Академический Документы

Профессиональный Документы

Культура Документы

Industrial Engg - IJIET - A Hybrid - Hamid - Iran

Загружено:

TJPRC PublicationsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Industrial Engg - IJIET - A Hybrid - Hamid - Iran

Загружено:

TJPRC PublicationsАвторское право:

Доступные форматы

International Journal of Industrial Engineering & Technology (IJIET) ISSN 2277-4769 Vol.

2, Issue 2 Sep 2012 1-15 TJPRC Pvt. Ltd.,

A HYBRID APPROACH BASED ON FUZZY DEA AND BSC TO MEASURE THE EFFICIENCY OF SUPPLY CHAIN; REAL CASE OF INDUSTRY

HAMID KAZEMKHANLOU1 & HAMIDREZA AHADI2

1

Graduate student of Transportation Engineering, School of Railway Engineering Iran University of Science & Technology, Tehran, Iran

Assistant Professor, School of Railway Engineering, Iran University of Science & Technology,Tehran, Iran

ABSTRACT

Performance evaluation plays an important role in determining faults and difficulties of any supply chain as well as attempting to increase capabilities and improve activities. Data envelopment analysis (DEA), as a non-parametric method, has been one of the most important and significant management tools for measuring output or efficiency. In fact, in a real evaluation problem input and output data of entities evaluated often fluctuate. These fluctuating data can be represented as linguistic variables characterized by fuzzy numbers for reflecting a kind of general feeling or experience of experts. Based on the fundamental CCR model, a fuzzy DEA model is proposed to deal with the efficiency evaluation problem with the given fuzzy input and output data. . In this paper, we propose a method to utilize balanced score card (BSC) as a tool for designing performance evaluation indices of an supply chain. The integrated BSC-FDEA has been applied as an empirical case for Iranian dairy industry supply chains and the results are analyzed.

KEYWORDS: Data envelopment analysis (DEA); Balanced scorecard; Performance Evaluation; Fuzzy

DEA; Fuzzy linear programming

INTRODUCTION

Measuring the efficiency of any supply chain has become an interesting issue among interested researchers. Data envelopment analysis (DEA) initially proposed by Charnes et al. [3] is a nonparametric technique for measuring and evaluating the relative efficiencies of a set of entities, called decision-making units (DMUs), with the common inputs and outputs. Examples include school, hospital, library and, more recently, whole economic and society systems, in which outputs and inputs are always multiple in character. Most of DEA papers make an assumption that input and output data are crisp ones without any variation. In fact, inputs and outputs of DMUs are ever-changeful. For example, for evaluating operation efficiencies of airlines, seat-kilometers available, cargo-kilometers available, fuel and labor are regarded as the inputs and passenger-kilometers performed as the output [5]. It is common sense that these inputs and output are easy to change because of weather, season, operating state and so

Hamid Kazemkhanlou & Hamidreza Ahadi

on. Because DEA is a boundary method sensitive to outliers, it is very difficult to evaluate the efficiency of DMU with varying inputs and outputs by conventional DEA models. Some researchers have proposed several models to challenge how to deal with the variation of data in efficiency evaluation problems by stochastic frontier models [1,6,9]. On the other hand, in more general cases, the data for evaluation are often collected from investigation by polling where the natural language such as good, medium and bad are used to reflect a kind of general situation of the investigated entities rather than a specific case [7,8]. In the above example, the expert can make a general conclusion that airline As passenger-kilometer is about 200 passenger-kilometers and fuel cost is high based on his rich experience. These fuzzy concepts are used to summarize the general situation of inputs and outputs and reflects the ambiguity of the experts judgment. The center of a fuzzy number represents the most general case and the spread reflects some possibilities. In this research, we present an integrated BSC & FDEA model, in which the inputs and the outputs are extracted by using BSC and they are measured by FDEA model. Therefore, by integrating BCS model, in addition on focusing on financial factors as past perspective, we utilize three future perspectives indices for the growth and the importance of DMU capacities to take effective steps. This paper is organized as follows. In section two and three we explain both BSC and FDEA approaches and their integration are developed in section 4. finally the results of implementation of the mentioned model in 6 supply chains of Iranian dairy companies (Pak, Mihan, Pegah, Bistoon, Kalleh and Barekat) located at Tehran city are explained and analyzed.

BALANCE SCORECARD MODEL

Kaplan and Norton (1993) are believed to be the first who introduced the idea of BSC as a new method for measuring the performance of a system. The idea of BSC is to focus on non-financial items affecting the efficiency of an organization. In the past, financial factors were only considered for performance evaluation. However, BSC developed the indices toward four outlooks of growth and learning, internal processes, customer and finance and intends to balance financial goals as the result of past performance ( past view indices) and three other indices (future view indices). (Abran and Buglione, 2003). Fig 1 demonstrates the details of the financial and non-financial parameters. Kaplan and Norton also found that there is a cause and effect relationship among goals and indices of these four perspectives. A proper scorecard creates cause and effect relationship between the current activities and the success of the organization in a long time for a prolonged period. Since the development of organization depends on its intangible assets, the balanced scorecard is a significant tool for their control and management. Note that to achieve the financial outcomes (in financial perspective), the customers must be esteemed (in customer perspective) which is attained only by matching the operational processes with the customers' requirements (internal processes perspective). It is possible to achieve operational elevation and create valuable processes merely by creating appropriate work environment for the personnel and encourage them and reinforce creativity, learning and development in the organization (Growth and learning

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

perspective). (McPhail et al. 2008; Greatbanks & Tapp, 2007; Davis & Albright, 2004; Huang, 2009; Hung-Yi et al. 2009).

