Академический Документы

Профессиональный Документы

Культура Документы

Alan Farley Newsletter

Загружено:

Ramos LewisИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Alan Farley Newsletter

Загружено:

Ramos LewisАвторское право:

Доступные форматы

Thursday, September 27, 2012

Today's Overview

Index futures ticked higher overnight but lost ground in Thursday's premarket, in reaction to the weakest durable goods data since 2009. Traders shook off that news into the U.S. open and then got hit by a surprisingly weak pending home sales report. Positive seasonality overcame negative news flow, yielding steady action on the S&P 500 and a recovery on the Nasdaq 100, thanks to a sizable Apple (AAPL) bounce. Spain announced budget austerity measures around 11:30 a.m. EDT, triggering euro whipsaws, followed by a midday rally that lifted U.S. indices to intraday highs. The uptick pushed the S&P 500 above overnight resistance at 1435 and into 1445, where the 200-bar EMA on the 60-minute all-sessions chart ended the upside. The broad market then wobbled sideways in quiet action for the rest of the day Banks opened the session strongly and showed leadership during the rally, with KBW Banking Index (KBX) bouncing back to 50. Newsletter pick Wells Fargo (WFC) jumped off support, despite weak home sales data and shows a broad rising channel, with resistance near $36.50. However, short-term resistance remains in place and I do not expect a straight up move back to the highs. Apple (AAPL) bounced strongly, rising more than 16 points and filling Wednesday's gap. Despite the recovery, the stock has lost momentum since its visit to $700 and choppy price action is likely between now and company earnings on October 23. The same holds true with big tech in the Nasdaq 100, which shows a less constructive pattern than the S&P 500 after the three-day decline. Chip stocks also had strong sessions, following through on Wednesday's reversal. However, the PHLX Semiconductor Index (SOX) is now firmly planted below new resistance at the 50- and 200-day EMAs, as well as a broken double top at 395. This suggests the current recovery will fail to trade over 400. Notably, Intel (INTC) ticked higher today but failed to remount broken support levels. (Continued on the next page.)

PLEASE SEE IMPORTANT LEGAL DISCLAIMER ON LAST PAGE

Thursday, September 27, 2012

The last day of the quarter tends to offer few trading opportunities because funds do not want to rock the boat and mess around with their quarterly results. It could be different this time around if European news flow intervenes. Given the market's strong buy reaction to today's weak data, I doubt that anything on this side of the Atlantic will interfere with the bounce that began this afternoon. I bought Wells Fargo (WFC) in Wednesday's premarket and flipped it into the rally. I bought Wal-Mart (WMT) at a trend line just a minute or two before the S&P 500 took off, so I added to it for mark-up exposure. I hope to hold it into the first trading day of the new quarter, on Monday.

2

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Random Notes: Bullet Points on the Market

The major indices are not set up to challenge the rally highs, despite today's reversal. Watch S&P 500 futures at 1450 or around 1458 on the cash index. The broad market will move higher more easily if that level gets remounted. Transports underperformed but closed well in the green. Gold and silver bounced back to their rally highs. I mentioned 1445 last evening as a possible mark-up high. The S&P 500 missed it by $0.50. The Russell 2000 now shows resistance at 850. Crude oil bounced but is now trading in a descending channel. Retail underperformed. salesforce.com (CRM) remounted broken support.

3

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

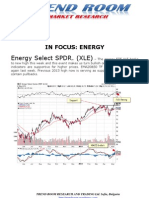

Daily Spotlight

General Motors (GM) is still struggling to enter an uptrend, nearly two years after coming out of bankruptcy. This follows a 20-year bear market into its 2008 collapse. The stock came public near $34 in November and peaked near $40 a few months later. The subsequent decline shows multiple waves that found support near $18 in October 2011. The price has been grinding sideways in a big rectangle for the last year.

GM is currently trading near the midpoint of the trading range, with weak volume that points to caution and apathy, in reaction to the deteriorating economy. The company also lost the twoyear advantage it had over Toyota (TM), which got hit with a double whammy of product recalls and a natural disaster. That benefit might reemerge if the China-Japan dispute shuts down that lucrative trading channel.

(Continued on the next page)

4

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Tempur-Pedic (TPX) topped out at an all-time high near $87 in April, following a threeyear rally. It accelerated to the downside in June, in an ugly collapse that is still in progress, despite today's 14% bounce. That rally took place in reaction to a company acquisition, but nothing on the daily pattern shows a trend change. As a result, the 2012 low near $20.50 remains in play and could still be broken.

