Академический Документы

Профессиональный Документы

Культура Документы

Description: Tags: tgrc01

Загружено:

anon-198828Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Description: Tags: tgrc01

Загружено:

anon-198828Авторское право:

Доступные форматы

Session Six — Refund and Repayment Calculations

Objective

To illustrate the determination of withdrawal date, the treatment of loan

proceeds, and the calculation of institutional charges.

School Information

Apex Community College:

✦ Two-year, term-based, public community college

✦ Measures progress in credit hours

✦ AY consists of two 15-week semesters

✦ If a student withdraws from individual courses (i.e., not a complete withdrawal

from the school), the tuition charge for the course(s) is reduced 100%

January 21, 1997

Session Six — Refund and Repayment Calculations

Case Study 1: Apex Community College (cont’d)

Repayment Policy

Living expenses are prorated based on the number of weeks the student completes during

the semester. For students who begin classes, 50% of the books and supplies allowance is

considered to be expended.

Student Information

✦ Adam is attending his second year at the school.

✦ Adam enrolls for 15 semester hours for the first semester and starts classes on August

25.

✦ On September 4, during the second week and the school’s add/drop period, Adam

withdraws from 6 semester hours.

✦ He officially withdraws on September 18 during the fourth week of the semester.

Program Costs

Costs for each semester:

Tuition ......................................................... $30 per semester hour

Fees .......................................................................................... $45

Books and supplies allowance ............................................. $ 300

School's allowance for off-campus living expenses ............. $2,750

Aid Awarded

Subsidized Federal Stafford Loan (total amount approved) . $3,500

TG 6-52 January 21, 1997

Session Six — Refund and Repayment Calculations

Case Study 1: Apex Community College (cont’d)

Aid Disbursed for the Payment Period

Subsidized Federal Stafford Loan ........................................ $1,680

The Federal Stafford Loan is scheduled to be disbursed in two equal installments of

$1,680 (i.e., half of the total amount approved minus the origination fee and insurance

premium) at the beginning of each semester.

Because Adam paid his charges for tuition and fees from his savings when he registered

on August 4, the school gave the Federal Stafford Loan check directly to him for his

noninstitutional expenses. Adam used his loan proceeds to pay for his books and

supplies. After the school adjusted Adam’s tuition charges on September 4 for the 6

semester hours he dropped, it returned to Adam $180 of his cash payment (i.e., the

amount by which his tuition charges were reduced).

Task

✦ Calculate the amount of refund and repayment, if any.

January 21, 1997 TG 6-53

Session Six — Refund and Repayment Calculations

WITHDRAWAL RECORD

1. Student Information

Name Start Date Withdrawal Date/LDA

Social Security Number Length of Enrollment Period Date of WD/LDA Determination

USE TOTALS

2. Program Costs FOR PERIOD

CHARGED*

non- non-

inst. inst. inst. inst. TOTAL

Tuition/Fees Personal/Living Inst. Costs:

Administrative Fee Dependent Care A

Room & Board Disability Costs TOTAL

Noninst. Costs:

Books & Supplies Miscellaneous

Transportation Miscellaneous

B

3. Payments/Disbursements TOTAL Aid Paid

To Inst. Costs:

DATE SOURCE

Paid to

Inst. Costs

Cash to

Student DATE SOURCE

Paid to

Inst. Costs

Cash to

Student C

TOTAL Paid To

(Exclude work-study awards.)

Inst. Costs:

D

TOTAL Aid Paid

as Cash:

E

*USE TOTALS AS CHARGED FOR THE ENROLLMENT PERIOD (The following minimums apply: for term programs, use

totals for the term; for all nonterm programs longer than or equal to the academic year, use totals for the payment period or for one-half of

the academic year, whichever is greater. For all nonterm programs shorter than the academic year, use totals for the program length. If you

charge by different periods for different charges, convert all totals to represent the longest period.)

