Академический Документы

Профессиональный Документы

Культура Документы

Lyxor Dow Jones

Загружено:

M Jawdat AudehИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lyxor Dow Jones

Загружено:

M Jawdat AudehАвторское право:

Доступные форматы

Lyxor ETF Dow Jones IA

The best way to reflect USA Exchange Traded Fund Lyxor ETF Dow Jones IA

Lyxor ETF Dow Jones IA is a French Mutual Fund (FCP), UCITS compliant, listed and tradable on Stock Exchanges. It reflects the evolution of the Dow Jones Industrial Average

31-Jan-09 ETF Data

Index Legal Form First Listing

Source: Lyxor AM

Dow Jones Industrial Average French Mutual Fund UCITS I & III compliant May 17, 2001 EUR 1 unit (1/100 of the index) 0.50% Yes Yes Annual 1.50 EUR (10.09.2008) 62.8 EUR 403.52 Mio. EUR 99.99941 % 0.754901 %

Risk factor (extraction from the prospectus)

EUR / USD exchange risk since the Mutual Funds value is calculated in EUR and the index replicated by the Mutual Fund is calculated in USD.

Currency Minimum Investment Management fees PEA SRD Dividends

Exchange Traded Funds (ETFs)

ETFs are index-linked funds tradable in real time during European market hours as easily as any ordinary shares. Their objective is simple: to replicate as perfectly as possible the performance of an index or of a selection of stocks.These products are easily accessible and flexible.Their numerous strategic applications make them the perfect tool for all types of investors.

Last dividend NAV Asset Under Management correlation Tracking Error

ISIN

FR0007056841 Reuters Bloomberg VLDJE DJE FP DJAM GY DJAM GR DJE SW DJE IM DJE AV

Lyxor Asset Management

iNav

.VLDJE DJE.PA DJE.DE DJE.SG DJE.S DJE.MI (ISIN).VI

A wholly owned subsidiary of Socit Generale, Lyxor AM, management company belonging to the Corporate Investment Banking arm of the group and is specialized on 3 businesses: Alternative Investment, Structured Funds, Index Tracking. The company is one of the top players of the European ETF industry with more than EUR 25 billion under management. Lyxor ETFs are listed on 10 Worldwide Stock Exchanges and reflect Money-, Equity-, Bond- and Commodity-markets.

Euronext Paris

Deutsche Brse Euwax SWX Borsa Italiana Wiener Brse

Index Evolution

14'000

Dow Jones IA

Source: Bloomberg, 31.01.2009

Index Data

13'000 12'000 11'000 10'000 9'000 8'000 7'000

Yearly Performances 2009 YTD 2008 2007 2006 2005 Rolling Performances 1 year 3 years 5 years

-8.84% -33.84% 6.43% 16.29% -0.61%

Exposure Assets Number of components Currency Bloomberg Reuters

United States Equity Market 30 USD INDU .DJI

-36.75% -26.36% -23.71%

Jan-04

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Allocation

Sectors Industrial Goods & Services Technology Oil & Gas Healthcare Food & Beverage Retail Travel & Leisure Personal & Household Goods Telecommunications Banks Chemicals Media Financial Services Basic Resources Automobiles & Parts 18.41% 15.60% 14.82% 9.99% 7.02% 6.83% 5.69% 5.45% 5.40% 3.66% 2.29% 2.07% 1.65% 0.79% 0.31%

Source: Bloomberg, 31.12.2008

Top holdings

Intl Business Machines Exxon Mobil Chevron Johnson & Johnson Mcdonald'S Procter & Gamble 3M United Technologies Wal-Mart Coca-Cola Boeing Hewlett-Packard Caterpillar Verizon Communications Merck & Co Kraft Foods Inc-Class A Jpmorgan Chase Kraft Foods Inc Du Pont (E.I.) De Nemours Home Depot