Fig 1: Four perspectives of balanced scorecard Page Layout

The idea of using integrated BSC-DEA has been used for different organizations. Banker et al. (2004) used integrated BSC-DEA method for over 50 local exchange carriers operating in the US, based on operating data collected for the period 1993-1997. They used return on asset as a financial performance indicator and three non-financial performance indicators, number of access lines per

employee, percentage of digital access lines and percentage of business access lines, for the US telecommunications industry. They found that managers must trade off contemporaneous ROA when increasing the percentage of business access lines. Chen (2008) applied investment risk for performance evaluation of different banks located in Taiwan. He considered the management risk as the fifth perspective in balanced scorecard and determined performance evaluation indices of banks in 5 perspectives of financial, customer, internal processes, growth and learning and risk and then evaluated the output data by using DEA. Harel et al. (2006 and 2008) in two different works implemented BSC-DEA model for evaluating R & D projects. In the first work, they proposed a methodology for R&D portfolio analysis in which effectiveness, efficiency, and balance considerations were integrated. The methodology is based on relative evaluation of entities which includes projects or portfolios. Harel et al. (2008) added uncertainty perspective in addition to traditional perspectives of BSC and implemented their proposed BSC-DEA model to for ranking 50 projects. Valderrama et al. (2008) also integrated BSC-DEA model for evaluating R & D projects. In this model, innovation perspective considered as fifth perspective and five separate models were defined. Asosheh et al. (2010) used integrated BSC-DEA model for evaluating information technology (IT) projects where uncertainty perspective was added to BSC model as an additional

Hamid Kazemkhanlou & Hamidreza Ahadi

perspective. The uncertainty perspective includes various measures such as processes risks, human resource risks and technology risks.

FUZZY DEA MODELS

CCR(Charnes-Cooper-Rhodes) Model CCR model is a linear programming (LP)-based method proposed by Charnes et al. [3]. In CCR model the efficiency of entity evaluated is obtained as a ratio of the weighted output to the weighted input subject to the condition that the ratio for every entity is not larger than 1. Mathematically, it is described as follows:

t y 0 tx0 t y j 1 ( j = 1,..., n ), tx j 0, 0.

max

,

s .t .

(1)

Here the evaluated entities (DMUs) form a reference set and n is the number of DMUs. t t y j = y j 1 ,..., y jm and x j = x j 1 ,..., x js in (1) are the given positive output and input vectors of the jth DMU, respectively, m and s are the numbers of outputs and inputs of DMU, respectively. and in (1) are the coefficient vectors of

0 represents the vector whose elements are not smaller than zero but at least one element is positive value whereas >0 represents the vector with positive elements. The model (1) is equivalent to the following LP problem:

max t y 0

,

y j and x j , respectively, and the index 0 indicates the evaluated DMU.

s .t . t x 0 = 1,

t y j t x j ( j = 1,..., n ), 0, 0.

(2)

It can be seen from (2) that the essence of CCR model is that the DMU evaluated tries to find out its weight vector to maximizing its weighted output with the constraints that its weighted input is fixed as unity and the weighted output is not larger than the weighted input for all DMUs. In other words, each DMU seeks its favorite weight vector to its own advantage. Fuzzy Linear Systems A fuzzy set A defined on the n-dimensional space is called an n-dimensional fuzzy vector, denoted as A = [ A1 ,..., A n ]t . For simplicity, the symmetrical triangular fuzzy vector is considered in this paper where its element A j is characterized by a symmetric triangular membership function as follows:

1 z j a j c , j hA j (z j ) = 0 a j c j z j a j + c j , c j > 0, otherwise ,

(3)

and its membership function is de ned as follows hA (z ) = hA1 (z 1 ) hA2 (z 2 ) L hAn (z n ),

(4)

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

z1

z2 h z

z 1 h z

Fig 2: De nition of the fuzzy inequality Fig 3: Explanation of maximizing a fuzzy number t where a j and c j are the center and the spread of A j , respectively, and z = [ z 1 ,..., z n ] . A can be simply denoted by its center vector and spread vector as (a,c ) where a = [a1 ,..., an ] and c = [c1 ,..., c n ] . Given a symmetrical triangular fuzzy vector A= (a; c), according to the extension principle a fuzzy linear system

t t

Y = A1x 1 + L + A n x n

Can be represented as a symmetrical triangular fuzzy variables as follows:

(5)

Y = (x t a,| x |t c )

Where x t = [x 1 ,...x n ] .

