Академический Документы

Профессиональный Документы

Культура Документы

Proof MNAT Represents Bain DelawareKB Case

Загружено:

RmuseManАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Proof MNAT Represents Bain DelawareKB Case

Загружено:

RmuseManАвторское право:

Доступные форматы

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) ) ) ) ) ) )

In re: KB Toys, Inc., et al., Debtors.

Chapter 11 Case No. 04-10120 (DDS) (Jointly Administered) RE: D.I. 1984

OPPOSITION OF BAIN CAPITAL FUND VII, L.P. TO MOTION OF COMMITTEE OF UNSECURED CREDITORS FOR AUTHORITY TO PURSUE CLAIMS Bain Capital Fund VII, L.P. (Bain) submits this opposition to the motion of the Official Committee of Unsecured Creditors (the Committee) for authority to commence fraudulent conveyance actions, as well as related claims of breach of fiduciary duty, against Bain, officers of the debtors (hereafter, the Debtors or KB Toys), and others on behalf of the Debtors estate.1 Preliminary Statement 1. By this motion, the Committee seeks authority to commence, on behalf of the

Debtors estates, fraudulent conveyance actions against Bain, officers of the Debtors, and others arising out of dividend and recapitalization transactions which occurred a year and three quarters prior to the Debtors Chapter 11 petitions. In addition, the Committee asserts related claims of breach of fiduciary duty which are premised entirely on the same transactions. Bain submits this opposition, first, to briefly respond to misstatements in the Committees motion, and second, to object to the Committees motion on the ground that the Committee has conflicts of interest which have already impaired the Committees performance of its duties and establish that it is

1

Bain expressly files this motion without appearing in the Bankruptcy Court or consenting to the jurisdiction of the Bankruptcy Court for purposes of any litigation against Bain, and without waiving any rights or

not the proper party to be authorized to initiate and pursue this litigation at a potential cost of millions of dollars to the estate. 2. As has been widely reported in the press, massive price-cutting by WalMart

during the 2003 Christmas Season caused a number of retailers in the toy business either to file for Chapter 11 or to consider exiting the retail toy business altogether. As a result of that pricecutting, the Debtors were forced to file their Chapter 11 petitions in January, 2004. During the 2003 Christmas Season, WalMart engaged in a massive price-cutting spree during which, we are advised, it was selling key toy items at prices at or below the prices at which products were being sold by the toy manufacturers to KB Toys. In all likelihood, WalMart could only have sold toys at such prices if the toy manufacturers were selling their products to WalMart at prices significantly lower than the prices at which they were selling to KB Toys. For months, the Debtors and Bain have urged the Committee and its professionals to investigate the pricing practices of the toymakers in relation to mass retailers to determine whether these practices contributed to the Debtors difficulties. However, the Committee -- three of whose six members2 consist of the large toy manufacturers themselves, Hasbro, Inc., Mattel, Inc., and Lego Systems, Inc. -- has, not surprisingly, refused to even investigate such matters. Instead, the Committee seeks standing to assert claims allocating blame for KB Toys failure to Bain, management, and others, based upon the dividend and recapitalizations transactions which occurred a year and three quarters before the Debtors Chapter 11 petitions. 3. As we shall describe below, the Committees claims that the April, 2002 dividend

and recapitalizations transactions left the Debtors insolvent or with unreasonably small working capital are without merit. More to the point, however, the Committee has clear conflicts of

objections, including any objections to jurisdiction or venue and any rights to a jury trial.

-2-

interest and is not the proper party to be pursuing claims arising out of the Debtors failure at a likely cost to the estate of millions of dollars. Bain recognizes that the Debtors cannot

themselves investigate or prosecute actions against their officers or shareholders. However, the Committee, which has clear conflicts of interest, is not the proper party to be investigating or pursuing actions relating to the Debtors failure, particularly now, when the Debtors are attempting to negotiate a sale of their business and a consensual Chapter 11 plan. At an appropriate time, a trustee, a liquidating trustee, or another party may be authorized and appointed to investigate and pursue any claims that he or she may think appropriate. A. Background 4. In its papers, the Committee suggests that the Debtors were left insolvent or

