Академический Документы

Профессиональный Документы

Культура Документы

Financial Services Overview

Загружено:

MAZtheSPAZИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Services Overview

Загружено:

MAZtheSPAZАвторское право:

Доступные форматы

Financial Services Overview

Overviews: Banking & Insurance

Financial Services is the occupation of managing monetary affairs. It is a very diverse industry with a wide array of job opportunities. The most widely known types of financial organizations include banks, insurance companies, personal credit institutions, accounting firms, brokerages, reporting companies, stock exchanges, hedge funds and private equity firms. Additionally, many organizations have internal financial divisions. Within these firms focuses include investments, lending, operations, internal finance, auditing, general management and administration. When hiring an entry level financial position, organizations will focus on core skills. While there may be some minor variations in these skills, most of them will be required by all financial institutions. These skills include: Adaptability Analytical Communication Decision Making Detail Oriented Initiative Interpersonal Judgment Leadership Organizational Research Results Oriented Sales Oriented Strategic Thinking Teamwork Quantitative

Cornell Career Services

Mergers and Acquisitions Advise an institution acquiring another company, or how to strategize against being acquired. Public Finance Assist public entities in raising money, portfolio management, project financing, restructuring debt and underwriting municipal securities. Sales/Trading Sell or buy financial products. Sales (Broker/Dealer) Present new offerings to institutional clients. Maintains a book of clients. Trading (Market Makers) Create positions in the market by purchasing and selling large amounts of securities. Research Provide analytical support to investment banking and sales & trading areas. The two main areas of research fall under fixed income and equities. Positions in investment banking include: Analyst Associate Block Trader Clerk Floor Broker Portfolio Manager Research Analyst Risk Analyst Sales Assistant Sales Trader Trading Assistant Underwriter

Top investment banks include: Bank of America Barclays BNP Paribas Citi Credit Suisse Deutsche Bank Goldman Sachs JP Morgan Morgan Stanley Nomura Holdings Societe Generale UBS

Banking

There are several different types of banks that one may choose to work for. These include Investment, Commercial, Savings & Loan, Credit Union and Federal Reserve. The following is an overview of investment and commercial banking. Investment Banking Investment banks are financial institutions that provide services predominately to institutional clients in the areas of raising capital/money, financial advice, sales and trading and research. The main areas of investment banking include: Corporate Finance Raise money to run and grow a business. Capital Markets Manages the interactions between corporate finance, S&T and research. Act as market advisors for the organizations deals.

Boutique investment firms include: Cowen Evercore GCA-Savvian Fox-Pitt, Kelton Jefferies Lazard Lincoln Intl Morgan Keegan Oppenheimer Perella Weinberg Piper Jaffray Sagent Advisors

Commercial Banking Commercial banks offer a wide variety of career opportunities, and hire more people than any of the other financial services sectors. Over the last decade commercial banks have been able to expand their services to include not only lending and retail, but investment services as well. Many commercial banks provide services to businesses, government entities and consumers including lending (personal, small business, middle market, corporate, and mortgage), credit underwriting, product management, private client wealth, brokerage, asset management, fixed

income, financial advising, trust, card services, custody, cash management, ADRs, mutual funds, management support (accounting, auditing/compliance, operations and finance), foreign exchange, securities operations, etc.

11/02/10

career.cornell.edu

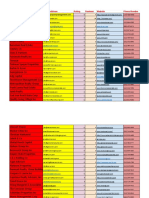

University 103 and 203 Barnes Agriculture & Life Sciences 140 Roberts Architecture, Art, & Planning 240 E. Sibley Arts & Sciences G55 Goldwin Smith Engineering 201 Carpenter Graduate School 350a Caldwell

Hotel 180 Statler Human Ecology 172 MVR ILR 201 Ives

Positions in commercial banking include: Accountant Account Manager Auditor Branch Manager Business Analyst Compliance Officer Credit Analyst Custody Officer Financial Analyst Loan Officer Loan Review Analyst Mortgage Banker Personal Banker Private Banker Trust Officer

