Академический Документы

Профессиональный Документы

Культура Документы

Ipo

Загружено:

keval_kanakharaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ipo

Загружено:

keval_kanakharaАвторское право:

Доступные форматы

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

PRICING MECHANISM AND EXPLAINING UNDERPRICING OF IPOS: EVIDENCE FROM BOMBAY STOCK EXCHANGE, INDIA

Rohit Bansal* Dr.Ashu Khanna**

ABSTRACT

Introduction: In 1999, investment banks were allowed to use a version of book building as a mechanism for bringing IPOs to the Indian capital market. Book building refers to the process of generating, capturing, and recording investor demand for shares during an IPO in order to support efficient price discovery. A second method, in which the company itself fixes the price, is known as the fixed-price method. The literature on IPO underpricing is extensive. However, few studies examine the effect of book building on underpricing. Comparing book built with fixed price IPOs, they found that underpricing is more in book built issues in all countries. Recent researches on IPOs have focused on difference in pricing mechanism across countries. Objectives: The paper attempts to analyze that whatever there is any significant difference in the magnitude of level of underpricing of ipos that priced through book build with those that are priced through the fixed price option. Research Methodology: A total of 619 IPOs were listed in Indian capital market from 20002011. At Bombay stock exchange a total of 550 IPOs were listed from 2000-2011. The sample for the study consists of these 550 IPOs, IPOs were priced through book built & Fixed price option. Out of 550 IPOs 405 (73.13%) through Book build and 145 (26.87) were issued through fixed price option. In the study offer price and 1st day closing price is used to calculate underpricing. And Mean is used to magnitude the level of underpricing. Findings: As far as magnitude of underpricing is concerned, the book-build and fixed price option gave different results. We found significant difference in level of magnitude of underpricing in IPOs that priced through book build with those that are priced through the fixed price option. Key words: IPO Underpricing, Overpricing, Book Build Process, Fixed Price Option.

*Research scholar, Indian Institute of Technology, Roorkee, Uttrakhand **Assistant Professor, Indian Institute of Technology, Roorkee, Uttrakhand

International Journal of Research in Finance & Marketing http://www.mairec.org

205

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

1 INTRODUCTION

The decision to go public, or make an initial public offering (IPO) of equity, represents an important landmark in a firms life cycle. There are several reasons for a company to go public. First, the business is able to raise capital at a lower cost. The money raised can be use to finance investments for future growth of the company or acquiring additional business. Second, reason for a company to go public is that selling shares on the stock market offers more liquidity to the existing shareholders. The shareholders of a private firm often have a large share of their wealth invested in the company. By turning to the stock market, the entrepreneur and existing shareholders have the opportunity to turn their investment into cash and diversify their investments. Third reason is that an IPO brings the firm into the spotlight of other companies and increases the chance of potential mergers and acquisitions. A well-functioning IPO market provides exit options for stakeholders in young firms, access to low cost capital for growing firms, and greater access to capital for future expansion of large firms. Flow of capital to firms can stimulate growth in an economy. Thus, regulators are interested in mechanisms that facilitate better functioning IPO markets. India has a relatively mature capital market, with a long history of uninterrupted operations even across the World Wars. Historically, the only alternative of pricing mechanism available for a firm contemplating a public issue was to make a fixed price offering. The firm going public would set a price and open the issue for subscription. Allocations were made on a strictly proportionate basis. The process of IPO deregulation took a major step forward in 1999 when pricing flexibility was coupled with discretion in allocation. After 1999, issuers could still opt for conventional fixed price offerings in which investment banks allocated shares on a prorata basis. Alternatively, they could choose a version of book building, in which a quota of shares, usually 50% of an offering, was set aside for discretionary allocation to QIBs, i.e., qualified institutional buyers. We have collected a sample of IPOs brought to the Indian market after book building was permitted from the Capitaline database. Book building was permitting from 2000. Our sample is comprehensive, as it includes virtually every IPO brought to the market between 2000 and 2011. We have also supplemented these data with information provided by the Prowess database maintained by the Center for Monitoring the Indian Economy. The research is based on an empirical study. A total of 619 IPOs were listed in Indian capital market from 2000-2011. At International Journal of Research in Finance & Marketing http://www.mairec.org