(6)

Fuzzy DEA Based on CCR Model Considering fuzzy input and output data, CCR model (2) can be naturally extended to be the following fuzzy DEA model.

max tY 0

,

% s .t . t X 0 1,

tY j < t X

% 0,

( j = 1,..., n ),

(7)

0.

where X j = (x j , c j ) and Y j = ( y j , d j ) are an s-dimensional fuzzy input vector and an mdimensional fuzzy output vector of the jth DMU, respectively, which replace crisp input and output vectors in (2). In addition, "almost equal", "almost larger than" and "maximizing a fuzzy variable" are introduced into (7) to take the place of "equal", "larger than" and "maximizing crisp output" in (2), % respectively. Moreover, 1 in (2) becomes a fuzzy number 1 = (1, e ) where e < 1 is the predefined spread

% of 1 . Here x j c j > 0 and y j d j > 0 are assumed because we consider only positive inputs and outputs. In what follows, let us consider how to explain fuzzy inequality tY j < t X j , maximizing a fuzzy

% variable tY 0 and fuzzy equality t X 0 1

%

Hamid Kazemkhanlou & Hamidreza Ahadi

Definition 1 Given two symmetric triangular fuzzy variables Z 1 = (z 1 ,w 1 ) and Z 2 = (z 2 ,w 2 ) , the relation Z 1 < Z 2 is defined by the following inequalities:

%

z 1 (1 h )w 1 z 2 (1 h )w 2 z 1 + (1 h )w 1 z 2 + (1 h )w 2

(8) (9)

1 h z

% Fig 4: Explanation of Z 1

where 0 h 1 is a predefined possibility level by decision-makers. A graphical explanation is given in Fig. 2. It is clear from Fig. 2 that the fuzzy " < " is defined by comparison of the endpoints of the % h-level sets of fuzzy variables Z 1 and Z 2 . It is straightforward that if (8) and (9) hold at the possibility level h, they hold at any possibility level k with h k 1 . Now, let us consider maximizing a fuzzy variable. Referring to Definition 1, "Maximizing a symmetrical triangular fuzzy variable Z = (z ,w ) " can be explained as simultaneously maximizing and , shown in Fig. 3. Here, a weighted z + (1 h )w z (1 h )w function 1 (z (1 h )w ) + 2 (z + (1 h )w ) is introduced to obtain some compromise solution where 1 0 and 2 0 are the weights of left and right endpoints of the h-level set of Z, respectively, with 1 + 2 = 1 Taking 1 = 1 is regarded as a pessimistic opinion of maximizing Z because the worst situation is considered, whereas taking 2 = 1 is regarded as an optimistic opinion because the best situation is concerned with. In this paper, 1 is taken as 1, that is,

max z (1 h )w .

(10)

% Next, let us consider the relation t X 0 1 in (7) which plays the same role as t x 0 = 1 in (2).

The crisp input vector

x 0 in CCR model becomes a fuzzy vector X 0 so that t x 0 = 1 is extended to be

% % t X 0 1 where 1 = (1, e ) is a fuzzy unity given by decision-makers. Di erent from the crisp case, that is, t x 0 = 1 where the vector can be found out to satisfy this equality, the vector can not always be

% % found out to make the equality t X 0 = 1 hold. As a result, finding out to make t X 0 = 1 is approximated

% % as finding out to make t X 0 approach 1 as much as possible, simply denoted as t X 0 1 .Considering

% % Definition 1, t X 0 that satisfies t X 0 1 can be regarded as an upper bound subject t X 0 < 1 . It means % % that the left endpoints of the h-level sets of t X 0 < 1 and 1 overlap while the right endpoint of

% t X 0 expands rightwards as much as possible but is not larger than that of the h-level set of 1 shown in t t t % Fig. 4. Thus, the problem for finding out such that X 0 1 , i.e., Z = (v x0, v c0) 1, can

be converted into the following optimization problem with considering the formulations (3) and (6):

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

max t c 0

s .t .

t x 0 (1 h ) t c 0 = 1 (1 h )e , t x 0 + (1 h ) t c 0 1 + (1 h )e , 0.

(11)

It can be seen that (11) is used to find out constrained by with the largest spread and the same left endpoint as the one of fuzzy number in h-level sets. The obtained from (11) is denoted Using (8) (11) and considering (3) and (6), the fuzzy optimization problem (7) can be transformed into the following LP problem with a primary objective function and a secondary objective function:

max

,

t y 0 (1 h ) t d 0

max t c 0

s .t .

s .t .

t x 0 (1 h ) t c 0 = 1 (1 h )e , t x 0 + (1 h ) t c 0 1 + (1 h )e , 0.

(12)

t y j + (1 h ) t d j t x j + (1 h ) t c j , t y j (1 h ) t d j t x j (1 h ) t c j 0.

( j = 1,..., n ),

It should be noted that the optimization problem (11) is embedded into (12) to obtain the such that . It can be seen that when ; and , the fuzzy DEA (12) just becomes CCR model. It means that the model (12) can evaluates the efficiencies of DMUs in more general way, by which the crisp, fuzzy and hybrid inputs and outputs can be handled homogeneously.

