Академический Документы

Профессиональный Документы

Культура Документы

Case 5 Nokia

Загружено:

DevspringИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case 5 Nokia

Загружено:

DevspringАвторское право:

Доступные форматы

STRATEGIC MANAGEMENT: TEXT AND CASES Published by McGraw-Hillflrwin, a business unit of The McGraw-Hill Companies, Inc.

, 1221 Avenue of the Americas, New York, NY, 10020. Copyright O 2006, 2004 by The McGraw-Hill Companies, Inc. All rights reserved. No part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written consent of The McGraw-Hill Companies, Inc., including, but not limited to, in any network or other electronic storage or transmission, or broadcast for distance learning. Some ancillaries, including electronic and print components, may not be available to customers outside the United States. This book is printed on acid-free paper.

ISBN 0-07-293391-7 Editorial director: John E. Biernat Sponsoring editor: Ryan Blankenship Developmental editor: Natalie J. Ruffatto Executive marketing manager: Ellen Cleary Producer, Media technology: Damian Moshak Project manager: Harvey Yep Production supervisor: Debra R. Sylvester Lead designer: Pam Verros Lead supplement producer: Cathy L. Tepper Senior digital content specialist: Brian Nacik Cover design: Pam Verros Interior design: Pam Verros Typeface: 10112 Times Roman Compositor: ElectraGraphics, Inc. Printer: Quebecor World krsailles lnc.

Library of Congress Cataloging-in-Publication Data

Dess, Gregory G. Strategic management : text and cases [Gregory G. Dess, G.T. Lumpkin, Alan 8 . Eisner.-2nd ed. Includes bibliographical references and index. ISBN 0-07-293391-7 (alk. paper) 1. Strategic planning. I. Lumpkin, G. T. 11. Eisner, Alan B. 111. Title. HD30.28.D4746 2006 658.4012--dc22

20040423 17

Case 27

Nokia's Strategic Intent for the 21st Century

Sitting in the corporate conference room on top of the Espoo Tower in Finland in March 2003, K. P. Wilska, president Nokia Americas, gazed out the window over a frozen lake at a glaringly visible Sony-Ericsson logo on the adjacent office tower. "Sony-Ericsson was started by some of our people with some of our ideas . . . With over 60,000 people and $33 billion in sales we are on top of the wireless communication industry today but it seems like there are more challenges and obstacles than when we began this journey over a decade ago." Pekka Ali-Peitella, global president, added, "we have helped create a fundamentally new global market in less than ten years-and an organization that has consistently created value with a track record of successful product innovation, rapid response and growing brand recognition." Holstein Moerk, executive vice president, Human Resources, added, "We are continually in a state of reorganization and resource reallocation, targeting new customers and markets while focusing on building high performance teams and making sure that our associates' life strategies coincide with our corporate strategy and vision." By the end of 2003, Nokia was the world's largest, most profitable maker of cellular phones-ahead of Motorola, Ericsson, Siemens, Samsung, and a host of others (Exhibit 1). Its products included mobile phones (wireless

voice and data devices for personal, business, and entertainment uses) and networks (wireless switching,and transmission equipment used by carriers). Nokia's other products included set-top boxes, home satellite systems, wireless network software, and cell phone displays. The company's Nokia Ventures division invested in technology-related start-ups. Chairman and CEO since 1992, Jorma Ollila's vision for the next decade was clear: Nokia would dominate the wireless communication space by expanding voice communications to developing markets, by delivering extended mobility to the enterprise, and by driving consumer mobile multimedia. The management team would face both old and new competitors and consortia alike in carving out their strategic intent in hopes of redefining a new information-communication-entertainmentindustry space.

Nokia Mobile Phones and the Early 1990s

In 1990, as newly appointed president of Nokia Mobile Phones (the smallest of five Nokia Group divisions, with just over 3,000 employees and sales of $500 million), Jorma Ollila would oversee the upstart mobile telephone division's ascendance within the group and, more importantly, within the industry at large. By mid-1991 his division had become the world's second largest producer of mobile telephones (a 13 percent market share), nearly half the size of number one Motorola (22 percent market share). Motorola, a fully integrated manufacturer of mobile telephony with $10 billion revenues, had fully owned operations in each phase of the value chain, from semiconductors to handsets to cellular infrastructure equipment and satellites. A close third was NEC Corporation (10 percent market share), a formidable competitor with $26 billion in revenues and vast financial resources. Both Motorola and NEC were poised to dominate the burgeoning cellular phone market (Exhibit 2). In the early 1990s the cellular market had grown rapidly with significant top-line and bottom-line growth. The consumer of choice was primarily the business user willing to pay for the functional mobility of cellular phones despite their high prices. These prices were unattractive to the mass-market consumer and cellular phone design remained bulky and functionally limited. Asia-Pacific manufacturers began to drive down the high initial margins of the leading competitors. Concurrently, cellular phone sales were expected to grow up to 20 percent annually for the next few years. These factors created considerable uncertainty and blurred the future of cellular phones as a mass communication medium. At this time, communication standards for cellular phones had yet to evolve. There were multiple proprietary

Exhibit 1 Worldwide Market Share of Cellular Handset Manufacturers by Units (%)

Nokia Motorola EricssonISony Samsung Siemens Kyocera Panasonic Others Total

13.00% 22.00 3.00 0.00 0.00 0.00 6.00 56.00 100.00%

Source: Micrologic Research. This case was prepared by research associate Dev Krishnan, under the supemision of Professor Michael D. Oliff, as a basis for classroom discussion rather than to illustrate the effective or ineffective handling of a business situation. It was developed within the scope of Enterprise 2020, a development program conducted with global enterprises. Copyright O School of Management, University of Texas, Dallas, 2004.

