Академический Документы

Профессиональный Документы

Культура Документы

Leasing Solution Ca-Final SFM (Full)

Загружено:

Pravinn_MahajanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Leasing Solution Ca-Final SFM (Full)

Загружено:

Pravinn_MahajanАвторское право:

Доступные форматы

PRAVINN MAHAJAN 9871255244, 8800684854

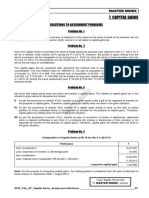

LEASING

Q1

Sunderam ltd.Is contemplating to acquire machine worth Rs 10,00,000. Company has 2 options

1

2

To lease the asset at annual lease rentals of Rs 3,34,000 for 5 years.

To take a Bank loan @ 15% p.a repayable in 5 yearly installments of Rs 2,00,000 + Interest

.

Tax rate 35%

Discount rate 16%

Depreciation 15% WDV

Option 1

Taking the asset on lease.

Lease rent p.a

Tax savings on Lease Rent

3,34,000 (0.35)

Rs 3,34,000

Rs 1,16,900

Statement of Present Value of Cash Outflow

Amount

Lease Rent

Tax saving

Option 2

Period

Factor

@ 16%

3.274

3.274

3,34,000

1-5

1,16,900

1-5

Net cash outlow

Present

Value

10,93,516

(3,82,731)

7,10,785

Purchasing the asset by obtaining loan from bank

Loan of Rs 10,00,000 @ 15%

Annual installment Rs 2,00,000 + interest

Depreciation

15% p.a WDV basis

Statement of cash outflow

1

Payment of Principal

2,00,000

Interest @ 15%

1,50,000

Tax savings on interest

52,500

Depriciation

1,50,000

Book value after 5 years 4,43,705

Tax savings on Depreciation

52500

Salvage value nil

2

2,00,000

1,20,000

42,000

1,27,500

3

2,00,000

90,000

31,500

1,08,375

4

2,00,000

60,000

21,000

92,119

44625

37,931

32,242

5

2,00,000

30,000

10,500

78,301

27,405

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of Present value on cash outflows

Amount

2,00,000

Period

1-5

Factor@16%

3.274

Present value

6,54,800

Interest

1,50,000

1,20,000

90,000

60,000

30,000

1end

2end

3end

4end

5end

0.862

0.743

0.641

0.552

0.476

1,29,300

89,160

57,690

33,120

14,280

Tax savings on Intt

52,500

42,000

31,500

21,000

10,500

1end

2end

3end

4end

5end

0.862

0.743

0.641

0.552

0.476

(45,255)

(31,206)

(20,192)

(11,592)

(4998)

Tax savings on Dep

52500

44,625

37,931

32,242

27,405

1end

2end

3end

4end

5end

0.862

0.743

0.641

0.552

0.476

(45,255)

(33,156)

(24,314)

(17,798)

(13,045)

1,55,297

5end

0.476

(73,921)

Principal

Salvage value

Scrap value

nil

Tax savings on

cap loss

(0 4,43,705)x 0.35

Present value of cash outflow

6,57,619

Present value of cash outflow is lower in case of loan option, So loan option is better

PRAVINN MAHAJAN 9871255244, 8800684854

Q2

Agrani Ltd needs Computer costing Rs 5,00,000. Company has 2 options

Option 1

To acquire the computer on lease at annual lease rent of Rs 1,25,000 payable at

Beginning of each year

Annual lease rent

Tax savings on Lease rent

(1,25,000 x 0.4)

Rs 1,25,000

Rs 50,000

Statement of present value of cash outflow in case of Lease option

Amount

Period

Factor

Present value

@10%

Lease Rent

Tax savings on

lease rent

Option 2

1,25,000

1,25,000

0

1-4beg

1

3.170

1,25,000

3,96,250

50,000

1-5end

Present value of Cash outflow

3.791

(1,89,550)

3,31,700

To Purchase computer by borrowing from bank @ 12%

Loan from Bank Rs 5,00,000 @ 12% , principal repayable as 30%, 25%, 20%,

15%, and 10% along with Interest

Statement of Principal and Interest

1end

2end

3end

4end

5end

Principal p.a

Interest

1,50,000 (30%)

1,25,000 (25%)

1,00,000 (20%)

75,000 (15%)

50,000

(10%)

60,000

42,000

27,000

15,000

6,000

Tax saving on

Interest @ 40%

24,000

16,800

10,800

6,000

2400

Installment of loan and interest is payable to bank at the end of each year

Depreciation p.a on SLM basis

Tax saving on depreciation

5,00,000 x 0.2

1,00,000 x 0.4

1,00,000

40,000

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of Present value of cash outflow if asset is purchased

Particulars

Installment

(Principal +

Interest)

Tax savings on

Interest

Tax savings on

Depreciation

Amount

Period

Factor@ 10%

Present

Value

2,10,000

1,67,000

1,27,000

90,000

56,000

1end

2end

3end

4end

5end

0.909

0.826

0.751

0.683

0621

1,90,890

1,37,942

95,377

61,470

34,776

24,000

16,800

10,800

6,000

2,400

1end

2end

3end

4end

5end

0.909

0.826

0.751

0.683

0.621

(21,816)

(13,877)

(8,111)

(4098)

(1,490)

3.791

(1,51,640)

3,19,423

40,000

1-5end

Net cash outflow

It is better to purchase the asset by borrowing from ban, as cash outflow in loan option is lower

than cash outflow in lease option

Q3

ABC company decided to acquire Pulp control device for Rs 5,00,000, Company has 2 options

Option1

To acquire the asset on lease by paying annual lease rent of Rs 55,000 at

beginning of each year.

Lease rent p.a

Rs 55,000 payable aty beginning of each year

Tax saving on lease rent

55,000 (1-0.5) = Rs 27,500

Discount rate is rate of Interest charge by bank after tax

10% ( 1 0.50) = 5%

Statement of Present value of cash outflow if asset is taken on lease

Lease Rent

Tax saving on

lease rent

Amount

Period

Factor @ 5%

55,000

55,000

0

1-9

1

7.108

27,500

1-10

7.722

Present value of Cash out flow

Present

Value

55,000

3,90,940

(2,12,355)

2,33,585

PRAVINN MAHAJAN 9871255244, 8800684854

Option 2

Purchase the Asset by borrowing from bank

Cost of Asset

Less Subsidy

Borrowing from bank

5,00,000

50,000

4,50,000

Loan of Rs 4,50,000 payable in 10 equal installments at the beginning of each year

Amount of each installment

Amount x factor = loan

Factor = 1 1.10 =

= 9 times

Amount x 6.759

= 4,50,000

GT

Amount

= 66,578

+1

Statement of Principal and Interest

Year

Installment

Interest

@ 10%

Principal

Principal outstanding

1beg

66,578

nil

66,578

450,000 66,578

= 3,83,422

2beg

66,578

38,342

28,236

3,83,422 28,236

= 355186

3beg

66,578

35,519

31,059

3,55,186 - 31,059

= 3,24,127

4beg

66,578

32,413

34,165

3,24,127 34,165

= 2,89,962

5beg

66,578

28,996

37,582

2,89,962 37,582

= 2,52,380

6beg

66,578

25,238

41,340

2,52,380 41,340

= 2,11,040

7beg

66,578

21,104

45,474

2,11,040 45474

= 1,65,566

8beg

66,578

16,557

50,021

1,65,566 50,021

= 1,15,545

9beg

66578

11,555

55,023

10beg

66,578

6,056

60,522

1,15,545 55,023

= 60,522

-

5,00,000 10

50,000 x 0.50

=

=

Depreciation on actual cost @ 10% p.a =

Tax saving on depreciation

=

50,000

25,000

PRAVINN MAHAJAN 9871255244, 8800684854

Particulars

Installment

Tax saving on

Interest

Tax saving

On depreciation

Statement of present value of cash outflow if asset is purchased

Amount

Period

factor

Present value

@ 5%

66,578

66578

0

1-9

1

7.108

66,578

4,73,236

38,342 x 0.5

= 19,171

1e

0.952

(18,251)

35,519 x 0.5

= 17,760

2e

0.907

(16,108)

32,413x0.5

= 16,207

3e

0.864

(14,003)

28,996x 0.5

= 14,498

4e

0.823

(11,932)

25,238x0.5

= 12,619

5e

0.784

(9,893)

21,104x0.5

= 10,552

6e

0.746

(7,872)

16,557x0.5

= 8,279

7e

0.711

(5,886)

11,555x0.5

= 5,778

8e

0.677

(3,912)

6,056x0.5

= 3027

9e

0.645

(1,952)

25,000

1-10e

7.722

(1,93,050)

Present value of cash outflow

2,56,955

It is better to take asset on lease as cash outflow in lease option is lower than cash outflow in

loan option.