206

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

Bombay stock exchange a total of 550 IPOs were listed from 2000-2011. The sample for the study consists of all the IPOs that were listed on BSE since 2000-2011 that is 550 IPOs. Out of 550 IPOs 405IPOs were priced through book built and 145 IPOs were priced through fixed price. To estimate underpricing, we took information on the stock prices of issues of their opening day of trading. These price data are obtained from the Capitaline database. In this study offer price and 1st day closing price is used to calculate underpricing & overpricing. The rest of the paper is organized as follows. Section 2 describes the set up and dynamics of book build process in India. Section 3 overviews the related IPO literature. Section 4 related with hypothesis Section 5 describes the data. Sections 6 and 7 discuss the empirical results. Section 8 concludes.

2: BOOK BUILDING IN INDIA

2.1: The institutional setup Until the early 1990s the Indian primary issue market was regulated by the Controller of Capital Issues (CCI), a government regulator, who also determined the price at which IPO firms offered their shares to the market. In 1992 the Capital Issues (Control) Act was abolished bringing an end to the control on pricing of new issues and the Securities and Exchange Board of India (SEBI) took over as the new market regulator. Even though SEBI introduced book building guidelines for primary markets as early as 1995, almost no book building activity was seen in the Indian IPO markets till the year 1999-2000. It is for this reason that Ljungqvist et al. (2003) excluded the Indian capital markets when conducting a cross country analysis of IPO book building activity. 2.2: The dynamics of the book building process in India According to the Indian regulatory setup, investors are divided into three categories and the allocation tranches of these categories are pre-defined. Institutional investors (known as Qualified Institutional Buyers or QIBs) are to be allocated no more than 50% of the offered shares. Non-institutional investors (NIIs), defined as individuals investing more than INR 100,000 in the issue are allocated 15% of the offered shares and retail investors, who invest upto a maximum of INR 100,000 have to be allocated no less than 35% of the offered shares.

International Journal of Research in Finance & Marketing http://www.mairec.org

207

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

The paper attempts to analyze that whether there is any significant difference in the level of in underpricing & overpricing of ipos that priced through book build with those that are priced through the fixed price option.

3: RELATED LITERATURE

Literature on IPO underpricing is extensive. However, few studies examine the, effect of book building on underpricing. Our study focuses on India, on domestic issues within this marketplace. Our study is also centered on a period when book building was introduced into the marketplace, and is therefore relatively free of the weight of un-observed fixed effects due to institutional history. One advantage of our analysis is that the fixed price and book building mechanisms in India have a sharply identified difference that of discretion in Pricing under book building. 1) B, Einar., et.al., (2010). Analyze the eect of public information on (i) the incentives of

rational investors to reveal private information to the underwriter during the book-building process, and (ii) their demand for allocations in the IPO. Their model generates several new predictions. First, investors require more underpricing to reveal positive private information in down markets than in up markets (the incentive eect). Second, the demand for shares and the proportion underpriced IPOs are increasing in market returns (the demand eect). Combined, these two counteracting eects can explain why IPO underpricing is positively related to preissue market returns, consistent with extant evidence. Using a sample of 5,000 U.S. IPOs from 1981-2008, they show that the empirical inferences of the model are borne out in the data. Their results are relevant for IPOs in Europe, where book building is the dominant sales process. 2) Chahine, S17., (2007). Investigates the relationship between underpricing and investor

interest level prior to and after the IPO date. Empirical results show that, except for some bookbuilt issues with a high level of underpricing, the book-building procedure is a better selling mechanism than the auction-like mechanism. Despite a high initial underpricing for some bookbuilt issues, the book-building procedure allows for more effective pricing and a lower divergence of opinion among investors in the aftermarket than the auction-like procedure. 3) I, Aminul, A, Zamri32., (2010). IPO underpricing, IPO long run underperformances;