Exhibit 2

Cellular Handset Sales by Technology (In millions of units)

Analog Other

GSM CDMA One W-CDMA CDMA 2000 Total Technology

13.5 47.6 274.3 49.0 01 . 2.4 386.9

0.8 19.1 391.5 23.5 102.7 196.9 734.5

Generation 1 Generation 2 Generation 3 Totals

15.79% 83.56 0.65 100.00%

2.71% 56.50 40.79 100.00%

Source: Micrologic Research; 3G Technologies.

standards across, and often within, markets. These standards gave firms the ability to own the value chain by developing proprietary hardware and software for cellular service providers. Communication standards consisted broadly of two disparate categories, analog and digital, with each player in the cellular industry committed to a variant of one or the other. Analog was a legacy system, with digital standards only gradually emerging at that time as the potential universal standard of the future. From their inception, digital communication standards increased network utilization by enabling higher data transmission on the same bandwidth. As an open communication standard, digital allowed cellular providers to mix and match equipment of different manufacturers. Consequently, these emerging standards provided marginalized cellular players with "the right to play," especially those who had been previously shut out of the cellular market because of the proprietary technology and equipment that analog standards required. Firms had to make the tough choice of which communication standard to back as it involved significant resource commitments no matter which path was chosen. The stage was set for the first war for the cellular phone industry.

The Road to 2002

Lacking the resources to compete head-on with either Motorola or NEC, Nokia focused on creating strong alliances across the value chain. Ollila bet on a rapid emer-

gence of digital standards and signed an agreement with AT&T to design new semiconductors for the coming digital cellular phones to which he had committed the company. Nokia also entered a consortium with Alcatel and AEG to design cellular systems for European digital markets. They initiated and signed an agreement with the consumer electronics retailer TandylRadio Shack to distribute a custom-made Nokia phone, called the Tandy Mobira, in the U.S. market. Nokia also acquired key resources to provide added impetus to its development efforts. In late 1991, the company bought Technophone, the number two European cellular phone manufacturer, which led to increased economies of scale, greater market share, and increased access to R&D resources. Committed to pursue and propagate digital technology, Nokia determined that players in the cellular phone market needed a uniform standard for communication and network interface. The firm leveraged its strength in building partnerships and entered into industrywide alliances with network equipment manufacturers to adopt a common communication standard. With its extensive digital technology experience, Nokia propelled the establishment of its global system for mobile communications (GSM) digital standard. Its alliances and industrywide consortiums were such effective platforms to propagate the standard that by 2001, three out of every four phones sold were GSM compatible. Ollila and his team realized that the keys to serving the changing markets were the new distribution channels that would open up as digital cellular phones became easier to configure with smart cards. Nokia entered into distribution alliances with key electronic retailers and significantly increased its penetration in key markets, resulting in higher visibility shelf space among trade channels compared to their competitors. Nokia grabbed the initial lead in the mid-90s and built the momentum critical for its meteoric rise. Forecasts made a year earlier of 400,000 units for 1993 turned into year-end sales in excess of 20 million digital phones. At the same time, production planning at Nokia was ill-equipped to handle the explosion in cellular phone sales. The turbulent market and plethora of communication standards required a multitude of proprietary parts for each mobile phone assembled, with some parts having lead times in excess of internal planning horizons. Consequently, Nokia's stockpile of work-in-process inventory grew out of control and became financially burdensome. This situation was further compounded by the lack of adequate information systems to help predict or prevent blockages in the supply chain. Nokia believed the key to success was the ability to drastically ramp up production to meet and exceed customer expectations, that is, the various channel partners. Consequently, the fr invested in a reliable information im system that served the needs of production planning, ac-

Case 27 Nokia's Strategic Intent for the 21st Century

753

curate forecasting, reliable sales reporting, and supplier integration to accurately assess bottlenecks in the supply chain and reduce inventory levels. By 1993 Nokia Mobile Phones had reduced its distribution sites from 18 to 9, decreased the number of suppliers from 300 to 150, and closed three plants in Finlanddrastically reducing complexity. Overall lead times were reduced by 50 percent through a number of related initiatives: R&D focus on the standardization of component parts, assembly process improvements, purchasing lead-time emphasis and measurement, and so forth. Developing a distinctive competency in rapid response proved successful and increased profits substantially while providing the much needed flexibility demanded by a turbulent market. Nokia also recognized early that increased price pressures would .render cell phones a commodity in the near future and began to "think like a consumer products company" well ahead of its competitors. They advertised aggressively, reallocated significant resources, and built brand image among the end consumers who they felt would increasingly dictate the choice of phones bought in the market. This brand competency was executed on a global scale as Nokia expanded its reach both east and west. By 1999, after several years of sponsoring the NCAA Sugar Bowl, over 90 percent of North Americans finally recognized the firm as "Scandinavian and not Japanese." Recognition of Nokia's distinctive competency in global brand management was indicated by BusinessWeek Interbrand's report* in which Nokia was ranked number six on the list of the "World's most admired brands" among heavyweights like Coca-Cola and Intel. Nokia spent the rest of the decade allocating significant resources to build a distinctive competency in product innovation. Like Sony and 3M, the company further complemented its brand image with superior product offerings. im The fr repeatedly and consistently exceeded consumer expectations with unique, appealing ergonomic designs, user-friendly interfaces, and easy-to-use phone services. With established distinctive competencies in rapid response, global brand management, and product innovation, Nokia signed deals in 1999 to put its wireless application protocol (WAP) software into network servers produced by Hewlett-Packard and IBM. The company, which also unveiled several WAP-enabled phones designed to access the Internet, widened its lead as the world's biggest seller of mobile phones and made several acquisitions to strengthen its Internet protocol networks business. Extending its push into Internet capability, Nokia also bought several smaller companies that developed e-commerce and telephony technologies. "Life went mobile"' as cellular communications came of age with cellular phones exceeding fixed tele*Khermooch, Gerry, 2003, "Brands in an age of anti-Americanism:' Businessweek, August 4: 69. 'Ollila, Jorma, 2003, Life goes mobile, Nokia Corporation.