PRAVINN MAHAJAN 9871255244, 8800684854

Q4

Company is planning to acquire a machine costing Rs 5,00,000. Company has two options

Option 1

To acquire the asset by taking a loan from Bank

Amount of Loan

=

Rs 5,00,000 @ 10%p.a

Statement of Principal and Interest

Year

1

2

3

4

5

Principal

1,00,000

1,00,000

1,00,000

1,00,000

1,00,000

Depreciation

Interest

5,00,000 x 0.1

4,00,000 x 0.1

3,00,000 x 0.1

2,00,000 x 0.1

1,00,000 x 0.1

= 50,000

= 40,000

= 30,000

= 20,000

= 10,000

Tax savings on interest @ 30%

15,000

12,000

9,000

6,000

3,000

Machine will be fully depreciated during its lifetime

Depreciation p.a =

5,00,000 5 = 1,00,000

Salvage value =

Rs 50,000

Capital gain

=

Salvage value - Book value after life

=

50,000 nil

=

50,000

Tax on capital gain

=

50,000 x 0,3

=

15,000

Salvage value after Tax =

50,000 15,000 =

35,000

Statement of Present Value of cash outflow

Particulars

Amount

Period

Factor

@ 8%

Present

Value

Principal

1,00,000

1-5end

3.993

3,99,300

Interest

50,000

40,000

30,000

20,000

10,000

1end

2end

3end

4end

5end

0.926

0.857

0.794

0.735

0.681

46,300

34,280

23,820

14,700

6810

Tax savings

On Interest

15,000

12,000

9,000

6,000

3,000

1end

2end

3end

4end

5end

0.926

0.857

0.794

0.735

0.681

(13,890)

(10,284)

(7146)

(4,410)

(2,043)

Tax savings

On Depreciation

(50,000 x 0.3)

1,00,000

1-5end

3.993

(1,19,790)

Salvage value

35,000

5end

0.681

(23,835)

Present value of cash outflow

3,43,812

PRAVINN MAHAJAN 9871255244, 8800684854

Option 2

To acquire asset on lease

Company will be indifferent between loan option and lease option if Present value of cash

outflow in lease option is equal to present value of cash outflow in loan option

Present value of Cash outflow of lease option required

3,43,812

Statement of Present value of cash outflow

Amount

Period

Present value

1-5end

Factor

@ 8%

3.993

Lease Rent

Tax savings on

lease rent

0.3x

1-5end

3,993

(1.1979x)

Present value of cash outflow

3.993x - 1.1979x

2.7951x

x

=

=

=

3.993x

3,43,812

3,43,812

3,43,812

1,23,005

Lease rent p.a to make company indifferent between loan option and lease option is

Rs 1,23,005

Q5

Agrani ltd needs a machine costing Rs 40,00,000. Company has 2 options

Option 1

Acquire the Machine on Lease at an annual lease rent of Rs12,00,000

Lease Rent p.a

Tax saving on lease rent

Rs 12,00,000

12,00,000 x 0.35

4,20,000

Statement of Present value of cash outflows

(if Asset is taken on lease)

Amount

Period

Factor

@ 16%

Present value

Lease Rent

12,00,000

1 5 end

3.274

39,28,800

Tax Savings on

lease rent

4,20,000

1 5 end

3.274

13,75,080

Present Value of Cash outflow

25,53,720

PRAVINN MAHAJAN 9871255244, 8800684854

Option 2

Purchase the asset by borrowing from bank

Amount of Loan

Rs 40,00,000 @ 20%

Loan is payable in 5 equal Installments. Amount of each installment is :

Amount x factor (5 yrs, 20% )

= 40,00,000

Amount x 2.991

Amount

= 40,00,000

= 13,37,345

Statement of Principal and Interest

Year

Installment

Interest

@ 20%

Principal

Principal

Outstanding

Tax saving

on intt @ 35%

1end

13,37,345

8,00,000

5,37,345

34,62,655

2,80,000

2end

13,37,345

6,92,531

6,44,814

28,17,841

2,42,386

3end

13,37,345

5,63,568

7,73,777

20,44,064

1,97,249

4end

13,37,345

4,08,813

9,28,532

11,15,532

1,43,085

5end

13,37,345

2,21,813

11,15,532

77,635

(13,37,345 11,15,532)

Depreciation @ 25% p.a WDV basis

Tax saving on dep @ 35%

40,00,000

10,00,000

3,50,000

30,00,000

7,50,000

2,62,500

22,50,000

5,62,500

1,96,875

16,87,500

4,21,875

1,47,656

12,65,625

3,16,406

1,10,742

9,49,219

8,00,000

1,49,219

52,226

(1,49,219 x 0.35)

8,00,000 + 52,226 =

8,52,226

Cost

Dep 1 year

Dep 2

nd

yr

rd

Dep 3 yr

th

Dep 4 yr

th

Dep 5 yr

WDV after 5 years

Salvage value after 5 yrs

Capital loss

Tax savings on cap loss

Net salvage value

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of Present value of cash outflow if Loan is taken from Bank

Installment (Principal

+ interest)

Tax savings on

Interest and dep

Amount

Period

factor

@ 16%

Present

value

13,37,345

1 5 end

3.274

43,78,468

6,30,000

1e

0.862

(5,43,060)

0.743

(3,75,130)

(2,80,000 + 3,50,000)

504,886

2e

(2,42,386 + 2,62,500)

Salvage value

3,94,124

3e

(0.641)

(2,52,633)

2,90,741

4e

(0.552)

(1,60,490)

1,88,377

5e

(0.476)

(89,667)

8,52,226

5e

(0.476)

(4,05,660)

25,51,828

Present value of Cash ouflow in loan option is lower than present value of cash outflow in lease

option, so company should purchase the asset by borrowing from Bank

b.

Evaluation of Proposal from the point of view of lessor, If lessors cost of capital is 14%

Lessor will receive Lease rent and pay tax on such lease rent

Lessor will claim depreciation on asset and tax saving on such depreciation and will claim

salvage value

Cash outflow will be purchase price of machine.

Statement of NPV of Lessor @ 14%

Amount

Period

factor

@ 14%

Present

value

Present value of cash inflows

Lease rent (net of tax)

12,00,000 (1 0.35)

7,80,000

1 5e

3.433

26,77,740

3,50,000

2,62,500

1,96,875

1,47,656

1,10,742

1e

2e

3e

4e

5e

0.877

0.769

0.675

0.592

0.519

3,06,950

2,01,863

1,32,891

87,412

57,475

8,52,226

Cash Inflows

5e

0.519

4,42,305

39,06,636

Tax savings on Depreciation

Salvage value

Present value of cash outflows

Purchase price of machine

40,00,000

0

1

NPV

Since NPV of lease is negative, so lessor should not lease the Asset

10

40,00,000

(93,364)

PRAVINN MAHAJAN 9871255244, 8800684854

Q6

Company is considering to buy personal computer with modem and printer costing Rs 60,000.

Company has 2 options.

Option 1

To purchase the asset by borrowing from bank @ 12% p.a. Principal is to be

repaid in 5 equal investments

Statement of Principal and Interest

Year

1

2

3

4

5

Principal

12,000

12,000

12,000

12,000

12,000

Interest

7,200

5760

4320

2,880

1,440

Tax saving on Interest

2,160

1,728

1,296

864

432

Statement of Depreciation on Asset

Full cost of the Asset is to be depreciated during the life

Depreciation p.a

12,000

Tax savings on depreciation

12,000 x 0.3 = 3,600

Statement of present value of cash outflows if asset is purchased

Particulars

Amount

Period

1 5 end

P.V factor

@ 11%

3.696

Present

value

44,352

Principal Payment

12,000

5,040

4,032

3,024

2,016

1,008

1e

2e

3e

4e

5e

0.901

0.812

0.731

0.659

0.593

4,541.04

3,273.98

2,210.54

1,328.54

597.74

3,600

15

3.696

(13,305.6)

Salvage value net of

tax on cap gain

(1500 120)

0.3(1500 - 120) 966

5e

0.593

Present value of cash outflows

(572.84)