Today's action looks far bullish than the high percentage gain, when evaluating the bounce into the 50-day EMA resistance and subsequent graveyard doji. The huge gap between $27 and $42 is the dominant feature in this pattern, with the price failing to close the hole when it topped out near $36 earlier this month. There is no guarantee that the stock will fill the gap completely, prior to rolling over and testing the low. * * * (Spotlight presents updated index analysis, quick takes on reader favorites and fresh views of active picks. The section belongs to our subscribers, so let Alan know what charts you would like to see by sending him your requests at trader@hardrightedge.com. Please note that Alan cant answer all of your requests due to time and space restrictions. Spotlight stocks are not recommendations to buy or sell, and will not be placed on the Watch List.)

(See Watch List on the next page)

5

2012 TheStreet, Inc. All rights reserved.

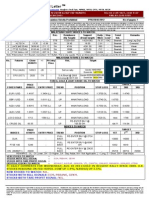

Thursday, September 27, 2012

[Up .

Watch List

LinkedIn (LNKD) filled Wednesday's gap. (long - 9/24/12) Geo Group (GEO) bounced to the midpoint of the three-week range. (long - 9/20/12) F5 Networks (FFIV) tested the two-day high and pulled back. (long - 9/18/12) Bloomin' Brands (BLMN) bounced strongly and is testing the rally high. (long - 9/18/12) Mattel (MAT) bounced along the 20-day SMA. (long - 9/13/12) HollyFrontier Corp. (HFC) bounced at breakout support. (long - 9/11/12) Westlake Chemicals (WLK) bounced at breakout support. (long - 9/10/12) Chevron (CVX) bounced above range support and may have posted a higher low. (long - 9/7/12) Mueller Water Products (MWA) is testing the rally high. (long - 9/6/12) Wells Fargo (WFC) bounced at breakout support. (long - 9/6/12) FleetCor Technologies (FLT) tried to establish support at the 20-day SMA. (long - 9/4/12) Fastenal (FAST) tested the two-day high and pulled back. (long - 8/28/12) Infinity Pharmaceuticals (INFI) is testing range resistance near $23.50. (long - 8/24/12) Medivation (MDVN) rallied to a new high. (long - 8/20/12) Ixia (XXIA) completed a cup and handle breakout pattern. (long 8/7/12) Xenoport (XNPT) is testing the rally high. (long - 8/2/12) CoreLogic (CLGX) bounced in a constructive session. (long - 7/30/12) Watson Pharmaceuticals (WPI) bounced at support and may have posted a higher low. (long -7/27/12) Alexion Pharmaceuticals (ALXN) posted an inside day. (long - 7/9/12)

6

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Watch List Ticker

BLMN will wave a red flag if it sells off here because it might complete and head-andshoulders top XXIA could take a very strong move off this platform but it might not evolve for a few sessions WPI looks good right here.

7

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Sarepta Therapeutics (SRPT)

Todays Close: $14.71, up $0.40

Sarepta Therapeutics (SRPT) is a high-risk small-cap biotech play with several drug applications in progress. The company got fast-track status for one group last week and bounced to the August high, which marks resistance going back to 2007. A breakout above $16.50 to $17 could yield an uptrend into the mid-$20s. In addition, the stock appears to be carving out the last stages of a cup-and-handle breakout pattern. Keep in mind this issue is vulnerable to news shocks that can trigger big losses. There are two options, depending on the time frame. SRPT been consolidating on the 20-day SMA for the last four sessions. This has set up a 60-minute basing pattern, with resistance at $14.80 to $15. Traders can buy that breakout or wait for the larger-scale setup. Longer-term positions carry more risk because the range could hold and yield a downtrend.

(See second chart on the next page.)

8

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Sarepta Therapeutics (SRPT)

9

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Alan welcomes your questions about The Daily Swing Trade and his swing trading strategy and techniques. Please email Alan with your questions at trader@hardrightedge.com. However, please remember that The Daily Swing Trade is not intended to provide personalized investment advice. Do not email Alan seeking personalized investment advice, which he cannot provide. Question: Why is the failure rate for new traders so high? Alan Farley: If you want to be a profitable trader, be patient because the market will take years to understand and master. Unfortunately, new traders are looking for something that does not exist: easy money. This dooms the majority from the beginning, but a few will survive and prosper. Others will fail because they are searching for a perfect market formula that works in all situations and never hurts their egos. That does not exist either. So, this leaves a small percentage of traders who really want to learn how to make money. The most important and least understood lesson for the new trader to learn is the duality or grayness of everything that passes for market knowledge. That annoying subjectivity makes brains melt but it also forces a razorlike concentration on risk management and discipline, which are the real skills needed to prosper.

