Академический Документы

Профессиональный Документы

Культура Документы

Monthly Pay Etc

Загружено:

Ann DyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Monthly Pay Etc

Загружено:

Ann DyАвторское право:

Доступные форматы

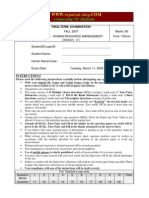

Before I can answer your question, and to protect the rights of your employees (including the the privilege

of the employer), I may need some facts from you as follows: 1. Reason for not entitling them (employees) to overtime pay. 2. Are they monthly paid employees or daily paid employees (based on the employment of contract or CBA)? Monthly-paid employees are those who are paid every day of the month, including unworked rest days, special days and regular holidays. Daily-paid employees are those who are paid on the days they actually worked and on unworked regular holidays.

Overtime pay laws and computation in the Philippines

October 10, 2009 by Admin Filed under Employer - employees 33 Comments

Man is not a machine. At the end of the day, he has to rest to rejuvenate and prepare himself for tomorrows work. That is why labor standard laws in many countries set up maximum hours of work for employees. In the Philippines, our Labor Code fixed the maximum at eight (8) hours a day (see Article 83, Labor Code of the Philippines) for six consecutive work days (Article 91, LCP). If the employee works beyond eight hours, the employer is required to pay an additional compensation equivalent to the employees regular wage plus at least twenty-five percent (25%) of such regular wage. The rate is increased to thirty percent (30%) if the worker renders overtime on a holiday or rest day. (Article 87, LCP). Who are covered? All employees in all establishments and undertakings whether for profit or not are entitled to overtime pay for work rendered beyond eight (8) hours. But this does not apply to managerial employees, field personnel, members of the family of the employer who are dependent on him for support, domestic helpers, persons in the personal service of another, and workers who are paid by results. Employees in the government are also entitled to overtime pay but they are governed by Civil Service laws and rules. Only employees in the private sector are covered by the Labor Code. Special rules for health personnel For health personnel in (1)cities and municipalities with a population of at least one million (1,000,000) or in (2)hospitals and clinics with a bed capacity of at least one hundred (100), their normal hours of work are eight (8) hours a day, for five (5) days a week, exclusive of time for meals. (Article 83, LCP) Health personnel includes resident physicians, nurses, nutritionists, dietitians, pharmacists, social workers, laboratory technicians, paramedical technicians, psychologists, midwives, attendants and all other hospital or clinic personnel. Overtime work by health personnel included in the two abovementioned instances is, as a rule, not allowed since it involves strenuous physical work considering the number of patients or clients they must attend to. However, they may be compelled to work beyond such hours where the exigencies of the service require that they work for six (6) days or forty-eight (48) hours. But the employer is required to pay an additional compensation of at least thirty percent (30%) of their regular wage for work on the sixth day. Can an employee be compelled to render overtime? When an employee spends additional time for work, he puts in more physical and mental effort. It is but proper that he be compensated for that. He is also delayed in going home and cannot spend time with family and enjoy the comforts of his home. As such, the law discourages employers to require employees to work overtime. Generally, he cannot compel the employee to render overtime, except in certain instances (Sec 10, Rule I, Bk. III, IRR) to wit: 1) When the country is at war or when any other national or local emergency has been declared by the National Assembly or the Chief Executive; 2) When overtime work is necessary to prevent loss of life or property, or in case of imminent danger to public safety due to actual or impending emergency in the locality caused by serious accident, fire, floods, typhoons, earthquake, epidemic or other disaster or calamities; 3) When there is urgent work to be performed on machineries, installations, or equipment, in order to avoid serious loss or damage to the employer or some other causes of similar nature; 4) When the work is necessary to prevent loss or damage to perishable goods; 5) When the completion or continuation of work started before the 8th hour is necessary to prevent serious obstruction or prejudice to the business or operations of the employer; 6) When overtime work is necessary to avail of favorable weather or environmental conditions where performance or quality of work is dependent thereon. Can an employee insist on working overtime?

