Академический Документы

Профессиональный Документы

Культура Документы

Course

Загружено:

MANUEL7000Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Course

Загружено:

MANUEL7000Авторское право:

Доступные форматы

1

Mean-variance portfolio theory

Reading

Luenberger, Chapter 6 and parts of Chapter 8

Campbell, Lo and McKinlay

Grinold and Kahn

Goals

Learn how to design optimal security portfolios

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 2

Asset portfolios

Portfolio return

Consider a portfolio composed of n assets with total value

x =

n

i=1

x

i

, where x

i

is the value of asset i today

Let w

i

=

x

i

x

be the constant fraction of the portfolio value

invested in asset i so

n

i=1

w

i

= 1

For a xed horizon, let r

i

be the random rate of return on

asset i

The rate of return on the portfolio is r =

n

i=1

w

i

r

i

The expected rate of return on the portfolio is

E[r] =

n

i=1

w

i

E[r

i

]

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 3

Asset portfolios

Portfolio variance

The variance of the portfolio return is

Var [r] = E[(r E[r])

2

] =

n

i=1

n

j=1

w

i

w

j

Cov [r

i

, r

j

]

The return covariance is given by

Cov [r

i

, r

j

] = E[(r

i

E[r

i

])(r

j

E[r

j

])]

= E[r

i

r

j

] E[r

i

]E[r

j

]

and we note that Cov [r

i

, r

i

] = Var [r

i

]

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 4

Asset portfolios

Covariance

The covariance measures the degree of linear dependence

between two random variables

If it is 0 we say the variables are uncorrelated

Note that uncorrelated variables are not independent in general

(take X N(0, 1) and Y = X

2

, for example)

It neglects any nonlinear dependence that might be present

The covariance of X and Y satises |Cov [X, Y ]| SD[X]SD[Y ]

Dene Z = Var [X]Y Cov [X, Y ]X and consider Var [Z]

The covariance is the natural measure of dependence for joint

elliptical variables (e.g. normal)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 5

Asset portfolios

Linear correlation

The linear correlation coecient is the normalized covariance

Corr [X, Y ] =

Cov [X, Y ]

SD[X]SD[Y ]

[1, 1]

assuming that X and Y have nite variances (Cauchy?)

Corr [X, Y ] is invariant under strictly increasing linear

transformations

Independence: Corr [X, Y ] = 0

Perfect linear dependence, i.e. Y = a +bX for b R \ {0} and

a R: Corr [X, Y ] {1, 1}

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 6

Asset portfolios

Classical assumption

From now on we measure

Risk of returns by standard deviation (variance); therefore we

penalize upside uctuations

Dependence of returns by covariance (linear correlation)

This is without loss of generality if returns are jointly elliptically

distributed (it is not enough that the marginals are elliptical)

If returns are not elliptical, then the standard deviation will

underestimate downside risk, and the covariance will not capture

the complete dependence any more

Alternatives are AVaR and rank correlation, for example

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 7

Asset portfolios

Diversication reduces variance (=risk)

This idea goes back at least to Bernoulli (1738), but even

Shakespeare knew it (see The Merchant of Venice)

Consider a portfolio of n equally weighted assets with iid returns

r

i

, which has E[r] = E[r

1

] and Var [r] =

1

n

Var [r

1

]; in the limit

there is no risk any more (strong LLN!)

Now consider a portfolio of n equally weighted assets with

identically distributed returns r

i

that have common pairwise

covariance

12

0, which has E[r] = E[r

1

] and the Var [r] is

n

i=1

w

2

i

Var [r

i

] +

n

i=1

n

j=1,j=i

w

i

w

j

Cov[r

i

, r

j

] =

1

n

Var [r

1

] + (1

1

n

)

12

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 8

Asset portfolios

Portfolio diagram

Consider a two asset portfolio with weights 1 a and a [0, 1]

The expected portfolio return is E[r] = (1 a)E[r

1

] +aE[r

2

]

The portfolio variance is

2

= (1 a)

2

2

1

+ 2a(1 a)

12

+a

2

2

2

Since |

12

|

1

2

we get the upper bound

(a)

_

(1 a)

2

2

1

+ 2a(1 a)

1

2

+a

2

2

2

= (1 a)

1

+a

2

and the lower bound

_

(1 a)

2

2

1

2a(1 a)

1

2

+a

2

2

2

= |(1 a)

1

a

2

| (a)

Draw the mean-standard deviation diagram as a function of a!