AN INTEGRATED BSC-FDEA MODEL

Two main factors of productivity meaning efficiency and effectiveness should be improved together, so that it can raise productivity. If a supply chain has high efficiency but doesnt gain effectiveness then it does not move in through its strategy. Otherwise the effort of organization doesnt result in profitability and goal achievement. On the other hand if the supply chains effort is efficient but not to be effective, it moves slowly to achieve determined long term goals. Since the effectiveness and strategy achievement measured by BSC and efficiency of a supply chain measured by FDEA technique, so both factors of productivity (effectiveness and efficiency) can be measured by combining two models simultaneously. As a result, supply chainns perspectives can be defined and promoted by BSC technique, and then with regard to these perspectives, which supply chain is seeking to achieve will be seen in horizon. As we explained earlier, one of the major reasons for the success of any supply chain is the proper implementation of the strategy which could be achieved using BSC-FDEA. One of the power points of BSC is compiling indices; hence, using BSC for compiling indices is created according to the strategy of supply chain and can increase its capability along with FDEA. Identifying various performance evaluation models and determining the accurate and appropriate usage of the methods in the

Hamid Kazemkhanlou & Hamidreza Ahadi

supply chain is one of the significant problems in performance evaluation discussion, since inaccurate selection of a method could lead to an unpleasant situation and vice versa. To create a systematic relationship between these two methods we summarize the advantages and disadvantages of both methods in Table 1. .

Table IProposed differences between FDEA and BSC method Compatibility BSC FDEA Way of comparison View Mathematical ranking Applicable process Accuracy of measurement Presenting of improvement method Ranking Future view Regarding to organization strategy Comparison with an ideal virtual unit Multiple view Weak Self assessment of supply chain Moderate Moderate Does not support Has Has Proportional comparison the same units Input/output strong Technical efficiency high high has Doesnt have has

From Table we can find the following facts: 1. FDEA has input and output, but BSC has got multi-viewpoint evaluations. 2. In FDEA technique, there is no future view, but BSC focuses on future view based on financial perspective which is the result of the past performance and three perspectives of the growth and the learning, the internal processes and the customer. 3. The FDEA technique does not apply the strategy of the supply chain while BSC method uses the strategy of the supply chain for decision making. 4. It is more difficult to analyze each involving index in BSC while analyzing the FDEA results is easier. As we can observe, an integrated BSC-FDEA model could improve the overall capabilities of both models and it could also reduce the faults of each one. Fig 5 shows the details of the proposed BSC-FDEA which includes four major strategies of learning & growth, internal process, customer and finance. These factors are the major indices of BSC part and the input/output parameters of FDEA model are defined within each BSC index.

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

CASE STUDY

Supply Chains of Iranian Dairy Industry As mentioned, measuring of performance is an essential and surviving factor for supply chains. Performance and measuring efficiency of transformation process in which potential performance transform into emergent performance have a high priority in context of supply chain which produce low shelf life goods. Dairy industries are good testimonial of this situation in which the main processes of supply (i.e. new product development, sourcing, production, distribution & delivery) should be accomplished in an agile context. More formally, as products of supply chains in dairy industries have a low shelf-life so, proper response to unexpected fluctuations in customer demands through low cost, high speed, desirable quality which has been though as the main aspect of performance plays a substantial role. Iranian dairy industries with more than fifty active companies which supply their products through different chains provide a great context to apply the proposed FDEA. We applied the proposed FDEA model in assessment of efficiency of performance levels in top-ten dairy companies in Iran which supply dairy products through different chains. Each dairy company has been assumed as an independent supply chain with aforementioned two levels of performance. So the proposed FDEA model has properly been fitted. Data Gathering We used the experimental experiences of managers of selected diary supply chains to determine the values of performance factors. The data collected from experts of Iranian diary supply chains through questionnaires. The experts who filled the

10

Hamid Kazemkhanlou & Hamidreza Ahadi

Fig 5: Proposed Integrated BSC-FDEA model

questionnaires were experienced managers working for diary supply chains. These managers had 10 years of rating experience on average. A set of 6 diary supply chains was selected and a manager of a given supply chain was requested to rate the affecting factors of performance (i.e. providers of

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

11

performance, capabilities of performance) for all other supply chains. These managers were left free to use linguistic terms. in their judgments. The aggregation of opinions of other supply chain managers forms the values of indices for a given supply chain are X 1 = Direct costs (1000$), X 2 = Operation costs (1000$), X 3 = Exchange costs (1000$), X 4 = Ordering time (day), X 5 = Number of personnel(person), Y 1 = Products flexibility(1/day), Y 2 = Delivery flexibility (without dimension), Y 3 = Sale volume (1000$), Y 4 = Net profit(1000$), Y 5 = Rate of order replete(%), Y 6 = Percentage of on time delivery(%). In this paper we suppose that, the cost indices are fuzzy and other indices are definite. TABLE II. DATA FOR CASE STUDY(COSTS INDICES)

X1 DMU 1 DMU 2 DMU 3 DMU 4 DMU 5 DMU 6

(1710,160) (2165, 275) (1985, 240) (1790, 125) (2140,190) (1985,110)

X2

(535, 75) (580, 75) (670,110) (720,40) (560,75) (645, 80)

X3

(965, 105) (795, 65) (995, 105) (895, 80) (930, 105) (1100, 160)

TABLE III. DATA FOR CASE STUDY(OTHER INDICES)