4. Data for Pro Rata and Federal Refund

IS THIS STUDENT A FIRST-TIME STUDENT? A first-time student is one who has not previously attended at least

one class at this school, or has received a 100 percent refund (less any permitted administrative fee) for previous attendance. (A first-

time student remains so until he or she withdraws after attending at least one class at the school or completes the period of enrollment.) YES NO

DID THIS STUDENT WITHDRAW ON OR BEFORE THE 60% POINT? For credit-hour programs, the

60% point is the point in calendar time when 60% of the enrollment period has elapsed. For clock-hour programs, it is the point

when this particular student completes 60% of the hours scheduled for the enrollment period.

YES NO

IF THE ANSWER TO BOTH QUESTIONS IS "YES," a statutory pro rata refund calculation is required for this student. For

this calculation, you must determine the Portion That Remains (of the enrollment period) and the institutional costs that may be excluded, if any.

TO DETERMINE THE PORTION THAT REMAINS, TO DETERMINE EXCLUDABLE INSTITUTIONAL COSTS:

calculate as follows and round DOWN to the nearest 10% •Administrative Fee (up to $100 or 5%, whichever is less) +

•For credit-hour programs: •Documented Cost of Unreturnable Equipment +

WEEKS REMAINING •Documented Cost of Returnable Equipment (if not returned in

TOTAL WEEKS IN good condition within 20 days of withdrawal) +

•For clock-hour programs:* TOTAL EXCLUDABLE INST. COSTS (for Pro Rata and

HOURS REMAINING Federal Refund calculations only):

TOTAL HOURS IN

•For correspondence programs: Pro Rata/Federal Refund

LESSONS NOT

Institutional Costs:

SUBMITTED

A A

*DO NOT use scheduled hours. Also, excused absences can count as “hours completed.” Total Institutional Costs Total Excludable Inst. Costs

1996-97

United States Department of Education

Student Financial Assistance Programs

TG 6-54 January 21, 1997

Session Six — Refund and Repayment Calculations

REFUND CALCULATION WORKSHEET

STEP ONE Total Institutional Costs

(from Withdrawal Record) A

Total Aid Paid to Inst. Costs*

Unpaid Charges (also from Withdrawal Record) C

*Scheduled SFA payments and FFEL/Direct late Scheduled Cash Payment (SCP)

disbursements that have not yet been received, for (attribution not allowable)

which the student is still eligible in spite of having

withdrawn, must be counted to reduce the student's Student's Cash Paid

scheduled cash payment. This includes late State aid (from Withdrawal Record)

disbursements as allowed under written State policy.

(Scheduled payments from sources other than those

above cannot be counted in this manner.) UNPAID CHARGES

STEP TWO Total Institutional Costs

(from Withdrawal Record) A

% Allowed to Retain*

Amount Retained

*Use the percentage specified by the State, accrediting

X (from refund policy being used)

agency, Federal Refund Calculation, or institutional Initial Amount Retained

refund policy being used for this calculation. For first- By The School If this amount is zero or

time students who withdraw on or before the 60% point negative, all SFA paid to

in the enrollment period (see Withdrawal Record for UNPAID CHARGES school charges must be

returned (exc. FWS).

details), a statutory pro rata refund must also be (from Step One)

calculated. For every student receiving SFA funds, the

school must compare the possible refunds and use the

calculation that provides the largest refund. AMOUNT RETAINED

STEP THREE Total Paid to Institutional Costs

(from Withdrawal Record) D

Amount Retained

Refund Amount (from Step Two)

Generally, funds must be returned to the appropriate

program account(s) within 30 days of the date of REFUND AMOUNT

withdrawal, and to the lender within 60 days of the same. TO BE DISTRIBUTED

REFUND DISTRIBUTION—Prescribed by Law and Regulation

TOTAL REFUND

1. Federal SLS Loan 8. Federal Perkins Loan

2. Unsubsidized Federal Stafford Loan 9. Federal Pell Grant

3. Subsidized Federal Stafford Loan 10. FSEOG

4. Federal PLUS Loan 11. Other Title IV Aid Programs

5. Unsubsidized Federal Direct Stafford Loan 12. Other Federal, state, private, or institutional aid

6. Subsidized Federal Direct Stafford Loan 13. The student

7. Federal Direct PLUS Loan

1996-97

United States Department of Education

Student Financial Assistance Programs

January 21, 1997 TG 6-55

Session Six — Refund and Repayment Calculations

FEDERAL REFUND CALCULATION WORKSHEET

STEP ONE* Total Institutional Costs

(from Withdrawal Record) A

Total Aid Paid to Inst. Costs*

Unpaid Charges (also from Withdrawal Record) C

*Scheduled SFA payments and FFEL/Direct late Scheduled Cash Payment (SCP)

disbursements that have not yet been received, for (attribution not allowable)

which the student is still eligible in spite of having

withdrawn, must be counted to reduce the student's Student's Cash Paid

scheduled cash payment. This includes late State aid (from Withdrawal Record)

disbursements as allowed under written State policy.