42,425.40

Interest (net of

Tax saving

7,200 - 2,160

4,320 1,296

Tax savings

On depreciation

Computation of Annual Lease rentals

Present value of Annual lease rentals

Lease rent p.a

x

3.696

Tax savings

0.3x

3.696

Present value of cash outflow

2.5872x

=

x

=

11

Rs 42,425.40

3.696x

1.1088x

2.5872 x

42,425.40

16,398.19

PRAVINN MAHAJAN 9871255244, 8800684854

Q7

Jags Ltd is contemplating to acquire a new truck. Company has two options

Option 1

To acquire the asset on lease on annual lease rent of Rs 1,20,000 p.a to be paid

at beginning at of each year

Discount rate is rate of Interest charged by bank after tax 10% (1 0.4) =

6%

Statement of present value of cash outflows if asset is taken on lease

Particulars

Amount

Period

Factor

@ 6%

Present

value

Lease Rent

1,20,000

1,20,000

0

13

1

2.673

1,20,000

3,20,760

Tax saving on

lease rent

48,000

1 4e

3.465

Present value of cash outflows

(1,66,320)

2,74,440

Maintenance cost is not considered as it is incurred in lease and purchase option

Option 2

To purchase the asset for Rs 4,80,000 by borrowing from bank @ 10%

Loan is to be paid in 4 equal installments. Amount of each installment is

Amount x factor @ 10% =

Amount x 3.170

=

Amount

=

4,80,000

4,80,000

1,51,420

Statement of Principal and Interest

Year

Installment

Interest

Principal

1

2

3

4

1,51,420

1,51,420

1,51,420

1,51,420

48,000

37,658

26,282

13,920

1,03,420

1,13,762

1,25,138

1,37,500

Principal

outstanding

3,76,580

2,62,818

1,37,500

-

Statement of depreciation

Year

1

2

3

4

33%

45%

15%

7%

Depreciation

1,58,400

2,16,000

72,000

33,600

Tax saving on Depreciation

63,360

86,400

28,800

13,440

12

tax

saving @40%

19,200

15,063

10,513

5,568

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of Present value of cash outflow if asset is purchased

Particulars

Amount

period

factor

@ 6%

Present

value

Installment

1,51,420

1 4e

3.465

5,24,670

1e

2e

3e

4e

0.943

0.890

0.840

0.792

(77,854)

(92,302)

(33,023)

(15,054)

0.792

(57,024)

2,49,413

Tax saving on

Interest & depreciation 82,560

1,01,463

39,313

19,008

Salvage value

1,20,000

0.4 x 1,20,000

72,000

4e

Present value of cash outflows

Maintenance cost is not considered as it is incurred in lease and purchase option

Since present value of cash outflow is lower in case of loan option so company should purchase

the asset by borrowing from bank

Q8

Highlighted line is missing in question in assignment

Zapak Ltd is faced with the decision to purchase or acquire on lease a mini car. The cost of mini

car is Rs 1,26,965. It has a life of 5 years. The mini car can be obtained on lease by paying equal

lease rentals annually. The leasing company desires a return of 10% on the gross value of the

asset. Company can also obtain 100% finance from its regular banking channel. The rate of

interest will be 15% p.a and the loan will be paid in 5 equal annual installments, inclusive of

interest. The effective tax rate of company is 40%. For the purpose of taxation it is to be assumed

that the asset will be written of over a period of 5 years on a straight line basis.

Lease rents are paid at beginning of each year

Advise the company about the method of acquiring the car.

What should be the annual lease rental to be charged by the leasing company to match

the loan option

(M96)

Sol

Zapak Ltd is considering to purchase a Mini car costing Rs 1,26,965. Company has two options

Option 1

to acquire the asset on lease, by paying equal annual lease rent for 5 years

At beginning of each year

Amount of Lease rent p.a shall be the amount which yields 10% return for Lessor. Thus from

point of view of lessor Present value all cash inflows should be equal to cost of assets.

13

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of present value of cash inflow from point of view of lessor

Particulars

Lease rent

Tax on lease rent

Tax saving on

Depreciation

Amount

x

x

0.4x

Period

0

1-4

15

factor

1

3.170

3.791

Present

x

3.170x

(1.5164x)

10,157

15

3.791

38,505

)0.4

Present value of all cash inflows

4.170x 1.5164x + 38,505

2.6536x

x

=

=

=

1,26,965

1,26,965

88,460

33,335

Statement of present value of cash outflow if asset is acquired on lease (point of view of lessee)

Particulars

Amount

Period

Lease rent

33,335

33,335

Tax saving on

Lease rent

13,334

Present value of Cash outflow

Option 2

0

1-4

factor

@ 9%

1

3.240

Present

Value

33,335

1,08,005

1 5e

3.890

(51,869)

89,741

To purchase the asset by borrowing from bank Rs 1,26,965 @ 15% to be paid in 5 equal

installments (it is assumed that installments of loan are payable at end of each year)

Amount of each installment should be such that present value of all installments @ 15%

is equal to cost of the asset.

Amount x factor @ 15%

=

1,26,965

Amount x 3.352

=

1,26,965

Amount

=

37,877

Statement of Principal and interest

Year

installment

interest

Principal

Principal o/s

1

2

3

4

5

37,877

37,877

37,877

37,877

37,877

19,045

16,220

12,971

9236

4948

18,832

21,657

24,906

28,641

32,929

1,08,133

86,476

61,570

32,929

-

14

tax saving on

interest

7618

6488

5188

3694

1979

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of present value of cash outflow

Amount

Period

factor@ 9%

Present value

Installment

37,877

15

3.890

1,47,342

Tax saving on intt

7618

6488

5188

3694

1979

1e

2e

3e

4e

5e

0.917

0.842

0.772

0.708

0.650

(6986)

(5463)

(4005)

(2615)

(1286)

3.890

(39,511)

87,476

Tax saving on dep

10,157

15

Present value of cash outflow

Since present value of cash outflow in case of purchase option is lower than present value of

cash outflow in case of lease option, so company should purchase the asset.

b.

Annual lease rent if lease option is to be matched with loan option

Present value of cash outflow in lease option

4.240 x 3.890 (0.4x)

4.240 x - 1.556 x

2.684 x

x

=

=

=

=

=

Present value of cash outflow in loan

option

87,746

87,746

87,746

32,692

if annual lease rent is Rs 32,692, company will be indifferent between loan option and lease

option

Q9a.

i.

flying hours required to make renting aircraft viable option will be the hours in which

Present value of contribution from the flying hours during the life of aircraft is equal to

present value of cash outflow during the life of aircraft

Statement of Net present value of cash inflow if rented

Amount

period factor(10%)

Present value

Cash inflows

Annual contribution

(if annual flying hrs is x)

(Contribution per hr VC / hr) no of

hrs p.a

36,100) x

15

30,567x

3.791

Cash outflows

Fixed costs (Rent)

2,50,00,000

0

1

2,50,00,000

1-4

3.17

Net present value of cash inflow

No of flying hours to make renting viable option is

1,15,879x - 1042,50,000

=

0

x

15

900 hours

1,15,879x

2,50,00,000

792,50,000

0

PRAVINN MAHAJAN 9871255244, 8800684854

ii.

flying hours required to make buying aircraft viable option will be the hours in which

Present value of contribution from the flying hours during the life of aircraft is equal to

present value of cash outflow during the life of aircraft

Statement of Present value of cash inflow if purchased

Amount

Period factor (10%)

Present value

Cash inflows

Annual contribution

15

66,667x

Cash outflows

Cost of Aircraft

Overhaul cost

Annual fixed operating cost

2,52,735x

20,00,00,000 0

1

6,00,00,000

3e

0.751

1,00,00,000

1 5 3.791

Net present value of cash inflows

No of flying hours to make renting viable option is

2,52,735x - 2829,70,000

=

b.

3.791

20,00,00,000

4,50,60,000

3,79,10,000

0

1120 hours per year

Company will be indifferent between buying and renting, NPV of renting an aircraft is equal to

NPV of Renting an aircraft

NPV of renting

=

NPV of Buying an aircraft

115879x - 1042,50,000

=

252735x - 2829,70,000

2829,70,000 1042,50,000

=

252735x 115879x

x

=

1306 hours

if annual flying hrs are

0 900

=

.> 900 < 1306 =

1306

=

> 1306

=

it is not viable to acquire a plane either by renting or buying

it is better to rent the plane

either rent or buy

Buy the aircraft

c.

if purchased, each aircraft flies for 2,400 hours per year

To make 5,750 flying hours per year, company will purchased 2 planes which will fly for 4,800 hrs

p.a and for balance 950 hours (5,750 4800), it will be better to rent an aircraft (as for flying

hours between 900 to 1306 buying an aircraft is not a viable option)

Q10

Armada company is a leasing company and is considering to lease a school bus at an annual

lease rent of 1,25,000 p.a for 8 years. Cost of bus is Rs 5,00,000

a. IRR is the rate at which present value of cash inflow is equal to present value of cash outflow

i.e

PV of cash inflow

=

5,00,000

Present value of cash inflows @ 15%(Random) =

Present value of cash inflows @ 20%

=

IRR =

=

15 +

1,25,000 x 4.487 = Rs 5,60,875

1,25,000 x 3.837 = Rs 4,79,625

At 15% . 5,60,875

At ?