Insurance

The purpose of an insurance company is to create policies that transfer risks from the customer to the company. The 3 major categories of insurance are Property and Casualty (cars, business, home), Life, and Health. Insurance organizations range from small local offices to large, multi-service brokerages. Insurance is one of the largest industries in the US and plays a significant role in the US economy. Insurance has gotten a bad reputation over the years and is seen as a boring industry or simply sales positions. This is very far from the truth. Insurance is a fast growing industry, particularly in the areas of malpractice, antiterrorism and heath insurance. Positions in the insurance field include: Account Representative Actuary Agent/Broker Benefits Analyst Claims Adjuster Claims Examiner Claims Rep. Fraud Investigator Loss Control Specialist Policy Rater Risk Analyst Risk Manager Sales Rep. Underwriter

Top commercial banking companies include: Bank of NY Mellon BB&T CIBC Citi Fifth Third HSBC North Fork JPMorganChase M&T PNC Financial State Street SunTrust Banks Wells Fargo/Wachovia Capital One Comerica Lasalle KeyCorp Regions Financial US Bank National

Banking Alternatives

There are numerous alternatives for students who are seeking jobs in finance outside of the traditional banking position. Some of these include: Working in a financial position within an organization (e.g., accounting, cost analysis, auditing/compliance, financial analyst, investor relations, credit analyst, operations, etc.). Working as a paralegal or analyst in a law firm who focuses on securities or public finance. Working for a stock exchange or financial reporting company. Working for an investment office at a University. Working for a government or nonprofit firm. For example, working in a financial and/or economic development focused firm such as the Federal Reserve Bank, The World Bank, FINRA, SIPC-Securities Investor Protection Corp., Nonprofit Financial Center, The Financial Services Forum, State Teachers Retirement System, etc. The government has a number of different finance focused positions including: Accountant Auditor Budget & Finance Analyst Economist Financial Analyst Housing Financial Analyst Investment Manager Management & Budget Analyst Policy & Financial Analyst Public Affairs Specialist Rate & Reserve Analyst Resource Analyst

Top Insurance companies/brokerages include: Aetna AON Cigna ING Lincoln Financial Lloyds of London MassMutual Marsh. Inc. MetLife NYLife Prudential Travelers

Job Search and Research Sources

To assist with research in the financial services industry you can use the following: Websites: Research: Careers-in-finance.com TheStreet.com Americanbanker.com Actuary.com Wetfeet.com* Thevault.com* Hoovers.com Finance.yahoo.com dealbook.blogs.nytimes.com Investopedia.com

(*download Vault and Wetfeet guides for free at career.cornell.edu/library/)

Job Search: Monster.com Hotjobs.com Indeed.com Flipdog.com Bankjobs.com Financialjobs.com Bankstaffers.com Studentjobs.gov USAjobs.gov Quantfinancejobs.com Jobs.phds.org Idealist.org Opportunityknocks.org Books: Some of the many finance related books in the career libraries include: Careers in Focus: Financial Services Careers in Finance Career Opportunities in Banking, Finance & Insurance Guide to Understanding Investing & Money Heard on the Street: Quantitative Questions from Wall Street Job Interviews Investment Banking Explained Newspapers/Magazines: Wall Street Journal Financial Times Business Week Fortune Money Forbes Kiplingers Barrons Entrepreneur

Students can find listings for these types of jobs on web sites such as Studentjobs.gov, USAjobs.gov, governmentjobs.com or WorkforAmerica.com.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Annual Report 2006 enДокумент154 страницыAnnual Report 2006 eniamdennismiracleОценок пока нет

- Untitled Spreadsheet - Sheet1Документ5 страницUntitled Spreadsheet - Sheet1Scientist 235Оценок пока нет

