Академический Документы

Профессиональный Документы

Культура Документы

Untitled

Загружено:

Vivek SinghАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Untitled

Загружено:

Vivek SinghАвторское право:

Доступные форматы

Today, The Indian Economy is in the process of becoming a world class economy.

T he Indian banking industry is making great advancement in terms of quality, quan tity, expansion and diversification and is keeping up with the updated technology, ability, stabilit y and thrust of a financial system, where the commercial banks play a very impor tant role, emphasize the very special need of a strong and effective control sys tem with extra concern for the risk involved in the business. Globalization, Lib eralization and Privatization have opened up a new methods of Financial transaction where risk level is very high. In banks and financial inst itutions risk is considered to be the most important factor of earnings. Therefo re they have to balance the Relationship between risk and return. In reality we can say that management of financial institution is nothing but a management of risk managing financial risk systematically and professionally bec omes an even more important task. Rising global competition, increasing deregulation, introduction of innova tive products and delivery channels have pushed risk management to the forefront of today's financial landscape. Ability to gauge the risks and take appropriate position will be the key to success. It can be said that risk takers will survi ve, effective risk managers will proper and risk averse are likely to perish. The risk arises due to uncertainties, which in turn arise due to changes taking place in prevailing economic, social and political environment and lack of non-a vailability of information concerning such changes. Risk is an exposure to a transaction with loss, which occurs with some probabili ty and which can be expected, measured and minimized. In financial institutions risk result from variations and fluctuations in assets or liability or both in i ncomes from assets or payments and on liabilities or in outflows and inflows of cash. Today, banks are facing various types of risks that financial Intermediaries are exposed to, in the course of their business, which can be pre sented through following chart: Credit Risk: Credit risk is defined as the possibility of losses associated with decrease in the credit quality of the borrower or the counter parties. In the b ank's portfolio, losses stem from outside default due to inability or unwillingn ess of the customer or the counter party to meet the commitments, losses may als o result from reduction in the portfolio value arising from actual or perceived deterioration in credit quality Market Risk: Market risk is the risk of incurring losses on account of movements in market prices on all positions held by the banks. Liquidity risk of banks ar ises from funding of long term assets (advances) by short term sources (deposits ) changes in interest rate can significantly affect the Net Interest Income (NII ). The risk of an adverse impact on NII due to variations of interest rate may b e called interest rate risk. Forex risk is the risk of loss that bank may suffer on account of adverse exchange rate movements against uncovered position in for eign currency. Non-Financial Risk: Non-financial risk refers to those risks that may affect a b ank's business growth, marketability of its product and services, likely failure of its strategies aimed at business growth etc. These risks may arise on accoun t of management failures, competition, non-availability of suitable products/ser vices, external factors etc. In these risk operational and strategic risk have a great need of consideration. Operational Risk: It may be defined as the risk of loss resulting from inadequat e or failed internal process people and systems or because of external events. Risk Management in Bank: Basel Committee Approach: In order to help the banks to recognize the different kinds of risks and to take adequate steps to overcome t he under capitalization of banks assets and lessen the credit and operational ri sks faced by banks. Banks of International Settlement (BIS) set up Basel Committ ee on banking supervision in 1988, which issued guidelines for updating risk man agement in banks. These guidelines brought about standardization and universaliz ation among the global banking committee for risk management and seek to protect the interest of the depositors/shareholders of the bank. As per the guidelines

issued, capital adequacy was considered panacea for risk management and all bank s were advised to have Capital Adequacy Ratio (CAR) at at least 8%. CAR is the r atio of capital to risk weighted assets and it provides the cushion to the depos itors in case of bankruptcy. In January 1999, the Basel Committee proposed a new capital accord, which is known as Basel II. A sound framework for measuring and quantifying the risk associated with banking operations put by it. The emphasis of New Basel Accord is on flexibility, efficient operations and higher revenues for banks with full acknowledgement of risks. The New Accord makes clear distin ction between the credit risk, market risk and operational risk stipulating asse ssment of risk weight age covering all the three categories separately.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- UN-Habitat Country Programme Document - KenyaДокумент32 страницыUN-Habitat Country Programme Document - KenyaUnited Nations Human Settlements Programme (UN-HABITAT)Оценок пока нет

- Capacity Management in Service FirmsДокумент10 страницCapacity Management in Service FirmsJussie BatistilОценок пока нет

