Академический Документы

Профессиональный Документы

Культура Документы

Case Study 4 Solution: Datsun Institute

Загружено:

anon-880400Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case Study 4 Solution: Datsun Institute

Загружено:

anon-880400Авторское право:

Доступные форматы

Session Six — Refund and Repayment Calculations

Case Study 4 Solution

Datsun Institute

Important Points

✦ Because the college charges for tuition and fees for the entire program at the time of the

student’s enrollment, the entire length of the 900-clock-hour program is the period of

enrollment for which Diane was charged.

✦ Institutional charges include Diane’s costs for the required books and equipment.

However, the school may exclude its costs for the equipment as well as the

administrative fee from the refund calculation. (Note the excluded amount is the

documented cost to the school for the equipment, not the amount the school charged the

student for the equipment.) Because Diane returned the books she purchased for the

program at the time of her withdrawal, the school may not exclude its costs for the books

from the refund calculation.

✦ Diane withdrew after completing 23% of the period of enrollment for which she was

charged (i.e., 210 clock hours divided by 900 clock hours). Because she was attending

the school for the first time and withdrew before completing at least 60% of the

enrollment period, Pro Rata refund requirements apply. Because there is no ED-

approved accrediting agency or state refund policy, the Pro Rata refund calculation is the

only refund calculation which the school must perform.

✦ The portion of the period of enrollment for which Diane was charged that remains after

Diane’s withdrawal is 70% (i.e., 690 clock hours divided by 900 clock hours, rounded

down to the nearest 10%).

✦ The total amount of Diane’s unpaid charges (i.e., $1,455) is deducted from the initial

amount of refund.

✦ No repayment calculation is required because no aid was disbursed directly to Diane.

January 21, 1997 TG 6-83

Session Six — Refund and Repayment Calculations

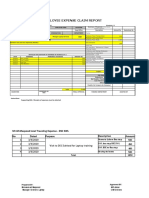

WITHDRAWAL RECORD

1. Student Information

Diane 1/5 2/20

Name Start Date Withdrawal Date/LDA

900 clock hours, 30 weeks 2/20

Social Security Number Length of Enrollment Period Date of WD/LDA Determination

USE TOTALS

2. Program Costs FOR PERIOD

CHARGED*

non- non-

inst. inst. inst. inst. TOTAL

✘ Tuition/Fees 2,515 Personal/Living Inst. Costs:

Administrative Fee Dependent Care 2,915 A

✘ Room & Board 5,000 Disability Costs TOTAL

Noninst. Costs:

✘ Books & Supplies 400 Miscellaneous

Transportation Miscellaneous

5,000 B

3. Payments/Disbursements TOTAL Aid Paid

To Inst. Costs:

DATE SOURCE

Paid to

Inst. Costs

Cash to

Student DATE SOURCE

Paid to

Inst. Costs

Cash to

Student

1,460 C

2/5 Direct Sub. Staff. 1,260 TOTAL Paid To

(Exclude work-study awards.)

Inst. Costs:

1/5 Federal Pell 200

1,460 D

TOTAL Aid Paid

as Cash:

0 E

*USE TOTALS AS CHARGED FOR THE ENROLLMENT PERIOD (The following minimums apply: for term programs, use

totals for the term; for all nonterm programs longer than or equal to the academic year, use totals for the payment period or for one-half of

the academic year, whichever is greater. For all nonterm programs shorter than the academic year, use totals for the program length. If you

charge by different periods for different charges, convert all totals to represent the longest period.)

4. Data for Pro Rata and Federal Refund

IS THIS STUDENT A FIRST-TIME STUDENT? A first-time student is one who has not previously attended at least

one class at this school, or has received a 100 percent refund (less any permitted administrative fee) for previous attendance. (A first- ✘

time student remains so until he or she withdraws after attending at least one class at the school or completes the period of enrollment.) YES NO

DID THIS STUDENT WITHDRAW ON OR BEFORE THE 60% POINT? For credit-hour programs, the

60% point is the point in calendar time when 60% of the enrollment period has elapsed. For clock-hour programs, it is the point

when this particular student completes 60% of the hours scheduled for the enrollment period.