This study analyzes the levels of underpricing in initial public offerings (IPOs) and its determinants of Dhaka Stock Exchange (DSE). Key trends in the levels of underpricing and International Journal of Research in Finance & Marketing http://www.mairec.org

208

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

overpricing are highlighted out on a year to year and industry to industry basis. Out of the 117 companies that were listed in the years 1995 to 2005, 102 (87.18%) IPOs were found to be underpriced, 13 (11.11%) overpriced while only 2 were accurately priced. The overall level of overpricing was 15.37% with a standard deviation of 18.89. 4) Kumar, A.,N34 et. al., (2008). Implied that the purpose of this paper is to investigate

empirically the difference in long run post issue performance of initial public offerings (IPOs) that tapped the Indian primary market through a fixed price offer and book-building offer. The results suggested that there is no difference in the direction of performance of the issues post listing in the short run, however in the long run the issues that tapped the market through the book building route seemed to perform far better than the ones that raised money through a fixed price offer. 5) S, Richard. & M, P, Luiz50. (2006). Examine the underpricing of twenty-seven

Brazilian IPOs from January 1999 to March 2006. The average underpricing is 6.0% while the accumulated adjusted one-year return is -17.2%. The underpricing is negatively correlated to the companys assets and positively related to issue size, while the accumulated adjusted one-year return is positively related to the companys assets, venture-backed and voting common share issuance. However, when they examine the period starting in 2004, the underpricing is 10.4% while accumulated adjusted one-year return is 12.7%.

4: OBJECTIVES OF THE STUDY

To determine the magnitude of ipos underpricing and overpricing of ipos that price through book building and fixed price option.

5: HYPOTHESIS TESTING:

H1: There is no significant difference in the level of magnitude in underpricing & overpricing that is priced through book-build with those that are priced through fixed price option.

6: DATA COLLECTION

We collected data on share prices of IPOs quoted in Bombay stock exchange (Sensex). A total of 619 IPOs were listed in Indian capital market from 2000-2011. At Bombay stock exchange a total of 550 IPOs were listed from 2000-2011. The sample for the study consists of these 550. IPOs out of the 550 IPOs, 405IPOs were priced through book built and 145 IPOs were priced through fixed price.(Table no-1). International Journal of Research in Finance & Marketing http://www.mairec.org

209

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

Further, secondary data used for this study. Necessary data collected mainly from Stock exchange sites, Capitaline Database, Annual reports, websites of the companies and various published reports. Sample of Initial public offer at Bombay stock exchange from 2000-2011

Total Year 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Total 118 16 5 14 28 70 90 106 38 21 73 40 619 Bse issue 67 10 5 11 25 67 89 105 38 21 73 39 550 11 2 1 4 17 48 68 91 33 21 71 38 405 56 8 4 7 8 19 21 14 5 0 2 1 145 BB FPO BBUnder 6 0 0 3 9 26 36 58 16 14 47 19 234 BBOver 5 2 1 1 8 21 32 32 17 7 24 19 169 FpoUnder 30 2 4 5 6 14 14 7 2 0 2 0 86 Fpoover 26 6 0 2 2 5 7 7 3 0 0 1 59

Table no 1: Ipos at Bombay stock exchange (2000-2011), source: www.bseindia.com

6:1. Data analysis The methodology consists of the following step: To measure and analyze: a. Underpricing as difference between offer price and listing day closing price. Underpricing = P1-P0/P0*100 Or Underpricing = ln(P1/P0)

b. To determine magnitude . We calculated mean or average percentage of underpricing and overpricing of IPOs that were priced through was book build and fixed price option. We also found mean, STD dev, median, min and max to determine the magnitude of pricing mechanism. (see table no-3) 1. The collected data analyzed using different statistical tools i.e. mean, median, standard deviation with the help of SPSS 18.0, Minitab 15.0 & Origin 6.0. (see table no-2). International Journal of Research in Finance & Marketing http://www.mairec.org