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 9

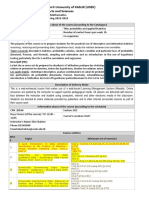

Mean-standard deviation diagram

Assume r

1

= 1%, r

2

= 7%,

1

= 0.05,

2

= 0.2, and

1,2

= 0.003

0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 0.2

0.01

0.02

0.03

0.04

0.05

0.06

0.07

Standard Deviation

E

x

p

e

c

t

e

d

R

e

t

u

r

n

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 10

Feasible set

Consider a portfolio with n assets and weights w

i

s.t.

n

i=1

= 1

By varying the weights we get portfolios with dierent means and

variances

2

; each such portfolio corresponds to a point (E[r], )

in the mean-standard deviation diagram

The set of all possible points is called the feasible set

If there are at least 3 assets with dierent expected returns and

|Corr[r

i

, r

j

]| < 1 then this set is a solid two-dimensional region

The feasible set is convex from the left because all 2 asset

portfolios with positive weights lie on or to the left of the line

connecting them

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 11

Feasible set

Minimum variance set and ecient frontier

The left boundary of the feasible set is called the minimum

variance set, since for any expected return value the feasible point

with the smallest variance is the corresponding left boundary point

The minimum variance point is the point with lowest possible

variance

Risk averse (less standard deviation is better than more for a

given mean) and nonsatiated (more money is better than less,

all else equal) investors will prefer the upper portion of the

minimum variance set, called the ecient frontier

This denition of risk aversion can be problematic...

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 12

Markowitz model

Finding the minimum variance portfolio with a given mean

Consider a portfolio with n assets and weights w

i

s.t.

n

i=1

w

i

= 1

Expected returns r

i

, variances

2

i

and covariances

ij

We want to nd the weights for a portfolio of minimum variance

that has a xed expected return r:

minimize

1

2

n

i=1

n

j=1

w

i

w

j

ij

subject to

n

i=1

w

i

r

i

= r

n

i=1

w

i

= 1

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 13

Markowitz model

Solving the Markowitz problem

The Lagrangian of the problem is given by

L =

1

2

n

i=1

n

j=1

w

i

w

j

ij

_

n

i=1

w

i

r

i

r

_

_

n

i=1

w

i

1

_

where and are the Langrange multipliers

Note that if we set = 0 (i.e. drop the expected return

constraint) then L describes the minimum variance point

We dierentiate L = L(w

1

, . . . , w

n

, , ) with respect to each of

the w

i

s and set the derivatives to zero

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 14

Markowitz model

Equations for the ecient set

The n weights and the 2 Langrange multipliers for an ecient

portfolio having expected return r satisfy the n+2 linear equations

n

j=1

w

j

ij

r

i

= 0, i = 1, 2, . . . , n

n

i=1

w

i

r

i

= r

n

i=1

w

i

= 1

Check these equations!

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 15

Markowitz model

Example

Consider a portfolio with 3 uncorrelated assets with expected

returns 1, 2 and 3 and unit variances

Find the equations for the ecient set based on an expected

portfolio return r!

Find the portfolio weights!

What is the minimum standard deviation for r = 2?