5,00,000

At 20% . 4,79,625

For diff in PV of 81,250, diff in rate is

5%. For diff in PV of 60,875, diff in

x5

18.746%

rate is

16

x 5 + 15

PRAVINN MAHAJAN 9871255244, 8800684854

b. Company will earn 20% return p.a on its investment if Present value of annual lease rent for 8

years is equal to cost of asset

Annual lease rent x facto @ 20%

=

Cost of asset

Lease rent

x

3.837

=

5,00,000

Annual lease rent

=

Rs 1,30,310 p.a

C

Company will earn 20% return p.a on its investment if Present value of annual cash inflows

for 8 years is equal to cost of asset

Statement of Net present value of cash inflows (of lessor)

Amount

Period

factor @ 20%

Present value

Lease rent

18e

3.837

3.837x

Tax on lease rent

0.4x

18e

3.837

(1.5348x)

Annual expenses

After tax savings

50,000(1 0.4) 1 - 8e

3.837

(1,15,110)

Ta savings on

Depreciation

20,000

1 8e

3.837

76,740

8e

0.233

23,300

0.4(

Salvage value

)

1,00,000

Present value of cash inflow

Annual lease rent to earn 20% rate of return

2.3022x 15,070 =

X

Annual lease rent

5,00,000

2,23,730

17

5,00,000

PRAVINN MAHAJAN 9871255244, 8800684854

Q11

Elite Builders will build 6 flats and lease them to foreign embassy for 15 years. Foreign embassy

will provide land to Elite builders, costing Rs 25 lakhs

i.

Lease rent per annum for lessor to earn minimum desired return of 10% (if rentals and

repairs will arise on the last day of the year and construction , registration and other costs

are to be incurred at time 0)

Lessor will earn 10% if present value of cash inflows (lease rent) Present value of cash

outflow = 0

Or present value of cash inflows (lease rent) = Present value of cash outflow

Statement of Net present value of cash inflows

Cash inflows

Lease rent

(after tax)

x (1 0.5) = 0.5x

1.20(1 0.5) = 0.60x

1.50(1 0.5) = 0.75x

1 5e

6 10e

11 15e

3.791

3.791 x 0.621

3.791 x 0.386

24,60,000

2,00,000

2,00,000

14e

15e

0.263

0.239

(52,600)

(47,800)

82,000

1 15

7.606

6,23,692

15e

0.239

95,600

0

1.8955x

1.4125x

1.09749x

Cash outflows

Construction cost

+ registration cost

(6 x 1000 x 400)

+ 2.5% of 24lacs

Repairs (net of tax)

4,00,000 ( 1 -0.5)

Tax saving on dep

x 0.50

(24,60,000)

Salvage value

(8,00,000 0.5 x 8 lac) 4,00,000

Net present value

Normal lease rent is

4.40549 x - 18,41,108 = 0

x

normal rent

4,17,912 for 6 flats

= Rs 69,652

18

PRAVINN MAHAJAN 9871255244, 8800684854

Q12

ABC Ltd is contemplating to acquire computer. Company has two options

Option 1

To Acquire computer at annual lease rent of Rs 85,000 + 5% of annual billings

Annual lease rent

Year 1

85,000 + 5% x 2,20,000 =

96,000

Year 2

85,000 + 5% x 2,60,000 =

98,000

Year 3

85,000 + 5% x 2,60,000 =

98,000

Statement of Present value of cash outflow

Lease rent

(after tax)

Option 2

96,000(1 0.5)= 48,000

1e

98,000( 1 0.5)= 49,000

2e

98,000( 1 0.5)= 49,000

3e

Present value of cash outflow

0.893

0.797

0.712

42,864

39,053

34,888

1,16,805

To purchase the computer by borrowing Rs 2,30,000 from bank @ 16% p.a

Statement of Present value of cash outflow

Repayment of loan

(interest after tax p.a

rd

+ principal in 3 year)

Maintenance, taxes

Insurance (after tax)

36,800(1 0.5)

18,400

18,400

2,30,000 + 18,400

1e

2e

3e

0.893

0.797

0.712

16,431

14,665

1,76,861

20,000( 1 0.5)

1 3e

2.402

24,020

20,000

1 3e

2.402

(48,040)

3e

0.712

(78,320)

1,05,617

Tax savings on depreciation

(

Salvage value

)x 0.5

1,10,000

Present value of cash outflow

Annual operating expenses of Rs 80,000 is ignored, as it is to be incurred in both lease

and purchase option

Since Present value of cash outflow is lower in case of purchase option, So company should

purchase the computer

19

PRAVINN MAHAJAN 9871255244, 8800684854

Evaluation of proposal from point of view of lessor

Lessor will purchase the asset for Rs 2,30,000 and incur maintenance, taxes and insurance

Lessor will claim depreciation and receive salvage value after life

Annual operating expenses Rs 80,000 are to be incurred by lessee

Statement of Net Present value of cash inflows

Cash inflows

Lease rent

(after tax)

96,000(1 0.5)= 48,000

98,000( 1 0.5)= 49,000

98,000( 1 0.5)= 49,000

1e

2e

3e

0.893

0.797

0.712

42,864

39,053

34,888

1,16,805

2,30,000

2,30,000

20,000( 1 0.5)

1 3e

2.402

24,020

20,000

1 3e

2.402

(48,040)

0.712

(78,320)

1,27,660

(10,855)

Cash outflows

Purchase Price

Maintenance, taxes

Insurance (after tax)

Tax savings on

depreciation

(

)x 0.5

Salvage value

1,10,000

3e

Cash outflows

NPV

(1,16,805 - 1,27,660)

Since NPV of lease proposal is ve, so it is not viable for lessor

Q13

IRR of leasing company is the rate at which present value of cash inflows are equal to present

value of cash outflows

Cash outflows are purchase price of bus i.e Rs 16,00,000

Cash inflows are Lease rent of Rs 4,00,000 for 8 years

Tax rate no given so depreciation is ignored. Salvage value not given

Present value of cash inflows @ 18% (random) =

Present value of cash outflows @ 19%

=

IRR is =

=

18 +

4,00,000 x 4.078 =

4,00,000 x 3.954 =

16,31,200

15,81,600

18%........

16,31,200

?

16,00,000

19%........

15,81,600

For change in PV of 49,600, change in

rate is 1%. For change in PV of

x1

18.629%

31,200 change in rate is

20

x1

PRAVINN MAHAJAN 9871255244, 8800684854

ii.

Annual lease rent to earn 20% compound interest

Lease rent x factor (20% , 8yrs)

Rent x 3.837

Rent

Q14

Cash outflow

Lease period

Required rate

=

=

=

16,00,000

16,00,000

4,16,992

Rs 100 lakh

5 years

20%

i.

Lease rent p.a for equated level

( Equated level is the rent at which present value of annual lease rent is equal to cash

outflow)

Lease rent x factor (5yrs, 20%)

=

100 lac

Rent

x 2.991

=

100 lac

Annual lease rent

=

33.434 lac p.a

ii.

Stepped lease rent i.e Lease rent if it increases 15% p.a

Present value of stepped lease rent for 5 years is equal to cost of asset)

st

Let lease rent of 1 year is x

0.833x + 0.694

+

+ 0.578

x

iii.