210

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

Descriptes Statistics: Offer price, first day, list price, high price and low price S.no Variable N Mean SE Mean 1 offer price 2 3 4 5 6 7 first day Size list price high low first day 550 550 165.8 413.9 9.23 57.4 9.55 9.99 8.37 9.23 216.4 1346.6 223.91 1.61 0.7 7 1709.4 15475.1 1655 1806.6 1651.1 1709.4 93.7 81.1 109.5 105.63 79.4 93.7 25*6 75*9 225*6 30*5 26.65*3 550 160.99 7.87 184.68 10 1310 100 StDev Min Max Median Mode

550 188.78 550 186.29 550 146.65 550 165.8

234.23 1.61 196.22 1.61 216.4 1.61

Table no 2: Descriptes Statistics: Offer price, first day, list price, high price and low price Magnitude of price mechanism for level of underpricing and overpricing

Year Bse issue 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Total 67 10 5 11 25 67 89 105 38 21 73 39 550 11 2 1 4 17 48 68 91 33 21 71 38 405 56 8 4 7 8 19 21 14 5 0 2 1 145 BB FPO BBUnder 6 0 0 3 9 26 36 58 16 14 47 19 234 BBOver 5 2 1 1 8 21 32 32 17 7 24 19 169 FpoUnder 30 2 4 5 6 14 14 7 2 0 2 0 86 Fpoover 26 6 0 2 2 5 7 7 3 0 0 1 59 % bbu 21.96 0.00 0.00 90.16 54.43 31.47 36.75 51.54 36.45 19.09 22.35 47.36 34.29 -46.87 -62.00 -50.93 -87.41 -45.45 -51.75 -46.33 -21.42 -26.36 -14.52 -12.85 -33.32 -41.6 191.32 47.50 16.07 97.86 74.10 60.37 38.91 113.67 18.06 0.00 60.77 0.00 59.88 -32.3 -52.0 0.0 -85.3 -56.0 -63.8 -25.0 -3.3 -32.3 0.0 0.0 -70.4 -35 %BBO %fpou %fpoo

Table no-3 Magnitude for book build & fixed price option

International Journal of Research in Finance & Marketing http://www.mairec.org

211

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

7: RESULTS & DISCUSSION

As far as proportion of underpricing and overpricing is concerned, the book-build and fixed price option gave similar results. We found there were no significant differences in the level of proportion of underpricing & overpricing of IPOs that priced through book build with those that are priced through the fixed price option. This result is not in agreement with the earlier researchers such as, Chahine, S17., (2007). Investigates the relationship between underpricing and investor interest level prior to IPO date. Empirical results show that, book-built issues with a high level of underpricing, the book-building procedure is a better selling mechanism than the auction-like mechanism. Despite a high initial underpricing for some book-built issues, the book-building procedure allows for more effective pricing. Kumar, A.,N34 et. al., (2008). Implied that the purpose of this paper is to investigate empirically the difference in long run post issue performance of initial public offerings (IPOs) that tapped the Indian primary market through a fixed price offer and book-building offer. The results suggested that there is no difference in the direction of underpricing in IPOs that were issued through the book building and fixed price option. Book building route seemed to perform far better than the ones that raised money through a fixed price offer. We found significant difference in level of magnitude of underpricing and overpricing that are price through book build and fixed option. The average of magnitude of underpricing of IPOs that were priced through book building is 34.29% of offer price and those IPO that were priced through fixed price option is to the tune of 60% (approx). This reveals that the level of underpricing in terms of magnitude is higher if we use fixed price option mechanism (Table no-3).