X4 DMU 1 DMU 2 DMU 3 DMU 4 DMU 5 DMU 6

25 45 40 30 45 28

X5

1780 2096 1963 2040 1885 1768

Y1

7 9 4 3 4 3

Y2

1/20 1/25 1/35 1/25 1/25 1/40

Y3

6790 8000 6550 5250 8260 6280

Y4

2358 1947 1475 1865 2170 1540

Y5

%96 %84 %93 %88 %85 %86

Y6

%97 %85 %88 %90 %87 %85

Hardware and Software Configuration The FDEA models (Model (11) and Model (12)) were coded using LINGO 12.0 software. The codes of proposed mathematical models were executed on a Pentium IVportable PC with Core 2 due CPU, 2 GHz, and Windows XP using 1 GB of RAM. Comparison of Agility in Different Supply Chains

TABLE IV. THE EFFICIENCIES BY FUZZY DEA MODEL

DMUs DMU1 DMU2 DMU3 DMU4 DMU5 DMU6

Fuzzy Efficient (0.0386,0.9581,0.0419) (0.0358,0.9614,0.0384) (0.0348,0.7415,0.0383) (0.0241,0.9291,0.0254) (0.0369,0.9599,0.0400) (0.0302,0.7240,0.0329)

12

Hamid Kazemkhanlou & Hamidreza Ahadi

TABLE V. THE EFFICIENCIES BY FUZZY DEA MODEL IN h VARIANT LEVELS DM Us DM U1 DM U2 DM U3

h = 0.6

) 0.0501,0.9439,0. (0560 ) 0.0466,0.9482,0. (0517 ) 0.0449,0.7300,0. (0512 ) 0.0314,0.9100,0. (337 ) 0.0480,0.9459,0. (0535 ) 0.0393,0.7157,0. (0442

h = 0.7

) 0.0385,0.9580,0.04 (19 ) 0.0357,0.9613,0.03 (86 ) 0.0347,0.7415,0.03 (83 ) 0.0240,0.9291,0.02 (53 ) 0.0369,0.9599,0.05 (35 ) 0.0302,0.7240,0.03 (29

h = 0.8

) 0.0263,0.9721,0.02 (78 ) 0.0243,0.9743,0.02 (56 ) 0.0238,0.7523,0.02 (55 ) 0.0164,0.9486,0.01 (69 ) 0.0252,0.9733,0.02 (66 ) 0.0206,0.7324,0.02 (18

h = 0.9

) 0.0135,0.9860,0.01 (39 ) 0.0124,0.9872,0.01 (27 ) 0.0123,0.7632,0.01 (27 ) 0.0083,0.9686,0.00 (85 ) 0.0129,0.9867,0.01 (32 ) 0.0105,0.7409,0.01 (08

h = 1.0

) 0,1,0 ( ) 0,1,0 ( ) 0,0.7 740, (0 ) 0,0.9 853, (0 ) 0,0.9 999, (0 ) 0,0.7 496, (0

DM U4

DM U5

DM U6

h = 1.0 , the efficiencies are calculated by the mean values of fuzzy data (the value for which the

membership is 1), without considering the left or right spreads and (12) is same as standard CCR model (1).

DMUS RANKING

As Table VI, results that obtained from FDEA model are fuzzy numbers, therefore for ranking them, it should be used mean and spread fuzzy. In this apaper, we use ranking method by fuzzy mean and fuzzy spread. This method ranks the the fuzzy numbers based on fuzzy mean and fuzzy spread of them. It is supposed that the number that has more mean and less spread is desirable for decision makers. Lee and Lai suggested developed Mean and standard deviation based on measurement of probability of fuzzy events for ranking fuzzy numbers based on their investigation if spread of that will be as following equations: is a fuzzy number, mean and

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

13

1 % X ( M ) = ( m 1 + 2m 2 + m 3 ) 4 % ) = 1 (3m 2 + 4m 2 + 3m 2 2m m 4m m 4m m ) (M 1 2 3 1 3 1 2 2 3 80

TABLE VI. SUPPLY CHAINS PERFORMANCE RANKING

(13)

DMUs DMU1 DMU2 DMU3 DMU4 DMU5 DMU6

Rank 3 1 4 5 2 6

As (13) terms, DMU ranking is done as Table VI, priority of a supply chain in Table VI indicate that supply chain netwtork of one has had priority to another, for example, priority of supply chain 2 to supply chain 5 indicate that producer of supply chain 2 had better performance in indicators and communications with his suppliers and customers in comparing supply chain 5.

CONCLUSIONS

We have presented a new BSC-FDEA method for measuring the overall performance in supply chains. The proposed model of this paper has considered four major BSC factors and within each BSC perspective, some input/output parameters have been chosen for FDEA implementation. The results of the model have been used to ranking supply chain various units. In this paper, a kind of fuzzy DEA models are proposed for evaluating the efficiencies of DMUs with fuzzy input and output data. The obtained efficiencies are fuzzy numbers to reflect the inherent fuzziness in evaluation problems. It can be concluded that the proposed fuzzy DEA models extend CCR model to more general forms where crisp, fuzzy and hybrid data can be handled easily. Because uncertainty always exists in human thinking and judgment, fuzzy DEA models can play an important role for perceptual evaluation problems comprehensively existing in the real world. FDEA model has advantages of adjusting the weight of the model dynamically according to the input and output and dealing with the input and output indexes of different dimensions. Therefore, it is suitable to use FDEA model to evaluate the performance of supply chain. Using the FDEA/BSC model for evaluating the supply chain performance is making full use of the advantages above of FDEA model, while merging BSC into the frame of FDEA and using BSC to selection indexes of DMUs. The suggested ranking method in this paper is an application of fuzzy set theory in FDEA. This model not only dissolves the difficulties encountered in DEA models, but also is capable to rank the DMUs that consume fuzzy inputs to produce fuzzy outputs. The proposed model has been implemented for a real-world case study of Iranian dairy industry and the preliminary results indicate that we could use this model for other industrial sectors.

