумент19 страницAFSA Cash Flow AnalysisRikhabh DasОценок пока нет

- SFAD - Course OutlineДокумент10 страницSFAD - Course OutlineMuhammad Shariq SiddiquiОценок пока нет

- Case Study On Buyback of Shares by BHARTI AIRTEL PVTДокумент8 страницCase Study On Buyback of Shares by BHARTI AIRTEL PVTAashish MittalОценок пока нет

- 3rd ActivityДокумент2 страницы3rd Activitydar •Оценок пока нет

- Summer Internship Project On Stock BrokingДокумент109 страницSummer Internship Project On Stock BrokingArun Kumar Naik86% (7)

- Management AccountingДокумент4 страницыManagement AccountingCalcutta PeppersОценок пока нет