(Scheduled payments from sources other than those

above cannot be counted in this manner.) UNPAID CHARGES

STEP TWO Federal Refund Calculation Inst.

Costs (from Withdrawal Record) A1

% to be Refunded

Refund Amount X (from the regulatory policy)

Generally, funds must be returned to the appropriate

program account(s) within 30 days of the date of

withdrawal, and to the lender within 60 days of the REFUND AMOUNT

same. TO BE DISTRIBUTED

*NOTE: Because calculating a Federal Refund in this manner does not show the amount

retained by the school, the subtraction of unpaid charges from that amount is also not shown.

However, the unpaid charges amount must still be calculated for the student because the refund

process may result in the school not keeping the full amount it is allowed to retain under the

Federal Refund Policy. In such a case, the school may collect the remaining balance from the

student (the unpaid charges amount).

REFUND DISTRIBUTION—Prescribed by Law and Regulation

TOTAL REFUND

1. Federal SLS Loan 8. Federal Perkins Loan

2. Unsubsidized Federal Stafford Loan 9. Federal Pell Grant

3. Subsidized Federal Stafford Loan 10. FSEOG

4. Federal PLUS Loan 11. Other Title IV Aid Programs

5. Unsubsidized Federal Direct Stafford Loan 12. Other Federal, state, private, or institutional aid

6. Subsidized Federal Direct Stafford Loan 13. The student

7. Federal Direct PLUS Loan

1996-97

United States Department of Education

Student Financial Assistance Programs

TG 6-56 January 21, 1997

Session Six — Refund and Repayment Calculations

Case Study 1 Solution

Apex Community College

Important Points

✦ Although none of Adam’s Federal Stafford Loan was used to pay his institutional

charges, a refund must be calculated. No repayment calculation is required because

Federal Stafford Loans (i.e., the only Title IV funds he received) are excluded from the

repayment calculation.

✦ Because Adam is not attending the school for the first-time, the Pro Rata refund does

not apply. Because there is no state or approved accrediting agency refund policy, the

school must calculate and compare the amount of refund that would be due under the

school’s refund policy and the Federal Refund Policy and pay an amount that is at least

as large as the larger of the refunds calculated.

✦ The amount of the Title IV refund is based only on the amount of institutional charges

that remained after the school adjusted Adam’s tuition charges on September 4 (i.e.,

$495 minus $180).

✦ Adam withdrew after completing 27% of the period of enrollment for which he was

charged (i.e., 4 weeks divided by 15 weeks), which is after the first 25% but before the

first 50%. Therefore, under the Federal Refund Policy calculation, he is due a 25%

refund of his institutional charges.

January 21, 1997 TG 6-57

Session Six — Refund and Repayment Calculations

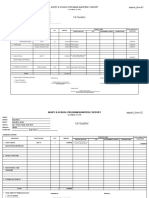

WITHDRAWAL RECORD

1. Student Information

Adam 8/25 9/18

Name Start Date Withdrawal Date/LDA

15-week semester 9/18

Social Security Number Length of Enrollment Period Date of WD/LDA Determination

USE TOTALS

2. Program Costs FOR PERIOD

CHARGED*

non- non-

inst. inst. inst. inst. TOTAL

✘ Tuition/Fees 315 Personal/Living Inst. Costs:

Administrative Fee Dependent Care 315 A

✘ Room & Board 2,750 Disability Costs TOTAL

Noninst. Costs:

✘ Books & Supplies 300 Miscellaneous

Transportation Miscellaneous

3,050 B

3. Payments/Disbursements TOTAL Aid Paid

To Inst. Costs:

DATE SOURCE

Paid to

Inst. Costs

Cash to

Student DATE SOURCE

Paid to

Inst. Costs

Cash to

Student

0 C

8/4 cash payment 315 TOTAL Paid To

(Exclude work-study awards.)