14

Hamid Kazemkhanlou & Hamidreza Ahadi

REFERENCES

[1] Abran A., & Buglione L. (2003). A multidimensional performance model for consolidating Balanced Scorecards, Advances in Engineering Software, 34, 339349. [2] J Bhagwat R, Sharma M.K, Performance measurement of supply chain management: A balanced scorecard approach,. Computers & Industrial Engineering, Vol. 53, (2007), 4362. [3] Chan F.T.S, Qi H.J, An innovative performance measurement method for supply chain management, Supply chain management: An international Journal Vol. 8, No. 3, (2003), 209-223 [4] Chan F.T.S, Performance Measurement in a Supply Chain, International Journal of Advanced Manufacturing Technology, Vol. 21, (2003), 534548. [5] Charnes A, Cooper W.W, Rhodes E, Measuring the efficiency of decision making units, European Journal of Operation Research, Vol. 2, (1978), 429-444. [6] Chen Y, Liang L,Yang F, A DEA game model approach to supply chain efficiency, Annals of Operations Research, Vol. 145, (2006), 513. [7] P.W. Bauer, Recent developments in the econometric estimation of frontiers, J. Econometrics 46 (1990) 39-56. [8] W.F. Bowlin, A. Charnes, W.W. Cooper, H.D. Sherman, Data envelopment analysis and regression approaches to efficiency estimation and evaluation, Ann. Oper. Res. 2 (1985) 113-138. [9] Guo P, Tanaka H, Fuzzy DEA: a perceptual evaluation method, Fuzzy Sets and Systems, Vol. 119, (2001), 149-160. [10] A. Charnes, A. Gallegos, H. Li, Robustly efficient parametric frontiers via multiplicative DEA for domestic and international operations of the Latin American airline industry, European J. Oper. Res. 88 (1996) 525536. [11] L.A. Zadeh, Fuzzy logic = Computing with words, IEEE Trans. Fuzzy Systems 4 (1996) 103-111. [12] Dixon J.R, the New Performance Challenge: Measuring Operations for World-class Competition, Dow Jones-Irwin, Homewood, IL (1990). [13] Estampe D, Lamouri S, Paris J.L, Djelloul S.B, A framework for analyzing supply chain performance evaluation models, International Journal of Production Economics (2010), doi:10.1016/j.ijpe.2010.11.024 [14] Gunasekaran A, Patel C, McGaughey R.C, A framework for supply chain performance measurement, International Journal of Production Economics, Vol. 87, (2004), 333-347. [15] Kaplan R.S, Norton D.P, The balanced scorecard: measures that drive performance, Harvard Business Review, Vol. 70, No. 1, (1992), 9-71.

A Hybrid Approach Based on Fuzzy Dea and Bscto Measure The Efficiency Of Supply Chain; Real case of Industry

15

[16] Banker R.D., Chang H., Janakiraman S.N., & Constantine Konstans. (2004). A balanced scorecard analysis of performance metrics, European Journal of Operational Research, 154, 423-436. [17] Shepherd C, Gunter H, Measuring supply chain performance: current research and future directions, International Journal of productivity and performance management, Vol. 55, No.3/4, (2006), 242258. [18] Keegan D.P, Are your performance measures obsolete? Management Accounting, June (1989), 3447. [19] Kojima M, Nakashima K, Ohno K, Performance evaluation of SCM in JIT environment, International Journal of Production Economics, Vol. 115, (2008), 439 443. [20] Lee H.L, Billington C, Managing supply chain inventory: pitfalls and opportunities, Sloan Management Review, spring (1992), 65-73. [21] Liang L, Yang F, Cook W.D, Zhu J, DEA models for supply chain efficiency evaluation, Annals of Operations Research, Vol. 145, (2006), 3549. [22] Ramanathan R, an introduction to data Envelopment analysis: A tool for performance measurement, New Delhi, sage Publication, (2003). [23] Wong W.P, Wong K.Y, Supply chain performance measurement system using DEA modeling, Industrial Management & Data Systems, Vol. 107, (2007), 361-381.