+

+ 0.482

= 100 lac

26,08,923

th

10,00,000 x 2.589

100 lac

+ 0.402

Annual lease rent of 10 lac for 4 years and balloon payment in 5

th

payment in 5 year

Present value of

Rs 10,00,000 for 4 years

+ P.V of lease

th

rent for 5 year

0.402 x

x

iv.

year. Amount of

100 lac

100 lac

=

Rs 184.35 lac

rd

Annual lease rent if rent is paid after 2 years from 3 year for 3 years

Annual lease rent x (factor 3 years 20%)(factor 2

nd

year, 20%) =

Lease rent x 2.106 x 0.694

Lease rent p.a

=

Rs 68.419 lacs p.a

21

100 lacs

100 lacs

PRAVINN MAHAJAN 9871255244, 8800684854

Q15

Alternative 1 Purchase option

Depriciation

22,00,000 10,00,000 =

Rs 4,00,000 p.a

3

Operating and training costs are common in both alternatives, hence not relevant

Effective discount rate 16% (1. 0.5) = 8%

Statement of cash flows under purchase option

Particulars

Year 1

Year 2

Year 3

Principal

5,00,000

8,50,000

8,50,000

Interest

3,52,000

2,72,000

1,36,000

Tax saving on Interest

1,76,000

1,36,000

68,000

Depreciation

4,00,000

4,00,000

4,00,000

Tax saving on depreciation

2,00,000

2,00,000

2,00,000

Salvage value

10,00,000

Particulars

Installment and interest

Payment

Tax saving on depreciation

And Interest

Salvage value

Statement of NPV under purchase option

period

Amount

Factor @ 8%

1end

8,52,000

0.926

2end

11,22,000

0.857

3end

9,86,000

0.794

1end

2 end

3 end

3 end

3,76,000

0.926

3,36,000

0.857

2,68,000

0.794

10,00,000

0.794

NPV of cash flows

Present value

7,88,952

9,61,554

7,82,884

(3,48,176)

(2,87,952)

(2,12,792)

(7,94,000)

8,90,470_

Alternative 2- Lease option

Statement of lease rent

Particulars

Year 1

Lease rent

5,00,000

10 % of revenue

2,25,000

Lump sum payment

7,25,000

Year 2

5,00,000

2,50,000

7,50,000

Year 3

5,00,000

2,75,000

6,00,000

13,75,000

Statement of NPV under Lease option

Particulars

period

Amount

Factor @ 8% Present value

Lease rent

1 end

7,25,000

0.926

6,71,350

2end

7,50,000

0.857

6,42,750

3 end

13,75,000

0.794

10,91,750

Tax savings on lease rent

1 end

3,62,500

0.926

(3,35,675)

2 end

3,75,000

0.857

(3,21,375)

3 end

6,87,500

0.794

(5,45,875)

NPV of cash flows

12,02,925

Since NPV is lower in purchase option, so company should purchase the computer

22

PRAVINN MAHAJAN 9871255244, 8800684854

Q16

Classic finance will lease a machine to customer for 3 years at lease rent which for 3 years will be

in the ratio of 3:2:1.

Year

1

2

3

Statement of Depreciation and tax saving on depreciation

(in lacs)

Book value

At beg of year

600

450

337.5

Cl WDV

Tax saving

450

337.5

253.125

52.50

39.375

29.531

Depreciation

of the year(25%)

150

112.5

84.375

Salvage value after 3 years

Capital loss after 3 years

Tax saving on capital loss

nil

253.125

88.59 lacs

Statement of lease rent

rd

Let lease rent of 3 year is x

Year

1

2

3

Lease rent

3x

2x

x

Lease rent after tax

3x ( 1 0.35) = 1.95x

2x ( 1 0.35) = 1.30x

x ( 1 - 0.35) = 0.65x

Lessor will earn 10% if PV of cash inflows @ 10% - Present value of cash outflows = 0

Statement of net present value of cash inflows

Amount

1.95x

1.30x

0.65x

period

1e

2e

3e

factor

0.909

0.826

0.751

Present value

1.77255 x

1.0738 x

0.48815x

52.5

39.375

29.531

1e

2e

3e

0.909

0.826

0.751

47.7225

32.52375

22.17778

Tax savings on cap loss

88.59

3e

0.751

66.5339

Purchase Price

600

NPV

(600)

0

Lease Rent (Net of tax)

Tax savings on dep

3.3345x - 431.042

=

rd

Lease rent of 3 year

nd

Lease rent of 2 year

st

Lease rent of 1 year

=

=

=

0

= 129.267 lacs

129.267 lacs

258.534 lacs

387.801 lacs

23

PRAVINN MAHAJAN 9871255244, 8800684854

Q17

Company X is considering to acquire a machine costing Rs 10 lakhs. Company has 2 options

Option 1

To acquire machine on hire purchase (just like loan option)

Company X will pay 2,50,000 at the time of signing of agreement and annual

installment of Rs 4,00,000 at the end of each year for 3 years. Rate of interest

paid by company X is the rate at which present value of cash outflow is equal to

loan (10,00,000 2,50,000) 7,50,000

Computation of rate of Interest paid by company X

Present value of 4,00,000 p.a for 3 years @ 27%

Present value of 4,00,000 p.a for 3 years @ 28%

27%.............758400

?...................7,50,000

28%..............7,47,200

For PV of 11,200 change in rate is

1%. For change in PV of 8,400

ROI paid is

27% +

=

7,58,400

7,47,200

x1

27.75%

change in rate is

x 1 = 0.75

Statement of Principal and interest

Period Installment

0

1e

2e

3e

2,50,000

4,00,000

4,00,000

4,00,000

Interest

@ 27.75%

2,08,125

1,53,484

88,391

Principal

Principal o/s

Tax saving on Intt

2,50,000

1,91,875

2,46,516

3,11,609

7,50,000

5,58,125

3,11,609

-

72,844

53,719

30,937

Discount rate is rate of interest charged by Hire purchase company after tax 27.75 (1 0.35)

18.0375%

Statement of Present value of cash outflow (if taken on hire purchase)

Present value

0

1 3e

factor

@ 18.0375%

1

2.173

Tax savings on intt 72,844

53,719

30,937

1e

2e

3e

0.847

0.718

0.608

(61,699)

(38,570)

(18,810)

Tax savings on

n

dep

1 3e

2.173

(2,53,517)

Installment

Amount

period

2,50,000

4,00,000

1,16,667

2,50,000

8,69,200

x 0.35

Present value of cash outflow

24

7,46,604

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of Present value of cash outflow (if asset is taken on lease)

Amount

Initial service fee 20,000

Tax savings on

this fee at

st

1 yr end

(20,000 x 0.35) 7,000

period

Present value

factor

@ 18.0375%

1

1e

0.847

(5,929)

2.173

6,10,178

6,24,249

Lease rent

after tax

( 4,32,000 x 0.65) 2,80,800

1 3e

Present value of cash outflow

20,000

Since present value of cash outflow is lower in case of lease option so, lease option is

better.

Q18

An industrial unit desires to acquire a diesel generating set costing Rs 20 lakhs having a life of 10

years. Company has 2 options

Option 1

To acquire machine on lease at an annual lease rent which gives lessor a return

of 10%

Statement of NPV for lessor

Lessor will earn 10% if PV of cash inflows is equal to present value of cash outflows at 10% i.e

NPV = 0

Amount

Period

factor@ 10%

Present value

Lease rent

After tax

x( 1 0.5)

x

x

0

19

1

5.759

x

5.759x

Tax on Lease rent

0.5x

1 10

6.145

(3.0725x)

1,00,000

1 10

6.145

6,14,500

20,00,000

NPV

(20,00,000)

0

Tax saving on dep

x 0.5

Purchase price

Annual lease rent

3.6865x x

13,85,500

25

3,75,831

PRAVINN MAHAJAN 9871255244, 8800684854

Statement of Present value of cash inflows for lessee

Amount

Period

Present value

0

19

factor @8%

16(1 0.5)

1

6.247

Lease rent

3,75,831

3,75,831

Tax saving on

lease rent

1,87,916

1 10

6.71

(12,60,916)

Present value of cash outflow

Option 2

3,75,831

23,47,816

14,62,731

To purchase the asset by taking loan from bank @ 16% p.a, repayable in 10

equal installments

Installment of loan each year

Amount x factor @ 16%

Amount x ( 1 + 4.607)

Amount

=

=

=

20,00,000

20,00,000

3,56,697

Statement of Principal and interest

Year

1

2

3

4

5

6

7

8

9

10

installment

3,56,697

3,56,697

3,56,697

3,56,697

3,56,697

3,56,697

3,56,697

3,56,697

3,56,697

3,56,697

interest

2,62,928

2,47,925

2,30,522

2,10,334

1,86,916

1,59,751

1,28,240

91,686

48,668

principal

3,56,697

93,769

1,08,771

1,26,175

1,46,363

1,69,781

1,96,946

2,28,457

2,65,011

3,08,029

principal o/s

16,43,303

15,49,534

14,40,762

13,14,587

11,68,224

9,98,443

8,01,497

5,73,040

3,08,029

-

Tax saving on intt

1,31,464

1,23,962

1,15,261

1,05,167

93,458

79,876

64,120

45,843

24,334

Statement of present value of cash outflow if asset is purchased

Amount

Period

Installment

3,56,697

3,56,697

0

19

Tax saving on intt

1,31,464

1e

1,23,962

2e

1,15,261

3e

1,05,167

4e

93,458

5e

79,876

6e

64,120

7e

45,843

8e

24,334

9e

1,00,000

1 10e

Present value of cash outflow

Tax saving on dep

Purchasing the asset is better option

26

factor

@ 8%

1

6.245

Present value

0.926

0.857

0.794

0.735

o.681

0.630

0.583

0.540

0.500

6.71

(1,21,736)

(1,06,235)

(91,517)

(77,298)

(63,645)

(50,322)

(37,382)

(24,755)

(12,167)

(6,71,000)

13,28,213

3,56,697

22,27,573

PRAVINN MAHAJAN 9871255244, 8800684854

Q19

Alfa Ltd. Is thinking of installing a computer. Company has two options.