phone lines worldwide (1.2 billion versus 1.0 billion, respectively). Continued reductibns in cost of use (both handset and network charges) would continue to drive growth. Cellular phones provided consumers worldwide with mobility and connectivity never imagined even a decade before. Studies showed that a significant number of North American families were doing away with fixedline phones and using wireless exclusively for the home and family. At the same time the majority of the world's population (outside of the G8 countries) had yet to have access to any form of telephony, providing Nokia and other mobile phone manufacturers with the opportunity to reach vast numbers of the world's population.

New Industries and Markets As it entered the second millennium, Nokia was well ahead of its rivals in wireless digital phones and dominated the European GSM market. It lagged slightly in the U.S. market where many large carriers adopted Qualcomm's code division multiple access (CDMA) standard. In 2000 Nokia began to cover the bases for the third generation by offering products to bridge the gap between generations. In an effort to jump-start declining handset sales as the cell phone market in the West and Japan approached saturation, Nokia set its sights on becoming the leader in third-generation (3G) wireless network equipment. The company teamed with other phone makers and wireless service providers to develop a common global standard for 3G phone software. The effort was backed by Motorola, Sony-Ericsson, and Japan's NTT DoCoMo. Nokia's management team had browsed through a University of Texas at Dallas Enterprise 2020 executive report during the first quarterly review for 2003. Broadly, the report predicted and described a set of forces and value drivers that would likely reshape the future of commercial and individual life concurrently. More specifically, it outlined emerging customer and consumer expectations, trends, and potential discontinuities that would impact the wireless industry directly. The future relevance of Nokia's global leadership in cellular handset production and the past decade of historic telecom success were put in question by the Enterprise 2020 executive report's focus on other rapidly converging global industries and markets. Nokia's management team was particularly interested in the commercial and consumer developments in:

Information communication and knowledge commerce. Innovation and performance improvement. Education and entertainment. Lifestyle enhancement and extension. Info-know-com, Inno-formance, Edu-tainment, and Life-enrichment were emerging as related but distinct global industries that would encompass over a trillion

C a s e 27

Nokia's Strategic Intent for t h e 21st Century

Exhibit 3 2002 Financial Information for Leading Global Cellular Service Providers

(All figures are $ millions, unless otherwise indicated)

Revenue Cost of goods sold Gross profit Gross profit margin (%) Selling, general, and administrative expense Depreciation and amortization Operating income Operating margin (%) Nonoperating income Nonoperating expenses Income before taxes Income taxes Net income after taxes Continuing operations Discontinued operations Total operations Total net income Net profit margin (%)

Source: www.hoovers.com.

(continued on facing page)

U.S. dollars of annual value in the foreseeable future. Excerpts from the 2020 report on the following subjects follow: new distribution channels, changing markets, cellular standards, customer revenue requirements, consumer expectations, and the convergence of appliances, as well as performance improvement. New Distribution Channels In the early 1990s, fragmented cellular standards, requiring proprietary products, gave cellular phone users limited choice of cellular handsets. As cellular communication standards converged and dominant cellular service providers (CSPs) emerged in each market, consumers were faced with an increasing array of cellular handsets. Initially, individual phones were configured at the point of sale by appliance store representatives and primed before use. As technology improved and standards emerged, phones came preconfigured and "ready-to-use." CSPs used this improvement in technology as an opportunity to gain control of both the

point of sale and the end consumer. Cellular phone manufacturers were increasingly pressured to introduce discounted custom-made phones which were provided at subsidized rates to consumers.2 Manufacturers in the Asia-Pacific region drove down prices faster than expected for lower-end, feature-sparse phones used by entry-level cellular consumers. By the turn of the century, CSPs worldwide had gone through a tumultuous process of expansion, acquisition, and consolidation in cellular markets. Three CSPs emerged as formidable players (see Exhibit 3 and Exhibit 4) in the global wireless cellularscope of 2004.

2CSPs were getting into the practice of running promotions on the latest cellular models, offering them at discounted prices. Low-end or entry-level phones were being given away at heavily discounted prices, in some cases free, to the end consumer upon signing an extended service plan. Extended service plans locked in consumers to the cellular carrier to the life of the plan, with penalties to the consumer for premature termination.

Case 27 Nokia's Strategic Intent f o r t h e 21 st Century

Exhibit 3' 2002 Financial Information (continued)

Assets Cash Net receivables Inventories Other current assets Total current assets Net fixed assets Other noncurrent assets Total assets Liabilities and shareholders' equity Current Liabilities Accounts payable Short-term debt Other current liabilities Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities

3,946.0 2,260.0 16,382.0 22,589.0 20,822.0 6,761O . 54,696.0 751.O 10,171.0 577.0 2,078.0 13,577.0 30,935.0 213,536.0 258,048.0

Preferred stock equity Common stock equity Total equity Shares outstanding (millions of shares)

203,352.0 203,352.0

29,436.0 29,436.0

7,541 .O 7,541 .O

Net operating cash flow Net investing cash flow Net financing cash flow Net change in cash

16,515.0 (16,204.0) 310.0 621.O

13,420.9 (7,380.61 (2,822.7) 3,217.6

3.592.0 (3,585.0) 334.0 341.O

Depreciation and amortization Capital expenditures

25,139.0

6,345.4 (5,932.7)

1,850.0 (3,085.0)

(16,227.0)

756

Case 27 Nokia's Strategic Intent for the 21 st Century

Exhibit 4

Key Financial Indicators of Cellular Phone Manufacturers, 2002 (All figures are $ millions, unless otherwise indicated)

Key Numbers Annual sales

Employees Market capitalization No. of shares outstanding Profitability (%) Gross profit margin Net profit margin Return on equity Return on assets Return on invested capital Valuation Pricelsales ratio Pricelearnings ratio Pricelbook ratio Operations Days of sales outstanding Inventory turnover Days cost of goods sold in inventory Asset turnover

Source: www.hoovers.com.