Inst. Costs:

8/25 Federal 1,680

Stafford

315 D

TOTAL Aid Paid

as Cash:

1,680 E

*USE TOTALS AS CHARGED FOR THE ENROLLMENT PERIOD (The following minimums apply: for term programs, use

totals for the term; for all nonterm programs longer than or equal to the academic year, use totals for the payment period or for one-half of

the academic year, whichever is greater. For all nonterm programs shorter than the academic year, use totals for the program length. If you

charge by different periods for different charges, convert all totals to represent the longest period.)

4. Data for Pro Rata and Federal Refund

IS THIS STUDENT A FIRST-TIME STUDENT? A first-time student is one who has not previously attended at least

one class at this school, or has received a 100 percent refund (less any permitted administrative fee) for previous attendance. (A first- ✘

time student remains so until he or she withdraws after attending at least one class at the school or completes the period of enrollment.) YES NO

DID THIS STUDENT WITHDRAW ON OR BEFORE THE 60% POINT? For credit-hour programs, the

60% point is the point in calendar time when 60% of the enrollment period has elapsed. For clock-hour programs, it is the point

when this particular student completes 60% of the hours scheduled for the enrollment period.

✘

YES NO

IF THE ANSWER TO BOTH QUESTIONS IS "YES," a statutory pro rata refund calculation is required for this student. For

this calculation, you must determine the Portion That Remains (of the enrollment period) and the institutional costs that may be excluded, if any.

TO DETERMINE THE PORTION THAT REMAINS, TO DETERMINE EXCLUDABLE INSTITUTIONAL COSTS:

calculate as follows and round DOWN to the nearest 10% •Administrative Fee (up to $100 or 5%, whichever is less) + 0

•For credit-hour programs: •Documented Cost of Unreturnable Equipment + 0

WEEKS REMAINING •Documented Cost of Returnable Equipment (if not returned in

TOTAL WEEKS IN good condition within 20 days of withdrawal) + 0

•For clock-hour programs:* TOTAL EXCLUDABLE INST. COSTS (for Pro Rata and

HOURS REMAINING Federal Refund calculations only): 0

TOTAL HOURS IN

•For correspondence programs: Pro Rata/Federal Refund

LESSONS NOT

Institutional Costs:

SUBMITTED 315 A 0 315 A

*DO NOT use scheduled hours. Also, excused absences can count as “hours completed.” Total Institutional Costs Total Excludable Inst. Costs

1996-97

United States Department of Education

Student Financial Assistance Programs

TG 6-58 January 21, 1997

Session Six — Refund and Repayment Calculations

REFUND CALCULATION WORKSHEET

Institutional

STEP ONE 315 Total Institutional Costs

(from Withdrawal Record) A

Total Aid Paid to Inst. Costs*

Unpaid Charges 0 (also from Withdrawal Record) C

*Scheduled SFA payments and FFEL/Direct late Scheduled Cash Payment (SCP)

disbursements that have not yet been received, for 315 (attribution not allowable)

which the student is still eligible in spite of having

withdrawn, must be counted to reduce the student's Student's Cash Paid

scheduled cash payment. This includes late State aid 315 (from Withdrawal Record)

disbursements as allowed under written State policy.

(Scheduled payments from sources other than those

above cannot be counted in this manner.) 0 UNPAID CHARGES

STEP TWO 315

Total Institutional Costs

(from Withdrawal Record) A

% Allowed to Retain*

Amount Retained

*Use the percentage specified by the State, accrediting

X 80% (from refund policy being used)

agency, Federal Refund Calculation, or institutional Initial Amount Retained

refund policy being used for this calculation. For first- 252 By The School If this amount is zero or

time students who withdraw on or before the 60% point negative, all SFA paid to

in the enrollment period (see Withdrawal Record for UNPAID CHARGES school charges must be

details), a statutory pro rata refund must also be 0 (from Step One) returned (exc. FWS).

calculated. For every student receiving SFA funds, the

school must compare the possible refunds and use the

calculation that provides the largest refund. 252 AMOUNT RETAINED

STEP THREE 315

Total Paid to Institutional Costs

(from Withdrawal Record) D

Amount Retained

Refund Amount 252 (from Step Two)

Generally, funds must be returned to the appropriate

program account(s) within 30 days of the date of

withdrawal, and to the lender within 60 days of the same.