with unreasonably small capital as a result of the dividend and related recapitalization transactions by the Debtors in April, 2002, and that the recapitalization transactions were the cause of the Debtors Chapter 11 petitions a year and three quarters later. While this is not the time to litigate those claims, the Committees assertions call for a brief response. 5. In December, 2000, Bain, other entities, and the companys management acquired

the KB Toys business for a price of approximately $302 million, financed with a contribution of equity and debt. 6. Despite the effects of a general slowdown in the national economy and the effects

of September 11, 2001, KB Toys was a highly profitable business. For its fiscal year ending February 2, 2002, alone, the last fiscal year before the recapitalization transactions, KB Toys generated EBITDA of more than $76 million. Moreover, as of the end of the fiscal year ending February 2, 2002, the operating business had a shareholder equity in excess of $150 million, and

Bain is informed and believes that Big Lots, Inc. has resigned from the Committee.

-3-

current assets exceeded current liabilities by more than $250 million.3 7. The suggestion that the recapitalization transactions left the Debtors insolvent or

with inadequate working capital is sheer nonsense. Thus: Following the recapitalization transactions, the Debtors operating companies had shareholders equity as reflected on their balance sheet in excess of $100 million. Following the recapitalization transactions, the Debtors had current assets in excess of current liabilities by more than $110 million. Following the recapitalization transactions, the Debtors had excess availability (i.e., borrowing capability) under their bank credit agreement equal to many times the amount that was required under that agreement. Moreover, contrary to the suggestion in the Committees papers, the Debtors continued to have excess availability and borrowing capability far in excess of what was required under their credit agreement until Christmas 2003, when WalMart engaged in its drastic price-cutting practices. In April, 2003, nearly a full year after the recapitalization transactions, KB Toys banks loaned the company additional monies and the banks further relaxed the limited covenant governing excess availability in KB Toys credit agreement. The transactions in question had the approval of 100% of KB Toys bank lenders. There can be little dispute that the company could have and would have survived,

8.

and possibly thrived, but for the actions of the toy manufacturers and WalMart during the Christmas 2003 season. During that season, WalMart -- with whom KB Toys had been able to coexist in the marketplace for years -- slashed its prices. As was widely reported in the press, WalMarts pricing actions during the Christmas 2003 season caused widespread crisis throughout the toy industry, and resulted in the failure or decisions of a number of retail toy companies to exit the retail toy business. In sum, the Debtors Chapter 11 petitions were the result of the actions by WalMart in slashing prices and, very likely, the actions of the toy

3

KB Toys corporate organization consists of a series of holding companies which in turn own the operating companies. The operating companies held substantially all of the assets. The only substantial debt at the level above the operating companies level was the $45 million Seller Note owed to Consolidated Stores Corp. (Big Lots, Inc.) issued to Consolidated in connection with the purchase of the business from Consolidated in December, 2000. However, none of the operating companies have any liability on that note and no payments of principal or interest were due on the note until December 7, 2010.

-4-

manufacturers in selling to WalMart at prices below the prices at which they were selling to KB Toys and others. 9. While Bain certainly does not dispute the right of an appropriate representative of

the estate to bring whatever claims he or she might want, the facts here do not even approach the kinds of circumstances in which the courts have found fraudulent conveyances. See e.g., Moody v. Security Pacific Business Credit, Inc., 971 F.2d 1056, 1073 (3d Cir. 1992) (Rejecting claims that leveraged buyout transactions (LBO) resulted in fraudulent conveyances where company did not fail for a year and a half after the transaction and resulted in part from price slashing and inventory dumping by a competitor, stating: Businesses fail for all sorts of reasons, and the fraudulent conveyances laws are not a panacea for such failures); Peltz v. Hatten, 279 B.R. 710 (D. Del. 2002) (Dismissing fraudulent conveyance claims challenging distributions in an LBO transaction, even though LBO occurred only one year before Chapter 11 petition and company had been losing -- not making -- money prior to the transaction); MFS/Sun Life Trust-High Yield Series v. Van Dusen Airport Services Co., 910 F.Supp 913 (S.D.N.Y. 1995) (Rejecting fraudulent conveyance claim where Debtors were not in default of notes or credit agreements for a period of 9 months after LBO). THE COMMITTEES MOTION SHOULD BE DENIED 10. The Committee in this cases consists of six members, three of whom are the