(Technolog) (Oil & Gas) (Oil & Gas) (Healthcare) (Trav Leis) (Pers Hous) (Ind Goods) (Ind Goods) (Retail) (Food Bev) (Ind Goods) (Technolog) (Ind Goods) (Telecom) (Healthcare) (Food Bev) (Banks) (Telecom) (Chemicals) (Retail)

Source: Bloomberg, 31.12.2008

9.12% 7.74% 7.08% 5.71% 5.69% 5.45% 5.37% 4.72% 4.70% 4.25% 4.12% 3.48% 2.99% 2.96% 2.81% 2.77% 2.62% 2.44% 2.29% 2.13%

Internet

www.lyxoretf.ch

info@lyxoretf.ch

Tel +41 (0)58 272 33 44

Equity Country & Zone Page 1/2

Lyxor ETF Dow Jones IA

The best way to reflect USA

31.01.2009

Disclaimer: The information in this document is illustrative and provided for informational purposes only. It is based on market data at a given moment and is subject to market variations. Past performance is not a guarantee of future returns. No fiduciary responsibility or liability shall be assumed for any material or typographical error, which may appear in this document. This document can not be copied, reproduced or distributed, entirely or partly, without Lyxor AM agreement. This MF was approved by the Autorit des Marchs Financiers (French Financial Markets Authority) on 15 mars 2001 under the number FCP20010203. Investors with any doubts as regards the suitability of an investment in these products should consult their usual financial advisers before purchasing any units. Source Bloomberg & Lyxor AM. Past performance is no guarantee for future performance. The fund is authorized for the offer and distribution in Switzerland or from Switzerland pursuant to article 120 of the Swiss Federal Act on Collective Investment Schemes dated June 23, 2006. The Federal Banking Commission has authorized Socit Gnrale, Zurich Branch, to act as Swiss Representative and Paying Agent of the Funds in Switzerland. The prospectuses, annual and semi-annual reports as well as the articles of association of the Funds and the list of sales and purchases undertaken for the funds can be obtained for free from the Swiss Representative (Socit Gnrale, Zurich Branch, Talacker 50, Zurich) or can be downloaded from the website www.lyxoretf.ch. LYXOR ETF DOW JONES INDUSTRIAL AVERAGE in no way benefits from the sponsorship, support or promotion, and is not sold by Dow Jones. Dow Jones grants no guarantee and undertakes no commitment, whether explicitly or implicitly, relative to the results to be obtained through the use of the Dow Jones Industrial Average index (hereinafter the "Index") and/or relative to the level at which the said Index may be at any given moment or day, or of any other type. The index is calculated by or in the name of Dow Jones. Dow Jones will not be liable (whether on the basis of negligence or any other basis) for any error affecting the Index with regard to any party, and it will have no obligation to inform anyone of any possible error affecting the index. The complete prospectus for this MF is downlodable on lyxoretf.com.

Internet

www.lyxoretf.ch

info@lyxoretf.ch

Tel +41 (0)58 272 33 44

Equity Country & Zone Page 2/2

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Bank Routing Numbers - NYДокумент12 страницBank Routing Numbers - NYAli Rasouli0% (1)

- Top 50 Wealth Management Family OfficesДокумент1 страницаTop 50 Wealth Management Family Officesabelardbonaventura100% (1)

- Bins 3Документ18 страницBins 3raimari bracho0% (1)

- IFSC CODE of BankДокумент1 890 страницIFSC CODE of Banksujesh100% (1)

- KPERS PE DataДокумент3 страницыKPERS PE DatadavidtollОценок пока нет

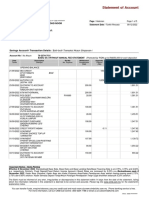

- Statement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, SelangorДокумент5 страницStatement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, Selangorputri nurishaОценок пока нет

- Acct Statement XX0012 25052023Документ5 страницAcct Statement XX0012 25052023JunoonОценок пока нет

- GMAT Review Part3Документ18 страницGMAT Review Part3M Jawdat AudehОценок пока нет