63 REFUND AMOUNT

TO BE DISTRIBUTED

REFUND DISTRIBUTION—Prescribed by Law and Regulation

TOTAL REFUND

1. Federal SLS Loan 8. Federal Perkins Loan

2. Unsubsidized Federal Stafford Loan 9. Federal Pell Grant

3. Subsidized Federal Stafford Loan 10. FSEOG

4. Federal PLUS Loan 11. Other Title IV Aid Programs

5. Unsubsidized Federal Direct Stafford Loan 12. Other Federal, state, private, or institutional aid

6. Subsidized Federal Direct Stafford Loan 13. The student

7. Federal Direct PLUS Loan

1996-97

United States Department of Education

Student Financial Assistance Programs

January 21, 1997 TG 6-59

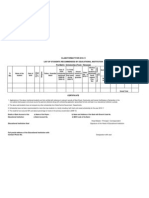

Session Six — Refund and Repayment Calculations

S

FEDERAL REFUND CALCULATION WORKSHEET

STEP ONE* 315 Total Institutional Costs

(from Withdrawal Record) A

Total Aid Paid to Inst. Costs*

Unpaid Charges 0 (also from Withdrawal Record) C

*Scheduled SFA payments and FFEL/Direct late Scheduled Cash Payment (SCP)

disbursements that have not yet been received, for 315 (attribution not allowable)

which the student is still eligible in spite of having

withdrawn, must be counted to reduce the student's Student's Cash Paid

scheduled cash payment. This includes late State aid 315 (from Withdrawal Record)

disbursements as allowed under written State policy.

(Scheduled payments from sources other than those

above cannot be counted in this manner.) 0 UNPAID CHARGES

STEP TWO 315

Federal Refund Calculation Inst.

Costs (from Withdrawal Record) A1

% to be Refunded

Refund Amount X 25% (from the regulatory policy)

Generally, funds must be returned to the appropriate

program account(s) within 30 days of the date of

withdrawal, and to the lender within 60 days of the 79 REFUND AMOUNT

same. TO BE DISTRIBUTED

*NOTE: Because calculating a Federal Refund in this manner does not show the amount

retained by the school, the subtraction of unpaid charges from that amount is also not shown.

However, the unpaid charges amount must still be calculated for the student because the refund

process may result in the school not keeping the full amount it is allowed to retain under the

Federal Refund Policy. In such a case, the school may collect the remaining balance from the

student (the unpaid charges amount).

REFUND DISTRIBUTION—Prescribed by Law and Regulation

TOTAL REFUND 79

1. Federal SLS Loan 8. Federal Perkins Loan

2. Unsubsidized Federal Stafford Loan 9. Federal Pell Grant

3. Subsidized Federal Stafford Loan 79 10. FSEOG

4. Federal PLUS Loan 11. Other Title IV Aid Programs

5. Unsubsidized Federal Direct Stafford Loan 12. Other Federal, state, private, or institutional aid

6. Subsidized Federal Direct Stafford Loan 13. The student

7. Federal Direct PLUS Loan

1996-97

United States Department of Education

Student Financial Assistance Programs

TG 6-60 January 21, 1997

Вам также может понравиться

- Case Study 5: Eagle Point State UniversityДокумент6 страницCase Study 5: Eagle Point State Universityanon-367174Оценок пока нет

- Case Study 9: Juno Community CollegeДокумент7 страницCase Study 9: Juno Community Collegeanon-854810Оценок пока нет

- Case Study 2: Beemis Technical CollegeДокумент5 страницCase Study 2: Beemis Technical Collegeanon-811984Оценок пока нет

- Case Study 7: Geiger State CollegeДокумент7 страницCase Study 7: Geiger State Collegeanon-194259Оценок пока нет