Option 1

To acquire computer on lease at annual lease rent of Rs 4,50,000 to be paid at

beg of each year

Annual maintenance expenses are ignored as such expenses are incurred

whether asset is taken on lease or purchase by loan

Statement of present value of cash outflow

Amount

Period

Present value

0

15

factor

@ 9%

1

3.890

Lease rent

4,50,000

4,50,000

Tax saving on

lease rent

1,80,000

16

4.486

(8,07,480)

4,50,000

17,50,500

Present value of cash outflow

Option 2

13,93,020

To purchase the asset by borrowing from bank Rs 20,00,000 @ 15% p.a.

Loan is repayable by making 6 year end installments of Rs 5,28,474 each

Year

installment

Statement of Principal and interest

interest

principal

principal o/s

1

2

3

4

5

6

5,28,474

5,28,474

5,28,474

5,28,474

5,28,474

5,28,474

3,00,000

2,65,729

2,26,317

1,80,994

1,28,872

68,932

2,28,474

2,62,745

3,02,157

3,47,480

3,99,602

4,59,642

Depreciation p.a

= 3,00,000

Tax saving on depreciation

17,71,526

15,08,781

12,06,624

8,59,144

4,59,542

-

tax saving

1,20,000

1,06,292

90,527

72,398

51549

27,573

3,00,000 x 0.4 = 1,20,000

Statement of Present value of cash outflows

Amount

period

Present value

16

factor

@ 9%

4.486

Installment

5,28,474

Tax saving on

n

Interest + dep

2,40,000

2,26,292

2,10,527

1,92,398

1,71,549

1,47,573

1e

2e

3e

4e

5e

6e

0.917

0.842

0.772

0.708

0.650

0.596

(2.20.080)

(1,90,538)

(1,62,527)

(1,36,218)

(1,11,507)

(87,954)

0.596

(1,19,200)

13,42,710

Salvage value

2,00,000

6e

Present value of cash outflow

Purchase option is better

23,70,734

Annual maintenance expenses are ignored as such expenses are incurred whether asset is taken on

lease or purchase by loan

27

PRAVINN MAHAJAN 9871255244, 8800684854

Q20

ITC finance is a leasing company, considering to lease a machine costing Rs 30 lac.

Discount rate

12%

Depreciation p.a

= 6,00,000

Lease period

5 years

Rent to be received at beginning of each year

Amount of Annual lease rent will be the amount at which PV of cash inflows are equal to present

value of cash outflows i.e NPV = 0

Statement of Present value of cash outflow

Amount

period

factor

12%

x

0

1

x

14

3.037

Lease rent

Purchase price

Annual lease rent

2.2345x x

Q21

x

3.037x

15

3.605

(1.8025x)

3,00,000

15

3.605

10.81,500

30,00,000

0

NPV

(30,00,000)

0

Tax paid on lease rent 0.5x

Tax saving on dep

Present value

19,18,500 =

=

0

8,58,581

MGF is a leasing company, which is considering to lease an equipment costing Rs 10,00,000 for

10 years

Depreciation p.a

= 1,00,000 p.a

Tax rate 40% for 5 years and 30% for next 5 years

1% management fee charged from lessee is to be ignored as it is equal to overhead cost incurred

Lease rents are to be collected at beginning of each year

Amount of Annual lease rent will be the amount at which PV of cash inflows are equal to present

value of cash outflows i.e NPV = 0

Lease rent

Statement of Present value of cash outflow

Amount

period

factor@ 10%

x

0

1

x

19

5.759

Present value

x

5.759x

Tax paid on

lease rent

0.4x

0.3x

15

6 10

3.791

3.791 x 0.621

(1.5164x)

(0.7063x)

Tax saving on

n

Dep

40,000

30,000

15

6 10

3.791

3.791 x 0.621

1,51,640

70,626

Purchase price

10,00,000

0

NPV

(10,00,000)

0

Annual lease rent

4.5363x - 7,77,734

x

= 0

= 1,71,447

28

PRAVINN MAHAJAN 9871255244, 8800684854

Q22

ITC Finance Ltd.a leasing company is considering to lease a machine costing 3,00,000 + 30,000

For 5 years

Tax rate

50%

Discount rate

8%

Year

Statement of depreciation

op.WDV

Depreciation

Cl. WDV

1

2

3

4

5

3,30,000

2,47,500

1,85,625

1,39,219

1,04,414

Salvage value assumed Nil

Tax saving on Capital loss

82,500

61,875

46,406

34.805

26,104

2,47,500

1,85,625

1,39,219

1,04,414

78,310

78,310 x 0.5

Tax saving

n

On Dep

41,250

30,937

23,203

17,402

13,052

39,155

Amount of Annual lease rent will be the amount at which PV of cash inflows are equal to present

value of cash outflows i.e NPV = 0

Lease rent

Statement of Present value of cash outflow

Amount

period

factor@ 8%

x

1-5

3.993

Tax paid on

lease rent

0.5x

15

3.993

(1.9965x)

41250

30937

23203

17402

13052

1e

2e

3e

4e

5e

0.926

0.857

0.794

0.735

0.681

38,198

26,513

18423

12790

8888

Salvage value

39,155

5e

0.681

26,665

Purchase price

3,30,000

0

NPV

(3,30,000)

0

Tax saving on

n

Dep

Annual lease rent

1.9965x - 1,98,523

x

= 0

= 99,436

29

Present value

3.993x

PRAVINN MAHAJAN 9871255244, 8800684854

Q23

A leasing company, which is considering to lease an equipment costing Rs 1,00,000 for 5 years

Salvage value Rs 10,000

i.

Lease rents are to be collected at end of each year

Amount of Annual lease rent will be the amount at which PV of cash inflows are equal to present

value of cash outflows i.e NPV = 0

Lease rent

Statement of Present value of cash outflow

Amount

period

factor@ 10%

x

15

3.791

Present value

3.791x

Salvage value

To be discounted

at 25%

10,000

5e

0.328

3,280

Purchase price

10,00,000

0

NPV

(1,00,000)

0

Annual lease rent

3.791x - 96,720

x

= 0

= 25,513

ii.

Lease rent are payable at beg of each year

Amount of Annual lease rent will be the amount at which PV of cash inflows are equal to present

value of cash outflows i.e NPV = 0

Statement of Present value of cash outflow

Amount

period

factor@ 10%

x

0

1

x

1-4

3.170

Present value

x

3.170x

Salvage value

To be discounted

at 25%

10,000

5e

0.328

3,280

Purchase price

10,00,000

0

NPV

(1,00,000)

0

Lease rent

Annual lease rent

4.170x - 96,720

x

= 0

= 23,194

30

PRAVINN MAHAJAN 9871255244, 8800684854

Q24

Lessee has received 2 offers from leasing company for leasing the asset costing Rs 1,50,000

Option 1

st

Pay lease rentals for 96 months. Rs 30 / 1000 for 1 72 months and Rs 5 / 1000

for next 24 months.

Lessor offered to transfer asset to lessee at 5% of original cost after expiry of

lease

(Tax saving on lease rent will be at the end of each year)

Payment of monthly lease rent

Year 1 6 (Month 1 72)

1,50,000 x

= Rs 4500 pm

Year 7 8 (Month 73 96)

1,50,000 x

= Rs 750 pm

Yearly lease rent

Year

16

78

=

=

4500 x 12

750 x 12

= 54,000 p.a

= 9,000 p.a

On Lease rent discount rate applicable is yearly discount rate calculated on Monthly average

basis

Sum of PV factor for 1 72 months

=

( 0.923 + 0.795 + 0.685 + 0.590 + 0.509 + 0.438)

=

3.940

Sum of PV factor for 73 96 months

(0.377 + 0.325)

Tax saving on lease rent

Year ( 1 6)

=

54,000 x 0.4

=

Factor (0.869 + 0.756 + 0.658 + 0.572 + 0.497 + 0.432) =

Year (7 8)

Factor ( 0.376 + 0.327_

9,000 x 0.4

=

=

0.702

21,600

3.784

3600

0.703

Statement of Present value of cash outflows

Lease rent

Tax saving on rent

Amount

54,000

9.000

Period

16

78

factor

3.940

0.702

Present value

2,12,760

6,318

21,600

3600

16

78

3.784

0.703

(81,734)

(2531)

1,34,813

There is no detailed information about the future life of asset. So it is assumed that the company

did not purchase the asset as offered by the leasing company.