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 16

Markowitz model

Example

The Lagrangian is

L =

1

2

(w

2

1

+w

2

2

+w

2

3

)(w

1

+2w

2

+3w

3

r)(w

1

+w

2

+w

3

1)

The equations for the ecient set are

w

1

= 0

w

2

2 = 0

w

3

3 = 0

w

1

+ 2w

2

+ 3w

3

= r

w

1

+w

2

+w

3

= 1

The solution is w = (

4

3

r

2

,

1

3

,

r

2

2

3

)

For r = 2 we get =

_

w

2

1

+w

2

2

+w

2

3

= 1/

3

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 17

Markowitz model

Solving the linear equations numerically (MATLAB)

% The problem is of the form A*X = B

% X = [w1 w2 w3 lambda mu];

% Expected return

rbar = 2;

% Defining A and B

A = [1 0 0 -1 -1; 0 1 0 -2 -1; 0 0 1 -3 -1; 1 2 3 0 0; 1 1 1 0 0];

B = [0;0;0;rbar;1];

% The solution

X = A\B; % solution to A*X = B

v = sum(X(1:3).^2); sigma = sqrt(v) % portfolio standard deviation

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 18

Markowitz model

Non-negativity constraints

If we prohibit short selling, the problem is quadratic:

minimize

1

2

n

i=1

n

j=1

w

i

w

j

ij

subject to

n

i=1

w

i

r

i

= r

n

i=1

w

i

= 1

w

i

0, i = 1, 2, . . . , n

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 19

Markowitz model

Consider the previous example with short selling constraints

In matrix formulation, the problem is

min

1

2

w

w s.t. A w = b, lb w

Here, w

= [w

1

, w

2

, w

3

] is the weight vector, is the 3 3

identity covariance matrix, lb

= [0, 0, 0] and A is the 2 3

constraint matrix

A =

_

_

1 2 3

1 1 1

_

_

Since the assets are uncorrelated, w

w = w

2

1

+w

2

2

+w

2

3

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 20

Markowitz model

Solving the problem numerically (MATLAB)

% Function to minimize

function [variance] = f(w,sigmaMatrix);

variance = .5*w*sigmaMatrix*w;

% We are solving a problem of the form

% min W*Sigma*W st : r*w = rbar and sum (w)=1 and w>=0

% Defining parameters

rbar = 2; % expected portfolio return

initialW = zeros(3,1); % initial weights

r = [1;2;3]; % asset return vector

sigmaMatrix = eye(3); % covariance matrix (3x3 identity matrix)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 21

% Defining the constraints

Aeq = [r;ones(1,3)]; % matrix of equality constraints

Beq = [rbar;1];

lb = zeros(3,1); % lower bound

% Optimization

[W,feval,exitflag]

=fmincon(@variance,initialW,[],[],

Aeq,Beq,lb,[],[],options,sigmaMatrix);

% Finding the value of sigma

y = sum(W(1:3).^2); sigma = sqrt(y)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 22

Input data

We require estimates of the expected return vector ( r

1

, . . . , r

n

)

and the return covariance matrix = (

ij

)

As shown above, the estimation of expected return is dicult

and leads to noisy estimates

With m the sample size, the sample covariance is

ij

=

1

m1

m

i=1

(r

i

r

i

)(r

j

r

j

)

The estimation error inuences the optimal portfolio allocation

Focus on minimum variance portfolios

Robust formulation of the mean-variance optimization

Factor models are often used in practice to reduce the

dimensionality of the estimation problem

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 23

Robust mean-variance optimization

In practice, the expected returns r

i

and the covariances

i,j

for

1 i, j n are estimated with error

Suppose there are sets S

r

R

n

and S

R

nn

such that

R = ( r

1

, . . . , r

n

)

S

R

and = (

i,j

) S

S

R

and S

are uncertainty sets containing all possible estimates

of the expected return vector and the return covariance matrix

S

R

is a neighborhood of the true estimate of the expected return

vector, and S

is a neighborhood of the true estimate of the

return covariance matrix (think of condence intervals)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 24