The Vodafone Group, based in the United Kingdom and, with its subsidiaries, the world's largest cellular service provider, catered to 123 million cellular service subscribers.3 The company owned stakes in leading wireless carriers around the globe. It held an interest in leading mobile phone operators in the United States (45 percentowned Verizon Wireless), Germany (D2), and the U.K. (Vodafone). The Vodafone Group owned stakes in operating affiliates in Europe, the Americas, the Asia-Pacific region, the Middle East, and Africa. It also held stakes in wireless carriers in several other European countries, including France, the Netherlands, and Spain. In 2002 Vodafone entered into a partnership with software giant Microsoft to develop better cellular services for consumers worldwide.

'Vodafone overview, 2004, February 29, www.hoavers.com.

By 2004 NTT DoCoMo had over 44 million digital network subscribers, second only to V ~ d a f o n eThe com.~ pany enjoyed a major commercial success with the rollout of the "i-mode" service in the second quarter of 2001 within the Japanese market.5 For the first time, the i-mode service provided consumers with the ability to access the World Wide Web through wireless handsets and, concurrently, the ability to use their handsets to purchase products and services directly. In 2003 nearly 38 million customers subscribed to DoCoMo's i-mode service. The company also offered paging, maritime, and in-flight phone services, and sold handsets and pagers. DoCoMo (which means "anywhere") cornered nearly 60 percent of

4NTI DoCoMo overview, 2004, March 1 1 , www.hoovers.com. 5"i-mode" is a registered trademark of NTT DoCoMo.

Case 27 Nokia's Strategic Intent for the 21st Century Exhibit 5 Financial Performance of Global Cellular Phone Manufacturers, 2002

Key Numbers

Annual sales ($ millions) Employees Market value ($ millions)

Profitability

(OIO)

Gross profit margin Pretax profit margin Net profit margin Return on equity Return on assets Return on invested capital

Valuation

Pricelsales ratio Pricelearnings ratio Pricelbook ratio Pricelcash flow ratio

Operations

Days of sales outstanding Inventory turnover Days cost of goods sold in inventory Asset turnover Net receivables turnover flow

Financial

Current ratio Quick ratio Leverage ratio Total debtlequity

Source: Company annual reports.

the Japanese market for mobile phones through its eight majority-owned regional operating subsidiaries. The company licensed its i-mode technology through a subsidiary to the telecom units in France, Italy, and Spain. As of the fourth quarter of 2003, DoCoMo Europe Ltd. had secured major bids on European next-generation mobile phone licenses as well. Two regional Bell companies combined assets to create the number two wireless carrier, after Verizon Wireless, in the United States: Cingular Wireless Communica-

tions.6 By January 2004, it had over 25 million customers, including subscribers to its Mobitex wireless data services network. Cingular operated primarily in the US.market. Soon after, Cingular bought domestic rival AT&T Wireless when it won a bidding war with the Vodafone Group. The deal, valued at $41 billion, created the leading U.S. wireless carrier with 46 million customers, topping the leader at the time, Verizon Wireless. Exhibit 5 illustrates the

Tingular Wireless overview, 2004, March 11, www.hoovers.com,

758

Case 27 Nokia's Strategic Intent for the 21st Century can Free Trade Agreement (NAFTA)-nations adopted liberalized trading policies (India, China), and many countries embraced world trade (under the auspices of the World Trade Organization). Two key emerging markets that showed potential for extensive deployment of cellular services were China and India (see Exhibit 8).

Exhibit 6 Sales of Nokia Operations and Business Groups, 2002

Nokia Operations

United States United Kingdom China Germany Finland Other regions Total 2002 Sales Nokia Mobile Phones Nokia Networks Nokia Ventures Organization Total

Source: Nokia annual reports.

China By the mid-1990s China had gradually embraced the free market model. At the turn of the century, the Chinese government opened up many sectors of the economy for foreign investment, including cellular communications infrastructure. Until 1997 China Telecom was the only organization allowed to operate cellular services. To foster competition the Chinese government set up another organization that was allowed to offer cellular services; China Unicom. Cellular services has grown at a feverish pace since the formation of these organizations. Before 2000 came to a close, China overtook the United States as the largest cellular communications market.7 In 2003 the Chinese government awarded licenses to cellular infrastructure providers to provide 3G infrastructure to China Unicom and China Telecom for WCDMA and CDMA 2000-compliant hardware. At the end of the third quarter of 2003, it was estimated that for every CDMA 2000 phone sold, seven GSM-based WCDMA phones were sold.8

India The Indian economy emerged from its socialist past to embrace the global economy in the early 1990s. In 1996 the Indian government awarded cellular licenses to private firms allowing them to offer and operate cellular services. With its large population and underdeveloped telecommunications market, this represented an ideal potential market for cellular phones. Since 2000 many large foreign cellular operators have invested in India, building on the early successes of other cellular operators and the liberalized trade policies in place. Following entry, players in the cellular industry were faced with significant implementation issues. Geographic disparity led to logistic issues while linguistic diversity led to higher than antici'China Unicom overview, 2004, February 29, www.hoovers.com

financial performance of leading cell phone manufacturers. Exhibits 6 and 7 provide details on Nokia's sales and organization.