- Price Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruДокумент8 страницPrice Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruBandono JnrОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Manta Aji Coroko Sungsang ASLIДокумент1 страницаManta Aji Coroko Sungsang ASLIFarhan HumamОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Event Managment Project MbaДокумент26 страницEvent Managment Project Mbasuruchi100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Japan CurrencyДокумент13 страницJapan CurrencymelisaОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Key Success Factors For The Apparel ManufacturingДокумент6 страницKey Success Factors For The Apparel ManufacturingMostaqueemОценок пока нет

- Digital Transformation A Road-Map For Billion-Dollar OrganizationsДокумент68 страницDigital Transformation A Road-Map For Billion-Dollar OrganizationsApurv YadavОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Ecosystem Services of The Congo Basin ForestsДокумент33 страницыEcosystem Services of The Congo Basin ForestsGlobal Canopy Programme100% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

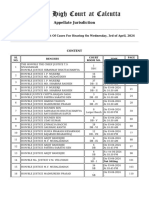

- Notice 11120 02 Apr 2024Документ669 страницNotice 11120 02 Apr 2024bhattacharya.devangana2Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

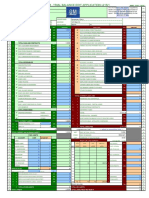

- GM OEM Financials Dgi9ja-2Документ1 страницаGM OEM Financials Dgi9ja-2Dananjaya GokhaleОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Introduction and Importance of Bank Reconciliation Statement (BRS)Документ12 страницIntroduction and Importance of Bank Reconciliation Statement (BRS)Rizwan BashirОценок пока нет

- Proposal Project AyamДокумент14 страницProposal Project AyamIrvan PamungkasОценок пока нет

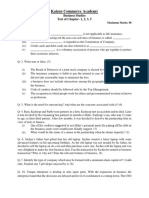

- Business StudiesДокумент2 страницыBusiness StudiesSonal JhaОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Certification of Residency - Form A - AccomplishedДокумент2 страницыCertification of Residency - Form A - AccomplishedjonbertОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Tax Reviewer For MidtermДокумент4 страницыTax Reviewer For Midtermjury jasonОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Banglore BPOДокумент2 страницыBanglore BPOwaris bhatОценок пока нет

- EcoTourism Unit 8Документ20 страницEcoTourism Unit 8Mark Angelo PanisОценок пока нет

- 08 Brushes PDFДокумент48 страниц08 Brushes PDFbelan_80Оценок пока нет

- Airport Design WIRATMAN ARCHITECTURE. Imelda Akmal Architecture Writer Studio Wiratman - Revisi CP II - Indd 3 10 - 5 - 16 10 - 21 AMДокумент9 страницAirport Design WIRATMAN ARCHITECTURE. Imelda Akmal Architecture Writer Studio Wiratman - Revisi CP II - Indd 3 10 - 5 - 16 10 - 21 AMRasyidashariОценок пока нет

- Economic Impact of Beef Ban - FinalДокумент18 страницEconomic Impact of Beef Ban - Finaldynamo vjОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 2013b Blanchard Latvia CrisisДокумент64 страницы2013b Blanchard Latvia CrisisrajaytОценок пока нет

- Bank Guarantee BrochureДокумент46 страницBank Guarantee BrochureVictoria Adhitya0% (1)

- Accounting EquationДокумент2 страницыAccounting Equationmeenagoyal9956Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Progressive Housing in New York City: A Closer Look at Model Tenements and Finnish CooperativesДокумент154 страницыProgressive Housing in New York City: A Closer Look at Model Tenements and Finnish Cooperativescarly143100% (5)

- Small Scale Industries in IndiaДокумент18 страницSmall Scale Industries in IndiaTEJA SINGHОценок пока нет

- The Affluent SocietyДокумент189 страницThe Affluent SocietyOtter1zОценок пока нет

- Contemporary World 5 PDF FreeДокумент3 страницыContemporary World 5 PDF FreeAlmira SocorОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Rallis India AR 2014-15 Page 25Документ168 страницRallis India AR 2014-15 Page 25bhomikjainОценок пока нет

- Read The Article and Tick BedzedДокумент1 страницаRead The Article and Tick BedzedYaqueline Santamaria FerreñanОценок пока нет