8: CONCLUSIONS & FUTURE IMPLICATION

This study attempts to fulfill the great need for the Indian evidence on pricing mechanism of IPOs. We have found significant difference between magnitude of level of underpricing and overpricing that are price through book build and fixed option that have not been documented before. The study provides useful insights into which market and firm specific variables are important in determining the extent of underpricing of IPOs. The study has more important International Journal of Research in Finance & Marketing http://www.mairec.org

212

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

implications for investors who subscribe to different IPOs for listing day gain as this study would help them in understanding which types of firms are more likely to underpriced.

REFERENCES:

1) Aggarwal, R., Prabhala, N R., and Puri, M., (2002). Institutional Allocation in Initial Public Offerings: Empirical Evidence, Journal of Finance, 57, pp. 14211442. 2) Aggarwal, R.K., Krigman, L., Womack, K.L., (2002). Strategic IPO underpricing, information momentum and lockup expiration selling, Journal of Financial Economics 66, pp. 105 137. 3) Anand, A., (2005). Is the Dutch Auction IPO a Good Idea?. Expresso Preprint Series, Paper, pp. 672-683. 4) Antn, M, J, Antonio., Rodrguez, S, Gema., (2011). IPO methods: A survey among Spanish investors, African Journal of Business Management Vol. 5(9), pp. 3745-3748, 4 May, 2011. 5) Antn, M, J, Antonio., Rodrguez, S, Gema., (2011), Are IPOs (Initial Public Offering) still outperforming the market.? Evidence from Spain in the period 2000 to 2010. African Journal of Business Management Vol. 5(14), pp. 5775-5783, 18 July, 2011. 6) Bradley, D. J., and B, D. Jordan., (2001). Partial Adjustment to Public Information and IPO Underpricing. Journal of Financial and Quantitative Analysis 17, pp. 595616. 7) Butler, A. W., G. Grullon and J. P. Weston, (2006). Stock Market Liquidity and the Cost of Issuing Equity. Journal of Financial and Quantitative Analysis,24,pp. 1062-1074. 8) Brav, A., and P, A. Gompers., (2003). The Role of Lockups in Initial Public Offerings. Review of Financial Studies 16, pp. 129. 9) B, Einar., E, Tore., K, Leite., S, Thorburn., (2010). Information revelation and public information in IPOs. International Journal of finance and management 12, pp. 12-27. 10) Bansal, R., and A. Yaron., (2004), Risks for the Long Run: A Potential Resolution of Asset Pricing Puzzles, Journal of Finance, 59, pp. 1481-1509. 11) Butler, A. W., G, Grullon., and J, P. Weston., (2005). Stock Market Liquidity and the Cost of Issuing Equity. Journal of Financial and Quantitative Analysis, pp. 21-35. 12) Baker, M., and J. Wurgler., (2006). Investor Sentiment and the Cross-Section of Stock Returns, Journal of Finance, 61, pp. 1645-1680. International Journal of Research in Finance & Marketing http://www.mairec.org