The Changing Nature of Markets The resolution of the analog versus digital standard battle of the early 1990s gave way to the frenzied jockeying for market position in emerging cellular service markets-North America, Europe, and Asia-Pacific-to own various parts of the cellular value chain. Gradually, these markets were saturated from the slowing economic growth in these regions. Moreover, the face of global trade was changing as trading blocs emerged-the European Union, North Ameri-

SVodafone overview.

Exhibit 7

Organizational Structure of the Nokia Group, 2002 Resource Allocation Model

Case 27

Nokia's Strategic Intent for the 21st Century

Exhibit 8

Potential Cellular Markets Based on Population and Telecommunication Penetration

India China Indonesia Pakistan Bangladesh Nigeria Brazil Russia Vietnam Philippines Ethiopia Mexico Egypt Iran Democratic Republic of the Congo Myanmar (Burma) Thailand Tanzania Sudan Ukraine

Source: Plunkett's Telecommunication Industry Almanac 2003.

pated marketing costs. To overcome consumer uncertainty concerning the cost of ownership of cellular handsets, manufacturers introduced inexpensive mobile phone models throughout India.9 Indian cellular infrastructure had been largely based on GSM standards. In 2003, however, cellular service providers started offering CDMA 2000compatible phones as well. Emerging Cellular S t a n d a r d s As the 1990s came to a close, voice usage revenues leveled, limiting growth for cellular service providers worldwide. The prevalent CDMA and GSM standards had limitations on the bandwidth available to individual users and the amount of data they could support on a communications network. In ad9Nokia launches entry-level phones for new growth markets, 2003, Asia Intelligence Wire, August 3 1.

dition, cellular phone users increasingly looked for a richer, more interactive cellular phone experience that required higher bandwidths than those then available. These factors led to a worldwide initiative to create the next generation cellular communication standard-3Gthe third iteration. The 3G peer-to-peer open standard was created to support higher data transmission levels across cellular networks and improve the communication experience of wireless terminal users through new data-rich services-games, photo and video messaging, and mapping. The open standard left many organizations vying to own strategic parts of the 3G pie10 content development, wireless terminal communication, and interface standards for phones (displays, operating systems, and network traffic

I0Heads we win, tails we win, 2003, Fortune (Europe), March 3: 50.

760

Case 27 Nokia's Strategic Intent for the 21st Century

Exhibit 9 Expected Value Chain for 36 Services

Network applications Middleware Hardware

Source: Nokia Corporation, 2003.

Tailored network application for CSP 1 Numerous middleware vendors Numerous hardware vendors

Tailored network application for CSP 2 Numerous middleware vendors Numerous hardware vendors

Tailored network application for CSP 3 Numerous middleware vendors Numerous hardware vendors

management). (See Exhibit 9.) Cellular service firms were eager to be the first to offer fully integrated 3G services to their customers. In 2002 European carriers spent upward of $100 billion on licenses for the radio spectrum necessary to offer 3G services. Adding to the allure of 3G service was the emergence of the Internet as the information backbone for a variety of information-related functions-personal, financial, social, to name a few. Cellular providers then faced the opportunity of seamlessly linking consumers with the Internet on their wireless terminals. The Internet provided the seemingly limitless databank for multimedia messaging services (MMSs), 3G's unique proposition to enhance the communications of cellular users with other contacts. MMSs enhanced the use of the wireless terminal as a communication tool by incorporating pictures, video, and streaming audio to enrich the effectiveness of the message sent. Content formatted for mobile terminals, standards for transmission of media over wireless terminals, and revenuejprofit models for content and carriers emerged as key concerns in integrating Internet-based services into wireless handsets. However, in the race for the dominant 3G cellular communication standard, a new battle loomed on the horizon. From the early 1990s GSM had come to dominate the world as the cellular communication standard of choice (three of every four cellular callers worldwide used a GSM-compatible phone on a GSM-based network). At the heart of the race stood two opposing network communication standards to offer 3G services. On one side were all the carriers who relied on the CDMA communication standard-most U.S.-based carriers, all of South Korea, and a host of other global carriers. On the other, much larger side adhering to the GSM communication standard were most of Europe, some U.S.-based carriers, and most of China and India. Each group offered its version of 3G; CDMA 2000 in the CDMA world and WCDMA among the GSM proponents. The outcome remained unclear as to

which standard would prevail. Most industry observers predicted that WCDMA would eventually become the dominant 3G network standard largely due to the GSM market share advantage. The actual number would ultimately depend on the emerging standard in developing cellular markets. As of the second quarter of 2003, 37 CDMA 2000 networks were up and running around the world, compared with 2 WCDMA networks. Implementing 3G-compliant networks based on CDMA 2000 outpaced equivalent 3G-compliant WCDMA implementations as CDMA 2000 chipset design licenses became easier to integrate across markets." By the end of 2003, problems with equipment and the rollout of worldwide technical upgrades had set back overall industry 3G projections by 12 to 24 months. The following issues remained key concerns in the rollout of 3G worldwide:

1. With content across wireless networks digitally stored, owned, and consumed, digital rights management (DRM) emerged as a primary concern for promoting wireless content and its lawful use.I2 DRM promoted lawful distribution and usage of copyrighted material by giving licenses for the requesting party to use or view the material for a limited period of time or indefinitely. An industry alliance was under way to speed the propagation of digital content to mobile terminals in an efficient, profitable, and effective manner.

"US.-based Qualcomm, a forerunner in CMDA technology, owns much of the chipset technology design patents, and licenses for 3G-compliant CDMA 2000 networks, which require CSPs to purchase technology licenses from im this f r .The resultant standardization of technology and related designs has increased portability of CDMA 2000-compliant technologies across markets. As of 2003, WCDMA had multiple design standards prevalent that sometimes limit portability across markets.