Robust mean-variance optimization

With estimation error, a portfolio w has worst case expected

return of r(w) = min

RS

R

n

i=1

w

i

r

i

and maximum variance of

V (w) = max

S

n

i,j=1

w

i

w

j

i,j

The robust minimum variance portfolio solves the problem

minimize V (w),

subject to r(w) r

n

i=1

w

i

= 1

w

i

0, i = 1, 2, . . . , n

Minimize maximum variance, generate return of at least r

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 25

Robust mean-variance optimization

Example

Consider the example from slide 15: A portfolio with 3

uncorrelated assets with expected returns 1, 2 and 3 and unit

variances

Suppose is estimated without error (S

= {})

Suppose the expected returns are estimated with error and lie in

the uncertainty sets (condence intervals)

S

r

1

= [1, 3], S

r

2

= [1, 3], S

r

3

= [2.5, 3.5]

We determine the robust portfolio weights for r = 2

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 26

Robust mean-variance optimization

Example

Since is estimated without error and the assets are uncorrelated

with unit variances, the maximal variance is V (w) = w

2

1

+w

2

2

+w

2

3

The uncertainty set for every expected return is given by a

condence interval. Because of this, the worst case expected return

r(w) has to be attained at a boundary of the uncertainty sets

The inequality r(w) r can be rewritten in terms of the

boundaries of the uncertainty sets S

r

1

, S

r

2

, and S

r

3

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 27

Robust mean-variance optimization

Example

The robust minimum variance optimization problem becomes

minimize w

2

1

+ w

2

2

+ w

2

3

,

subject to 3w

1

+ 3w

2

+ 3.5w

3

2

3w

1

+ 3w

2

+ 2.5w

3

2

3w

1

+ w

2

+ 3.5w

3

2

3w

1

+ w

2

+ 2.5w

3

2

w

1

+ 3w

2

+ 3.5w

3

2

w

1

+ 3w

2

+ 2.5w

3

2

w

1

+ w

2

+ 3.5w

3

2

w

1

+ w

2

+ 2.5w

3

2

w

1

+ w

2

+ w

3

= 1

w

i

0, i = 1, 2, . . . , n

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 28

Robust mean-variance optimization

Example

The robust optimal portfolio for r = 2 is w = (0,

1

3

,

2

3

); the

minimum standard deviation is = 0.75

The worst case expected return of this portfolio is 2, such that the

target r is attained in the worst case where the estimates of the

returns r

i

were completely erroneous

Compare to the solution without any uncertainty: w = (

1

3

,

1

3

,

1

3

)

and = 0.58

The robust optimization moves away from asset 1 with the highest

estimation risk, and allocates more weight to asset 3 which has a

more accurately estimated expected return

Because of a more restrictive portfolio selection, the standard

deviation of the robust portfolio is higher

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 29

Robust mean-variance optimization

Solving the problem numerically (MATLAB)

% Function to minimize

function [variance] = f(w);

variance = w*w;

% We are solving a problem of the form

% min W*Sigma*W st : r*w >= rbar and sum (w)=1 and w>=0

% Defining parameters

rbar = 2*ones(8,1); % expected portfolio return

initialW = zeros(3,1); % initial weights

r = [1;2;3]; % asset return vector

sigmaMatrix = eye(3); % covariance matrix (3x3 identity matrix)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 30

% Defining the constraints

A = [-3 -3 -3.5; -3 -3 -2.5; -3 -1 -3.5; % inequality

-3 -1 -2.5; 1 -3 -3.5; 1 -3 -2.5; 1 -1 -3.5; 1 -1 -2.5];

B = -[rbar];

Aeq = [1 1 1 ]; % equality

Beq = [1];

lb = zeros(3,1); % lower bound

% Optimization

[W,feval,exitflag]

=fmincon(@f,initialW,A,B,Aeq,Beq,lb,[]);

% Finding the value of sigma

y = sum(W(1:3).^2); sigma = sqrt(y)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 31