✘

YES NO

IF THE ANSWER TO BOTH QUESTIONS IS "YES," a statutory pro rata refund calculation is required for this student. For

this calculation, you must determine the Portion That Remains (of the enrollment period) and the institutional costs that may be excluded, if any.

TO DETERMINE THE PORTION THAT REMAINS, TO DETERMINE EXCLUDABLE INSTITUTIONAL COSTS:

calculate as follows and round DOWN to the nearest 10% •Administrative Fee (up to $100 or 5%, whichever is less) + 100

•For credit-hour programs: •Documented Cost of Unreturnable Equipment + 135

WEEKS REMAINING •Documented Cost of Returnable Equipment (if not returned in

TOTAL WEEKS IN good condition within 20 days of withdrawal) + 0

•For clock-hour programs:* TOTAL EXCLUDABLE INST. COSTS (for Pro Rata and

HOURS REMAINING 690 Federal Refund calculations only): 235

TOTAL HOURS IN

•For correspondence programs: 900 Pro Rata/Federal Refund

LESSONS NOT

Institutional Costs:

SUBMITTED 2,915 A 235 2,680 A

*DO NOT use scheduled hours. Also, excused absences can count as “hours completed.” Total Institutional Costs Total Excludable Inst. Costs

1996-97

United States Department of Education

Student Financial Assistance Programs

TG 6-84 January 21, 1997

Session Six — Refund and Repayment Calculations

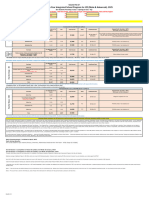

PRO RATA REFUND CALCULATION WORKSHEET

STEP ONE 2,915 Total Institutional Costs

(from Withdrawal Record) A

Total Aid Paid to Inst. Costs*

Unpaid Charges 1,460 (also from Withdrawal Record) C

*Scheduled SFA payments and FFEL/Direct late Student's Scheduled

disbursements that have not yet been received, for 1,455 Cash Payment (SCP)

which the student is still eligible in spite of having

withdrawn, must be counted to reduce the student's Student's Cash Paid

scheduled cash payment. This includes late State aid 0 (from Withdrawal Record)

disbursements as allowed under written State policy.

(Scheduled payments from sources other than those

above cannot be counted in this manner.) 1,455 UNPAID CHARGES

STEP TWO 2,680 Pro Rata Institutional Costs

(from Withdrawal Record) A1

% to be Refunded

Refund Amount X 70% (from the Portion That Remains)

Generally, funds must be returned to the appropriate

program account(s) within 30 days of the date of

withdrawal, and to the lender within 60 days of the

1,876 Initial Refund Amount

If this amount is negative,

same. Unpaid Charges the school may bill the

1,455 (from Step One) student for that amount.

No refund is due.

421 ACTUAL REFUND

TO BE DISTRIBUTED

REFUND DISTRIBUTION—Prescribed by Law and Regulation

TOTAL REFUND 421

1. Federal SLS Loan 8. Federal Perkins Loan

2. Unsubsidized Federal Stafford Loan 9. Federal Pell Grant

3. Subsidized Federal Stafford Loan 10. FSEOG

4. Federal PLUS Loan 11. Other Title IV Aid Programs

5. Unsubsidized Federal Direct Stafford Loan 12. Other Federal, state, private, or institutional aid

6. Subsidized Federal Direct Stafford Loan 421 13. The student

7. Federal Direct PLUS Loan

1996-97

United States Department of Education

Student Financial Assistance Programs

January 21, 1997 TG 6-85

Вам также может понравиться

- Case Study 6 Solution: Fishburn InstituteДокумент4 страницыCase Study 6 Solution: Fishburn Instituteanon-613687Оценок пока нет

- Case Study 2 Solution: Beemis Technical CollegeДокумент4 страницыCase Study 2 Solution: Beemis Technical Collegeanon-954643Оценок пока нет

- Case Study 9 Solution: Juno Community CollegeДокумент5 страницCase Study 9 Solution: Juno Community Collegeanon-735551Оценок пока нет

- Case Study 7 Solution: Geiger State CollegeДокумент5 страницCase Study 7 Solution: Geiger State Collegeanon-256811Оценок пока нет