- Case Study 4: Datsun InstituteДокумент5 страницCase Study 4: Datsun Instituteanon-470348Оценок пока нет

- Case Study 2 Solution: Beemis Technical CollegeДокумент4 страницыCase Study 2 Solution: Beemis Technical Collegeanon-954643Оценок пока нет

- Case Study 4 Solution: Datsun InstituteДокумент3 страницыCase Study 4 Solution: Datsun Instituteanon-194603Оценок пока нет

- Case Study 9 Solution: Juno Community CollegeДокумент5 страницCase Study 9 Solution: Juno Community Collegeanon-735551Оценок пока нет

- Case Study 6 Solution: Fishburn InstituteДокумент4 страницыCase Study 6 Solution: Fishburn Instituteanon-613687Оценок пока нет

- Case Study 7 Solution: Geiger State CollegeДокумент5 страницCase Study 7 Solution: Geiger State Collegeanon-256811Оценок пока нет

- Description: Tags: ch3 s4csДокумент30 страницDescription: Tags: ch3 s4csanon-918027Оценок пока нет

- Department of Computing: Hardship Fund Application FormДокумент4 страницыDepartment of Computing: Hardship Fund Application FormVladОценок пока нет

- ST TH ST TH ND TH ST TH ND TH RD TH TH THДокумент2 страницыST TH ST TH ND TH ST TH ND TH RD TH TH THGundeti TejaОценок пока нет

- Quarterly Report on Donations to Suba Elementary SchoolДокумент18 страницQuarterly Report on Donations to Suba Elementary SchoolBaby PascuaОценок пока нет

- Prematric ClaimДокумент1 страницаPrematric ClaimThariq AhamadОценок пока нет

- DepEd Health Report FormДокумент5 страницDepEd Health Report FormDaRylОценок пока нет

- Application Form For Grant of Financial Assistance For Education To The Wards of BSF Serving/ Deceased Personnel For The Academic SessionДокумент5 страницApplication Form For Grant of Financial Assistance For Education To The Wards of BSF Serving/ Deceased Personnel For The Academic SessionMohammadaslamali MullaОценок пока нет

- Owlsome Fees Structure - Year2022Документ4 страницыOwlsome Fees Structure - Year2022Sylvena LooОценок пока нет

- Fee Card5Документ2 страницыFee Card5habeebschoolОценок пока нет

- Payment PlanДокумент2 страницыPayment PlanA B?Оценок пока нет

- Consolidated District Schoolformschecking ReportДокумент2 страницыConsolidated District Schoolformschecking Reportjhon rey corderoОценок пока нет

- DO s2018 028-Converted-1Документ29 страницDO s2018 028-Converted-1Jenie Viva AndradeОценок пока нет

- Introduction For Computer Science 1234566yygyhggvvcccffdddДокумент10 страницIntroduction For Computer Science 1234566yygyhggvvcccffdddRahul KannanОценок пока нет

- The Japanese School Fees For 2019: Payment Items Fee Details Cheque PayeeДокумент1 страницаThe Japanese School Fees For 2019: Payment Items Fee Details Cheque PayeeAshmith BОценок пока нет

- 2020 DOST-SEI Science and Technology Undergraduate Scholarships Application FormДокумент6 страниц2020 DOST-SEI Science and Technology Undergraduate Scholarships Application FormAdaОценок пока нет

- Pune Institute of Business Management: Fees Undertaking FormДокумент2 страницыPune Institute of Business Management: Fees Undertaking FormPranav TripathiОценок пока нет

- Division Travel Authority Revise Template 1 4Документ2 страницыDivision Travel Authority Revise Template 1 4JOEL D. BATERISNAОценок пока нет

- Internship Tasks at Kohat UniversityДокумент12 страницInternship Tasks at Kohat UniversityTabish KhanОценок пока нет

- Oplan Kalusugan Form BДокумент5 страницOplan Kalusugan Form BEzekiel ReyesОценок пока нет

- Borang Kemasukan Updated 9 Sept 2017 Uum SintokДокумент10 страницBorang Kemasukan Updated 9 Sept 2017 Uum SintokJenz JenabОценок пока нет

