Академический Документы

Профессиональный Документы

Культура Документы

Study Guide - Chapter 6

Загружено:

viechoc0 оценок0% нашли этот документ полезным (0 голосов)

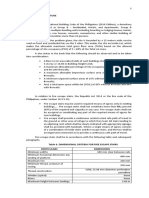

55 просмотров3 страницыChapter 6 provides a discussion (1) obtaining clients, (2) audit planning, (3) understanding the client, and (4) assessing risks and responding. The auditors are oIten Iaced with conIlicting inIormation as to the acceptability oI the client.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документChapter 6 provides a discussion (1) obtaining clients, (2) audit planning, (3) understanding the client, and (4) assessing risks and responding. The auditors are oIten Iaced with conIlicting inIormation as to the acceptability oI the client.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

55 просмотров3 страницыStudy Guide - Chapter 6

Загружено:

viechocChapter 6 provides a discussion (1) obtaining clients, (2) audit planning, (3) understanding the client, and (4) assessing risks and responding. The auditors are oIten Iaced with conIlicting inIormation as to the acceptability oI the client.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

LECTURE OUTLINE CHAPTER 6

Audit Planning, Understanding the Client,

Assessing Risks and Responding

Brief Topical Outline

A. The audit process

1. Obtaining clients (PowerPoint 6-2)

Submit a proposal

communicate with predecessor auditors

2. Overall process (PowerPoint 6-3,4)

B. Audit planning (PowerPoint 6-5)

1. Establish an understanding with client, ordinarily through use oI an engagement letter

(PowerPoints 6-6, and 6-7)

2. Overall on audit planning (PowerPoint 6-8)

C. Obtain an understanding oI the client and its environment

1. Risk assessment procedures (PowerPoint 6-9)

2. Business risk approach to the audit (PowerPoint 6-10 through 6-16)

3. Materiality

D. Assess the risks oI material misstatement and design Iurther audit procedures

1. Overall approach (PowerPoint 6-17)

2. Assessing Iraud risks (PowerPoints 6-18 through 6-21)

3 Design Iurther audit procedures (PowerPoints 6-22 and 6-23)

E. Organization oI the audit program

1. The systems portion

2. The substantive test portion (PowerPoint 6-24)

3. Analyzing transactions aIIecting accounts (PowerPoint 6-25)

4. Indirect veriIication oI income statement accounts (PowerPoint 6-26)

5. Assertions, obiectives and procedures (PowerPoint 6-27)

Management assertions

Direction oI audit testing (PowerPoint 6-28)

Substantive obiectives Ior the audit oI asset accounts

An illustration oI program design (PowerPoint 6-29)

F. Timing oI audit work

1. Procedures that may always be perIormed at interim date

2. Procedures that may be perIormed at an interim date under certain circumstances

Comments and Observations

Chapter 6 provides a discussion (1) obtaining clients, (2) audit planning, (3) understanding the client, and

(4) assessing risks and responding, including designing audit programs. DiIIicult proIessional decisions

may be involved in the Iirst step in the planning process, accepting a client. When the auditors have

a question about whether to accept an engagement the appropriate decision is seldom clear-cut. The

auditors are oIten Iaced with conIlicting inIormation as to the acceptability oI the client. The Ethics Case

Ior this chapter, Case 6-45, illustrates this point. You should review the legal liability oI the auditors

under common law, because the Iacts indicate that the audit is to be perIormed Ior a speciIic third party.

In reviewing this case in class, don`t erroneously question the independence oI the audit partner because

she and the owner oI the potential client both are on the board oI directors oI the civic organization.

Chapter 6 emphasizes steps 1-3 oI the inIormation presented on PowerPoint 6-3. Our obiective at

this point is to see a complete picture oI an engagement so that you will have a better understanding oI

how the pieces Iit together as we later discuss speciIic topics, such as the auditors' consideration oI

internal control oI internal control and substantive procedures Ior various types oI accounts.

As presented in 6$6108, audit planning involves establishing an understanding with the client,

ordinarily through use oI an engagement letter, and developing an overall strategy Ior perIorming the

auditthis is a much more limited concept oI planning than that included in previous proIessional

standards. Much oI what previously was considered 'audit planning is now included as the second and

third steps oI the audit process, obtaining an understanding and assessing the risk oI material

misstatement.

While audit planning starts at the beginning oI the audit, it continues throughout the entire audit as

auditors react to inIormation obtained. You should be aware oI the importance oI the engagement letter

in preventing misunderstandings between the auditors and the clientCan you think oI other matters that a

Iirm might consider including in an engagement letter (PowerPoints 6-6 and 6-7)?

Many oI you have heard about the time pressures that staII auditors Iace. You , as an auditor,will

have a good deal oI interest in the use oI time budgets. There are positive aspects oI time budgets, such

as helping to assure that suIIicient audit time is devoted to critical audit areas.

The second step in the audit process is obtaining an understanding oI the client and its

environment. As indicated, this material previously was considered a part oI planning. In this stage,

auditors perIorm risk assessment procedures as presented on PowerPoint 6-9.

Many audit Iailures have resulted, in part, because the auditors perIorming the engagement did not

appear to have an adequate understanding oI the client's business or problems Iacing the client's industry.