The employee cannot compel his employer to allow him to work overtime when the circumstances does not require him to do so as when there is actually no work to be performed. Under time cannot be offset by overtime Under time work on any particular day shall not be offset by overtime work on any other day (Article 88, LCP). The reason behind this is fairness. If the employee works for less than eight hours, he will be paid only for the corresponding number of hours he had actually worked. If on another day he works beyond the maximum hours, he should be given additional compensation. Non-payment of overtime pay is not only illegal but also contrary to public policy. The employer cannot use the overtime to offset the under time because payment of overtime pay is mandatory. However, he may either deduct the under time from the wage of the employee, or through other approaches. Although these methods are not provided by law, these may be found in company policies or established by company practices. Computation of wages The computation of overtime pay, pay for work done on holidays, premium on nightshift and 13th month pay are set out by the following rules: Computing Overtime: On Ordinary Days Number of hours in excess of 8 hours (125% x hourly rate) On a rest day, special day or regular holiday Number of hours in excess of 8 hours (130% x hourly rate) Computing pay for work done on: A special day (130% x basic pay) A special day, which is also a scheduled rest day (150% x basic pay) A regular holiday (200% x basic pay) A regular holiday, which is also a scheduled rest day (260% x basic pay) Computing Night Shift Premium Where Night Shift is a Regular Work: On Ordinary day (110% x basic hourly rate) On a rest day, special day, regular holiday (110% of regular hourly rate for a rest day, special day, regular holiday) Computing Overtime on Night Shift: On ordinary day (110%) x overtime hourly rate) On rest day, special day or regular holiday (110% x overtime hourly rate for rest days, special days, regular holidays) Computing 13th Month Pay: Total basic salary earned for the year exclusive of overtime, holiday, and night shift differential pay divided by 12 = 13th month pay

COLA

Thus, monthly-paid employees whose monthly salaries cover all days in a month are deemed paid their basic wages, and should be entitled to their COLA on all those days even if unworked. Conversely, if the CBA computes monthly basic pay on the basis of five days a week (or 22 days a month) the employees" COLA should be computed on this basis. The CBA is the law between the parties, and if not acceptable, it can be the subject of future negotiations. (Globe Mckay vs. NLRC, supra)

On the other hand, Section 6 of the Implementing Rules and Regulations of Republic Act No. 6727 provides: Sec. 6. Suggested Formula in Determining the Equivalent Monthly Statutory Minimum Wage Rates. Without prejudice from existing company practices, agreements or policies, the following formulas may be used as guides in determining the equivalent monthly statutory minimum wage rates: xxx xxx xxx d) For those who do not work and are not considered paid on Saturdays and Sundays or rest days: Equivalent Monthly = Average Daily Wage Rate x 262 days Rate (EMR) 12 Where 262 days =

250 days Ordinary working days 10 days Regular holidays 2 days Special days (If considered paid; if actually worked, this is equivalent to 2.6 days) 262 days Total equivalent number of days Based on the above, the proper divisor that should be used for a situation wherein the employees do not work and are not considered paid on Saturdays and Sundays or rest days is 262 days. In the present case, since the employees of Trans-Asia are required to work half-day on Saturdays, 26 days should be added to the divisor of 262 days, thus, resulting to 288 days. However, due to the fact that the rest days of petitioners fall on a Sunday, the number of unworked but paid legal holidays should be reduced to nine (9), instead of ten (10), since one legal holiday under E.O. No. 203 always falls on the last Sunday of August, National Heroes Day. Thus, the divisor that should be used in the present case should be 287 days. However, the Court notes that if the divisor is increased to 287 days, the resulting daily rate for purposes of overtime pay, holiday pay and conversions of accumulated leaves would be diminished. To illustrate, if an employee receives P8,000.00 as his monthly salary, his daily rate would be P334.49, computed as follows: P8,000.00 x 12 months = P334.49/day 287 days Whereas if the divisor used is only 286 days, the employee's daily rate would be P335.66, computed as follows: P8,000.00 x 12 months = P335.66/day 286 days Clearly, this muddled situation would be violative of the proscription on the non-diminution of benefits under Section 100 of the Labor Code. On the other hand, the use of the divisor of 287 days would be to the advantage of petitioners if it is used for purposes of computing for deductions due to the employee's absences. In view of this situation, the Court rules that the adjusted divisor of 287 days should only be used by Trans-Asia for computations which would be advantageous to petitioners, i.e., deductions for absences, and not for computations which would diminish the existing benefits of the employees, i.e., overtime pay, holiday pay and leave conversions. For their second assignment of error, petitioners argue that, since they provided the NLRC with "overwhelming proof" of their claim against Trans-Asia, the least that the NLRC could have done was to declare that there existed an ambiguity with regard to TransAsia's payment of holiday pay. Petitioners then posits that if the NLRC had only done so, this ambiguity would have been resolved in their favor because of the constitutional mandate to resolve doubts in favor of labor. We are not persuaded. As previously stated, the decision of the labor arbiter and the resolutions of the NLRC were based on substantial evidence and, as such, no ambiguity or doubt exists which could be resolved in petitioners' favor. WHEREFORE, premises considered, the Resolutions of the NLRC, dated 23 November 1993 and 13 September 1994, are hereby AFFIRMED with the MODIFICATION that Trans-Asia is hereby ordered to adjust its divisor to 287 days and pay the resulting holiday pay in arrears brought about by this adjustment starting from 30 June 1987, the date of effectivity of E.O. No. 203. SO ORDERED.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Walmart 1 Percent ReportДокумент20 страницWalmart 1 Percent ReportClare O'ConnorОценок пока нет