10

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Guidelines and Frequently Asked Questions

For guidelines about the best way to use The Daily Swing Trade and for answers to the questions readers ask most often, a guide, "Your Questions Answered About Swing Trading," has been created. For the guide, click here: http://www.thestreet.com/tsc/dst_rep_questions.pdf Farleys latest book, The Master Swing Trader Toolkit: The Market Survival Guide, was released in April 2010.

11

2012 TheStreet, Inc. All rights reserved.

Thursday, September 27, 2012

Contact Info

Customer Service: Please email swingtrade@thestreet.com, or call 1-866-321-TSCM (8726) Mon. Fri. 8 a.m. to 6 p.m. ET; or outside the U.S. and in Canada, call 1-212-321-5200 Reader Feedback and Questions: Please send an email directly to Alan at trader@hardrightedge.com. Again, please direct all account-related inquiries to customer service.

Legal Information

Please see the Terms of Use here.

12

2012 TheStreet, Inc. All rights reserved.

Вам также может понравиться

- Stocks and QE All Things Must PassДокумент27 страницStocks and QE All Things Must Passambasyapare1Оценок пока нет

- This Is Not A New Bull Market For StocksДокумент3 страницыThis Is Not A New Bull Market For StocksValuEngine.comОценок пока нет

- Fred Tam News LetterДокумент7 страницFred Tam News LetterTan Lip SeongОценок пока нет

- 2012 01 09 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 09 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- 2012 01 06 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 06 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- 2012 01 04 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 04 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- 2011 08 08 Migbank Daily Technical Analysis Report+Документ15 страниц2011 08 08 Migbank Daily Technical Analysis Report+migbankОценок пока нет

- Weekly Market Commentary 03112013Документ3 страницыWeekly Market Commentary 03112013monarchadvisorygroupОценок пока нет

- Volume 9 Highlights: InsideДокумент20 страницVolume 9 Highlights: InsidedpbasicОценок пока нет

- Technically Speaking - October 21, 2015Документ12 страницTechnically Speaking - October 21, 2015dpbasicОценок пока нет

- 2012 01 10 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 10 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- LossesДокумент7 страницLossesplato363Оценок пока нет

- The Technical Take - April 21, 2014Документ18 страницThe Technical Take - April 21, 2014dpbasicОценок пока нет

- Technical Trend: (05 July 2011) Equity Market: India Daily UpdateДокумент4 страницыTechnical Trend: (05 July 2011) Equity Market: India Daily UpdateTirthankar DasОценок пока нет

- Hammerstone Midday Look 9-24-2014Документ4 страницыHammerstone Midday Look 9-24-2014TheHammerstoneReportОценок пока нет

- Market Commentary 4/25/2012Документ1 страницаMarket Commentary 4/25/2012CJ MendesОценок пока нет

- Jun 11, 2012Документ12 страницJun 11, 2012molodowОценок пока нет

- 2012 01 03 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 03 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Stock Newsletter Vol 1 Issue 2 1-15-14Документ10 страницStock Newsletter Vol 1 Issue 2 1-15-14Liam McMahonОценок пока нет

- 2011 12 05 Migbank Daily Technical Analysis ReportДокумент15 страниц2011 12 05 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- 2011 08 05 Migbank Daily Technical Analysis Report+Документ15 страниц2011 08 05 Migbank Daily Technical Analysis Report+migbankОценок пока нет

- Today's Highlights - 06-27-11Документ14 страницToday's Highlights - 06-27-11timurrsОценок пока нет

- STA MarketUpdate 5-17-10Документ9 страницSTA MarketUpdate 5-17-10Ed CarlsonОценок пока нет

- Edition 10 - Chartered 7th July 2010Документ9 страницEdition 10 - Chartered 7th July 2010Joel HewishОценок пока нет

- US Market Review For Oct 8 2014Документ12 страницUS Market Review For Oct 8 2014FusionIQОценок пока нет

- Wildebeests Head Into A New Year 1-4-12Документ12 страницWildebeests Head Into A New Year 1-4-12Jeb Terry SrОценок пока нет

- 2011 12 06 Migbank Daily Technical Analysis ReportДокумент15 страниц2011 12 06 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Market Tops BookletДокумент16 страницMarket Tops BookletDebarshi MajumdarОценок пока нет