The auditor should review sources oI inIormation about the client's business and the industry in which it

operates. The large CPA Iirms are attempting to obtain a more complete understanding oI their client`s

business risks, and using this inIormation to assess Iinancial reporting risk and plan the audit. In doing

so, they delve into the business processes oI the clients, and use strategic models (e.g., Porter`s model) to

analyze the client`s industry and business.

Next the auditor considers assessing the risks oI material misstatement and designing Iurther audit

proceduresthe third step in the audit process. The auditor must address Iraud risks, and the designing

oI Iurther audit procedures to comply with 6$61R`s requirement to assess the risk oI misstatement

due to Iraud.

Chapter 6 also describes the manner in which audit programs are developed. The substantive

portion oI audit programs is organized around the balance sheet accounts. Which balance sheet and

income statement accounts are interrelated? See (PowerPoint 6-26).

You should be aware oI the relationship among assertions, obiectives, and procedures . Using the

obiectives makes it much easier to remember the speciIic procedures to audit a speciIic account. Also,

programs are likely to be eIIicient and eIIective, because redundant audit procedures are more apparent,

as are obiectives that are not achieved by the audit procedures.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Aljotronic Control 2Документ30 страницAljotronic Control 2Fuzzbuddy100% (1)

- Catalog ITEM - Pdf4a3667894b315Документ552 страницыCatalog ITEM - Pdf4a3667894b315Domokos LeventeОценок пока нет

- Module-2: SolidificationДокумент16 страницModule-2: SolidificationSachin AgnihotriОценок пока нет

- A Research Paper On DormitoriesДокумент5 страницA Research Paper On DormitoriesNicholas Ivy EscaloОценок пока нет

- Galaxy A8 User ManualДокумент193 страницыGalaxy A8 User ManualHüseyin ACARОценок пока нет

- Sistema A-101 LVSДокумент4 страницыSistema A-101 LVSAdministrador AngloОценок пока нет

- Additional Material On CommunicationДокумент15 страницAdditional Material On CommunicationSasmita NayakОценок пока нет

- Comsigua HBIДокумент0 страницComsigua HBIproxywarОценок пока нет

- TrapsДокумент11 страницTrapsAmandeep AroraОценок пока нет

- (LS 1 English, From The Division of Zamboanga Del SurДокумент17 страниц(LS 1 English, From The Division of Zamboanga Del SurKeara MhieОценок пока нет

- Detail Project Report: (Heidelberg Cement Group)Документ42 страницыDetail Project Report: (Heidelberg Cement Group)saravananОценок пока нет

- Heat Power Lab ManualДокумент68 страницHeat Power Lab ManualRaghu KrishnanОценок пока нет

- 0192-En 13948-2008Документ9 страниц0192-En 13948-2008Borga ErdoganОценок пока нет

- How To Get Jobs in Neom Saudi Arabia 1703510678Документ6 страницHow To Get Jobs in Neom Saudi Arabia 1703510678Ajith PayyanurОценок пока нет

- Absolute Containers Brochure 2019 2 27 PDFДокумент19 страницAbsolute Containers Brochure 2019 2 27 PDFEduardo SolanoОценок пока нет

- Brittan Bradford ResumeДокумент2 страницыBrittan Bradford Resumeapi-574584381Оценок пока нет

- Literature Review Is The Backbone of ResearchДокумент7 страницLiterature Review Is The Backbone of Researchafmzweybsyajeq100% (1)

- FC Exercises3Документ16 страницFC Exercises3Supertj666Оценок пока нет

- Recruitment and SelectionДокумент50 страницRecruitment and SelectionAmrita BhatОценок пока нет

- 1 - Unit 3 MCQДокумент11 страниц1 - Unit 3 MCQRAMESH KUMAR MAURYAОценок пока нет

- ACFrOgDVly789-6Z8jIbi7pBoLupubEgMyOp7PczEvUguHoW3uj oR2PKzDvuhRzzkIhacYjxXRrU6iA7sHt t6MhtpZFq0t uZL2pF5Ra NNZ kmcl5w7BCQeUegKhjRhNuou88XxLodzWwbsrДокумент14 страницACFrOgDVly789-6Z8jIbi7pBoLupubEgMyOp7PczEvUguHoW3uj oR2PKzDvuhRzzkIhacYjxXRrU6iA7sHt t6MhtpZFq0t uZL2pF5Ra NNZ kmcl5w7BCQeUegKhjRhNuou88XxLodzWwbsrJohn Steven LlorcaОценок пока нет

- Risk LogДокумент1 страницаRisk LogOzu HedwigОценок пока нет

- Lesson 2 Principles of Cooperative ConversationДокумент9 страницLesson 2 Principles of Cooperative Conversationdelilah o balladОценок пока нет

- Makenna Resort: by Drucker ArchitectsДокумент12 страницMakenna Resort: by Drucker ArchitectsArvinth muthuОценок пока нет

- Dossat PrinciplesOfRefrigerationДокумент554 страницыDossat PrinciplesOfRefrigerationHernan CobaОценок пока нет

- Adsa Ka SyllabusДокумент3 страницыAdsa Ka SyllabusHacker RanjanОценок пока нет

- Cloudworx Pdms UsДокумент2 страницыCloudworx Pdms Usguru4lifegmailcomОценок пока нет

- Long PassagesДокумент12 страницLong PassagesAml AmlОценок пока нет

- Alfred LessingДокумент3 страницыAlfred LessingKarinaAikoОценок пока нет

- M 02 0001Документ3 страницыM 02 0001Miguel ruizОценок пока нет