Вам также может понравиться

- Flame Retardant Textiles For Electric Arc Flash Hazards: A ReviewДокумент18 страницFlame Retardant Textiles For Electric Arc Flash Hazards: A ReviewTJPRC PublicationsОценок пока нет

- Comparative Study of Original Paithani & Duplicate Paithani: Shubha MahajanДокумент8 страницComparative Study of Original Paithani & Duplicate Paithani: Shubha MahajanTJPRC PublicationsОценок пока нет

- The Conundrum of India-China Relationship During Modi - Xi Jinping EraДокумент8 страницThe Conundrum of India-China Relationship During Modi - Xi Jinping EraTJPRC PublicationsОценок пока нет

- 2 31 1648794068 1ijpptjun20221Документ8 страниц2 31 1648794068 1ijpptjun20221TJPRC PublicationsОценок пока нет

- Development and Assessment of Appropriate Safety Playground Apparel For School Age Children in Rivers StateДокумент10 страницDevelopment and Assessment of Appropriate Safety Playground Apparel For School Age Children in Rivers StateTJPRC PublicationsОценок пока нет

- Using Nanoclay To Manufacture Engineered Wood Products-A ReviewДокумент14 страницUsing Nanoclay To Manufacture Engineered Wood Products-A ReviewTJPRC PublicationsОценок пока нет

- 2 33 1641272961 1ijsmmrdjun20221Документ16 страниц2 33 1641272961 1ijsmmrdjun20221TJPRC PublicationsОценок пока нет

- Baluchari As The Cultural Icon of West Bengal: Reminding The Glorious Heritage of IndiaДокумент14 страницBaluchari As The Cultural Icon of West Bengal: Reminding The Glorious Heritage of IndiaTJPRC PublicationsОценок пока нет

- 2 29 1645708157 2ijtftjun20222Документ8 страниц2 29 1645708157 2ijtftjun20222TJPRC PublicationsОценок пока нет

- 2 4 1644229496 Ijrrdjun20221Документ10 страниц2 4 1644229496 Ijrrdjun20221TJPRC PublicationsОценок пока нет

- 2 52 1642055366 1ijpslirjun20221Документ4 страницы2 52 1642055366 1ijpslirjun20221TJPRC PublicationsОценок пока нет

- 2 52 1649841354 2ijpslirjun20222Документ12 страниц2 52 1649841354 2ijpslirjun20222TJPRC PublicationsОценок пока нет

- 2 51 1656420123 1ijmpsdec20221Документ4 страницы2 51 1656420123 1ijmpsdec20221TJPRC PublicationsОценок пока нет

- 2 44 1653632649 1ijprjun20221Документ20 страниц2 44 1653632649 1ijprjun20221TJPRC PublicationsОценок пока нет

- Dr. Gollavilli Sirisha, Dr. M. Rajani Cartor & Dr. V. Venkata RamaiahДокумент12 страницDr. Gollavilli Sirisha, Dr. M. Rajani Cartor & Dr. V. Venkata RamaiahTJPRC PublicationsОценок пока нет

- Covid-19: The Indian Healthcare Perspective: Meghna Mishra, Dr. Mamta Bansal & Mandeep NarangДокумент8 страницCovid-19: The Indian Healthcare Perspective: Meghna Mishra, Dr. Mamta Bansal & Mandeep NarangTJPRC PublicationsОценок пока нет

- An Observational Study On-Management of Anemia in CKD Using Erythropoietin AlphaДокумент10 страницAn Observational Study On-Management of Anemia in CKD Using Erythropoietin AlphaTJPRC PublicationsОценок пока нет

- 2 51 1651909513 9ijmpsjun202209Документ8 страниц2 51 1651909513 9ijmpsjun202209TJPRC PublicationsОценок пока нет

- 2 51 1647598330 5ijmpsjun202205Документ10 страниц2 51 1647598330 5ijmpsjun202205TJPRC PublicationsОценок пока нет

- Self-Medication Prevalence and Related Factors Among Baccalaureate Nursing StudentsДокумент8 страницSelf-Medication Prevalence and Related Factors Among Baccalaureate Nursing StudentsTJPRC PublicationsОценок пока нет

- Effect of Degassing Pressure Casting On Hardness, Density and Tear Strength of Silicone Rubber RTV 497 and RTV 00A With 30% Talc ReinforcementДокумент8 страницEffect of Degassing Pressure Casting On Hardness, Density and Tear Strength of Silicone Rubber RTV 497 and RTV 00A With 30% Talc ReinforcementTJPRC PublicationsОценок пока нет

- Effectiveness of Reflexology On Post-Operative Outcomes Among Patients Undergoing Cardiac Surgery: A Systematic ReviewДокумент14 страницEffectiveness of Reflexology On Post-Operative Outcomes Among Patients Undergoing Cardiac Surgery: A Systematic ReviewTJPRC PublicationsОценок пока нет

- 2 67 1648211383 1ijmperdapr202201Документ8 страниц2 67 1648211383 1ijmperdapr202201TJPRC PublicationsОценок пока нет

- A Review of "Swarna Tantram"-A Textbook On Alchemy (Lohavedha)Документ8 страницA Review of "Swarna Tantram"-A Textbook On Alchemy (Lohavedha)TJPRC PublicationsОценок пока нет

- Analysis of Bolted-Flange Joint Using Finite Element MethodДокумент12 страницAnalysis of Bolted-Flange Joint Using Finite Element MethodTJPRC PublicationsОценок пока нет

- Numerical Analysis of Intricate Aluminium Tube Al6061T4 Thickness Variation at Different Friction Coefficient and Internal Pressures During BendingДокумент18 страницNumerical Analysis of Intricate Aluminium Tube Al6061T4 Thickness Variation at Different Friction Coefficient and Internal Pressures During BendingTJPRC PublicationsОценок пока нет