- Labor RelationsДокумент31 страницаLabor RelationsSalahuddin Sultan78% (9)

- Problem 1Документ14 страницProblem 1Zenedel De JesusОценок пока нет

- 104 EFREN P. PAGUIO VS NLRC G.R. No. 147816 May 9, 2003Документ2 страницы104 EFREN P. PAGUIO VS NLRC G.R. No. 147816 May 9, 2003Region 6 MTCC Branch 3 Roxas City, Capiz100% (1)

- The Great Bombay Textile StrikeДокумент11 страницThe Great Bombay Textile Strikekdkaushaldubey99580% (1)

- Mango Salsa Recipe: IngredientsДокумент1 страницаMango Salsa Recipe: IngredientsAnn DyОценок пока нет

- Tom Yum Soup Original Recipe Makes 4 - 6 ServingsДокумент1 страницаTom Yum Soup Original Recipe Makes 4 - 6 ServingsAnn DyОценок пока нет

- Puff Pastry RecipeДокумент3 страницыPuff Pastry RecipeAnn DyОценок пока нет

- Fetuccinne CarbonaraДокумент1 страницаFetuccinne CarbonaraAnn DyОценок пока нет

- Puff Pastry RecipeДокумент3 страницыPuff Pastry RecipeAnn DyОценок пока нет

- Puff Pastry: Recipe Makes 3 1/2 PoundДокумент1 страницаPuff Pastry: Recipe Makes 3 1/2 PoundAnn DyОценок пока нет

- Krispy Kreme DonutsДокумент1 страницаKrispy Kreme DonutsAnn DyОценок пока нет

- Manggo With Sticky RiceДокумент2 страницыManggo With Sticky RiceAnn DyОценок пока нет

- Indian Rice and DalДокумент2 страницыIndian Rice and DalAnn DyОценок пока нет

- MojitoДокумент1 страницаMojitoAnn DyОценок пока нет

- Beef KalderetaДокумент1 страницаBeef KalderetaAnn DyОценок пока нет

- Chocolate CrinklesДокумент1 страницаChocolate CrinklesAnn DyОценок пока нет

- Quinoa With Garlic ShrimpДокумент1 страницаQuinoa With Garlic ShrimpAnn DyОценок пока нет

- Airphil Domestic Taxes - Fees - Surcharges On 2P As of 05 Oct 2012c - tcm42-86265Документ1 страницаAirphil Domestic Taxes - Fees - Surcharges On 2P As of 05 Oct 2012c - tcm42-86265Ann DyОценок пока нет

- Fresh Fettuccine With Mushroom and Truffle OilДокумент2 страницыFresh Fettuccine With Mushroom and Truffle OilAnn DyОценок пока нет

- Cookies and Cream Fudge BrowniesДокумент1 страницаCookies and Cream Fudge BrowniesAnn DyОценок пока нет