principal toy manufacturers who may, themselves, be to blame for the Debtors chapter 11 petitions. Three of the six members of the Committee are Hasbro, Mattel, and Lego. There is no doubt that those members of the Committee -- and the Committees counsel in this case -- have every incentive to blame Bain and others for the Debtors Chapter 11 petitions, and to take the blame away from themselves, or WalMart, one of their largest customers, where it may well belong. Moreover, the actions of the Committee and its representatives clearly establish their -5-

conflicts of interest. 11. Bain, counsel for the Debtors, and the Debtors own officers have advised the

Committees attorneys that the facts concerning the activities of the toy manufacturers in this case -- including the actions of the three toy manufacturers on the Committeehave direct bearing on the bona fides of claims of fraudulent conveyance and breach of fiduciary duty asserted against insiders. Despite the many hundreds of thousands of dollars of legal and professional fees incurred by the Committees professionals and billed to the estate to date, the Committee and its professionals have not even investigated the possible claims against toy manufacturers or against WalMart, with whom the toy manufacturers on the Committee continue to do a large volume of business. Instead, the Committee and its professionals seek authority to file a lawsuit against Bain and the Debtors management blaming them for the Debtors Chapter 11 petitions as a result of a transaction which occurred a year and three quarters before the Debtors Chapter 11 filings. 12. Bain does not dispute the right of an appropriate representative of the debtor to

file any legal proceeding he or she may wish. But the Committee has clear and demonstrated conflicts in seeking to blame Bain and the Debtors management rather than the toy manufacturers and WalMart. Before the estate becomes obligated to pay millions of dollars of legal and other professional fees to pursue litigation allocating blame for the Chapter 11 petitions, it is incumbent that any such litigation be brought by a proper professional -- such as a trustee, liquidating trustee, or other person -- who will review such claims without the Committees conflicts of interest. The limited resources of the estate should be under the oversight of a party who can determine, free of conflicts, what litigation should be brought, against whom it should be brought, whether it should be resolved, and how much of the estates

-6-

money should be spent pursuing such claims. 13. The rationale for granting creditors derivative standing to pursue claims under

Sections 547 and 548 of the Bankruptcy Code has been articulated as follows: A debtor-in-possession often acts under the influence of conflicts of interest and may be tempted to use its discretion under Sections 547 and 548 as a sword to favor certain creditors over others, rather than as a tool to further its reorganization for the benefit of all creditors as Congress intended. Canadian Pacific Forest Products Ltd v. J.D. Irving, Ltd. (In re The Gibson Group, Inc.), 66 F.3d 1436, 1441 (6th Cir. 1995); cited in In re Cybergenics Corp., 330 F.3d 548, 573 (3d Cir. 2003). This same rationale demands denial of a request for derivative standing where, as here, the creditors seeking standing to pursue claims on behalf of the estate also have conflicts of interest that may tempt them to use their discretion to favor certain creditors [i.e., themselves] over others. See The Gibson Group, Inc., 66 F.3d at 1441; see also In re Bohack Corp., 607 F.2d 258, 264-65 (2d Cir. 1979) (finding that creditors committee should not be permitted to recommend counsel to pursue action where complaint alleged, among other things, that several of the debtors trade creditors improperly tightened the debtors credit at a competitors request and thus contributed to the financial disaster which overtook [the debtor]). 14. As at least one court has noted, there are distinct costs to permitting derivative

standing, such as creditor conflicts of interest . . . potential for spiteful, dilatory or wasteful litigation tactics, and the risk of side deal settlements. NBP Park Ridge Bank v. SRJ Enters., Inc. (In re SRJ Enters., Inc.), 151 B.R. 189, 196, n.7 (Bankr. N.D. Ill. 1993). The mirror image of these costs are benefits of appointing an independent examiner or trustee. Id. Such should occur here. 15. In light of the Committees apparent conflicts of interest in this case, the