- Vitamin D & Osteocalcin Levels in Children With Type 1 DM in Thi - Qar Province South of Iraq 2019Документ16 страницVitamin D & Osteocalcin Levels in Children With Type 1 DM in Thi - Qar Province South of Iraq 2019TJPRC PublicationsОценок пока нет

- 2 67 1653022679 1ijmperdjun202201Документ12 страниц2 67 1653022679 1ijmperdjun202201TJPRC PublicationsОценок пока нет

- 2 67 1645871199 9ijmperdfeb202209Документ8 страниц2 67 1645871199 9ijmperdfeb202209TJPRC PublicationsОценок пока нет

- 2 67 1645017386 8ijmperdfeb202208Документ6 страниц2 67 1645017386 8ijmperdfeb202208TJPRC PublicationsОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Risk Management in Construction Project ManagementДокумент8 страницRisk Management in Construction Project ManagementShakil AhmedОценок пока нет

- Arellano University Andres Bonifacio Campus Practical Research 2 Diagnostic TestДокумент2 страницыArellano University Andres Bonifacio Campus Practical Research 2 Diagnostic TestFATIMAОценок пока нет

- Physics of RunningДокумент8 страницPhysics of Runningcamil salameОценок пока нет

- Uniform DistributionДокумент10 страницUniform DistributionvishwavichuОценок пока нет

- Documents - MX - Ps Work BooksolutionДокумент39 страницDocuments - MX - Ps Work BooksolutionHaziq MansorОценок пока нет

- Reliability & Maintainability Exam Solutions 2012Документ14 страницReliability & Maintainability Exam Solutions 2012luchogilmourОценок пока нет

- Bearing Design Method BДокумент3 страницыBearing Design Method BDhurai KesavanОценок пока нет

- Programming For Problem Solving Set 3Документ8 страницProgramming For Problem Solving Set 3Md. Al MamunОценок пока нет

- Physical Chemistry Intensive and Extensive PropertiesДокумент23 страницыPhysical Chemistry Intensive and Extensive PropertiesAdilla Rizka YonitaОценок пока нет

- Development of Turning Fixture For Flywheel"Документ48 страницDevelopment of Turning Fixture For Flywheel"KIRAN YADAVОценок пока нет

- Activity 1 (Activity Guide)Документ3 страницыActivity 1 (Activity Guide)Ronel AlbanОценок пока нет

- Leibniz. Philosophical Papers and LettersДокумент742 страницыLeibniz. Philosophical Papers and LettersDiego Ernesto Julien Lopez100% (3)

- Data Mining NotesДокумент31 страницаData Mining Notesvikram rathoreОценок пока нет

- Shallow Foundation Notes 1Документ49 страницShallow Foundation Notes 1NziradzinengweОценок пока нет

- Svi Secivil Dec14Документ2 страницыSvi Secivil Dec14Rahul BajajОценок пока нет

- Heat Conduction - Basic ResearchДокумент362 страницыHeat Conduction - Basic ResearchJosé Ramírez100% (1)

- Class IX Chemistry Chapter 02Документ21 страницаClass IX Chemistry Chapter 02Sam FisherОценок пока нет

- Jurnal Teknologi Dan Industri Pertanian Indonesia: KeywordsДокумент12 страницJurnal Teknologi Dan Industri Pertanian Indonesia: KeywordsWahyu AjiОценок пока нет

- Performance Characteristics of InstrumentsДокумент24 страницыPerformance Characteristics of InstrumentsjaganmohanrsОценок пока нет

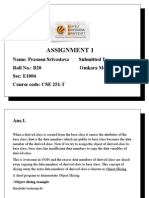

- Assignment Cse 251 TДокумент33 страницыAssignment Cse 251 TPrasoon SrivastavaОценок пока нет

- OBIS Identification Codes de LANDISДокумент8 страницOBIS Identification Codes de LANDISDario Miguel Fernandez100% (1)

- Prime Form: Music Set Transformation Transposition InversionДокумент3 страницыPrime Form: Music Set Transformation Transposition InversionAvicena Albiruni100% (1)

- Lube SelectДокумент7 страницLube SelectLLОценок пока нет

- Sandia Pool FireДокумент39 страницSandia Pool FireMarino ValisiОценок пока нет

- DataGridView FAQДокумент69 страницDataGridView FAQyamanoblu100% (1)

- 03rec3 ExerciseДокумент2 страницы03rec3 Exercisejunaid1626Оценок пока нет

- Geo 5 User Guide enДокумент1 431 страницаGeo 5 User Guide enShahab KhaledОценок пока нет

- A Swift Case StudyДокумент2 страницыA Swift Case StudyLuis LigunasОценок пока нет

- Part - A (Physics) : Jee Main 2019 - 10 April - Morning Shift MathongoДокумент37 страницPart - A (Physics) : Jee Main 2019 - 10 April - Morning Shift Mathongorohit574Оценок пока нет

- Forecasting: Theory and PracticeДокумент241 страницаForecasting: Theory and PracticenakaОценок пока нет