31

PRAVINN MAHAJAN 9871255244, 8800684854

Option 2

Lease rent is to be paid @ Rs 35 / 1000 for 60 months

Initial deposit of 15% is to be paid at the time of agreement

After expiry of lease, asset will be sold to lessee against initial deposit. Further life of asset is 3

years. Thus total life of asset is 5 + 3 = 8 years

Monthly lease rent

1,50,000 x

Annual rent

5,250 x 12

Discounted at ( 0.923 + 0.795 + 0.685 + 0.590 + 0.509) =

Yearly rate on monthly average basis

= Rs 5,250 pm

=

Rs 63,000

3.502

Tax saving on lease rent

=

63,000 x 0.4

=

Discounted at yearly rate (0.869 + 0.756 + 0.658 + 0.572 + 0.497)=

25,200 p.a

3.352

At the beginning of lease initial deposit of 15% i.e 22,500 is to be paid. It will be adjusted and the

asset is given to lessee at the end of year 5. Lessee becomes the owner of asset and claim tax

saving on depreciation. He also receives salvage net of tax

Statement of depreciation and tax saving

Year

WDV

Dep

tax saving @ 40%

6

22,500

5,625

2,250

7

16,875

4219

1688

8

12,656

3164

1266

Cl WDV 9492 (assumed asset sold at 9492 after life)

Statement of Present value of cash outflow

Amount

Period

factor

Present value

Initial deposit

Lease rent

Tax saving on rent

Tax saving on dep

22,500

63,000

25,200

2250

1688

1266

0

1 60 month

1 5 yr

6e

7e

8e

1

3.502

3.352

0.432

0.376

0.327

22,500

2,20,626

(84,470)

(972)

(635)

(414)

Salvage value

9492

8e

0.327

(3104)

1,53,531

NPV

32

Вам также может понравиться

- FINANCIAL MANAGEMENT Assignment 2Документ14 страницFINANCIAL MANAGEMENT Assignment 2dangerous saifОценок пока нет

- FM Revision 3rd YearДокумент39 страницFM Revision 3rd YearBharat Satyajit100% (1)

- 333FF2 - Bond Pricing & Bond Pricing Theorems 1Документ23 страницы333FF2 - Bond Pricing & Bond Pricing Theorems 1Sai PavanОценок пока нет

- Introduction to Accounting and Business FundamentalsДокумент147 страницIntroduction to Accounting and Business Fundamentalsannie100% (1)

- Ratio AnalysisДокумент42 страницыRatio AnalysiskanavОценок пока нет

- Amoun Company Analysis and Credit RatingДокумент9 страницAmoun Company Analysis and Credit RatingHesham TabarОценок пока нет

- Lecture 7 Adjusted Present ValueДокумент19 страницLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Insurance Employee Phone Call Survey StatisticsДокумент3 страницыInsurance Employee Phone Call Survey StatisticsMohamad KhairiОценок пока нет

- Investment Analysis & Portfolio Management: Equity ValuationДокумент5 страницInvestment Analysis & Portfolio Management: Equity ValuationNitesh Kirar100% (1)

- Problems With Solution Capital GainsДокумент12 страницProblems With Solution Capital Gainsnaqi aliОценок пока нет

- Digital Notes Financial ManagementДокумент89 страницDigital Notes Financial ManagementDHARANI PRIYAОценок пока нет

- Financial Analysis of Sun PharmaДокумент7 страницFinancial Analysis of Sun PharmahemanshaОценок пока нет

- A. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueДокумент30 страницA. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueAfroz AlamОценок пока нет

- Techniques of Capital Budgeting SumsДокумент15 страницTechniques of Capital Budgeting Sumshardika jadavОценок пока нет

- B LawДокумент240 страницB LawShaheer MalikОценок пока нет

- Cost of Capital ExplainedДокумент18 страницCost of Capital ExplainedzewdieОценок пока нет

- Banking CompaniesДокумент68 страницBanking CompaniesKiran100% (2)

- 340 - Resource - 10 (F) Learning CurveДокумент19 страниц340 - Resource - 10 (F) Learning Curvebaby0310100% (2)

- Dec-13 Leasing Vs Borrowing SolutionДокумент1 страницаDec-13 Leasing Vs Borrowing Solutiondon_mahinОценок пока нет

- Final Citi BankДокумент9 страницFinal Citi BankBilal EhsanОценок пока нет

- Point of IndifferenceДокумент3 страницыPoint of IndifferenceSandhyaОценок пока нет

- Valuation of Securities - ASSIGNMENTДокумент63 страницыValuation of Securities - ASSIGNMENTNaga Nagendra0% (2)

- 14 - Dividend Policy SumsДокумент17 страниц14 - Dividend Policy SumsRISHA SHETTYОценок пока нет

- Ascertainment of ProfitДокумент18 страницAscertainment of ProfitsureshОценок пока нет

- Cost of Capital Lecture Slides in PDF FormatДокумент18 страницCost of Capital Lecture Slides in PDF FormatLucy UnОценок пока нет

- Unit-II AДокумент26 страницUnit-II APaytm KaroОценок пока нет

- Limitations of Break Even AnalysisДокумент4 страницыLimitations of Break Even AnalysissowmyaОценок пока нет

- SFM - Forex - QuestionsДокумент23 страницыSFM - Forex - QuestionsVishal SutarОценок пока нет

- Financial Management in Sick UnitsДокумент29 страницFinancial Management in Sick Unitsagarwalatish100% (1)

- Measuring and Managing Investment RiskДокумент41 страницаMeasuring and Managing Investment RiskAryan PandeyОценок пока нет

- Capital Structure TheoriesДокумент47 страницCapital Structure Theoriesamol_more37Оценок пока нет

- IPCC Income Tax Material for AY 2016-17Документ69 страницIPCC Income Tax Material for AY 2016-17KunalKumarОценок пока нет

- Security Law Practical QuestionsДокумент18 страницSecurity Law Practical QuestionsIsha YadavОценок пока нет

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsДокумент63 страницыChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsДокумент1 страницаDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliОценок пока нет

- Fa IiiДокумент76 страницFa Iiirishav agarwalОценок пока нет

- Caiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersДокумент2 страницыCaiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersssssОценок пока нет

- Lecture SixДокумент10 страницLecture SixSaviusОценок пока нет

- Calculating finance lease accounting entriesДокумент7 страницCalculating finance lease accounting entriessajedulОценок пока нет

- Presentation 2. Understanding The Interest Rates. The Yield To MaturityДокумент30 страницPresentation 2. Understanding The Interest Rates. The Yield To MaturitySadia SaeedОценок пока нет

- 2.2-Module 2 Only QuestionsДокумент46 страниц2.2-Module 2 Only QuestionsHetviОценок пока нет

- BCG ApproachДокумент2 страницыBCG ApproachAdhityaОценок пока нет

- Law II R. Kit Final As at 3 July 2006Документ248 страницLaw II R. Kit Final As at 3 July 2006kevoh1Оценок пока нет

- Calculating operating, financial and combined leverageДокумент4 страницыCalculating operating, financial and combined leveragek,hbibk,n0% (1)

- Capitalisation Meaning DefinitionДокумент19 страницCapitalisation Meaning DefinitionPooja SheoranОценок пока нет

- Valuation of Bonds and Shares ExplainedДокумент40 страницValuation of Bonds and Shares ExplainedJyoti Bansal67% (3)

- Financial Management MCQs on Capital Budgeting, Risk AnalysisДокумент17 страницFinancial Management MCQs on Capital Budgeting, Risk Analysis19101977Оценок пока нет

- Problems On Hire Purchase and LeasingДокумент5 страницProblems On Hire Purchase and Leasingprashanth mvОценок пока нет

- Financial Derivatives and Risk Management ExplainedДокумент1 страницаFinancial Derivatives and Risk Management Explainedmm1979Оценок пока нет

- Calculating Capital Adequacy RatiosДокумент4 страницыCalculating Capital Adequacy Ratiosshuvo dasОценок пока нет

- Assignment Cost Sheet SumsДокумент3 страницыAssignment Cost Sheet SumsMamta PrajapatiОценок пока нет

- Working Capital Management in Reliance Industries LimitedДокумент5 страницWorking Capital Management in Reliance Industries LimitedVurdalack666Оценок пока нет