Committees request for derivative standing to pursue claims against Bain and the Debtors

-7-

management should be denied. Under the circumstances, there is a clear risk that the awarding the Committee standing to pursue such claims will result in a waste of the Debtors limited resources and permit the Committee to divert attention away from the role that WalMart and the toy manufacturers (including three Committee members) had to play in forcing the Debtors into bankruptcy. To date, the Committee and its professionals have consumed huge amounts of estate assets while obstructing every effort by management and the Board to fashion a timely plan of reorganization of the Debtors estates. It has taken seriatim inconsistent positions, which can only be understood as supporting the desire of certain Committee members to continue to sell toys to the Debtors whether the operations of estate contribute to realization of value by all creditors or not. Given the willingness of the Committee members and counsel to prolong this Chapter 11 case for their own benefits, it is impossible to believe that they will resist the temptation to protect their own interests if they also control any litigation choices of the estates. The only way to avoid that risk is to place the task of investigating and determining what, if any, litigation should be brought by the estate and against whom into the hands of an independent third party, such as a trustee. WHEREFORE, Bain respectfully submits that the Committees request for standing should be denied. Dated: February 25, 2005 Respectfully submitted, MORRIS, NICHOLS, ARSHT & TUNNELL /s/ Daniel B. Butz Thomas R. Hunt, Jr. (No. 466) Daniel B. Butz (No. 4227) 1201 North Market Street P.O. Box 1347 Wilmington, Delaware 19899-1347 (302) 658-9200 -and-

-8-

William F. McCarthy, Esq. David S. Elkind, Esq. Don S. DeAmicis, Esq. ROPES & GRAY LLP 45 Rockefeller Plaza New York, N.Y. 10111 (212) 841-0608 -andOne International Place Boston, MA 02110-2624 Tel: (617) 951-7000 Fax: (617) 051-7050 Counsel to Bain Capital Fund VII, L.P.

452931

-9-

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 6.1-2. PriorityДокумент8 страниц6.1-2. PriorityTonyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Founders AgreementДокумент10 страницFounders AgreementZc100% (2)

- Test Bank Accounting 25th Editon Warren Chapter 12 Accounting For PDFДокумент103 страницыTest Bank Accounting 25th Editon Warren Chapter 12 Accounting For PDFKristine Vertucio100% (1)

- Hanil Vs BNIДокумент2 страницыHanil Vs BNIashrizas100% (1)

- Notice of Hearing Dec 4 2012Документ1 страницаNotice of Hearing Dec 4 2012RmuseManОценок пока нет

- Haas 503b and 18 USC 3057a Motion Oct2012 Version 31aДокумент40 страницHaas 503b and 18 USC 3057a Motion Oct2012 Version 31aRmuseManОценок пока нет

- Bain Cap Inv, LLC - 1997 Application For Reg. As A Foreign Ltd. Liability Co.Документ5 страницBain Cap Inv, LLC - 1997 Application For Reg. As A Foreign Ltd. Liability Co.RmuseManОценок пока нет

- Bain Cap, Inc - 1990 Foreign Corp. Cert.Документ5 страницBain Cap, Inc - 1990 Foreign Corp. Cert.RmuseManОценок пока нет

- Bain Cap Inv, LLC Annual Rep 12-2002Документ2 страницыBain Cap Inv, LLC Annual Rep 12-2002RmuseManОценок пока нет

- Paul Traub Lied - Disgorge Motion - See Part 19 and 35Документ21 страницаPaul Traub Lied - Disgorge Motion - See Part 19 and 35RmuseManОценок пока нет

- Bain Cap, Inc - 1990 Foreign Corp. Cert.Документ5 страницBain Cap, Inc - 1990 Foreign Corp. Cert.RmuseManОценок пока нет

- Affidavit of Stephen (Laser) Haas Aug 3, 2012Документ3 страницыAffidavit of Stephen (Laser) Haas Aug 3, 2012RmuseManОценок пока нет

- Judges Opinion MNAT Lied - See Pages 16-21Документ60 страницJudges Opinion MNAT Lied - See Pages 16-21RmuseManОценок пока нет