Markowitz model

Generalizations

Minimize VaR or AVaR given target expected return

No closed-form solutions anymore

Incorporate higher moments

Mean-variance-skewness optimization: maximize mean and

skewness and minimize variance, subject to the constraint

In general, maximize odd moments and minimize even

moments, subject to the constraint

Caveat: problem may not have a solution that satises all

optimizations simultaneously

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 32

Markowitz model

Polynomial Goal Program

With w the vector of weights, for risk preference parameters

, , 0 we solve

min

w

Z = (1 +d

1

(w))

+ (1 +d

2

(w))

+ (1 +d

3

(w))

such that d

k

(w) = (1)

k+1

(Z

k

Z

k

(w)), k = 1, 2, 3

where

Z

k

= max{(1)

k+1

Z

k

(w) :

i

w

i

= 1}

is the optimal kth moment under the capital constraint

Natural extension to higher moments

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 33

Two-fund theorem

Consider two solutions (w

1

,

1

,

1

) and (w

2

,

2

,

2

) to the

Markowitz problem

The portfolio formed by taking of the rst portfolio and 1

of the second portfolio is also a solution to the Markowitz problem

As varies over (, +), the portfolios gotten this way sweep

out the entire minimum variance set

It follows that 2 ecient portfolios (funds) can be established so

that any ecient portfolio can be duplicated (in terms of mean

and variance) as a combination of these two

In other words, investors seeking ecient portfolios need only

invest in combinations of these two funds

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 34

Two-fund theorem

Practical implications

Two mutual funds could provide ecient investment service for

everyonethere is no need to buy individual stocks separately

Note however, that this is based on a restrictive set of

assumptions:

Investors care only about mean and variance of returns

Everyone estimates the same mean vector and covariance

matrix

There is a xed investment horizon (buy and hold)

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 35

Including a risk-free asset

Suppose there is a risk-free asset available for investment

The risk-free return r

f

on this asset is constant

Positive weight corresponds to lending money at r

f

Negative weight corresponds to borrowing money at r

f

Consider a 2 asset portfolio with a invested in the risk-free asset

and 1 a invested in some risky asset

If a = 1 we get a point on the mean axis given by r

f

If a = 0 we get a point in the feasible set corresponding to the

risky asset

As a varies, the point representing the portfolio traces out a

straight line in the r- plane

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 36

Including a risk-free asset

Now consider portfolios consisting of some combination of n risky

assets (long only) and the risk-free asset (long or short)

For each asset/portfolio on the feasible region, we form

combinations with the risk-free asset

These combinations trace out an innite straight line

originating at the risk-free point and passing through the risky

asset/portfolio

Since there is a line for every feasible portfolio, all these lines form

a triangularly shaped feasible region when a risk-free asset is

available

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 37

One-fund theorem

With a risk-free asset, the ecient set consists of a single straight

line (the top of the triangular feasible region)

This line is tangent to the ecient set of the risky assets

Any portfolio on the line can be expressed as a combination of the

risk-free asset and the tangent portfolio F

Hence, there is a single fund F of risky assets such that any

ecient portfolio can be constructed as a combination of F and

the risk-free asset

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 38

Appendix

Perfect dependence in the general case

Suppose the random variables X and Y are continuous

Perfect positive dependence (comonotonicity) means that

Y = f(X) for f = F

1

Y

F

X

increasing

If X and Y are comonotone and F

X

= F

Y

then X = Y

Perfect negative dependence (countermonotonicity) means that

Y = f(X) for f = F

1

Y

(1 F

X

) decreasing

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 39

Appendix

Perfect dependence in the general case

Assume X and Y have nite and strictly positive variances

The set of all possible correlations Corr[X, Y ] is a closed interval

[

min

,

max

] and for the extremal correlations

min

0

max

The extremal correlation Corr[X, Y ] =

min

is attained if and only

if X and Y are countermonotonic; Corr[X, Y ] =

max

is attained

if and only if X and Y are comonotonic.