- Key Factors: Q-1 Key-Factor Product Mix Decision - Minimum Production Condition - Additional CostДокумент11 страницKey Factors: Q-1 Key-Factor Product Mix Decision - Minimum Production Condition - Additional CostPRABESH GAJURELОценок пока нет

- Concept and Classification of BetaДокумент16 страницConcept and Classification of BetamonuОценок пока нет

- Kota Tutoring: Financing The ExpansionДокумент7 страницKota Tutoring: Financing The ExpansionAmanОценок пока нет

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsДокумент90 страниц35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Corporate Financial Analysis with Microsoft ExcelОт EverandCorporate Financial Analysis with Microsoft ExcelРейтинг: 5 из 5 звезд5/5 (1)

- Solution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanДокумент18 страницSolution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanPravinn_Mahajan50% (2)

- Solution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanДокумент18 страницSolution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanPravinn_Mahajan50% (2)

- Ca-Ipcc Cost-Fm Question Paper Nov 13Документ8 страницCa-Ipcc Cost-Fm Question Paper Nov 13Pravinn_MahajanОценок пока нет

- Ca-Ipcc Question Paper Cost - FM Nov 13Документ8 страницCa-Ipcc Question Paper Cost - FM Nov 13Pravinn_MahajanОценок пока нет

- Valuation of Business SolutionДокумент16 страницValuation of Business SolutionPravinn_MahajanОценок пока нет

- Foreign Exchange Risk Management - Complete Sol PDFДокумент120 страницForeign Exchange Risk Management - Complete Sol PDFPravinn_Mahajan50% (2)

- Cost-Fm Question Paper Nov 13Документ8 страницCost-Fm Question Paper Nov 13Pravinn_MahajanОценок пока нет

- Forward Rate Agreements (Definition and Hedging)Документ28 страницForward Rate Agreements (Definition and Hedging)Pravinn_MahajanОценок пока нет

- Ca-Final SFM Question Paper Nov 13Документ11 страницCa-Final SFM Question Paper Nov 13Pravinn_MahajanОценок пока нет

- Solution To Foreign Exchange Risk Management...Документ56 страницSolution To Foreign Exchange Risk Management...Pravinn_Mahajan100% (1)

- Cost FM WordДокумент8 страницCost FM WordPravinn_MahajanОценок пока нет

- Solution To Assignment MUTUAL FUNDДокумент17 страницSolution To Assignment MUTUAL FUNDPravinn_MahajanОценок пока нет

- CA FINAL SFM - NOV 2012 Question PAPERДокумент8 страницCA FINAL SFM - NOV 2012 Question PAPERPravinn_MahajanОценок пока нет

- Dividend Decision SolДокумент25 страницDividend Decision SolPravinn_Mahajan0% (1)

- Pravinn Mahajan CA Ipcc Cost & FM Nov 2011 SolutionДокумент15 страницPravinn Mahajan CA Ipcc Cost & FM Nov 2011 SolutionPravinn_MahajanОценок пока нет

- Solution MERGER & ACQUISITION, CA-FINAL-SFM by CA PRAVINN MAHAJANДокумент51 страницаSolution MERGER & ACQUISITION, CA-FINAL-SFM by CA PRAVINN MAHAJANPravinn_Mahajan80% (5)

- Solution To Right Issue CA FINAL SFM by PRAVINN MAHAJANДокумент15 страницSolution To Right Issue CA FINAL SFM by PRAVINN MAHAJANPravinn_Mahajan100% (1)

- Ca - Final - SFM TheoryДокумент13 страницCa - Final - SFM TheoryPravinn_MahajanОценок пока нет

- Solution To Assignment BOND VALUATION PDFДокумент45 страницSolution To Assignment BOND VALUATION PDFPravinn_MahajanОценок пока нет

- Operational Research Assignment............ (Ca Final Cost and Or)Документ87 страницOperational Research Assignment............ (Ca Final Cost and Or)Pravinn_Mahajan80% (5)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- CA Final SFM May 2012 QUESTION PAPERДокумент7 страницCA Final SFM May 2012 QUESTION PAPERPravinn_MahajanОценок пока нет

- CA FINAL SFM Solution Nov2011Документ15 страницCA FINAL SFM Solution Nov2011Pravinn_MahajanОценок пока нет

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperДокумент9 страницPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanОценок пока нет

- Cracking Mba Finance InterviewДокумент41 страницаCracking Mba Finance InterviewJITHIN PADINCHARE RAMATH KANDIYIL100% (1)

- Real Options and Financial Structuring - Case Study 2 Corning: Convertible Preferred StockДокумент6 страницReal Options and Financial Structuring - Case Study 2 Corning: Convertible Preferred StockRoy SarkisОценок пока нет

- Our Thoughts About Risk Parity and All WeatherДокумент13 страницOur Thoughts About Risk Parity and All Weatherdpbasic100% (1)

- Guidelines UGCF BCOMP 2.1 Corporate AccountingДокумент7 страницGuidelines UGCF BCOMP 2.1 Corporate AccountingShiv KumarОценок пока нет

- Colgate Palmolive India financial ratios analysis 2019-20Документ3 страницыColgate Palmolive India financial ratios analysis 2019-20wantAОценок пока нет

- Asset Master: Plan Summary (In PHP)Документ15 страницAsset Master: Plan Summary (In PHP)JULIUS TIBERIO100% (1)

- Special Economic Zones - Ram Krishna RanjanДокумент45 страницSpecial Economic Zones - Ram Krishna RanjanVibhas KumarОценок пока нет

- Arrow Et. Al. - 2004Документ34 страницыArrow Et. Al. - 2004Ayush KumarОценок пока нет

- FIN 5001 - Course OutlineДокумент6 страницFIN 5001 - Course OutlineJoe Thampi KuruppumadhomОценок пока нет

- CH 07Документ59 страницCH 07Haroon NaseerОценок пока нет

- Assignment 1 2015Документ2 страницыAssignment 1 2015marryam nawazОценок пока нет

- Solution Manual For Real Estate Principles A Value Approach Ling Archer 4th EditionДокумент11 страницSolution Manual For Real Estate Principles A Value Approach Ling Archer 4th EditionDawnCalderonwtmy100% (35)

- Cmu MSCF f17 ViewbookДокумент8 страницCmu MSCF f17 Viewbookmaimai175Оценок пока нет

- 2.3 Capital Budgeting PDFДокумент26 страниц2.3 Capital Budgeting PDFOwlHeadОценок пока нет

- Chapter I Company ProfileДокумент62 страницыChapter I Company ProfileSherlin DisouzaОценок пока нет

- RIL RightsДокумент16 страницRIL Rightsprajakt_pieОценок пока нет

- Flames of Binary Option Vip Secrets: 60% Winrate MethodeДокумент12 страницFlames of Binary Option Vip Secrets: 60% Winrate MethodeDaniel Andres Aislant Caro100% (1)

- Ca ReportДокумент3 страницыCa ReportMonu MonuОценок пока нет

- Financial Management Training. OKДокумент139 страницFinancial Management Training. OKGina Serafica SocratesОценок пока нет

- PT PP Persero TBK Des17 Final PDFДокумент145 страницPT PP Persero TBK Des17 Final PDFaprillia ikaОценок пока нет

- A, B, C - Specialised Accounting - 2Документ15 страницA, B, C - Specialised Accounting - 2محمود احمدОценок пока нет

- Historical Data Analysis: (DIGI: Appendix 6.0-8.0)Документ9 страницHistorical Data Analysis: (DIGI: Appendix 6.0-8.0)Ayame DelanoОценок пока нет

- Chapter 9 MafinДокумент36 страницChapter 9 MafinReymilyn SanchezОценок пока нет

- Cash and Cash EquivalentsДокумент2 страницыCash and Cash EquivalentsMary Jullianne Caile SalcedoОценок пока нет

- Comparison of Habib Metro ModarabaДокумент8 страницComparison of Habib Metro ModarabaihtashamОценок пока нет

- BFS L0 Ques464Документ360 страницBFS L0 Ques464Aayush AgrawalОценок пока нет

- Leveraged Recapitalization and Exchange Offers: Prof. Ian GiddyДокумент28 страницLeveraged Recapitalization and Exchange Offers: Prof. Ian GiddyMohit KhandelwalОценок пока нет

- MGMT 109 HWДокумент2 страницыMGMT 109 HWgorillaОценок пока нет

- Syla F552Документ7 страницSyla F552Aiman Maimunatullail RahimiОценок пока нет

- Six PMs Describe How They Read The News 2016 June 102 PDFДокумент24 страницыSix PMs Describe How They Read The News 2016 June 102 PDFsusan_hoover2915Оценок пока нет