213

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

13) Baker, M., and J. Wurgler., (2007). Investor Sentiment in the Stock Market, Journal of Economic Perspectives, 21, pp. 129-151. 14) Bubna, A., and Prabhala, N R., (2007). "When Bookbuilding Meets IPOs". AFA 2008 New Orleans Meetings Paper Available at SSRN: http://ssrncom/abstract , 972757. 15) Burhop C., D. Chambers and B. Cheffins (2011). Is Regulation Essential to Stock Market Development? Going Public in London and Berlin, 1900-1913 Cambridge Judge Business School working paper. 16) Chahine, S., (2003). Ex-ante uncertainty and gross spreads for small and medium sized IPOs .Euro journal of finance, 32, pp. 231-240. 17) Chahine, S., (2007). Investor interest, trading volume, and the choice of IPO mechanism in France, International Review of Financial Analysis Sciecne direct, 11b, pp. 11211132. 18) Corwin, S. A., J, H. Harris., and M, L. Lipson., (2004). The Development of Secondary Market Liquidity for NYSE-Listed IPOs. Journal of Finance 59, pp. 23392373. 19) C, David., (2011) .IPOs on the London Stock Exchange since 1900.Journal of Review, 11. 20) Demers, E., and K, Lewellen., (2003). The Marketing Role of IPOs: Evidence from Internet Stocks. Journal of Financial Economics 68, pp. 413437. 21) Derrien, F., & Womack, K. L., (2003). Auctions vs. book-building and the control of underpricing. Review of Financial Studies, 16, pp. 3161. 22) Dechow, P., R, Sloan., and M, Soliman., (2004). Implied Equity Duration: A New Measure of Equity Risk. Review of Accounting Studies, 9, pp.197228. 23) Degeorge, F., Derrien, F., woamck, K., (2004). "Quid Pro Quo in IPOs: Why BookBuilding is Dominating Auctions?". Euro journal of finance edition 6, pp. 23-45. 24) Degeorge, F., Derrien, F., & Womack, K., (2007). Analyst Hype in IPOs: Explaining the Popularity of Bookbuilding. Review of Financial Studies (20), pp.1021-1058. 25) Derrien, F., Womack, K, L., (2003). Auction vs book-building and the control of underpricing in hot IPO markets. Review of Financial Studies, 16, pp. 3161.

International Journal of Research in Finance & Marketing http://www.mairec.org

214

IJRFM M

Volume 2 Issue 2 ( 2, (February 2012)

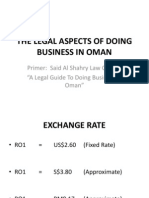

Marginal Plo of Bse issue vs Year ot

(ISS 2231-5985) SN

100 80 Bse issue 60 40 20 0 2000 200 02 2004 200 06 Year 2008 2010 2012

Gr raph no 1: Pl of Bse issu and year lot ue

Graph no 2: Plot of Bo build vs B issue and year o ook Bse d

In nternational Journal of R Research in F Finance & M Marketing http://w www.mairec. .org

215

IJRFM

Volume 2, Issue 2 (February 2012)

(ISSN 2231-5985)

Graph no 3: Plot of Fixed price option vs Bse issue and year

International Journal of Research in Finance & Marketing http://www.mairec.org

216

Вам также может понравиться

- Initial Public Offering (Ipo)Документ59 страницInitial Public Offering (Ipo)Arun Guleria85% (40)

- 1 M Yaseen Khan Research Article Aug 2011Документ14 страниц1 M Yaseen Khan Research Article Aug 2011keval_kanakharaОценок пока нет

- Print - Jewellery ReportДокумент66 страницPrint - Jewellery Reportkeval_kanakharaОценок пока нет

- Spice - Gallery Photos in PDFДокумент1 страницаSpice - Gallery Photos in PDFkeval_kanakharaОценок пока нет

- Print - Jewellery ReportДокумент66 страницPrint - Jewellery Reportkeval_kanakharaОценок пока нет

- NpaДокумент86 страницNpakeval_kanakharaОценок пока нет

- Bank ManagementДокумент112 страницBank Managementsat237Оценок пока нет

- 3Документ35 страниц3Vishal SoniОценок пока нет

- InsightHR - Regulatory CertificationsДокумент13 страницInsightHR - Regulatory Certificationskeval_kanakharaОценок пока нет

- Marketing, Finance and International Strategy-06-Krishna C PandeyДокумент23 страницыMarketing, Finance and International Strategy-06-Krishna C Pandeykeval_kanakharaОценок пока нет

- 8 1 1Документ23 страницы8 1 1keval_kanakharaОценок пока нет

- Internship ProjectДокумент34 страницыInternship Projectkeval_kanakharaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Amalgamation of CompaniesДокумент40 страницAmalgamation of CompaniesalexanderОценок пока нет

- QuizДокумент55 страницQuizMuhammad Ben Mahfouz Al-ZubairiОценок пока нет

- Corporate RestructuringДокумент17 страницCorporate RestructuringSantosh....Оценок пока нет