'ZMMS entering into the next phase, 2003, White paper by Nokia Corporation, 11-12.

Case 27

Nokia's Strategic Intent for the 21st Century

Year

Interconnection Voice Data

Exhibit 10

2.

Projected Sources of Revenue for Mobile Operators

Security remained a prime concern for mobile users; its impact had already been felt on application developers. New standards on the existing transfer of sensitive data, personal information, and privacy had not yet reached the required security levels because networks were constrained by the amount of volume-heavy encrypted information they could support. Additionally, smart cards had been embedded in some cellular handsets, giving handset users the ability to purchase goods and services (from objects with embedded smart cards) by authenticating purchases through their cellular handsets. The key concerns of security and authentication for this technology remained unanswered as 2004 began.

Customers- Revenue Growth Requirements At the turn of the 21st century most cellular camers faced worldwide declines in revenue growth, resulting from the saturation of key markets in North America, Europe, and the Asia-Pacific region. At the time players in the telecommunications industry had made capital expenditures to upgrade or maintain aging infrastructure, resulting in a profits squeeze in the industry. Additionally, voice services, the bread and butter for most carriers, were fast becoming commodity products, and voice usage rates were peaking as well (see Exhibit 10). The near simultaneous squeeze in top-line and bottom-line growth from these factors left many carriers scrambling for new sources of

growth or profits. Key initiatives were sought to widen the subscriber base and improve network utilization. Cellular service providers also planned to widen their subscriber base by entering new emerging markets. CSPs fast discovered that cellular customers in different markets had divergent needs. In most emerging markets, offering low-cost options to consumers was the most important factor. According to consumer behavior studies in these markets, the prevailing price sensitivity associated with consumers switching to cellular phones from other forms of telecommunication indicated that halving the total cost of ownership would more than double penetration. As a method of inducing cellular subscribers to try out cellular phones, prepaid cellular services seemed to be the model of choice for consumers in emerging markets. Furthermore, the lagging infrastructure and diverse geographic conditions in those markets required cellular infrastructure providers to introduce low-cost options to help carriers deploy their networks cost-effectively. Cellular infrastructure providers started offering network base station planning and alternative base station designs as add-on services to reduce implementation costs of CSPs in emerging markets. The cellular industry responded to the limited potential voice services offered for differentiation by investing in new technology that allowed users to communicate over cellular networks using rich media like pictures, streaming audio, and video. Rich media carried over 3G networks that tap into the Internet were being pushed

762

Case 27 Nokia's Strategic Intent for the 21st Century

actively by major carriers worldwide as the next "star service.'' CSPs then had the opportunity to differentiate these services and drive bottom-line growth. CSPs intensified work with application designers to deliver technologies that would enrich the lives of mobile handset users. Key challenges remained with the seamless transition from old to new technologies.

Consumer Expectations-Phones, Mobility, Usage, and Lifestyle For many consumers, cellular phones had moved far beyond a one-dimensional instrument for voice conversation. To them the cellular phone had become a tool for entertainment (e.g., gaming, audio, imaging, media), personal expression, and extended communication. These diverse applications had ushered in the age of the "wireless terminal." The ability to perform multiple functions in addition to voice and data transmission had become a basic consumer requirement. The most common uses for wireless terminals were voice, personal expression, active usage, and fashion. Based on consumer usage statistics and psychographics, consumers' preferences could be effectively segmented by usage (high versus low usage), lifestyle (activity-specific terminals), and product category (application-specific terminals). The following trends had emerged in consumer preferences related to the performance of their mobile terminals:

Content from a strong o r trusted brand+onsumers were interested in browsing for content on their mobile terminals. Furthermore, consumers were willing to accept content only from a trusted brand or portal. Targeted content-the content needed to appeal to a specific consumer group and ideally would be selected based on the consumer's preset preferences-for example, "mobile wallets" for financial applications. Friendly portal navigation-consumers preferred the richer browsing experience afforded by color browsers built in to their wireless terminals. Navigating between portals was often cumbersome with traditional terminal design. Consumer "mobile personality "--users sought a wireless terminal as an extension of their personality, a communicator to and from their friends and peers. The last trend posed immense potential in segmenting consumers, building applications, and delivering services in the new wired world. However, the "mobile personality" concept raised issues in the creation and completion of cellular transactions-identity, authentication, user profile, and privacy. Players in the cellular industry scrambled to address these issues in the race to offer consumers the "killer app" of 3G services.

Convergence of Appliances The early 1990s saw a proliferation in the form and nature of electronic appliances. Not only did appliances get smaller and more portable, but they became increasingly multifunctional. Consumers began to expect an appliance to perform beyond its primary functional use. The rise of the Internet brought a hitherto untapped opportunity for interconnectivity among appliances. In the past data was stored, consumed, or retrieved from the source appliances with little or no interconnectivity between the appliances themselves. The Internet provided the ability to link seemingly incongruent devices that stored, disseminated, or captured information. The influence on consumers' lifestyles from these trends-multifunctionality among appliances and the sustained need for computing power-spawned new genres of information-friendly portable devices that sought to bridge the gap between mobility and multifunctional computing. The personal digital assistant (PDA) and other smart terminals provided iinks between computers and other computing devices to share information. Device communication protocols like Bluetooth further aided and encouraged information exchange between seemingly incompatible devices.13The lines between pure computing devices and mobile terminals became increasingly blurred. These trends fueled the emergence of "smart phones" that allowed for word processing, spreadsheet manipulation, e-mail and Internet browsing, and personal information management as well as data synchronization to desktop applications. By 2003 smart phones were growing at the expense of nonconnected PDAs which recorded their second consecutive year of decline that year-down 8.4 percent to 11.35 million units-according to IDC, an independent research firm. Of the 118 million mobile handsets shipped during the first quarter of 2003, 2 million were smart phones. A wireless handset market analyst at IDC opined that, by 2007,75 percent of all mobile phones would be converged devices, with a major segment from the smart phones category.14 With its 61 percent share, Nokia continued to dominate in converged devices, trailed far behind by Sony-Ericsson and Motorola with a 10.2 and 5.6 percent share, respectively. Smart handsets had begun the race to own the operating systems on which wireless terminals ran. Microsoft, not surprisingly, had made a concerted effort to promote its operating system for such wireless terminals. Digital TV (DTV) had increased its reach as a medium to propagate digital content with increased presence in Europe and the Asia-Pacific region.15 DTV pro13Bluetooth the registered trademark of Bluetooth SIG Limited, is www.bluetooth.com. I4n>C, 2003, September 12, www.idc.com. 15Nokia Corporation, 2003, Digital convergence in the home, slides.