- Case Study 4: Datsun InstituteДокумент5 страницCase Study 4: Datsun Instituteanon-470348Оценок пока нет

- Case Study 2: Beemis Technical CollegeДокумент5 страницCase Study 2: Beemis Technical Collegeanon-811984Оценок пока нет

- Case Study 5: Eagle Point State UniversityДокумент6 страницCase Study 5: Eagle Point State Universityanon-367174Оценок пока нет

- Description: Tags: ch3 s4csДокумент30 страницDescription: Tags: ch3 s4csanon-918027Оценок пока нет

- Case Study 9: Juno Community CollegeДокумент7 страницCase Study 9: Juno Community Collegeanon-854810Оценок пока нет

- Description: Tags: tgrc01Документ10 страницDescription: Tags: tgrc01anon-198828Оценок пока нет

- Case Study 7: Geiger State CollegeДокумент7 страницCase Study 7: Geiger State Collegeanon-194259Оценок пока нет

- Division Travel Authority Revise Template 1 4Документ2 страницыDivision Travel Authority Revise Template 1 4JOEL D. BATERISNAОценок пока нет

- Employee Expense Claim Report: Instructions: Supporting Bills / Receipts of Expenses Must Be AttachedДокумент2 страницыEmployee Expense Claim Report: Instructions: Supporting Bills / Receipts of Expenses Must Be Attachedwaqas ansariОценок пока нет

- Department of Computing: Hardship Fund Application FormДокумент4 страницыDepartment of Computing: Hardship Fund Application FormVladОценок пока нет

- 1st Quarter Adopt A School ReportДокумент18 страниц1st Quarter Adopt A School ReportBaby PascuaОценок пока нет

- Liquidation SHSДокумент16 страницLiquidation SHSRio Ferdinand P. MarcelinoОценок пока нет

- Tagbac ES Supplemental Printing SLMsДокумент5 страницTagbac ES Supplemental Printing SLMsKlairjh Talagtag-realingoОценок пока нет

- Corrected: Brigham Young University 7195.00 Brigham Young University A153A ASBДокумент2 страницыCorrected: Brigham Young University 7195.00 Brigham Young University A153A ASBNathan MonsonОценок пока нет

- OBJECTIVE 23 Liquidation ReportДокумент16 страницOBJECTIVE 23 Liquidation ReportRegine LetchejanОценок пока нет

- Ok Sa Deped Form BFДокумент5 страницOk Sa Deped Form BFDaRylОценок пока нет

- OPLAN KALUSUGAN SA DEPED SoftДокумент5 страницOPLAN KALUSUGAN SA DEPED SoftRonnel Andres HernandezОценок пока нет

- FeesДокумент5 страницFeesSouradip DasОценок пока нет

- Tuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceДокумент4 страницыTuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceGeozzzyОценок пока нет

- (To Be Accomplished by The School Head) : Plan Alusugan Sa DepedДокумент14 страниц(To Be Accomplished by The School Head) : Plan Alusugan Sa DepedIrene TorredaОценок пока нет

- UgApplicationsOptionsReport DoДокумент1 страницаUgApplicationsOptionsReport Dosaroja sasaneОценок пока нет

- Fees 2023 PHD Risk Management 5CA R08Документ3 страницыFees 2023 PHD Risk Management 5CA R08Yanga KalipaОценок пока нет

- Application For Employment: Personal DetailsДокумент2 страницыApplication For Employment: Personal DetailsMarkОценок пока нет

- Self-Declaration Form For Claims Under The COVID Childcare Program - USIДокумент2 страницыSelf-Declaration Form For Claims Under The COVID Childcare Program - USISiva Sagar JaggaОценок пока нет

- STADIO SOE DL S1 Certificate - Education Fees 2024Документ2 страницыSTADIO SOE DL S1 Certificate - Education Fees 2024karishmasailor87Оценок пока нет

- Student Ledger (BME1701011342)Документ2 страницыStudent Ledger (BME1701011342)bariОценок пока нет

- Ok Sa Deped Form B (Dsfes)Документ10 страницOk Sa Deped Form B (Dsfes)Maan Bautista100% (2)

- Final-1stYear ProgrammeFees SAE September 2021-4Документ1 страницаFinal-1stYear ProgrammeFees SAE September 2021-4David JuniorОценок пока нет