- A Look at Lay Off Under Industrial Dispute Act, 1947Документ16 страницA Look at Lay Off Under Industrial Dispute Act, 1947Ragini SharmaОценок пока нет

- Labour Law Recognition NotesДокумент13 страницLabour Law Recognition NotesBrishti MondalОценок пока нет

- HA3021 Week 9 Lecture 2Документ52 страницыHA3021 Week 9 Lecture 2Sheshan Induwara MallawaarachchiОценок пока нет

- IRP Replacement for Failure to Conduct CIRPДокумент9 страницIRP Replacement for Failure to Conduct CIRPKashaf JunaidОценок пока нет

- Agreement For Marketing ServicesДокумент4 страницыAgreement For Marketing ServiceskhriskammОценок пока нет

- Indemnity bond trainingДокумент3 страницыIndemnity bond trainingSudipta MishraОценок пока нет

- Construction Contracts LiabilityДокумент6 страницConstruction Contracts Liability517wangyiqiОценок пока нет

- Partnership QuestionsДокумент2 страницыPartnership Questionslachimolaluv chimОценок пока нет

- Civil Law Review Case DigestsДокумент29 страницCivil Law Review Case DigestsKenneth HolascaОценок пока нет

- Generic ATC Mutual (Inbound Balance) NDA - IndiaДокумент5 страницGeneric ATC Mutual (Inbound Balance) NDA - IndiaTELECOME SOFTWAREОценок пока нет

- Full First Coupon IBoxx TRS GuideДокумент11 страницFull First Coupon IBoxx TRS GuideEdwin ChanОценок пока нет

- Partnership Formation and TypesДокумент37 страницPartnership Formation and Typeslili cutieОценок пока нет

- Employment ContractДокумент17 страницEmployment Contractsnelu1178Оценок пока нет

- Intellectual Property Guide South Africa 2016: Intellectual Property Office Is An Operating Name of The Patent OfficeДокумент22 страницыIntellectual Property Guide South Africa 2016: Intellectual Property Office Is An Operating Name of The Patent OfficePriscilla ChataikaОценок пока нет

- Nabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Документ9 страницNabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Dhananjai RaiОценок пока нет

- Lsl-Oc Contracts Part 2Документ6 страницLsl-Oc Contracts Part 2Ezekiel T. MostieroОценок пока нет

- REAL ESTATE MORTGAGE-CalubayanДокумент5 страницREAL ESTATE MORTGAGE-CalubayanChristopher JuniarОценок пока нет

- Annex E Advance Payment GuaranteeДокумент1 страницаAnnex E Advance Payment GuaranteeRizriyasОценок пока нет

- Indemnification Agreements and Motor Carrier Transportation Contracts - 2112 SSL Draft, The Council of State GovernmentsДокумент2 страницыIndemnification Agreements and Motor Carrier Transportation Contracts - 2112 SSL Draft, The Council of State Governmentsbvoit1895Оценок пока нет

- Option Chain - NSE India1Документ1 страницаOption Chain - NSE India1bharatОценок пока нет

- Credit Concurrence CasesДокумент11 страницCredit Concurrence CasesRaven Claire MalacaОценок пока нет

- Insurance Case DigestДокумент2 страницыInsurance Case Digestmaximum jicaОценок пока нет

- SALES - Negotiable Documents of TitleДокумент6 страницSALES - Negotiable Documents of TitleAlexandra KhadkaОценок пока нет

- Essential Steps to Enforce Payment and Liability for Negotiable InstrumentsДокумент12 страницEssential Steps to Enforce Payment and Liability for Negotiable InstrumentsHuzzain PangcogaОценок пока нет

- United States Court of Appeals, Tenth CircuitДокумент5 страницUnited States Court of Appeals, Tenth CircuitScribd Government DocsОценок пока нет

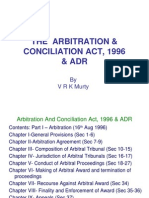

- The Arbitration & Conciliation Act - DДокумент46 страницThe Arbitration & Conciliation Act - DArchana Ramani0% (1)