Case 27 Nokia's Strategic intent for the 21st Century vided the opportunity to facilitate interoperability among electronics devices in the consumer's home. New appliances emerged to facilitate this integration and provide a unique arena where wireless terminals networked between linked appliances. Firms across diverse industries competed in the development of consumer "devices" that networked home appliances which stored, captured, or disseminated digital information for the consumer's entertainment and basic lifestyle support.

763

Selected Responses of Nokia to the Challenges Ahead By 2003 Nokia had developed and introduced

the Vertu Premium Phone at prices listed between $4,900 and $19,450 each. These stylish handsets featured a sapphire-crystal screen and ruby bearings and were available in stainless steel, gold, and platinum finishes. Singer Jennifer Lopez and actress Gwyneth Paltrow were two of the first celebrity consumers to match their Rolex watches and Chanel accessories with Nokia's "designer earpiece." Also in 2003, Nokia acquired Sega.com to improve its online games and services. Coupled with its internally developed mobile N-Gage gaming console, Nokia penetrated the multiplayer gaming environment and a niche of consumers willing to pay to play over 3G networks. Purposing to "drive voice totally wireless," Nokia placed a heavy focus on less developed markets. The development of a range of entry-level wireless terminals and

innovative solutions to reduce carrier fixed costs also had become a high priority by this time. The Nokia Image Viewer f as introduced in Europe and Asia-Pacific markets during 2003 to support DTV's "digital presence in the home." The product addressed interoperability among home electronics devices and provided management and distribution of digital content, linking personal computers, televisions, and wireless terminals to share content. A 16-member alliance between Nokia and leading computing, consumer appliance, and mobile device enterprises was established concurrently to explore other products and services in the same user space.

Next Steps and a Strategic Intent for 2010

As Nokia's top management team reconvened in Espoo in March 2004, they were convinced that dramatic change was ahead. The most recent market share results for wireless handsets were less than encouraging (see Exhibit 11). Both Motorola and Sarnsung had gained significant ground over the previous 12 months. As foreseen, Nokia's bread-and-butter products-wireless handsets-were not likely to provide the double-digit, year-to-year revenue and profit growth required to sustain the firm's dominance in the coming decade. They began to discuss a "new" view of Nokia's "chosen markets" and the distinctive competencies required to sustain the company's influence in them.

Exhibit 11 Worldwide Handset Sales and Market Shares

Nokia Motorola Samsung Siemens Sony-Ericsson Lucky Goldstar Others

Total

Source: Gartner Inc.

Вам также может понравиться

- CASE 6 Ferrofluidics Case StudyДокумент7 страницCASE 6 Ferrofluidics Case StudyDevspringОценок пока нет

- Case 4 DHLДокумент6 страницCase 4 DHLDevspringОценок пока нет

- CASE 3 CorningДокумент14 страницCASE 3 CorningDevspringОценок пока нет

- TPM 4Документ6 страницTPM 4DevspringОценок пока нет

- Totalqualityservicemanagementbook1 090715110223 Phpapp01Документ82 страницыTotalqualityservicemanagementbook1 090715110223 Phpapp01coolbbeeeeeОценок пока нет

- Good Technology, Bad Management: A Case Study of The Satellite Phone IndustryДокумент8 страницGood Technology, Bad Management: A Case Study of The Satellite Phone IndustryKaushal Kumar100% (1)

- 5 - Drug Patent PatentДокумент13 страниц5 - Drug Patent PatentDevspringОценок пока нет

- TPMДокумент12 страницTPMDevspringОценок пока нет

- 3 - Mobile Banking Case StudyДокумент7 страниц3 - Mobile Banking Case StudyDevspringОценок пока нет

- XEROX-The Benchmarking StoryДокумент7 страницXEROX-The Benchmarking StoryDevspringОценок пока нет

- TPM3Документ10 страницTPM3DevspringОценок пока нет

- TPM 2Документ9 страницTPM 2DevspringОценок пока нет

- A Case Study of ERP Implementation For Opto-Electronics IndustryДокумент18 страницA Case Study of ERP Implementation For Opto-Electronics IndustryBoloroo_gbОценок пока нет

- Implementation of ISO 14000 in Luggage Manufacturing Industry: A Case StudyДокумент14 страницImplementation of ISO 14000 in Luggage Manufacturing Industry: A Case StudyDevspringОценок пока нет

- QFD CaseДокумент13 страницQFD CaseDevspringОценок пока нет

- Marketing Magazine of Iim Shillong Vol 3, Issue 3: Interview: Harsha Bhogle, TV Commentator/ Presenter/ JournalistДокумент33 страницыMarketing Magazine of Iim Shillong Vol 3, Issue 3: Interview: Harsha Bhogle, TV Commentator/ Presenter/ JournalistDevspringОценок пока нет