min

= 1 i X and Y are of the same type;

max

= 1 i X

and Y are of the same type

Recall that X and Y are of the same type if we can nd a > 0

and b R so that Y = aX +b, i.e. the variables are perfectly

linearly dependent

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 40

Appendix

Copula describes dependence structure

A copula is a joint distribution function with standard uniform

marginals

For any joint distribution function F with marginals F

i

there is an

associated copula C such that

F(x

1

, . . . , x

n

) = C(F

1

(x

1

), . . . , F

n

(x

n

))

where C is unique if each F

i

is continuous

In the continuous case, we can construct C from F via

C(u

1

, . . . , u

n

) = F

_

F

1

1

(u

1

), . . . , F

1

n

(u

n

)

_

C is invariant under strictly increasing transformations

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 41

Appendix

Two standard copulas

Gaussian copula

C

Ga

(u

1

, . . . , u

n

) =

n

(

1

(u

1

), . . . ,

1

(u

n

))

where

n

is the n-variate standard normal distribution function

with correlation matrix , and

1

is the inverse of the standard

normal distribution function

t-copula

C

t

,

(u

1

, . . . , u

n

) = t

n

,

(t

1

(u

1

), . . . , t

1

(u

n

))

where t

n

,

is the n-variate standard t-distribution function with

correlation matrix and degrees of freedom, and t

1

is the

inverse of the standard t-distribution function with degrees of

freedom

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 42

Appendix

Frechet bounds

As a joint distribution function, a copula satises

max(u +v 1, 0) C(u, v) min(u, v)

for all u and v in [0, 1]

Upper bound: comonotonicity

Lower bound: countermonotonicty

C(u, v) = uv if and only if the variables are independent

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 43

Appendix

Frechet copulas

0

0.2

0.4

0.6

0.8

1

0

0.2

0.4

0.6

0.8

1

0

0.25

0.5

0.75

1

0

0.2

0.4

0.6

0.8

0

0.2

0.4

0.6

0.8

1

0

0.2

0.4

0.6

0.8

1

0

0.25

0.5

0.75

1

0

0.2

0.4

0.6

0.8

Kay Giesecke

MS&E 242H: Mean-variance portfolio theory 44

Appendix

Measures of monotonic dependence

Spearmans rank correlation:

S(X

1

, X

2

) = Corr [F

1

(X

1

), F

2

(X

2

)]

= 12

_

1

0

_

1

0

_

C(u, v) uv

_

dudv [1, 1]

Scaled version of the volume enclosed by C and the

independence copula

Invariant under increasing transformations

S(X

1

, X

2

) = +1 i the variables are comonotonic

S(X

1

, X

2

) = 1 i the variables are countermonotonic

Kay Giesecke

Вам также может понравиться

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Log Pearson Type III CalculatorДокумент12 страницLog Pearson Type III CalculatorTogap Sinambela0% (1)

- Propensity Scores: A Practical Introduction Using RДокумент21 страницаPropensity Scores: A Practical Introduction Using RMunirul UlaОценок пока нет

- Ch2 SlidesДокумент80 страницCh2 SlidesYiLinLiОценок пока нет

- 3 Ggplot PDFДокумент19 страниц3 Ggplot PDFSaitama DekuОценок пока нет

- A TextbookДокумент460 страницA TextbookJose Antonio VillalobosОценок пока нет

- Abas 3 Chapter 5Документ62 страницыAbas 3 Chapter 5GF David SalasОценок пока нет

- STA301 Assignment 1 Solution 2022Документ4 страницыSTA301 Assignment 1 Solution 2022Fahad WaqarОценок пока нет

- Stat Paper For 2 YearДокумент3 страницыStat Paper For 2 Yearfazalulbasit9796100% (1)