- The Technical Take July 15 2013 2 PDFДокумент21 страницаThe Technical Take July 15 2013 2 PDFfu jiОценок пока нет

- Welcome Morning Update & Oscillator Chat Room Charting Programs FAQ'sДокумент1 страницаWelcome Morning Update & Oscillator Chat Room Charting Programs FAQ'sHarvey DychiaoОценок пока нет

- Trendroom q2 ThemesДокумент8 страницTrendroom q2 ThemesTREND ROOM Research & Trading Ltd.100% (2)

- Gold Report: Analyst: Hareesh VДокумент2 страницыGold Report: Analyst: Hareesh Vhitesh315Оценок пока нет

- Get Daily Nifty Market News - 08 Oct 2015Документ8 страницGet Daily Nifty Market News - 08 Oct 2015Pranjali UpadhyayОценок пока нет

- Daily Technical Analysis Report 20/october/2015Документ14 страницDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedОценок пока нет

- Tactical Playbook 10222012 - IdeafarmДокумент28 страницTactical Playbook 10222012 - IdeafarmmaikubОценок пока нет

- May 2, 2010Документ10 страницMay 2, 2010Stanky LeeОценок пока нет

- The Technical Take - September 16, 2013Документ20 страницThe Technical Take - September 16, 2013dpbasicОценок пока нет

- Daily Market Letter 09 May 2013Документ4 страницыDaily Market Letter 09 May 2013TREND ROOM Research & Trading Ltd.Оценок пока нет

- 2011 08 01 Migbank Daily Technical Analysis Report+Документ15 страниц2011 08 01 Migbank Daily Technical Analysis Report+migbankОценок пока нет

- Pid 14 MT23 160412Документ20 страницPid 14 MT23 160412Amol ChavanОценок пока нет

- Today's Highlights - 06-20-11Документ13 страницToday's Highlights - 06-20-11timurrsОценок пока нет

- General Market Update - July 2019Документ7 страницGeneral Market Update - July 2019Anonymous kOLTDa6Оценок пока нет

- DT Stock and ETF Report 1-9-2015Документ20 страницDT Stock and ETF Report 1-9-2015chr_maxmannОценок пока нет

- 2011 12 09 Migbank Daily Technical Analysis ReportДокумент15 страниц2011 12 09 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Aus Tin 20106163Документ158 страницAus Tin 20106163david_smith_med1946Оценок пока нет

- Technically Speaking - September 22, 2015Документ11 страницTechnically Speaking - September 22, 2015dpbasicОценок пока нет

- Derivatives 2012Документ44 страницыDerivatives 2012a p100% (1)

- Today's Highlights - 07-20-11Документ10 страницToday's Highlights - 07-20-11timurrsОценок пока нет

- Finding The Next AppleДокумент75 страницFinding The Next AppleForbesОценок пока нет

- Global FX Insights - 25 July 2016Документ12 страницGlobal FX Insights - 25 July 2016alvarocantarioОценок пока нет

- Dynamic Trader Daily Report: Special NoteДокумент2 страницыDynamic Trader Daily Report: Special NoteBudi MulyonoОценок пока нет

- The Multi-Year Bear Market Appears Ready To ReturnДокумент2 страницыThe Multi-Year Bear Market Appears Ready To ReturnValuEngine.comОценок пока нет

- 2011 12 02 Migbank Daily Technical Analysis ReportДокумент15 страниц2011 12 02 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- 2011 10 25 Migbank Daily Technical Analysis ReportДокумент15 страниц2011 10 25 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Structures in TradeДокумент2 страницыStructures in TraderegdddОценок пока нет

- Free Commodity Market TipsДокумент9 страницFree Commodity Market TipsRahul SolankiОценок пока нет

- Weekly Trends March 10, 2016Документ5 страницWeekly Trends March 10, 2016dpbasicОценок пока нет

- Today's Highlights - 06-21-11Документ14 страницToday's Highlights - 06-21-11timurrsОценок пока нет

- The Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexОт EverandThe Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Shoulder Case Study 2Документ2 страницыShoulder Case Study 2Ramos LewisОценок пока нет

- ShoulderДокумент4 страницыShoulderRamos LewisОценок пока нет

- Western Medical Conditions1Документ3 страницыWestern Medical Conditions1Ramos LewisОценок пока нет

- Saez Janitorial Invoice1Документ1 страницаSaez Janitorial Invoice1Ramos LewisОценок пока нет