- OPLAN KALUSUGAN SA DEPED SoftДокумент5 страницOPLAN KALUSUGAN SA DEPED SoftRonnel Andres HernandezОценок пока нет

- University of Sahiwal, Sahiwal: Fee Concession/Financial Assistance FormДокумент4 страницыUniversity of Sahiwal, Sahiwal: Fee Concession/Financial Assistance FormSajid MunirОценок пока нет

- BCIT 2021-22 Full-time/Cohort Technology Fee Schedule Effective Date of This Tuition Schedule: August 1, 2021Документ4 страницыBCIT 2021-22 Full-time/Cohort Technology Fee Schedule Effective Date of This Tuition Schedule: August 1, 2021Aung ThihaОценок пока нет

- Fees Circular Jan-May 2024Документ5 страницFees Circular Jan-May 2024gopichandstoreОценок пока нет

- Ugradapp 2020Документ6 страницUgradapp 2020John Vincent Navarro RiveraОценок пока нет

- Pre Qualifier PG MGMTДокумент7 страницPre Qualifier PG MGMTsfarithaОценок пока нет

- Debtermined Budget Worksheet 1Документ17 страницDebtermined Budget Worksheet 1Nhoj Cire ZevodrocОценок пока нет

- Ok Sa Deped Form BДокумент5 страницOk Sa Deped Form BKhulyn Castro AlvarezОценок пока нет

- Who Really Benefits? How Education Dollars are Spent in Santa Clara CountyДокумент20 страницWho Really Benefits? How Education Dollars are Spent in Santa Clara CountyPraveen KumarОценок пока нет

- DepEd Health Report FormДокумент5 страницDepEd Health Report FormLyra Lyn R BaniquidОценок пока нет

- Master of Science (Science and Mathematics Education) : Credit For Previous StudyДокумент2 страницыMaster of Science (Science and Mathematics Education) : Credit For Previous Studytiti wahyuniОценок пока нет

- Local Media7845099801181969752Документ1 страницаLocal Media7845099801181969752Atienza, Francheska Isabela C.Оценок пока нет

- Division of Pampanga: Brigada Eskwela 2020 District/Cluster Consolidated ReportДокумент1 страницаDivision of Pampanga: Brigada Eskwela 2020 District/Cluster Consolidated ReportIan BondocОценок пока нет

- Corrected: Brigham Young University 7195.00 Brigham Young University A153A ASBДокумент2 страницыCorrected: Brigham Young University 7195.00 Brigham Young University A153A ASBNathan MonsonОценок пока нет

- AISD tuition fees and charges for 2020-21 school yearДокумент4 страницыAISD tuition fees and charges for 2020-21 school yearAhmed shakilОценок пока нет

- Need Based Scholarship Form Spring 2022Документ6 страницNeed Based Scholarship Form Spring 2022Syed FaisalОценок пока нет

- Diploma Engg Pre-QualifierДокумент6 страницDiploma Engg Pre-QualifierUmesh PatilОценок пока нет

- Fee Schedule TitleДокумент2 страницыFee Schedule TitleRahul GuptaОценок пока нет

- Guidelines FormДокумент4 страницыGuidelines FormKaran PeshwaniОценок пока нет

- Training - Important Documents - HST-Fund-Form - 2021-2022Документ2 страницыTraining - Important Documents - HST-Fund-Form - 2021-2022Collen Tinashe MakoniОценок пока нет

- Division of Pampanga: Brigada Eskwela 2020 District/Cluster Consolidated ReportДокумент1 страницаDivision of Pampanga: Brigada Eskwela 2020 District/Cluster Consolidated ReportIan BondocОценок пока нет

- Graduate tuition and fees for international studentsДокумент1 страницаGraduate tuition and fees for international studentsMuhammad Shabbar AliОценок пока нет

- Fee Structure For 2023 24 RenewalsДокумент2 страницыFee Structure For 2023 24 RenewalsshanmukhsagarОценок пока нет

- Starter Budget Worksheet For College Students: IncomeДокумент1 страницаStarter Budget Worksheet For College Students: IncomeAria TiscareñoОценок пока нет