- Gmat For SvuДокумент18 страницGmat For SvuMohammad Hanefa0% (1)

- GMAT Review Part2.ppsxДокумент21 страницаGMAT Review Part2.ppsxM Jawdat AudehОценок пока нет

- GMAT Review Part2.ppsxДокумент21 страницаGMAT Review Part2.ppsxM Jawdat AudehОценок пока нет

- Lyxor Non EnergyДокумент2 страницыLyxor Non EnergyM Jawdat AudehОценок пока нет

- GMAT Review Part1Документ29 страницGMAT Review Part1M Jawdat AudehОценок пока нет

- LyxorДокумент2 страницыLyxorM Jawdat AudehОценок пока нет

- Lyxor CommoditiesДокумент2 страницыLyxor CommoditiesM Jawdat AudehОценок пока нет

- EI and Social WorkДокумент19 страницEI and Social WorkM Jawdat AudehОценок пока нет

- Bangladesh Steel Bank CodeДокумент16 страницBangladesh Steel Bank CodeshovaghoОценок пока нет

- CS Global Money Notes 2Документ26 страницCS Global Money Notes 2rockstarliveОценок пока нет

- HW1Документ4 страницыHW1Annie JuliaОценок пока нет

- Ifcb2009 45Документ45 страницIfcb2009 45Jai JpОценок пока нет

- Histori TransaksiДокумент1 страницаHistori TransaksiChicy IntanОценок пока нет

- List of Finance Companies of IndiaДокумент2 страницыList of Finance Companies of IndiaSurinder TanwarОценок пока нет

- FiboДокумент49 страницFiboCerio DuroОценок пока нет

- Scrip Code Scrip NameДокумент5 страницScrip Code Scrip NamenitmemberОценок пока нет

- Aviva (HTD) - Candidate Tracker InterestedДокумент6 страницAviva (HTD) - Candidate Tracker InterestedYugant RajОценок пока нет

- Ghana Financial InstitutionsДокумент2 страницыGhana Financial InstitutionsKristineCostanzaОценок пока нет

- 60Документ3 страницы60Rebuild BoholОценок пока нет

- CORPORATE GOVERNANCE CASE STUDY: American Express Boardroom BattleДокумент11 страницCORPORATE GOVERNANCE CASE STUDY: American Express Boardroom BattleShikha Varshney0% (1)

- List of POPs for NPS with Reg No, Name and AddressДокумент8 страницList of POPs for NPS with Reg No, Name and Address98675Оценок пока нет

- IPO ScheduleДокумент3 страницыIPO Scheduleashish.in.iitr6614Оценок пока нет

- Bandhan BankДокумент3 страницыBandhan Bankmanjunathganguly771275Оценок пока нет

- October 16, 2023 Philippine Stock ExchangeДокумент5 страницOctober 16, 2023 Philippine Stock ExchangePaul De CastroОценок пока нет

- Lamp IranДокумент53 страницыLamp IranMushanokoji ShienОценок пока нет

- HDFC SIP Debit AlertДокумент3 страницыHDFC SIP Debit AlertManoj KumarОценок пока нет

- Statement of AccountДокумент34 страницыStatement of AccountMVN HodalОценок пока нет

- The Following Is A List of Banks in IndiaДокумент9 страницThe Following Is A List of Banks in IndiaSubash SundarОценок пока нет

- History of Banking Indian Banks Taglines Headpersons Headquarters Final 1 96Документ9 страницHistory of Banking Indian Banks Taglines Headpersons Headquarters Final 1 96sonam1991Оценок пока нет

- Lmpiran 1Документ3 страницыLmpiran 1YondrichsОценок пока нет

- PT. Manis Logistik Buku Besar Periode 1 Juli 2023 S/D 31 Juli 2023 Nomor Nama AkunДокумент8 страницPT. Manis Logistik Buku Besar Periode 1 Juli 2023 S/D 31 Juli 2023 Nomor Nama AkunJamil AvishaОценок пока нет