- Degree Online Services, Telangana (Dost)Документ1 страницаDegree Online Services, Telangana (Dost)Banoth NithinОценок пока нет

- CBREG-JANДокумент4 страницыCBREG-JANJONATHAN VILLANUEVAОценок пока нет

- CDR July August Calawaan ESДокумент2 страницыCDR July August Calawaan ESWILBERT QUINTUAОценок пока нет

- Exam 4 MДокумент2 страницыExam 4 MGaneshОценок пока нет

- Abu Dhabi University Tuition and Fee Rates: Academic Year 2018-2019Документ7 страницAbu Dhabi University Tuition and Fee Rates: Academic Year 2018-2019UsmanОценок пока нет

- Fees Circular Jan-May 2024Документ5 страницFees Circular Jan-May 2024gopichandstoreОценок пока нет

- January 2023Документ8 страницJanuary 2023Arlene MalarasОценок пока нет

- North Rift Institute of Management Studies: YEAR 2019/2020Документ1 страницаNorth Rift Institute of Management Studies: YEAR 2019/2020Kangogo Pett100% (1)

- Bunny School FeesДокумент1 страницаBunny School FeesyouvsyouОценок пока нет

- Davao Doctors College: Course Year Level School Year SemesterДокумент2 страницыDavao Doctors College: Course Year Level School Year SemesterJULIANNE BAYHONОценок пока нет

- 1098T17Документ2 страницы1098T17RegrubdiupsОценок пока нет

- Cdr-July - August 2023Документ3 страницыCdr-July - August 2023MarieAnne RoblesОценок пока нет

- Certificate of Registration: 267770 Summer AY 2020-2021Документ1 страницаCertificate of Registration: 267770 Summer AY 2020-2021iza leopОценок пока нет

- WebOptions Report AK Rama NujanДокумент2 страницыWebOptions Report AK Rama NujanraghuramraghurammudavthОценок пока нет

- Medgulf Nextcare Rn2 QuoteДокумент1 страницаMedgulf Nextcare Rn2 Quotekcatolico00Оценок пока нет

- Ilq 1 Bjxrypizq 2 Lvy 3 SMTBTWДокумент1 страницаIlq 1 Bjxrypizq 2 Lvy 3 SMTBTWMark Aaron WilsonОценок пока нет

- 104722130ilq1bjxrypizq2lvy3smtbtw PDFДокумент1 страница104722130ilq1bjxrypizq2lvy3smtbtw PDFMark Aaron WilsonОценок пока нет

- Panini 90%Документ2 страницыPanini 90%ramanyadav3150Оценок пока нет

- ShowДокумент2 страницыShowBrian williamОценок пока нет

- ST TH ST TH ND TH ST TH ND TH RD TH TH THДокумент2 страницыST TH ST TH ND TH ST TH ND TH RD TH TH THGundeti TejaОценок пока нет

- Copy B For Student 1098-T: Tuition StatementДокумент1 страницаCopy B For Student 1098-T: Tuition Statementqqvhc2x2prОценок пока нет

- Liquidation JHSДокумент16 страницLiquidation JHSRio Ferdinand P. MarcelinoОценок пока нет

- Fees Shown Are Not To Be Charged To The Student But To CHED-Unifast ONLYДокумент1 страницаFees Shown Are Not To Be Charged To The Student But To CHED-Unifast ONLYKimberly GatchalianОценок пока нет

- Prematric ClaimДокумент1 страницаPrematric ClaimThariq AhamadОценок пока нет

- A62da2466a154a 1658463334poovarasan Murugasamy UJJ39393 Elevation Letter Updated 20220722 094412 67460965062da24144cf94435614311Документ2 страницыA62da2466a154a 1658463334poovarasan Murugasamy UJJ39393 Elevation Letter Updated 20220722 094412 67460965062da24144cf94435614311Poovarasan MОценок пока нет

- UE Online Registration 2Документ2 страницыUE Online Registration 2Jovcel ObcenaОценок пока нет

- 1098-T Copy B: Tuition StatementДокумент2 страницы1098-T Copy B: Tuition StatementJonathan EllisОценок пока нет