- Ac 426 A A A 6Документ8 страницAc 426 A A A 6Ramos LewisОценок пока нет

- Read MeДокумент3 страницыRead MeRamos LewisОценок пока нет

- Start DermatologyДокумент1 страницаStart DermatologyRamos LewisОценок пока нет

- CiudadaniaДокумент5 страницCiudadaniaMargarita AnteloОценок пока нет

- Content Forms 000000 Form Claim Vision enДокумент1 страницаContent Forms 000000 Form Claim Vision enRamos LewisОценок пока нет

- Project Profile On Bakery Products: Mixing of Ingredients Except Flour in Required Proportion in Paste FormДокумент4 страницыProject Profile On Bakery Products: Mixing of Ingredients Except Flour in Required Proportion in Paste FormKomma RameshОценок пока нет

- Factors Affecting Balance of PaymentsДокумент3 страницыFactors Affecting Balance of Paymentsashu khetan100% (5)

- HRM Report FullДокумент13 страницHRM Report FullfarzanaОценок пока нет

- KV Recruitment 2013Документ345 страницKV Recruitment 2013asmee17860Оценок пока нет

- RVU Distribution - New ChangesДокумент5 страницRVU Distribution - New Changesmy indiaОценок пока нет

- 07 Opportunities For PoA in Energy Efficiency by Konrad Von RitterДокумент11 страниц07 Opportunities For PoA in Energy Efficiency by Konrad Von RitterThe Outer MarkerОценок пока нет

- Saln 2012 Form Chris 2018Документ2 страницыSaln 2012 Form Chris 2018Ronel FillomenaОценок пока нет

- Paramount InvoiceДокумент4 страницыParamount InvoiceDipak KotkarОценок пока нет

- Evaluasi Penerapan Tarif Angkutan Umum Kereta Api (Studi Kasus Kereta Api Madiun Jaya Ekspres)Документ8 страницEvaluasi Penerapan Tarif Angkutan Umum Kereta Api (Studi Kasus Kereta Api Madiun Jaya Ekspres)sekar arinОценок пока нет

- Comp Data2312 PDFДокумент338 страницComp Data2312 PDFkunalОценок пока нет

- Saturn in LibraДокумент13 страницSaturn in Librasands109Оценок пока нет

- Documents - Tips Chopra Scm5 Tif Ch05Документ23 страницыDocuments - Tips Chopra Scm5 Tif Ch05shahad100% (2)

- Markets and Market Failure With Cases: Chris - Herbert@harvard - EduДокумент10 страницMarkets and Market Failure With Cases: Chris - Herbert@harvard - EduTOM ZACHARIASОценок пока нет

- الاعتماد على مصادر التمويل المحلي لتحقيق التنمية الاقتصادية عرض تجربة الهند PDFДокумент10 страницالاعتماد على مصادر التمويل المحلي لتحقيق التنمية الاقتصادية عرض تجربة الهند PDFnono rezigОценок пока нет

- Tugas ToeflДокумент3 страницыTugas ToeflIkaa NurОценок пока нет

- Jittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Документ8 страницJittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Jittipat PoonkhamОценок пока нет

- The Truth About EtawahДокумент4 страницыThe Truth About EtawahPoojaDasgupta100% (1)

- FM QuizДокумент3 страницыFM QuizSheila Mae AramanОценок пока нет

- #Last Will and TestamentДокумент3 страницы#Last Will and Testamentmatsumoto100% (1)

- ECS1601Документ68 страницECS1601JamesHHowell50% (2)

- Telecommuting Report FormДокумент1 страницаTelecommuting Report FormCarlo OroОценок пока нет

- Network HospitalДокумент2 271 страницаNetwork HospitalNamanОценок пока нет

- Company Profile PT BTR 2022 - 220611 - 085254 - 220707 - 113639Документ20 страницCompany Profile PT BTR 2022 - 220611 - 085254 - 220707 - 11363902171513Оценок пока нет

- Emerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHOДокумент25 страницEmerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHObuximranОценок пока нет

- A True History of Oil and GasДокумент2 страницыA True History of Oil and GasKaiysse YoukéОценок пока нет

- Planning and Economic DevelopmentДокумент9 страницPlanning and Economic DevelopmentGurleen KaurОценок пока нет

- Airports in Cities and RegionsДокумент192 страницыAirports in Cities and RegionsMarlar Shwe100% (2)

- Bamboo MethodДокумент76 страницBamboo Methodmusharafsaith88Оценок пока нет

- 50 KWord EbookДокумент247 страниц50 KWord EbookLio PermanaОценок пока нет

- Globalization and International BusinessДокумент14 страницGlobalization and International BusinesskavyaambekarОценок пока нет