- Process FMEAДокумент13 страницProcess FMEADevspringОценок пока нет

- InTech-Implementation of Iso 14000 in Luggage Manufacturing Industry A Case StudyДокумент18 страницInTech-Implementation of Iso 14000 in Luggage Manufacturing Industry A Case StudyDevspringОценок пока нет

- 17 - Benchmarking Case StudyДокумент2 страницы17 - Benchmarking Case Studyaneetamadhok9690Оценок пока нет

- Fmea 4Документ9 страницFmea 4DevspringОценок пока нет

- A Case Study of ERP ImplementationДокумент24 страницыA Case Study of ERP ImplementationDevspringОценок пока нет

- FMEAДокумент12 страницFMEADevspringОценок пока нет

- Hindustan Unilever LimitedДокумент6 страницHindustan Unilever LimitedDevspringОценок пока нет

- MarkathonSept Oct2010Документ28 страницMarkathonSept Oct2010DevspringОценок пока нет

- 3.process MGMT at Celestica LTDДокумент4 страницы3.process MGMT at Celestica LTDDevspringОценок пока нет

- Mark at Hon November 2010Документ28 страницMark at Hon November 2010DevspringОценок пока нет

- Implementing Quality MGMT System at Hyundai MotorsДокумент2 страницыImplementing Quality MGMT System at Hyundai MotorsDevspring0% (1)

- Mark at Hon May 2011Документ30 страницMark at Hon May 2011DevspringОценок пока нет

- Mark at Hon January 2012 EditionДокумент31 страницаMark at Hon January 2012 EditionDevspringОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- HRM Unit 2Документ69 страницHRM Unit 2ranjan_prashant52Оценок пока нет

- Sale Agreement SampleДокумент4 страницыSale Agreement SampleAbdul Malik67% (3)

- How To Use Google FormsДокумент126 страницHow To Use Google FormsBenedict Bagube100% (1)

- 9 Specific Relief Act, 1877Документ20 страниц9 Specific Relief Act, 1877mostafa faisalОценок пока нет

- Schematic Electric System Cat D8T Vol1Документ33 страницыSchematic Electric System Cat D8T Vol1Andaru Gunawan100% (1)

- Farm Policy Options ChecklistДокумент2 страницыFarm Policy Options ChecklistJoEllyn AndersonОценок пока нет

- Donut FenderДокумент5 страницDonut FenderMaria Angelin NaiborhuОценок пока нет

- NQC User ManualДокумент6 страницNQC User ManualgarneliОценок пока нет

- Dead Can Dance - How Fortunate The Man With None LyricsДокумент3 страницыDead Can Dance - How Fortunate The Man With None LyricstheourgikonОценок пока нет

- STD Symptoms, Causes and PreventionДокумент3 страницыSTD Symptoms, Causes and PreventionSakshi TyagiОценок пока нет

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterДокумент24 страницыPowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterJiya Nitric AcidОценок пока нет

- Business Data Communications and Networking 13Th Edition Fitzgerald Test Bank Full Chapter PDFДокумент40 страницBusiness Data Communications and Networking 13Th Edition Fitzgerald Test Bank Full Chapter PDFthrongweightypfr100% (12)

- Annexure 2 Form 72 (Scope) Annexure IДокумент4 страницыAnnexure 2 Form 72 (Scope) Annexure IVaghasiyaBipinОценок пока нет

- Misbehaviour - Nges Rgyur - I PDFДокумент32 страницыMisbehaviour - Nges Rgyur - I PDFozergyalmoОценок пока нет

- Chapter 3Документ11 страницChapter 3Leu Gim Habana PanuganОценок пока нет

- Oilwell Fishing Operations Tools and TechniquesДокумент126 страницOilwell Fishing Operations Tools and Techniqueskevin100% (2)

- International BankingДокумент3 страницыInternational BankingSharina Mhyca SamonteОценок пока нет

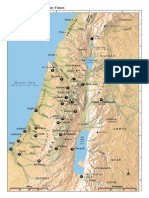

- Israel Bible MapДокумент1 страницаIsrael Bible MapMoses_JakkalaОценок пока нет

- Here Late?", She Asked Me.: TrangДокумент3 страницыHere Late?", She Asked Me.: TrangNguyễn Đình TrọngОценок пока нет

- Amadora V CA Case DigestДокумент3 страницыAmadora V CA Case DigestLatjing SolimanОценок пока нет

- 25 Lanzar V Director of LandsДокумент5 страниц25 Lanzar V Director of LandsFlorieanne May ReyesОценок пока нет

- Edpb 506 Intergrated Unit Project RubricДокумент1 страницаEdpb 506 Intergrated Unit Project Rubricapi-487414247Оценок пока нет

- Diaz, Rony V. - at War's End An ElegyДокумент6 страницDiaz, Rony V. - at War's End An ElegyIan Rosales CasocotОценок пока нет

- Alluring 60 Dome MosqueДокумент6 страницAlluring 60 Dome Mosqueself sayidОценок пока нет

- 001 Joseph Vs - BautistacxДокумент2 страницы001 Joseph Vs - BautistacxTelle MarieОценок пока нет

- Sleeping Habits: HH Mahanidhi SwamiДокумент3 страницыSleeping Habits: HH Mahanidhi SwamiJeevanОценок пока нет

- EDMOTO 4th TopicДокумент24 страницыEDMOTO 4th TopicAngel Delos SantosОценок пока нет

- Compassion and AppearancesДокумент9 страницCompassion and AppearancesriddhiОценок пока нет

- Soap - WikipediaДокумент57 страницSoap - Wikipediayash BansalОценок пока нет

- Thesis Proposal On Human Resource ManagementДокумент8 страницThesis Proposal On Human Resource Managementsdeaqoikd100% (2)