- Pengaruh Disiplin Kerja Dan Pengalaman Kerja Terhadap Kinerja Pegawai Dinas Pendapatan Pengelolaan Keuangan Dan Aset Kabupaten Barito TimurДокумент12 страницPengaruh Disiplin Kerja Dan Pengalaman Kerja Terhadap Kinerja Pegawai Dinas Pendapatan Pengelolaan Keuangan Dan Aset Kabupaten Barito TimurVincentia AudriОценок пока нет

- Week 12Документ38 страницWeek 12Mate MetreveliОценок пока нет

- Test of Hypothesis in Statistics and ProbabilityДокумент7 страницTest of Hypothesis in Statistics and ProbabilityMaria Theresa Nartates-EguitaОценок пока нет

- Practice Problems FOR BiostatisticsДокумент37 страницPractice Problems FOR BiostatisticsVik SharОценок пока нет

- Full FactorialДокумент4 страницыFull FactorialMohd Hafizi Abdul RahmanОценок пока нет

- (BAFI 1045) T03 (Markowitz Portfolio)Документ46 страниц(BAFI 1045) T03 (Markowitz Portfolio)Red RingoОценок пока нет

- Short Quiz 1Документ3 страницыShort Quiz 1Alroby Margarete SaludagaОценок пока нет

- 6.3 (2) : and of Binomial Random Variables AP Statistics NameДокумент2 страницы6.3 (2) : and of Binomial Random Variables AP Statistics NameMcKenna ThomОценок пока нет

- Chapter 3 - Methodology Revised (Partial - Data Gathering)Документ7 страницChapter 3 - Methodology Revised (Partial - Data Gathering)Emmanuel Sida100% (4)

- RegressionResultsДокумент15 страницRegressionResultsJenni AHОценок пока нет

- ANOVA (Analysis of Variance)Документ5 страницANOVA (Analysis of Variance)Mary Jean EmpengОценок пока нет

- Multiple Choice Questions from Past ExamsДокумент31 страницаMultiple Choice Questions from Past Examsmasti funОценок пока нет

- Case Study 1Документ5 страницCase Study 1Nisha Lauren VishvanathОценок пока нет

- Sums For Practice in StatisticsДокумент5 страницSums For Practice in StatisticsRahul WaniОценок пока нет

- Central Limit TheoremДокумент38 страницCentral Limit TheoremNiraj Gupta100% (2)

- Syllabus STA220 - E02-USEK-Spring 2022-2023-202320-CRN 20566Документ3 страницыSyllabus STA220 - E02-USEK-Spring 2022-2023-202320-CRN 20566PamelaОценок пока нет

- Ashish+Gupta+Project+Report Advanced+Statistics 13 11 2022Документ21 страницаAshish+Gupta+Project+Report Advanced+Statistics 13 11 2022Ashish Gupta50% (2)

- Meam 601 Activity 4 Yamuta, Adonis Jeff E.Документ6 страницMeam 601 Activity 4 Yamuta, Adonis Jeff E.Jeff YamsОценок пока нет

- Where The Job Satisfaction of Bank Employees Lies: An Analysis of The Satisfaction Factors in Dhaka CityДокумент13 страницWhere The Job Satisfaction of Bank Employees Lies: An Analysis of The Satisfaction Factors in Dhaka CityOporadhBigganОценок пока нет

- Carver - The Case Against Statistical Significance TestingДокумент18 страницCarver - The Case Against Statistical Significance TestingmauberleyОценок пока нет

- Do Data Characteristics Change According To The Number of Scale Points Used ? An Experiment Using 5 Point, 7 Point and 10 Point Scales.Документ20 страницDo Data Characteristics Change According To The Number of Scale Points Used ? An Experiment Using 5 Point, 7 Point and 10 Point Scales.Angela GarciaОценок пока нет

- 2770 11284 1 PBДокумент12 страниц2770 11284 1 PBMuhammad Fauzan Zul AzmiОценок пока нет