- AP 5902 Liability Supporting NotesДокумент6 страницAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- Stock Articles of IncorporationДокумент5 страницStock Articles of IncorporationRuffa TagalagОценок пока нет

- SNV Supporting Shea Sector in Northern GhanaДокумент32 страницыSNV Supporting Shea Sector in Northern GhanaDean Reeves100% (1)

- Global Ambitions: How Mehraj Mattoo Is Building Commerzbank's Alternatives BusinessДокумент4 страницыGlobal Ambitions: How Mehraj Mattoo Is Building Commerzbank's Alternatives BusinesshedgefundnewzОценок пока нет

- Audit ProceduresДокумент14 страницAudit ProceduresAnand Rocker100% (1)

- MIA Publication Order FormДокумент2 страницыMIA Publication Order Formhafis820% (1)

- Business Contacts Bulletin - May Sri LankaДокумент19 страницBusiness Contacts Bulletin - May Sri LankaDurban Chamber of Commerce and IndustryОценок пока нет

- Conversion of DFI's Into Banks With Special Reference To ICICI and IDBI BanksДокумент63 страницыConversion of DFI's Into Banks With Special Reference To ICICI and IDBI Banksdarshan71219892205100% (1)

- Credit Ratings PDFДокумент1 страницаCredit Ratings PDFkirti gОценок пока нет

- Analyzing Financial Data: Ratio AnalysisДокумент12 страницAnalyzing Financial Data: Ratio AnalysiscpdОценок пока нет

- 032465913X 164223Документ72 страницы032465913X 164223March AthenaОценок пока нет

- Understanding Bank De-Risking and Its Effects On Financial Inclusion: An Exploratory StudyДокумент57 страницUnderstanding Bank De-Risking and Its Effects On Financial Inclusion: An Exploratory StudyOxfamОценок пока нет

- Midland Energy A1Документ30 страницMidland Energy A1CarsonОценок пока нет

- ACAS Taxation 2 (Income Tax - Full Midterm Coverage)Документ15 страницACAS Taxation 2 (Income Tax - Full Midterm Coverage)Steven OrtizОценок пока нет

- Empirical Methods: UvA - Lecture - 01 2019Документ57 страницEmpirical Methods: UvA - Lecture - 01 2019Jason SpanoОценок пока нет

- EduTap Finance NotesДокумент22 страницыEduTap Finance NotesHormaya Zimik100% (3)

- 2nd GNLU Moot On Securities and Investment 2016Документ38 страниц2nd GNLU Moot On Securities and Investment 2016akshi100% (1)

- New Heritage Doll Company Capital Budgeting for ExpansionДокумент11 страницNew Heritage Doll Company Capital Budgeting for ExpansionDeep Dey0% (1)

- The Analysis of The Statement of Shareholders'EquityДокумент24 страницыThe Analysis of The Statement of Shareholders'EquityShihab HasanОценок пока нет

- Living TrustДокумент7 страницLiving TrustRocketLawyer100% (30)

- PDFДокумент664 страницыPDFparth patelОценок пока нет

- 'Ol50C PH: Dist ICДокумент9 страниц'Ol50C PH: Dist ICscion.scionОценок пока нет

- Definition of Terms-TAXДокумент5 страницDefinition of Terms-TAXAnonymous iOYkz0wОценок пока нет

- Healthcare: Hospitals: A Deep-Dive Into What Drives ProfitabilityДокумент18 страницHealthcare: Hospitals: A Deep-Dive Into What Drives Profitabilityakumar4uОценок пока нет

- Audit UniverseДокумент4 страницыAudit UniverseabcdefgОценок пока нет

- Capital Budgeting DCFДокумент38 страницCapital Budgeting DCFNadya Rizkita100% (4)

- Economic Entity AssumptionДокумент4 страницыEconomic Entity AssumptionNouman KhanОценок пока нет