- Sf2 TemplateДокумент12 страницSf2 TemplateKeith Lavin100% (1)

- Practical IFRSДокумент282 страницыPractical IFRSahmadqasqas100% (1)

- Banking and Economics AbbreviationsДокумент9 страницBanking and Economics AbbreviationsShekhar BeheraОценок пока нет

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueДокумент1 страницаShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatОценок пока нет

- Accounting Chapter 10Документ4 страницыAccounting Chapter 1019033Оценок пока нет

- Fixed DepositДокумент16 страницFixed DepositPrashant MathurОценок пока нет

- Myths and Realities of Eminent Domain AbuseДокумент14 страницMyths and Realities of Eminent Domain AbuseInstitute for JusticeОценок пока нет

- AAEC 3301 - Lecture 5Документ31 страницаAAEC 3301 - Lecture 5Fitrhiianii ExBrilliantОценок пока нет

- Boneless & Skinless Chicken Breasts: Get $6.00 OffДокумент6 страницBoneless & Skinless Chicken Breasts: Get $6.00 OffufmarketОценок пока нет

- GIMPA SPSG Short Programmes 10.11.17 Full PGДокумент2 страницыGIMPA SPSG Short Programmes 10.11.17 Full PGMisterAto MaisonОценок пока нет

- International Finance - TCS Case StudyДокумент22 страницыInternational Finance - TCS Case StudyPrateek SinglaОценок пока нет

- Terms of TradeДокумент3 страницыTerms of TradePiyushJainОценок пока нет

- Oct 2022 Act BillДокумент2 страницыOct 2022 Act Billdurga prasadОценок пока нет

- Description of Empirical Data Sets: 1. The ExamplesДокумент3 страницыDescription of Empirical Data Sets: 1. The ExamplesMANOJ KUMARОценок пока нет

- Bahasa Inggris SMK Kur 2013Документ13 страницBahasa Inggris SMK Kur 2013Jung Eunhee100% (2)

- Mahanagar CO OP BANKДокумент28 страницMahanagar CO OP BANKKaran PanchalОценок пока нет

- Marico Over The Wall Operations Case StudyДокумент4 страницыMarico Over The Wall Operations Case StudyMohit AssudaniОценок пока нет

- Lumad Struggle for Land and Culture in the PhilippinesДокумент10 страницLumad Struggle for Land and Culture in the PhilippinesAlyssa Molina100% (1)

- A4 - Productivity - City Plan 2036 Draft City of Sydney Local Strategic Planning StatementДокумент31 страницаA4 - Productivity - City Plan 2036 Draft City of Sydney Local Strategic Planning StatementDorjeОценок пока нет

- Botswana Etssp 2015-2020Документ174 страницыBotswana Etssp 2015-2020sellojkОценок пока нет

- PDF1902 PDFДокумент190 страницPDF1902 PDFAnup BhutadaОценок пока нет

- The Millennium Development Goals Report: United NationsДокумент21 страницаThe Millennium Development Goals Report: United Nationshst939Оценок пока нет

- JVA JuryДокумент22 страницыJVA JuryYogesh SharmaОценок пока нет

- Chapter 1-Introduction To Green BuildingsДокумент40 страницChapter 1-Introduction To Green Buildingsniti860Оценок пока нет

- (Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)Документ165 страниц(Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)gootОценок пока нет

- Encyclopedia of American BusinessДокумент863 страницыEncyclopedia of American Businessshark_freire5046Оценок пока нет

- Philippines Solar PV Guidebook Legal RequirementsДокумент64 страницыPhilippines Solar PV Guidebook Legal RequirementsRon GuevaraОценок пока нет

- AGI3553 Plant ProtectionДокумент241 страницаAGI3553 Plant ProtectionDK White LionОценок пока нет

- Alyansa Vs ErcДокумент44 страницыAlyansa Vs ErcrichardgomezОценок пока нет

- Economics ProjectДокумент15 страницEconomics ProjectAniket taywadeОценок пока нет

- "Tsogttetsii Soum Solid Waste Management Plan" Environ LLCДокумент49 страниц"Tsogttetsii Soum Solid Waste Management Plan" Environ LLCbatmunkh.eОценок пока нет