- Philippine Legal FormatsДокумент38 страницPhilippine Legal FormatsAnn DyОценок пока нет

- 10 ACCT 1A&B MFGДокумент14 страниц10 ACCT 1A&B MFGShannon MojicaОценок пока нет

- Director Human Resources Healthcare in Orange County CA Resume Catherine ShortridgeДокумент2 страницыDirector Human Resources Healthcare in Orange County CA Resume Catherine ShortridgeCatherineShortridgeОценок пока нет

- New Cross Leaflet 3Документ2 страницыNew Cross Leaflet 3api-246118197Оценок пока нет

- June 2018 Mark Scheme 11 PDFДокумент18 страницJune 2018 Mark Scheme 11 PDFBOMMBОценок пока нет

- Elasticty and DemandДокумент7 страницElasticty and DemandNemish RanavatОценок пока нет

- SOEN Research Study - PovertyДокумент23 страницыSOEN Research Study - PovertyJose Patrick Edward EspinosaОценок пока нет

- A National Policy Study On Child Labour and Development in The PhilippinesДокумент66 страницA National Policy Study On Child Labour and Development in The PhilippinesJerelynPorcalLigarayОценок пока нет

- 23 Allan Bazar Vs Carlos Ruizol G.R. No. 198782, October 19, 2016Документ4 страницы23 Allan Bazar Vs Carlos Ruizol G.R. No. 198782, October 19, 2016Robelle RizonОценок пока нет

- MGT501 Collection OF OLD PAPERSДокумент53 страницыMGT501 Collection OF OLD PAPERScs619finalproject.com0% (1)

- Bifd050202.PDF Why Tax CorporationsДокумент10 страницBifd050202.PDF Why Tax CorporationsAntonioMarinielloОценок пока нет

- Wagner DiagДокумент13 страницWagner Diagilove2shopОценок пока нет

- Maruti SuzukiДокумент69 страницMaruti SuzukiDhrubojyoti ChaudhuriОценок пока нет

- Redundancy Case Labor GR - 229746 - 2017 PDFДокумент15 страницRedundancy Case Labor GR - 229746 - 2017 PDFAnonymous AsHKqbivhsОценок пока нет

- Expression of Interest To Hire Foreign Worker(s) Form New Brunswick EmployersДокумент1 страницаExpression of Interest To Hire Foreign Worker(s) Form New Brunswick EmployersMaster Of GamesОценок пока нет

- John Kay's "Flying Shuttle": Inventions and DiscoveriesДокумент3 страницыJohn Kay's "Flying Shuttle": Inventions and DiscoveriesSmitha SОценок пока нет

- Somany CeramicsДокумент16 страницSomany CeramicsAMIT SHARMA100% (1)

- Handout 04 Data DescriptionДокумент44 страницыHandout 04 Data Descriptionakbar100% (1)

- San Miguel V SemillanoДокумент15 страницSan Miguel V Semillanorgtan3Оценок пока нет

- Markets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Документ24 страницыMarkets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Sapna RohitОценок пока нет

- Microeconomics-Final.: October 8, 2010Документ3 страницыMicroeconomics-Final.: October 8, 2010Anu AmruthОценок пока нет

- Insider Outsider TheoryДокумент21 страницаInsider Outsider TheorysukandeОценок пока нет

- Women Have Always Worked A Concise History FДокумент29 страницWomen Have Always Worked A Concise History FIsabella Villegas CorreaОценок пока нет

- Supreme Court: Today Is Saturday, March 09, 2019Документ8 страницSupreme Court: Today Is Saturday, March 09, 2019carmzy_ela24Оценок пока нет

- For Citation or Quotation Without Prior Permission of AuthorsДокумент36 страницFor Citation or Quotation Without Prior Permission of AuthorsJeremie M. CruzОценок пока нет

- Princess Talent Center Production, Inc. vs. Masagca, 860 SCRA 602, G.R. No. 191310 April 11, 2018Документ62 страницыPrincess Talent Center Production, Inc. vs. Masagca, 860 SCRA 602, G.R. No. 191310 April 11, 2018Jm SantosОценок пока нет