- Activity 4Документ13 страницActivity 4Lala FordОценок пока нет

- BTON - Annual Report 2016Документ114 страницBTON - Annual Report 2016Wind 980Оценок пока нет

- 20191221203424BN001501223Документ2 страницы20191221203424BN001501223Alverdo RicardoОценок пока нет

- Denway Motors AnRep 2005Документ96 страницDenway Motors AnRep 2005rafa avisenaОценок пока нет

- Sarbanes Oxley Vs PH LegislationsДокумент5 страницSarbanes Oxley Vs PH LegislationsJОценок пока нет

- List of Scsbs and Their Branches - 150720151824Документ649 страницList of Scsbs and Their Branches - 150720151824Munish SharmaОценок пока нет

- Advanced Accounting: Stock Investments - Investor Accounting and ReportingДокумент40 страницAdvanced Accounting: Stock Investments - Investor Accounting and Reporting19-Geby Agnes LG100% (2)

- PE in China EY May2011Документ20 страницPE in China EY May2011pareshsharmaОценок пока нет

- RAJ VARDHAN AGARWAL (BBA - LLB (H) ) MERGERS AND ACQUISITIONS INTERNAL EXAM 8TH SEMESTERДокумент3 страницыRAJ VARDHAN AGARWAL (BBA - LLB (H) ) MERGERS AND ACQUISITIONS INTERNAL EXAM 8TH SEMESTERraj vardhan agarwalОценок пока нет

- Avolta Partners VC France 2021Документ33 страницыAvolta Partners VC France 2021jackОценок пока нет

- Company Law PDFДокумент81 страницаCompany Law PDFYounis Khan50% (2)

- CEO Agenda - Tips, Actions and Insights For CEOs - EY - GlobalДокумент9 страницCEO Agenda - Tips, Actions and Insights For CEOs - EY - GlobalLesley Lonely ShiriОценок пока нет

- Claw Assignment NewestДокумент6 страницClaw Assignment NewestclaraОценок пока нет

- Wal Mart Stores Inc Walmart Is The Largest Retailing Firm in TheДокумент1 страницаWal Mart Stores Inc Walmart Is The Largest Retailing Firm in TheAmit PandeyОценок пока нет

- Case - Amazon in Emerging MarketsДокумент36 страницCase - Amazon in Emerging MarketsInfotainment PlanetОценок пока нет

- Septiembre 2017 PDFДокумент383 страницыSeptiembre 2017 PDFmmoreno_184442Оценок пока нет

- Business Studies Project - BHARAT BHARATДокумент11 страницBusiness Studies Project - BHARAT BHARATabarajitha sureshkumarОценок пока нет

- Application For Group Personal Accident InsuranceДокумент2 страницыApplication For Group Personal Accident InsuranceJobert HidalgoОценок пока нет

- Company Law SummaryДокумент48 страницCompany Law SummaryKaustubh BasuОценок пока нет

- Divestitures and Spin OffsДокумент14 страницDivestitures and Spin Offsaridaman raghuvanshiОценок пока нет

- Commerce Week QuotesДокумент4 страницыCommerce Week QuoteszakafuОценок пока нет

- Section 47aДокумент16 страницSection 47aDrishti PriyaОценок пока нет

- Advantages and Disadvantages of IncorporationДокумент5 страницAdvantages and Disadvantages of IncorporationSarahОценок пока нет

- Investment in Equity SecuritiesДокумент3 страницыInvestment in Equity SecuritiesNicole Galnayon100% (1)

- Internship Law FirmsДокумент7 страницInternship Law Firmszuhaib habibОценок пока нет

- Dividend Policy MCQДокумент3 страницыDividend Policy MCQYasser Maamoun100% (4)

- Hindalco Novelis FINALДокумент18 страницHindalco Novelis FINALanushriОценок пока нет

- Merger and AquiseationДокумент13 страницMerger and AquiseationBabasab Patil (Karrisatte)100% (1)